Key Insights

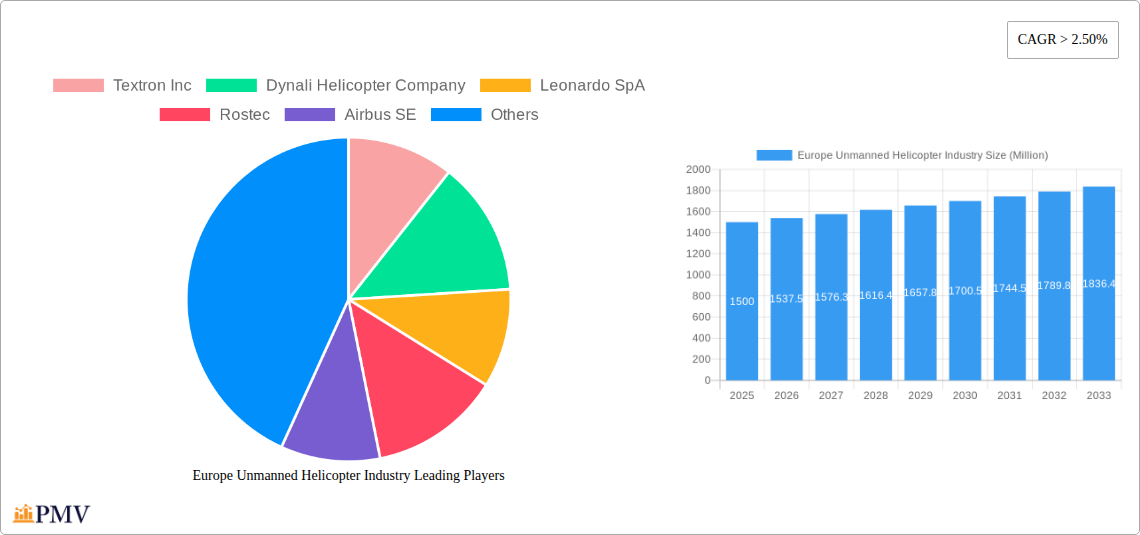

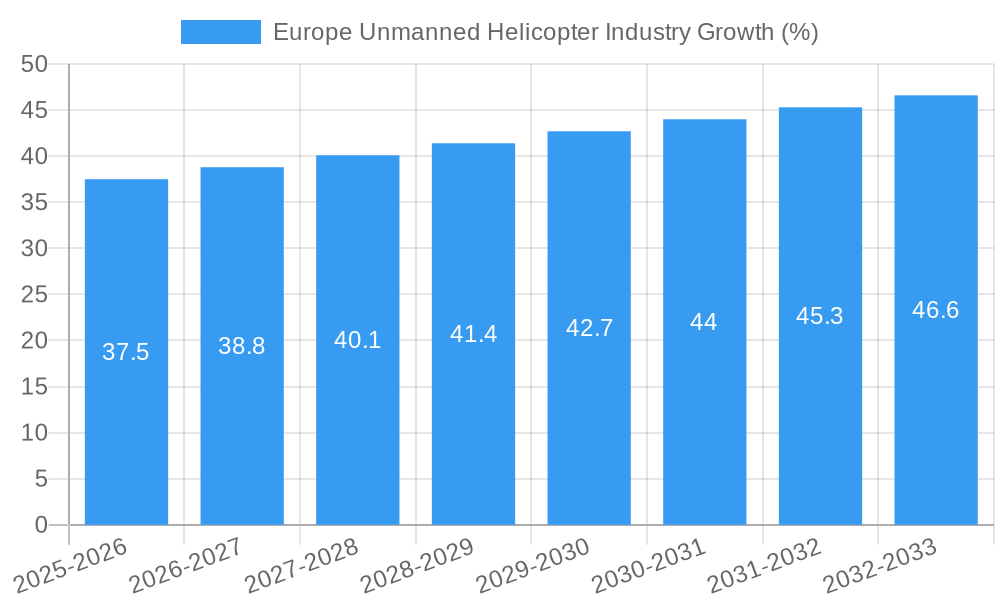

The European unmanned helicopter market is experiencing robust growth, driven by increasing demand across military and civil applications. A compound annual growth rate (CAGR) exceeding 2.5% from 2019 to 2024, suggests a healthy and expanding market. This growth is fueled by several key factors. Firstly, advancements in technology are leading to more sophisticated and reliable unmanned helicopter systems, capable of performing complex tasks with greater autonomy. Secondly, the rising adoption of unmanned aerial vehicles (UAVs) in surveillance, search and rescue, and precision agriculture is significantly contributing to market expansion. Furthermore, government initiatives promoting the use of drones and unmanned systems for various purposes are also stimulating market growth. Specific applications like infrastructure inspection, cargo delivery, and environmental monitoring are creating further opportunities for unmanned helicopter deployment. Major players like Textron, Airbus, and Leonardo are actively investing in research and development, fueling innovation within the sector and fostering competition. Germany, France, and the UK are currently the largest markets within Europe, but significant growth potential exists in other regions such as the Netherlands and Sweden, indicating opportunities for expansion across the continent.

The market segmentation highlights the significant role played by different types of unmanned helicopters. The lighter models are generally favoured for civilian and commercial applications due to their cost-effectiveness and ease of operation. Medium and heavy-duty models cater more to military contracts and specialized tasks requiring heavy-lift capabilities. While the precise market size in 2025 isn't explicitly provided, a reasonable estimation can be made by extrapolating the provided CAGR from the known historical data (2019-2024). Given the growth trajectory, coupled with continued technological advancements and increasing adoption, the European unmanned helicopter market is positioned for substantial expansion throughout the forecast period (2025-2033). This is likely to be reflected in an increased market value, further penetration of existing segments, and the potential emergence of new applications for this promising technology.

Europe Unmanned Helicopter Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides a detailed analysis of the European unmanned helicopter industry, offering invaluable insights for stakeholders seeking to understand market dynamics, competitive landscapes, and future growth potential. Covering the period from 2019 to 2033, with a focus on 2025, this report utilizes rigorous research methodologies to provide actionable intelligence for strategic decision-making. The study period is 2019-2033, with 2025 as the base and estimated year, and 2025-2033 as the forecast period. The historical period covered is 2019-2024. The report segments the market by Maximum Take-off Weight (Light, Medium, Heavy Helicopters) and Application (Military, Civil & Commercial), offering granular analysis of key trends and drivers.

Europe Unmanned Helicopter Industry Market Structure & Competitive Dynamics

The European unmanned helicopter market exhibits a moderately concentrated structure, with several key players vying for market share. The industry is characterized by a dynamic interplay of established aerospace giants like Airbus SE and The Boeing Company, alongside specialized unmanned systems developers. Market concentration is estimated at xx%, with Airbus SE and Boeing holding a combined xx% market share in 2025. Innovation ecosystems are burgeoning, fueled by investments in R&D and collaborations between universities, research institutions, and industry players. Regulatory frameworks are evolving, with agencies like EASA (European Union Aviation Safety Agency) actively shaping safety standards and operational guidelines for unmanned aerial vehicles (UAVs). Product substitutes, such as fixed-wing drones, present competitive challenges, while end-user trends, particularly in the military and commercial sectors, are driving demand for advanced capabilities like autonomous flight, enhanced payload capacity, and improved sensor integration. Mergers and acquisitions (M&A) activity has been moderate, with deal values averaging xx Million in recent years. Key M&A events include [Insert specific M&A examples if available, otherwise use "xx acquisitions with a total value of xx Million"].

Europe Unmanned Helicopter Industry Industry Trends & Insights

The European unmanned helicopter market is experiencing robust growth, driven by factors such as increasing military expenditure, the growing adoption of UAVs in civil applications (e.g., surveillance, inspection, logistics), and technological advancements in areas such as battery technology, autonomous navigation, and sensor integration. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as the development of hybrid-electric propulsion systems and artificial intelligence (AI)-powered autonomous flight capabilities, are reshaping the competitive landscape. Consumer preferences are shifting towards UAVs offering enhanced operational efficiency, improved safety features, and greater payload capacity. Market penetration rates are increasing across various sectors, notably in the surveillance, search and rescue, and precision agriculture applications. Competitive dynamics are intensified by the entry of new players, leading to price reductions and increased innovation. The increasing demand for unmanned helicopter services in both the civilian and defense sectors is expected to propel market growth.

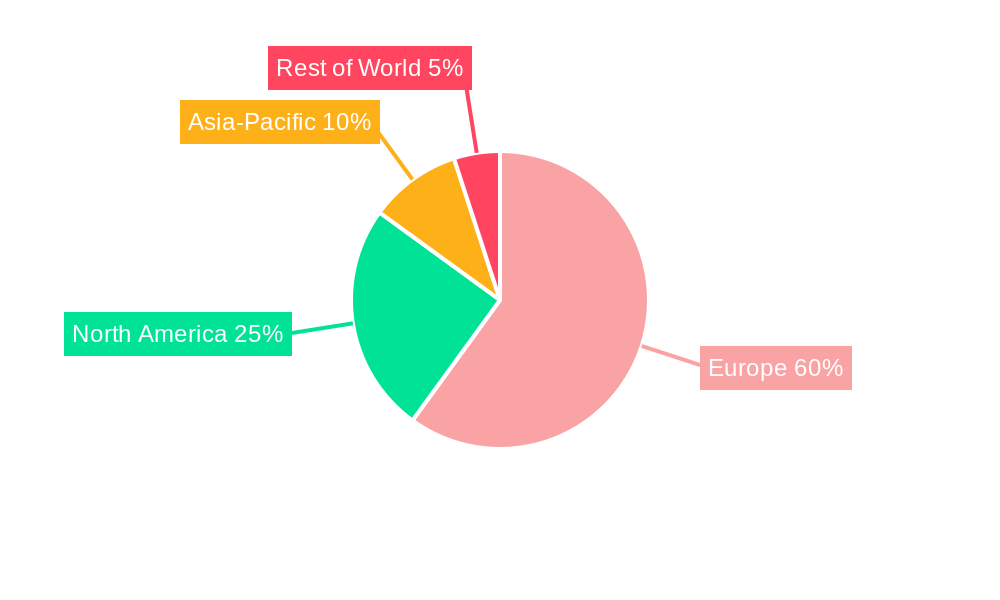

Dominant Markets & Segments in Europe Unmanned Helicopter Industry

- Leading Region: Western Europe (Germany, France, UK) accounts for the largest market share, driven by robust defense spending, a well-developed aerospace industry, and supportive regulatory environments.

- Leading Country: Germany is anticipated to be the leading national market, fuelled by its strong industrial base and significant investment in defense and security technologies. The UK will likely retain a substantial share, propelled by technological advancements in UAV development.

- Dominant Maximum Take-off Weight Segment: The light helicopter segment currently holds the largest market share, due to its versatility and lower operational costs. However, medium helicopter segments will display higher growth rates during the forecast period due to increasing demand for larger payload capacities. The heavy helicopter segment is expected to grow at a slower rate, due to high operational costs and limited applications.

- Dominant Application Segment: The military segment commands a significant share, particularly in Western Europe. However, the civil and commercial segments exhibit faster growth rates, driven by the expanding adoption of UAVs in diverse applications, including infrastructure inspection, search and rescue, and aerial photography.

Key Drivers:

- Germany: Robust aerospace industry, high defense spending, supportive government policies.

- France: Strong domestic defense industry, significant investments in R&D, advanced technological capabilities.

- UK: Significant military and commercial applications, strong research capabilities, substantial governmental investments in drone technology.

- Across Europe: Growing awareness of cost-effectiveness, increasing demand for efficient solutions across civil and military applications.

Europe Unmanned Helicopter Industry Product Innovations

Recent product developments focus on enhancing autonomy, increasing payload capacity, and integrating advanced sensors. Hybrid-electric propulsion systems are emerging as a key technological trend, offering improved fuel efficiency and reduced emissions. Manufacturers are striving to improve flight endurance, range, and operational capabilities to cater to diverse customer needs. Market fit is being achieved through the development of specialized UAVs tailored to specific applications, such as precision agriculture, search and rescue, and infrastructure inspection.

Report Segmentation & Scope

Maximum Take-off Weight: The report segments the market based on maximum take-off weight into light, medium, and heavy helicopters, providing growth projections and market size estimations for each segment. Competitive dynamics vary across segments, with intense competition observed in the light helicopter segment.

Application: The market is further segmented by application into military, civil, and commercial, with varying growth rates and competitive landscapes. The military segment is expected to experience a higher CAGR due to significant military spending, while the commercial and civil segments display substantial potential due to broader adoption in diverse sectors.

Key Drivers of Europe Unmanned Helicopter Industry Growth

The growth of the European unmanned helicopter industry is driven by technological advancements, expanding applications across diverse sectors, increasing military expenditure, and supportive regulatory frameworks. Advancements in battery technology, autonomous flight capabilities, and sensor integration enhance efficiency and expand applications. Favorable government policies and rising investments in R&D promote technological innovation and industry growth. Furthermore, the growing need for cost-effective solutions in various sectors is a major driver for growth.

Challenges in the Europe Unmanned Helicopter Industry Sector

The industry faces challenges including stringent regulatory hurdles, potential supply chain disruptions, and intense competition. Evolving safety regulations and certification processes require significant investment and can delay product launches. Supply chain vulnerabilities can lead to production delays and cost increases. Competition from established players and new entrants intensifies pressure on pricing and profitability.

Leading Players in the Europe Unmanned Helicopter Industry Market

- Textron Inc

- Dynali Helicopter Company

- Leonardo SpA

- Rostec

- Airbus SE

- Enstrom Helicopter Corp

- Alpi Aviation srl

- Heli-Sport sr

- Robinson Helicopter Company

- The Boeing Company

- MD HELICOPTERS INC

Key Developments in Europe Unmanned Helicopter Industry Sector

- 2022 Q3: Airbus SE announced a significant investment in the development of a new hybrid-electric unmanned helicopter.

- 2023 Q1: Leonardo SpA launched a new autonomous flight control system for its unmanned helicopter platforms.

- 2024 Q2: A major merger between two European unmanned helicopter companies resulted in a xx Million deal [Insert more specific examples if available].

Strategic Europe Unmanned Helicopter Industry Market Outlook

The future of the European unmanned helicopter industry appears promising, with continued growth driven by technological advancements, expanding applications, and increasing investments. Strategic opportunities lie in developing advanced technologies, focusing on niche applications, and exploring new partnerships to expand market reach. The focus on sustainable technologies, such as hybrid-electric propulsion, will be crucial for future market leadership. The market holds significant potential for growth, particularly in the civil and commercial sectors, where innovative applications of unmanned helicopters are constantly emerging.

Europe Unmanned Helicopter Industry Segmentation

-

1. Maximum Take-off Weight

- 1.1. Light Helicopters

- 1.2. Medium Helicopters

- 1.3. Heavy Helicopters

-

2. Application

- 2.1. Military

- 2.2. Civil and Commercial

Europe Unmanned Helicopter Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. France

- 1.3. Germany

- 1.4. Italy

- 1.5. Spain

- 1.6. Russia

- 1.7. Rest of Europe

Europe Unmanned Helicopter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military Helicopters to Exhibit the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Unmanned Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 5.1.1. Light Helicopters

- 5.1.2. Medium Helicopters

- 5.1.3. Heavy Helicopters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military

- 5.2.2. Civil and Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 6. Germany Europe Unmanned Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Unmanned Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Unmanned Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Unmanned Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Unmanned Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Unmanned Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Unmanned Helicopter Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Textron Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Dynali Helicopter Company

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Leonardo SpA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Rostec

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Airbus SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Enstrom Helicopter Corp

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Alpi Aviation srl

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Heli-Sport sr

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Robinson Helicopter Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 The Boeing Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 MD HELICOPTERS INC

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Textron Inc

List of Figures

- Figure 1: Europe Unmanned Helicopter Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Unmanned Helicopter Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Unmanned Helicopter Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Unmanned Helicopter Industry Revenue Million Forecast, by Maximum Take-off Weight 2019 & 2032

- Table 3: Europe Unmanned Helicopter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Unmanned Helicopter Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Unmanned Helicopter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Unmanned Helicopter Industry Revenue Million Forecast, by Maximum Take-off Weight 2019 & 2032

- Table 14: Europe Unmanned Helicopter Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Unmanned Helicopter Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: France Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Europe Unmanned Helicopter Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Unmanned Helicopter Industry?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Europe Unmanned Helicopter Industry?

Key companies in the market include Textron Inc, Dynali Helicopter Company, Leonardo SpA, Rostec, Airbus SE, Enstrom Helicopter Corp, Alpi Aviation srl, Heli-Sport sr, Robinson Helicopter Company, The Boeing Company, MD HELICOPTERS INC.

3. What are the main segments of the Europe Unmanned Helicopter Industry?

The market segments include Maximum Take-off Weight, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military Helicopters to Exhibit the Highest Growth Rate.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Unmanned Helicopter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Unmanned Helicopter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Unmanned Helicopter Industry?

To stay informed about further developments, trends, and reports in the Europe Unmanned Helicopter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence