Key Insights

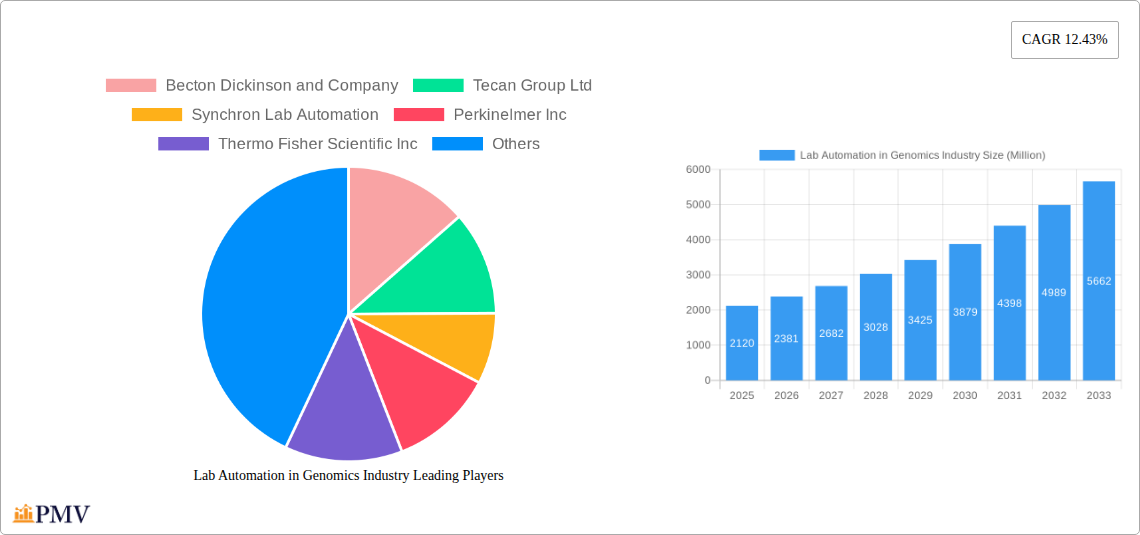

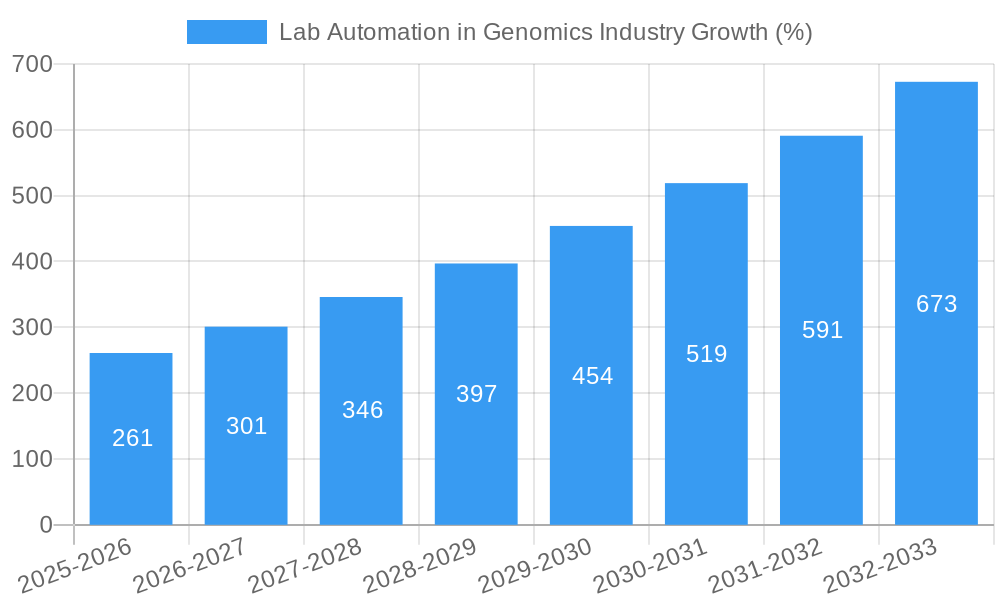

The global lab automation in genomics market is experiencing robust growth, projected to reach $2.12 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.43% from 2025 to 2033. This expansion is fueled by several key factors. The increasing complexity of genomic research necessitates high-throughput, automated solutions for tasks such as sample preparation, sequencing, and data analysis. The rising prevalence of genetic testing and personalized medicine is driving demand for faster, more efficient, and cost-effective lab processes. Advances in automation technologies, including robotic arms, automated liquid handlers, and sophisticated software, are improving accuracy, reducing human error, and enabling the analysis of larger datasets. Furthermore, the growing adoption of next-generation sequencing (NGS) technologies, which generate massive amounts of data, is a significant driver, emphasizing the need for efficient automation.

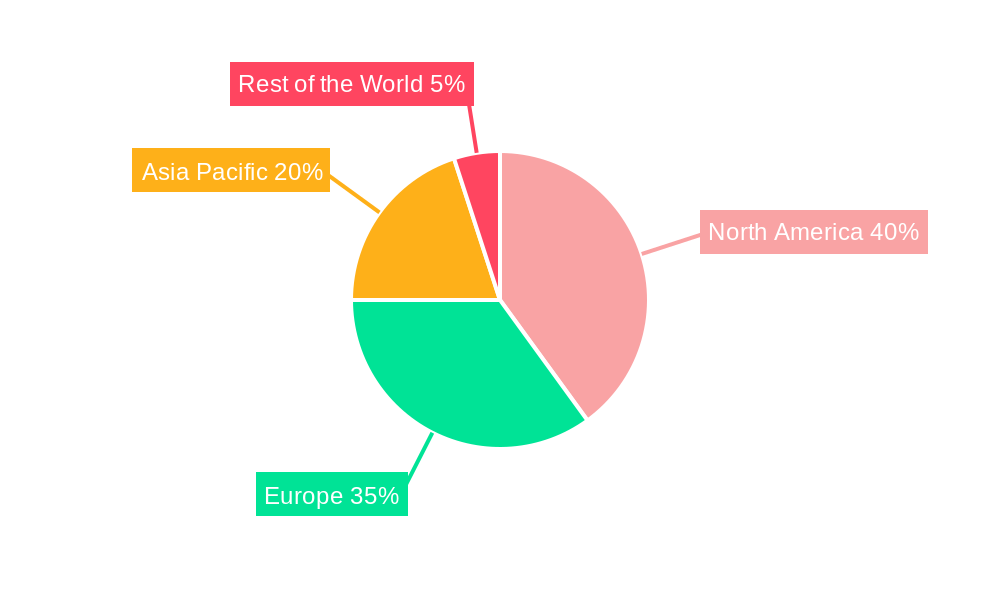

Major players in the market, including Becton Dickinson, Tecan Group, Thermo Fisher Scientific, and Illumina (though not explicitly listed, a key player in genomics), are investing heavily in research and development to enhance their product offerings and expand their market share. Competition is driving innovation and leading to the development of more integrated and user-friendly automation solutions. Geographic distribution shows significant growth across North America and Europe, reflecting established research infrastructure and high adoption rates. However, the Asia-Pacific region is predicted to witness the fastest growth, driven by increasing investments in genomic research and healthcare infrastructure. Market restraints include high initial investment costs associated with automation technologies and the need for skilled personnel to operate and maintain these systems. Nevertheless, the long-term benefits of increased efficiency, reduced costs, and improved accuracy outweigh these challenges, ensuring continued market expansion.

Lab Automation in Genomics Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Lab Automation in Genomics Industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive historical data (2019-2024) to project future market trends and opportunities. The market is valued at $XX Million in 2025 and is projected to reach $XX Million by 2033, exhibiting a CAGR of XX%. This report meticulously examines market structure, competitive dynamics, leading players, technological advancements, and future growth potential within the genomics sector.

Lab Automation in Genomics Industry Market Structure & Competitive Dynamics

The Lab Automation in Genomics Industry is characterized by a moderately concentrated market structure, with a few dominant players and numerous smaller niche players. Key players such as Thermo Fisher Scientific Inc, Danaher Corporation / Beckman Coulter, and Becton Dickinson and Company hold significant market share, collectively accounting for approximately XX% of the total market revenue in 2025. The industry exhibits a dynamic innovation ecosystem, driven by continuous advancements in robotics, AI, and software solutions. Regulatory frameworks, while generally supportive of innovation, vary across geographies, influencing market access and product adoption. Product substitutes are limited, largely due to the specialized nature of genomics applications. End-user trends indicate a growing preference for integrated, automated solutions offering higher throughput and reduced human error.

The industry has witnessed considerable M&A activity in recent years, with deal values exceeding $XX Million in the historical period (2019-2024). These mergers and acquisitions are driven by the desire to expand product portfolios, enhance technological capabilities, and gain access to new markets. Examples include (but are not limited to) strategic partnerships between instrument manufacturers and software developers. Further analysis of market share and M&A deal values are detailed within the full report.

- Market Concentration: Moderately concentrated with a few dominant players.

- Innovation Ecosystem: Highly dynamic, driven by technological advancements.

- Regulatory Frameworks: Vary across geographies, impacting market access.

- Product Substitutes: Limited due to specialized applications.

- End-User Trends: Preference for integrated, automated solutions.

- M&A Activity: Significant activity driving market consolidation.

Lab Automation in Genomics Industry Industry Trends & Insights

The Lab Automation in Genomics Industry is experiencing robust growth, fueled by several key factors. The increasing demand for high-throughput genomics applications in research, diagnostics, and drug discovery is a major driver. Technological advancements, such as the development of more sophisticated robotics, AI-powered software, and miniaturized assay systems, are significantly enhancing automation capabilities. This trend is further amplified by decreasing costs and increasing accessibility of automation technologies, enabling adoption by smaller laboratories and research groups. The market is witnessing a shift towards integrated workflows, wherein multiple automation steps are integrated into a single platform, resulting in improved efficiency and reduced turnaround time. This has led to increased market penetration of automated solutions, especially in high-volume testing settings. Consumer preferences are leaning towards flexible, modular systems that can be easily adapted to evolving needs. The industry's competitive landscape is highly dynamic, marked by continuous innovation and product differentiation, driving further growth. The overall market exhibits a significant growth trajectory, with a projected CAGR of XX% during the forecast period (2025-2033).

Dominant Markets & Segments in Lab Automation in Genomics Industry

The North American region currently dominates the global Lab Automation in Genomics Industry, driven by robust research funding, a strong regulatory framework, and a high concentration of genomics research institutions and pharmaceutical companies. Within North America, the United States represents the largest market, benefiting from its advanced healthcare infrastructure and substantial investments in genomic research.

- Key Drivers for North American Dominance:

- High concentration of genomics research institutions and pharmaceutical companies.

- Robust research funding and government initiatives.

- Advanced healthcare infrastructure and technological capabilities.

- Favorable regulatory environment supporting innovation.

Among the equipment segments, Automated Liquid Handlers hold the largest market share, driven by their critical role in various genomics workflows, including DNA/RNA extraction, library preparation, and PCR setup. Automated Plate Handlers are experiencing rapid growth, particularly in high-throughput screening applications. Robotic Arms are crucial for integrating various automated systems within the laboratory, enhancing operational efficiency. Automated Storage and Retrieval Systems (AS/RS) are gaining traction as laboratories seek to streamline sample management and storage. Vision Systems are increasingly integrated for automated quality control and image analysis. The full report provides a detailed analysis of each segment's market size, growth projections, and competitive dynamics.

Lab Automation in Genomics Industry Product Innovations

Recent product innovations focus on enhancing speed, accuracy, and flexibility in genomics workflows. This includes miniaturization of assay systems for higher throughput, integration of AI and machine learning for data analysis and process optimization, and development of user-friendly interfaces to reduce training requirements. These innovations are directly improving market fit by addressing the need for increased efficiency and reduced costs in genomic testing. Companies are constantly developing new modules and software to enhance existing platforms, making them adaptable to various laboratory needs and thereby broadening their market reach.

Report Segmentation & Scope

This report segments the Lab Automation in Genomics Industry market by equipment type:

Automated Liquid Handlers: This segment is projected to witness significant growth due to the widespread adoption of liquid handling automation in various genomics applications. The competitive landscape is highly fragmented, with numerous players offering a wide range of products.

Automated Plate Handlers: Demand for automated plate handling is driven by the increasing need for high-throughput screening and sample processing in genomics research and drug discovery. This segment is expected to exhibit healthy growth.

Robotic Arms: Robotic arms provide flexibility and integration capabilities, enabling automation of complex workflows. The market for robotic arms in genomics is expected to grow steadily.

Automated Storage and Retrieval Systems (AS/RS): These systems are crucial for managing and storing large volumes of samples efficiently. This segment's growth is driven by the increasing need for high-density sample storage.

Vision Systems: Vision systems are increasingly integrated for automated quality control, image analysis, and process monitoring. This segment is expected to experience moderate growth.

Key Drivers of Lab Automation in Genomics Industry Growth

The growth of the Lab Automation in Genomics Industry is propelled by several key factors: the increasing demand for high-throughput genomic testing in research and diagnostics, advancements in robotics, AI, and software, falling equipment costs making automation accessible to smaller labs, and government initiatives supporting genomics research and healthcare. Regulations promoting faster drug development and personalized medicine also contribute to the market's expansion. The ongoing need for improved efficiency, reduced error rates, and increased data analysis capability in genomics labs further strengthens market demand.

Challenges in the Lab Automation in Genomics Industry Sector

The Lab Automation in Genomics Industry faces several challenges, including high initial investment costs for equipment, the need for skilled personnel to operate and maintain complex systems, and potential supply chain disruptions impacting the availability of components and consumables. Regulatory hurdles in certain regions can also delay market entry and product adoption. Furthermore, intense competition among established players and emerging companies can influence pricing and profitability. These challenges can result in a decrease of predicted market growth by approximately XX% by 2033.

Leading Players in the Lab Automation in Genomics Industry Market

- Becton Dickinson and Company

- Tecan Group Ltd

- Synchron Lab Automation

- Perkinelmer Inc

- Thermo Fisher Scientific Inc

- Eli Lilly and Company

- Danaher Corporation / Beckman Coulter

- Siemens Healthineers AG

- Agilent Technologies Inc

- Hudson Robotics Inc

- F Hoffmann-La Roche Ltd

- List Not Exhaustive

Key Developments in Lab Automation in Genomics Industry Sector

July 2022: MAKO Medical Laboratories purchased four additional high-tech liquid handling automation systems, significantly expanding its molecular and COVID-19 testing capacity. This highlights the growing demand for automation in high-volume testing environments.

July 2022: University Hospital Southampton (UHS) NHS Foundation Trust partnered with Automata, a robotic automation solution provider, to develop new applications for laboratory automation technology. This signifies the increasing collaboration between healthcare providers and technology companies in advancing lab automation.

Strategic Lab Automation in Genomics Industry Market Outlook

The Lab Automation in Genomics Industry is poised for continued strong growth, driven by technological advancements, increasing demand for high-throughput genomics applications, and favorable regulatory support. Strategic opportunities exist for companies focused on developing innovative, integrated solutions, expanding into emerging markets, and establishing strategic partnerships to enhance market reach. The focus on user-friendly interfaces, modular systems, and cost-effective solutions will further contribute to market expansion. This translates to significant potential for market growth and profitability for companies effectively positioned to meet these evolving market needs in the coming years.

Lab Automation in Genomics Industry Segmentation

-

1. Equipment

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage and Retrieval Systems (AS/RS)

- 1.5. Vision Systems

Lab Automation in Genomics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Lab Automation in Genomics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Research and Development by Pharmaceutical and Biotech Companies; Growing Demand from Drug Discovery and Genomics

- 3.3. Market Restrains

- 3.3.1. Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handlers to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.5. Vision Systems

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 6.1.5. Vision Systems

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 7.1.5. Vision Systems

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 8.1.5. Vision Systems

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Latin America Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 9.1.5. Vision Systems

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. Middle East and Africa Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Equipment

- 10.1.1. Automated Liquid Handlers

- 10.1.2. Automated Plate Handlers

- 10.1.3. Robotic Arms

- 10.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 10.1.5. Vision Systems

- 10.1. Market Analysis, Insights and Forecast - by Equipment

- 11. North America Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Rest of the World Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Becton Dickinson and Company

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Tecan Group Ltd

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Synchron Lab Automation

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Perkinelmer Inc

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Thermo Fisher Scientific Inc

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Eli Lilly and Company

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Danaher Corporation / Beckman Coulter

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Siemens Healthineers AG

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Agilent Technologies Inc

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Hudson Robotics Inc

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 F Hoffmann-La Roche Ltd *List Not Exhaustive

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Lab Automation in Genomics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Lab Automation in Genomics Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Lab Automation in Genomics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Lab Automation in Genomics Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Lab Automation in Genomics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Lab Automation in Genomics Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Lab Automation in Genomics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Lab Automation in Genomics Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Lab Automation in Genomics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Lab Automation in Genomics Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 11: North America Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 12: North America Lab Automation in Genomics Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Lab Automation in Genomics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Lab Automation in Genomics Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 15: Europe Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 16: Europe Lab Automation in Genomics Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Lab Automation in Genomics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Lab Automation in Genomics Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 19: Asia Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 20: Asia Lab Automation in Genomics Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Lab Automation in Genomics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Latin America Lab Automation in Genomics Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 23: Latin America Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 24: Latin America Lab Automation in Genomics Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Latin America Lab Automation in Genomics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East and Africa Lab Automation in Genomics Industry Revenue (Million), by Equipment 2024 & 2032

- Figure 27: Middle East and Africa Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2024 & 2032

- Figure 28: Middle East and Africa Lab Automation in Genomics Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Middle East and Africa Lab Automation in Genomics Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 3: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Lab Automation in Genomics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Lab Automation in Genomics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Lab Automation in Genomics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Lab Automation in Genomics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 13: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 15: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 17: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 19: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2019 & 2032

- Table 21: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Automation in Genomics Industry?

The projected CAGR is approximately 12.43%.

2. Which companies are prominent players in the Lab Automation in Genomics Industry?

Key companies in the market include Becton Dickinson and Company, Tecan Group Ltd, Synchron Lab Automation, Perkinelmer Inc, Thermo Fisher Scientific Inc, Eli Lilly and Company, Danaher Corporation / Beckman Coulter, Siemens Healthineers AG, Agilent Technologies Inc, Hudson Robotics Inc, F Hoffmann-La Roche Ltd *List Not Exhaustive.

3. What are the main segments of the Lab Automation in Genomics Industry?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Research and Development by Pharmaceutical and Biotech Companies; Growing Demand from Drug Discovery and Genomics.

6. What are the notable trends driving market growth?

Automated Liquid Handlers to Witness High Growth.

7. Are there any restraints impacting market growth?

Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated.

8. Can you provide examples of recent developments in the market?

July 2022: MAKO Medical Laboratories announced to expand molecular and COVID-19 test processing capacity by purchasing four additional high-tech liquid handling automation systems to allow the lab to more than double the COVID-19 testing capacity of a single lab technician in the future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab Automation in Genomics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab Automation in Genomics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab Automation in Genomics Industry?

To stay informed about further developments, trends, and reports in the Lab Automation in Genomics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence