Key Insights

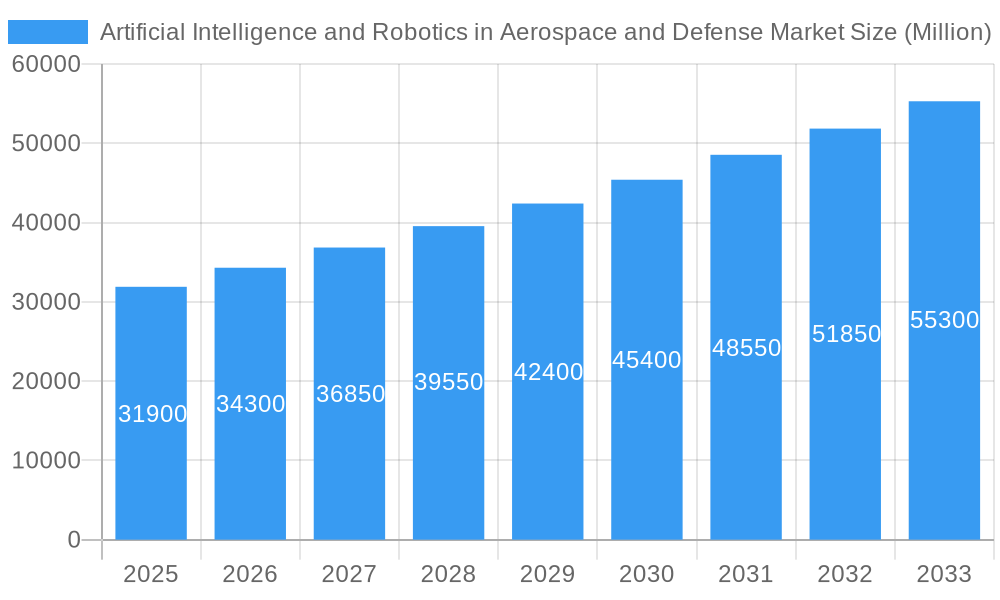

The Artificial Intelligence (AI) and Robotics in Aerospace and Defense market is poised for substantial expansion, projected to reach a market size of USD 31.90 billion. This impressive growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 7.50% throughout the forecast period of 2025-2033. This significant market momentum is driven by a confluence of factors, including the increasing demand for enhanced surveillance and reconnaissance capabilities, the critical need for advanced threat detection and response systems, and the continuous pursuit of operational efficiencies through automation. The integration of AI and robotics is revolutionizing critical sectors such as military operations, commercial aviation, and space exploration, enabling more sophisticated data analysis, autonomous navigation, predictive maintenance, and enhanced safety protocols. These advancements are crucial for maintaining a competitive edge in a rapidly evolving global landscape.

Artificial Intelligence and Robotics in Aerospace and Defense Market Market Size (In Billion)

The market's growth is further fueled by key trends such as the development of autonomous drones for various defense and commercial applications, the implementation of AI-powered predictive analytics for aircraft maintenance and operational planning, and the growing adoption of robotic systems for hazardous tasks and intricate manufacturing processes. While the growth is strong, certain restraints could impact the pace, including stringent regulatory frameworks, high initial investment costs for advanced AI and robotics solutions, and concerns regarding data security and ethical implications. The market encompasses diverse offerings, including hardware, software, and services, catering to specific applications across military, commercial aviation, and space sectors. Leading players like Microsoft, Honeywell, Raytheon Technologies, Lockheed Martin, and The Boeing Company are actively investing in research and development, strategic partnerships, and product innovation to capitalize on this burgeoning market.

Artificial Intelligence and Robotics in Aerospace and Defense Market Company Market Share

Here is an SEO-optimized, detailed report description for the Artificial Intelligence and Robotics in Aerospace and Defense Market.

Artificial Intelligence and Robotics in Aerospace and Defense Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report offers a definitive analysis of the Artificial Intelligence (AI) and Robotics in Aerospace and Defense Market, providing critical insights into market dynamics, growth trajectories, and competitive landscapes from 2019 to 2033. Covering the historical period (2019–2024), base year (2025), estimated year (2025), and forecast period (2025–2033), this study is an indispensable resource for stakeholders seeking to understand and capitalize on the rapid advancements in AI and robotics within these crucial sectors. We explore cutting-edge technologies, emerging applications, and strategic imperatives shaping the future of aerospace and defense operations, from advanced manufacturing and autonomous systems to enhanced situational awareness and cybersecurity.

Artificial Intelligence and Robotics in Aerospace and Defense Market Market Structure & Competitive Dynamics

The Artificial Intelligence and Robotics in Aerospace and Defense Market is characterized by a moderately concentrated structure, with a blend of large, established defense contractors and innovative AI technology providers. Market concentration is influenced by the high barriers to entry, including substantial R&D investments, stringent regulatory approvals, and the need for specialized expertise. Key players are actively engaged in fostering innovation ecosystems through strategic partnerships, academic collaborations, and internal R&D initiatives to push the boundaries of AI and robotics. Regulatory frameworks, particularly those concerning national security and data privacy, play a pivotal role in shaping market entry and product development. Product substitutes, while emerging, are largely focused on incremental improvements rather than radical disruptions to AI-driven systems. End-user trends indicate a strong demand for enhanced autonomy, predictive maintenance, intelligent decision support, and secure communication networks, driving significant investment. Mergers and acquisitions (M&A) are a significant aspect of market dynamics, with deal values often in the hundreds of millions to billions of dollars, aimed at consolidating capabilities and expanding market reach. For instance, collaborations are common to integrate specialized AI solutions into larger defense platforms.

- Market Concentration: Moderate, with leading players holding significant market share.

- Innovation Ecosystems: Driven by strategic partnerships, R&D centers, and academic tie-ups.

- Regulatory Frameworks: Strict oversight for security, safety, and data integrity.

- End-User Trends: Focus on autonomy, predictive analytics, and cybersecurity.

- M&A Activities: Strategic acquisitions to enhance technological portfolios and market presence, with deal values ranging from tens of millions to several billion dollars.

Artificial Intelligence and Robotics in Aerospace and Defense Market Industry Trends & Insights

The Artificial Intelligence and Robotics in Aerospace and Defense Market is poised for robust growth, driven by escalating geopolitical tensions, the increasing complexity of military operations, and the imperative for enhanced efficiency and safety in commercial aviation and space exploration. The CAGR of this market is projected to be substantial, reflecting the rapid adoption of AI and robotics across diverse applications. Technological disruptions are at the forefront, with advancements in machine learning, computer vision, natural language processing, and robotic autonomy revolutionizing capabilities. AI-powered systems are enabling autonomous flight, sophisticated threat detection, predictive maintenance for aircraft and spacecraft, and intelligent logistics management. In the defense sector, AI is crucial for enhancing situational awareness, improving command and control, and developing next-generation unmanned aerial vehicles (UAVs) and ground systems. For commercial aviation, AI is optimizing flight paths, improving air traffic management, and personalizing passenger experiences. The space sector is leveraging AI for autonomous satellite operations, space debris management, and advanced data analysis from remote sensing. Consumer preferences are shifting towards systems that offer greater reliability, reduced operational costs, and improved performance under challenging conditions. Competitive dynamics are intensifying as established aerospace and defense giants invest heavily in AI capabilities, while agile tech companies provide specialized solutions. Key trends include the development of AI-driven cybersecurity solutions to protect critical infrastructure and sensitive data, the integration of AI with quantum computing for enhanced processing power and security, and the increasing deployment of collaborative robots (cobots) in manufacturing and maintenance. Market penetration for AI and robotics is steadily increasing across all segments, fueled by continuous innovation and government-led modernization programs. The demand for intelligent automation is a universal trend, impacting everything from drone swarming capabilities to sophisticated pilot assistance systems. The integration of AI across the entire aerospace and defense value chain, from design and manufacturing to operation and maintenance, is a significant industry insight.

Dominant Markets & Segments in Artificial Intelligence and Robotics in Aerospace and Defense Market

The Artificial Intelligence and Robotics in Aerospace and Defense Market exhibits distinct dominance patterns across various regions and segments.

Dominant Regions & Countries:

- North America: Currently leads the market, driven by substantial government defense spending, significant investments in R&D by leading aerospace and defense companies, and a strong presence of AI and robotics technology providers. The United States, in particular, is a hub for innovation and adoption, with extensive programs in autonomous systems, AI-driven intelligence, surveillance, and reconnaissance (ISR), and advanced fighter jet technologies. Economic policies supporting defense modernization and technological advancement are key drivers.

- Europe: Represents a significant and growing market, propelled by initiatives like the European Defence Fund and strong national defense programs in countries such as France, Germany, and the UK. Increased focus on autonomous systems for border security, surveillance, and logistics, alongside commercial aviation advancements in automation and passenger experience, contributes to its dominance. Infrastructure development for testing and deployment of advanced systems is also notable.

- Asia Pacific: Emerging as a rapidly growing region, fueled by increasing defense expenditures in countries like China, India, and South Korea, and a burgeoning commercial aviation sector. Investments in AI for national security, drone technology, and smart manufacturing for aerospace components are on the rise. Government initiatives promoting indigenous defense manufacturing and technological self-reliance are also key drivers.

Dominant Segments:

Offering:

- Software: This segment holds a dominant position due to the increasing demand for AI algorithms, machine learning platforms, data analytics, simulation software, and cybersecurity solutions. Software forms the intelligence layer for robotic systems and enables advanced decision-making processes.

- Key Drivers: Need for intelligent automation, predictive analytics, enhanced situational awareness, cybersecurity of critical systems.

- Hardware: While software is paramount, hardware, including AI-enabled sensors, processors, robotic components, and advanced computing platforms, is also critical. The development of specialized AI chips and integrated robotic platforms is a significant growth area.

- Key Drivers: Demand for advanced sensors, specialized AI processors, autonomous robotic platforms, edge computing capabilities.

- Service: The service segment, encompassing integration, maintenance, training, and consulting for AI and robotics solutions, is experiencing substantial growth as organizations seek expert support in deploying and managing complex systems.

- Key Drivers: Need for system integration, skilled workforce development, ongoing support for complex AI/robotic deployments.

- Software: This segment holds a dominant position due to the increasing demand for AI algorithms, machine learning platforms, data analytics, simulation software, and cybersecurity solutions. Software forms the intelligence layer for robotic systems and enables advanced decision-making processes.

Application:

- Military: This segment is the largest and most dominant, driven by substantial defense budgets globally. The integration of AI and robotics is transforming warfare through autonomous vehicles, intelligent target recognition, enhanced ISR capabilities, logistics optimization, and personnel protection.

- Key Drivers: National security imperatives, modernization of armed forces, counter-terrorism efforts, strategic advantage through advanced technology.

- Commercial Aviation: A rapidly growing segment, focusing on AI for flight path optimization, air traffic control modernization, predictive maintenance of aircraft, enhanced passenger safety, and improved in-flight experiences. Automation in ground operations and aircraft manufacturing also contributes to this segment's growth.

- Key Drivers: Cost reduction in operations, improved safety standards, enhanced passenger experience, efficiency in air traffic management.

- Space: This segment is witnessing significant expansion with AI powering autonomous satellite operations, space debris monitoring and mitigation, advanced data analysis for scientific research, and the development of next-generation space exploration vehicles.

- Key Drivers: Space exploration initiatives, satellite constellation management, need for autonomous space operations, data analysis from celestial bodies.

- Military: This segment is the largest and most dominant, driven by substantial defense budgets globally. The integration of AI and robotics is transforming warfare through autonomous vehicles, intelligent target recognition, enhanced ISR capabilities, logistics optimization, and personnel protection.

Artificial Intelligence and Robotics in Aerospace and Defense Market Product Innovations

Product innovations in the Artificial Intelligence and Robotics in Aerospace and Defense Market are primarily focused on enhancing autonomy, intelligence, and efficiency. Companies are developing sophisticated AI algorithms for real-time data processing, enabling autonomous navigation, predictive maintenance, and dynamic mission planning. Innovations in robotic platforms include advanced manipulators for intricate tasks in space or on aircraft, collaborative robots for manufacturing, and swarming drone technologies for reconnaissance and surveillance. Computer vision and sensor fusion are crucial for improved situational awareness in both military and commercial applications. The competitive advantage stems from creating AI-powered systems that offer superior performance, reduced operational costs, enhanced safety, and the ability to operate in complex, unpredictable environments. The market is seeing a surge in AI-driven cybersecurity solutions to protect sensitive aerospace and defense assets.

Report Segmentation & Scope

This report segments the Artificial Intelligence and Robotics in Aerospace and Defense Market across key dimensions to provide a granular view of market dynamics.

- Offering: The market is analyzed based on Hardware (e.g., sensors, processors, robotic components), Software (e.g., AI algorithms, ML platforms, data analytics, simulation tools), and Service (e.g., integration, maintenance, training, consulting). Each offering segment is evaluated for its current market size, projected growth rates, and competitive landscapes, with services expected to witness significant expansion as adoption rates rise.

- Application: The report further segments the market by Military applications (e.g., autonomous vehicles, ISR, command and control), Commercial Aviation (e.g., flight optimization, predictive maintenance, air traffic management), and Space applications (e.g., satellite operations, space exploration, debris management). Detailed analysis of each application segment includes its specific growth drivers, market penetration, and the unique technological demands it presents.

Key Drivers of Artificial Intelligence and Robotics in Aerospace and Defense Market Growth

The growth of the Artificial Intelligence and Robotics in Aerospace and Defense Market is propelled by several key factors. Increasing defense budgets worldwide are a primary driver, as governments invest in modernizing their military capabilities with advanced technologies like AI-powered drones and autonomous systems. The growing demand for enhanced operational efficiency and cost reduction in both military and commercial aviation sectors is another significant driver, leading to the adoption of AI for predictive maintenance and optimized logistics. Furthermore, rapid technological advancements in AI, machine learning, and robotics are continuously creating new possibilities and applications, pushing the boundaries of what is achievable. The need for improved safety and security, particularly in autonomous systems and cybersecurity for defense, is also fueling market expansion.

Challenges in the Artificial Intelligence and Robotics in Aerospace and Defense Market Sector

Despite its robust growth, the Artificial Intelligence and Robotics in Aerospace and Defense Market faces several significant challenges. Stringent regulatory hurdles and ethical considerations, especially concerning autonomous weapons systems and data privacy in defense applications, can slow down adoption and development. High development and implementation costs associated with cutting-edge AI and robotics technologies pose a barrier for some organizations. Supply chain disruptions and the availability of specialized components can impact production timelines. Moreover, the shortage of skilled personnel with expertise in AI, robotics, and cybersecurity remains a critical bottleneck. Cybersecurity vulnerabilities inherent in interconnected AI systems present a constant threat, requiring continuous investment in robust security measures.

Leading Players in the Artificial Intelligence and Robotics in Aerospace and Defense Market Market

- Microsoft

- Indra Sistemas SA

- Honeywell International Inc

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Iris Automation Inc

- Lockheed Martin Corporation

- IBM Corporation

- Airbus SE

- Spark Cognition

- Thales Group

- SITA

- T-Systems International Gmb

- GE Aviation

- The Boeing Comapny

- Nvidia Corporation

- Northrop Grumman Corporation

- Intel Corporation

Key Developments in Artificial Intelligence and Robotics in Aerospace and Defense Market Sector

- October 2021: IBM and Raytheon Technologies signed a partnership agreement to develop advanced AI, cryptographic, and quantum solutions for the aerospace, defense, and intelligence industries. The systems integrated with AI and quantum technologies are expected to have better-secured communication networks and improved decision-making processes for aerospace and government customers.

- March 2021: HamiltonJet and Sea Machines Robotics signed an agreement to develop a new pilot-assist system that utilizes computer vision and autonomous command and control technologies for waterjets. The companies will integrate autonomy platform capabilities (Sea Machines) and propulsion systems and vessel controls (HamiltonJet) plan to develop a helm-based system that will reduce manual workload and automate navigation control onboard unmanned systems.

Strategic Artificial Intelligence and Robotics in Aerospace and Defense Market Market Outlook

The strategic outlook for the Artificial Intelligence and Robotics in Aerospace and Defense Market is exceptionally promising, characterized by continuous innovation and expanding application horizons. Growth accelerators include the increasing integration of AI and robotics into next-generation defense platforms, driving demand for autonomous capabilities and enhanced combat effectiveness. In commercial aviation, the focus on sustainable operations and passenger safety will further bolster the adoption of AI for flight optimization and predictive maintenance. The burgeoning space sector, with its ambitions for lunar missions, Mars exploration, and satellite constellations, presents vast opportunities for AI-driven autonomous systems. Strategic collaborations between technology providers and large aerospace and defense firms will continue to shape the market, facilitating the development and deployment of sophisticated solutions. Investments in edge AI, quantum computing integration, and advanced cybersecurity will be critical for future growth and maintaining a competitive edge in this dynamic and vital market.

Artificial Intelligence and Robotics in Aerospace and Defense Market Segmentation

-

1. Offering

- 1.1. Hardware

- 1.2. Software

- 1.3. Service

-

2. Application

- 2.1. Military

- 2.2. Commercial Aviation

- 2.3. Space

Artificial Intelligence and Robotics in Aerospace and Defense Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Artificial Intelligence and Robotics in Aerospace and Defense Market Regional Market Share

Geographic Coverage of Artificial Intelligence and Robotics in Aerospace and Defense Market

Artificial Intelligence and Robotics in Aerospace and Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Military Application Segment is Expected to Dominate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Service

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military

- 5.2.2. Commercial Aviation

- 5.2.3. Space

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Service

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Military

- 6.2.2. Commercial Aviation

- 6.2.3. Space

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Service

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Military

- 7.2.2. Commercial Aviation

- 7.2.3. Space

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Service

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Military

- 8.2.2. Commercial Aviation

- 8.2.3. Space

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Service

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Military

- 9.2.2. Commercial Aviation

- 9.2.3. Space

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Microsoft

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Indra Sistemas SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Honeywell International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Raytheon Technologies Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 General Dynamics Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Iris Automation Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Lockheed Martin Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 IBM Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Airbus SE

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Spark Cognition

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Thales Group

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 SITA

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 T-Systems International Gmb

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 GE Aviation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 The Boeing Comapny

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Nvidia Corporation

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Northrop Grumman Corporation

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Intel Corporation

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.1 Microsoft

List of Figures

- Figure 1: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Offering 2025 & 2033

- Figure 3: North America Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 4: North America Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Offering 2025 & 2033

- Figure 9: Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 10: Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Offering 2025 & 2033

- Figure 15: Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 16: Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Offering 2025 & 2033

- Figure 21: Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 22: Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 5: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 8: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 11: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 14: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Artificial Intelligence and Robotics in Aerospace and Defense Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Intelligence and Robotics in Aerospace and Defense Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Artificial Intelligence and Robotics in Aerospace and Defense Market?

Key companies in the market include Microsoft, Indra Sistemas SA, Honeywell International Inc, Raytheon Technologies Corporation, General Dynamics Corporation, Iris Automation Inc, Lockheed Martin Corporation, IBM Corporation, Airbus SE, Spark Cognition, Thales Group, SITA, T-Systems International Gmb, GE Aviation, The Boeing Comapny, Nvidia Corporation, Northrop Grumman Corporation, Intel Corporation.

3. What are the main segments of the Artificial Intelligence and Robotics in Aerospace and Defense Market?

The market segments include Offering, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.90 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Military Application Segment is Expected to Dominate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2021, IBM and Raytheon Technologies signed a partnership agreement to develop advanced AI, cryptographic, and quantum solutions for the aerospace, defense, and intelligence industries. The systems integrated with AI and quantum technologies are expected to have better-secured communication networks and improved decision-making processes for aerospace and government customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Artificial Intelligence and Robotics in Aerospace and Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Artificial Intelligence and Robotics in Aerospace and Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Artificial Intelligence and Robotics in Aerospace and Defense Market?

To stay informed about further developments, trends, and reports in the Artificial Intelligence and Robotics in Aerospace and Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence