Key Insights

The European small satellite market is poised for significant expansion, driven by escalating demand for cost-efficient Earth observation, communication, and navigation services. This dynamic sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.1%. Key growth drivers include advancements in miniaturization and propulsion technologies, notably electric propulsion, which are reducing launch expenses and facilitating more frequent missions. The increasing adoption of small satellites for diverse applications, including environmental monitoring, precision agriculture, and IoT connectivity, is broadening market reach. Furthermore, supportive government initiatives and robust private sector investment are fostering innovation and competition within the European space industry. Germany, France, and the United Kingdom are leading regions, leveraging established space infrastructures and strong research expertise. Persistent challenges include the imperative for standardized regulations and mitigation of potential supply chain disruptions.

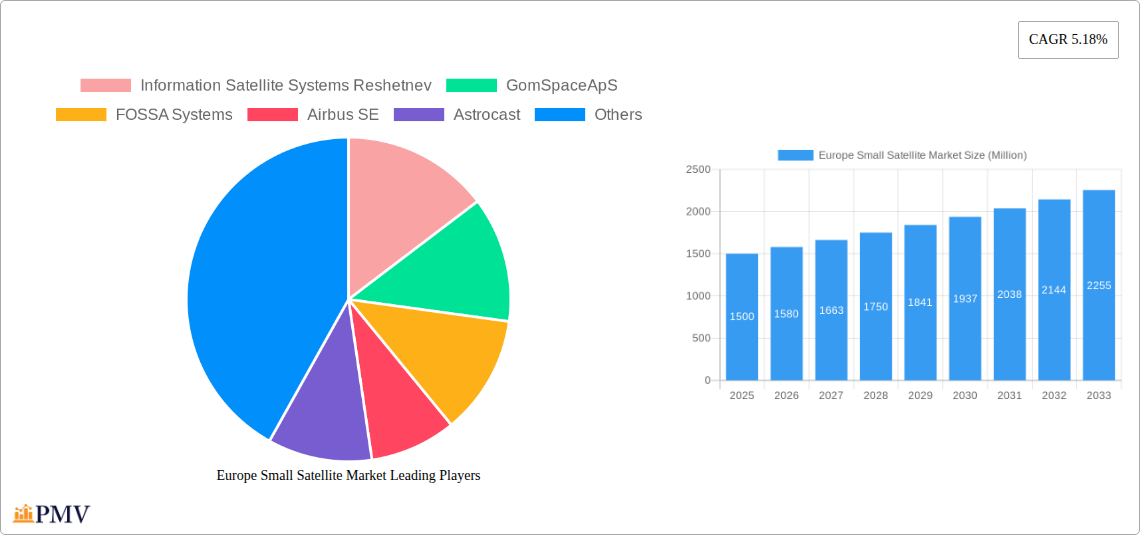

Europe Small Satellite Market Market Size (In Billion)

The market is forecast to continue its robust growth trajectory through 2033. Communication and Earth observation applications are expected to spearhead this expansion, fueled by the escalating need for real-time data and global connectivity. Within propulsion technologies, electric propulsion is anticipated to exhibit the highest growth due to its cost-effectiveness and superior efficiency. The Low Earth Orbit (LEO) segment is set for substantial expansion, aligning with various application requirements, while the commercial end-user segment is projected to maintain market dominance, driven by heightened private investment and demand. The estimated market size for 2025 is projected to reach $1.33 billion. Sustained innovation, strategic collaborations, and a conducive regulatory framework will be pivotal in unlocking the full potential of this burgeoning market.

Europe Small Satellite Market Company Market Share

Europe Small Satellite Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European small satellite market, covering the period from 2019 to 2033. It offers actionable insights into market dynamics, competitive landscapes, and future growth potential, equipping stakeholders with the knowledge to make informed strategic decisions. The report incorporates detailed segmentation across propulsion technology, application, orbit class, and end-user, providing granular market sizing and forecasting. The base year for this analysis is 2025, with a forecast period spanning from 2025 to 2033, and a historical period covering 2019-2024. The total market size in 2025 is estimated at xx Million.

Europe Small Satellite Market Market Structure & Competitive Dynamics

The European small satellite market is characterized by a moderately concentrated structure, with a few major players alongside a growing number of smaller, specialized companies. Key players like Airbus SE, OHB SE, and Information Satellite Systems Reshetnev hold significant market share, while companies like GomSpace ApS, FOSSA Systems, Astrocast, SatRev, Thale, and Alba Orbital contribute to a dynamic and innovative landscape. The market exhibits a strong innovation ecosystem, driven by government initiatives, research institutions, and private investments. The regulatory framework, while evolving, generally supports the growth of the small satellite sector. Product substitution is limited, given the specialized nature of these technologies. However, the increasing affordability and accessibility of launch services are driving competition. End-user trends show a strong shift towards commercial applications, particularly in Earth observation and communication.

Mergers and acquisitions (M&A) are frequent, reflecting consolidation and strategic expansion within the sector. While precise M&A deal values are proprietary data, recent activity indicates significant investments and a trend toward larger players acquiring smaller companies with specialized technologies. For instance, the acquisition of xx by yy for approximately xx Million in 2024 highlights this trend. Further research into the individual deal values will be undertaken by the report. Market share distribution in 2025 is estimated as follows: Airbus SE (xx%), OHB SE (xx%), Information Satellite Systems Reshetnev (xx%), Others (xx%).

Europe Small Satellite Market Industry Trends & Insights

The European small satellite market is experiencing robust growth, driven by several key factors. The increasing demand for high-resolution Earth observation data, the expansion of satellite-based communication networks (particularly for IoT applications), and the growing adoption of small satellites for navigation and space observation are major drivers. Technological advancements, such as miniaturization of components, the development of more efficient propulsion systems (electric propulsion technology is gaining traction), and improved launch capabilities are further fueling market expansion. The CAGR for the market during the forecast period (2025-2033) is estimated to be xx%. This is being fuelled by increased investment in R&D and growing government support in fostering growth in the small satellite launch services area. The market penetration is expanding beyond traditional commercial applications to encompass military and government sectors, driven by the need for cost-effective, agile satellite solutions. Competitive dynamics are intensifying, with companies focusing on innovation, partnerships, and vertical integration to maintain a competitive edge. The consumer preference is shifting towards more adaptable and affordable satellite-based services which encourages the growth of small satellite launches.

Dominant Markets & Segments in Europe Small Satellite Market

The LEO (Low Earth Orbit) segment dominates the European small satellite market, driven by the increasing demand for Earth observation and communication services. The communication application segment is also a major contributor to market growth, with significant investment in constellations of small satellites for IoT and other communication needs. Within the propulsion technology segment, electric propulsion is rapidly gaining market share due to its cost-effectiveness and efficiency.

- Key Drivers for LEO Dominance: Reduced launch costs, improved accessibility, and suitability for various applications.

- Key Drivers for Communication Application Dominance: Growing demand for IoT services, enhanced connectivity requirements, and the development of cost-effective constellations.

- Key Drivers for Electric Propulsion Dominance: Increased efficiency, reduced fuel consumption, and extended mission lifespan.

Germany, the UK, and France are the leading European countries in the small satellite market, benefiting from strong aerospace industries, research infrastructure, and supportive government policies.

Europe Small Satellite Market Product Innovations

Recent innovations in the European small satellite market focus on miniaturization, improved payload capabilities, and more efficient propulsion systems. The development of advanced electric propulsion technologies is extending mission life and reducing operational costs. New materials and manufacturing processes are leading to lighter, more robust satellites. These innovations are improving the cost-effectiveness and versatility of small satellites, expanding their applications across various sectors. The focus on modularity and standardized interfaces is fostering greater collaboration and accelerating product development cycles.

Report Segmentation & Scope

This report segments the European small satellite market across several key parameters:

Propulsion Technology: Electric, Gas-based, Liquid Fuel. Electric propulsion is projected to show the fastest growth due to its efficiency and cost-effectiveness.

Application: Communication, Earth Observation, Navigation, Space Observation, Others. Communication and Earth Observation segments are expected to dominate.

Orbit Class: GEO, LEO, MEO. LEO will remain the most significant segment due to its suitability for various applications and lower launch costs.

End User: Commercial, Military & Government, Other. The commercial sector will drive most of the market growth, followed by government and military sectors.

Key Drivers of Europe Small Satellite Market Growth

The European small satellite market is fueled by several factors: increasing demand for high-resolution Earth observation data, the expansion of IoT applications requiring enhanced satellite communication, government initiatives promoting space innovation, and advancements in miniaturization and propulsion technologies. Reduced launch costs due to increased competition and the emergence of reusable launch vehicles are further accelerating market growth. Furthermore, supportive regulatory frameworks and increased private investments are contributing to the sector's overall dynamism.

Challenges in the Europe Small Satellite Market Sector

Despite strong growth potential, the European small satellite market faces challenges. Regulatory complexities related to spectrum allocation and licensing can hinder operations. Supply chain disruptions can impact the availability of critical components, leading to project delays and increased costs. Competition is intense, requiring companies to constantly innovate and optimize their offerings to remain competitive. The availability of skilled labor in the satellite development and launch segments is also a bottleneck to the expansion of this market.

Key Developments in Europe Small Satellite Market Sector

- November 2021: FOSSA Systems partners with ienai SPACE for the use of electric thrusters in picosatellites, furthering electric propulsion adoption.

- January 2022: SatRevolution launched two satellites, STORK 3 (Earth-imaging nanosatellite) and SteamSat 2, showcasing advancements in Earth observation capabilities.

- June 2022: Falcon 9 launched Globalstar FM15 to low-Earth orbit, highlighting the increasing reliance on commercial launch services.

Strategic Europe Small Satellite Market Market Outlook

The European small satellite market is poised for continued strong growth, driven by technological advancements, increasing demand for various applications, and supportive government policies. Strategic opportunities exist in developing innovative propulsion systems, expanding satellite constellations for enhanced connectivity, and capitalizing on the growing demand for Earth observation data. Companies that can effectively navigate the regulatory landscape and manage supply chain complexities will be best positioned to succeed in this dynamic market. The market is expected to continue to grow in the coming decade, with increased activity across the key segments outlined in this report.

Europe Small Satellite Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

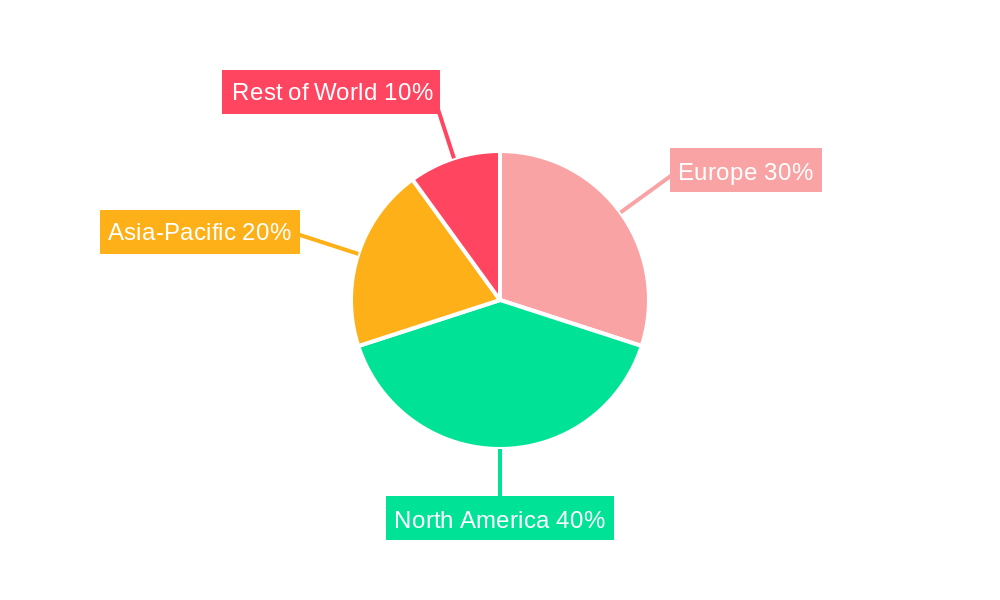

Europe Small Satellite Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Small Satellite Market Regional Market Share

Geographic Coverage of Europe Small Satellite Market

Europe Small Satellite Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Small Satellite Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Information Satellite Systems Reshetnev

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GomSpaceApS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FOSSA Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Airbus SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Astrocast

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OHB SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SatRev

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thale

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alba Orbital

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Information Satellite Systems Reshetnev

List of Figures

- Figure 1: Europe Small Satellite Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Small Satellite Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Small Satellite Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Europe Small Satellite Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Europe Small Satellite Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Europe Small Satellite Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 5: Europe Small Satellite Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Small Satellite Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Europe Small Satellite Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Europe Small Satellite Market Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Europe Small Satellite Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 10: Europe Small Satellite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Small Satellite Market?

The projected CAGR is approximately 16.1%.

2. Which companies are prominent players in the Europe Small Satellite Market?

Key companies in the market include Information Satellite Systems Reshetnev, GomSpaceApS, FOSSA Systems, Airbus SE, Astrocast, OHB SE, SatRev, Thale, Alba Orbital.

3. What are the main segments of the Europe Small Satellite Market?

The market segments include Application, Orbit Class, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Falcon 9 launched Globalstar FM15 to low-Earth orbit from Space Launch Complex 40 (SLC-40) at Cape Canaveral Space Force Station in Florida.January 2022: SatRevolution launched two satellites STORK 3 and SteamSat 2. STORK 3 is an Earth-imaging nanosatellite.November 2021: FOSSA Systems partners with ienai SPACE for the use of electric thrusters in picosatellites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Small Satellite Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Small Satellite Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Small Satellite Market?

To stay informed about further developments, trends, and reports in the Europe Small Satellite Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence