Key Insights

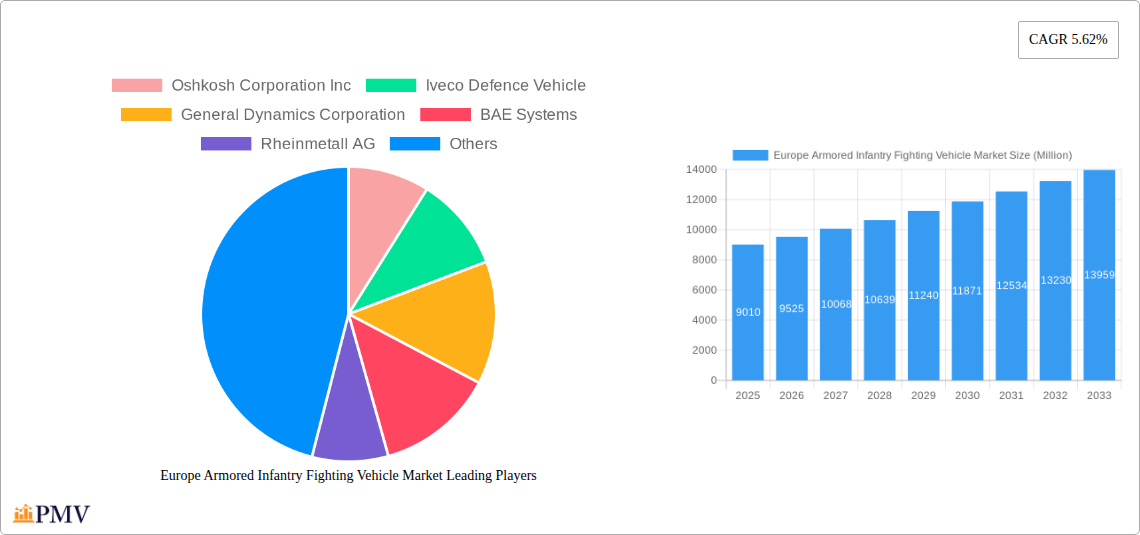

The European Armored Infantry Fighting Vehicle (IFV) market, valued at €9.01 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions and a renewed focus on defense modernization across the region. A Compound Annual Growth Rate (CAGR) of 5.62% from 2025 to 2033 indicates a significant expansion of the market, reaching an estimated value exceeding €14 billion by 2033. Key drivers include increasing defense budgets in major European nations like Germany, France, and the United Kingdom, a demand for technologically advanced vehicles with enhanced protection and firepower, and the ongoing modernization of armed forces across the continent. The market is segmented by vehicle type (Armored Personnel Carriers, Infantry Fighting Vehicles, Main Battle Tanks, and Others) and by country (Germany, UK, France, Russia, Spain, and Rest of Europe), reflecting the diverse needs and procurement strategies of individual nations. Competition is fierce, with major players like Oshkosh, Iveco Defence Vehicles, General Dynamics, BAE Systems, and Rheinmetall vying for market share through technological innovation and strategic partnerships.

Europe Armored Infantry Fighting Vehicle Market Market Size (In Billion)

The market's growth trajectory is influenced by several trends. The increasing adoption of hybrid and electric propulsion systems in military vehicles is a significant factor, alongside the integration of advanced sensor technologies and improved battlefield communication systems. While the market faces restraints such as budget constraints in some European countries and the cyclical nature of military spending, the overall outlook remains positive. The continued threat of regional conflicts and the need for enhanced military readiness will likely propel the market's expansion in the forecast period, with a particular emphasis on technological advancements and the development of next-generation IFVs capable of operating in diverse and challenging environments. The continued focus on collaborative defence projects within the European Union also supports this market growth.

Europe Armored Infantry Fighting Vehicle Market Company Market Share

Europe Armored Infantry Fighting Vehicle Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Armored Infantry Fighting Vehicle (AIFV) market, offering invaluable insights for industry stakeholders, investors, and strategists. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth trajectories. The study delves into key segments, including Armored Personal Carrier (APC), Infantry Fighting Vehicle (IFV), Main Battle Tank (MBT), and Other Types, across major European countries like Germany, the United Kingdom, France, Russia, Spain, and the Rest of Europe. The total market value is projected to reach xx Million by 2033.

Europe Armored Infantry Fighting Vehicle Market Market Structure & Competitive Dynamics

The European AIFV market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Key players, including Oshkosh Corporation Inc, Iveco Defence Vehicles, General Dynamics Corporation, BAE Systems, Rheinmetall AG, ARQUUS Defense, KNDS N V, Patria, Supacat Limited (SC Group), and Military Industrial Company, are engaged in intense competition, characterized by continuous innovation and strategic partnerships. Market share fluctuations are driven by technological advancements, government procurement policies, and ongoing M&A activities. The estimated total market value in 2025 is xx Million.

The regulatory landscape significantly influences market dynamics, with stringent safety and export control regulations impacting production and sales. Innovation ecosystems are evolving rapidly, with significant R&D investments focused on enhancing vehicle functionalities, such as advanced protection systems, improved mobility, and integrated fire control. Product substitutes, like drones and unmanned ground vehicles, are gaining traction, although their impact on the AIFV market remains relatively limited at present. End-user trends reflect a growing emphasis on modularity, adaptability, and network-centric warfare capabilities. M&A activity has been moderate in recent years, with deal values ranging from xx Million to xx Million, primarily focused on strengthening technological capabilities and expanding geographical reach.

Europe Armored Infantry Fighting Vehicle Market Industry Trends & Insights

The European AIFV market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several key factors, including escalating geopolitical tensions, increasing defense budgets across Europe, and a growing demand for modernization and upgrade of existing fleets. Technological advancements, specifically in areas like active protection systems, AI-powered surveillance, and autonomous functionalities, are further fueling market expansion. Changing consumer preferences towards lighter, more agile, and easily maintainable vehicles are also influencing market trends. Market penetration of advanced technologies, such as networked communication systems, is expected to increase significantly during the forecast period, reaching xx% by 2033. Competitive dynamics are shaped by both established players and new entrants vying to capture market share through product differentiation, technological innovation, and strategic alliances.

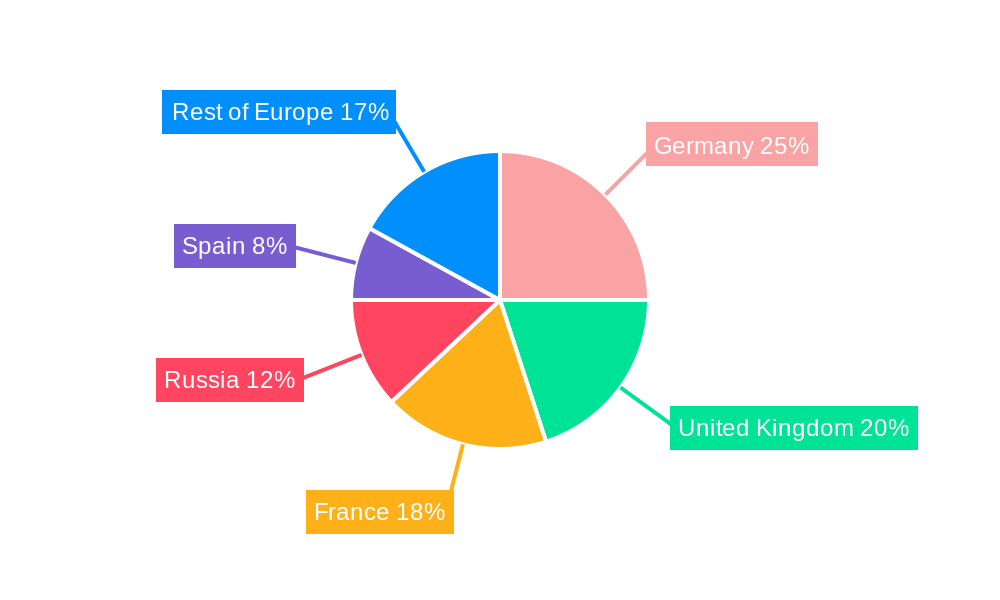

Dominant Markets & Segments in Europe Armored Infantry Fighting Vehicle Market

Germany, the United Kingdom, and France represent the largest markets for AIFVs in Europe, accounting for a combined market share of approximately xx%.

- Key Drivers for Germany: Strong defense spending, robust domestic manufacturing capabilities, and a focus on advanced technology integration.

- Key Drivers for the United Kingdom: Significant military modernization programs, emphasis on interoperability within NATO, and a proactive approach to defense technology development.

- Key Drivers for France: Significant investments in national defense, a strong export orientation, and an emphasis on developing cutting-edge military technologies.

The Infantry Fighting Vehicle (IFV) segment dominates the overall market, driven by its versatility and suitability for a wide range of operational scenarios. The Armored Personal Carrier (APC) segment also holds significant market share, particularly in peacekeeping and internal security operations. The Main Battle Tank (MBT) segment constitutes a smaller portion of the market, primarily due to its high cost and specialized applications.

Europe Armored Infantry Fighting Vehicle Market Product Innovations

Recent innovations in the European AIFV market are largely focused on improving survivability, mobility, and lethality. This includes the incorporation of advanced armor systems, improved suspension and drive systems, and the integration of advanced sensors and weapon systems. Companies are also focusing on the development of hybrid and electric propulsion systems to enhance fuel efficiency and reduce the environmental impact. These innovations aim to enhance operational effectiveness, reduce lifecycle costs, and meet the evolving needs of modern warfare.

Report Segmentation & Scope

This report segments the European AIFV market by type (Armored Personal Carrier (APC), Infantry Fighting Vehicle (IFV), Main Battle Tank (MBT), Other Types) and country (Germany, United Kingdom, France, Russia, Spain, Rest of Europe). Each segment is analyzed based on market size, growth projections, and competitive dynamics. The report provides detailed insights into market trends, competitive landscapes, and growth opportunities within each segment. For instance, the IFV segment is anticipated to witness substantial growth, driven by modernization efforts across various European armed forces. The geographic segmentation reveals country-specific market characteristics and trends, highlighting regional variations in market size, growth rate, and technological adoption.

Key Drivers of Europe Armored Infantry Fighting Vehicle Market Growth

Several factors drive the growth of the European AIFV market. Firstly, rising geopolitical instability and conflicts in the region are prompting increased defense spending by European nations. Secondly, the need to modernize and upgrade aging armored vehicle fleets fuels demand for new AIFVs. Thirdly, technological advancements, such as the integration of advanced sensors, improved communication systems, and autonomous capabilities, are driving innovation and market expansion. Lastly, favorable government policies and initiatives supporting domestic defense industries further stimulate market growth.

Challenges in the Europe Armored Infantry Fighting Vehicle Market Sector

The European AIFV market faces several challenges. Budgetary constraints in some European countries could limit defense spending and hinder market growth. Supply chain disruptions and material shortages due to geopolitical uncertainties can impact production and delivery schedules. Furthermore, intense competition among established players and the emergence of new entrants pose significant competitive pressures, impacting market share and profitability. Stringent regulatory requirements and export control regulations further complicate market dynamics.

Leading Players in the Europe Armored Infantry Fighting Vehicle Market Market

- Oshkosh Corporation Inc

- Iveco Defence Vehicles

- General Dynamics Corporation

- BAE Systems

- Rheinmetall AG

- ARQUUS Defense

- KNDS N V

- Patria

- Supacat Limited (SC Group)

- Military Industrial Company

Key Developments in Europe Armored Infantry Fighting Vehicle Market Sector

- 2023 Q2: Rheinmetall AG announced a significant contract for the supply of AIFVs to a European nation.

- 2022 Q4: BAE Systems unveiled a new generation of AIFV featuring advanced armor and integrated fire control.

- 2021 Q3: Iveco Defence Vehicles secured a contract to upgrade existing AIFV fleets in a European country. (Add more relevant developments with year/month and impactful details)

Strategic Europe Armored Infantry Fighting Vehicle Market Market Outlook

The European AIFV market is poised for continued growth, driven by sustained defense spending, technological advancements, and geopolitical uncertainties. Strategic opportunities exist for companies focused on innovation, particularly in areas such as autonomous systems, AI-powered functionalities, and enhanced protection technologies. Partnerships and collaborations with research institutions and other industry players will play a crucial role in shaping the future of the European AIFV market. The focus on developing lighter, more agile, and environmentally friendly vehicles will also present significant growth opportunities.

Europe Armored Infantry Fighting Vehicle Market Segmentation

-

1. Type

- 1.1. Armored Personal Carrier (APC)

- 1.2. Infantry Fighting Vehicle (IFV)

- 1.3. Main Battle Tank (MBT)

- 1.4. Other Types

Europe Armored Infantry Fighting Vehicle Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Armored Infantry Fighting Vehicle Market Regional Market Share

Geographic Coverage of Europe Armored Infantry Fighting Vehicle Market

Europe Armored Infantry Fighting Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Main Battle Tank Segment is Projected to Lead the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Armored Infantry Fighting Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Armored Personal Carrier (APC)

- 5.1.2. Infantry Fighting Vehicle (IFV)

- 5.1.3. Main Battle Tank (MBT)

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Oshkosh Corporation Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Iveco Defence Vehicle

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Dynamics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BAE Systems

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rheinmetall AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ARQUUS Defense

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KNDS N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Patria

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Supacat Limited (SC Group)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Military Industrial Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Oshkosh Corporation Inc

List of Figures

- Figure 1: Europe Armored Infantry Fighting Vehicle Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Armored Infantry Fighting Vehicle Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Europe Armored Infantry Fighting Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Armored Infantry Fighting Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Armored Infantry Fighting Vehicle Market?

The projected CAGR is approximately 5.62%.

2. Which companies are prominent players in the Europe Armored Infantry Fighting Vehicle Market?

Key companies in the market include Oshkosh Corporation Inc, Iveco Defence Vehicle, General Dynamics Corporation, BAE Systems, Rheinmetall AG, ARQUUS Defense, KNDS N V, Patria, Supacat Limited (SC Group), Military Industrial Company.

3. What are the main segments of the Europe Armored Infantry Fighting Vehicle Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.01 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Main Battle Tank Segment is Projected to Lead the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Armored Infantry Fighting Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Armored Infantry Fighting Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Armored Infantry Fighting Vehicle Market?

To stay informed about further developments, trends, and reports in the Europe Armored Infantry Fighting Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence