Key Insights

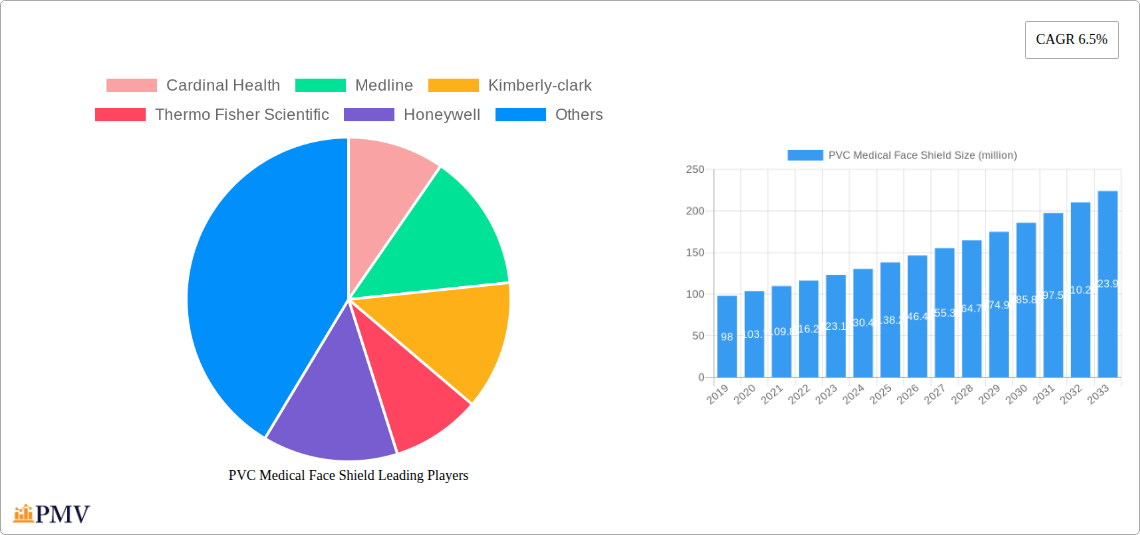

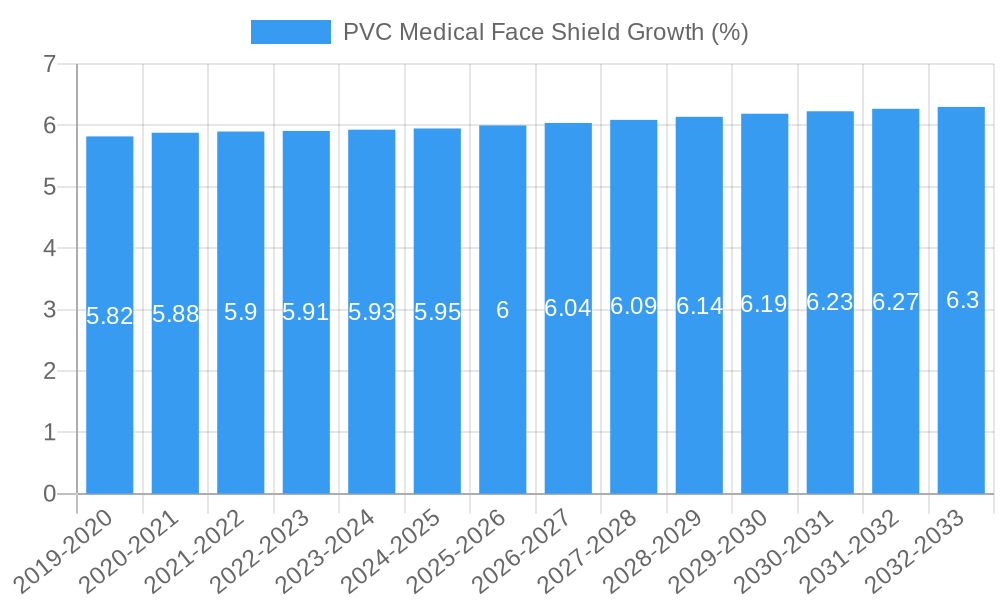

The global PVC medical face shield market is poised for significant expansion, projected to reach a substantial market size by 2033. Driven by an estimated Compound Annual Growth Rate (CAGR) of 6.5%, the market's value is expected to grow from its current standing, reaching approximately $151.65 million by 2025 and continuing its upward trajectory throughout the forecast period. This growth is fundamentally fueled by escalating demands across critical healthcare sectors. Surgical applications represent a primary driver, where the necessity for sterile environments and robust protection against splashes and aerosols during procedures remains paramount. Furthermore, the expanding scope of medical examinations, coupled with the ongoing need for advanced protective equipment in research institutions undertaking complex scientific endeavors, contributes significantly to market expansion. The increasing prevalence of infectious diseases and a heightened global awareness regarding healthcare-associated infections further underscore the indispensable role of effective personal protective equipment (PPE) like PVC medical face shields.

The market's evolution is further shaped by prevailing trends that favor enhanced product features and accessibility. The prevalent adoption of both full-length and 3/4 length face shields highlights a demand for varied levels of protection catering to diverse clinical and research scenarios. While the market is experiencing robust growth, certain factors present potential headwinds. The availability and increasing adoption of alternative materials and designs for face shields, such as PET or reusable options, could pose a competitive challenge. Additionally, stringent regulatory compliances and the associated costs of product development and certification, alongside potential fluctuations in raw material prices for PVC, could influence market dynamics. However, the overarching imperative for patient and healthcare worker safety, amplified by global health events and a proactive approach to infection control, solidifies the PVC medical face shield market's resilient growth trajectory.

PVC Medical Face Shield Market: Comprehensive Industry Report 2019–2033

Unveiling the Global PVC Medical Face Shield Market Landscape: Opportunities, Challenges, and Future Projections

This in-depth report provides a panoramic view of the global PVC medical face shield market, meticulously dissecting its structure, dynamics, and future trajectory. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this analysis offers invaluable insights for stakeholders navigating this critical segment of the healthcare industry. Explore market segmentation, key growth drivers, prevalent challenges, innovative product developments, and the competitive strategies of leading manufacturers. Gain actionable intelligence on market penetration, CAGR, and the impact of technological advancements on applications such as Surgical Use, Medical Examination, and Research Institutions, across various product types including Full Length, 3/4 Length, and Half Length face shields.

PVC Medical Face Shield Market Structure & Competitive Dynamics

The global PVC medical face shield market exhibits a moderately concentrated structure, with a significant portion of the market share held by a handful of prominent players. The Cardinal Health and Medline consortium, alongside Kimberly-Clark, Thermo Fisher Scientific, and Honeywell, represent key entities driving innovation and market penetration. The innovation ecosystem is characterized by ongoing research and development focused on enhanced material durability, optical clarity, and ergonomic design, aiming to meet stringent healthcare professional demands. Regulatory frameworks, primarily governed by bodies like the FDA and CE marking, play a crucial role in market entry and product standardization, ensuring patient and healthcare worker safety. Product substitutes, including polycarbonate and PET-based face shields, present a competitive challenge, necessitating continuous product differentiation through superior performance and cost-effectiveness. End-user trends are largely dictated by the evolving global healthcare landscape, including an increased emphasis on infection control protocols and the recurring need for personal protective equipment (PPE) during public health crises. Mergers and acquisition (M&A) activities, while not overtly prevalent in recent historical periods, remain a strategic avenue for market consolidation and expansion, with potential deal values in the range of several hundred million dollars for significant acquisitions. Understanding these structural elements is paramount for strategic planning and identifying competitive advantages within this dynamic market.

PVC Medical Face Shield Industry Trends & Insights

The PVC medical face shield industry is poised for robust growth, propelled by an escalating global demand for effective infection control measures. The estimated Compound Annual Growth Rate (CAGR) for the forecast period 2025–2033 is projected to be approximately xx%, reflecting sustained market expansion. Key growth drivers include the increasing prevalence of infectious diseases, a heightened awareness among healthcare professionals regarding the importance of eye and face protection, and government initiatives promoting the adoption of advanced medical supplies. Technological disruptions are primarily centered on improving the manufacturing processes for PVC face shields, leading to enhanced product quality and reduced production costs. Innovations in anti-fog coatings, scratch-resistant surfaces, and disposable designs are transforming consumer preferences towards lighter, more comfortable, and highly functional face shields. The market penetration of PVC medical face shields is expected to witness a substantial uptick, particularly in emerging economies where healthcare infrastructure is rapidly developing. Competitive dynamics are intensifying, with companies like 3M, Henry Schein, and Southmedic actively investing in research and development to capture market share. The growing emphasis on reusability and sustainability is also influencing product development, with some manufacturers exploring eco-friendlier PVC formulations and advanced cleaning solutions. The global market size is projected to reach several billion dollars by 2033. The expansion of telehealth services also indirectly fuels demand for medical examination face shields, as these are integral to remote patient consultations and diagnostic procedures. Furthermore, the ongoing geopolitical landscape and potential for future pandemics continue to underscore the critical role of reliable and accessible PPE, including PVC medical face shields, thereby bolstering market confidence and investment. The increasing investment in hospital infrastructure and the growing number of surgical procedures being performed worldwide are also significant contributors to the sustained growth trajectory of the PVC medical face shield market.

Dominant Markets & Segments in PVC Medical Face Shield

The Surgical Use segment is projected to dominate the PVC medical face shield market, driven by the inherent need for robust protection during invasive medical procedures. The global market size for this segment is expected to reach several hundred million dollars by 2033. Key drivers for this dominance include stringent infection control protocols in operating rooms, the high frequency of surgical interventions, and the critical requirement for healthcare professionals to prevent splashes and aerosols from contaminating their faces. Countries with advanced healthcare systems and a high volume of surgical procedures, such as the United States, Germany, and Japan, are leading this segment. The Full Length face shield type is anticipated to command the largest market share within this segment due to its comprehensive coverage, offering maximum protection to the entire face.

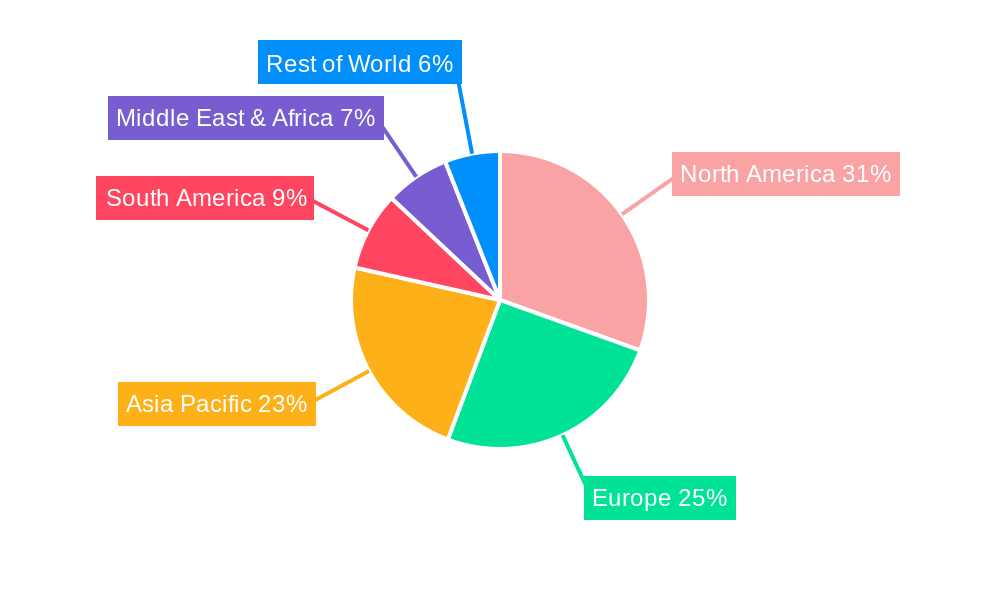

In terms of geographical dominance, North America is expected to lead the market, with an estimated market share of approximately xx% by 2033. This leadership is attributed to a well-established healthcare infrastructure, high per capita healthcare spending, and a proactive approach to public health and safety. The presence of major players like Cardinal Health and Medline in the region further solidifies its leading position. Economic policies supporting the healthcare sector, coupled with advanced research and development capabilities, fuel the demand for high-quality medical face shields. The infrastructure for manufacturing and distribution within North America is also highly developed, ensuring efficient supply chains.

The Medical Examination segment, while secondary to surgical use, is also experiencing significant growth. This is fueled by an increasing number of outpatient procedures, diagnostic imaging, and routine patient check-ups. The 3/4 Length face shield type is gaining traction in this segment due to its balance of protection and wearer comfort, allowing for better communication and facial visibility during examinations.

The Research Institutions segment represents a niche but growing application, driven by the need for sterile environments and protection during laboratory experiments, particularly in fields like virology and biotechnology. The Half Length face shield can find application here for less critical procedures, offering a lightweight and less cumbersome option.

PVC Medical Face Shield Product Innovations

Recent product innovations in the PVC medical face shield market are primarily focused on enhancing user comfort, safety, and functionality. Manufacturers are developing lighter-weight designs, incorporating improved anti-fog and anti-scratch coatings for superior visibility, and exploring more ergonomic headbands for extended wear. Advancements in material science are leading to more durable and resilient PVC formulations, offering better protection against liquid splashes and airborne particles. The integration of advanced sealing technologies is further minimizing potential exposure points. These innovations provide a significant competitive advantage by meeting the evolving needs of healthcare professionals and ensuring compliance with increasingly stringent safety standards.

Report Segmentation & Scope

This report segments the PVC medical face shield market by Application and Type.

Application Segments:

- Surgical Use: This segment encompasses face shields used in operating rooms and during surgical procedures. Growth projections indicate a consistent demand, with market sizes expected to reach several hundred million dollars. Competitive dynamics are characterized by a focus on high-performance, sterile-grade products.

- Medical Examination: This segment includes face shields utilized in general medical check-ups, consultations, and diagnostic procedures. Growth is driven by the expanding healthcare access and the need for basic protection.

- Research Institutions: This segment covers face shields used in laboratories and research settings, particularly for handling biological samples and conducting experiments. Market growth is tied to advancements in scientific research and biotech industries.

Type Segments:

- Full Length: Offering comprehensive facial coverage, this type is projected to hold a dominant market share.

- 3/4 Length: Providing a balance of protection and mobility, this type is experiencing growing adoption.

- Half Length: Offering a more minimalistic approach, this type caters to specific applications requiring less extensive coverage.

Key Drivers of PVC Medical Face Shield Growth

The growth of the PVC medical face shield market is propelled by several key factors. Firstly, the escalating global concern over infectious disease outbreaks, highlighted by recent pandemics, has significantly amplified the demand for personal protective equipment (PPE), including face shields. Secondly, advancements in material science and manufacturing techniques are leading to the development of more comfortable, durable, and cost-effective PVC medical face shields, enhancing their appeal to healthcare providers. Thirdly, stricter regulatory mandates and guidelines from health organizations worldwide regarding infection control protocols in healthcare settings are compelling the adoption of comprehensive facial protection. Furthermore, the continuous expansion of healthcare infrastructure, particularly in emerging economies, and the increasing number of medical procedures being performed globally, are creating a sustained demand for these essential medical devices.

Challenges in the PVC Medical Face Shield Sector

Despite the positive growth trajectory, the PVC medical face shield sector faces several challenges. Intense competition from alternative materials such as polycarbonate and PET can exert downward pressure on pricing and market share. Fluctuations in raw material costs, particularly for PVC resin, can impact manufacturing profitability and lead to price volatility. Supply chain disruptions, as experienced during global health crises, can affect product availability and lead times. Furthermore, evolving environmental regulations and a growing preference for sustainable products may necessitate innovation in biodegradable or recyclable materials, posing a challenge for traditional PVC manufacturers. The cost of compliance with diverse international regulatory standards also adds a significant burden.

Leading Players in the PVC Medical Face Shield Market

- Cardinal Health

- Medline

- Kimberly-Clark

- Thermo Fisher Scientific

- Honeywell

- 3M

- Henry Schein

- Southmedic

- Cantel Medical

- Alpha ProTech

- Nipro Medical

- TIDI Products

- Hygeco

- Ruhof Healthcare

- WeeTect

- Healthmark

Key Developments in PVC Medical Face Shield Sector

- 2023/10: Launch of a new line of anti-fogging, scratch-resistant PVC face shields by Alpha ProTech, enhancing visual clarity for medical professionals.

- 2023/07: Medline announces significant expansion of its PPE manufacturing capacity to meet sustained demand for face shields.

- 2022/12: Thermo Fisher Scientific introduces a biodegradable PVC alternative for specific research applications, addressing sustainability concerns.

- 2022/05: 3M patents an innovative ergonomic headband design for medical face shields, improving wearer comfort during long procedures.

- 2021/09: Kimberly-Clark acquires a specialized PPE manufacturer, strengthening its market presence in medical face shields.

- 2020/03: The global COVID-19 pandemic triggers an unprecedented surge in demand for PVC medical face shields, highlighting supply chain vulnerabilities and prompting rapid production increases from all major players.

Strategic PVC Medical Face Shield Market Outlook

The strategic outlook for the PVC medical face shield market remains exceptionally strong, driven by an enduring emphasis on infection prevention and control within the global healthcare ecosystem. Future growth accelerators will stem from continued investment in healthcare infrastructure, particularly in emerging markets, and the ongoing need for reliable PPE in the face of potential future pandemics. Manufacturers that can prioritize product innovation, focusing on enhanced comfort, advanced protective features, and cost-effectiveness, will be well-positioned for success. Strategic partnerships and collaborations within the supply chain will be crucial for ensuring resilience and responsiveness to market demands. The market also presents opportunities for the development of specialized face shields tailored to niche applications within medical and research environments, further diversifying product portfolios and capturing incremental market share.

PVC Medical Face Shield Segmentation

-

1. Application

- 1.1. Surgical Use

- 1.2. Medical Examination

- 1.3. Research Institutions

-

2. Types

- 2.1. Full Length

- 2.2. 3/4 Length

- 2.3. Half Length

PVC Medical Face Shield Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

PVC Medical Face Shield REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PVC Medical Face Shield Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Surgical Use

- 5.1.2. Medical Examination

- 5.1.3. Research Institutions

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Full Length

- 5.2.2. 3/4 Length

- 5.2.3. Half Length

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America PVC Medical Face Shield Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Surgical Use

- 6.1.2. Medical Examination

- 6.1.3. Research Institutions

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Full Length

- 6.2.2. 3/4 Length

- 6.2.3. Half Length

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America PVC Medical Face Shield Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Surgical Use

- 7.1.2. Medical Examination

- 7.1.3. Research Institutions

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Full Length

- 7.2.2. 3/4 Length

- 7.2.3. Half Length

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe PVC Medical Face Shield Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Surgical Use

- 8.1.2. Medical Examination

- 8.1.3. Research Institutions

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Full Length

- 8.2.2. 3/4 Length

- 8.2.3. Half Length

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa PVC Medical Face Shield Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Surgical Use

- 9.1.2. Medical Examination

- 9.1.3. Research Institutions

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Full Length

- 9.2.2. 3/4 Length

- 9.2.3. Half Length

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific PVC Medical Face Shield Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Surgical Use

- 10.1.2. Medical Examination

- 10.1.3. Research Institutions

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Full Length

- 10.2.2. 3/4 Length

- 10.2.3. Half Length

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cardinal Health

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medline

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kimberly-clark

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thermo Fisher Scientific

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Honeywell

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3M

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Henry Schein

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Southmedic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cantel Medical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alpha ProTech

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nipro Medical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TIDI Products

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hygeco

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ruhof Healthcare

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 WeeTect

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Healthmark

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Cardinal Health

List of Figures

- Figure 1: Global PVC Medical Face Shield Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America PVC Medical Face Shield Revenue (million), by Application 2024 & 2032

- Figure 3: North America PVC Medical Face Shield Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America PVC Medical Face Shield Revenue (million), by Types 2024 & 2032

- Figure 5: North America PVC Medical Face Shield Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America PVC Medical Face Shield Revenue (million), by Country 2024 & 2032

- Figure 7: North America PVC Medical Face Shield Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America PVC Medical Face Shield Revenue (million), by Application 2024 & 2032

- Figure 9: South America PVC Medical Face Shield Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America PVC Medical Face Shield Revenue (million), by Types 2024 & 2032

- Figure 11: South America PVC Medical Face Shield Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America PVC Medical Face Shield Revenue (million), by Country 2024 & 2032

- Figure 13: South America PVC Medical Face Shield Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe PVC Medical Face Shield Revenue (million), by Application 2024 & 2032

- Figure 15: Europe PVC Medical Face Shield Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe PVC Medical Face Shield Revenue (million), by Types 2024 & 2032

- Figure 17: Europe PVC Medical Face Shield Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe PVC Medical Face Shield Revenue (million), by Country 2024 & 2032

- Figure 19: Europe PVC Medical Face Shield Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa PVC Medical Face Shield Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa PVC Medical Face Shield Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa PVC Medical Face Shield Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa PVC Medical Face Shield Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa PVC Medical Face Shield Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa PVC Medical Face Shield Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific PVC Medical Face Shield Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific PVC Medical Face Shield Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific PVC Medical Face Shield Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific PVC Medical Face Shield Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific PVC Medical Face Shield Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific PVC Medical Face Shield Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global PVC Medical Face Shield Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global PVC Medical Face Shield Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global PVC Medical Face Shield Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global PVC Medical Face Shield Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global PVC Medical Face Shield Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global PVC Medical Face Shield Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global PVC Medical Face Shield Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global PVC Medical Face Shield Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global PVC Medical Face Shield Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global PVC Medical Face Shield Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global PVC Medical Face Shield Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global PVC Medical Face Shield Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global PVC Medical Face Shield Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global PVC Medical Face Shield Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global PVC Medical Face Shield Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global PVC Medical Face Shield Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global PVC Medical Face Shield Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global PVC Medical Face Shield Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global PVC Medical Face Shield Revenue million Forecast, by Country 2019 & 2032

- Table 41: China PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific PVC Medical Face Shield Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PVC Medical Face Shield?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the PVC Medical Face Shield?

Key companies in the market include Cardinal Health, Medline, Kimberly-clark, Thermo Fisher Scientific, Honeywell, 3M, Henry Schein, Southmedic, Cantel Medical, Alpha ProTech, Nipro Medical, TIDI Products, Hygeco, Ruhof Healthcare, WeeTect, Healthmark.

3. What are the main segments of the PVC Medical Face Shield?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 98 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PVC Medical Face Shield," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PVC Medical Face Shield report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PVC Medical Face Shield?

To stay informed about further developments, trends, and reports in the PVC Medical Face Shield, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence