Key Insights

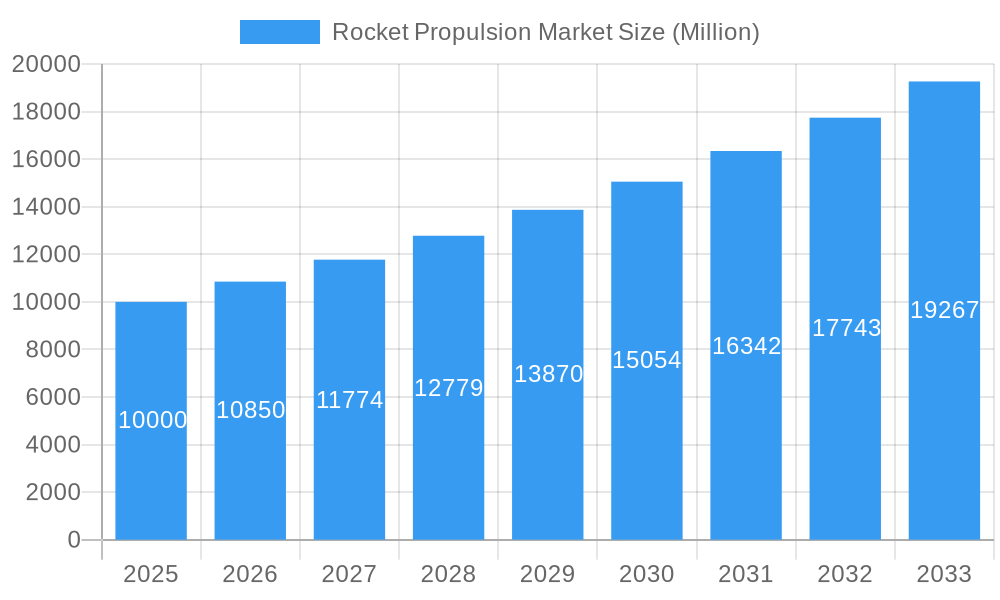

The Rocket Propulsion Market is projected to grow significantly, with a market size expected to reach USD 10,000 million by 2025 and a Compound Annual Growth Rate (CAGR) of over 8.50% during the forecast period from 2025 to 2033. The market's expansion is driven by increasing space exploration missions and the growing commercial space industry, which demand advanced propulsion technologies. Key drivers include the rise in satellite launches for communication, navigation, and earth observation purposes, as well as the development of reusable rocket technologies. Trends shaping the market include the shift towards eco-friendly propulsion systems and the integration of artificial intelligence in rocket design and operation, enhancing efficiency and reliability.

Rocket Propulsion Market Market Size (In Billion)

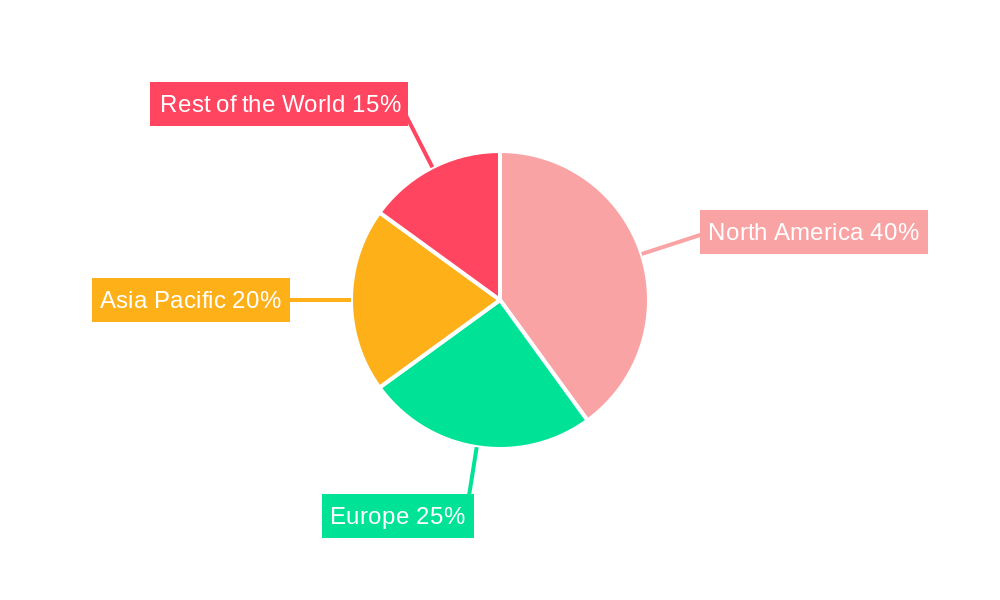

The Rocket Propulsion Market is segmented by type and end user, with solid, liquid, and hybrid propulsion systems catering to both civil and commercial, as well as military applications. Leading companies such as Space Exploration Technologies Corp, Aerojet Rocketdyne, and Blue Origin Federation LLC are at the forefront of innovation, focusing on cost reduction and performance enhancement. Regionally, North America holds a significant share due to the presence of major aerospace companies and government initiatives supporting space programs. However, Asia Pacific is anticipated to witness rapid growth, fueled by increasing investments in space technology from countries like China and India. The market faces challenges such as high development costs and stringent regulatory frameworks, yet the potential for technological advancements and new market entrants continues to propel the industry forward.

Rocket Propulsion Market Company Market Share

Rocket Propulsion Market Market Structure & Competitive Dynamics

The Rocket Propulsion Market is characterized by a mix of established players and emerging innovators, with a market concentration that has seen shifts due to various mergers and acquisitions (M&A) activities. The market is dominated by companies like Space Exploration Technologies Corp, Aerojet Rocketdyne, and Safran SA, which together hold a significant market share estimated at around 40% in 2025. Innovation ecosystems are thriving, driven by investments in R&D, with notable advancements in reusable rocket technologies and propulsion efficiency.

Regulatory frameworks play a crucial role in shaping the market dynamics. For instance, stringent environmental regulations have pushed companies towards developing cleaner propulsion technologies. The presence of product substitutes like electric propulsion for smaller satellites is another factor influencing market dynamics. End-user trends show a growing demand from both civil and commercial sectors, as well as military applications, which continue to fuel market growth.

M&A activities have been pivotal, with deals valued at over $100 Million in the last year alone. These activities have not only altered market shares but have also facilitated technology transfers and market expansions. For example, the acquisition of a smaller propulsion company by a major player like Northrop Grumman Corporation for $50 Million in 2024 has strengthened its position in the solid rocket propulsion segment.

- Market Concentration: Dominated by top players with a 40% market share.

- Innovation Ecosystems: Focus on reusable and efficient propulsion technologies.

- Regulatory Frameworks: Impacting development towards eco-friendly solutions.

- Product Substitutes: Electric propulsion as a growing alternative.

- End-User Trends: Increased demand from civil, commercial, and military sectors.

- M&A Activities: Over $100 Million in deals, enhancing market positions and technology.

Rocket Propulsion Market Industry Trends & Insights

The Rocket Propulsion Market is experiencing robust growth, fueled by a confluence of factors. The burgeoning demand for space-based assets—satellites for communication, navigation, Earth observation, and scientific research—is a primary driver. This global push towards space exploration and utilization is projected to propel the market to a substantial $15 billion valuation by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.5% from 2025. This expansion is not merely incremental; it represents a significant transformation within the aerospace sector.

Technological innovation is fundamentally reshaping the industry. Advanced manufacturing techniques like 3D printing are revolutionizing rocket engine production, enabling greater design flexibility, reduced costs, and faster production cycles. Simultaneously, advancements in propulsion system efficiency, including the development of more powerful and fuel-efficient engines, are significantly enhancing payload capabilities and reducing launch costs. Companies like Rocket Lab are at the forefront of this revolution, demonstrating the viability of cost-effective solutions and accelerating market penetration.

Environmental consciousness is also a powerful force. The increasing demand for sustainable and reusable propulsion systems reflects a growing global commitment to responsible space exploration. Liquid propulsion systems, with their inherent advantages in terms of reduced environmental impact compared to solid propulsion, are experiencing a surge in popularity. This drive for sustainability is further intensified by the competitive landscape, where companies relentlessly pursue technological superiority through innovation and strategic partnerships to gain a competitive edge.

The competitive dynamics are highly dynamic. The market is witnessing the emergence of new players and the strategic expansion of established companies into new market segments. Companies such as Blue Origin are making significant investments in reusable rocket technology, aiming to disrupt the market and capture a larger market share. This combination of established players and innovative newcomers creates a fiercely competitive, yet highly innovative, market environment.

Dominant Markets & Segments in Rocket Propulsion Market

The Rocket Propulsion Market is segmented by propulsion type (Solid, Liquid, and Hybrid) and end-user (Civil & Commercial, and Military). Currently, the liquid propulsion segment dominates, owing to its inherent versatility and superior efficiency. This segment is projected to experience robust growth, achieving a CAGR of 7% and reaching a market size of $10 billion by 2033.

- Key Drivers for Liquid Propulsion Growth:

- Supportive Government Policies: Increased government investment in space programs worldwide.

- Robust Infrastructure Development: Expansion of launch facilities and advanced testing centers.

- Continuous Technological Advancements: Ongoing innovation in engine design and fuel efficiency.

The civil and commercial sector represents the largest end-user segment, encompassing a wide range of applications from satellite launches to burgeoning space tourism. The increasing demand for satellite constellations for global communication networks and advanced Earth observation fuels this segment's significant growth. While smaller in size, the military segment exhibits steady growth driven by ongoing defense modernization initiatives and the requirement for advanced propulsion systems in military satellites.

The Asia-Pacific region is rapidly emerging as a key market, with nations like China and India heavily investing in their respective space programs. China's advancements in both solid and liquid propulsion technologies are particularly noteworthy, positioning it as a significant global contender. This regional growth is underpinned by favorable government policies, substantial R&D investments, and the thriving emergence of numerous private sector companies.

Rocket Propulsion Market Product Innovations

Recent product innovations in the Rocket Propulsion Market include the development of reusable rocket engines and the use of advanced materials for enhanced performance. Companies like Space Exploration Technologies Corp have pioneered reusable rocket technology, significantly reducing the cost of space travel. Additionally, the adoption of 3D printing for manufacturing rocket components is revolutionizing the industry, offering greater design flexibility and cost efficiency. These innovations are well-aligned with market demands for sustainable and cost-effective propulsion solutions.

Report Segmentation & Scope

The Rocket Propulsion Market is segmented by type into Solid, Liquid, and Hybrid, and by end-user into Civil and Commercial, and Military.

- Solid Propulsion: Expected to grow at a CAGR of 5% from 2025 to 2033, reaching a market size of $3 Billion. This segment is driven by its simplicity and reliability for certain applications.

- Liquid Propulsion: Projected to grow at a CAGR of 7%, reaching $10 Billion by 2033. Its dominance is due to its efficiency and versatility in various missions.

- Hybrid Propulsion: Anticipated to see a CAGR of 8%, with a market size of $2 Billion by 2033. This segment is growing due to its potential for safety and cost-effectiveness.

- Civil and Commercial: Expected to grow at a CAGR of 6.5%, reaching $12 Billion by 2033. Driven by satellite launches and space tourism.

- Military: Projected to grow at a CAGR of 5.5%, reaching $3 Billion by 2033. Fueled by defense modernization and satellite technology.

Key Drivers of Rocket Propulsion Market Growth

The Rocket Propulsion Market is driven by several key factors. Technological advancements in propulsion systems, such as the development of reusable rockets, are significantly reducing costs and increasing accessibility to space. Economic factors, including government investments in space programs and private sector funding, are also pivotal. For instance, the U.S. government's commitment to NASA's Artemis program is a major driver. Regulatory support for space activities further propels market growth, with initiatives like the FAA's streamlined licensing process for commercial launches.

Challenges in the Rocket Propulsion Market Sector

Despite its promising outlook, the Rocket Propulsion Market faces significant challenges. Regulatory complexities, particularly the often lengthy and demanding process of securing launch licenses, can lead to project delays and escalating costs. Supply chain disruptions, frequently exacerbated by geopolitical events and resource scarcity, impact the timely availability of critical materials and components. The intense competitive pressure, with both established players and new entrants vying for market share, further adds to the complexity of the market landscape. These factors collectively contribute to potential project delays and increased operational costs, impacting overall market growth.

Leading Players in the Rocket Propulsion Market Market

Key Developments in Rocket Propulsion Market Sector

- January 2024: SpaceX successfully launched and recovered a reusable rocket, setting a new benchmark for cost-effective space travel.

- March 2024: Aerojet Rocketdyne partnered with NASA to develop cutting-edge propulsion systems for lunar missions.

- May 2024: Rocket Lab USA Inc. achieved its 50th successful launch, reinforcing its dominance in the small satellite launch market.

- July 2024: Blue Origin unveiled a novel engine design emphasizing enhanced efficiency and reduced environmental impact.

Strategic Rocket Propulsion Market Market Outlook

The Rocket Propulsion Market is poised for significant growth, driven by increasing demand for satellite launches, space exploration, and technological advancements. Strategic opportunities include the development of more sustainable and cost-effective propulsion technologies, such as reusable rockets and advanced materials. The market's future potential is also supported by growing investments from both public and private sectors, which are expected to fuel further innovation and market expansion.

Rocket Propulsion Market Segmentation

-

1. Type

- 1.1. Solid

- 1.2. Liquid

- 1.3. Hybrid

-

2. End User

- 2.1. Civil and Commercial

- 2.2. Military

Rocket Propulsion Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Rocket Propulsion Market Regional Market Share

Geographic Coverage of Rocket Propulsion Market

Rocket Propulsion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Enhanced Expenditure on Space Exploration Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solid

- 5.1.2. Liquid

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Civil and Commercial

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solid

- 6.1.2. Liquid

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Civil and Commercial

- 6.2.2. Military

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solid

- 7.1.2. Liquid

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Civil and Commercial

- 7.2.2. Military

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solid

- 8.1.2. Liquid

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Civil and Commercial

- 8.2.2. Military

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solid

- 9.1.2. Liquid

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Civil and Commercial

- 9.2.2. Military

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Space Exploration Technologies Corp

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Land Space Technology Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Antrix Corporation Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aerojet Rocketdyne

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Safran SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NPO Energomash

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 IHI Corporatio

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rocket Lab USA Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Blue Origin Federation LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Northrop Grumman Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Mitsubishi Heavy Industries Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Global Rocket Propulsion Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Rocket Propulsion Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Rocket Propulsion Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Rocket Propulsion Market Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Rocket Propulsion Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Rocket Propulsion Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Rocket Propulsion Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Rocket Propulsion Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Rocket Propulsion Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Rocket Propulsion Market Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Rocket Propulsion Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Rocket Propulsion Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Rocket Propulsion Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Rocket Propulsion Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Rocket Propulsion Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Rocket Propulsion Market Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Rocket Propulsion Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Rocket Propulsion Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Rocket Propulsion Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Rocket Propulsion Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Rest of the World Rocket Propulsion Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Rocket Propulsion Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Rest of the World Rocket Propulsion Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Rocket Propulsion Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Rocket Propulsion Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Rocket Propulsion Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Rocket Propulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: Global Rocket Propulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Rocket Propulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Rocket Propulsion Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rocket Propulsion Market?

The projected CAGR is approximately 7.06%.

2. Which companies are prominent players in the Rocket Propulsion Market?

Key companies in the market include Space Exploration Technologies Corp, Land Space Technology Co Ltd, Antrix Corporation Limited, Aerojet Rocketdyne, Safran SA, NPO Energomash, IHI Corporatio, Rocket Lab USA Inc, Blue Origin Federation LLC, Northrop Grumman Corporation, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Rocket Propulsion Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Enhanced Expenditure on Space Exploration Activities.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rocket Propulsion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rocket Propulsion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rocket Propulsion Market?

To stay informed about further developments, trends, and reports in the Rocket Propulsion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence