Key Insights

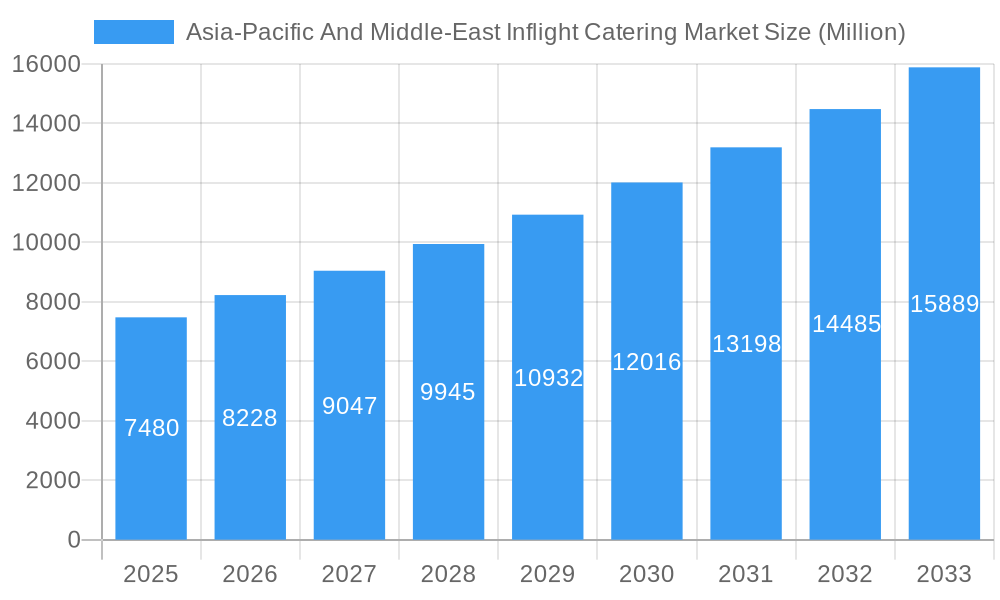

The Asia-Pacific and Middle-East inflight catering market, valued at $7.48 billion in 2025, is projected to experience robust growth, driven by the burgeoning air travel sector and increasing passenger demand for diverse and high-quality meal options. A Compound Annual Growth Rate (CAGR) of 10.05% is anticipated from 2025 to 2033, indicating a significant market expansion. Key drivers include rising disposable incomes in emerging economies, a surge in both domestic and international air travel, and the increasing preference for premium inflight dining experiences, particularly within business and first-class cabins. The market is segmented by food type (meals, bakery & confectionery, beverages, other), flight type (full-service, low-cost, hybrid), and aircraft seating class (economy, business, first). The Asia-Pacific region, specifically countries like China, India, and Japan, is expected to contribute significantly to market growth due to rapid economic development and increasing air passenger traffic. Growth within the region will be fueled by the expansion of low-cost carriers alongside the continued presence and growth of established full-service carriers. While challenges such as fluctuating fuel prices and stringent food safety regulations exist, the overall market outlook remains positive, driven by the continuous expansion of the airline industry and evolving consumer preferences. Competition amongst established players and the emergence of new caterers will be a key dynamic shaping the market.

Asia-Pacific And Middle-East Inflight Catering Market Market Size (In Billion)

The segments within the Asia-Pacific and Middle-East inflight catering market show varied growth potentials. The demand for meals will likely remain the largest segment, driven by the fundamental need for inflight food service. However, the bakery and confectionery segment is poised for rapid growth due to increasing passenger interest in convenient snacks and desserts. The beverages segment is also expected to show steady growth, with a focus on expanding the range of non-alcoholic and alcoholic options to enhance passenger experience. Full-service carriers are anticipated to invest more heavily in premium food services to differentiate themselves, while low-cost carriers will focus on cost-effective options without compromising quality. The business and first-class segments will drive premiumization trends, supporting the growth of specialized catering services and high-end meal choices. Regional variations will persist, with some markets demonstrating stronger preference for specific cuisines and dietary requirements, underscoring the importance of catering to diverse tastes and preferences.

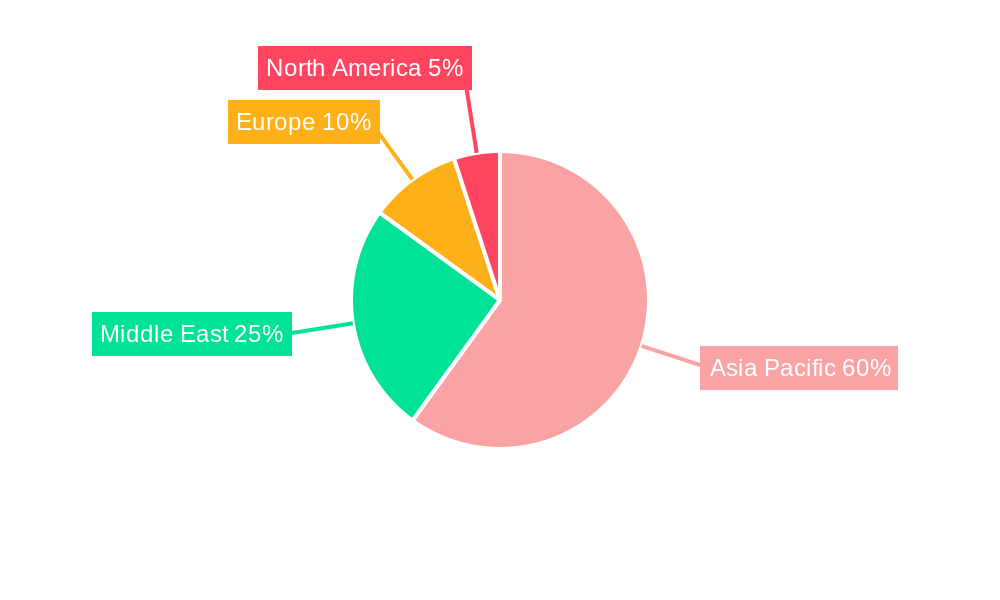

Asia-Pacific And Middle-East Inflight Catering Market Company Market Share

Asia-Pacific and Middle-East Inflight Catering Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific and Middle-East inflight catering market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's structure, competitive landscape, growth drivers, challenges, and future outlook. The report covers key segments including food type (Meals, Bakery and Confectionary, Beverages, Other Food Types), flight type (Full-service Carriers, Low-cost Carriers, Hybrid and Other Flight Types), and aircraft seating class (Economy Class, Business Class, First Class). The market size is valued in Millions.

Asia-Pacific And Middle-East Inflight Catering Market Market Structure & Competitive Dynamics

The Asia-Pacific and Middle-East inflight catering market exhibits a moderately concentrated structure, with a handful of large multinational players commanding significant market share. Key players like The Emirates Group, Newrest Group Services SAS, LSG Airline Catering & Retail GmbH, Air China, SATS Ltd, Gategroup, Cathay Pacific Catering Services Ltd, and JAL Royal Catering dominate the market, leveraging their extensive network, established infrastructure, and brand recognition. Smaller, regional players also contribute significantly, particularly in niche segments.

The market's innovation ecosystem is driven by technological advancements in food preparation, preservation, and delivery, alongside rising consumer demand for customized and healthier meal options. Regulatory frameworks concerning food safety and hygiene standards significantly impact market operations. Product substitutes are limited, with the primary alternatives being in-flight retail offerings or passenger-provided food.

Mergers and acquisitions (M&A) activity has played a notable role in shaping the market landscape, with deal values averaging xx Million in the recent past. For example, the recent expansion of TajSATS showcases a trend of strategic growth via airport infrastructure investments.

Asia-Pacific And Middle-East Inflight Catering Market Industry Trends & Insights

The Asia-Pacific and Middle-East inflight catering market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors. The rising number of air travelers across the region, coupled with a growing preference for in-flight meals, especially among long-haul passengers in business and first class, significantly boosts market demand. Technological advancements such as automated food preparation systems and improved packaging solutions enhance efficiency and reduce waste, driving market expansion. Increasing disposable incomes in several parts of the region contribute to elevated demand for premium inflight catering services.

Furthermore, evolving consumer preferences towards healthier and customized meal options are shaping market trends. The increasing adoption of sustainable practices within the industry, addressing concerns about environmental impact and waste management, adds another layer to the industry's growth trajectory. The competitive dynamics within the market are intense, with established players focusing on innovation and expansion, while new entrants seek to capture market share through differentiated offerings and cost-effective solutions. Market penetration rates for premium inflight catering services are steadily increasing, mirroring the rise in air travel and disposable incomes.

Dominant Markets & Segments in Asia-Pacific And Middle-East Inflight Catering Market

The Asia-Pacific region, particularly countries like China, India, and Japan, and the Middle East (UAE, Saudi Arabia) dominate the inflight catering market. These regions benefit from substantial air passenger traffic, expanding aviation infrastructure, and favorable economic conditions.

- Key Drivers for Dominance:

- High Air Passenger Traffic: Rapid growth in air travel within and between these regions.

- Expanding Aviation Infrastructure: Investments in new airports and upgraded facilities.

- Economic Growth: Rising disposable incomes and increased spending on premium services.

- Tourism Boom: A surge in tourism contributes to higher demand for inflight catering.

Within the segments:

- Food Type: Meals remain the dominant segment, with premium meal options experiencing the highest growth. Bakery and confectionary also show substantial growth, driven by increased demand for snacks and desserts.

- Flight Type: Full-service carriers significantly contribute to market revenue due to their offering of comprehensive meal services. However, the Low-cost carrier segment is also growing as they increasingly offer paid meal options.

- Aircraft Seating Class: Business and First Class segments command higher prices and drive substantial revenue due to premium food and beverage options.

Asia-Pacific And Middle-East Inflight Catering Market Product Innovations

The inflight catering industry is witnessing significant innovation, with a focus on healthier options, customized meals tailored to dietary restrictions, and improved packaging for sustainability. Technological advancements such as meal pre-ordering apps and automated meal preparation systems are enhancing efficiency and personalization. Companies are actively investing in research and development to create innovative food products that meet evolving consumer preferences while optimizing cost-effectiveness and minimizing environmental impact. The focus is on enhancing the passenger experience by offering high-quality, delicious, and convenient meal options that align with consumer expectations.

Report Segmentation & Scope

This report segments the Asia-Pacific and Middle-East inflight catering market based on:

- Food Type: Meals, Bakery and Confectionary, Beverages, Other Food Types (with detailed growth projections and market size for each). Competitive intensity varies across these segments, with meals commanding the largest market share but seeing increased competition from other types of food and beverage.

- Flight Type: Full-service Carriers, Low-cost Carriers, Hybrid and Other Flight Types (growth projections and market share for each, noting the different catering strategies employed).

- Aircraft Seating Class: Economy Class, Business Class, First Class (market size and growth projections for each, highlighting the premium pricing in higher classes). Competitive dynamics vary significantly across classes, with premium classes driving higher profit margins.

Key Drivers of Asia-Pacific And Middle-East Inflight Catering Market Growth

Several factors fuel the growth of this market. The surge in air passenger numbers across the Asia-Pacific and Middle-East regions is a key driver. Technological advancements in food preservation and packaging, allowing for longer shelf life and improved quality, are crucial. Furthermore, rising disposable incomes and a growing preference for convenient and high-quality inflight meals contribute to market expansion. Government policies supporting the aviation industry and tourism also play a vital role.

Challenges in the Asia-Pacific And Middle-East Inflight Catering Market Sector

Significant challenges exist. Stringent food safety and hygiene regulations necessitate high compliance costs. Fluctuations in fuel prices and economic downturns can impact airline profitability and reduce inflight catering budgets. Maintaining a consistent supply chain, particularly for perishable goods across diverse geographic locations, poses logistical difficulties. Intense competition among established players and new entrants adds pressure on pricing and profitability. These factors can lead to reduced profit margins and hinder market growth.

Leading Players in the Asia-Pacific And Middle-East Inflight Catering Market Market

- Ambassadors Sky Chef

- The Emirates Group

- Newrest Group Services SAS

- LSG Airline Catering & Retail GmbH

- Air China

- SATS Ltd

- Aerofood ACS

- Gategroup

- Cathay Pacific Catering Services Ltd

- JAL Royal Catering

Key Developments in Asia-Pacific And Middle-East Inflight Catering Market Sector

- August 2023: TajSATS Air Catering Limited opened a new kitchen at the newly inaugurated Manohar International Airport at Mopa in Goa, expanding its operational capacity and market reach.

- June 2023: Emirates Flight Catering signed its first deal with GMG to provide ready-to-go meals, signifying a strategic move into the rapidly expanding UAE ready-to-go meal sector. This reflects changing consumer preferences and demographic shifts in the UAE.

Strategic Asia-Pacific And Middle-East Inflight Catering Market Market Outlook

The Asia-Pacific and Middle-East inflight catering market presents significant growth opportunities. Continued expansion of air travel, increasing disposable incomes, and evolving consumer preferences for customized and healthier meal options will drive market expansion. Companies focused on innovation, sustainability, and strategic partnerships will be best positioned to capitalize on this potential. Further investments in technology, infrastructure, and supply chain optimization will be key to success in this dynamic market.

Asia-Pacific And Middle-East Inflight Catering Market Segmentation

-

1. Food Type

- 1.1. Meals

- 1.2. Bakery and Confectionary

- 1.3. Beverages

- 1.4. Other Food Types

-

2. Flight Type

- 2.1. Full-service Carriers

- 2.2. Low-cost Carriers

- 2.3. Hybrid and Other Flight Types

-

3. Aircraft Seating Class

- 3.1. Economy Class

- 3.2. Business Class

- 3.3. First Class

-

4. Geography

-

4.1. Asia-Pacific

- 4.1.1. China

- 4.1.2. India

- 4.1.3. Japan

- 4.1.4. Australia

- 4.1.5. New Zealand

- 4.1.6. Indonesia

- 4.1.7. Thailand

- 4.1.8. Malaysia

- 4.1.9. Rest of Asia-Pacific

-

4.2. Middle-East

- 4.2.1. United Arab Emirates

- 4.2.2. Saudi Arabia

- 4.2.3. Qatar

- 4.2.4. Israel

- 4.2.5. Egypt

- 4.2.6. Oman

- 4.2.7. Rest of Middle-East

-

4.1. Asia-Pacific

Asia-Pacific And Middle-East Inflight Catering Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. New Zealand

- 1.6. Indonesia

- 1.7. Thailand

- 1.8. Malaysia

- 1.9. Rest of Asia Pacific

-

2. Middle East

- 2.1. United Arab Emirates

- 2.2. Saudi Arabia

- 2.3. Qatar

- 2.4. Israel

- 2.5. Egypt

- 2.6. Oman

- 2.7. Rest of Middle East

Asia-Pacific And Middle-East Inflight Catering Market Regional Market Share

Geographic Coverage of Asia-Pacific And Middle-East Inflight Catering Market

Asia-Pacific And Middle-East Inflight Catering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Full-service Carriers Segment is Anticipated to Show Significant Growth During the Forecasted Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific And Middle-East Inflight Catering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 5.1.1. Meals

- 5.1.2. Bakery and Confectionary

- 5.1.3. Beverages

- 5.1.4. Other Food Types

- 5.2. Market Analysis, Insights and Forecast - by Flight Type

- 5.2.1. Full-service Carriers

- 5.2.2. Low-cost Carriers

- 5.2.3. Hybrid and Other Flight Types

- 5.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 5.3.1. Economy Class

- 5.3.2. Business Class

- 5.3.3. First Class

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia-Pacific

- 5.4.1.1. China

- 5.4.1.2. India

- 5.4.1.3. Japan

- 5.4.1.4. Australia

- 5.4.1.5. New Zealand

- 5.4.1.6. Indonesia

- 5.4.1.7. Thailand

- 5.4.1.8. Malaysia

- 5.4.1.9. Rest of Asia-Pacific

- 5.4.2. Middle-East

- 5.4.2.1. United Arab Emirates

- 5.4.2.2. Saudi Arabia

- 5.4.2.3. Qatar

- 5.4.2.4. Israel

- 5.4.2.5. Egypt

- 5.4.2.6. Oman

- 5.4.2.7. Rest of Middle-East

- 5.4.1. Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.5.2. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 6. Asia Pacific Asia-Pacific And Middle-East Inflight Catering Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 6.1.1. Meals

- 6.1.2. Bakery and Confectionary

- 6.1.3. Beverages

- 6.1.4. Other Food Types

- 6.2. Market Analysis, Insights and Forecast - by Flight Type

- 6.2.1. Full-service Carriers

- 6.2.2. Low-cost Carriers

- 6.2.3. Hybrid and Other Flight Types

- 6.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 6.3.1. Economy Class

- 6.3.2. Business Class

- 6.3.3. First Class

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Asia-Pacific

- 6.4.1.1. China

- 6.4.1.2. India

- 6.4.1.3. Japan

- 6.4.1.4. Australia

- 6.4.1.5. New Zealand

- 6.4.1.6. Indonesia

- 6.4.1.7. Thailand

- 6.4.1.8. Malaysia

- 6.4.1.9. Rest of Asia-Pacific

- 6.4.2. Middle-East

- 6.4.2.1. United Arab Emirates

- 6.4.2.2. Saudi Arabia

- 6.4.2.3. Qatar

- 6.4.2.4. Israel

- 6.4.2.5. Egypt

- 6.4.2.6. Oman

- 6.4.2.7. Rest of Middle-East

- 6.4.1. Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 7. Middle East Asia-Pacific And Middle-East Inflight Catering Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 7.1.1. Meals

- 7.1.2. Bakery and Confectionary

- 7.1.3. Beverages

- 7.1.4. Other Food Types

- 7.2. Market Analysis, Insights and Forecast - by Flight Type

- 7.2.1. Full-service Carriers

- 7.2.2. Low-cost Carriers

- 7.2.3. Hybrid and Other Flight Types

- 7.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 7.3.1. Economy Class

- 7.3.2. Business Class

- 7.3.3. First Class

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Asia-Pacific

- 7.4.1.1. China

- 7.4.1.2. India

- 7.4.1.3. Japan

- 7.4.1.4. Australia

- 7.4.1.5. New Zealand

- 7.4.1.6. Indonesia

- 7.4.1.7. Thailand

- 7.4.1.8. Malaysia

- 7.4.1.9. Rest of Asia-Pacific

- 7.4.2. Middle-East

- 7.4.2.1. United Arab Emirates

- 7.4.2.2. Saudi Arabia

- 7.4.2.3. Qatar

- 7.4.2.4. Israel

- 7.4.2.5. Egypt

- 7.4.2.6. Oman

- 7.4.2.7. Rest of Middle-East

- 7.4.1. Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Ambassadors Sky Chef

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 The Emirates Group

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Newrest Group Services SAS

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 LSG Airline Catering & Retail GmbH

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Air China

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 SATS Ltd

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Aerofood ACS

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Gategroup

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Cathay Pacific Catering Services Ltd

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 JAL Royal Catering

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Ambassadors Sky Chef

List of Figures

- Figure 1: Asia-Pacific And Middle-East Inflight Catering Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific And Middle-East Inflight Catering Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Food Type 2020 & 2033

- Table 2: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 3: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 4: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Food Type 2020 & 2033

- Table 7: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 8: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 9: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Japan Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Australia Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: New Zealand Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Indonesia Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Thailand Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Asia Pacific Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Food Type 2020 & 2033

- Table 21: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 22: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 23: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific And Middle-East Inflight Catering Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: United Arab Emirates Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Saudi Arabia Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Qatar Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Israel Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Egypt Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Oman Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East Asia-Pacific And Middle-East Inflight Catering Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific And Middle-East Inflight Catering Market?

The projected CAGR is approximately 10.05%.

2. Which companies are prominent players in the Asia-Pacific And Middle-East Inflight Catering Market?

Key companies in the market include Ambassadors Sky Chef, The Emirates Group, Newrest Group Services SAS, LSG Airline Catering & Retail GmbH, Air China, SATS Ltd, Aerofood ACS, Gategroup, Cathay Pacific Catering Services Ltd, JAL Royal Catering.

3. What are the main segments of the Asia-Pacific And Middle-East Inflight Catering Market?

The market segments include Food Type, Flight Type, Aircraft Seating Class, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.48 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Full-service Carriers Segment is Anticipated to Show Significant Growth During the Forecasted Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2023: TajSATS Air Catering Limited opened a new kitchen at the newly inaugurated Manohar International Airport at Mopa in Goa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific And Middle-East Inflight Catering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific And Middle-East Inflight Catering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific And Middle-East Inflight Catering Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific And Middle-East Inflight Catering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence