Key Insights

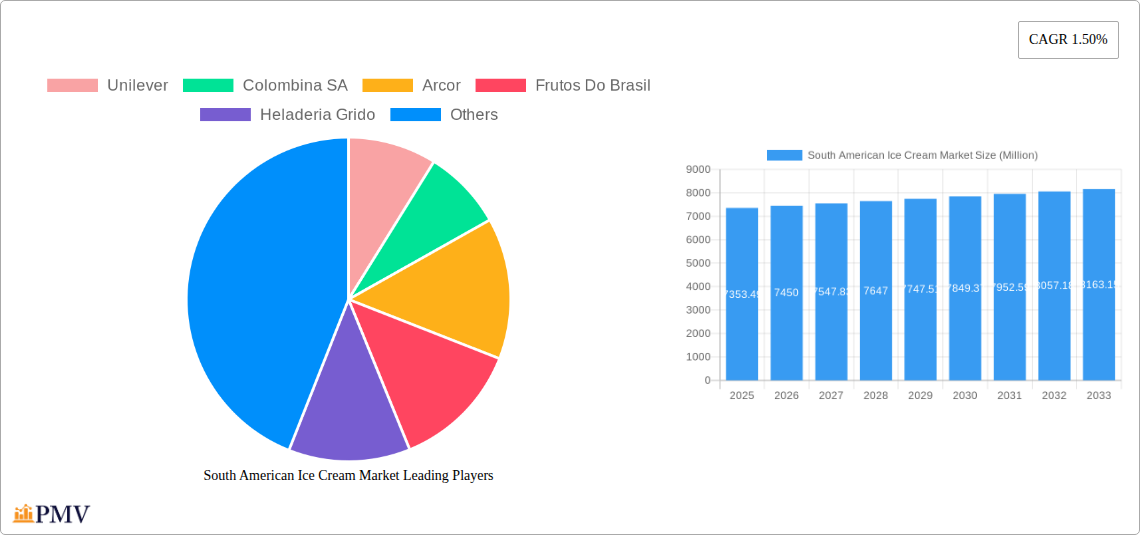

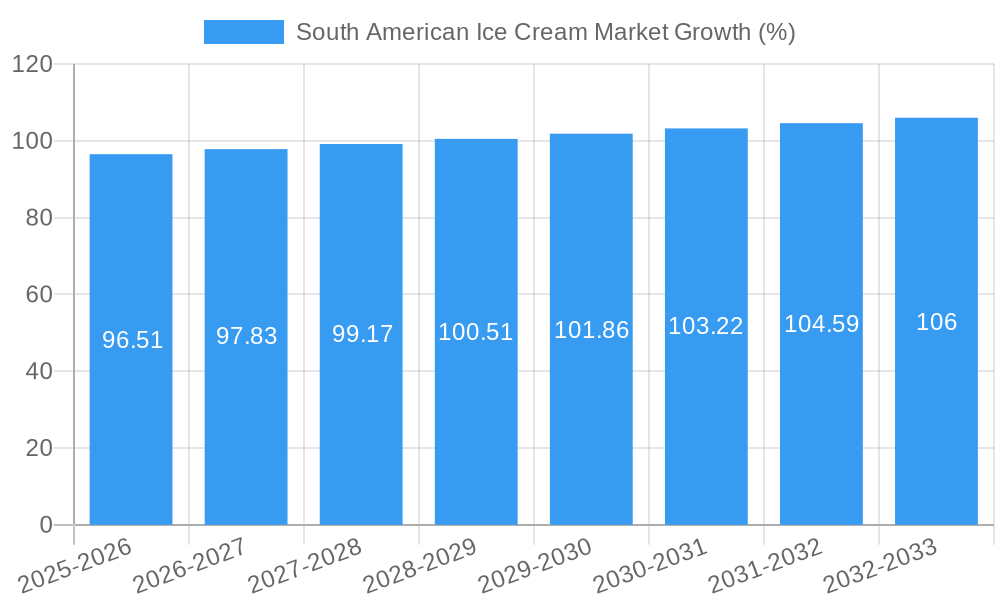

The South American ice cream market, valued at $7,353.49 million in 2025, is projected to experience steady growth, driven by rising disposable incomes, increasing urbanization, and a growing preference for convenient and indulgent treats. The market's Compound Annual Growth Rate (CAGR) of 1.50% from 2019-2024 suggests a consistent, albeit moderate, expansion. Key segments driving this growth include impulse ice cream, readily available in convenience stores and supermarkets, catering to immediate consumption desires. The take-home ice cream segment also contributes significantly, fueled by rising family sizes and increased occasions for at-home consumption. Artisanal ice cream, offering premium quality and unique flavors, represents a niche but rapidly growing segment, appealing to consumers seeking higher-quality experiences. Brazil and Argentina are the largest markets within South America, owing to their significant populations and established ice cream consumption cultures. Competitive pressures from established multinational players like Unilever (with its Kibon brand), Nestlé (including Dreyer's Grand Ice Cream), and Arcor, alongside regional giants like Colombina SA and Heladeria Grido, shape market dynamics. However, economic fluctuations and potential health-consciousness trends could act as restraints on overall market growth. Successful companies will likely focus on innovative product development, effective distribution strategies across diverse channels, and targeted marketing campaigns to reach specific consumer segments.

The forecast period (2025-2033) anticipates continued expansion, although the pace might vary due to external factors. Expansion into smaller cities and towns across South America presents significant opportunities for growth. Companies focusing on sustainable sourcing and eco-friendly packaging will likely find favour with environmentally conscious consumers. The market is likely to see increased diversification of flavors and product formats, driven by evolving consumer tastes and preferences. Furthermore, the integration of technology in ice cream production and distribution could improve efficiency and streamline operations across the supply chain. The successful navigation of these trends will ultimately determine the market leaders in the coming decade.

South American Ice Cream Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South American ice cream market, offering valuable insights into market dynamics, competitive landscape, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report incorporates extensive data and analysis on market size, segmentation, key players, and emerging trends.

South American Ice Cream Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the South American ice cream market, examining market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is characterized by a mix of multinational corporations and regional players, leading to a moderately concentrated structure. Unilever, through brands like Kibon, and Nestlé (including Dreyer's Grand Ice Cream) hold significant market share, estimated at a combined xx% in 2025. However, regional players like Colombina SA, Arcor, and Frutos Do Brasil maintain strong positions within their respective territories, often specializing in local flavors and preferences.

Market share fluctuations are driven by new product launches, aggressive marketing strategies, and strategic acquisitions. The past five years (2019-2024) witnessed several M&A activities, with total deal values estimated at $xx Million. These acquisitions largely focused on consolidating market presence and expanding distribution networks. Innovation in the sector centers around novel flavors catering to diverse consumer tastes, exploring sustainable packaging options, and enhancing the convenience of ice cream consumption. Regulatory frameworks vary across countries but generally focus on food safety and labeling standards. The primary product substitutes include frozen yogurt and other frozen desserts, while increasing health consciousness influences consumer preferences towards lower-sugar or healthier options.

- Key Metrics:

- Unilever/Nestlé Combined Market Share (2025): xx%

- Total M&A Deal Value (2019-2024): $xx Million

- Average Deal Size (2019-2024): $xx Million

South American Ice Cream Market Industry Trends & Insights

The South American ice cream market exhibits robust growth, driven by rising disposable incomes, increasing urbanization, and changing consumer preferences. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the growing popularity of impulse ice cream purchases, particularly among younger demographics. The increasing adoption of online ordering and delivery platforms is also contributing significantly to market expansion. Technological advancements, such as improved refrigeration technologies and automated production lines, are enhancing efficiency and expanding the reach of ice cream manufacturers.

However, challenges persist. Fluctuations in raw material prices, particularly dairy products and fruits, can impact profitability. Furthermore, intense competition requires continuous product innovation and strategic marketing to maintain market share. Consumer preference for healthier options presents both a challenge and an opportunity, motivating companies to develop lower-sugar and organic ice cream varieties. The market penetration of premium ice cream segments is gradually increasing, reflecting growing consumer willingness to spend more on higher-quality products.

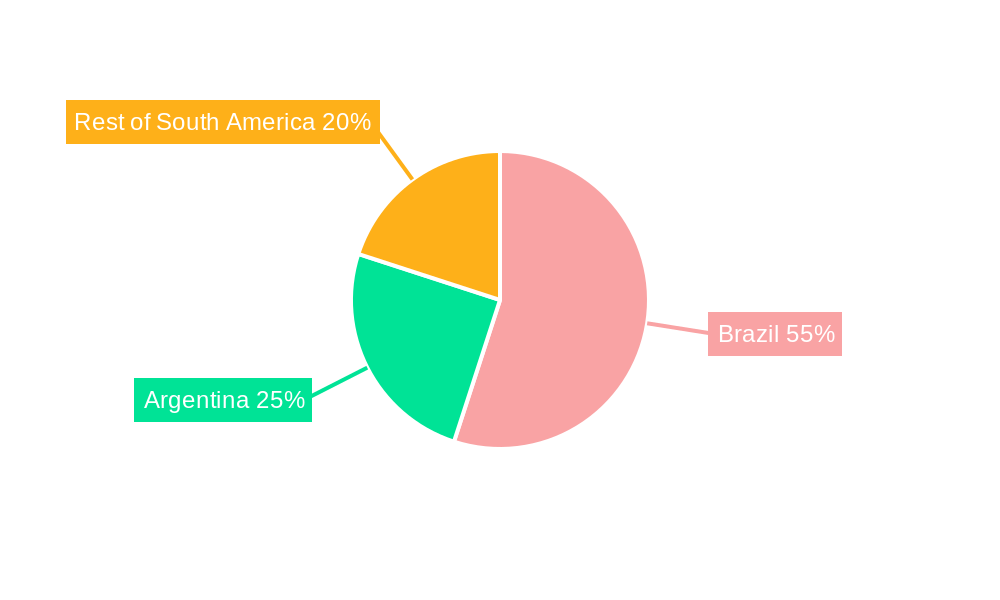

Dominant Markets & Segments in South American Ice Cream Market

Brazil remains the dominant market within South America, accounting for xx% of the total market value in 2025, primarily due to its large population and robust economy. Argentina and Colombia follow as significant markets.

Dominant Segments:

- Type: Take-home ice cream holds the largest market share, followed by impulse ice cream and artisanal ice cream.

- Distribution Channel: Hypermarkets/supermarkets dominate the distribution channels, followed by convenience stores and specialty stores.

Key Drivers of Dominance (Brazil):

- Large and growing population

- High disposable income

- Well-developed retail infrastructure

- Strong consumer preference for ice cream

South American Ice Cream Market Product Innovations

The South American ice cream market witnesses constant product innovation, focusing on diverse flavors catering to local palates, incorporating healthier ingredients, and introducing convenient packaging formats. Technological advancements in production processes enable greater efficiency and lower costs. Companies are actively developing new product lines featuring unique flavor combinations using locally sourced ingredients, aiming to establish a competitive edge. The increasing popularity of plant-based and low-sugar options signifies a shift in consumer preferences, shaping future product development strategies.

Report Segmentation & Scope

This report segments the South American ice cream market by product type (Impulse Ice Cream, Take-home Ice Cream, Artisanal Ice Cream) and distribution channel (Hypermarket/Supermarket, Convenience Store, Specialty Stores, Others). Each segment’s market size, growth projections, and competitive landscape are analyzed in detail. For instance, the take-home ice cream segment is expected to witness steady growth due to its convenient format, while the artisanal ice cream segment is anticipated to exhibit higher growth rates driven by increasing consumer preference for premium products. Similarly, the hypermarket/supermarket channel dominates distribution, but the convenience store and online channels are demonstrating robust growth potential.

Key Drivers of South American Ice Cream Market Growth

Several factors contribute to the growth of the South American ice cream market. Rising disposable incomes in several countries fuel increased spending on discretionary items like ice cream. Urbanization leads to higher ice cream consumption due to increased access to retail outlets and changing lifestyles. Innovative product offerings, including diverse flavors and convenient packaging, attract a broader consumer base. Favorable regulatory frameworks support industry growth. Finally, the rising popularity of e-commerce platforms enhances market access and expands reach.

Challenges in the South American Ice Cream Market Sector

Despite growth prospects, challenges exist. Fluctuating raw material prices, particularly dairy and sugar, impact production costs and profitability. Intense competition requires continuous product innovation and efficient marketing strategies. Seasonal demand fluctuations affect production planning and inventory management. Finally, varying regulatory environments across South American countries present operational complexities.

Leading Players in the South American Ice Cream Market

- Unilever

- Colombina SA

- Arcor

- Frutos Do Brasil

- Heladeria Grido

- Nestlé

- Kibon (a brand of Unilever)

- Grupo Bimbo

- Dreyer's Grand Ice Cream (a division of Nestlé)

- Arcor S A I C

- Cacau Show

Key Developments in South American Ice Cream Market Sector

- 2022 Q3: Unilever launches a new line of vegan ice cream in Brazil.

- 2023 Q1: Arcor expands its distribution network into new regions of Argentina.

- 2024 Q2: Nestlé acquires a smaller artisanal ice cream producer in Colombia.

- 2025 Q1: Increased adoption of e-commerce platforms for ice cream delivery in major cities across South America.

Strategic South American Ice Cream Market Outlook

The South American ice cream market presents significant growth opportunities. Continued investment in product innovation, particularly in healthy and convenient options, is crucial. Expanding distribution channels, particularly in underserved regions and through e-commerce, will enhance market reach. Strategic acquisitions and partnerships can accelerate growth and market consolidation. Companies adept at adapting to changing consumer preferences and navigating regulatory complexities will be best positioned to succeed in this dynamic market.

South American Ice Cream Market Segmentation

-

1. Type

- 1.1. Impulse Ice Cream

- 1.2. Take-home Ice Cream

- 1.3. Artisanal Ice Cream

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Convenience Store

- 2.3. Speciality Stores

- 2.4. Others

-

3. Geography

-

3.1. South America

- 3.1.1. Brazil

- 3.1.2. Argentina

- 3.1.3. Rest of South America

-

3.1. South America

South American Ice Cream Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South American Ice Cream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for meat alternatives

- 3.3. Market Restrains

- 3.3.1. Presence of numerous alternatives in the plant proteins

- 3.4. Market Trends

- 3.4.1. Active Participation of Medium and Small Enterprises in Brazil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South American Ice Cream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Impulse Ice Cream

- 5.1.2. Take-home Ice Cream

- 5.1.3. Artisanal Ice Cream

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Convenience Store

- 5.2.3. Speciality Stores

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.1.1. Brazil

- 5.3.1.2. Argentina

- 5.3.1.3. Rest of South America

- 5.3.1. South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South American Ice Cream Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South American Ice Cream Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South American Ice Cream Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Unilever

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Colombina SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Arcor

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Frutos Do Brasil

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Heladeria Grido

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Nestle*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Kibon (a brand of Unilever)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Grupo Bimbo

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Dreyer's Grand Ice Cream (a division of Nestlé)

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Arcor S A I C

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Cacau Show

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Unilever

List of Figures

- Figure 1: South American Ice Cream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South American Ice Cream Market Share (%) by Company 2024

List of Tables

- Table 1: South American Ice Cream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South American Ice Cream Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: South American Ice Cream Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: South American Ice Cream Market Volume K Tons Forecast, by Type 2019 & 2032

- Table 5: South American Ice Cream Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: South American Ice Cream Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: South American Ice Cream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: South American Ice Cream Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: South American Ice Cream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: South American Ice Cream Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: South American Ice Cream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South American Ice Cream Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: Brazil South American Ice Cream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Brazil South American Ice Cream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Argentina South American Ice Cream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina South American Ice Cream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America South American Ice Cream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of South America South American Ice Cream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: South American Ice Cream Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: South American Ice Cream Market Volume K Tons Forecast, by Type 2019 & 2032

- Table 21: South American Ice Cream Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: South American Ice Cream Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 23: South American Ice Cream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: South American Ice Cream Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 25: South American Ice Cream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South American Ice Cream Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 27: Brazil South American Ice Cream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Brazil South American Ice Cream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Argentina South American Ice Cream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina South American Ice Cream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America South American Ice Cream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America South American Ice Cream Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South American Ice Cream Market?

The projected CAGR is approximately 1.50%.

2. Which companies are prominent players in the South American Ice Cream Market?

Key companies in the market include Unilever, Colombina SA, Arcor, Frutos Do Brasil, Heladeria Grido, Nestle*List Not Exhaustive, Kibon (a brand of Unilever) , Grupo Bimbo , Dreyer's Grand Ice Cream (a division of Nestlé), Arcor S A I C , Cacau Show.

3. What are the main segments of the South American Ice Cream Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7,353.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for meat alternatives.

6. What are the notable trends driving market growth?

Active Participation of Medium and Small Enterprises in Brazil.

7. Are there any restraints impacting market growth?

Presence of numerous alternatives in the plant proteins.

8. Can you provide examples of recent developments in the market?

The launch of new products and flavors

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South American Ice Cream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South American Ice Cream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South American Ice Cream Market?

To stay informed about further developments, trends, and reports in the South American Ice Cream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence