Key Insights

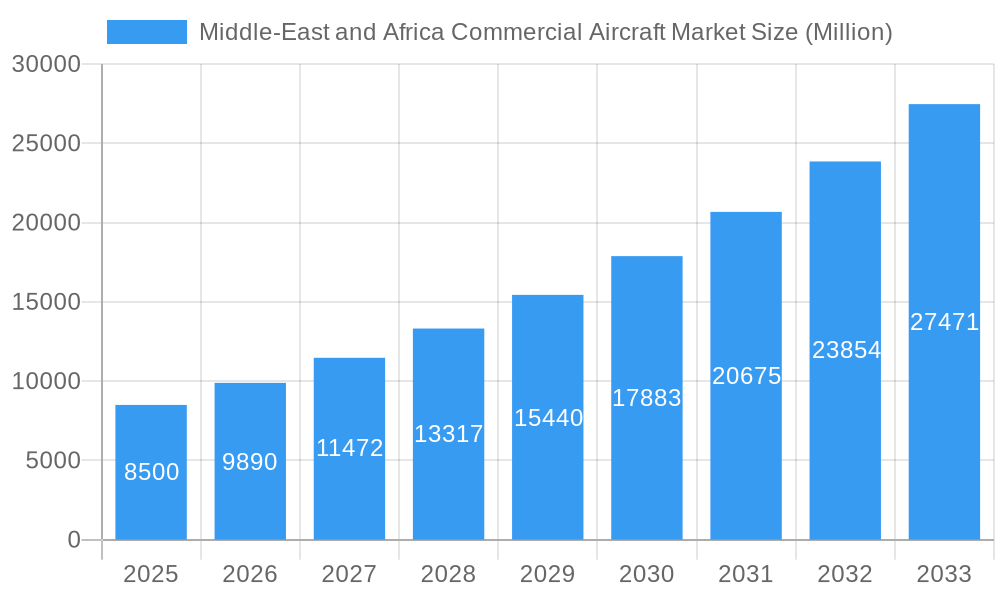

The Middle-East and Africa commercial aircraft market is poised for robust expansion, projected to witness a Compound Annual Growth Rate (CAGR) exceeding 16.00% over the forecast period. With an estimated market size of [estimate a reasonable value based on CAGR and a potential starting point, e.g., $8,500 Million in 2025], this dynamic region is attracting significant investment and witnessing burgeoning demand for air travel. Key drivers fueling this growth include expanding tourism sectors, increasing disposable incomes, and a growing need for modernized fleets to accommodate rising passenger volumes and cargo operations. The region's strategic location also makes it a vital hub for international travel and trade, further stimulating the demand for commercial aircraft. The market segments are primarily driven by turbofan and turboprop engines, serving both passenger aircraft and freighter applications. Key players like Boeing, Airbus, Embraer, and Commercial Aircraft Corporation of China Ltd. are actively vying for market share through fleet modernization programs and strategic partnerships.

Middle-East and Africa Commercial Aircraft Market Market Size (In Billion)

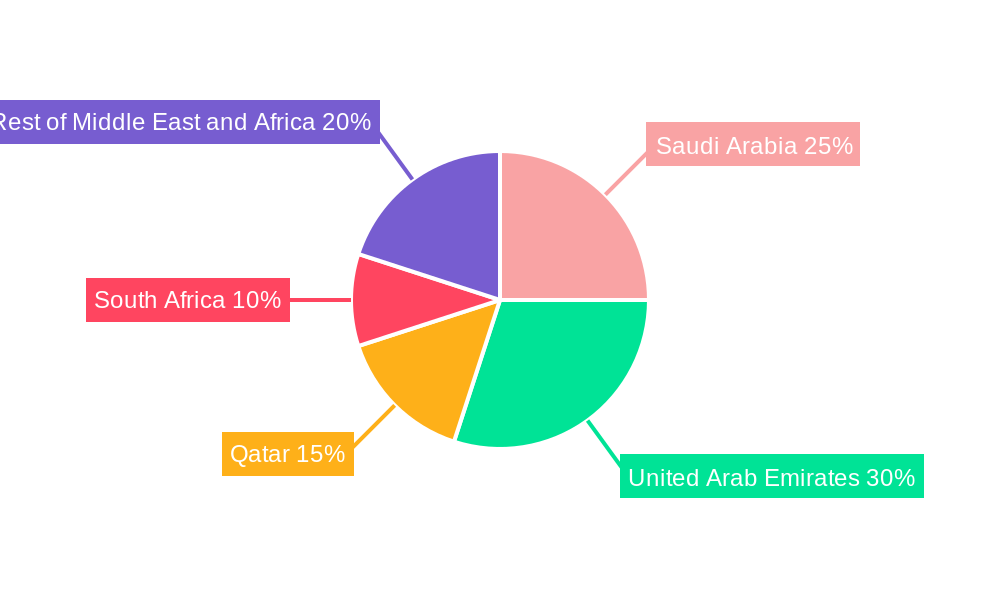

Geographically, Saudi Arabia, the United Arab Emirates, and Qatar are emerging as significant growth pockets, driven by ambitious national visions focused on economic diversification and tourism development. South Africa also presents considerable potential, supported by its established aviation infrastructure and growing economic activity. The "Rest of the Middle-East and Africa" category encompasses a multitude of developing aviation markets, each with unique growth trajectories influenced by infrastructure development and liberalization of air travel policies. While the market exhibits strong upward momentum, potential restraints may include geopolitical instability, fluctuating fuel prices, and the need for substantial investments in airport infrastructure and air traffic management systems to support the projected increase in aircraft operations. Nevertheless, the overarching trend points towards sustained and substantial growth for the commercial aircraft sector across the Middle-East and Africa.

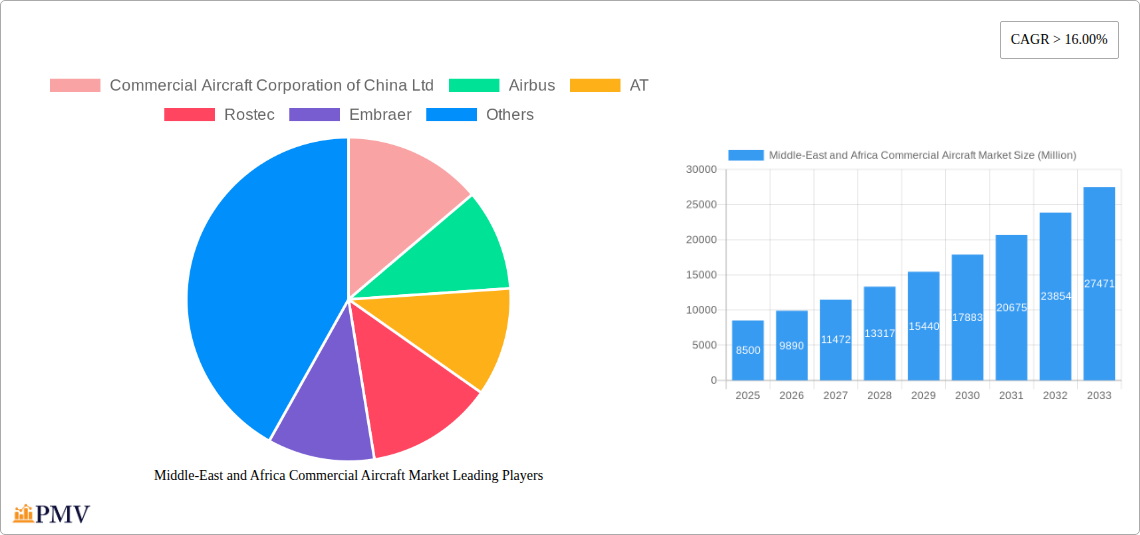

Middle-East and Africa Commercial Aircraft Market Company Market Share

This comprehensive report delivers a detailed analysis of the Middle-East and Africa (MEA) Commercial Aircraft Market, spanning from 2019 to 2033. With 2025 as the base and estimated year, and a forecast period extending to 2033, this study provides unparalleled insights into market dynamics, key players, and future trajectories. We delve into the intricate segments of engine types (Turbofan, Turboprop), applications (Passenger Aircraft, Freighter), and geographical regions including Saudi Arabia, United Arab Emirates, Qatar, South Africa, and the Rest of Middle-East and Africa.

Middle-East and Africa Commercial Aircraft Market Market Structure & Competitive Dynamics

The MEA Commercial Aircraft Market exhibits a moderately concentrated structure, with established global manufacturers like Boeing and Airbus holding significant market share. However, emerging players and regional initiatives are fostering a more dynamic competitive landscape. Innovation ecosystems are primarily driven by advancements in fuel efficiency, sustainable aviation technologies, and enhanced passenger comfort. Regulatory frameworks, while evolving, are crucial in shaping market entry and operational standards across countries like Saudi Arabia and the UAE. Potential product substitutes, though limited in the commercial aviation sector, are being explored through advancements in cargo drone technology and the potential for next-generation air mobility solutions for specific niche applications. End-user trends are leaning towards increased demand for fuel-efficient, longer-range aircraft for passenger travel and specialized freighter aircraft to support e-commerce growth. Mergers and acquisition (M&A) activities, while less prevalent in recent years due to large capital investments, are strategically important for consolidating capabilities and expanding market reach. M&A deal values are significant, often involving multi-billion dollar transactions when they occur.

Middle-East and Africa Commercial Aircraft Market Industry Trends & Insights

The MEA Commercial Aircraft Market is poised for robust growth, driven by a confluence of economic expansion, burgeoning tourism, and significant infrastructure investments across the region. The projected Compound Annual Growth Rate (CAGR) for the commercial aircraft sector in MEA is expected to be around 5.5% over the forecast period. This growth is underpinned by increasing air passenger traffic, fueled by a young and growing population, coupled with government initiatives to boost tourism and economic diversification. Technological disruptions, particularly in the form of more fuel-efficient turbofan engines and the growing interest in sustainable aviation fuels (SAFs), are reshaping aircraft design and procurement decisions. Consumer preferences are increasingly prioritizing passenger experience, leading to demand for advanced cabin interiors, in-flight connectivity, and enhanced safety features. Competitive dynamics are intensifying, with established players vying for market share and new entrants exploring niche segments. Market penetration of advanced aircraft technologies is steadily increasing as airlines seek to optimize operational costs and comply with stricter environmental regulations. The expansion of low-cost carriers and the development of new air routes are further accelerating market growth. The ongoing modernization of air fleets across the region, especially in key markets like the UAE and Saudi Arabia, will continue to be a significant market driver.

Dominant Markets & Segments in Middle-East and Africa Commercial Aircraft Market

The United Arab Emirates and Saudi Arabia are emerging as the dominant markets within the MEA Commercial Aircraft sector, driven by their strategic geographic locations, significant economic diversification efforts, and ambitious aviation infrastructure development plans.

- Key Drivers of Dominance (UAE & Saudi Arabia):

- Economic Policies: Governments in these nations are actively promoting aviation as a cornerstone of their economic diversification strategies, leading to substantial investments in airlines, airports, and aerospace manufacturing capabilities.

- Infrastructure Development: Massive investments in airport expansion and modernization, including new mega-projects, are creating a robust ecosystem to support increased air traffic and accommodate larger aircraft.

- Tourism Growth: Ambitious tourism targets and promotional campaigns are driving a surge in passenger demand, necessitating the expansion and modernization of airline fleets.

- Geostrategic Location: The UAE and Saudi Arabia serve as crucial aviation hubs connecting Europe, Asia, and Africa, further bolstering the demand for commercial aircraft.

The Turbofan engine type is overwhelmingly dominant in the MEA Commercial Aircraft Market, accounting for approximately 90% of the market share. This is primarily due to their efficiency, power, and suitability for the long-haul routes that characterize the region's aviation landscape. The Passenger Aircraft application segment leads the market significantly, driven by the burgeoning demand for air travel for both business and leisure. Freighter aircraft, while growing, represent a smaller but important segment, fueled by the expansion of e-commerce and global trade.

Within the geographical breakdown:

- Saudi Arabia: Experiencing rapid growth due to Vision 2030 initiatives, focusing on tourism and economic diversification, leading to substantial aircraft orders for passenger and cargo operations.

- United Arab Emirates: Already a global aviation hub, continues to expand its fleet to cater to its massive transit traffic and growing domestic tourism.

- Qatar: Consistently investing in its national carrier and aviation infrastructure, maintaining a strong presence in the premium passenger and cargo segments.

- South Africa: While facing economic headwinds, remains a key market with a significant need for fleet modernization and expansion to serve its large population and intra-African connectivity.

- Rest of Middle-East and Africa: This diverse segment includes rapidly developing economies in North Africa and parts of Sub-Saharan Africa, where nascent aviation markets are showing promising growth potential, albeit with smaller order sizes.

Middle-East and Africa Commercial Aircraft Market Product Innovations

Product innovations in the MEA Commercial Aircraft Market are sharply focused on enhancing fuel efficiency, reducing emissions, and improving passenger comfort. Manufacturers are heavily investing in advanced aerodynamics, lighter composite materials, and next-generation turbofan engines. The development of sustainable aviation fuels (SAFs) is a critical trend influencing future aircraft design and airline procurement strategies. These innovations aim to provide airlines with reduced operating costs and a stronger environmental profile, aligning with global sustainability goals and regional regulatory pressures.

Report Segmentation & Scope

This report meticulously segments the MEA Commercial Aircraft Market. The Engine Type segmentation includes Turbofan and Turboprop, with Turbofan projected to dominate due to its prevalence in long-haul and medium-haul passenger and freighter aircraft. The Application segmentation covers Passenger Aircraft and Freighter aircraft, with Passenger Aircraft expected to represent the largest market share owing to increasing travel demand. Geographically, the market is analyzed across Saudi Arabia, United Arab Emirates, Qatar, South Africa, and the Rest of Middle-East and Africa. Saudi Arabia and UAE are forecast to exhibit the highest growth rates, while the Rest of MEA presents significant untapped potential.

Key Drivers of Middle-East and Africa Commercial Aircraft Market Growth

Key growth drivers for the MEA Commercial Aircraft Market include robust economic growth and diversification strategies across many nations, particularly Saudi Arabia's Vision 2030. Significant government investments in aviation infrastructure, including new airports and the expansion of existing ones, are creating a favorable environment for fleet expansion. The burgeoning tourism sector, driven by ambitious targets and promotional campaigns in countries like the UAE and Saudi Arabia, is directly fueling demand for passenger aircraft. Furthermore, the strategic location of the region as a global transit hub continues to support substantial passenger and cargo traffic, necessitating larger and more efficient aircraft fleets.

Challenges in the Middle-East and Africa Commercial Aircraft Market Sector

Despite strong growth prospects, the MEA Commercial Aircraft Market faces several challenges. Geopolitical instability in certain regions can deter investment and impact travel demand. Economic downturns or fluctuations in oil prices can affect airlines' purchasing power and operational budgets. High capital expenditure for new aircraft acquisition remains a significant barrier, particularly for smaller carriers. Supply chain disruptions and the increasing complexity of aircraft manufacturing can lead to delivery delays. Stringent regulatory environments and the need for substantial infrastructure upgrades in some parts of the "Rest of MEA" also present hurdles to widespread market penetration.

Leading Players in the Middle-East and Africa Commercial Aircraft Market Market

- Boeing

- Airbus

- Commercial Aircraft Corporation of China Ltd

- Embraer

- AT

- Rostec

- MITSUBISHI HEAVY INDUSTRIES Ltd

Key Developments in Middle-East and Africa Commercial Aircraft Market Sector

- 2023/Q4: Saudi Arabia announces ambitious plans to expand its aviation sector, including new airlines and airport developments, leading to significant interest in new aircraft orders.

- 2023/Q3: Emirates announces a major order for Boeing 787 Dreamliners, reinforcing its commitment to fleet modernization and fuel efficiency.

- 2022/Q1: The UAE announces significant investments in sustainable aviation technologies and infrastructure, signaling a long-term commitment to greener air travel.

- 2021/Q4: Qatar Airways continues its fleet expansion and renewal program, focusing on long-haul passenger and cargo aircraft.

Strategic Middle-East and Africa Commercial Aircraft Market Market Outlook

The strategic outlook for the MEA Commercial Aircraft Market is highly promising, characterized by a continued demand for fuel-efficient and advanced aircraft. Growth accelerators include the ongoing economic diversification and tourism promotion efforts in key countries, substantial investments in aviation infrastructure, and the region's pivotal role as a global air transit hub. The increasing focus on sustainability will drive the adoption of newer generation aircraft and the exploration of alternative fuels. Opportunities lie in catering to the expanding low-cost carrier segment and supporting the growth of e-commerce through dedicated freighter aircraft. Strategic partnerships and collaborations will be crucial for manufacturers to navigate the evolving market demands.

Middle-East and Africa Commercial Aircraft Market Segmentation

-

1. Engine Type

- 1.1. Turbofan

- 1.2. Turboprop

-

2. Application

- 2.1. Passenger Aircraft

- 2.2. Freighter

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Qatar

- 3.4. South Africa

- 3.5. Rest of Middle-East and Africa

Middle-East and Africa Commercial Aircraft Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. South Africa

- 5. Rest of Middle East and Africa

Middle-East and Africa Commercial Aircraft Market Regional Market Share

Geographic Coverage of Middle-East and Africa Commercial Aircraft Market

Middle-East and Africa Commercial Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Airline Fleet Expansion Plans is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 5.1.1. Turbofan

- 5.1.2. Turboprop

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Passenger Aircraft

- 5.2.2. Freighter

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. South Africa

- 5.3.5. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. South Africa

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Engine Type

- 6. Saudi Arabia Middle-East and Africa Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 6.1.1. Turbofan

- 6.1.2. Turboprop

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Passenger Aircraft

- 6.2.2. Freighter

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Qatar

- 6.3.4. South Africa

- 6.3.5. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Engine Type

- 7. United Arab Emirates Middle-East and Africa Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 7.1.1. Turbofan

- 7.1.2. Turboprop

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Passenger Aircraft

- 7.2.2. Freighter

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Qatar

- 7.3.4. South Africa

- 7.3.5. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Engine Type

- 8. Qatar Middle-East and Africa Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Engine Type

- 8.1.1. Turbofan

- 8.1.2. Turboprop

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Passenger Aircraft

- 8.2.2. Freighter

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Qatar

- 8.3.4. South Africa

- 8.3.5. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Engine Type

- 9. South Africa Middle-East and Africa Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Engine Type

- 9.1.1. Turbofan

- 9.1.2. Turboprop

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Passenger Aircraft

- 9.2.2. Freighter

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Qatar

- 9.3.4. South Africa

- 9.3.5. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Engine Type

- 10. Rest of Middle East and Africa Middle-East and Africa Commercial Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Engine Type

- 10.1.1. Turbofan

- 10.1.2. Turboprop

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Passenger Aircraft

- 10.2.2. Freighter

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. Qatar

- 10.3.4. South Africa

- 10.3.5. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Engine Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Commercial Aircraft Corporation of China Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Airbus

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AT

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rostec

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Embraer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MITSUBISHI HEAVY INDUSTRIES Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Boeing

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Commercial Aircraft Corporation of China Ltd

List of Figures

- Figure 1: Middle-East and Africa Commercial Aircraft Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Commercial Aircraft Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 2: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 6: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 10: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 14: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 18: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Engine Type 2020 & 2033

- Table 22: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Middle-East and Africa Commercial Aircraft Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Commercial Aircraft Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Middle-East and Africa Commercial Aircraft Market?

Key companies in the market include Commercial Aircraft Corporation of China Ltd, Airbus, AT, Rostec, Embraer, MITSUBISHI HEAVY INDUSTRIES Ltd, Boeing.

3. What are the main segments of the Middle-East and Africa Commercial Aircraft Market?

The market segments include Engine Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Airline Fleet Expansion Plans is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Commercial Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Commercial Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Commercial Aircraft Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Commercial Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence