Key Insights

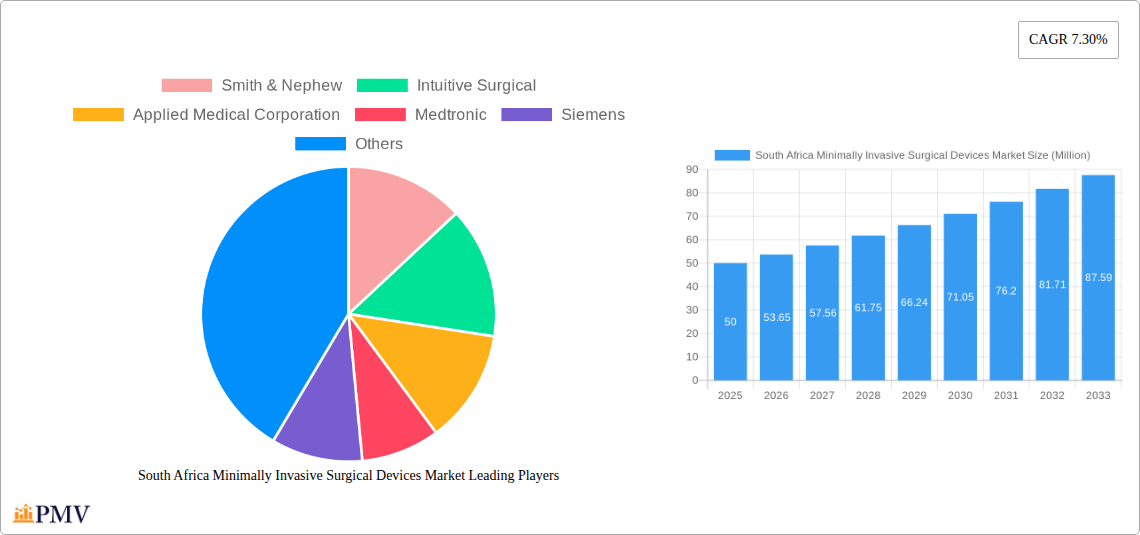

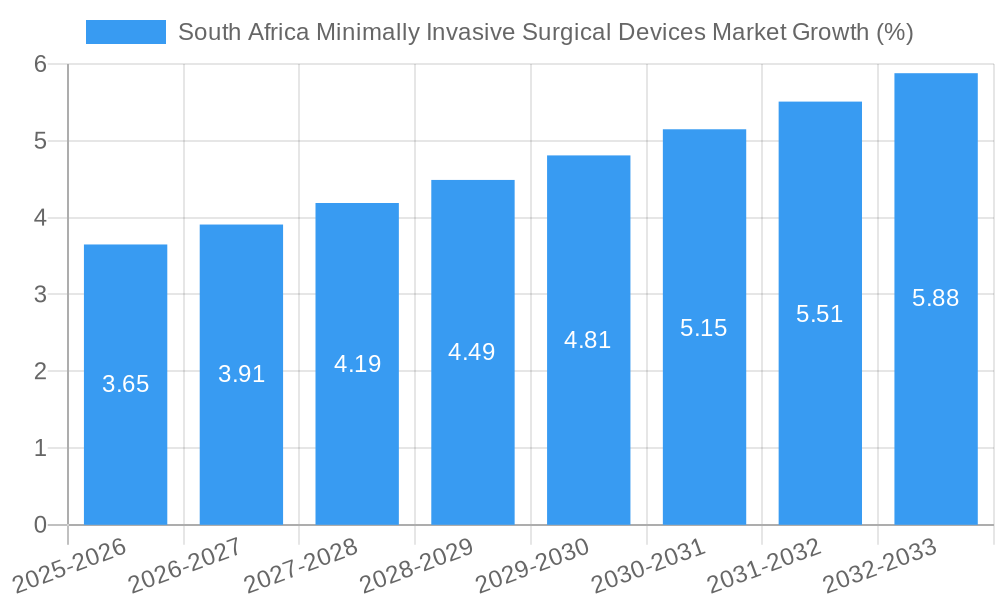

The South African minimally invasive surgical devices (MIS) market is experiencing robust growth, driven by factors such as increasing prevalence of chronic diseases requiring surgical intervention, rising disposable incomes fueling healthcare expenditure, and government initiatives promoting advanced medical technologies. The market's expansion is further propelled by a growing preference for MIS procedures due to their reduced invasiveness, shorter recovery times, and improved patient outcomes compared to traditional open surgeries. Key segments within the market include laparoscopic devices, robotic-assisted surgical systems, and endoscopic devices, all demonstrating significant traction. While the precise market size for South Africa in 2025 is unavailable, considering the global CAGR of 7.3% and South Africa's developing healthcare infrastructure, a reasonable estimation places the market value at approximately $50 million in 2025. This figure is based on extrapolating regional growth trends observed in similar emerging markets. Growth is expected to continue, fuelled by increasing adoption of advanced technologies and expanding private healthcare sector participation.

However, challenges remain. High costs associated with MIS devices, limited healthcare infrastructure in certain regions, and a shortage of skilled surgical professionals may restrain market growth to some extent. Nevertheless, the long-term outlook for the South African MIS devices market remains positive, with consistent growth anticipated throughout the forecast period (2025-2033). The expansion of private healthcare facilities, continuous medical device innovation and government investments in healthcare infrastructure are expected to mitigate some of the existing challenges and fuel ongoing market expansion. Key players like Smith & Nephew, Medtronic, and Intuitive Surgical are likely to maintain a strong presence, while smaller, specialized companies focusing on niche applications within the MIS landscape could also see considerable success.

South Africa Minimally Invasive Surgical Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South Africa minimally invasive surgical devices market, offering invaluable insights for stakeholders across the healthcare ecosystem. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It analyzes market size, growth drivers, challenges, competitive dynamics, and key trends, providing a granular view of this dynamic market expected to reach xx Million by 2033.

South Africa Minimally Invasive Surgical Devices Market Structure & Competitive Dynamics

This section delves into the competitive landscape of the South African minimally invasive surgical devices market. We analyze market concentration, assessing the market share held by key players like Smith & Nephew, Intuitive Surgical, Applied Medical Corporation, Medtronic, Siemens, GE Healthcare, Abbott Laboratories, Philips Healthcare, Johnson & Johnson, Stryker Corporation, and Zimmer Biomet. The report examines the innovation ecosystems, regulatory frameworks governing medical device approvals and distribution, and the presence of substitute products impacting market growth. Furthermore, it explores end-user trends (e.g., increasing preference for minimally invasive procedures) and the impact of mergers and acquisitions (M&A) activities on market consolidation. We estimate that M&A activity in this sector generated xx Million in deal value during the historical period (2019-2024), with a projected increase to xx Million during the forecast period. The report also analyzes the competitive intensity through metrics such as the Herfindahl-Hirschman Index (HHI) and assesses the market's overall competitiveness.

South Africa Minimally Invasive Surgical Devices Market Industry Trends & Insights

This section offers a comprehensive overview of the South African minimally invasive surgical devices market trends, highlighting significant market growth drivers, technological disruptions, evolving consumer preferences, and the resulting impact on competitive dynamics. We project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven primarily by factors such as the increasing prevalence of chronic diseases requiring surgical intervention, rising disposable incomes, and government initiatives promoting healthcare infrastructure development. The market penetration of minimally invasive surgical procedures is also expected to significantly increase, reaching xx% by 2033. The report further analyzes the influence of technological advancements, such as the adoption of robotic-assisted surgical systems and advanced imaging technologies, on market growth and their impact on the preference for minimally invasive procedures.

Dominant Markets & Segments in South Africa Minimally Invasive Surgical Devices Market

This section identifies the dominant segments within the South African minimally invasive surgical devices market, considering both product types and application areas.

Product Segments:

- Robotic Assisted Surgical Systems: This segment is projected to witness the highest growth due to increasing adoption in various surgical specialities.

- Laparoscopic Devices: Strong growth is driven by its wide applications across various surgical specialities.

- Endoscopic Devices: This segment benefits from the increasing demand for minimally invasive diagnostic and therapeutic procedures.

Application Segments:

- Cardiovascular Surgery: This segment is a major contributor to market growth due to the high prevalence of cardiovascular diseases in South Africa.

- Orthopedic Surgery: Growing demand for minimally invasive orthopedic procedures is driving market expansion.

- Gynecological Surgery: This segment is witnessing strong growth due to the increased preference for less invasive gynecological procedures.

Key drivers for these dominant segments include favorable government policies, increasing healthcare expenditure, and improving healthcare infrastructure. The report provides a detailed analysis of each segment’s market size, growth rate, and competitive landscape.

South Africa Minimally Invasive Surgical Devices Market Product Innovations

Recent product developments emphasize miniaturization, improved precision, and enhanced visualization capabilities. Innovations include advanced robotic systems offering increased dexterity and precision, along with improved imaging technologies for better visualization during procedures. These advancements enhance surgical outcomes, reduce recovery times, and contribute to the increasing adoption of minimally invasive surgical techniques. The market is witnessing a trend toward disposable instruments and single-use devices to mitigate infection risks and simplify procedural workflows.

Report Segmentation & Scope

This report segments the South Africa minimally invasive surgical devices market based on product type (Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic Devices, Laproscopic Devices, Monitoring and Visualization Devices, Robotic Assisted Surgical Systems, Ablation Devices, Laser-based Devices, Other MIS Devices) and application (Aesthetic Surgery, Cardiovascular Surgery, Gastrointestinal Surgery, Gynecological Surgery, Orthopedic Surgery, Urological Surgery, Other Applications). Each segment's growth projections, market size (in Millions), and competitive dynamics are detailed within the report. For example, the robotic assisted surgical systems segment is expected to show robust growth, while the laparoscopic devices segment maintains a significant market share.

Key Drivers of South Africa Minimally Invasive Surgical Devices Market Growth

Several factors contribute to the market's growth. Firstly, a rising prevalence of chronic diseases necessitates more surgical interventions. Secondly, technological advancements such as robotic surgery and enhanced imaging capabilities drive demand for sophisticated devices. Thirdly, growing government initiatives promoting healthcare infrastructure development and increasing healthcare expenditure further fuel market growth. Finally, improving access to healthcare and increased health awareness contribute to increased adoption rates.

Challenges in the South Africa Minimally Invasive Surgical Devices Market Sector

The South Africa minimally invasive surgical devices market faces several challenges, including high costs of advanced technologies, limitations in healthcare infrastructure in certain regions, stringent regulatory requirements for device approvals, and the potential for supply chain disruptions. These factors can hinder market growth and affect the affordability and accessibility of minimally invasive surgical procedures for a segment of the population. The report quantifies the impact of these challenges on market growth projections.

Leading Players in the South Africa Minimally Invasive Surgical Devices Market Market

- Smith & Nephew (Smith & Nephew)

- Intuitive Surgical (Intuitive Surgical)

- Applied Medical Corporation (Applied Medical Corporation)

- Medtronic (Medtronic)

- Siemens (Siemens)

- GE Healthcare (GE Healthcare)

- Abbott Laboratories (Abbott Laboratories)

- Philips Healthcare (Philips Healthcare)

- Johnson & Johnson (Johnson & Johnson)

- Stryker Corporation (Stryker Corporation)

- Zimmer Biomet (Zimmer Biomet)

Key Developments in South Africa Minimally Invasive Surgical Devices Market Sector

- July 2022: Netcare Christiaan Barnard Hospital, Cape Town, established a cardiothoracic robotic-assisted surgery program, expanding access to less invasive heart and lung cancer surgeries.

- July 2022: Tygerberg Hospital launched its da Vinci surgical robotic program, marking a first for the South African public health system in robotic surgery. This significantly enhances surgical capabilities and patient care within the public healthcare sector.

Strategic South Africa Minimally Invasive Surgical Devices Market Outlook

The South African minimally invasive surgical devices market presents significant growth potential. Continued technological advancements, increasing healthcare expenditure, and expanding healthcare infrastructure will drive market expansion. Strategic opportunities exist for companies focusing on innovative product development, strategic partnerships, and effective market penetration strategies to capitalize on this growing market. The report highlights specific growth accelerators and strategic opportunities for businesses operating in this sector.

South Africa Minimally Invasive Surgical Devices Market Segmentation

-

1. Products

- 1.1. Handheld Instruments

- 1.2. Guiding Devices

- 1.3. Electrosurgical Devices

- 1.4. Endoscopic Devices

- 1.5. Laproscopic Devices

- 1.6. Monitoring and Visualization Devices

- 1.7. Robotic Assisted Surgical Systems

- 1.8. Ablation Devices

- 1.9. Laser-based Devices

- 1.10. Other MIS Devices

-

2. Application

- 2.1. Aesthetic Surgery

- 2.2. Cardiovascular Surgery

- 2.3. Gastrointestinal Surgery

- 2.4. Gynecological Surgery

- 2.5. Orthopedic Surgery

- 2.6. Urological Surgery

- 2.7. Other Applications

South Africa Minimally Invasive Surgical Devices Market Segmentation By Geography

- 1. South Africa

South Africa Minimally Invasive Surgical Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Adoption Rate of Minimally Invasive Procedures over Traditional Procedures; Technological Advancements in the Field of Minimally Invasive Surgery; Increasing Prevalence of Lifestyle-related and Chronic Disorders

- 3.3. Market Restrains

- 3.3.1. Shortage of Experienced Professionals

- 3.4. Market Trends

- 3.4.1. The Orthopedic segment is expected to Register the Fastest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Minimally Invasive Surgical Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Handheld Instruments

- 5.1.2. Guiding Devices

- 5.1.3. Electrosurgical Devices

- 5.1.4. Endoscopic Devices

- 5.1.5. Laproscopic Devices

- 5.1.6. Monitoring and Visualization Devices

- 5.1.7. Robotic Assisted Surgical Systems

- 5.1.8. Ablation Devices

- 5.1.9. Laser-based Devices

- 5.1.10. Other MIS Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Aesthetic Surgery

- 5.2.2. Cardiovascular Surgery

- 5.2.3. Gastrointestinal Surgery

- 5.2.4. Gynecological Surgery

- 5.2.5. Orthopedic Surgery

- 5.2.6. Urological Surgery

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. Africa South Africa Minimally Invasive Surgical Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. South Africa South Africa Minimally Invasive Surgical Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. Sudan South Africa Minimally Invasive Surgical Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. Uganda South Africa Minimally Invasive Surgical Devices Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. Tanzania South Africa Minimally Invasive Surgical Devices Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. Kenya South Africa Minimally Invasive Surgical Devices Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Smith & Nephew

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Intuitive Surgical

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Applied Medical Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Medtronic

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Siemens

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 GE Healthcare

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Abbott Laboratories

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Philips Healthcare

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Johnson & Johnson

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Stryker Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Zimmer Biomet

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Smith & Nephew

List of Figures

- Figure 1: South Africa Minimally Invasive Surgical Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Minimally Invasive Surgical Devices Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Products 2019 & 2032

- Table 4: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Products 2019 & 2032

- Table 5: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Products 2019 & 2032

- Table 22: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Products 2019 & 2032

- Table 23: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 25: South Africa Minimally Invasive Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South Africa Minimally Invasive Surgical Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Minimally Invasive Surgical Devices Market?

The projected CAGR is approximately 7.30%.

2. Which companies are prominent players in the South Africa Minimally Invasive Surgical Devices Market?

Key companies in the market include Smith & Nephew, Intuitive Surgical, Applied Medical Corporation, Medtronic, Siemens, GE Healthcare, Abbott Laboratories, Philips Healthcare, Johnson & Johnson, Stryker Corporation, Zimmer Biomet.

3. What are the main segments of the South Africa Minimally Invasive Surgical Devices Market?

The market segments include Products, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Adoption Rate of Minimally Invasive Procedures over Traditional Procedures; Technological Advancements in the Field of Minimally Invasive Surgery; Increasing Prevalence of Lifestyle-related and Chronic Disorders.

6. What are the notable trends driving market growth?

The Orthopedic segment is expected to Register the Fastest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Shortage of Experienced Professionals.

8. Can you provide examples of recent developments in the market?

July 2022: At Netcare Christiaan Barnard Hospital Cape Town, a cardiothoracic robotic-assisted surgery program has been formed to offer less invasive alternatives for treatments involving the chest cavity, including, among other things, lung cancer and heart surgeries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Minimally Invasive Surgical Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Minimally Invasive Surgical Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Minimally Invasive Surgical Devices Market?

To stay informed about further developments, trends, and reports in the South Africa Minimally Invasive Surgical Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence