Key Insights

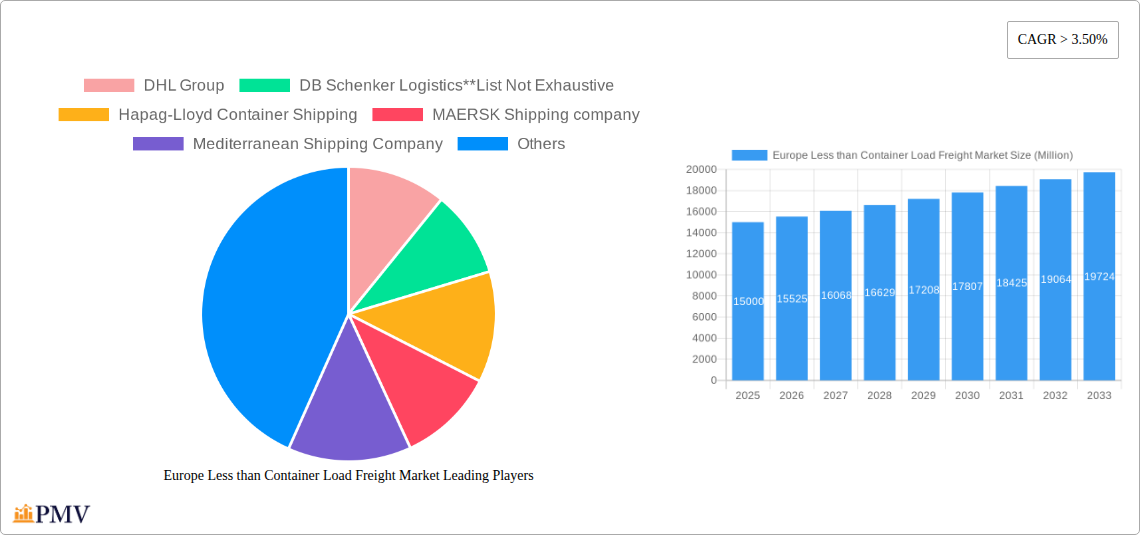

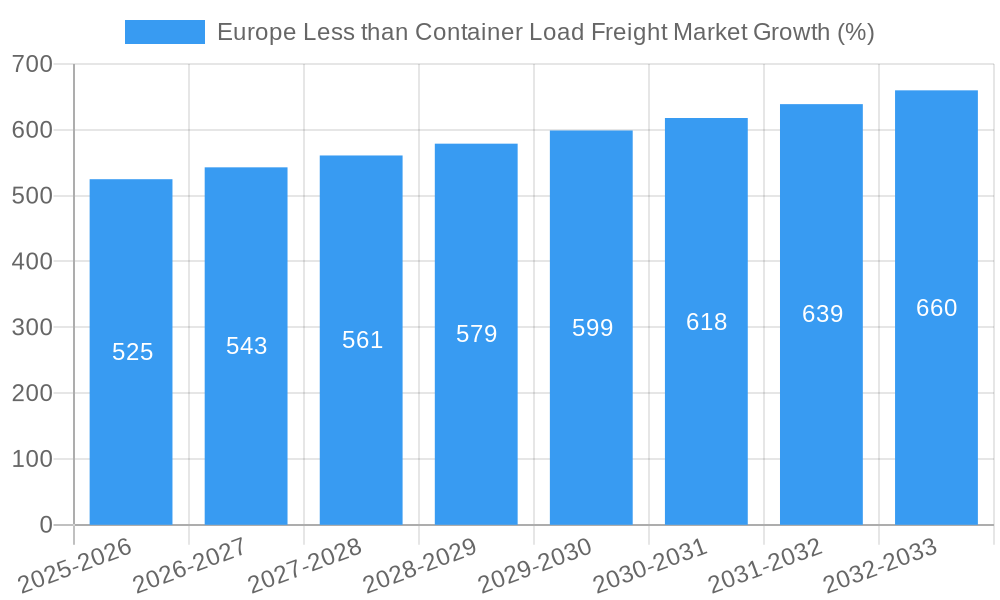

The European Less than Container Load (LCL) freight market is experiencing robust growth, driven by the increasing e-commerce sector and the expansion of global trade. The market's size in 2025 is estimated at €[Insert Estimated Market Size in Millions based on CAGR and provided data, e.g., 15000 Million], exhibiting a Compound Annual Growth Rate (CAGR) exceeding 3.50%. This growth is fueled by several key factors. Firstly, the rise of e-commerce necessitates efficient and cost-effective shipping solutions for smaller shipments, making LCL a preferred choice for businesses of all sizes. Secondly, the increasing globalization and interconnectedness of European economies are driving demand for efficient cross-border freight transportation. Finally, the ongoing trend toward just-in-time inventory management further strengthens the reliance on flexible and reliable LCL services. Key segments driving this growth include manufacturing, retail, and healthcare & pharmaceuticals, each contributing significantly to the overall market volume. While challenges such as port congestion and fluctuating fuel prices exist, the market’s resilience is underscored by the continuous improvement of logistics infrastructure and the adoption of advanced technologies like digital freight platforms.

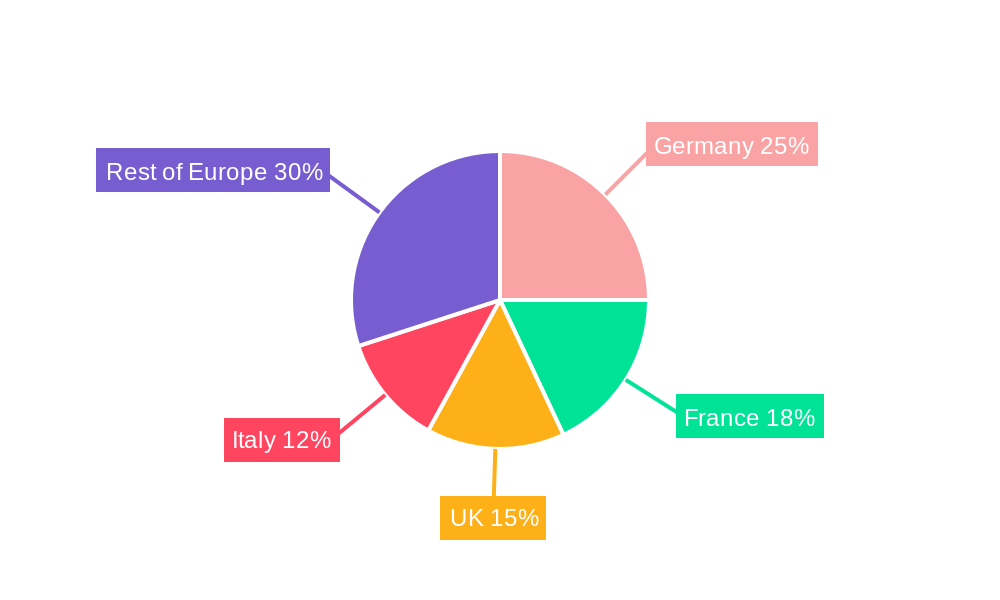

The dominance of major players like DHL, DB Schenker, Maersk, and CMA CGM shapes the competitive landscape. However, smaller, specialized logistics providers are also finding success by catering to niche markets and offering customized solutions. Regional analysis reveals strong growth across major European economies, including Germany, France, the UK, and Italy, reflecting their importance as manufacturing and trade hubs. Looking ahead to 2033, sustained growth is projected, driven by continued e-commerce expansion and advancements in logistics technologies. The market's evolution will likely be marked by increased consolidation, technological innovation, and a stronger focus on sustainability in the face of growing environmental concerns. Future growth will also hinge on effective management of supply chain vulnerabilities and adapting to geopolitical shifts.

Europe Less than Container Load Freight (LCL) Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe Less than Container Load (LCL) Freight market, offering in-depth insights into market dynamics, competitive landscape, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers seeking to understand and navigate this dynamic market. The report includes detailed segmentation by destination (domestic and international) and end-user (manufacturing, retail, healthcare & pharmaceuticals, agriculture, and other end-users). Market size is estimated in Millions.

Europe Less than Container Load Freight Market Market Structure & Competitive Dynamics

The European LCL freight market exhibits a moderately consolidated structure, with several major players commanding significant market share. The top five companies—DHL Group, DB Schenker Logistics, Maersk, Mediterranean Shipping Company (MSC), and CMA CGM—hold an estimated xx% of the market in 2025. However, a considerable number of smaller regional and niche players also contribute significantly to the overall market volume. This competitive landscape is characterized by intense rivalry, driven by price competition, service differentiation, and technological innovation.

The market's innovation ecosystem is vibrant, with ongoing investments in digitalization, automation, and supply chain optimization technologies. Regulatory frameworks, such as those related to customs compliance, environmental regulations, and data privacy, significantly influence market operations. Product substitutes, primarily including full container load (FCL) shipments for larger volumes, exert competitive pressure. End-user trends, particularly the growing demand for e-commerce and faster delivery times, are reshaping the market's dynamics. M&A activities have been relatively frequent in recent years, with several significant deals valued at over xx Million aiming to consolidate market share and enhance service offerings. For instance, the acquisition of [Company X] by [Company Y] in [Year] resulted in a combined market share of xx%. This trend is expected to continue, driven by the desire for scale and expansion into new geographical markets.

Europe Less than Container Load Freight Market Industry Trends & Insights

The European LCL freight market is witnessing robust growth, driven by several key factors. The increasing globalization of trade and the expansion of e-commerce are major contributors to the market's expansion. The rise of just-in-time inventory management strategies further fuels demand for efficient and reliable LCL services. Technological advancements, including the adoption of digital platforms for freight management and real-time tracking, are streamlining operations and enhancing transparency. However, the market also faces challenges, including fluctuating fuel prices, geopolitical uncertainties, and port congestion.

The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of digital freight platforms is growing rapidly, with an estimated xx% adoption rate in 2025. Consumer preferences are shifting towards greater transparency and traceability in the shipping process, pushing companies to invest in advanced tracking and communication technologies. Competitive dynamics are characterized by the ongoing consolidation of the market, with larger players acquiring smaller companies to expand their service offerings and geographical reach.

Dominant Markets & Segments in Europe Less than Container Load Freight Market

The International segment of the Europe LCL freight market holds the largest market share, driven by the expansion of global trade and cross-border e-commerce. Key drivers for this dominance include robust international trade relationships, well-established infrastructure, and the presence of major shipping hubs across Europe. The Manufacturing end-user segment dominates due to the high volume of component and finished goods shipped across Europe and beyond.

Key Drivers for International Segment Dominance:

- Strong export and import activity within Europe.

- Extensive network of seaports and airports.

- Development of efficient intermodal transport systems.

- Growth in e-commerce and global supply chains.

Key Drivers for Manufacturing Segment Dominance:

- High volume of component and finished goods shipments.

- Just-in-time inventory management.

- Global supply chain integration.

- Manufacturing clusters across different European regions.

Germany, followed by the United Kingdom and France, are currently the leading national markets, driven by strong manufacturing sectors and significant import/export activity. Other prominent regions include the Benelux countries, Italy, and the Scandinavian nations. The dominance of these regions is attributed to strong economic activity, well-developed infrastructure, and strategic geographical locations facilitating efficient freight movement.

Europe Less than Container Load Freight Market Product Innovations

Recent product innovations in the European LCL freight market focus on enhancing efficiency, transparency, and sustainability. Digital platforms integrating various supply chain processes are gaining popularity, offering real-time tracking, automated documentation, and improved communication among stakeholders. Technological trends such as blockchain technology are being explored to improve security and transparency in the tracking of goods. The market is witnessing a growing focus on sustainable logistics solutions, with companies adopting practices to reduce their environmental impact, such as using eco-friendly packaging and optimizing transportation routes.

Report Segmentation & Scope

This report segments the Europe LCL freight market by destination (Domestic and International) and by end-user (Manufacturing, Retail, Healthcare & Pharmaceuticals, Agriculture, and Other End-Users).

By Destination: The International segment is projected to exhibit faster growth due to the increasing globalization of trade. The Domestic segment maintains a significant share, driven by robust intra-European trade. Competitive dynamics within each segment are shaped by varying levels of concentration and service differentiation.

By End-User: The Manufacturing segment dominates, reflecting the high volume of LCL shipments for components and finished goods. The Retail and Healthcare & Pharmaceuticals segments are experiencing significant growth, fueled by e-commerce and the need for efficient delivery of time-sensitive goods. The Agriculture and Other End-Users segments contribute moderately to the overall market size.

Key Drivers of Europe Less than Container Load Freight Market Growth

Growth in the European LCL freight market is driven by several factors. The expansion of e-commerce necessitates efficient and cost-effective LCL solutions for smaller shipments. Technological advancements, such as digital platforms for freight management, improve transparency and streamline processes. Furthermore, supportive government policies aimed at fostering international trade and improving logistics infrastructure contribute to market expansion.

Challenges in the Europe Less than Container Load Freight Market Sector

The European LCL freight market faces significant challenges. Fluctuations in fuel prices and port congestion cause disruptions to supply chains and increase transportation costs. Stringent regulations related to customs compliance and environmental standards increase operational complexity and compliance burdens. Intense competition among freight forwarders and carriers pressures profit margins.

Leading Players in the Europe Less than Container Load Freight Market Market

- DHL Group

- DB Schenker Logistics

- Hapag-Lloyd Container Shipping

- MAERSK Shipping company

- Mediterranean Shipping Company

- The CMA CGM Group

- Hamburg Sud Logistics company

- Dachser Logistics company

- ECS European Containers

- GEODIS Freight Forwarding

Key Developments in Europe Less than Container Load Freight Market Sector

- 2022 Q4: DHL Group launched a new digital platform for LCL freight management, enhancing transparency and efficiency.

- 2023 Q1: DB Schenker acquired a regional LCL carrier, expanding its network and service offerings.

- 2023 Q2: New environmental regulations in the EU impacted LCL operations, necessitating adjustments in transportation strategies.

Strategic Europe Less than Container Load Freight Market Market Outlook

The European LCL freight market presents significant opportunities for growth and strategic expansion. Continued investment in digitalization and automation will enhance efficiency and transparency. Companies focusing on sustainable and environmentally friendly practices will gain a competitive advantage. Expansion into underserved markets and strategic partnerships will further fuel market growth. The market's future hinges on adapting to technological advancements, regulatory changes, and evolving consumer preferences.

Europe Less than Container Load Freight Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. End User

- 2.1. Manufacturing

- 2.2. Retail

- 2.3. Healthcare and Pharmaceuticals

- 2.4. Agriculture

- 2.5. Other End Users

Europe Less than Container Load Freight Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. UK

- 1.3. France

- 1.4. Russia

- 1.5. Spain

- 1.6. Rest of Europe

Europe Less than Container Load Freight Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Evolving consumer preferences towards fresh and frozen products4.; Innovations in temperature monitoring systems

- 3.2.2 fleet management solutions

- 3.2.3 and warehouse automation

- 3.3. Market Restrains

- 3.3.1 4.; Limited cold storage facilities

- 3.3.2 inadequate transportation networks

- 3.3.3 and a lack of skilled personnel hinder the efficient functioning of the cold chain logistics sector.

- 3.4. Market Trends

- 3.4.1. Sales of E-commerce in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing

- 5.2.2. Retail

- 5.2.3. Healthcare and Pharmaceuticals

- 5.2.4. Agriculture

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Germany Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Less than Container Load Freight Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 DHL Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 DB Schenker Logistics**List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hapag-Lloyd Container Shipping

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 MAERSK Shipping company

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Mediterranean Shipping Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 The CMA CGM Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Hamburg Sud Logistics company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Dachser Logistics company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ECS European Containers

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 GEODIS Freight Forwarding

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 DHL Group

List of Figures

- Figure 1: Europe Less than Container Load Freight Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Less than Container Load Freight Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Less than Container Load Freight Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Less than Container Load Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 3: Europe Less than Container Load Freight Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Europe Less than Container Load Freight Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Less than Container Load Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Less than Container Load Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 14: Europe Less than Container Load Freight Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Europe Less than Container Load Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Germany Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: UK Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Russia Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe Less than Container Load Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Less than Container Load Freight Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Europe Less than Container Load Freight Market?

Key companies in the market include DHL Group, DB Schenker Logistics**List Not Exhaustive, Hapag-Lloyd Container Shipping, MAERSK Shipping company, Mediterranean Shipping Company, The CMA CGM Group, Hamburg Sud Logistics company, Dachser Logistics company, ECS European Containers, GEODIS Freight Forwarding.

3. What are the main segments of the Europe Less than Container Load Freight Market?

The market segments include Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Evolving consumer preferences towards fresh and frozen products4.; Innovations in temperature monitoring systems. fleet management solutions. and warehouse automation.

6. What are the notable trends driving market growth?

Sales of E-commerce in Europe.

7. Are there any restraints impacting market growth?

4.; Limited cold storage facilities. inadequate transportation networks. and a lack of skilled personnel hinder the efficient functioning of the cold chain logistics sector..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Less than Container Load Freight Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Less than Container Load Freight Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Less than Container Load Freight Market?

To stay informed about further developments, trends, and reports in the Europe Less than Container Load Freight Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence