Key Insights

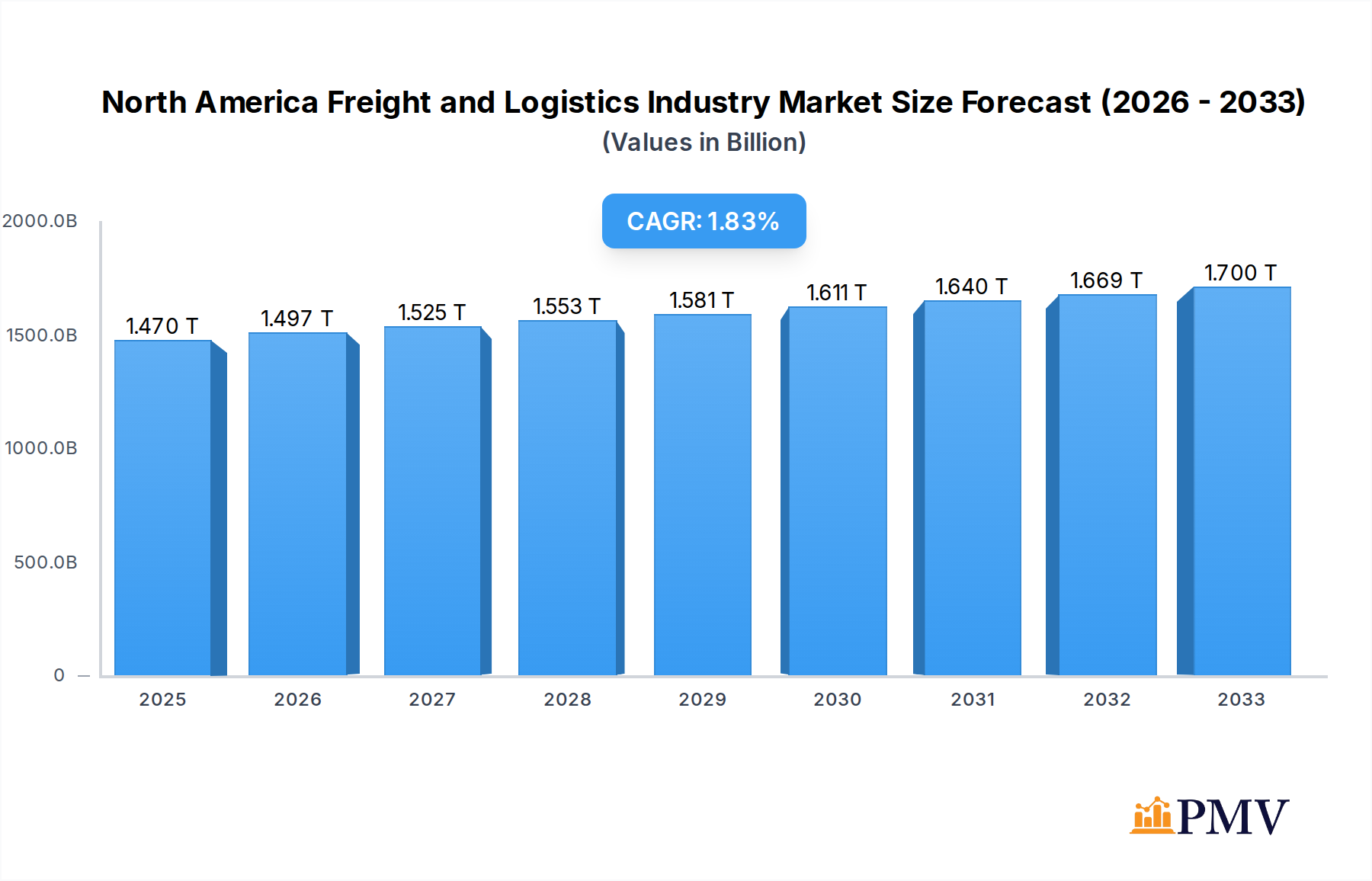

The North American freight and logistics market is poised for steady growth, with an estimated market size of $1.47 billion in 2025, driven by increasing e-commerce penetration and a robust manufacturing sector. The industry is projected to experience a Compound Annual Growth Rate (CAGR) of 1.8% over the forecast period of 2025-2033, indicating sustained expansion. Key drivers include the expanding retail sector, particularly online retail, which necessitates efficient and rapid delivery networks. Furthermore, the ongoing infrastructure development projects across North America, from road and rail upgrades to port expansions, are crucial enablers for improved freight movement and reduced transit times. The Oil and Gas and Mining industries, though cyclical, also contribute to demand for specialized logistics solutions, especially in resource-rich regions. The burgeoning demand for faster delivery times, coupled with the increasing complexity of supply chains, is pushing logistics providers to invest in technology and optimize their operational efficiencies.

North America Freight and Logistics Industry Market Size (In Million)

Despite the positive outlook, the market faces certain restraints. Fluctuations in fuel prices can significantly impact operating costs for transportation companies, affecting profitability and pricing strategies. Labor shortages, particularly for skilled truck drivers and warehouse personnel, remain a persistent challenge, potentially hindering capacity and service levels. Moreover, stringent environmental regulations and the growing emphasis on sustainability are compelling companies to adopt greener logistics practices, which may involve substantial upfront investments in fleet upgrades and alternative fuel technologies. The competitive landscape is intense, with a significant number of established players and emerging disruptors vying for market share, leading to pressure on margins and a constant need for innovation and service differentiation. Nonetheless, the overarching trend towards digitalization and automation within the logistics sector, including the adoption of AI, IoT, and advanced analytics, is expected to mitigate some of these challenges and unlock new avenues for efficiency and growth.

North America Freight and Logistics Industry Company Market Share

Unlock critical insights into the dynamic North American freight and logistics industry with this in-depth market report. Covering the historical period from 2019-2024 and projecting growth through 2033, this study offers a comprehensive analysis of market structure, trends, dominant segments, and key players. Delve into crucial developments, innovations, and strategic outlooks shaping the future of North American logistics, freight transportation, supply chain management, and intermodal shipping. Essential for stakeholders seeking to navigate the evolving landscape of US logistics, Canadian logistics, and Mexican logistics, this report provides actionable data on market share, CAGR, and competitive dynamics.

North America Freight and Logistics Industry Market Structure & Competitive Dynamics

The North American freight and logistics market exhibits a highly competitive landscape, characterized by a blend of large, integrated players and specialized niche providers. Market concentration varies across segments, with road freight and warehousing generally more fragmented than rail freight and large-scale freight forwarding. Innovation ecosystems are robust, driven by investments in digitalization, automation, and sustainable logistics solutions. Regulatory frameworks, including cross-border trade agreements and environmental mandates, significantly influence operational strategies and market entry. Product substitutes are continuously emerging, particularly with the rise of e-commerce demanding faster and more flexible delivery options. End-user trends, such as the sustained growth in e-commerce logistics, demand for cold chain logistics, and the increasing importance of last-mile delivery, are reshaping the industry. Mergers and Acquisitions (M&A) activity remains a key strategy for consolidation and expansion, with significant deal values observed as companies aim to broaden their service offerings and geographical reach. Key M&A deals in the historical period have focused on acquiring technological capabilities and expanding network coverage.

- Market Concentration: Moderate to high in rail and air freight, moderate in road freight, and high in warehousing services.

- Innovation Ecosystems: Driven by startups and established players investing in AI, IoT, and blockchain for supply chain visibility and efficiency.

- Regulatory Frameworks: Influenced by DOT regulations, NAFTA/USMCA, and increasing ESG reporting requirements.

- Product Substitutes: Emerging from technology platforms offering on-demand logistics and drone delivery solutions.

- End-User Trends: E-commerce growth, just-in-time manufacturing, and increasing demand for temperature-controlled shipments are paramount.

- M&A Activities: Strategic acquisitions focused on technology integration, market expansion, and service diversification, with deal values in the billions.

North America Freight and Logistics Industry Industry Trends & Insights

The North American freight and logistics industry is experiencing significant growth, driven by a confluence of factors including expanding e-commerce volumes, reshoring initiatives, and a general rebound in economic activity. The CAGR for the forecast period is projected to be robust, reflecting the essential role of logistics in supporting trade and commerce across the continent. Technological disruptions are at the forefront, with artificial intelligence (AI), machine learning (ML), and IoT devices revolutionizing supply chain visibility, route optimization, and predictive maintenance. The adoption of digital freight marketplaces and transportation management systems (TMS) is accelerating market penetration for innovative solutions. Consumer preferences are increasingly geared towards faster, more reliable, and sustainable delivery options. This has led to a surge in demand for express parcel services, same-day delivery, and environmentally friendly logistics. Competitive dynamics are intensifying, with a focus on service differentiation through technology, sustainability, and customer experience. The ongoing digital transformation is creating new business models and challenging traditional logistics providers to adapt. The global supply chain resilience narrative is also a significant trend, pushing for greater diversification of sourcing and logistics networks. Intermodal transportation is gaining prominence as a cost-effective and sustainable solution, particularly for long-haul freight. The last-mile delivery segment continues to be a hotbed of innovation and competition, driven by the need for efficient and cost-effective urban logistics. The report will explore trends such as the increasing use of autonomous vehicles, the development of smart warehouses, and the impact of data analytics on operational efficiency. Market penetration of advanced logistics technologies is expected to reach significant levels within the forecast period.

Dominant Markets & Segments in North America Freight and Logistics Industry

The North America freight and logistics industry is dominated by several key segments, each driven by distinct economic forces and operational characteristics. Within the End User Industry, the Wholesale and Retail Trade segment, heavily influenced by the booming e-commerce sector, commands a substantial market share. The Manufacturing sector also remains a critical driver, demanding efficient inbound and outbound logistics for raw materials and finished goods. Emerging industries and niche sectors like Oil and Gas and Mining and Quarrying contribute significantly during periods of high commodity prices, though their demand can be cyclical.

In terms of Logistics Functions, Courier, Express, and Parcel (CEP) services, particularly domestic CEP, are experiencing unparalleled growth due to online retail. Freight Transport, with road freight (trucking) being the dominant mode for its flexibility and reach, represents the largest segment in terms of volume and revenue. Rail freight remains crucial for long-haul, heavy-duty cargo, offering cost and environmental advantages. Freight Forwarding, encompassing both air freight and sea freight, is vital for international trade, connecting North America with global markets. The Warehousing and Storage segment, particularly non-temperature controlled warehousing, is expanding rapidly to support inventory management for the retail and manufacturing sectors, with a growing sub-segment for temperature-controlled warehousing catering to the food and pharmaceutical industries.

- Wholesale and Retail Trade: Fueled by e-commerce, this segment is a primary growth engine, driving demand for CEP and warehousing services. Economic policies supporting consumer spending directly impact this segment's logistics needs.

- Manufacturing: Constant demand for efficient supply chains, influencing freight transport (road and rail) and warehousing solutions for lean inventory management. Infrastructure investments are critical for this segment.

- Courier, Express, and Parcel (CEP) - Domestic: Unprecedented growth driven by online retail, requiring extensive networks for last-mile delivery. Technological advancements in tracking and delivery optimization are key drivers.

- Freight Transport - Road: The backbone of North American logistics, characterized by a vast trucking fleet and significant investment in fleet modernization and driver retention initiatives. Fuel prices and regulatory changes are significant influences.

- Freight Forwarding - Air: Essential for time-sensitive high-value goods, with significant contributions from sectors like electronics and pharmaceuticals. Airport infrastructure and capacity are critical factors.

- Warehousing and Storage - Non-Temperature Controlled: Essential for inventory management across various industries, with increasing demand for strategically located distribution centers. Real estate development and labor availability are key considerations.

North America Freight and Logistics Industry Product Innovations

Recent product innovations in the North American freight and logistics industry are centered on enhancing efficiency, sustainability, and customer experience. Technologies like AI-powered route optimization and predictive analytics are transforming freight visibility and reducing transit times. The development of advanced warehouse automation, including robotics and automated storage and retrieval systems (AS/RS), is increasing throughput and reducing operational costs. Furthermore, the industry is witnessing a surge in sustainable logistics solutions, such as the adoption of electric vehicles (EVs) for last-mile delivery and the implementation of Book & Claim insetting solutions for carbon offsetting. These innovations offer significant competitive advantages by improving service levels, reducing environmental impact, and aligning with corporate ESG goals.

Report Segmentation & Scope

This report segments the North America freight and logistics industry across key dimensions. The End User Industry segmentation includes Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; and Others. The Logistics Function segmentation encompasses Courier, Express, and Parcel (CEP) (by Destination Type: Domestic, International); Freight Forwarding (by Mode of Transport: Air, Sea and Inland Waterways, Others); Freight Transport (Pipelines, Rail, Road); Warehousing and Storage (by Temperature Control: Non-Temperature Controlled, Temperature Controlled); and Other Services. Each segment is analyzed for its market size, growth projections, and competitive dynamics.

Key Drivers of North America Freight and Logistics Industry Growth

Several key drivers are propelling the growth of the North America freight and logistics industry.

- Economic Growth & E-commerce Expansion: A steadily growing economy and the relentless expansion of e-commerce are creating unprecedented demand for freight movement and delivery services.

- Technological Advancements: Investments in AI, ML, IoT, and automation are enhancing efficiency, visibility, and sustainability across the supply chain.

- Infrastructure Investment: Government and private sector investments in transportation infrastructure, including roads, rail, and ports, are crucial for improving capacity and reducing transit times.

- Reshoring and Nearshoring Trends: A shift towards bringing manufacturing closer to North American markets is boosting domestic freight volumes and the need for robust regional logistics networks.

Challenges in the North America Freight and Logistics Industry Sector

Despite robust growth, the North America freight and logistics industry faces significant challenges.

- Labor Shortages: Persistent shortages of truck drivers and warehouse personnel are impacting operational capacity and increasing labor costs.

- Supply Chain Disruptions: Geopolitical events, natural disasters, and port congestion continue to pose risks to supply chain stability and lead times.

- Regulatory Complexity: Evolving environmental regulations, cross-border trade policies, and safety standards require continuous adaptation and investment.

- Rising Fuel Costs: Volatility in fuel prices directly impacts operating costs for transportation companies, affecting profitability.

- Intense Competition: The highly competitive nature of the market puts pressure on pricing and margins, necessitating continuous innovation and efficiency gains.

Leading Players in the North America Freight and Logistics Industry Market

- Patriot Rail Company

- Norfolk Southern Railway

- A P Moller - Maersk

- Hub Group Inc

- DB Schenker

- XPO Inc

- Nippon Express Holdings

- SEKO Logistics

- Transportation Insight Holding Company

- Old Dominion Freight Line

- Canada Post

- Landstar System Inc

- Fomento Económico Mexicano S A B de C V

- DHL Group

- Uber Technologies Inc

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Americold Logistics

- Knight-Swift Transportation

- M3 Transport LLC

- GEODIS

- Burris Logistics

- Penske Logistics

- Union Pacific Railroad

- Arrive Logistics

- Canadian National Railway Company

- Yellow Corporation

- FedEx

- GXO Logistics

- Fastfrate Group

- Lineage Logistics LLC

- Kuehne + Nagel

- MODE Global LLC

- Excel Group

- Berkshire Hathaway Inc (including BNSF Railway Company)

- United Parcel Service of America Inc (UPS)

- Total Quality Logistics LLC

- Polaris Development Corporation

- Werner Enterprises

- OnTrac

- Omni Logistics

- Ascent Global Logistics

- C H Robinson

- Mactrans Logistics

- Congebec

- Canadian Pacific Kansas City Limited

- AIT Worldwide Logistics

- ArcBest

- CSX Corporation

- Purolator

- NFI Industries

- Traxion

- Schneider National Inc

- Grupo Mexico

- TFI International Inc

- J B Hunt Transport Inc

- Brookfield Infrastructure Partners L P (including Genesee & Wyoming Inc)

- Capstone Logistics LLC

- KEX Express (US) LLC

- Expeditors International of Washington Inc

- Ryder System Inc

Key Developments in North America Freight and Logistics Industry Sector

- February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes, significantly improving freight scheduling and appointment logistics.

- January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles, bolstering sustainable logistics and EV adoption.

- December 2023: Canadian National Railway Company announced an upgrade to its Falcon Premium Intermodal Service. CN said recent operational changes by its business partner, Union Pacific (UP), will remove a full day of transit time for customers using the Canada-US-Mexico service. The Falcon Premium Intermodal Service is a best-in-class Mexico-US-Canada service with a seamless rail connection in Chicago, Illinois. It directly connects all CN origin points within Canada and Detroit, Michigan to GMXT terminals in Mexico. This service benefits intermodal customers shipping automotive parts, food, FAK (freight - all kinds), home appliances, and temperature-controlled products, enhancing intermodal efficiency and cross-border freight.

Strategic North America Freight and Logistics Industry Market Outlook

The strategic outlook for the North America freight and logistics industry is characterized by continued innovation and adaptation. The increasing focus on supply chain resilience, driven by lessons learned from recent global disruptions, will accelerate investment in diversified networks and advanced visibility technologies. The ongoing digital transformation, encompassing AI, automation, and data analytics, will unlock new efficiencies and create competitive advantages. Furthermore, the imperative for sustainable logistics will drive adoption of greener transportation modes and alternative fuels. Opportunities lie in catering to the evolving demands of e-commerce, supporting the growth of specialized sectors like cold chain logistics, and leveraging technological advancements for seamless last-mile delivery solutions. Companies that embrace these trends and proactively invest in technology and sustainability are well-positioned for sustained growth and market leadership.

North America Freight and Logistics Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

North America Freight and Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Freight and Logistics Industry Regional Market Share

Geographic Coverage of North America Freight and Logistics Industry

North America Freight and Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Freight and Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Patriot Rail Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Norfolk Southern Railway

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 A P Moller - Maersk

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hub Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DB Schenker

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 XPO Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nippon Express Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SEKO Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Transportation Insight Holding Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Old Dominion Freight Line

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Canada Post

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Landstar System Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Fomento Económico Mexicano S A B de C V

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 DHL Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Uber Technologies Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Americold Logistics

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Knight-Swift Transportation

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 M3 Transport LLC

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 GEODIS

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Burris Logistics

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Penske Logistics

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 Union Pacific Railroad

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 Arrive Logistics

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.25 Canadian National Railway Company

- 6.2.25.1. Overview

- 6.2.25.2. Products

- 6.2.25.3. SWOT Analysis

- 6.2.25.4. Recent Developments

- 6.2.25.5. Financials (Based on Availability)

- 6.2.26 Yellow Corporatio

- 6.2.26.1. Overview

- 6.2.26.2. Products

- 6.2.26.3. SWOT Analysis

- 6.2.26.4. Recent Developments

- 6.2.26.5. Financials (Based on Availability)

- 6.2.27 FedEx

- 6.2.27.1. Overview

- 6.2.27.2. Products

- 6.2.27.3. SWOT Analysis

- 6.2.27.4. Recent Developments

- 6.2.27.5. Financials (Based on Availability)

- 6.2.28 GXO Logistics

- 6.2.28.1. Overview

- 6.2.28.2. Products

- 6.2.28.3. SWOT Analysis

- 6.2.28.4. Recent Developments

- 6.2.28.5. Financials (Based on Availability)

- 6.2.29 Fastfrate Group

- 6.2.29.1. Overview

- 6.2.29.2. Products

- 6.2.29.3. SWOT Analysis

- 6.2.29.4. Recent Developments

- 6.2.29.5. Financials (Based on Availability)

- 6.2.30 Lineage Logistics LLC

- 6.2.30.1. Overview

- 6.2.30.2. Products

- 6.2.30.3. SWOT Analysis

- 6.2.30.4. Recent Developments

- 6.2.30.5. Financials (Based on Availability)

- 6.2.31 Kuehne + Nagel

- 6.2.31.1. Overview

- 6.2.31.2. Products

- 6.2.31.3. SWOT Analysis

- 6.2.31.4. Recent Developments

- 6.2.31.5. Financials (Based on Availability)

- 6.2.32 MODE Global LLC

- 6.2.32.1. Overview

- 6.2.32.2. Products

- 6.2.32.3. SWOT Analysis

- 6.2.32.4. Recent Developments

- 6.2.32.5. Financials (Based on Availability)

- 6.2.33 Excel Group

- 6.2.33.1. Overview

- 6.2.33.2. Products

- 6.2.33.3. SWOT Analysis

- 6.2.33.4. Recent Developments

- 6.2.33.5. Financials (Based on Availability)

- 6.2.34 Berkshire Hathaway Inc (including BNSF Railway Company)

- 6.2.34.1. Overview

- 6.2.34.2. Products

- 6.2.34.3. SWOT Analysis

- 6.2.34.4. Recent Developments

- 6.2.34.5. Financials (Based on Availability)

- 6.2.35 United Parcel Service of America Inc (UPS)

- 6.2.35.1. Overview

- 6.2.35.2. Products

- 6.2.35.3. SWOT Analysis

- 6.2.35.4. Recent Developments

- 6.2.35.5. Financials (Based on Availability)

- 6.2.36 Total Quality Logistics LLC

- 6.2.36.1. Overview

- 6.2.36.2. Products

- 6.2.36.3. SWOT Analysis

- 6.2.36.4. Recent Developments

- 6.2.36.5. Financials (Based on Availability)

- 6.2.37 Polaris Development Corporation

- 6.2.37.1. Overview

- 6.2.37.2. Products

- 6.2.37.3. SWOT Analysis

- 6.2.37.4. Recent Developments

- 6.2.37.5. Financials (Based on Availability)

- 6.2.38 Werner Enterprises

- 6.2.38.1. Overview

- 6.2.38.2. Products

- 6.2.38.3. SWOT Analysis

- 6.2.38.4. Recent Developments

- 6.2.38.5. Financials (Based on Availability)

- 6.2.39 OnTrac

- 6.2.39.1. Overview

- 6.2.39.2. Products

- 6.2.39.3. SWOT Analysis

- 6.2.39.4. Recent Developments

- 6.2.39.5. Financials (Based on Availability)

- 6.2.40 Omni Logistics

- 6.2.40.1. Overview

- 6.2.40.2. Products

- 6.2.40.3. SWOT Analysis

- 6.2.40.4. Recent Developments

- 6.2.40.5. Financials (Based on Availability)

- 6.2.41 Ascent Global Logistics

- 6.2.41.1. Overview

- 6.2.41.2. Products

- 6.2.41.3. SWOT Analysis

- 6.2.41.4. Recent Developments

- 6.2.41.5. Financials (Based on Availability)

- 6.2.42 C H Robinson

- 6.2.42.1. Overview

- 6.2.42.2. Products

- 6.2.42.3. SWOT Analysis

- 6.2.42.4. Recent Developments

- 6.2.42.5. Financials (Based on Availability)

- 6.2.43 Mactrans Logistics

- 6.2.43.1. Overview

- 6.2.43.2. Products

- 6.2.43.3. SWOT Analysis

- 6.2.43.4. Recent Developments

- 6.2.43.5. Financials (Based on Availability)

- 6.2.44 Congebec

- 6.2.44.1. Overview

- 6.2.44.2. Products

- 6.2.44.3. SWOT Analysis

- 6.2.44.4. Recent Developments

- 6.2.44.5. Financials (Based on Availability)

- 6.2.45 Canadian Pacific Kansas City Limited

- 6.2.45.1. Overview

- 6.2.45.2. Products

- 6.2.45.3. SWOT Analysis

- 6.2.45.4. Recent Developments

- 6.2.45.5. Financials (Based on Availability)

- 6.2.46 AIT Worldwide Logistics

- 6.2.46.1. Overview

- 6.2.46.2. Products

- 6.2.46.3. SWOT Analysis

- 6.2.46.4. Recent Developments

- 6.2.46.5. Financials (Based on Availability)

- 6.2.47 ArcBest

- 6.2.47.1. Overview

- 6.2.47.2. Products

- 6.2.47.3. SWOT Analysis

- 6.2.47.4. Recent Developments

- 6.2.47.5. Financials (Based on Availability)

- 6.2.48 CSX Corporation

- 6.2.48.1. Overview

- 6.2.48.2. Products

- 6.2.48.3. SWOT Analysis

- 6.2.48.4. Recent Developments

- 6.2.48.5. Financials (Based on Availability)

- 6.2.49 Purolator

- 6.2.49.1. Overview

- 6.2.49.2. Products

- 6.2.49.3. SWOT Analysis

- 6.2.49.4. Recent Developments

- 6.2.49.5. Financials (Based on Availability)

- 6.2.50 NFI Industries

- 6.2.50.1. Overview

- 6.2.50.2. Products

- 6.2.50.3. SWOT Analysis

- 6.2.50.4. Recent Developments

- 6.2.50.5. Financials (Based on Availability)

- 6.2.51 Traxion

- 6.2.51.1. Overview

- 6.2.51.2. Products

- 6.2.51.3. SWOT Analysis

- 6.2.51.4. Recent Developments

- 6.2.51.5. Financials (Based on Availability)

- 6.2.52 Schneider National Inc

- 6.2.52.1. Overview

- 6.2.52.2. Products

- 6.2.52.3. SWOT Analysis

- 6.2.52.4. Recent Developments

- 6.2.52.5. Financials (Based on Availability)

- 6.2.53 Grupo Mexico

- 6.2.53.1. Overview

- 6.2.53.2. Products

- 6.2.53.3. SWOT Analysis

- 6.2.53.4. Recent Developments

- 6.2.53.5. Financials (Based on Availability)

- 6.2.54 TFI International Inc

- 6.2.54.1. Overview

- 6.2.54.2. Products

- 6.2.54.3. SWOT Analysis

- 6.2.54.4. Recent Developments

- 6.2.54.5. Financials (Based on Availability)

- 6.2.55 J B Hunt Transport Inc

- 6.2.55.1. Overview

- 6.2.55.2. Products

- 6.2.55.3. SWOT Analysis

- 6.2.55.4. Recent Developments

- 6.2.55.5. Financials (Based on Availability)

- 6.2.56 Brookfield Infrastructure Partners L P (including Genesee & Wyoming Inc )

- 6.2.56.1. Overview

- 6.2.56.2. Products

- 6.2.56.3. SWOT Analysis

- 6.2.56.4. Recent Developments

- 6.2.56.5. Financials (Based on Availability)

- 6.2.57 Capstone Logistics LLC

- 6.2.57.1. Overview

- 6.2.57.2. Products

- 6.2.57.3. SWOT Analysis

- 6.2.57.4. Recent Developments

- 6.2.57.5. Financials (Based on Availability)

- 6.2.58 KEX Express (US) LLC

- 6.2.58.1. Overview

- 6.2.58.2. Products

- 6.2.58.3. SWOT Analysis

- 6.2.58.4. Recent Developments

- 6.2.58.5. Financials (Based on Availability)

- 6.2.59 Expeditors International of Washington Inc

- 6.2.59.1. Overview

- 6.2.59.2. Products

- 6.2.59.3. SWOT Analysis

- 6.2.59.4. Recent Developments

- 6.2.59.5. Financials (Based on Availability)

- 6.2.60 Ryder System Inc

- 6.2.60.1. Overview

- 6.2.60.2. Products

- 6.2.60.3. SWOT Analysis

- 6.2.60.4. Recent Developments

- 6.2.60.5. Financials (Based on Availability)

- 6.2.1 Patriot Rail Company

List of Figures

- Figure 1: North America Freight and Logistics Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Freight and Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Freight and Logistics Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: North America Freight and Logistics Industry Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 3: North America Freight and Logistics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Freight and Logistics Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: North America Freight and Logistics Industry Revenue billion Forecast, by Logistics Function 2020 & 2033

- Table 6: North America Freight and Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Freight and Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Freight and Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Freight and Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Freight and Logistics Industry?

The projected CAGR is approximately 1.8%.

2. Which companies are prominent players in the North America Freight and Logistics Industry?

Key companies in the market include Patriot Rail Company, Norfolk Southern Railway, A P Moller - Maersk, Hub Group Inc, DB Schenker, XPO Inc, Nippon Express Holdings, SEKO Logistics, Transportation Insight Holding Company, Old Dominion Freight Line, Canada Post, Landstar System Inc, Fomento Económico Mexicano S A B de C V, DHL Group, Uber Technologies Inc, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Americold Logistics, Knight-Swift Transportation, M3 Transport LLC, GEODIS, Burris Logistics, Penske Logistics, Union Pacific Railroad, Arrive Logistics, Canadian National Railway Company, Yellow Corporatio, FedEx, GXO Logistics, Fastfrate Group, Lineage Logistics LLC, Kuehne + Nagel, MODE Global LLC, Excel Group, Berkshire Hathaway Inc (including BNSF Railway Company), United Parcel Service of America Inc (UPS), Total Quality Logistics LLC, Polaris Development Corporation, Werner Enterprises, OnTrac, Omni Logistics, Ascent Global Logistics, C H Robinson, Mactrans Logistics, Congebec, Canadian Pacific Kansas City Limited, AIT Worldwide Logistics, ArcBest, CSX Corporation, Purolator, NFI Industries, Traxion, Schneider National Inc, Grupo Mexico, TFI International Inc, J B Hunt Transport Inc, Brookfield Infrastructure Partners L P (including Genesee & Wyoming Inc ), Capstone Logistics LLC, KEX Express (US) LLC, Expeditors International of Washington Inc, Ryder System Inc.

3. What are the main segments of the North America Freight and Logistics Industry?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.47 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes.January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.December 2023: Canadian National Railway Company announced an upgrade to its Falcon Premium Intermodal Service. CN said recent operational changes by its business partner, Union Pacific (UP), will remove a full day of transit time for customers using the Canada-US-Mexico service. The Falcon Premium Intermodal Service is a best-in-class Mexico-US-Canada service with a seamless rail connection in Chicago, Illinois. It directly connects all CN origin points within Canada and Detroit, Michigan to GMXT terminals in Mexico. This service benefits intermodal customers shipping automotive parts, food, FAK (freight - all kinds), home appliances, and temperature-controlled products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Freight and Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Freight and Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Freight and Logistics Industry?

To stay informed about further developments, trends, and reports in the North America Freight and Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence