Key Insights

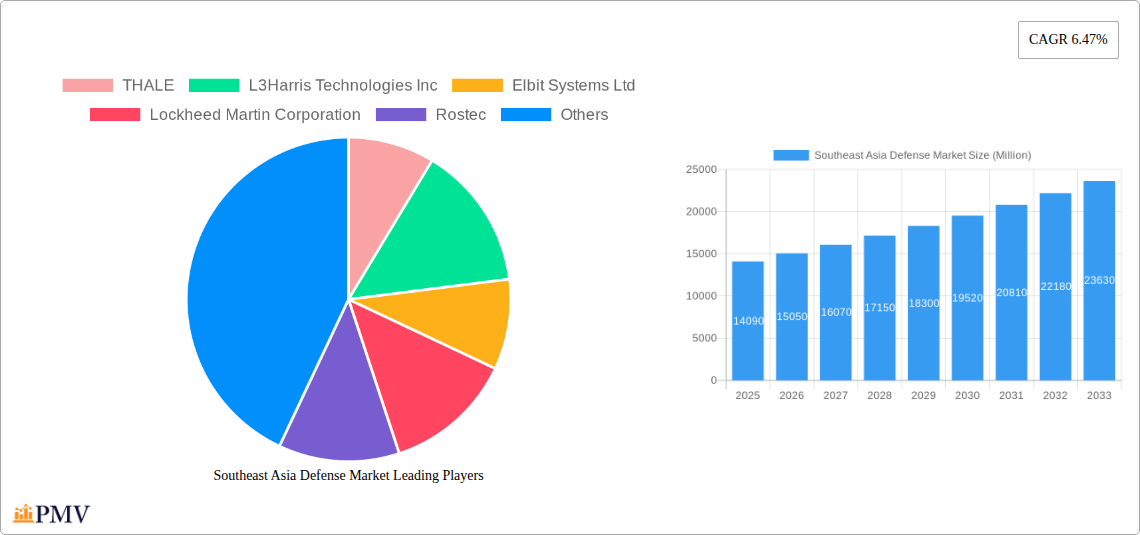

The Southeast Asia defense market, valued at $14.09 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, modernization efforts by regional armed forces, and increasing cross-border security concerns. The 6.47% CAGR from 2025 to 2033 indicates a significant expansion, exceeding $25 billion by the end of the forecast period. Key drivers include the rising demand for advanced C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems to enhance situational awareness and improve response times to threats. Furthermore, investments in personnel training and protection programs, coupled with the modernization of existing weapon systems and procurement of new vehicles and ammunition, will fuel market growth. While budgetary constraints and potential economic downturns could pose restraints, the strategic importance of regional security, particularly amidst evolving geopolitical dynamics within the Asia-Pacific region, ensures continued high defense spending. Growth is expected to be particularly strong in countries like Singapore, Indonesia, and Thailand, which are proactively enhancing their defense capabilities. The market segmentation shows substantial investments across all segments (Personnel Training and Protection, C4ISR and EW, Vehicles, Weapons and Ammunition) further highlighting the comprehensive nature of the defense modernization within the region. The participation of major global players like Thales, Lockheed Martin, and Elbit Systems, alongside regional companies like Singapore Technologies Engineering, underscores the market's significance and attractiveness to both international and domestic businesses.

Southeast Asia Defense Market Market Size (In Billion)

The market's growth trajectory is largely influenced by individual country defense budgets and their respective modernization priorities. For instance, Singapore's advanced technological integration and consistent defense spending will likely drive demand for high-tech systems. Meanwhile, Indonesia and Thailand are focusing on enhancing their naval and air forces, respectively, creating further opportunities for suppliers of related equipment and services. The "Rest of Southeast Asia" segment also presents notable potential, reflecting growing regional cooperation and individual nation's increasing focus on strengthening their defense capabilities. The ongoing competition among defense contractors for lucrative contracts in the region further contributes to the dynamic nature of the market. This competitive landscape drives innovation and ensures that Southeast Asia's armed forces receive cutting-edge technologies to safeguard national interests.

Southeast Asia Defense Market Company Market Share

Southeast Asia Defense Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Southeast Asia defense market, encompassing market size, growth drivers, competitive landscape, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and government agencies seeking to understand this dynamic market. The report segments the market by type (Personnel Training and Protection, C4ISR and EW, Vehicles, Weapons and Ammunition), country (Singapore, Indonesia, Thailand, Malaysia, Rest of Southeast Asia), and armed forces (Air Force, Army, Navy). The total market value in 2025 is estimated at xx Million.

Southeast Asia Defense Market Structure & Competitive Dynamics

The Southeast Asia defense market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Key players such as THALES, L3Harris Technologies Inc, Elbit Systems Ltd, Lockheed Martin Corporation, Rostec, Airbus SE, IAI, Leonardo S p A, Singapore Technologies Engineering Ltd, Saab AB, and The Boeing Company compete intensely, driving innovation and influencing market dynamics. Market share distribution is fluid, with ongoing M&A activities reshaping the competitive landscape. Recent M&A deal values have ranged from xx Million to xx Million, signaling significant consolidation. Regulatory frameworks vary across Southeast Asian nations, impacting market access and investment decisions. The market's innovation ecosystem is characterized by collaborations between defense primes, local manufacturers, and research institutions. End-user trends reveal a growing emphasis on advanced technologies, such as unmanned aerial systems and cybersecurity solutions, driving demand for sophisticated defense equipment. Product substitution is limited due to the specialized nature of defense products, but competition focuses on cost efficiency, technological superiority, and after-sales support.

Southeast Asia Defense Market Industry Trends & Insights

The Southeast Asia defense market is experiencing robust growth, driven by rising geopolitical tensions, increasing defense budgets, and modernization initiatives across the region. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%, fueled by the adoption of advanced technologies and regional security concerns. Market penetration of new technologies, such as AI-powered surveillance systems and hypersonic weaponry, remains relatively low but is expected to increase significantly over the forecast period. Consumer preferences among armed forces show a clear shift towards advanced capabilities, interoperability, and reduced lifecycle costs. However, budget constraints and economic volatility in some Southeast Asian countries could pose challenges to market expansion. Competitive dynamics are characterized by intense rivalry amongst established players and the emergence of new players offering niche technologies.

Dominant Markets & Segments in Southeast Asia Defense Market

- Leading Country: Singapore consistently leads the Southeast Asia defense market due to its advanced technological capabilities, strong economic stability, and high defense spending.

- Leading Segment (Type): The C4ISR and EW segment commands the largest market share owing to the increasing need for advanced surveillance, communication, and electronic warfare capabilities in the region. The Weapons and Ammunition segment also displays strong growth, driven by rising demand for modern weaponry.

- Leading Armed Force: Air Force modernization programs across the region contribute significantly to market growth, driven by the need to upgrade aging fleets and adopt advanced combat aircraft. Navy modernization is also a significant driver in certain countries.

Key Drivers:

- Singapore: Strong economic growth, strategic geopolitical location, robust defense spending, and well-developed defense infrastructure.

- Indonesia: Growing defense budget, focus on maritime security, and modernization of its armed forces.

- Thailand: Ongoing efforts to modernize its military and maintain regional stability.

- Malaysia: Investment in enhancing defense capabilities, primarily focused on maritime security.

The Rest of Southeast Asia also exhibits growth potential, driven by increasing defense budgets and regional security concerns.

Southeast Asia Defense Market Product Innovations

Recent advancements in unmanned aerial systems (UAS), like Elbit Systems' Skylark 3 Hybrid STUAS, highlight the technological emphasis on enhanced endurance and cost efficiency. The integration of artificial intelligence (AI) and machine learning (ML) into defense systems is transforming capabilities in areas such as target identification, threat assessment, and autonomous operations. These innovations enhance operational effectiveness, reduce human risk, and improve overall mission success. The market exhibits a strong fit for these innovations, as regional armed forces increasingly seek to modernize their equipment and enhance their operational capabilities.

Report Segmentation & Scope

This report provides a detailed segmentation of the Southeast Asia defense market based on type, country, and armed forces:

- Type: Personnel Training and Protection (market size xx Million in 2025, projected growth xx%), C4ISR and EW (market size xx Million in 2025, projected growth xx%), Vehicles (market size xx Million in 2025, projected growth xx%), Weapons and Ammunition (market size xx Million in 2025, projected growth xx%).

- Country: Singapore (market size xx Million in 2025, projected growth xx%), Indonesia (market size xx Million in 2025, projected growth xx%), Thailand (market size xx Million in 2025, projected growth xx%), Malaysia (market size xx Million in 2025, projected growth xx%), Rest of Southeast Asia (market size xx Million in 2025, projected growth xx%).

- Armed Forces: Air Force (market size xx Million in 2025, projected growth xx%), Army (market size xx Million in 2025, projected growth xx%), Navy (market size xx Million in 2025, projected growth xx%). Each segment's competitive dynamics are unique, reflecting the specific needs and priorities of the respective armed forces and nations.

Key Drivers of Southeast Asia Defense Market Growth

Several factors fuel the growth of the Southeast Asia defense market. These include rising geopolitical tensions in the region, necessitating increased defense spending; the modernization of armed forces, driven by the desire for advanced technologies and improved capabilities; increasing defense budgets allocated by various governments; and the growing focus on maritime security, particularly in island nations. Economic growth in several Southeast Asian countries also contributes to increased defense spending capacity.

Challenges in the Southeast Asia Defense Market Sector

The Southeast Asia defense market faces challenges, including the fluctuating global economic climate which influences defense budgets; supply chain disruptions and their impact on procurement timelines; intense competition among global and regional players; and varying regulatory landscapes across different countries which can impact market entry and operations. These factors can significantly impact market growth and profitability.

Leading Players in the Southeast Asia Defense Market Market

- THALE

- L3Harris Technologies Inc

- Elbit Systems Ltd

- Lockheed Martin Corporation

- Rostec

- Airbus SE

- IAI

- Leonardo S p A

- Singapore Technologies Engineering Ltd

- Saab AB

- The Boeing Company

Key Developments in Southeast Asia Defense Market Sector

- March 2023: Singapore’s Ministry of Defense exercised an option to acquire eight F-35B Lightning II Fighter multirole combat aircraft from Lockheed Martin Corporation, further solidifying Lockheed Martin's position in the region.

- September 2023: Elbit Systems showcased its Skylark 3 Hybrid STUAS at the Singapore Airshow, highlighting advancements in UAS technology and potentially increasing its market share.

Strategic Southeast Asia Defense Market Outlook

The Southeast Asia defense market presents significant opportunities for growth, driven by continuing modernization efforts, increased defense budgets, and rising geopolitical concerns. Strategic partnerships, technological innovation, and a focus on meeting the specific needs of individual nations will be crucial for success in this dynamic market. The focus on enhancing maritime security, cybersecurity, and asymmetric warfare capabilities presents lucrative avenues for both established players and new entrants. The market is expected to see continued consolidation through mergers and acquisitions, further shaping the competitive landscape.

Southeast Asia Defense Market Segmentation

-

1. Armed Forces

- 1.1. Air Force

- 1.2. Army

- 1.3. Navy

-

2. Type

- 2.1. Personnel Training and Protection

- 2.2. C4ISR and EW

- 2.3. Vehicles

- 2.4. Weapons and Ammunition

Southeast Asia Defense Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Southeast Asia Defense Market Regional Market Share

Geographic Coverage of Southeast Asia Defense Market

Southeast Asia Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Navy Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Southeast Asia Defense Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 5.1.1. Air Force

- 5.1.2. Army

- 5.1.3. Navy

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Personnel Training and Protection

- 5.2.2. C4ISR and EW

- 5.2.3. Vehicles

- 5.2.4. Weapons and Ammunition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6. North America Southeast Asia Defense Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6.1.1. Air Force

- 6.1.2. Army

- 6.1.3. Navy

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Personnel Training and Protection

- 6.2.2. C4ISR and EW

- 6.2.3. Vehicles

- 6.2.4. Weapons and Ammunition

- 6.1. Market Analysis, Insights and Forecast - by Armed Forces

- 7. South America Southeast Asia Defense Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Armed Forces

- 7.1.1. Air Force

- 7.1.2. Army

- 7.1.3. Navy

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Personnel Training and Protection

- 7.2.2. C4ISR and EW

- 7.2.3. Vehicles

- 7.2.4. Weapons and Ammunition

- 7.1. Market Analysis, Insights and Forecast - by Armed Forces

- 8. Europe Southeast Asia Defense Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Armed Forces

- 8.1.1. Air Force

- 8.1.2. Army

- 8.1.3. Navy

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Personnel Training and Protection

- 8.2.2. C4ISR and EW

- 8.2.3. Vehicles

- 8.2.4. Weapons and Ammunition

- 8.1. Market Analysis, Insights and Forecast - by Armed Forces

- 9. Middle East & Africa Southeast Asia Defense Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Armed Forces

- 9.1.1. Air Force

- 9.1.2. Army

- 9.1.3. Navy

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Personnel Training and Protection

- 9.2.2. C4ISR and EW

- 9.2.3. Vehicles

- 9.2.4. Weapons and Ammunition

- 9.1. Market Analysis, Insights and Forecast - by Armed Forces

- 10. Asia Pacific Southeast Asia Defense Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Armed Forces

- 10.1.1. Air Force

- 10.1.2. Army

- 10.1.3. Navy

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Personnel Training and Protection

- 10.2.2. C4ISR and EW

- 10.2.3. Vehicles

- 10.2.4. Weapons and Ammunition

- 10.1. Market Analysis, Insights and Forecast - by Armed Forces

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 THALE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 L3Harris Technologies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Elbit Systems Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lockheed Martin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rostec

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Airbus SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IAI

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Leonardo S p A

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Singapore Technologies Engineering Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Saab AB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Boeing Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 THALE

List of Figures

- Figure 1: Global Southeast Asia Defense Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Southeast Asia Defense Market Revenue (Million), by Armed Forces 2025 & 2033

- Figure 3: North America Southeast Asia Defense Market Revenue Share (%), by Armed Forces 2025 & 2033

- Figure 4: North America Southeast Asia Defense Market Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Southeast Asia Defense Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Southeast Asia Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Southeast Asia Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Southeast Asia Defense Market Revenue (Million), by Armed Forces 2025 & 2033

- Figure 9: South America Southeast Asia Defense Market Revenue Share (%), by Armed Forces 2025 & 2033

- Figure 10: South America Southeast Asia Defense Market Revenue (Million), by Type 2025 & 2033

- Figure 11: South America Southeast Asia Defense Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Southeast Asia Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Southeast Asia Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Southeast Asia Defense Market Revenue (Million), by Armed Forces 2025 & 2033

- Figure 15: Europe Southeast Asia Defense Market Revenue Share (%), by Armed Forces 2025 & 2033

- Figure 16: Europe Southeast Asia Defense Market Revenue (Million), by Type 2025 & 2033

- Figure 17: Europe Southeast Asia Defense Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Southeast Asia Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Southeast Asia Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Southeast Asia Defense Market Revenue (Million), by Armed Forces 2025 & 2033

- Figure 21: Middle East & Africa Southeast Asia Defense Market Revenue Share (%), by Armed Forces 2025 & 2033

- Figure 22: Middle East & Africa Southeast Asia Defense Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Middle East & Africa Southeast Asia Defense Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Southeast Asia Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Southeast Asia Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Southeast Asia Defense Market Revenue (Million), by Armed Forces 2025 & 2033

- Figure 27: Asia Pacific Southeast Asia Defense Market Revenue Share (%), by Armed Forces 2025 & 2033

- Figure 28: Asia Pacific Southeast Asia Defense Market Revenue (Million), by Type 2025 & 2033

- Figure 29: Asia Pacific Southeast Asia Defense Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Southeast Asia Defense Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Southeast Asia Defense Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Southeast Asia Defense Market Revenue Million Forecast, by Armed Forces 2020 & 2033

- Table 2: Global Southeast Asia Defense Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Southeast Asia Defense Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Southeast Asia Defense Market Revenue Million Forecast, by Armed Forces 2020 & 2033

- Table 5: Global Southeast Asia Defense Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Southeast Asia Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Southeast Asia Defense Market Revenue Million Forecast, by Armed Forces 2020 & 2033

- Table 11: Global Southeast Asia Defense Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Southeast Asia Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Southeast Asia Defense Market Revenue Million Forecast, by Armed Forces 2020 & 2033

- Table 17: Global Southeast Asia Defense Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Southeast Asia Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Southeast Asia Defense Market Revenue Million Forecast, by Armed Forces 2020 & 2033

- Table 29: Global Southeast Asia Defense Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Southeast Asia Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Southeast Asia Defense Market Revenue Million Forecast, by Armed Forces 2020 & 2033

- Table 38: Global Southeast Asia Defense Market Revenue Million Forecast, by Type 2020 & 2033

- Table 39: Global Southeast Asia Defense Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Southeast Asia Defense Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Defense Market?

The projected CAGR is approximately 6.47%.

2. Which companies are prominent players in the Southeast Asia Defense Market?

Key companies in the market include THALE, L3Harris Technologies Inc, Elbit Systems Ltd, Lockheed Martin Corporation, Rostec, Airbus SE, IAI, Leonardo S p A, Singapore Technologies Engineering Ltd, Saab AB, The Boeing Company.

3. What are the main segments of the Southeast Asia Defense Market?

The market segments include Armed Forces, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Navy Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

September 2023: Elbit Systems announced that it would present Skylark 3 Hybrid Small Tactical Unmanned Aerial Systems (STUAS) for the first time at the Singapore Airshow. The Skylark 3 Hybrid system is equipped with a hybrid propulsion system that offers 18 hours of operations and improves mission effectiveness and cost efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Defense Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence