Key Insights

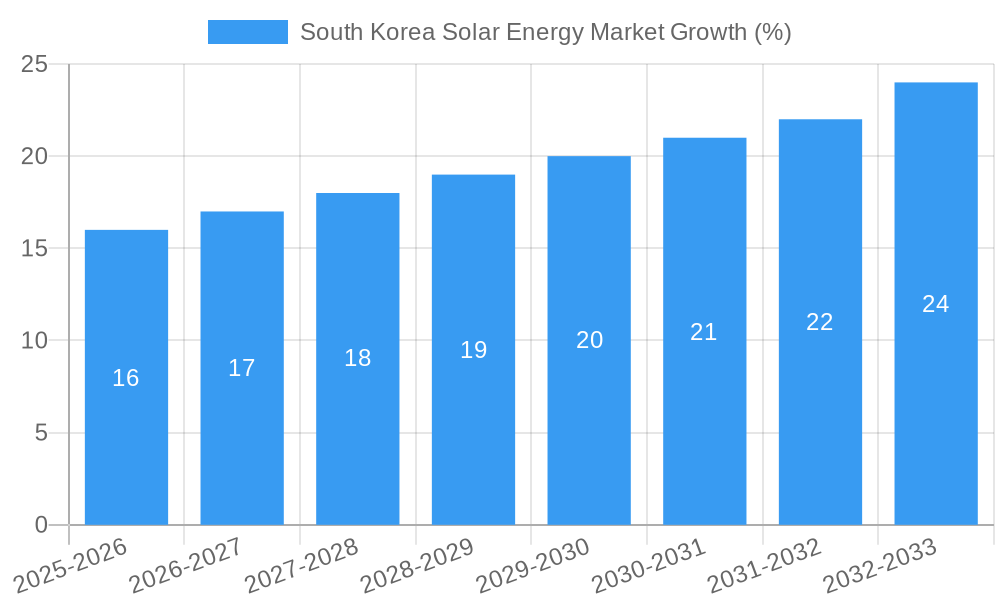

The South Korean solar energy market exhibits robust growth potential, driven by the government's ambitious renewable energy targets and increasing environmental awareness among citizens. With a Compound Annual Growth Rate (CAGR) exceeding 5.5% from 2019 to 2033, the market is projected to experience significant expansion. The market size in 2025 is estimated to be in the hundreds of millions of USD (a precise figure requires more specific data from the original source), considering the global trend of increasing solar adoption and South Korea's proactive policies. Key growth drivers include supportive government policies promoting solar energy adoption, decreasing solar panel costs, and increasing electricity prices making solar a more cost-effective alternative. Trends indicate a shift towards large-scale solar farms (onshore) alongside continued growth in smaller residential and commercial installations. While challenges remain such as land availability for large-scale projects and grid integration complexities, the overall positive outlook is fueled by strong investor interest and technological advancements that continue to enhance efficiency and reduce the cost of solar energy.

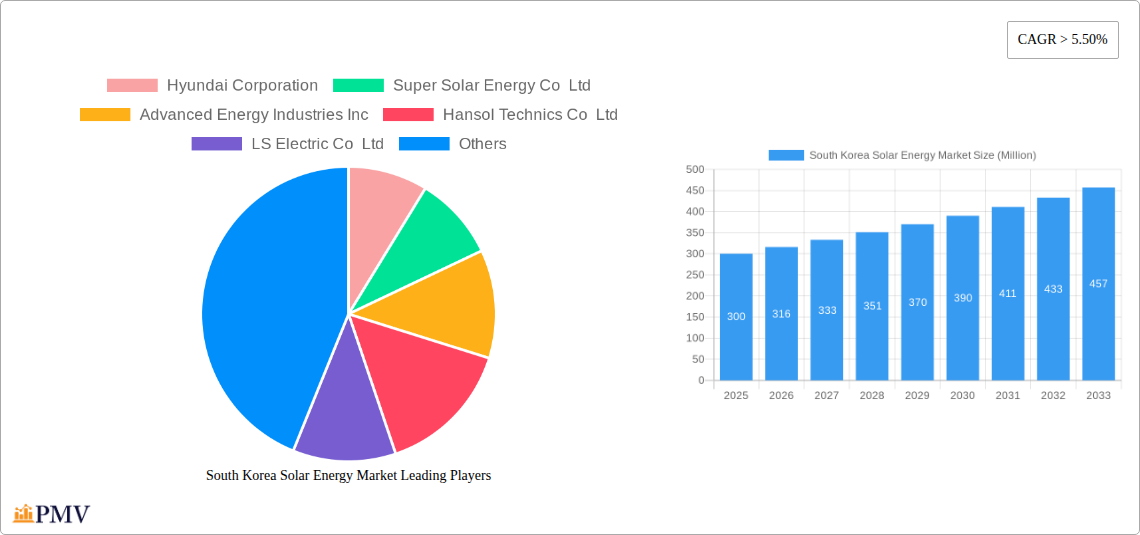

The competitive landscape includes both domestic players like Hyundai Corporation, HanSol Technics Co Ltd, and LS Electric Co Ltd, and international companies. This competition fosters innovation and drives down costs, further accelerating market growth. Segmentation reveals strong performance across both onshore and offshore deployments, although onshore projects likely dominate due to infrastructure advantages and ease of access. While precise regional breakdowns within South Korea are needed for a complete picture, data suggests strong growth potential across various provinces depending on factors like solar irradiance levels and land availability. The forecast period (2025-2033) anticipates sustained growth, making South Korea a key market to watch in the broader Asian renewable energy sector. The historical period (2019-2024) likely showcased a steady increase paving the way for the robust projections. Further analysis incorporating specific market size data would provide even greater clarity.

South Korea Solar Energy Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the South Korea solar energy market, offering in-depth insights into market structure, competitive dynamics, industry trends, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and policymakers seeking to understand this dynamic market.

South Korea Solar Energy Market Market Structure & Competitive Dynamics

The South Korean solar energy market exhibits a moderately concentrated structure, with several key players vying for market share. The market is characterized by a dynamic interplay between established domestic players like Hyundai Corporation, Hansol Technics Co Ltd, LS Electric Co Ltd, Super Solar Energy Co Ltd, S Energy Co Ltd, SG Networks, Topsun Co Ltd, and Luxco Co Ltd, and international companies such as Advanced Energy Industries Inc and Solarwindow Technologies Inc. (Note: This list is not exhaustive).

Market share data for 2024 indicates that the top five players collectively hold approximately xx% of the market, with Hyundai Corporation maintaining a leading position at xx%. Innovation ecosystems are largely driven by government initiatives and research collaborations between universities and private companies. The regulatory framework, while supportive of renewable energy development, faces ongoing challenges in streamlining permitting processes and ensuring grid stability. Product substitutes, primarily fossil fuels, continue to exert competitive pressure, though their market share is gradually declining. End-user trends show a growing preference for rooftop solar installations, particularly among residential consumers. M&A activities in the sector have been relatively moderate in recent years, with deal values totaling approximately xx Million USD in 2024. Notable transactions have involved [mention specific M&A deals if data is available].

South Korea Solar Energy Market Industry Trends & Insights

The South Korean solar energy market is experiencing robust growth, driven by government policies aimed at increasing renewable energy penetration, rising energy costs, and growing environmental awareness among consumers. The market is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million USD by 2033. Technological disruptions are evident in the increasing adoption of high-efficiency solar panels, energy storage solutions, and smart grid technologies. Consumer preferences are shifting towards aesthetically pleasing and cost-effective solar systems, driving innovation in product design and installation methods. The competitive landscape is characterized by intense price competition, ongoing technological advancements, and strategic alliances among market players. Market penetration of solar energy in the electricity mix currently stands at xx% and is expected to increase significantly to xx% by 2033.

Dominant Markets & Segments in South Korea Solar Energy Market

Location of Deployment: Onshore solar installations currently dominate the South Korean market, driven by readily available land and established infrastructure. However, the upcoming Saemangeum Floating Solar Power Project, with its 1,200 MW capacity, signifies the growing potential of the offshore segment. Key drivers for onshore dominance include established grid connections, readily available land in certain regions and government incentives tailored to land-based projects. Offshore development faces challenges related to cost and technological complexities, though it offers the advantage of utilizing otherwise unusable water surface area.

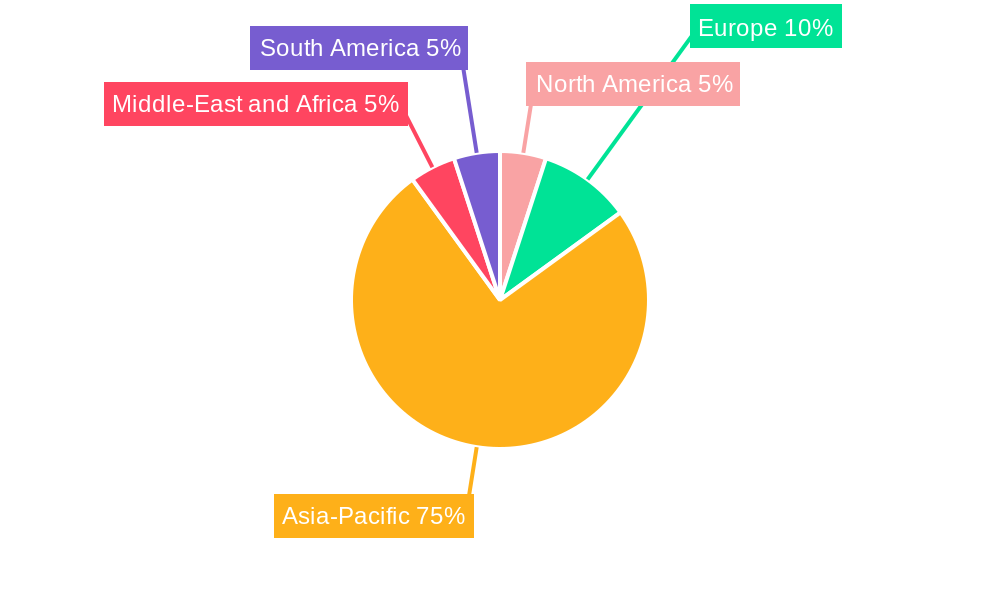

Geography: The Asia-Pacific region, and specifically South Korea itself, represents the dominant market segment within this report’s scope. Government support, including the 2.05 GW allocation in the 2021 auction, coupled with increasing electricity demand, fuels this dominance. Other geographical regions such as North America and Europe have limited direct relevance to this specific market analysis focused on South Korea, though they may indirectly influence technological trends and investment patterns.

The economic policies favoring renewable energy, along with a supportive regulatory environment and robust infrastructure, underpin the South Korean solar energy market's strong performance. Further government investments and a commitment to decarbonization are expected to solidify its leading position within the forecast period.

South Korea Solar Energy Market Product Innovations

Recent product developments focus on enhancing the efficiency and cost-effectiveness of solar panels and energy storage systems. The integration of smart technologies into solar power systems is gaining traction, improving energy management and grid integration capabilities. The development of floating solar power plants signifies a significant technological advancement, optimizing the use of available land resources. These innovations contribute to the increased competitiveness of solar energy in the South Korean market, offering superior performance and reduced costs compared to traditional energy sources.

Report Segmentation & Scope

This report segments the South Korea solar energy market along several key dimensions.

Geography: The analysis is primarily focused on South Korea, with a limited consideration of global trends to provide context.

Location of Deployment: The market is segmented into onshore and offshore installations. Both segments are analyzed separately based on market size, growth projections, and competitive dynamics. Onshore currently holds the larger market share, but offshore is anticipated to demonstrate significant growth.

Each segment is assessed based on its market size, growth projections, and competitive dynamics.

Key Drivers of South Korea Solar Energy Market Growth

Several key factors are driving the growth of the South Korea solar energy market:

- Government support: Subsidies, tax incentives, and feed-in tariffs incentivize solar energy adoption.

- Renewable energy targets: The government's commitment to increasing renewable energy generation fuels demand.

- Technological advancements: Improved efficiency and reduced costs of solar panels boost market attractiveness.

- Rising electricity prices: Increasing electricity costs make solar energy a more financially viable option.

The 2021 KNERC auction, allocating 2.05 GW of capacity, exemplifies this strong government support.

Challenges in the South Korea Solar Energy Market Sector

Despite its growth potential, the South Korean solar energy market faces several challenges:

- Land availability: Limited suitable land for large-scale solar projects can constrain growth.

- Grid integration: Integrating intermittent solar energy into the existing grid requires significant upgrades.

- Supply chain disruptions: Global supply chain issues can impact the availability and cost of solar components. This can impact the timeline for project completion and negatively affect overall growth.

- Competition from other renewable sources: Wind energy and other renewables compete for funding and policy support.

Leading Players in the South Korea Solar Energy Market Market

- Hyundai Corporation

- Super Solar Energy Co Ltd

- Advanced Energy Industries Inc

- Hansol Technics Co Ltd

- LS Electric Co Ltd

- Solarwindow Technologies Inc

- S Energy Co Ltd

- SG Networks

- Topsun Co Ltd

- Luxco Co Ltd

Key Developments in South Korea Solar Energy Market Sector

- July 2021: KNERC allocates 2.05 GW of solar capacity in a recent auction, including 7,663 projects.

- Ongoing: Development of the Saemangeum Floating Solar Power Project (1,200 MW) is underway, expected to commence commercial operation in 2022. This project represents a key development with significant implications for the expansion of the offshore solar energy market in South Korea.

Strategic South Korea Solar Energy Market Market Outlook

The South Korea solar energy market is poised for continued expansion, driven by sustained government support, technological innovation, and increasing environmental awareness. Strategic opportunities exist in the development of large-scale solar projects, particularly offshore, energy storage solutions, and smart grid technologies. Focus on enhancing grid integration capabilities and streamlining permitting processes will further unlock the market's considerable growth potential. The country's ambitious renewable energy targets, coupled with a favorable investment climate, will attract substantial capital investment in the years to come, creating lucrative opportunities for both domestic and international players.

South Korea Solar Energy Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Korea Solar Energy Market Segmentation By Geography

- 1. South Korea

South Korea Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Production from Unconventional Sources4.; Growing Energy Demand in the Region

- 3.3. Market Restrains

- 3.3.1. 4.; Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Upcoming Solar PV Projects Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hyundai Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Super Solar Energy Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Advanced Energy Industries Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hansol Technics Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LS Electric Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Solarwindow Technologies Inc *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 S Energy Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SG Networks

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Topsun Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Luxco Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hyundai Corporation

List of Figures

- Figure 1: South Korea Solar Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Solar Energy Market Share (%) by Company 2024

List of Tables

- Table 1: South Korea Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Solar Energy Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: South Korea Solar Energy Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: South Korea Solar Energy Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: South Korea Solar Energy Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: South Korea Solar Energy Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: South Korea Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Korea Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Korea Solar Energy Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: South Korea Solar Energy Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: South Korea Solar Energy Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: South Korea Solar Energy Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: South Korea Solar Energy Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: South Korea Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Solar Energy Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the South Korea Solar Energy Market?

Key companies in the market include Hyundai Corporation, Super Solar Energy Co Ltd, Advanced Energy Industries Inc, Hansol Technics Co Ltd, LS Electric Co Ltd, Solarwindow Technologies Inc *List Not Exhaustive, S Energy Co Ltd, SG Networks, Topsun Co Ltd, Luxco Co Ltd.

3. What are the main segments of the South Korea Solar Energy Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Production from Unconventional Sources4.; Growing Energy Demand in the Region.

6. What are the notable trends driving market growth?

Upcoming Solar PV Projects Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Environmental Concerns.

8. Can you provide examples of recent developments in the market?

In July 2021, the Korea New and Renewable Energy Center (KNERC), the branch of the Korea Energy Agency, announced that it had allocated 2.05 GW of solar capacity in the latest auction. It included 7,663 solar projects with an average tariff of around KRW 136/kWh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Solar Energy Market?

To stay informed about further developments, trends, and reports in the South Korea Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence