Key Insights

The North American flexographic printing market, projected at $86.6 billion in 2025, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 0.5% from 2025 to 2033. Key growth drivers include the escalating demand for flexible packaging, propelled by e-commerce expansion and consumer preference for portable products. Technological advancements in flexographic printing, such as high-definition and digital flexo, are enhancing print quality and efficiency. The increasing adoption of sustainable packaging solutions also supports market growth, as flexographic printing is compatible with eco-friendly materials. However, the market faces challenges from competition with digital printing and rising raw material costs. Flexible packaging represents the largest market segment, followed by labels and folding cartons. Narrow web presses currently lead in equipment, with wider web and sheetfed presses expected to grow. Major players like Koenig & Bauer, Barry-Wehmiller, and BOBST are driving innovation and competition.

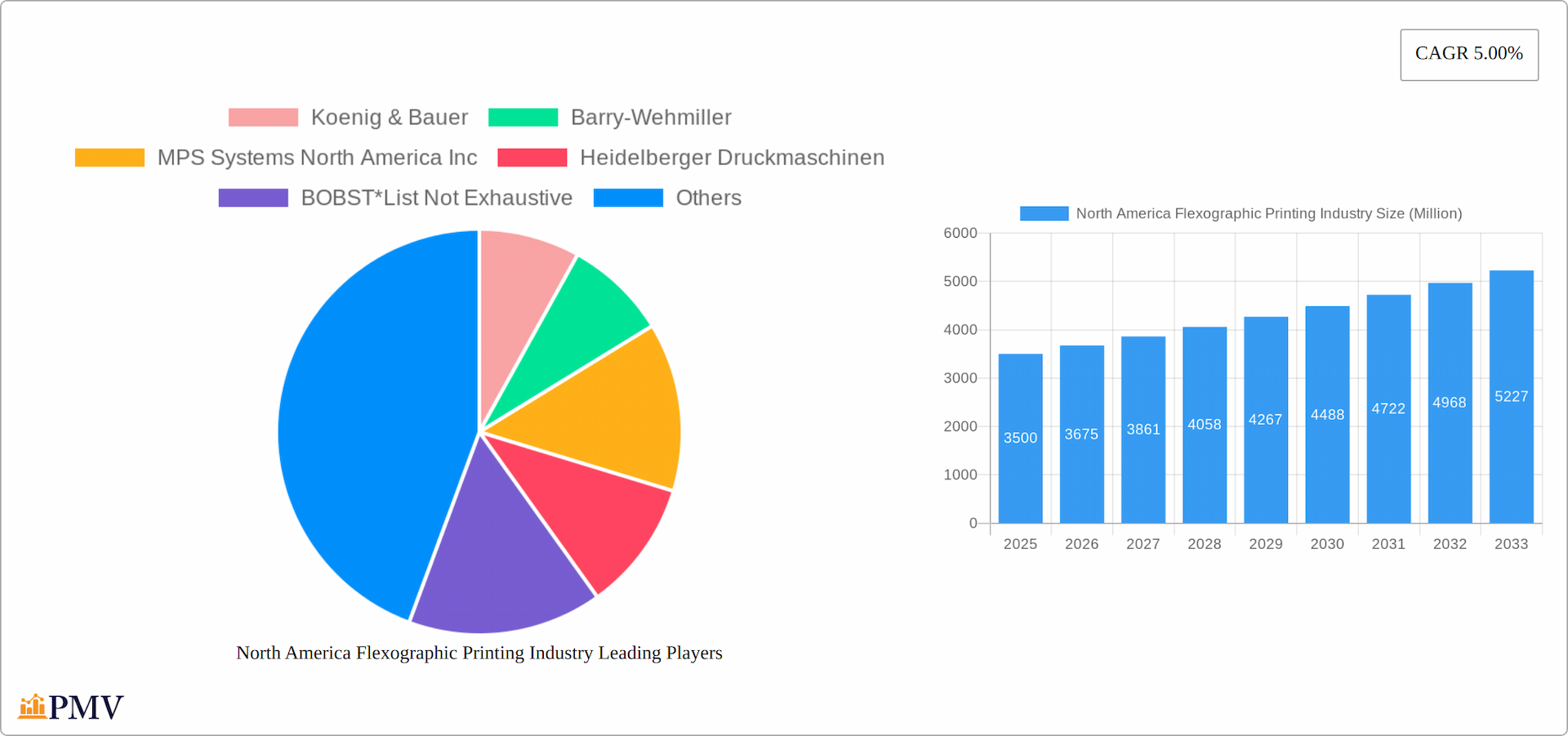

North America Flexographic Printing Industry Market Size (In Billion)

North America's leading position in the flexographic printing market is attributed to its strong manufacturing base, advanced technology, and high consumer spending. The United States holds the largest market share within the region, with Canada and Mexico also contributing significantly. Opportunities exist for companies offering innovative printing technologies, sustainable solutions, and efficient post-press services. Intense competition necessitates a focus on differentiation through advanced features, superior customer support, and competitive pricing to maintain market prominence.

North America Flexographic Printing Industry Company Market Share

North America Flexographic Printing Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America flexographic printing industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, growth drivers, challenges, and competitive dynamics. The report's detailed segmentation by equipment type (Narrow Web, Wide Web, Sheetfed, Other Equipment) and application (Flexible Packaging, Bags and Sacks, Labels, Folding Cartons, Corrugated Packaging, Other Applications) offers granular understanding crucial for strategic decision-making. The report's quantitative data is complemented by qualitative analysis, providing a holistic perspective on the North American flexographic printing landscape. Expected market value is in Millions.

North America Flexographic Printing Industry Market Structure & Competitive Dynamics

The North American flexographic printing industry exhibits a moderately concentrated market structure, with key players holding significant market share. Major companies such as Koenig & Bauer, Barry-Wehmiller, MPS Systems North America Inc, Heidelberger Druckmaschinen, BOBST, Uteco North America, Mark Andy, and Flint Group drive innovation and competition. The industry is characterized by ongoing M&A activity, with deal values fluctuating depending on market conditions. For example, in 2024, M&A activity totaled approximately $xx Million, driven primarily by consolidation among smaller players and expansion into new segments. Market share distribution is dynamic, with leading companies consistently striving for increased market penetration through product innovation and strategic acquisitions. The regulatory framework significantly impacts industry practices, while substitutes like digital printing pose a competitive threat, influencing technology adoption and overall market growth. End-user trends, particularly in sustainability and packaging customization, are shaping demand across various application segments.

North America Flexographic Printing Industry Industry Trends & Insights

The North American flexographic printing market is experiencing substantial growth, driven by several key factors. The CAGR for the forecast period (2025-2033) is estimated at xx%, fueled by the expanding flexible packaging market, increased demand for high-quality printed labels, and growth in e-commerce, which necessitates efficient and cost-effective packaging solutions. Technological advancements, including advancements in digital flexographic printing, are streamlining processes and enhancing print quality. This is improving efficiency and reducing production costs, thereby increasing market penetration. Consumer preferences are shifting towards sustainable and eco-friendly packaging, creating opportunities for flexographic printers to adopt sustainable materials and processes. However, the competitive landscape remains intense, requiring companies to adapt to evolving consumer needs and technological disruptions. Market penetration rates vary significantly across segments, with flexible packaging showing strong growth compared to other applications. The industry faces challenges such as increasing raw material costs and stringent environmental regulations, but the overall outlook remains positive due to continued demand for printed packaging across diverse sectors.

Dominant Markets & Segments in North America Flexographic Printing Industry

Within the dynamic North American flexographic printing industry, the flexible packaging segment undeniably commands the largest market share, representing a substantial portion of the total market value. This segment's preeminence is underpinned by several critical advantages:

- Unwavering Demand for Flexible Packaging: Fueled by the sustained growth of major sectors such as food and beverage, consumer goods, and healthcare, the need for versatile and protective flexible packaging remains exceptionally high.

- Cost-Effectiveness for High-Volume Production: Flexographic printing offers a compelling economic advantage for the mass production of flexible packaging compared to many alternative printing methodologies, making it the preferred choice for brands.

- Continuous Technological Enhancement: Ongoing advancements in flexographic printing technology are consistently elevating print quality, speed, and overall efficiency, further solidifying its position in flexible packaging applications.

Geographically, the United States stands as the foremost market, benefiting from robust consumer spending, a mature manufacturing base, and a well-established industrial infrastructure. Key growth drivers within the US region include:

- Sustained Economic Growth: A healthy economy translates directly into increased demand for a wide array of packaged goods and, consequently, packaging materials.

- Advanced Infrastructure: The presence of sophisticated transportation and logistics networks ensures the efficient movement of raw materials and finished products across the nation.

- Supportive Regulatory Landscape: While environmental regulations are becoming more stringent, they also serve as a catalyst for innovation, particularly in the development and adoption of sustainable packaging solutions.

In terms of equipment, the narrow web segment holds a dominant position, perfectly suited for the high-volume printing of labels and flexible packaging materials. Other equipment segments, including sheetfed and wide web, maintain significant market shares and are projected to experience steady, albeit more moderate, growth compared to the flexible packaging sector.

North America Flexographic Printing Industry Product Innovations

Significant product innovations are transforming the flexographic printing industry. Advancements in platemaking technology, such as digital platemaking and improved plate materials, are enhancing print quality and reducing waste. New ink formulations are focusing on sustainability and improved adhesion. The integration of automation and digital printing technologies into flexographic presses is driving efficiency and enabling customized packaging solutions. These innovations are improving the overall competitiveness of flexographic printing, particularly in responding to the growing demand for short-run and personalized packaging.

Report Segmentation & Scope

This comprehensive report meticulously segments the North American flexographic printing industry by key equipment categories and diverse application areas. This detailed segmentation provides invaluable insights into market dynamics, growth drivers, and potential opportunities.

Equipment Segmentation:

- Narrow Web: This segment is forecast to experience robust expansion during the stipulated forecast period, primarily driven by the burgeoning demands of the label and flexible packaging markets. The competitive landscape is dynamically shaped by the continuous introduction of sophisticated and automated narrow web printing presses.

- Wide Web: The wide web segment is projected for steady growth, catering to the increasing requirements for large-format flexible packaging solutions. This market is characterized by intense competition among established and emerging equipment manufacturers.

- Sheetfed: The sheetfed segment is expected to exhibit moderate but consistent growth, largely propelled by specialized niche applications where its particular capabilities are most advantageous.

- Other Equipment: This category encompasses essential ancillary equipment and advanced post-press solutions. Its growth is anticipated to be driven by the increasing need for automation, integrated workflows, and digital connectivity within flexographic printing operations.

Application Segmentation:

- Flexible Packaging: This dominant segment is poised for significant growth, propelled by persistent high demand and ongoing technological advancements that enhance its versatility and performance. The market remains highly competitive.

- Bags and Sacks: This segment is projected for healthy growth, influenced by evolving consumer purchasing habits and the sustained rise of e-commerce, which relies heavily on robust packaging solutions.

- Labels: The labels segment continues to exhibit strong upward momentum, driven by the critical need for product identification, branding, and regulatory compliance across a vast array of industries.

- Folding Cartons: Growth in the folding cartons segment is expected to be bolstered by advancements in printing technologies that enable greater efficiency and by the increasing emphasis on sustainable packaging materials.

- Corrugated Packaging: Driven by the continued expansion of e-commerce and the associated surge in demand for shipping and protective packaging, the corrugated packaging segment is anticipated to experience moderate but steady growth.

- Other Applications: This category comprises a range of specialized and niche applications, collectively projected to grow at a steady CAGR, reflecting the diverse utility of flexographic printing.

Key Drivers of North America Flexographic Printing Industry Growth

Several factors contribute to the growth of the North American flexographic printing industry. The increasing demand for flexible packaging from various end-use sectors is a primary driver. Technological advancements, such as the development of high-quality, sustainable inks and improved plate-making technologies, are enhancing print quality and production efficiency. Growth in e-commerce is fueling the need for cost-effective and innovative packaging solutions. Government regulations promoting sustainable packaging practices also contribute to industry growth by encouraging the adoption of eco-friendly materials and processes.

Challenges in the North America Flexographic Printing Industry Sector

The North American flexographic printing industry grapples with several significant challenges that impact its operational efficiency and profitability. Escalating raw material costs present a continuous strain on profit margins, while unpredictable supply chain disruptions can lead to costly production delays and missed delivery windows. Intense competition from alternative printing technologies, particularly digital printing, necessitates ongoing investment in innovation and process improvement. Furthermore, stringent environmental regulations, while driving sustainability, also impose considerable compliance costs and require substantial investment in new technologies and practices. These collective factors can exert downward pressure on overall market growth potential. The inherent market volatility in the pricing of essential raw materials and inks further exacerbates operational cost management for printing businesses.

Leading Players in the North America Flexographic Printing Industry Market

- Koenig & Bauer

- Barry-Wehmiller

- MPS Systems North America Inc

- Heidelberger Druckmaschinen

- BOBST

- Uteco North America

- Mark Andy

- Flint Group

Key Developments in North America Flexographic Printing Industry Sector

- January 2023: Flint Group introduced a groundbreaking new series of sustainable inks, aligning with the industry's growing focus on eco-friendly solutions.

- March 2024: MPS Systems unveiled its latest advancements in automated press technology, signaling a move towards greater efficiency and reduced human intervention in the printing process.

- June 2024: Koenig & Bauer announced a strategic partnership aimed at enhancing digital solutions within the flexographic printing space, underscoring the industry's embrace of digital transformation.

- October 2024: A notable period of consolidation within the industry saw significant M&A activity involving two smaller flexographic printing companies, indicating a trend towards market consolidation and strategic growth.

Strategic North America Flexographic Printing Industry Market Outlook

The North American flexographic printing industry presents considerable growth potential driven by increasing demand for sustainable and customized packaging. Strategic opportunities exist in developing eco-friendly inks and materials, integrating automation and digital technologies, and focusing on niche applications. Companies adopting innovative solutions and proactively addressing sustainability concerns are well-positioned for success in this competitive landscape. The long-term outlook remains positive, with continuous technological advancements shaping the future of flexographic printing.

North America Flexographic Printing Industry Segmentation

-

1. Equipment

- 1.1. Narrow Web

- 1.2. Wide Web

- 1.3. Sheetfed

- 1.4. Other Equipment

-

2. Application

- 2.1. Flexible Packaging

- 2.2. Bags and Sacks

- 2.3. Labels

- 2.4. Folding Cartons

- 2.5. Corrugated packaging

- 2.6. Other Applications

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

-

3.1. North America

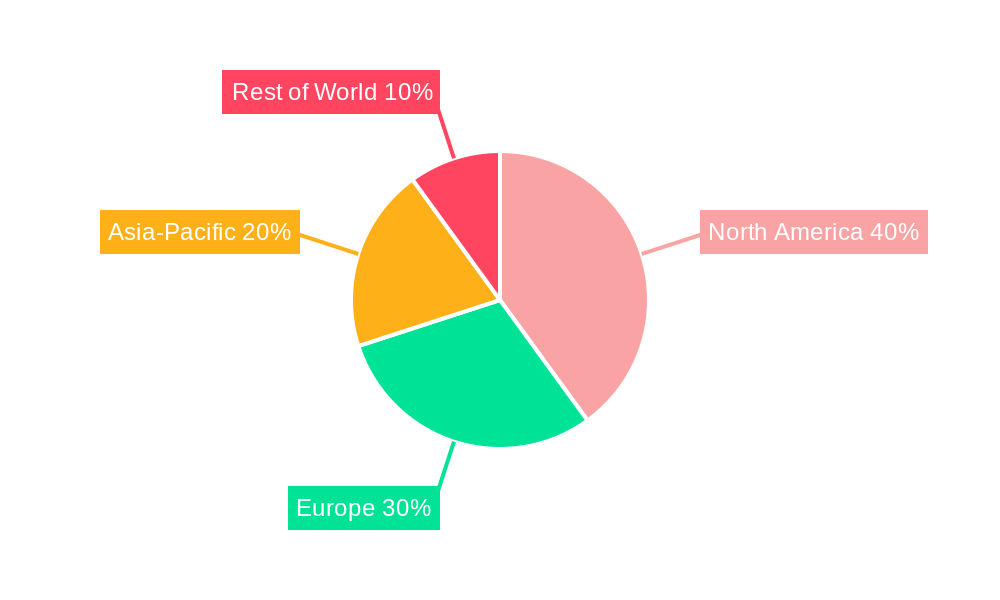

North America Flexographic Printing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America Flexographic Printing Industry Regional Market Share

Geographic Coverage of North America Flexographic Printing Industry

North America Flexographic Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Development of Advanced Equipment that Offer Shorter Turnaround Time with Greater Accuracy; Rapid Growth of Consumer Goods

- 3.3. Market Restrains

- 3.3.1. ; Offset Printing can Hinder the Growth of Flexographic Printing

- 3.4. Market Trends

- 3.4.1. Flexible Packaging is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Flexographic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Narrow Web

- 5.1.2. Wide Web

- 5.1.3. Sheetfed

- 5.1.4. Other Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Flexible Packaging

- 5.2.2. Bags and Sacks

- 5.2.3. Labels

- 5.2.4. Folding Cartons

- 5.2.5. Corrugated packaging

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Koenig & Bauer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Barry-Wehmiller

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MPS Systems North America Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Heidelberger Druckmaschinen

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BOBST*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Uteco North America

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mark Andy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Flint Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Koenig & Bauer

List of Figures

- Figure 1: North America Flexographic Printing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Flexographic Printing Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Flexographic Printing Industry Revenue billion Forecast, by Equipment 2020 & 2033

- Table 2: North America Flexographic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Flexographic Printing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Flexographic Printing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Flexographic Printing Industry Revenue billion Forecast, by Equipment 2020 & 2033

- Table 6: North America Flexographic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America Flexographic Printing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Flexographic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Flexographic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Flexographic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Flexographic Printing Industry?

The projected CAGR is approximately 0.5%.

2. Which companies are prominent players in the North America Flexographic Printing Industry?

Key companies in the market include Koenig & Bauer, Barry-Wehmiller, MPS Systems North America Inc, Heidelberger Druckmaschinen, BOBST*List Not Exhaustive, Uteco North America, Mark Andy, Flint Group.

3. What are the main segments of the North America Flexographic Printing Industry?

The market segments include Equipment, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 86.6 billion as of 2022.

5. What are some drivers contributing to market growth?

; Development of Advanced Equipment that Offer Shorter Turnaround Time with Greater Accuracy; Rapid Growth of Consumer Goods.

6. What are the notable trends driving market growth?

Flexible Packaging is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Offset Printing can Hinder the Growth of Flexographic Printing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Flexographic Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Flexographic Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Flexographic Printing Industry?

To stay informed about further developments, trends, and reports in the North America Flexographic Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence