Key Insights

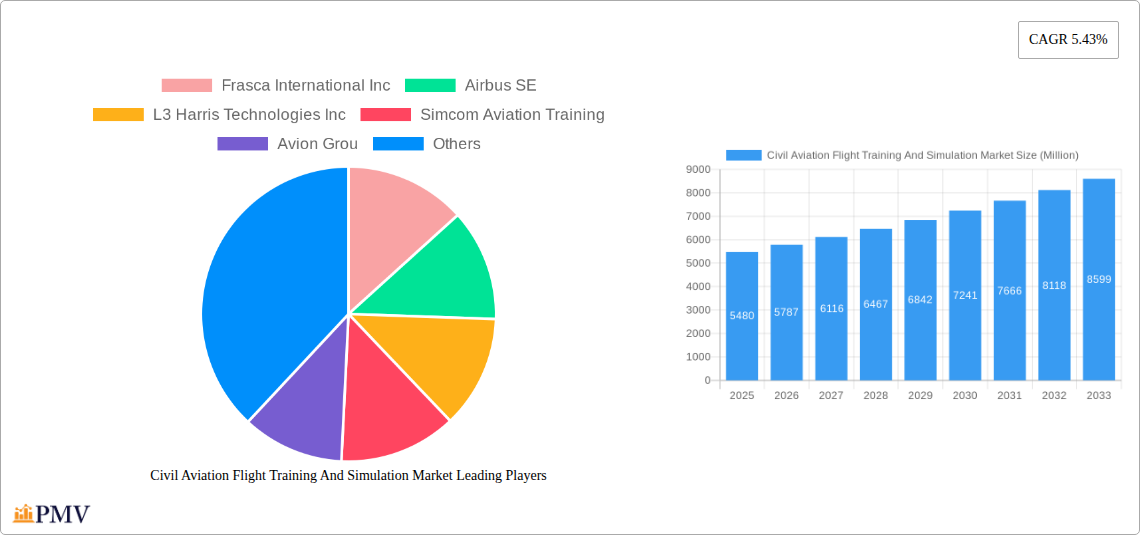

The global Civil Aviation Flight Training and Simulation market, valued at $5.48 billion in 2025, is projected to experience robust growth, driven by increasing air passenger traffic, stringent safety regulations demanding enhanced pilot training, and technological advancements in simulation technology. The market's Compound Annual Growth Rate (CAGR) of 5.43% from 2025 to 2033 indicates a significant expansion, primarily fueled by the adoption of sophisticated Full Flight Simulators (FFS) and Flight Training Devices (FDS) across various aircraft types, including fixed-wing and rotary-wing. The rising demand for efficient and cost-effective training solutions, coupled with the integration of advanced technologies like virtual reality and artificial intelligence, further propels market growth. North America and Europe currently dominate the market due to well-established aviation industries and substantial investments in flight training infrastructure. However, the Asia-Pacific region is expected to witness significant growth during the forecast period, driven by rapid expansion of its airline industry and increasing pilot training needs. Market restraints include the high initial investment costs associated with procuring and maintaining simulators and the need for continuous software and hardware updates to reflect evolving aircraft technologies. Nevertheless, the long-term outlook remains positive, with several key players like CAE Inc, Boeing, and Airbus continuing to invest in research and development to enhance simulation technologies and expand their market share.

Civil Aviation Flight Training And Simulation Market Market Size (In Billion)

The segmentation of the market by simulator type (FFS, FDS, other) and aircraft type (fixed-wing, rotary-wing) offers valuable insights into specific market dynamics. The FFS segment is anticipated to hold a substantial market share owing to its realistic replication of flight conditions. The fixed-wing segment will likely dominate the aircraft type segment, reflecting the higher number of fixed-wing aircraft in operation globally. Competitive intensity is high, with established players and emerging companies vying for market share through product innovation, strategic partnerships, and geographical expansion. The increasing emphasis on sustainable aviation practices will also influence market trends, with a growing need for simulators that incorporate eco-friendly flight operations and fuel efficiency training modules. This evolution will necessitate continuous adaptation and innovation within the industry to meet the evolving needs of the global aviation sector.

Civil Aviation Flight Training And Simulation Market Company Market Share

Civil Aviation Flight Training and Simulation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Civil Aviation Flight Training and Simulation market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The report segments the market by simulator type (Full Flight Simulator (FFS), Flight Training Devices (FDS), Other Training Types) and aircraft type (Fixed-wing, Rotary-wing), providing granular analysis of each segment's performance and growth drivers. Key players like Frasca International Inc, Airbus SE, L3 Harris Technologies Inc, and others are profiled, revealing their market share, strategic initiatives, and competitive advantages. This detailed report will equip you with actionable intelligence to navigate the complexities of this dynamic market.

Civil Aviation Flight Training And Simulation Market Market Structure & Competitive Dynamics

The Civil Aviation Flight Training and Simulation market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The market's competitive intensity is driven by technological innovation, regulatory compliance, and intense competition for contracts with airlines and training organizations. The market’s innovation ecosystem is characterized by continuous advancements in simulation technology, including the integration of Artificial Intelligence (AI) and Virtual Reality (VR) for enhanced training experiences. Regulatory frameworks, such as those set by the FAA and EASA, play a crucial role in shaping product standards and safety protocols. Product substitutes, while limited, include traditional ground-based training methods, but the growing emphasis on realistic simulation is driving market growth. End-user trends, such as the increasing demand for cost-effective and efficient training solutions, are significantly influencing market dynamics.

Mergers and acquisitions (M&A) activities have played a significant role in shaping the market landscape, with several large players consolidating their positions through strategic acquisitions. The total M&A deal value in the period 2019-2024 is estimated at xx Million, with an average deal size of xx Million. CAE Inc., for instance, has consistently engaged in acquisitions to expand its product portfolio and geographic reach. Market share distribution amongst the top 5 players is estimated to be approximately 60% in 2025, indicating the significant influence of larger players. The market is further characterized by intense competition, necessitating continuous innovation and strategic partnerships to maintain a competitive edge.

Civil Aviation Flight Training And Simulation Market Industry Trends & Insights

The Civil Aviation Flight Training and Simulation market is experiencing robust growth, driven by several key factors. The burgeoning global air travel industry is a primary driver, necessitating a substantial increase in the number of trained pilots and maintenance personnel. This growing demand is fueling the adoption of advanced flight simulators and training devices. Technological advancements, including the integration of VR/AR, AI, and advanced data analytics, are revolutionizing training methodologies, offering more realistic and immersive simulations. Furthermore, the rising emphasis on safety and regulatory compliance is propelling the adoption of sophisticated training solutions.

The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%, while the projected CAGR for the forecast period (2025-2033) is xx%. Market penetration of advanced simulation technologies, such as FFS and FTDs, is steadily increasing, as airlines and training institutions prioritize high-fidelity training environments. The increasing adoption of cloud-based training solutions and the development of modular training programs are further contributing to market growth. Competitive dynamics are characterized by continuous innovation, strategic partnerships, and a focus on providing comprehensive training packages that meet the evolving needs of the aviation industry.

Dominant Markets & Segments in Civil Aviation Flight Training And Simulation Market

North America currently holds the largest market share in the Civil Aviation Flight Training and Simulation market, driven by strong domestic air travel demand and a well-established aviation training infrastructure. Within North America, the United States is the dominant market.

- Key Drivers for North American Dominance:

- Strong regulatory framework supporting aviation safety and training.

- Large number of established flight schools and training centers.

- High investment in advanced simulation technologies.

- Significant presence of major flight simulator manufacturers.

The Full Flight Simulator (FFS) segment dominates the market by simulator type, owing to its high fidelity and realistic representation of flight conditions. Fixed-wing aircraft training accounts for a larger segment compared to rotary-wing, due to the greater number of fixed-wing aircraft in operation globally.

Factors Contributing to FFS Segment Dominance:

- Enhanced realism and improved training efficacy.

- Compliance with stringent regulatory requirements.

- Growing demand for advanced pilot training programs.

Factors Contributing to Fixed-Wing Segment Dominance:

- Larger fleet size compared to rotary-wing aircraft.

- Increased passenger air travel contributing to higher pilot demand.

The European market is a close second, exhibiting strong growth potential due to a robust aviation industry and increasing investments in advanced training technologies. Asia-Pacific is emerging as a rapidly growing market, driven by rapid expansion in air travel and government initiatives to improve aviation infrastructure.

Civil Aviation Flight Training And Simulation Market Product Innovations

Recent years have witnessed significant advancements in flight simulation technology, including the integration of high-fidelity visual systems, advanced motion platforms, and sophisticated software that simulates various flight scenarios and emergencies. The integration of AI and VR/AR is enhancing the realism and effectiveness of training programs. New simulation platforms are becoming more modular, allowing for customization to suit specific aircraft types and training needs. This enhances market fit by offering flexible solutions to various aviation operators. Companies are also emphasizing cost-effectiveness and cloud-based training solutions to expand accessibility and affordability.

Report Segmentation & Scope

This report segments the Civil Aviation Flight Training and Simulation market in two key ways:

By Simulator Type:

Full Flight Simulators (FFS): This segment represents the highest fidelity training devices, offering a highly realistic simulation environment. The market size for FFS is projected to reach xx Million by 2033, growing at a CAGR of xx%. The market is characterized by high initial investment costs but offers significant long-term returns in terms of improved pilot training and safety.

Flight Training Devices (FTDs): FTDs offer a cost-effective alternative to FFS, suitable for basic and procedural training. The market size for FTDs is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. The market is characterized by increasing demand from flight schools and training institutions seeking affordable training solutions.

Other Training Types: This segment encompasses various other training devices and methods used in aviation training, such as desktop simulators and classroom-based training. The market size is estimated at xx Million in 2025 and is projected to grow at a CAGR of xx% during the forecast period.

By Aircraft Type:

Fixed-wing: This segment dominates the market due to the larger number of fixed-wing aircraft in operation. The market size for fixed-wing simulation training is projected to reach xx Million by 2033, with a CAGR of xx%. The competitive landscape is characterized by intense competition amongst major manufacturers.

Rotary-wing: The rotary-wing segment is experiencing steady growth, driven by the increasing demand for helicopter pilots in various sectors like offshore oil and gas, emergency medical services, and law enforcement. The market size for rotary-wing simulation training is projected to reach xx Million by 2033, at a CAGR of xx%.

Key Drivers of Civil Aviation Flight Training And Simulation Market Growth

Several factors are driving the growth of the Civil Aviation Flight Training and Simulation market: Firstly, the ever-increasing global air travel demand necessitates a large pool of well-trained pilots and maintenance personnel. Secondly, the stringent regulatory requirements for flight safety are driving the adoption of advanced simulation technologies that offer more realistic and effective training. Finally, the continuous technological innovations in simulation technology, incorporating AI and VR/AR, are further bolstering market growth by offering highly immersive and efficient training experiences. These factors are expected to continue driving market expansion in the coming years.

Challenges in the Civil Aviation Flight Training And Simulation Market Sector

The Civil Aviation Flight Training and Simulation market faces several challenges. High initial investment costs for advanced simulators can be a barrier to entry for smaller training organizations. Furthermore, the complexity of integrating new technologies and maintaining compliance with ever-evolving regulatory requirements presents significant hurdles. The market is also characterized by intense competition among established players, necessitating continuous innovation and cost optimization to maintain a competitive edge. Supply chain disruptions can also impact the timely delivery of simulators and related equipment. These challenges necessitate strategic planning and adaptability for market players to thrive in this dynamic landscape.

Leading Players in the Civil Aviation Flight Training And Simulation Market Market

- Frasca International Inc

- Airbus SE

- L3 Harris Technologies Inc

- Simcom Aviation Training

- Avion Grou

- Pureflight Aviation Training

- RTX Corporation

- ALSIM EMEA

- CAE Inc

- TRU Simulation + Training Inc (Textron Inc)

- FAAC Inc

- FlightSafety International Inc

- The Boeing Company

Key Developments in Civil Aviation Flight Training And Simulation Market Sector

- 2023 Q3: CAE Inc. announces a significant investment in AI-powered training solutions.

- 2022 Q4: Frasca International Inc. launches a new generation of FFS with enhanced VR capabilities.

- 2021 Q2: L3Harris Technologies Inc. acquires a smaller simulation company, expanding its product portfolio.

- 2020 Q1: Airbus SE partners with a technology provider to integrate AI-based training modules in its FFS products.

Strategic Civil Aviation Flight Training And Simulation Market Market Outlook

The Civil Aviation Flight Training and Simulation market exhibits strong future potential, driven by continued growth in air travel, increasing regulatory scrutiny, and ongoing technological advancements. Strategic opportunities exist for companies to invest in innovative training technologies, expand into emerging markets, and develop comprehensive training packages that cater to the evolving needs of the aviation industry. Focusing on cost-effective solutions, modular training programs, and the integration of AI and VR/AR will be crucial for success in this dynamic and rapidly evolving market. The market is projected to experience robust growth, driven by factors outlined in the preceding sections, leading to substantial opportunities for market participants who can adapt to and leverage these trends.

Civil Aviation Flight Training And Simulation Market Segmentation

-

1. Simulator Type

- 1.1. Full Flight Simulator (FFS)

- 1.2. Flight Training Devices (FDS)

- 1.3. Other Training Types

-

2. Aircraft Type

- 2.1. Fixed-wing

- 2.2. Rotary-wing

Civil Aviation Flight Training And Simulation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Civil Aviation Flight Training And Simulation Market Regional Market Share

Geographic Coverage of Civil Aviation Flight Training And Simulation Market

Civil Aviation Flight Training And Simulation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Full Flight Simulator (FFS) Segment is Projected to Occupy the Largest Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Civil Aviation Flight Training And Simulation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Simulator Type

- 5.1.1. Full Flight Simulator (FFS)

- 5.1.2. Flight Training Devices (FDS)

- 5.1.3. Other Training Types

- 5.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.2.1. Fixed-wing

- 5.2.2. Rotary-wing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Simulator Type

- 6. North America Civil Aviation Flight Training And Simulation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Simulator Type

- 6.1.1. Full Flight Simulator (FFS)

- 6.1.2. Flight Training Devices (FDS)

- 6.1.3. Other Training Types

- 6.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.2.1. Fixed-wing

- 6.2.2. Rotary-wing

- 6.1. Market Analysis, Insights and Forecast - by Simulator Type

- 7. Europe Civil Aviation Flight Training And Simulation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Simulator Type

- 7.1.1. Full Flight Simulator (FFS)

- 7.1.2. Flight Training Devices (FDS)

- 7.1.3. Other Training Types

- 7.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.2.1. Fixed-wing

- 7.2.2. Rotary-wing

- 7.1. Market Analysis, Insights and Forecast - by Simulator Type

- 8. Asia Pacific Civil Aviation Flight Training And Simulation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Simulator Type

- 8.1.1. Full Flight Simulator (FFS)

- 8.1.2. Flight Training Devices (FDS)

- 8.1.3. Other Training Types

- 8.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.2.1. Fixed-wing

- 8.2.2. Rotary-wing

- 8.1. Market Analysis, Insights and Forecast - by Simulator Type

- 9. Latin America Civil Aviation Flight Training And Simulation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Simulator Type

- 9.1.1. Full Flight Simulator (FFS)

- 9.1.2. Flight Training Devices (FDS)

- 9.1.3. Other Training Types

- 9.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.2.1. Fixed-wing

- 9.2.2. Rotary-wing

- 9.1. Market Analysis, Insights and Forecast - by Simulator Type

- 10. Middle East and Africa Civil Aviation Flight Training And Simulation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Simulator Type

- 10.1.1. Full Flight Simulator (FFS)

- 10.1.2. Flight Training Devices (FDS)

- 10.1.3. Other Training Types

- 10.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.2.1. Fixed-wing

- 10.2.2. Rotary-wing

- 10.1. Market Analysis, Insights and Forecast - by Simulator Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Frasca International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Airbus SE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 L3 Harris Technologies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Simcom Aviation Training

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Avion Grou

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pureflight Aviation Training

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RTX Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ALSIM EMEA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CAE Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TRU Simulation + Training Inc (Textron Inc )

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 FAAC Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FlightSafety International Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 The Boeing Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Frasca International Inc

List of Figures

- Figure 1: Global Civil Aviation Flight Training And Simulation Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Civil Aviation Flight Training And Simulation Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 3: North America Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 4: North America Civil Aviation Flight Training And Simulation Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 5: North America Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 6: North America Civil Aviation Flight Training And Simulation Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Civil Aviation Flight Training And Simulation Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 9: Europe Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 10: Europe Civil Aviation Flight Training And Simulation Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 11: Europe Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 12: Europe Civil Aviation Flight Training And Simulation Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Civil Aviation Flight Training And Simulation Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 15: Asia Pacific Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 16: Asia Pacific Civil Aviation Flight Training And Simulation Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 17: Asia Pacific Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 18: Asia Pacific Civil Aviation Flight Training And Simulation Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Civil Aviation Flight Training And Simulation Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 21: Latin America Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 22: Latin America Civil Aviation Flight Training And Simulation Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 23: Latin America Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 24: Latin America Civil Aviation Flight Training And Simulation Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Civil Aviation Flight Training And Simulation Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 27: Middle East and Africa Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 28: Middle East and Africa Civil Aviation Flight Training And Simulation Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 29: Middle East and Africa Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 30: Middle East and Africa Civil Aviation Flight Training And Simulation Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Civil Aviation Flight Training And Simulation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 2: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 3: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 5: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 6: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 10: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 11: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 18: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 19: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 26: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 27: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 31: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 32: Global Civil Aviation Flight Training And Simulation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East and Africa Civil Aviation Flight Training And Simulation Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Civil Aviation Flight Training And Simulation Market?

The projected CAGR is approximately 5.43%.

2. Which companies are prominent players in the Civil Aviation Flight Training And Simulation Market?

Key companies in the market include Frasca International Inc, Airbus SE, L3 Harris Technologies Inc, Simcom Aviation Training, Avion Grou, Pureflight Aviation Training, RTX Corporation, ALSIM EMEA, CAE Inc, TRU Simulation + Training Inc (Textron Inc ), FAAC Inc, FlightSafety International Inc, The Boeing Company.

3. What are the main segments of the Civil Aviation Flight Training And Simulation Market?

The market segments include Simulator Type, Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.48 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Full Flight Simulator (FFS) Segment is Projected to Occupy the Largest Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Civil Aviation Flight Training And Simulation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Civil Aviation Flight Training And Simulation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Civil Aviation Flight Training And Simulation Market?

To stay informed about further developments, trends, and reports in the Civil Aviation Flight Training And Simulation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence