Key Insights

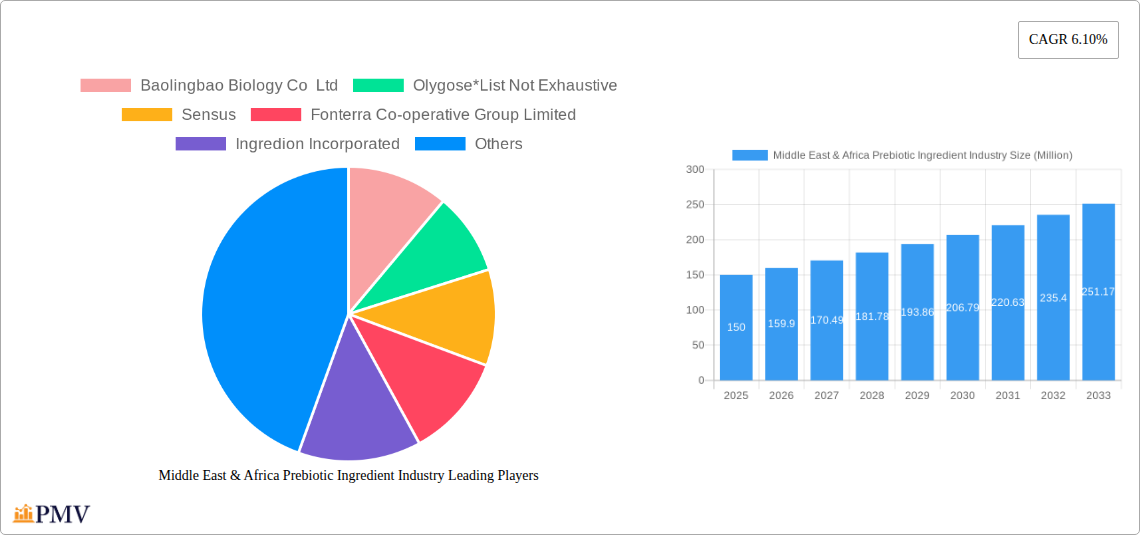

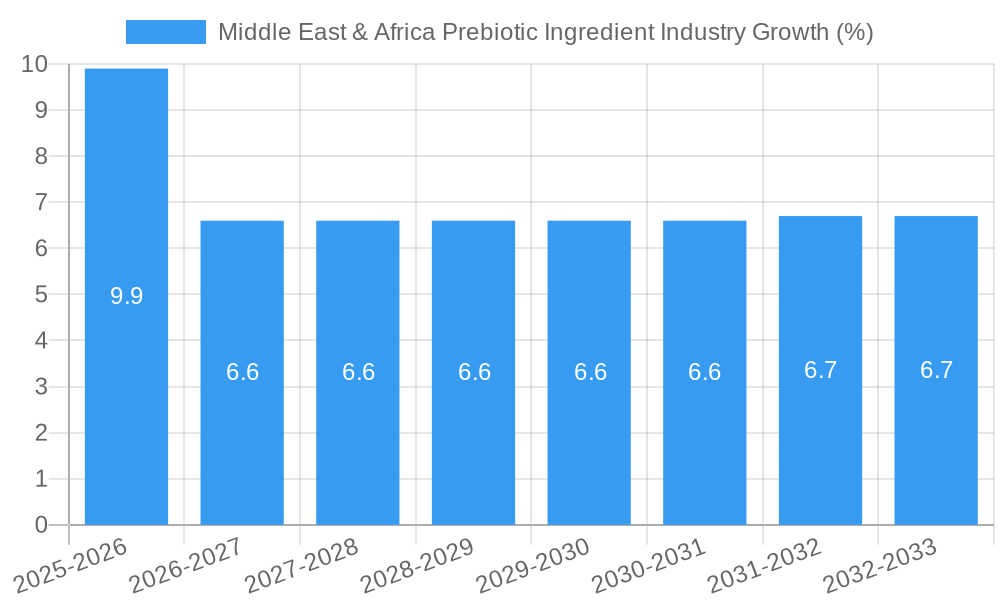

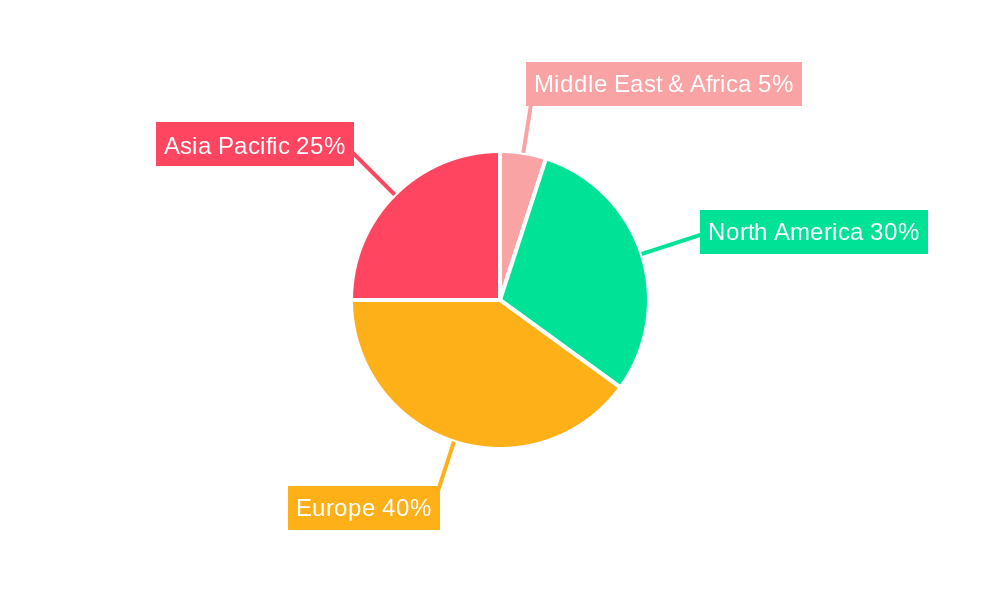

The Middle East and Africa prebiotic ingredient market is experiencing robust growth, driven by increasing consumer awareness of gut health and the functional benefits of prebiotics. The region's expanding population, rising disposable incomes, and a growing preference for healthier food and beverage options are significant contributors to this expansion. The market is segmented by ingredient type (insulin, FOS, GOS, other functional fibers) and application (infant formula, fortified food and beverages, dietary supplements, animal feed). While infant formula currently dominates the application segment, growing demand for functional foods and dietary supplements is fueling expansion in these sectors. Key players like Baolingbao Biology Co Ltd, Olygose, Sensus, Fonterra, and Ingredion are actively competing in this dynamic market, offering a diverse range of prebiotic ingredients tailored to the region's specific needs. The 6.10% CAGR projected for the period 2025-2033 indicates strong future growth potential. Specific regional variations exist within the MEA market, with countries like the UAE, South Africa, and Saudi Arabia representing significant growth pockets, driven by factors such as favorable regulatory environments and investments in food and beverage infrastructure. However, challenges like fluctuating raw material prices and the need for increased consumer education about the benefits of prebiotics remain.

The forecast for the MEA prebiotic ingredient market suggests continued expansion through 2033, driven by factors including increasing health consciousness, the rising prevalence of chronic diseases linked to gut health, and the growth of the food and beverage industry in the region. The market's segmentation by ingredient type and application provides opportunities for targeted product development and marketing strategies. Companies are likely to invest further in research and development to create innovative prebiotic products tailored to the region’s specific dietary preferences and cultural nuances. A focus on sustainable sourcing and ethical manufacturing practices will also become increasingly important, given consumer demand for transparency and sustainability. The substantial growth potential warrants further investment and innovation within the MEA prebiotic market.

Middle East & Africa Prebiotic Ingredient Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the Middle East & Africa prebiotic ingredient market, offering valuable insights for businesses operating in or considering entry into this dynamic sector. Covering the period 2019-2033, with a focus on 2025, this report analyzes market trends, competitive dynamics, and growth opportunities. The study includes detailed segmentations by type and application, allowing for a granular understanding of market performance and future prospects.

Middle East & Africa Prebiotic Ingredient Industry Market Structure & Competitive Dynamics

The Middle East & Africa prebiotic ingredient market exhibits a moderately consolidated structure. Key players such as Baolingbao Biology Co Ltd, Olygose, Sensus, Fonterra Co-operative Group Limited, and Ingredion Incorporated hold significant market share, but the presence of numerous smaller players fosters competition. The market share of the top 5 players is estimated at xx% in 2025. Innovation within the industry is driven by ongoing research into new prebiotic sources and improved extraction techniques. Regulatory frameworks, particularly concerning food safety and labeling, significantly impact market dynamics. The market witnesses considerable M&A activity, with deal values exceeding xx Million in the period 2019-2024. Product substitutes, such as synthetic fibers, pose a competitive threat, but consumer preference for natural ingredients remains a key driver. End-user trends, particularly the growing awareness of gut health, fuel market growth.

- Market Concentration: xx% held by top 5 players in 2025.

- M&A Deal Value (2019-2024): > xx Million

- Key Innovation Areas: Novel prebiotic sources, improved extraction methods.

- Regulatory Focus: Food safety, labeling regulations.

Middle East & Africa Prebiotic Ingredient Industry Industry Trends & Insights

The Middle East & Africa prebiotic ingredient market is experiencing robust growth, with a CAGR of xx% projected from 2025 to 2033. This growth is primarily driven by rising consumer awareness of gut health benefits, increased demand for functional foods and beverages, and the expanding infant formula market. Technological advancements in prebiotic extraction and characterization contribute significantly. Consumer preferences shift towards natural and organic ingredients further boosting demand for prebiotic ingredients. Market penetration of prebiotics in functional food and beverage categories is growing at a rate of xx% annually. Competitive dynamics involve strategies like product diversification, partnerships, and investment in R&D to improve product efficacy and cost-effectiveness. The market is characterized by a growing emphasis on sustainability and ethical sourcing of raw materials.

Dominant Markets & Segments in Middle East & Africa Prebiotic Ingredient Industry

The infant formula segment dominates the prebiotic ingredient market in the Middle East and Africa, driven by growing awareness of the importance of gut health in infants. Within the "By Type" segment, FOS (Fructo-oligosaccharide) and GOS (Galacto-oligosaccharide) hold the largest market shares due to their established efficacy and widespread use. Geographically, xx country is a leading market.

Key Drivers for Infant Formula Segment Dominance:

- Growing awareness of infant gut health benefits.

- Increased disposable incomes and rising health consciousness amongst parents.

- Government initiatives promoting child nutrition.

Key Drivers for FOS/GOS Dominance:

- Established efficacy and safety profiles.

- Wide range of applications across various food products.

- Relatively lower cost compared to other prebiotic types.

Dominant Regions/Countries:

- xx (driven by factors such as [explain country specific reasons, e.g., strong economy, high population growth, supportive regulatory environment])

Other dominant segments: xx (detailed paragraph explaining the reasons for dominance)

Middle East & Africa Prebiotic Ingredient Industry Product Innovations

Recent innovations focus on developing novel prebiotic ingredients derived from sustainable and readily available sources, enhancing their functionality and efficacy. There's a growing trend toward personalized prebiotic formulations catering to specific dietary needs and gut microbiome profiles. This includes exploring prebiotic combinations for synergistic effects. The focus is on improving the solubility, stability, and bioavailability of prebiotics to optimize their effects on gut health. These innovations enhance product differentiation and meet evolving consumer demands, driving market growth.

Report Segmentation & Scope

This report provides a detailed segmentation of the Middle East & Africa prebiotic ingredient market based on:

By Type: Insulin, FOS (Fructo-oligosaccharide), GOS (Galacto-oligosaccharide), Other Ingredients (Including MOS and Other Functional Fibers). Each type displays distinct growth projections, market sizes, and competitive dynamics shaped by factors such as production costs, availability, and functional properties.

By Application: Infant Formula, Fortified Food and Beverage, Dietary Supplements, Animal Feed, Other Applications. Market size and growth vary across applications, reflecting consumer demand trends and regulatory influences within each sector. Competitive landscapes also differ across these applications due to specific requirements and consumer preferences.

Key Drivers of Middle East & Africa Prebiotic Ingredient Industry Growth

The Middle East & Africa prebiotic ingredient market growth is fueled by several key factors: increasing consumer awareness of gut health's importance, expanding functional food and beverage sectors, government support for healthy food initiatives, and advancements in prebiotic extraction and formulation technologies. Rising disposable incomes in several regions further boost market expansion. Favorable regulatory landscapes that support the use of prebiotic ingredients also contribute positively.

Challenges in the Middle East & Africa Prebiotic Ingredient Industry Sector

Challenges include fluctuating raw material prices, inconsistent supply chains impacting production, stringent regulatory approval processes delaying product launches, and the need for robust quality control and standardization. Competition from synthetic alternatives and consumer skepticism about prebiotic efficacy also present headwinds. These factors can create uncertainty and impact profitability within the industry.

Leading Players in the Middle East & Africa Prebiotic Ingredient Industry Market

- Baolingbao Biology Co Ltd

- Olygose

- Sensus

- Fonterra Co-operative Group Limited

- Ingredion Incorporated

- List Not Exhaustive

Key Developments in Middle East & Africa Prebiotic Ingredient Industry Sector

- October 2022: Launch of a novel prebiotic ingredient by X company targeting the infant formula market.

- June 2023: Acquisition of Y company by Z company, expanding market reach and product portfolio.

- March 2024: Introduction of a new regulatory framework concerning prebiotic labeling, impacting market dynamics.

- Further developments will be added in the final report

Strategic Middle East & Africa Prebiotic Ingredient Industry Market Outlook

The Middle East & Africa prebiotic ingredient market holds substantial future potential, driven by ongoing research into novel prebiotic sources, growing health consciousness, and expanding applications across food, beverages, and dietary supplements. Strategic opportunities lie in developing innovative, sustainable, and cost-effective prebiotic solutions tailored to regional preferences. Partnerships and collaborations among industry players can accelerate market growth and improve accessibility to these beneficial ingredients. Focus on sustainability and traceability will become increasingly crucial in enhancing brand reputation and consumer trust.

Middle East & Africa Prebiotic Ingredient Industry Segmentation

-

1. Type

- 1.1. Insulin

- 1.2. FOS (Fructo-oligosaccharide)

- 1.3. GOS (Galacto-oligosaccharide)

- 1.4. Other In

-

2. Application

- 2.1. Infant Formula

- 2.2. Fortified Food and Beverage

- 2.3. Dietary Supplements

- 2.4. Animal Feed

- 2.5. Other Applications

-

3. Geography

- 3.1. South Africa

- 3.2. Saudi Arabia

- 3.3. Rest of Middle East & Africa

Middle East & Africa Prebiotic Ingredient Industry Segmentation By Geography

- 1. South Africa

- 2. Saudi Arabia

- 3. Rest of Middle East

Middle East & Africa Prebiotic Ingredient Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein Rich Food and Supplements; Increasing Application of Collagen in Personal Care Products

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. Acquisitive Demand of Prebiotics for Animal Feed

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insulin

- 5.1.2. FOS (Fructo-oligosaccharide)

- 5.1.3. GOS (Galacto-oligosaccharide)

- 5.1.4. Other In

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infant Formula

- 5.2.2. Fortified Food and Beverage

- 5.2.3. Dietary Supplements

- 5.2.4. Animal Feed

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Saudi Arabia

- 5.3.3. Rest of Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Saudi Arabia

- 5.4.3. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Middle East & Africa Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Insulin

- 6.1.2. FOS (Fructo-oligosaccharide)

- 6.1.3. GOS (Galacto-oligosaccharide)

- 6.1.4. Other In

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infant Formula

- 6.2.2. Fortified Food and Beverage

- 6.2.3. Dietary Supplements

- 6.2.4. Animal Feed

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Saudi Arabia

- 6.3.3. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Saudi Arabia Middle East & Africa Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Insulin

- 7.1.2. FOS (Fructo-oligosaccharide)

- 7.1.3. GOS (Galacto-oligosaccharide)

- 7.1.4. Other In

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infant Formula

- 7.2.2. Fortified Food and Beverage

- 7.2.3. Dietary Supplements

- 7.2.4. Animal Feed

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Saudi Arabia

- 7.3.3. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of Middle East Middle East & Africa Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Insulin

- 8.1.2. FOS (Fructo-oligosaccharide)

- 8.1.3. GOS (Galacto-oligosaccharide)

- 8.1.4. Other In

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infant Formula

- 8.2.2. Fortified Food and Beverage

- 8.2.3. Dietary Supplements

- 8.2.4. Animal Feed

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Saudi Arabia

- 8.3.3. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. UAE Middle East & Africa Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2019-2031

- 10. South Africa Middle East & Africa Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2019-2031

- 11. Saudi Arabia Middle East & Africa Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of MEA Middle East & Africa Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Baolingbao Biology Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Olygose*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sensus

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Fonterra Co-operative Group Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Ingredion Incorporated

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.1 Baolingbao Biology Co Ltd

List of Figures

- Figure 1: Middle East & Africa Prebiotic Ingredient Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East & Africa Prebiotic Ingredient Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 5: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 7: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 9: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 11: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 13: UAE Middle East & Africa Prebiotic Ingredient Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: UAE Middle East & Africa Prebiotic Ingredient Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: South Africa Middle East & Africa Prebiotic Ingredient Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Middle East & Africa Prebiotic Ingredient Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Saudi Arabia Middle East & Africa Prebiotic Ingredient Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Saudi Arabia Middle East & Africa Prebiotic Ingredient Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Rest of MEA Middle East & Africa Prebiotic Ingredient Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of MEA Middle East & Africa Prebiotic Ingredient Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 23: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 25: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 27: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 29: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 31: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 33: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 35: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 37: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 39: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 41: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 43: Middle East & Africa Prebiotic Ingredient Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Middle East & Africa Prebiotic Ingredient Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Prebiotic Ingredient Industry?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Middle East & Africa Prebiotic Ingredient Industry?

Key companies in the market include Baolingbao Biology Co Ltd, Olygose*List Not Exhaustive, Sensus, Fonterra Co-operative Group Limited, Ingredion Incorporated.

3. What are the main segments of the Middle East & Africa Prebiotic Ingredient Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein Rich Food and Supplements; Increasing Application of Collagen in Personal Care Products.

6. What are the notable trends driving market growth?

Acquisitive Demand of Prebiotics for Animal Feed.

7. Are there any restraints impacting market growth?

Increasing Demand for Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Prebiotic Ingredient Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Prebiotic Ingredient Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Prebiotic Ingredient Industry?

To stay informed about further developments, trends, and reports in the Middle East & Africa Prebiotic Ingredient Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence