Key Insights

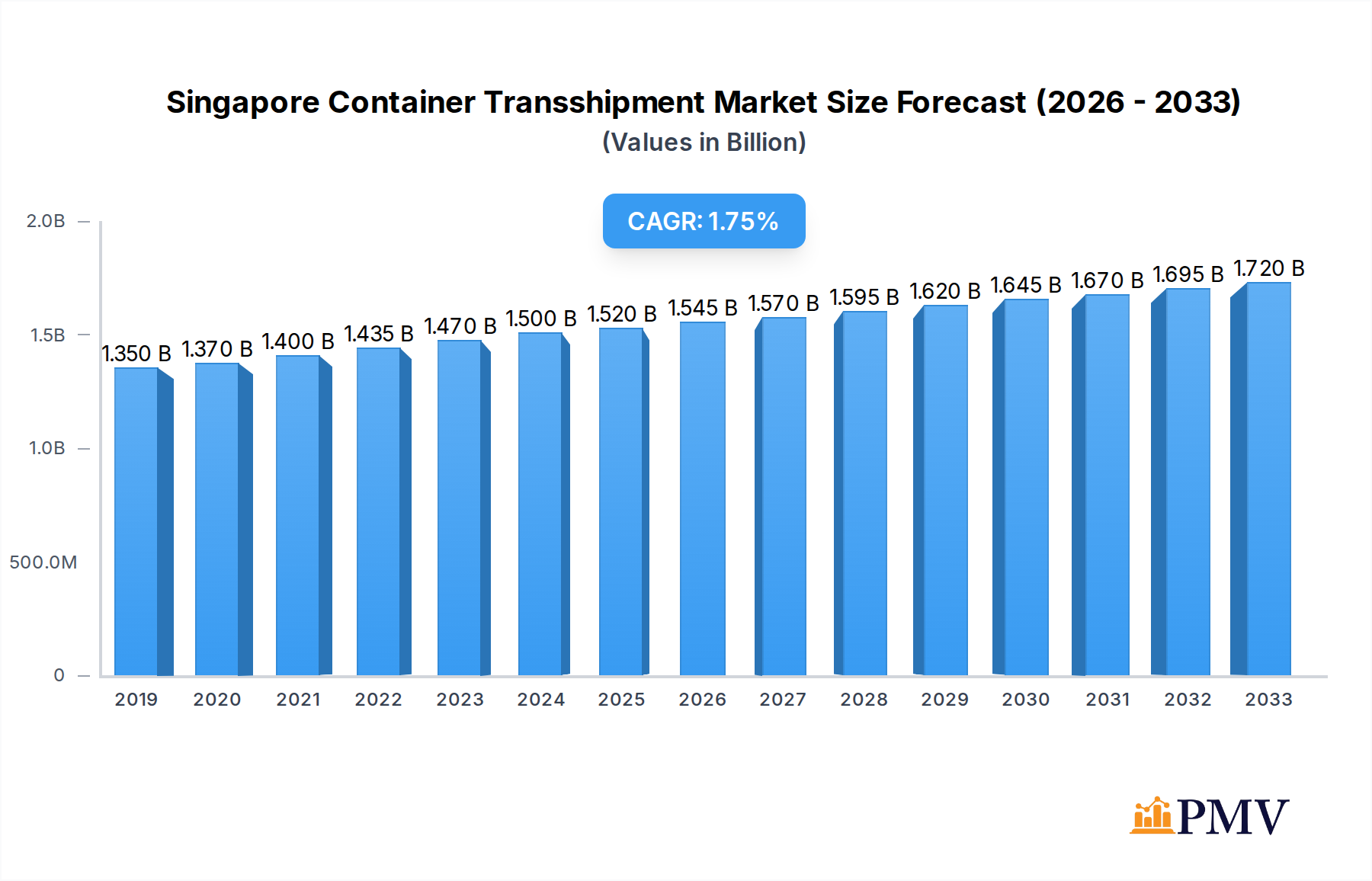

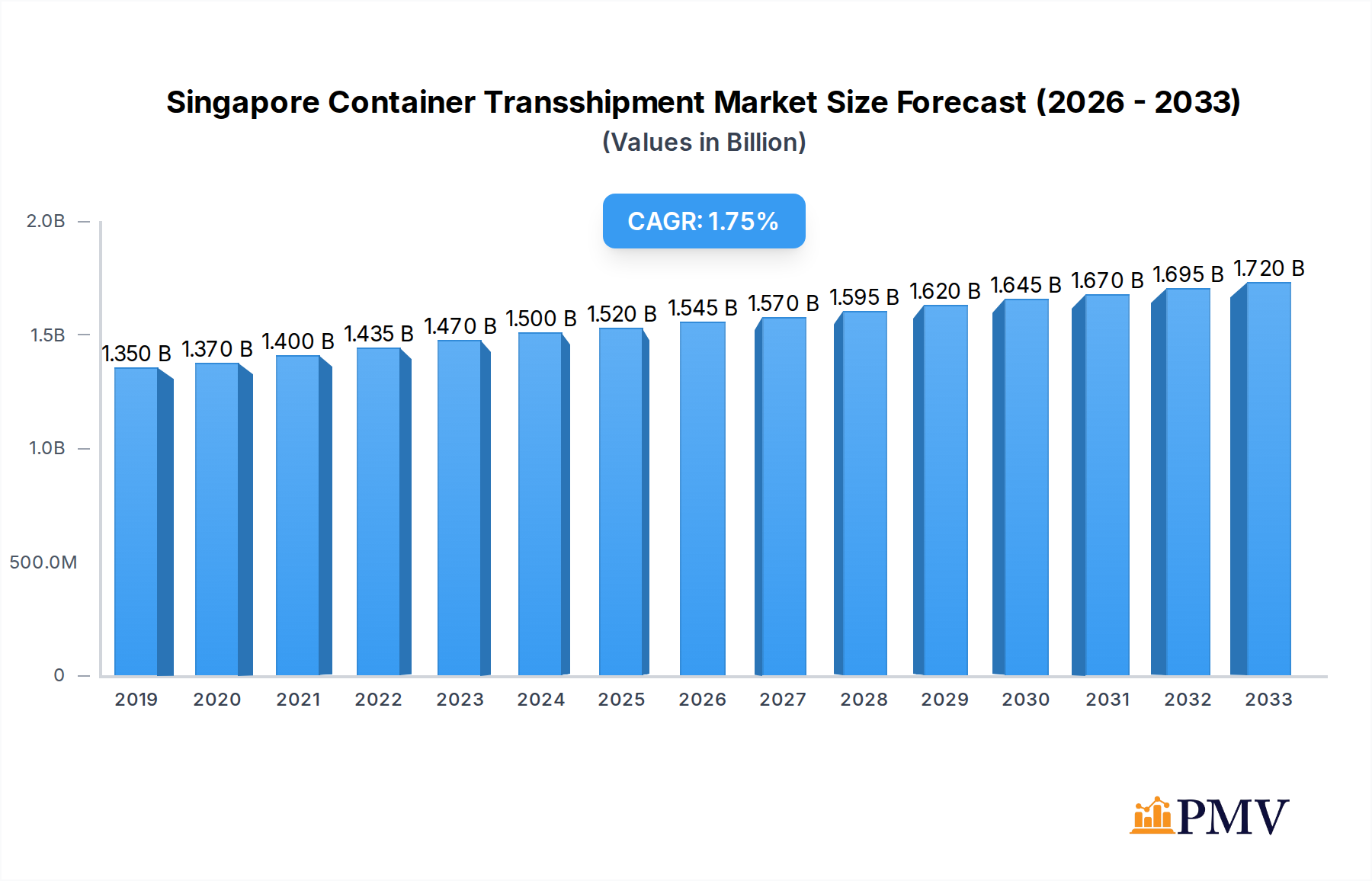

The Singapore Container Transshipment Market is poised for steady growth, projected to reach a substantial market size of USD 1.52 Billion by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 1.69% through 2033. This robust expansion is primarily fueled by Singapore's strategic location as a global maritime hub, its world-class port infrastructure, and the increasing complexity of global supply chains that necessitate efficient transshipment operations. Key drivers include the escalating demand for containerized goods across various industries, particularly in the automotive, food and beverages, and retail sectors, which rely heavily on Singapore's connectivity for onward distribution. Furthermore, ongoing investments in port modernization and technological advancements, such as automation and digitalization, are enhancing operational efficiency and capacity, thereby attracting more shipping lines and cargo volumes. The market's resilience is also buttressed by the continuous flow of trade in the Asia-Pacific region, a significant contributor to global container traffic.

Singapore Container Transshipment Market Market Size (In Billion)

While the market enjoys strong fundamental drivers, certain factors could influence its trajectory. The increasing emphasis on sustainability and green shipping initiatives might present both opportunities and challenges. Companies will need to adapt to stricter environmental regulations, potentially investing in more eco-friendly transshipment processes. Conversely, this can also become a competitive advantage for ports and operators leading in sustainability. The dynamic nature of global trade, including geopolitical shifts and trade policy changes, can introduce volatility, though Singapore's established position as a neutral and efficient hub offers a degree of stability. The market is segmented by container type, with General and Refrigerator containers being dominant, serving a diverse range of end-users like the booming food and beverage industry and the ever-expanding automotive sector. Leading global shipping giants such as Maersk Line, MSC, CMA CGM, and Evergreen Marine Corporation are key players, actively leveraging Singapore's unparalleled transshipment capabilities.

Singapore Container Transshipment Market Company Market Share

Here is an SEO-optimized, detailed report description for the Singapore Container Transshipment Market, incorporating your specified keywords, structure, and content:

This comprehensive report delves into the dynamic Singapore Container Transshipment Market, a critical nexus for global maritime trade. Analyzing the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this study provides in-depth insights into market structure, industry trends, dominant segments, and future outlook. Leveraging high-ranking keywords such as "container transshipment hub," "maritime logistics," "Singapore Port," "PSA Singapore," "Southeast Asia supply chain," and "container shipping," this report targets industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this vital sector. We meticulously examine the competitive landscape, technological advancements, regulatory environment, and key growth drivers, offering actionable intelligence for navigating the evolving demands of international trade.

Singapore Container Transshipment Market Market Structure & Competitive Dynamics

The Singapore Container Transshipment Market is characterized by a moderately concentrated structure, dominated by a few key global shipping lines and the influential terminal operator, PSA Singapore. Innovation ecosystems are driven by the relentless pursuit of operational efficiency, digitalization, and sustainability. Regulatory frameworks are robust, with Singapore's Maritime and Port Authority (MPA) and PSA Singapore playing pivotal roles in facilitating trade and ensuring compliance. Product substitutes are limited given Singapore's strategic geographical advantage and its status as a premier transshipment hub. End-user trends reflect the burgeoning manufacturing and consumption power of Southeast Asia, with sectors like Automotive, Chemicals & Petrochemicals, and Food & Beverages showing significant reliance on efficient transshipment services. Merger and acquisition (M&A) activities, while not pervasive, are strategic, often involving infrastructure expansions or technology integrations aimed at enhancing competitive edge. The market share of major players is substantial, with PSA Singapore handling an impressive 38.8 million TEUs in 2023. While specific M&A deal values are not publicly disclosed for this segment, investments in infrastructure by major carriers, such as Maersk's USD 500 million commitment, indicate significant capital deployment within the broader supply chain ecosystem supporting transshipment.

Singapore Container Transshipment Market Industry Trends & Insights

The Singapore Container Transshipment Market is experiencing robust growth, propelled by several interconnected industry trends. A significant growth driver is Southeast Asia's rapid emergence as a global manufacturing and consumption powerhouse, increasing the volume of goods requiring efficient transshipment. The continuous expansion of global trade routes and the growing preference for mega-vessels necessitate sophisticated transshipment hubs like Singapore to facilitate seamless cargo movement. Technological disruptions are transforming the sector, with a strong emphasis on digitalization, automation, and AI-powered solutions to optimize port operations, enhance tracking capabilities, and improve overall supply chain visibility. For instance, the February 2024 collaboration between HERE Technologies and PSA Singapore aims to revolutionize the container truck ecosystem, demonstrating a commitment to leveraging location data for enhanced efficiency. Consumer preferences are increasingly leaning towards faster delivery times and more sustainable logistics practices, pushing transshipment hubs to adopt greener technologies and streamline operations. Competitive dynamics are intense, with global shipping lines vying for market share through service innovation, network optimization, and strategic investments. The CAGR for the container transshipment market in this region is projected to be strong, driven by these factors. Market penetration of advanced logistics solutions is steadily increasing, reflecting the industry's embrace of digital transformation.

Dominant Markets & Segments in Singapore Container Transshipment Market

Within the Singapore Container Transshipment Market, the General Container segment consistently dominates due to the sheer volume of non-specialized cargo moved globally. This dominance is underpinned by Singapore's extensive connectivity and its role as a primary hub for major east-west trade lanes. The Automotive and Food & Beverages end-user segments also represent significant contributors, driven by robust regional demand and the critical need for timely, temperature-controlled logistics for the latter.

Container Type Dominance:

- General Containers: The backbone of the transshipment market, handling diverse non-perishable goods. Key drivers include global manufacturing output, e-commerce growth, and diverse commodity flows.

- Refrigerator Containers: Growing in importance due to increasing demand for chilled and frozen goods, particularly in the Food & Beverages and Pharmaceuticals sectors. Singapore's advanced cold chain infrastructure supports this segment's growth.

End-User Dominance:

- Automotive: Singapore's strategic location facilitates the movement of automotive parts and finished vehicles for assembly and distribution across Southeast Asia. Economic policies promoting manufacturing and trade agreements are key drivers.

- Food & Beverages: Rising disposable incomes and changing dietary habits in Southeast Asia fuel demand for imported and exported food and beverage products, necessitating efficient transshipment.

- Chemicals & Petrochemicals: A significant sector with substantial volume requirements, driven by regional industrial growth. Stringent safety and handling protocols are paramount.

- Retail: The burgeoning retail sector in Southeast Asia, fueled by urbanization and e-commerce, relies heavily on efficient supply chains for finished goods.

The dominance of these segments is further bolstered by Singapore's state-of-the-art infrastructure, government support for the maritime industry, and its strategic geographical position. The efficiency and reliability of PSA Singapore's terminals are paramount in maintaining this dominance.

Singapore Container Transshipment Market Product Innovations

Product innovations in the Singapore Container Transshipment Market are primarily focused on enhancing operational efficiency, visibility, and sustainability. This includes the development and adoption of advanced terminal automation systems, smart container tracking technologies, and AI-driven logistics optimization platforms. Digitalization initiatives are creating seamless data flows between shipping lines, terminals, and end-users, reducing dwell times and improving inventory management. Innovations in eco-friendly port operations, such as the use of electric or alternative fuel-powered port equipment, are also gaining traction, aligning with global sustainability goals and providing a competitive advantage in attracting environmentally conscious clients. These advancements aim to reduce operational costs, enhance cargo security, and improve the overall customer experience in the transshipment process.

Report Segmentation & Scope

This report segments the Singapore Container Transshipment Market based on key operational and end-user categories. The Container Type segmentation includes General Containers, which constitute the largest share due to the diverse nature of global trade, and Refrigerator Containers, a rapidly growing segment driven by the demand for perishable goods across the Food & Beverages and Pharmaceuticals sectors. The End-User segmentation covers Automotive, Mining & Minerals, Agriculture, Chemicals & Petrochemicals, Pharmaceuticals, Food & Beverages, Retail, and Other End Users. Each segment's growth projections are influenced by regional economic development, trade policies, and specific industry demands. The market size for each segment is estimated based on historical data and current trends, with competitive dynamics shaped by the specialized needs and volumes associated with each sector.

Key Drivers of Singapore Container Transshipment Market Growth

Several key factors are driving the growth of the Singapore Container Transshipment Market. Technologically, the adoption of digitalization, automation, and AI is significantly enhancing operational efficiency and reducing turnaround times. Economically, Southeast Asia's rapid industrialization and expanding consumer markets are generating increased cargo volumes that require efficient transshipment. Regulatory frameworks in Singapore, characterized by pro-trade policies and investments in maritime infrastructure by the MPA, create a conducive environment for growth. Furthermore, Singapore's strategic geographical location at the crossroads of major shipping lanes remains an immutable advantage, attracting a vast network of global shipping lines.

Challenges in the Singapore Container Transshipment Market Sector

Despite its strong growth, the Singapore Container Transshipment Market faces several challenges. Global supply chain disruptions, stemming from geopolitical events, trade disputes, and unforeseen circumstances like pandemics, can impact cargo flows and operational stability. Intense competition from other regional transshipment hubs poses a constant threat, requiring continuous investment in efficiency and service quality. Furthermore, the increasing demand for sustainable logistics necessitates significant capital expenditure in greener technologies and practices, which can be a financial burden. Evolving regulatory landscapes in different countries can also create complexities for seamless international transshipment.

Leading Players in the Singapore Container Transshipment Market Market

- SITC Container Lines

- Orient Overseas Container Line (OOCL)

- ZIM Integrated Shipping Services

- CMA CGM

- Wan Hai Lines

- NYK Line

- Hapag-Lloyd

- Pacific International Lines (PIL)

- Mediterranean Shipping Company (MSC)

- Maersk Line

- Evergreen Marine Corporation

- 7 Other Companies

Key Developments in Singapore Container Transshipment Market Sector

- February 2024: A.P. Moller-Maersk (Maersk) announced more than USD 500 million in investment to expand its supply chain infrastructure to support Southeast Asia's emergence as a global production hub and a consumption powerhouse. Maersk’s planned three-year investment will target its Logistics & Services arm. Still, at the same time, a substantial amount of investment will also be channeled into its Ocean and Terminals infrastructure. By 2026, Maersk expects to add nearly 480,000 sqm capacity spread across Malaysia, Indonesia, Singapore, and the Philippines. With these investments, Maersk will be able to better serve customers with mega distribution centers that are strategically located, sustainable, and equipped with advanced automation to drive increased efficiency.

- February 2024: HERE Technologies, a major provider of location data and technology solutions, has announced its collaboration with PSA Singapore, the operator of the world's largest transshipment hub, to revolutionize the container truck ecosystem in Singapore. The aim is to enhance the efficiency of goods movement at Singapore's terminals. Singapore is the top maritime capital globally, with the Port of Singapore ranking as the world's second busiest port in terms of container volumes. PSA boasts connectivity to over 600 ports worldwide, handling 38.8 million TEUs in 2023.

Strategic Singapore Container Transshipment Market Market Outlook

The Singapore Container Transshipment Market is poised for continued strategic growth, driven by the robust economic expansion of Southeast Asia and the ongoing globalization of trade. Future market potential lies in further embracing digital transformation, including the implementation of advanced analytics for predictive maintenance and optimized routing, and the adoption of sustainable logistics solutions to meet increasing environmental demands. Strategic opportunities exist in enhancing connectivity to emerging markets, developing specialized services for high-value cargo segments, and fostering closer collaborations between port authorities, shipping lines, and technology providers to create a more integrated and efficient logistics ecosystem. The market's ability to adapt to evolving trade dynamics and technological advancements will be crucial for maintaining its competitive edge.

Singapore Container Transshipment Market Segmentation

-

1. Container Type

- 1.1. General

- 1.2. Refrigerator

-

2. End-User

- 2.1. Automotive

- 2.2. Mining & Minerals

- 2.3. Agriculture

- 2.4. Chemicals & Petrochemicals

- 2.5. Pharmaceuticals

- 2.6. Food & Beverages

- 2.7. Retail

- 2.8. Other End Users

Singapore Container Transshipment Market Segmentation By Geography

- 1. Singapore

Singapore Container Transshipment Market Regional Market Share

Geographic Coverage of Singapore Container Transshipment Market

Singapore Container Transshipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 1.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce is Booming the Market; Increasing Intra-Regional Trade

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor; Competition From the Global Players

- 3.4. Market Trends

- 3.4.1. Increasing Trade Activities are Boosting the Market Growth in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Container Transshipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Container Type

- 5.1.1. General

- 5.1.2. Refrigerator

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automotive

- 5.2.2. Mining & Minerals

- 5.2.3. Agriculture

- 5.2.4. Chemicals & Petrochemicals

- 5.2.5. Pharmaceuticals

- 5.2.6. Food & Beverages

- 5.2.7. Retail

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Container Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SITC Container Lines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orient Overseas Container Line (OOCL)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ZIM Integrated Shipping Services**List Not Exhaustive 7 3 Other Companie

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CMA CGM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wan Hai Lines

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NYK Line

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hapag-Lloyd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pacific International Lines (PIL)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mediterranean Shipping Company (MSC)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Maersk Line

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Evergreen Marine Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 SITC Container Lines

List of Figures

- Figure 1: Singapore Container Transshipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Container Transshipment Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Container Transshipment Market Revenue Million Forecast, by Container Type 2020 & 2033

- Table 2: Singapore Container Transshipment Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Singapore Container Transshipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Singapore Container Transshipment Market Revenue Million Forecast, by Container Type 2020 & 2033

- Table 5: Singapore Container Transshipment Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Singapore Container Transshipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Container Transshipment Market?

The projected CAGR is approximately > 1.69%.

2. Which companies are prominent players in the Singapore Container Transshipment Market?

Key companies in the market include SITC Container Lines, Orient Overseas Container Line (OOCL), ZIM Integrated Shipping Services**List Not Exhaustive 7 3 Other Companie, CMA CGM, Wan Hai Lines, NYK Line, Hapag-Lloyd, Pacific International Lines (PIL), Mediterranean Shipping Company (MSC), Maersk Line, Evergreen Marine Corporation.

3. What are the main segments of the Singapore Container Transshipment Market?

The market segments include Container Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.52 Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce is Booming the Market; Increasing Intra-Regional Trade.

6. What are the notable trends driving market growth?

Increasing Trade Activities are Boosting the Market Growth in the Country.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor; Competition From the Global Players.

8. Can you provide examples of recent developments in the market?

February 2024: A.P. Moller-Maersk (Maersk) announced more than USD 500 million in investment to expand its supply chain infrastructure to support Southeast Asia's emergence as a global production hub and a consumption powerhouse. Maersk’s planned three-year investment will target its Logistics & Services arm. Still, at the same time, a substantial amount of investment will also be channeled into its Ocean and Terminals infrastructure. By 2026, Maersk expects to add nearly 480,000 sqm capacity spread across Malaysia, Indonesia, Singapore, and the Philippines. With these investments, Maersk will be able to better serve customers with mega distribution centers that are strategically located, sustainable, and equipped with advanced automation to drive increased efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Container Transshipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Container Transshipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Container Transshipment Market?

To stay informed about further developments, trends, and reports in the Singapore Container Transshipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence