Key Insights

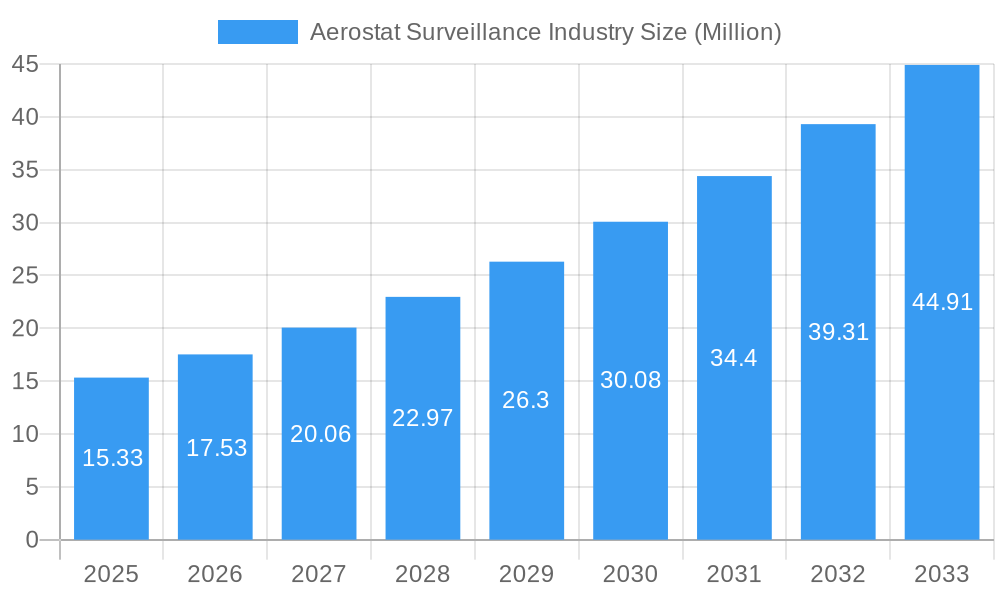

The Aerostat Surveillance market is poised for significant expansion, with a current market size estimated at $15.33 billion in 2025, and projected to grow at an impressive Compound Annual Growth Rate (CAGR) of 14.16% through 2033. This robust growth is fueled by a confluence of factors, primarily the escalating demand for advanced persistent surveillance capabilities across defense and homeland security sectors. Governments worldwide are investing heavily in non-traditional aerial platforms for intelligence, surveillance, and reconnaissance (ISR) missions, driven by an increasing need for real-time situational awareness in complex geopolitical landscapes and border security challenges. The inherent advantages of aerostats, such as extended endurance, wide-area coverage, and cost-effectiveness compared to traditional aircraft and satellites, make them an attractive solution for prolonged monitoring operations. Furthermore, advancements in sensor technology, miniaturization, and data processing are enhancing the operational effectiveness and data delivery of aerostat systems, further stimulating market adoption.

Aerostat Surveillance Industry Market Size (In Million)

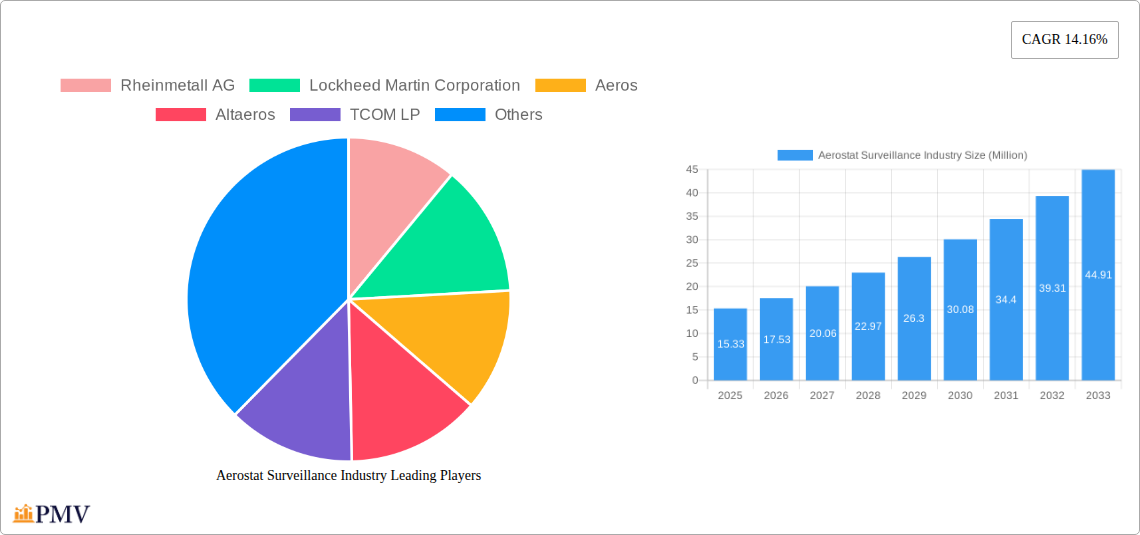

The market's dynamism is further shaped by evolving technological trends and strategic regional developments. Key growth drivers include the increasing deployment of aerostats for border surveillance, counter-terrorism operations, disaster management, and critical infrastructure protection. Emerging applications in commercial sectors, such as telecommunications and environmental monitoring, are also beginning to contribute to market expansion. However, the market is not without its challenges. High initial deployment costs, regulatory hurdles concerning airspace management, and susceptibility to extreme weather conditions represent significant restraints. Despite these challenges, the ongoing innovation in materials, propulsion, and autonomous capabilities, coupled with strategic partnerships and mergers among key players like Rheinmetall AG, Lockheed Martin Corporation, and TCOM LP, are expected to mitigate these limitations and propel the industry forward. The competitive landscape is characterized by a mix of established defense contractors and specialized aerostat manufacturers, all vying for a larger share of this burgeoning market.

Aerostat Surveillance Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global Aerostat Surveillance Industry, providing critical insights for stakeholders seeking to understand market evolution, competitive landscapes, and future growth opportunities. Spanning the historical period of 2019-2024 and projecting forward to 2033, with a base year of 2025, this report leverages advanced analytical methodologies to deliver actionable intelligence. Our study encompasses aerostat systems, surveillance balloons, aerial surveillance technology, persistent surveillance, ISR platforms, and high-altitude platforms, crucial for defense, security, and commercial applications.

Aerostat Surveillance Industry Market Structure & Competitive Dynamics

The Aerostat Surveillance Industry is characterized by a moderate to high level of market concentration, with key players such as Lockheed Martin Corporation, Rheinmetall AG, and IAI dominating significant portions of the global market share. Innovation is a critical competitive differentiator, driven by continuous advancements in sensor technology, communication systems, and materials science. The ecosystem thrives on partnerships between aerostat manufacturers, sensor providers, and end-users, fostering specialized solutions. Regulatory frameworks, particularly in defense and national security, play a pivotal role in shaping market access and product development. While direct product substitutes are limited, competing technologies like drones and satellites present indirect competition, driving the need for aerostats' unique advantages such as prolonged endurance and cost-effectiveness for persistent surveillance. End-user trends indicate a growing demand for integrated ISR solutions, enhanced data processing capabilities, and flexible deployment options. Mergers and acquisitions (M&A) have been strategically employed to consolidate market positions, acquire innovative technologies, and expand geographical reach. For instance, M&A deals valued in the tens of millions to hundreds of millions of dollars have reshaped the competitive landscape, consolidating expertise and market access.

Aerostat Surveillance Industry Industry Trends & Insights

The Aerostat Surveillance Industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This upward trajectory is fueled by escalating global security concerns, the need for persistent intelligence, surveillance, and reconnaissance (ISR) capabilities, and the increasing adoption of aerostat systems for border security, disaster management, and critical infrastructure monitoring. Technological disruptions are at the forefront of this evolution, with advancements in lightweight materials, miniaturized sensors, and artificial intelligence (AI) for data analytics enhancing aerostat performance and operational efficiency. End-user preferences are shifting towards more modular, adaptable, and cost-effective aerial surveillance solutions, where aerostats offer distinct advantages over traditional manned aircraft and satellite systems in terms of loiter time and lower operational costs. Competitive dynamics are intensifying, pushing companies to invest heavily in research and development (R&D) to offer superior sensor payloads, improved communication links, and enhanced autonomous capabilities. The market penetration of sophisticated aerostat surveillance solutions is expected to rise significantly as governments and private entities recognize their strategic value in providing continuous aerial oversight and rapid response capabilities. Market growth drivers include the increasing demand for early warning systems, the need for non-kinetic border monitoring, and the utilization of aerostats for mobile communications relays in remote or disaster-stricken areas.

Dominant Markets & Segments in Aerostat Surveillance Industry

Production Analysis:

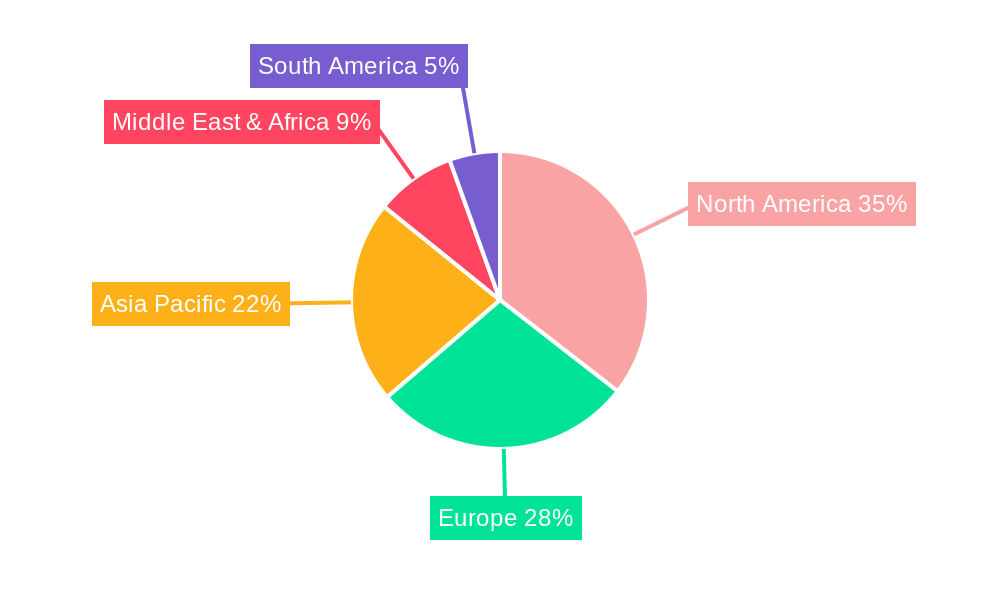

The dominant region in aerostat production is North America, driven by significant government defense spending and the presence of major manufacturers like Lockheed Martin Corporation and TCOM LP. Key drivers include robust R&D investment in advanced aerospace technologies and a strong demand for sophisticated ISR platforms for national security applications. The United States, in particular, leads in the production of large-scale, high-endurance aerostats.

Consumption Analysis:

North America and the Middle East emerge as the dominant regions for aerostat surveillance consumption. In North America, this is driven by ongoing military operations and homeland security initiatives. In the Middle East, geopolitical tensions and border security requirements fuel substantial demand for persistent surveillance solutions. Factors such as the need for advanced threat detection and the deployment of aerostats for intelligence gathering are key consumption drivers.

Import Market Analysis (Value & Volume):

The import market is significantly influenced by countries with advanced defense capabilities and specific operational needs that may not be fully met by domestic production. While North America is a major producer, it also imports specialized components and technologies. The Middle East and certain Asia-Pacific nations are significant importers, driven by a need to bolster their defense and security infrastructure with state-of-the-art aerostat systems. Import values are projected to reach approximately $800 Million by 2025.

Export Market Analysis (Value & Volume):

The United States and Israel are key exporters of aerostat surveillance technology, capitalizing on their technological superiority and established defense relationships. Exports are primarily directed towards allied nations in regions requiring enhanced border security and strategic surveillance. Export volumes are expected to grow, driven by demand for cost-effective and persistent ISR solutions. Export values are estimated to reach around $750 Million by 2025.

Price Trend Analysis:

Price trends in the aerostat surveillance industry are influenced by the complexity of the systems, the payload (sensors, communication equipment), and the scale of the aerostat. While initial capital expenditure can be high, ranging from $1 Million to $50 Million per unit depending on capability, the long operational lifespan and reduced manning requirements offer a favorable total cost of ownership. Pricing is also affected by government procurement cycles and the competitive landscape. The market anticipates a slight downward pressure on prices for standard configurations due to increased competition and technological maturation, while highly customized and advanced systems will command premium pricing.

Aerostat Surveillance Industry Product Innovations

Recent product innovations in the aerostat surveillance industry focus on enhancing ISR capabilities and operational versatility. The joint introduction of a Cellular Geolocation System by IAI/ELTA and RT Aerostat Systems in March 2023 exemplifies this trend, leveraging aerostat platforms to improve emergency response through enhanced cellular signal geolocation. Advancements in radar technology, such as the new radar for long-range threat detection tested with TCOM's High Availability Aerostat System (HAAS), demonstrate a commitment to providing superior situational awareness. These innovations aim to offer greater endurance, improved payload integration, and more intelligent data processing, providing a competitive edge in demanding surveillance environments.

Report Segmentation & Scope

This report meticulously segments the Aerostat Surveillance Industry across crucial analytical dimensions. Production Analysis examines the manufacturing capabilities and output by key regions and companies. Consumption Analysis delves into the demand patterns and adoption rates across various end-user sectors and geographies. Import Market Analysis (Value & Volume) quantifies the inbound flow of aerostat systems and components, identifying key trading partners. Export Market Analysis (Value & Volume) highlights the outbound flow and the global reach of aerostat manufacturers. Finally, Price Trend Analysis tracks the fluctuations in pricing for different aerostat configurations and associated technologies. The scope covers the entire aerostat value chain, from design and manufacturing to deployment and end-user applications, encompassing both military and civilian uses.

Key Drivers of Aerostat Surveillance Industry Growth

The Aerostat Surveillance Industry's growth is primarily driven by an escalating global demand for persistent, cost-effective ISR capabilities. Key drivers include:

- Enhanced National Security Requirements: Governments worldwide are investing in advanced surveillance technologies to bolster border security, counter-terrorism efforts, and monitor critical infrastructure.

- Technological Advancements: Innovations in lighter materials, miniaturized sensors, improved communication systems, and AI-driven data analytics are making aerostats more capable and versatile.

- Cost-Effectiveness: Compared to manned aircraft and some satellite solutions, aerostats offer a lower cost of operation and deployment for long-duration surveillance missions, typically in the range of $10,000 to $50,000 per day.

- Increased Demand for Persistent ISR: The need for continuous aerial observation in complex environments necessitates platforms like aerostats that can remain airborne for extended periods, often weeks or months.

- Disaster Management and Communications: Aerostats are increasingly recognized for their utility in providing aerial support during natural disasters, acting as communication relays and surveillance platforms in areas with damaged infrastructure.

Challenges in the Aerostat Surveillance Industry Sector

Despite robust growth, the Aerostat Surveillance Industry faces several challenges that can impact market expansion:

- Regulatory Hurdles: Obtaining flight permits and navigating airspace regulations, especially for commercial applications, can be complex and time-consuming.

- Supply Chain Vulnerabilities: Reliance on specialized components and materials can lead to supply chain disruptions, impacting production timelines and costs.

- Perception and Acceptance: In some sectors, there might be a lag in the adoption of aerostat technology due to unfamiliarity or a preference for established systems.

- Adverse Weather Conditions: While designed for resilience, extreme weather events can temporarily affect aerostat operations, necessitating robust contingency planning.

- Competition from Emerging Technologies: Continuous advancements in drone technology and other aerial platforms present ongoing competitive pressures, requiring aerostat manufacturers to consistently innovate.

Leading Players in the Aerostat Surveillance Industry Market

- Rheinmetall AG

- Lockheed Martin Corporation

- Aeros

- Altaeros

- TCOM LP

- Icarus Training Systems & Airborne Industries

- RosAeroSystems

- RT LTA Systems LTD

- Skydoc Systems Inc

- IAI

- Lindstrand Technologies Ltd

- Carolina Unmanned Vehicles Inc

- Allsopp Helikites Ltd

- CNIM

- Raven Industries Inc

- ILC Dover LP

- Otonom Technology

Key Developments in Aerostat Surveillance Industry Sector

- March 2023: IAI/ELTA and RT Aerostat Systems jointly introduced a life-saving Cellular Geolocation System. Leveraging aerostat technology, this system enhances cellular signals for geolocation in emergencies, aiding in swift & accurate location determination, improving response times and potentially saving lives in critical scenarios.

- May 2022: Spire Global received a five-year, multimillion-dollar award to provide weather forecasts for TCOM, an intelligence, surveillance, and reconnaissance (ISR) firm based in the US. The subcontract would provide weather forecasts in ten sites where TCOM operates aerostats.

- November 2021: The Israeli Ministry of Defense (MoD) announced that the Israel Missile Defense Organization (IMDO) was testing an aerostat with a new radar capable of detecting long-range threats. The High Availability Aerostat System (HAAS) was manufactured by the US company TCOM. The radar was developed with the US Missile Defense Agency and Elta Systems Ltd., a subsidiary of IAI.

Strategic Aerostat Surveillance Industry Market Outlook

The strategic outlook for the Aerostat Surveillance Industry is highly positive, driven by an increasing recognition of aerostats as indispensable tools for modern ISR and communication needs. Future growth will be propelled by the integration of advanced AI and machine learning for real-time data analysis, enabling more sophisticated threat detection and intelligence gathering. The development of modular and rapidly deployable aerostat systems will cater to diverse operational requirements, from border security to rapid response in disaster zones. Strategic partnerships and collaborations between aerostat manufacturers, sensor developers, and software providers will be crucial for delivering comprehensive, end-to-end solutions. The industry is also likely to see expanded applications in commercial sectors, including environmental monitoring, telecommunications, and infrastructure inspection, further diversifying the market and accelerating its growth trajectory, with market valuations projected to exceed $5 Billion by 2033.

Aerostat Surveillance Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Aerostat Surveillance Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aerostat Surveillance Industry Regional Market Share

Geographic Coverage of Aerostat Surveillance Industry

Aerostat Surveillance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Military and Law Enforcement Segment to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerostat Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Aerostat Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Aerostat Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Aerostat Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Aerostat Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Aerostat Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rheinmetall AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aeros

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Altaeros

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TCOM LP

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Icarus Training Systems & Airborne Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RosAeroSystems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RT LTA Systems LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Skydoc Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 IAI

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lindstrand Technologies Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Carolina Unmanned Vehicles Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Allsopp Helikites Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 CNIM

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Raven Industries Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ILC Dover LP

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Otonom Technology

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Rheinmetall AG

List of Figures

- Figure 1: Global Aerostat Surveillance Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aerostat Surveillance Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Aerostat Surveillance Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Aerostat Surveillance Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Aerostat Surveillance Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Aerostat Surveillance Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Aerostat Surveillance Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Aerostat Surveillance Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Aerostat Surveillance Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Aerostat Surveillance Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Aerostat Surveillance Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Aerostat Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Aerostat Surveillance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Aerostat Surveillance Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Aerostat Surveillance Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Aerostat Surveillance Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Aerostat Surveillance Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Aerostat Surveillance Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Aerostat Surveillance Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Aerostat Surveillance Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Aerostat Surveillance Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Aerostat Surveillance Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Aerostat Surveillance Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Aerostat Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Aerostat Surveillance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Aerostat Surveillance Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Aerostat Surveillance Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Aerostat Surveillance Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Aerostat Surveillance Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Aerostat Surveillance Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Aerostat Surveillance Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Aerostat Surveillance Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Aerostat Surveillance Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Aerostat Surveillance Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Aerostat Surveillance Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Aerostat Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Aerostat Surveillance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Aerostat Surveillance Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Aerostat Surveillance Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Aerostat Surveillance Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Aerostat Surveillance Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Aerostat Surveillance Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Aerostat Surveillance Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Aerostat Surveillance Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Aerostat Surveillance Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Aerostat Surveillance Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Aerostat Surveillance Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Aerostat Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Aerostat Surveillance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Aerostat Surveillance Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Aerostat Surveillance Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Aerostat Surveillance Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Aerostat Surveillance Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Aerostat Surveillance Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Aerostat Surveillance Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Aerostat Surveillance Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Aerostat Surveillance Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Aerostat Surveillance Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Aerostat Surveillance Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Aerostat Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Aerostat Surveillance Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerostat Surveillance Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Aerostat Surveillance Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Aerostat Surveillance Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Aerostat Surveillance Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Aerostat Surveillance Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Aerostat Surveillance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Aerostat Surveillance Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Aerostat Surveillance Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Aerostat Surveillance Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Aerostat Surveillance Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Aerostat Surveillance Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Aerostat Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Aerostat Surveillance Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Aerostat Surveillance Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Aerostat Surveillance Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Aerostat Surveillance Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Aerostat Surveillance Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Aerostat Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Aerostat Surveillance Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Aerostat Surveillance Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Aerostat Surveillance Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Aerostat Surveillance Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Aerostat Surveillance Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Aerostat Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Aerostat Surveillance Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Aerostat Surveillance Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Aerostat Surveillance Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Aerostat Surveillance Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Aerostat Surveillance Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Aerostat Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Aerostat Surveillance Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Aerostat Surveillance Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Aerostat Surveillance Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Aerostat Surveillance Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Aerostat Surveillance Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Aerostat Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Aerostat Surveillance Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerostat Surveillance Industry?

The projected CAGR is approximately 14.16%.

2. Which companies are prominent players in the Aerostat Surveillance Industry?

Key companies in the market include Rheinmetall AG, Lockheed Martin Corporation, Aeros, Altaeros, TCOM LP, Icarus Training Systems & Airborne Industries, RosAeroSystems, RT LTA Systems LTD, Skydoc Systems Inc, IAI, Lindstrand Technologies Ltd, Carolina Unmanned Vehicles Inc, Allsopp Helikites Ltd, CNIM, Raven Industries Inc, ILC Dover LP, Otonom Technology.

3. What are the main segments of the Aerostat Surveillance Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Military and Law Enforcement Segment to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

March 2023: IAI/ELTA and RT Aerostat Systems jointly introduced a life-saving Cellular Geolocation System. Leveraging aerostat technology, this system enhances cellular signals for geolocation in emergencies. It aids in swift & accurate location determination, improving response times and potentially saving lives in critical scenarios.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerostat Surveillance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerostat Surveillance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerostat Surveillance Industry?

To stay informed about further developments, trends, and reports in the Aerostat Surveillance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence