Key Insights

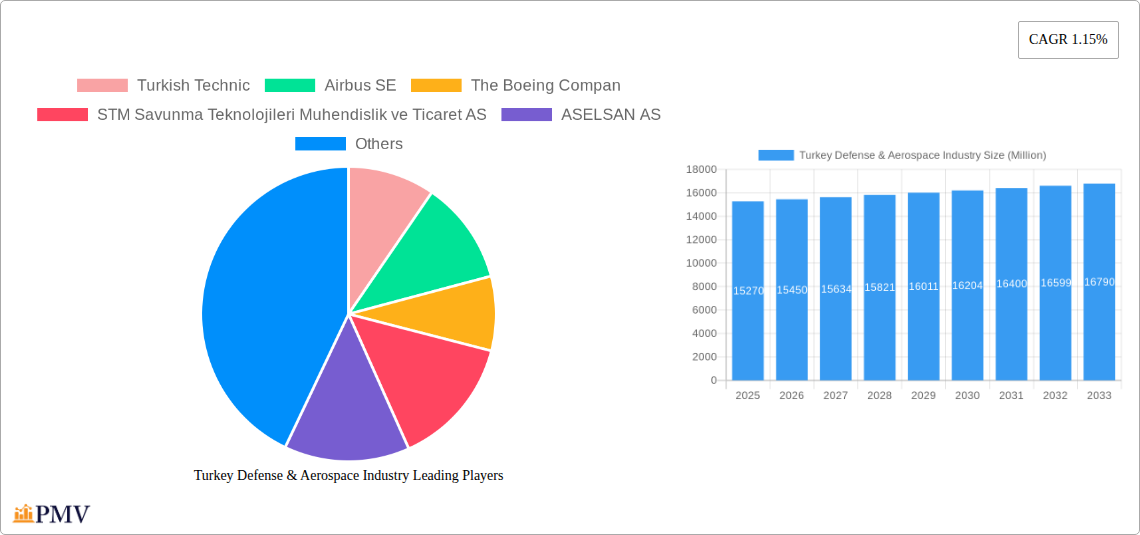

The Turkish defense and aerospace industry, valued at $15.27 billion in 2025, is projected to experience steady growth, driven by increasing government spending on military modernization and a robust domestic manufacturing base. A Compound Annual Growth Rate (CAGR) of 1.15% between 2025 and 2033 indicates a market expected to reach approximately $17.2 billion by 2033. Key growth drivers include the country's strategic geopolitical location, a focus on indigenous technological development, and increasing demand for advanced defense systems and aerospace technologies both domestically and from regional allies. This growth is further fueled by the presence of prominent players such as Turkish Technic, Airbus, Boeing, and several indigenous defense companies like ASELSAN and ROKETSAN, each contributing significantly to various segments including aerospace manufacturing, maintenance, repair, and overhaul (MRO), and defense equipment production. The industry segments are well-defined, with a strong focus on both aerospace and defense products and services. Government initiatives promoting technological advancement and self-sufficiency in defense capabilities are vital catalysts for this growth.

Turkey Defense & Aerospace Industry Market Size (In Billion)

However, global economic fluctuations, competition from established international players, and potential supply chain disruptions could pose challenges. While the industry demonstrates a promising trajectory, navigating these external factors will be crucial for sustaining the projected growth rate. The Turkish government's continued commitment to investing in R&D and supporting domestic manufacturers will be pivotal in ensuring the long-term success and competitiveness of the Turkish defense and aerospace sector in the global market. Specific regional focus and participation in international collaborations will also contribute to future industry expansion.

Turkey Defense & Aerospace Industry Company Market Share

Turkey Defense & Aerospace Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Turkey Defense & Aerospace Industry, covering market structure, competitive dynamics, industry trends, and future growth prospects from 2019 to 2033. The study period spans 2019-2024 (historical period), with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and policymakers seeking actionable insights into this dynamic market. The report delves into market sizes worth Millions USD.

Turkey Defense & Aerospace Industry Market Structure & Competitive Dynamics

The Turkish defense and aerospace industry exhibits a complex market structure characterized by a mix of state-owned enterprises, private companies, and international collaborations. Market concentration is moderate, with several key players holding significant shares, but a considerable number of smaller, specialized firms contributing to innovation. The regulatory framework, shaped by the Turkish government's strategic priorities, promotes domestic manufacturing and technological self-sufficiency, while also encouraging foreign investment in certain areas. This encourages both domestic and international M&A activity. The industry is witnessing increasing consolidation, with larger companies acquiring smaller firms to expand their capabilities and market reach. Recent M&A deals have involved values ranging from xx Million to xx Million USD.

- Market Share: ASELSAN AS and Turkish Aerospace Industries (TUSAS) hold substantial market shares in their respective segments. Exact figures are proprietary, but estimates suggest each holds above 10% share in their specializations.

- Innovation Ecosystems: Collaboration between universities, research institutions, and industry players fosters innovation, leading to the development of advanced technologies in areas like UAVs and air defense systems.

- Regulatory Framework: Government policies and regulations play a critical role in shaping market dynamics. Regulations focus on technological advancement, indigenous production, and export promotion.

- Product Substitutes: The industry is also facing competition from global players, necessitating continuous innovation and cost optimization.

- End-User Trends: The Turkish Armed Forces' modernization efforts, along with growing regional demand, drive significant industry growth. The focus is on advanced capabilities, such as next-generation fighter aircraft and air defense systems.

- M&A Activities: Consolidation is a prominent trend, with larger firms strategically acquiring smaller companies to expand their product portfolios and technological expertise.

Turkey Defense & Aerospace Industry Industry Trends & Insights

The Turkish defense and aerospace industry is experiencing robust growth, driven by increased government spending, modernization of the armed forces, and a growing export market. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, propelled by government initiatives promoting domestic production and technological self-reliance. Technological disruptions, particularly in areas such as UAV technology and AI-powered systems, are reshaping the competitive landscape. Market penetration for indigenous defense products is steadily increasing, reflecting the government's emphasis on self-sufficiency. Consumer preferences are shifting towards advanced, high-tech systems with enhanced capabilities and reliability. This dynamic necessitates companies to focus on research & development and strategic partnerships to maintain competitiveness in the global market. The industry is also undergoing significant transformation due to increasing digitalization and automation.

Dominant Markets & Segments in Turkey Defense & Aerospace Industry

The Turkish defense and aerospace industry is dominated by the domestic market, with significant contributions from both the aerospace and defense segments. The Manufacturing, Design, and Engineering segment holds a commanding position within the industry, driven by the government's focus on indigenous production and technological self-reliance. The Maintenance, Repair, & Overhaul (MRO) segment is also gaining traction, particularly with the increased operational tempo of the Turkish Armed Forces and the growing commercial aviation sector.

- Key Drivers for Manufacturing, Design, and Engineering:

- Government initiatives promoting domestic production and technological self-reliance.

- Investments in research and development.

- Strong focus on export diversification.

- Key Drivers for Maintenance, Repair, & Overhaul:

- Growing fleet size of both military and commercial aircraft.

- Increased operational tempo of the Turkish Armed Forces.

- Investments in modern MRO facilities.

The dominance of the domestic market is further reinforced by the government's strategic focus on fostering a self-sufficient defense industry. This policy prioritizes domestic production and reduces reliance on foreign suppliers, creating a favorable environment for local companies.

Turkey Defense & Aerospace Industry Product Innovations

Recent product innovations demonstrate a strong emphasis on technological advancements. Turkey is increasingly focusing on the development of advanced UAVs, sophisticated air defense systems, and domestically produced fighter jets. These innovations are driven by technological advancements in areas such as AI, machine learning, and material science, resulting in enhanced capabilities and competitive advantages in both domestic and international markets. These advancements improve both defensive and offensive capabilities, allowing Turkey to enhance its position on the global stage.

Report Segmentation & Scope

This report segments the Turkey defense and aerospace industry along two dimensions: Industry (Manufacturing, Design, and Engineering; Maintenance, Repair, & Overhaul) and Type (Aerospace; Defense). Each segment's growth projections, market size (in Millions USD), and competitive dynamics are analyzed in detail. The Manufacturing, Design, and Engineering segment is expected to witness significant growth driven by government initiatives promoting local production. The MRO segment is also projected to grow steadily, driven by increasing aircraft operations and a focus on cost-effective maintenance solutions. The Aerospace segment, with its commercial and military components, showcases a substantial market, mirroring Turkey’s robust air travel industry and military modernization programs. The Defense segment shows a similar growth trajectory, propelled by national security priorities and increased governmental investment.

Key Drivers of Turkey Defense & Aerospace Industry Growth

Several key factors drive the growth of Turkey's defense and aerospace industry: Government investments in modernization of the armed forces, a growing emphasis on technological self-sufficiency, and increasing regional demand for defense products and services are major contributors. Furthermore, the development of indigenous technologies and strategic partnerships with international firms fuel expansion and provide access to global markets. Finally, supportive government policies and regulations incentivize domestic production, research & development, and export-oriented growth.

Challenges in the Turkey Defense & Aerospace Industry Sector

The Turkish defense and aerospace industry faces several challenges, including potential supply chain disruptions, intense global competition, and the need for continuous technological innovation to stay ahead of market trends. Maintaining a skilled workforce and attracting foreign investment while balancing national interests are ongoing challenges. Regulatory hurdles and fluctuating currency rates can also impact market stability and long-term growth projections. These factors influence overall development and stability of the industry.

Leading Players in the Turkey Defense & Aerospace Industry Market

- Turkish Technic

- Airbus SE

- The Boeing Company

- STM Savunma Teknolojileri Muhendislik ve Ticaret AS

- ASELSAN AS

- FNSS Savunma Sistemleri AS

- KOC Holding AS

- HAVELSAN AS

- Mechanical and Chemical Industry Company (MKEK)

- TUSAS (Turkish Aerospace Industries)

- ROKETSAN AS

- BMC Otomotiv Sanayi ve Ticaret AS

Key Developments in Turkey Defense & Aerospace Industry Sector

- September 2023: Turkish Airlines ordered ten Airbus A350-900 aircraft, expanding its fleet to 24. This signifies confidence in the airline's future and boosts demand for Airbus aircraft.

- July/August 2022: Turkish Airlines acquired three Airbus A350 aircraft originally intended for Aeroflot, illustrating the impact of geopolitical events on market dynamics.

- July 2022: The Turkish Armed Forces received the first batch of the Sungur Weapon System from Roketsan, showcasing advancements in domestic defense technology and strengthening the nation's defense capabilities.

Strategic Turkey Defense & Aerospace Industry Market Outlook

The Turkish defense and aerospace industry is poised for sustained growth over the forecast period, fueled by continuous governmental investment, technological advancements, and a strategic focus on both domestic market dominance and expanding its global presence. Strategic opportunities lie in capitalizing on technological disruptions, focusing on research and development, and strategically engaging with international partners to broaden the reach and impact of Turkish innovation in the global defense and aerospace sector. The strong emphasis on indigenous technology ensures future stability and competitive advantage in the global market.

Turkey Defense & Aerospace Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Turkey Defense & Aerospace Industry Segmentation By Geography

- 1. Turkey

Turkey Defense & Aerospace Industry Regional Market Share

Geographic Coverage of Turkey Defense & Aerospace Industry

Turkey Defense & Aerospace Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Aerospace Segment to Witness Highest Grwoth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Defense & Aerospace Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Turkish Technic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Airbus SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Boeing Compan

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 STM Savunma Teknolojileri Muhendislik ve Ticaret AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ASELSAN AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FNSS Savunma Sistemleri AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KOC Holding AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HAVELSAN AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mechanical and Chemical Industry Company (MKEK)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TUSAS (Turkish Aerospace Industries)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ROKETSAN AS

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BMC Otomotiv Sanayi ve Ticaret AS

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Turkish Technic

List of Figures

- Figure 1: Turkey Defense & Aerospace Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Turkey Defense & Aerospace Industry Share (%) by Company 2025

List of Tables

- Table 1: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Turkey Defense & Aerospace Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Defense & Aerospace Industry?

The projected CAGR is approximately 1.15%.

2. Which companies are prominent players in the Turkey Defense & Aerospace Industry?

Key companies in the market include Turkish Technic, Airbus SE, The Boeing Compan, STM Savunma Teknolojileri Muhendislik ve Ticaret AS, ASELSAN AS, FNSS Savunma Sistemleri AS, KOC Holding AS, HAVELSAN AS, Mechanical and Chemical Industry Company (MKEK), TUSAS (Turkish Aerospace Industries), ROKETSAN AS, BMC Otomotiv Sanayi ve Ticaret AS.

3. What are the main segments of the Turkey Defense & Aerospace Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Aerospace Segment to Witness Highest Grwoth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

September 2023: Turkish Airlines placed an order for ten Airbus A350-900 aircraft. Currently, Turkish Airlines operates a fleet of 14 A350-900s.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Defense & Aerospace Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Defense & Aerospace Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Defense & Aerospace Industry?

To stay informed about further developments, trends, and reports in the Turkey Defense & Aerospace Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence