Key Insights

The Direct-to-Consumer (DTC) Outsourced Fulfillment market is experiencing robust growth, projected to reach $12.24 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 13.70% from 2025 to 2033. This expansion is fueled by several key drivers. The surge in e-commerce, particularly DTC brands seeking to scale efficiently without large upfront investments in warehousing and logistics, is a primary catalyst. Consumers increasingly demand faster shipping and convenient delivery options, pushing companies to outsource fulfillment to specialized providers who offer expertise in order management, inventory control, and last-mile delivery. Furthermore, technological advancements like automated warehousing systems and advanced analytics are streamlining operations, enhancing efficiency, and reducing costs, thereby attracting more businesses to outsource their fulfillment needs. The competitive landscape is marked by a mix of large global players like FedEx Fulfillment and DHL Fulfillment, alongside smaller, more agile companies like ShipMonk and WareIQ, catering to various business sizes and fulfillment needs. This diverse landscape fosters innovation and provides businesses with options suited to their specific requirements.

Direct To Customer Outsourced Fulfillment Market Market Size (In Billion)

Market restraints include the potential for supply chain disruptions, particularly given recent global events, and the need for robust technology integration to ensure seamless data flow between the DTC brand and the fulfillment provider. Pricing pressures and the need for flexible contract terms also pose challenges. Despite these hurdles, the long-term outlook for the DTC outsourced fulfillment market remains positive, driven by continuous e-commerce growth, technological progress, and the increasing preference for efficient, reliable, and cost-effective fulfillment solutions among DTC brands. The market is segmented based on various factors such as service type (e.g., order fulfillment, warehousing, returns management), industry served, and geographic region. A deeper analysis of these segments would reveal further market nuances and growth opportunities. The continued evolution of the e-commerce landscape, coupled with the ongoing advancements in logistics technology, ensures the DTC outsourced fulfillment market will remain a dynamic and attractive investment opportunity.

Direct To Customer Outsourced Fulfillment Market Company Market Share

Direct To Customer Outsourced Fulfillment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Direct To Customer (DTC) Outsourced Fulfillment market, offering invaluable insights for businesses, investors, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. The report covers market size, segmentation, competitive landscape, key drivers, challenges, and strategic outlook, providing actionable intelligence to navigate this dynamic market. The total market size is projected to reach xx Million by 2033.

Direct To Customer Outsourced Fulfillment Market Market Structure & Competitive Dynamics

The DTC Outsourced Fulfillment market exhibits a moderately concentrated structure, with several major players commanding significant market share. Market concentration is influenced by factors such as technological advancements, economies of scale, and strategic acquisitions. The competitive landscape is characterized by intense rivalry, with companies vying for market share through service differentiation, pricing strategies, and technological innovations. Innovation ecosystems play a crucial role, fostering the development of new technologies and solutions. Regulatory frameworks, such as data privacy regulations and environmental standards, also impact market dynamics. Product substitutes, such as in-house fulfillment solutions, present competition. End-user trends, like the rising preference for faster delivery and personalized experiences, significantly influence market demand. Furthermore, M&A activities are reshaping the market structure, with several significant deals occurring in recent years, with estimated deal values exceeding xx Million.

- Market Concentration: xx% of market share held by the top 5 players (2024).

- M&A Activity: A total of xx M&A deals were recorded between 2019 and 2024, with an aggregate value of approximately xx Million. Examples include the GXO Logistics acquisition of PFSweb.

- Key Players' Market Share (estimated 2024): FedEx Fulfillment (xx%), Amazon FBA (xx%), DHL Fulfillment (xx%), ShipMonk (xx%), and others (xx%).

Direct To Customer Outsourced Fulfillment Market Industry Trends & Insights

The DTC Outsourced Fulfillment market is experiencing robust growth, driven by the burgeoning e-commerce sector and shifting consumer preferences. The compound annual growth rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, such as automation and AI-powered solutions, are transforming fulfillment processes, enhancing efficiency and reducing costs. Consumers are increasingly demanding faster shipping times, personalized experiences, and seamless returns, placing pressure on fulfillment providers to innovate and adapt. Market penetration of outsourced fulfillment solutions is rising steadily, particularly among smaller and medium-sized businesses (SMBs) lacking the resources for in-house operations. The competitive dynamics are marked by intense competition, technological innovation, and strategic partnerships.

Dominant Markets & Segments in Direct To Customer Outsourced Fulfillment Market

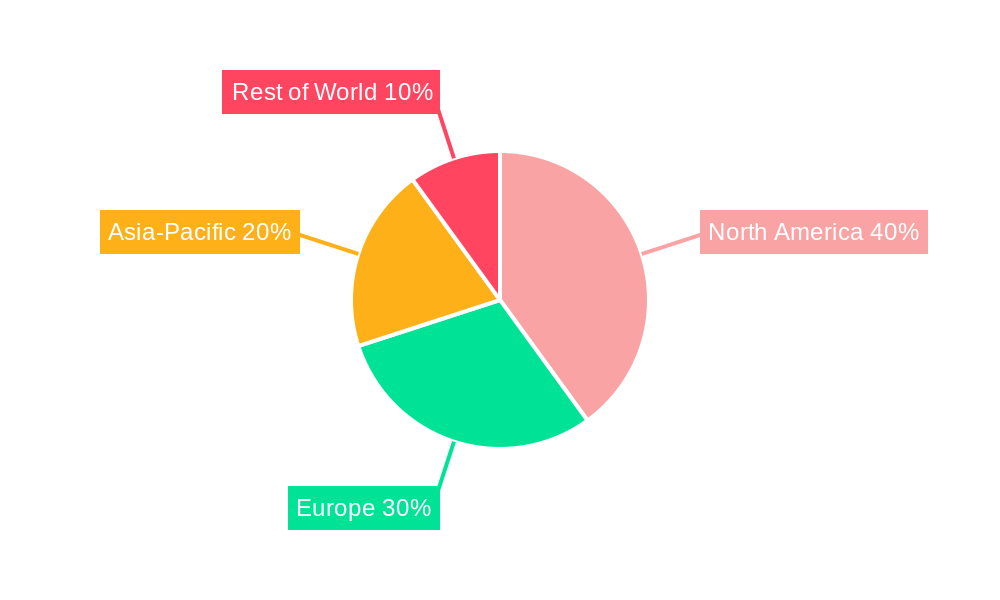

The North American region currently dominates the DTC Outsourced Fulfillment market, driven by factors such as the high penetration of e-commerce, advanced logistics infrastructure, and a large consumer base. Within North America, the United States holds the largest market share. Key drivers for this dominance include:

- Robust E-commerce Sector: The US boasts one of the largest and most developed e-commerce markets globally.

- Advanced Logistics Infrastructure: Extensive transportation networks, warehousing facilities, and technological infrastructure support efficient fulfillment operations.

- Favorable Regulatory Environment: A relatively streamlined regulatory framework eases market entry and operations.

Other regions, such as Europe and Asia-Pacific, are also experiencing significant growth, although at a slower pace compared to North America. Factors such as increasing e-commerce adoption, improving logistics infrastructure, and rising disposable incomes are contributing to the growth in these regions.

Direct To Customer Outsourced Fulfillment Market Product Innovations

Recent product innovations focus on enhancing speed, efficiency, and personalization in fulfillment operations. The adoption of automation technologies, such as robotic process automation (RPA) and automated guided vehicles (AGVs), significantly streamlines operations. Artificial intelligence (AI) and machine learning (ML) are utilized for predictive analytics, inventory management, and route optimization. These advancements enable faster delivery times, reduced operational costs, and improved customer satisfaction, creating significant competitive advantages. The market is also witnessing the growth of specialized fulfillment solutions catering to specific industry needs, such as those for bulky or temperature-sensitive goods.

Report Segmentation & Scope

This report segments the DTC Outsourced Fulfillment market based on several key parameters:

By Service Type: This includes warehousing, pick and pack, order processing, shipping, and returns management. Each segment shows varied growth projections, influenced by factors like technological advancement and consumer demand. Market sizes for each segment are estimated for the forecast period.

By End-User: This includes various industries such as fashion and apparel, consumer electronics, beauty and cosmetics, and healthcare. Competitive dynamics within each end-user segment vary based on specific needs and requirements.

By Region: This includes North America, Europe, Asia-Pacific, and the Rest of the World (ROW). Each region displays unique growth trajectories and competitive landscapes based on its economic conditions, infrastructure, and consumer behaviors.

Key Drivers of Direct To Customer Outsourced Fulfillment Market Growth

Several key factors drive the growth of the DTC Outsourced Fulfillment market:

- E-commerce Boom: The rapid expansion of e-commerce fuels the demand for efficient and reliable fulfillment services.

- Technological Advancements: Automation, AI, and robotics enhance efficiency and reduce operational costs.

- Focus on Customer Experience: Consumers prioritize fast and convenient delivery, prompting businesses to outsource fulfillment.

Challenges in the Direct To Customer Outsourced Fulfillment Market Sector

Despite strong growth potential, the DTC Outsourced Fulfillment market faces challenges:

- Supply Chain Disruptions: Global supply chain volatility can affect order fulfillment times and costs. The impact is estimated to be xx Million in lost revenue annually (2024).

- Rising Labor Costs: Increased labor costs impact overall fulfillment expenses, impacting profitability.

- Competition: Intense competition among fulfillment providers necessitates continuous innovation and efficiency improvements.

Leading Players in the Direct To Customer Outsourced Fulfillment Market Market

The market is characterized by a mix of large, established players and smaller, specialized providers. Key players include:

- FedEx Fulfillment

- Red Stag Fulfillment

- PFS Commerce

- FBA (Fulfillment by Amazon)

- DCL Logistics

- Sekel Tech

- WareIQ

- Ship Network (Formerly Rakuten Super Logistics)

- DHL Fulfillment

- ShipMonk

- Whiplash (A Part of Ryder System Inc)

This list is not exhaustive.

Key Developments in Direct To Customer Outsourced Fulfillment Market Sector

January 2024: Ryder System Inc. and Kodiak Robotics Inc. collaborate to integrate autonomous trucking solutions into Ryder's service network, potentially improving efficiency and reducing transportation costs within the fulfillment process.

January 2024: GXO Logistics Inc. acquires PFSweb and wins Glossier's direct-to-consumer fulfillment operations, expanding its capabilities in high-end customer experiences and bespoke fulfillment solutions. This acquisition significantly enhances GXO's market position and service offerings.

Strategic Direct To Customer Outsourced Fulfillment Market Market Outlook

The DTC Outsourced Fulfillment market presents significant growth opportunities for businesses that can effectively leverage technological advancements, optimize operations, and provide exceptional customer experiences. Strategic partnerships, investments in automation, and expansion into new markets will be key success factors. The market's future is bright, driven by the continued expansion of e-commerce and the growing demand for sophisticated and efficient fulfillment solutions. Companies that can adapt to evolving consumer demands and technological trends will be best positioned for success in this dynamic landscape.

Direct To Customer Outsourced Fulfillment Market Segmentation

-

1. Service

- 1.1. Warehousing and Storage

- 1.2. Distribution

- 1.3. Value-Added Services

-

2. Application

- 2.1. Fashion and Apparel

- 2.2. Consumer Electronics

- 2.3. Home Appliances

- 2.4. Furniture

- 2.5. Beauty and Personal Care Products

- 2.6. Other Applications (Toys, Food Products, Etc.)

Direct To Customer Outsourced Fulfillment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Singapore

- 3.5. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Oman

- 4.4. Egypt

- 4.5. South Africa

- 4.6. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Mexico

- 5.3. Rest of South America

Direct To Customer Outsourced Fulfillment Market Regional Market Share

Geographic Coverage of Direct To Customer Outsourced Fulfillment Market

Direct To Customer Outsourced Fulfillment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The rapid expansion of e-commerce globally driving the market; Increasing technological advancements in warehousing automation and inventory management

- 3.3. Market Restrains

- 3.3.1. The rapid expansion of e-commerce globally driving the market; Increasing technological advancements in warehousing automation and inventory management

- 3.4. Market Trends

- 3.4.1. Warehousing and Storage Segment to Drive Market Growth in the Near Future

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Direct To Customer Outsourced Fulfillment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Warehousing and Storage

- 5.1.2. Distribution

- 5.1.3. Value-Added Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fashion and Apparel

- 5.2.2. Consumer Electronics

- 5.2.3. Home Appliances

- 5.2.4. Furniture

- 5.2.5. Beauty and Personal Care Products

- 5.2.6. Other Applications (Toys, Food Products, Etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Direct To Customer Outsourced Fulfillment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Warehousing and Storage

- 6.1.2. Distribution

- 6.1.3. Value-Added Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Fashion and Apparel

- 6.2.2. Consumer Electronics

- 6.2.3. Home Appliances

- 6.2.4. Furniture

- 6.2.5. Beauty and Personal Care Products

- 6.2.6. Other Applications (Toys, Food Products, Etc.)

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Direct To Customer Outsourced Fulfillment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Warehousing and Storage

- 7.1.2. Distribution

- 7.1.3. Value-Added Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Fashion and Apparel

- 7.2.2. Consumer Electronics

- 7.2.3. Home Appliances

- 7.2.4. Furniture

- 7.2.5. Beauty and Personal Care Products

- 7.2.6. Other Applications (Toys, Food Products, Etc.)

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Direct To Customer Outsourced Fulfillment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Warehousing and Storage

- 8.1.2. Distribution

- 8.1.3. Value-Added Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Fashion and Apparel

- 8.2.2. Consumer Electronics

- 8.2.3. Home Appliances

- 8.2.4. Furniture

- 8.2.5. Beauty and Personal Care Products

- 8.2.6. Other Applications (Toys, Food Products, Etc.)

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East and Africa Direct To Customer Outsourced Fulfillment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Warehousing and Storage

- 9.1.2. Distribution

- 9.1.3. Value-Added Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Fashion and Apparel

- 9.2.2. Consumer Electronics

- 9.2.3. Home Appliances

- 9.2.4. Furniture

- 9.2.5. Beauty and Personal Care Products

- 9.2.6. Other Applications (Toys, Food Products, Etc.)

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. South America Direct To Customer Outsourced Fulfillment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Warehousing and Storage

- 10.1.2. Distribution

- 10.1.3. Value-Added Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Fashion and Apparel

- 10.2.2. Consumer Electronics

- 10.2.3. Home Appliances

- 10.2.4. Furniture

- 10.2.5. Beauty and Personal Care Products

- 10.2.6. Other Applications (Toys, Food Products, Etc.)

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FedEx Fulfillment

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Red Stag Fulfillment

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PFS Commerce

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FBA (Fulfillment by Amazon)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DCL Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sekel Tech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 WareIQ

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ship Network (Formerly Rakuten Super Logistics)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DHL Fulfillment

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ShipMonk

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Whiplash (A Part of Ryder System Inc )**List Not Exhaustive 7 3 Other companie

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

List of Figures

- Figure 1: Global Direct To Customer Outsourced Fulfillment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Direct To Customer Outsourced Fulfillment Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Service 2025 & 2033

- Figure 4: North America Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Service 2025 & 2033

- Figure 5: North America Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Service 2025 & 2033

- Figure 7: North America Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Service 2025 & 2033

- Figure 16: Europe Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Service 2025 & 2033

- Figure 17: Europe Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Service 2025 & 2033

- Figure 18: Europe Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Service 2025 & 2033

- Figure 19: Europe Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Application 2025 & 2033

- Figure 21: Europe Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Service 2025 & 2033

- Figure 28: Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Service 2025 & 2033

- Figure 29: Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Service 2025 & 2033

- Figure 30: Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Service 2025 & 2033

- Figure 31: Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Application 2025 & 2033

- Figure 33: Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Service 2025 & 2033

- Figure 40: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Service 2025 & 2033

- Figure 41: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Service 2025 & 2033

- Figure 42: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Service 2025 & 2033

- Figure 43: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Application 2025 & 2033

- Figure 44: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Application 2025 & 2033

- Figure 45: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Service 2025 & 2033

- Figure 52: South America Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Service 2025 & 2033

- Figure 53: South America Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Service 2025 & 2033

- Figure 54: South America Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Service 2025 & 2033

- Figure 55: South America Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Application 2025 & 2033

- Figure 56: South America Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Application 2025 & 2033

- Figure 57: South America Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Country 2025 & 2033

- Figure 61: South America Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Service 2020 & 2033

- Table 3: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Service 2020 & 2033

- Table 9: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Service 2020 & 2033

- Table 18: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Service 2020 & 2033

- Table 19: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 21: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Germany Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: France Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Service 2020 & 2033

- Table 34: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Service 2020 & 2033

- Table 35: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 37: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Country 2020 & 2033

- Table 39: China Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: India Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: India Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Japan Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Japan Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Singapore Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Singapore Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Service 2020 & 2033

- Table 50: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Service 2020 & 2033

- Table 51: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 52: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 53: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Saudi Arabia Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Saudi Arabia Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: United Arab Emirates Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: United Arab Emirates Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Oman Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Oman Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Egypt Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Egypt Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: South Africa Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Service 2020 & 2033

- Table 68: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Service 2020 & 2033

- Table 69: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 70: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 71: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Country 2020 & 2033

- Table 73: Brazil Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Mexico Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Mexico Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Direct To Customer Outsourced Fulfillment Market?

The projected CAGR is approximately 13.70%.

2. Which companies are prominent players in the Direct To Customer Outsourced Fulfillment Market?

Key companies in the market include 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles, FedEx Fulfillment, Red Stag Fulfillment, PFS Commerce, FBA (Fulfillment by Amazon), DCL Logistics, Sekel Tech, WareIQ, Ship Network (Formerly Rakuten Super Logistics), DHL Fulfillment, ShipMonk, Whiplash (A Part of Ryder System Inc )**List Not Exhaustive 7 3 Other companie.

3. What are the main segments of the Direct To Customer Outsourced Fulfillment Market?

The market segments include Service, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.24 Million as of 2022.

5. What are some drivers contributing to market growth?

The rapid expansion of e-commerce globally driving the market; Increasing technological advancements in warehousing automation and inventory management.

6. What are the notable trends driving market growth?

Warehousing and Storage Segment to Drive Market Growth in the Near Future.

7. Are there any restraints impacting market growth?

The rapid expansion of e-commerce globally driving the market; Increasing technological advancements in warehousing automation and inventory management.

8. Can you provide examples of recent developments in the market?

January 2024: Ryder System Inc., a leader in the supply chain, transportation, and fleet management solutions, and Kodiak Robotics Inc., a leading autonomous trucking company, announced a collaboration to leverage Ryder’s service network to enable the commercialization and scaling of Kodiak’s autonomous truck solution.January 2024: GXO Logistics Inc. announced that following its successful acquisition of PFSweb (PFS), it had won Glossier’s direct-to-consumer fulfillment operations and will manage its business-to-business order fulfillment to its retail partners in the United States. Together with PFS, GXO now expands its capabilities to provide bespoke, high-end customer experiences to leading beauty and wellness companies, from start-ups to iconic, globally recognized brands. Pick and pack operations are handled according to the most detailed specifications, giving the consumer a memorable unboxing experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Direct To Customer Outsourced Fulfillment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Direct To Customer Outsourced Fulfillment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Direct To Customer Outsourced Fulfillment Market?

To stay informed about further developments, trends, and reports in the Direct To Customer Outsourced Fulfillment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence