Key Insights

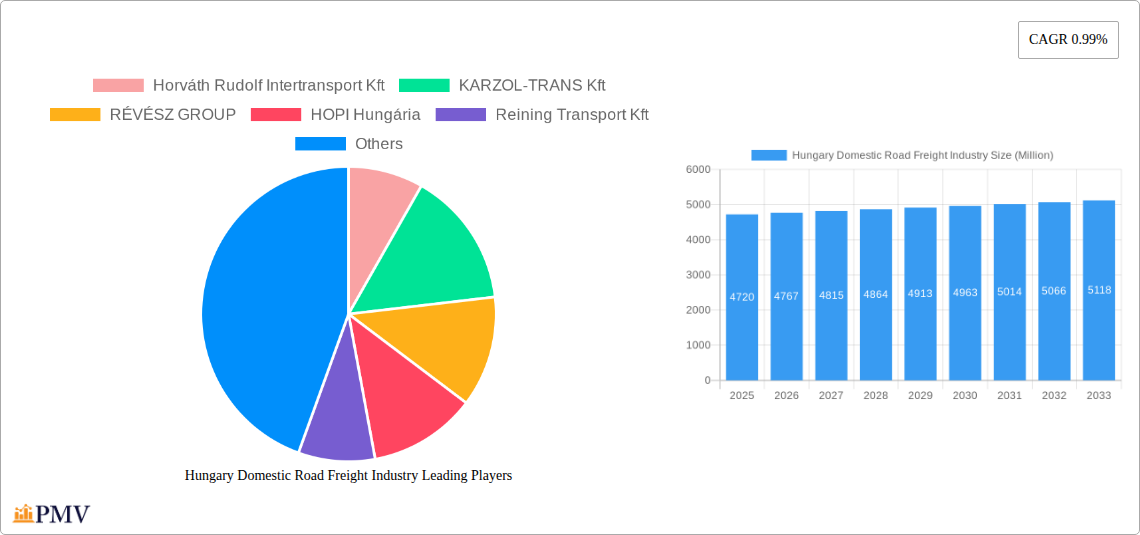

The Hungarian domestic road freight industry, valued at €4.72 billion in 2025, is projected to experience steady growth, albeit at a modest CAGR of 0.99%, extending through 2033. This relatively low growth rate likely reflects a mature market with established players and existing infrastructure. Key drivers include the robust performance of sectors like manufacturing (particularly automotive), construction, and distributive trade, all significant users of road freight services. Increasing e-commerce activity and the need for efficient last-mile delivery solutions also contribute to market demand. However, factors such as rising fuel costs, driver shortages, and potential regulatory changes pose significant restraints to higher growth. The industry's segmentation reveals a strong reliance on domestic transport, although international cross-border movements also play a role. The diverse end-user base underscores the broad applicability of road freight, highlighting its importance within Hungary's economic landscape. The presence of both large multinational logistics providers (e.g., DHL, GEFCO) and numerous smaller, domestic companies signifies a competitive market with opportunities for various business models.

Hungary Domestic Road Freight Industry Market Size (In Billion)

The competitive landscape is characterized by a mix of large multinational corporations and smaller, domestically-owned businesses. Large players benefit from economies of scale and established networks, while smaller firms offer specialized services or regional expertise. The forecast period indicates continued growth, although the pace suggests a market reaching a level of saturation. Strategic investments in technological advancements, such as fleet management systems and route optimization software, will be crucial for companies to maintain competitiveness and improve efficiency in the face of increasing operating costs and a tightening labor market. Focus on sustainability initiatives, such as utilizing alternative fuels and adopting eco-friendly practices, may also become increasingly important for attracting customers and meeting evolving environmental regulations.

Hungary Domestic Road Freight Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Hungary domestic road freight industry, offering invaluable insights for businesses, investors, and policymakers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, key trends, and future growth prospects. The study incorporates extensive data analysis, revealing crucial information on market size, segmentation, and leading players, enabling informed strategic decision-making.

Hungary Domestic Road Freight Industry Market Structure & Competitive Dynamics

The Hungarian domestic road freight market exhibits a moderately concentrated structure, with a few large players holding significant market share, alongside numerous smaller and medium-sized enterprises (SMEs). The market is characterized by intense competition, driven by factors such as fluctuating fuel prices, stringent regulatory requirements, and evolving customer demands. Innovation within the sector is largely focused on technological advancements, particularly in areas such as fleet management systems, route optimization software, and digital freight platforms. The regulatory framework plays a significant role, impacting operational costs and compliance standards. Substitutes for road freight, such as rail and air freight, are limited due to Hungary's geographical characteristics and the nature of many transported goods. End-user trends showcase a growing preference for reliable, efficient, and technologically advanced logistics solutions. M&A activity in recent years has been moderate, with deal values averaging xx Million, primarily driven by larger companies consolidating their market positions. Key players include Waberer's International Nyrt, Waberer's International Nyrt, and others.

- Market Concentration: xx% held by top 5 players.

- M&A Activity (2019-2024): xx deals, average value xx Million.

- Innovation Focus: Digitalization, fleet optimization, and sustainability.

- Regulatory Landscape: Stringent emission standards, driver regulations, and cabotage rules.

Hungary Domestic Road Freight Industry Industry Trends & Insights

The Hungarian domestic road freight industry is experiencing steady growth, driven by a robust economy and expanding e-commerce sector. The compound annual growth rate (CAGR) for the period 2025-2033 is projected at xx%, fueled by increasing demand for efficient and reliable transportation services across diverse sectors. Technological disruptions, including the adoption of telematics, IoT-enabled devices, and advanced analytics, are transforming operational efficiency and supply chain visibility. Consumer preferences are shifting towards greater transparency, traceability, and sustainability, prompting companies to invest in green logistics initiatives. Intense competition necessitates continuous innovation and operational excellence. Market penetration of digital freight platforms is growing rapidly, leading to improved efficiency and cost reduction for both shippers and carriers.

Dominant Markets & Segments in Hungary Domestic Road Freight Industry

The domestic segment dominates the Hungarian road freight market, driven by strong internal consumption and robust industrial activity. Within end-user segments, Manufacturing (including Automotive) holds the largest market share due to the strong presence of the automotive industry in Hungary.

By Destination: Domestic (xx% market share), International/Cross-border (xx% market share). Domestic segment dominance is primarily due to robust internal trade and manufacturing activity.

By End User:

- Manufacturing (Including Automotive): Largest segment, driven by high production volumes and extensive supply chains.

- Distributive Trade (wholesale and retail trade): Significant growth driven by e-commerce expansion.

- Construction: Moderate growth tied to infrastructure projects.

- Other End Users (Telecommunications, etc.): Steady demand across various sectors.

Key drivers for the dominant segments include:

- Robust economic growth: Hungary's GDP growth fuels demand for transportation services.

- Developed infrastructure: A relatively well-developed road network facilitates efficient transportation.

- Government support: Government policies supporting industrial development and infrastructure investment.

Hungary Domestic Road Freight Industry Product Innovations

Recent product innovations focus on enhancing efficiency, safety, and sustainability. This includes the implementation of telematics systems for real-time tracking and fleet management, the adoption of fuel-efficient vehicles, and the use of route optimization software to minimize fuel consumption and delivery times. These innovations improve operational efficiency, reduce costs, and enhance customer satisfaction, providing competitive advantages in a dynamic market.

Report Segmentation & Scope

This report segments the Hungarian domestic road freight market by destination (domestic, international/cross-border) and by end-user (Manufacturing, Oil and Gas, Mining and Quarrying, Agriculture, Fishing and Forestry, Construction, Distributive Trade, Pharmaceutical and Healthcare, Other End Users). Each segment’s growth projections, market size estimates, and competitive dynamics are analyzed to provide a comprehensive view. Market sizes are projected to reach xx Million by 2033 for the domestic segment and xx Million for the international segment. Competitive analysis focuses on market share, pricing strategies, and technological advancements within each segment.

Key Drivers of Hungary Domestic Road Freight Industry Growth

Growth in the Hungary domestic road freight industry is primarily driven by several factors. The flourishing manufacturing sector, particularly automotive, creates a substantial demand for transportation services. The expansion of e-commerce and the increasing reliance on just-in-time delivery models further stimulate market growth. Government investments in infrastructure upgrades are expected to improve logistics efficiency and reduce transportation costs, fueling additional growth. Technological advancements, enabling optimized routes and enhanced supply chain visibility, also play a significant role.

Challenges in the Hungary Domestic Road Freight Industry Sector

The Hungarian road freight industry faces several challenges, including fluctuating fuel prices, driver shortages, and increasing regulatory scrutiny. Stringent environmental regulations are driving up operational costs, while intense competition puts pressure on profit margins. Supply chain disruptions, including geopolitical instability and potential pandemics, pose significant risks, impacting reliability and operational efficiency. The overall impact of these challenges on market growth is estimated at a reduction of xx% annually.

Leading Players in the Hungary Domestic Road Freight Industry Market

- Horváth Rudolf Intertransport Kft

- KARZOL-TRANS Kft

- RÉVÉSZ GROUP

- HOPI Hungária

- Reining Transport Kft

- Huncargo Holding Zrt

- Genezis-Trans Kft

- Qualitrans - Cargo Kft

- GEFCO

- K&V Nemzetközi Fuvarozó Kft

- Alba-Zöchling Kft

- GARTNER group

- Transintertop Kft

- Deutsche Post DHL Group

- BHS Trans

- Gelbmann Kft

- Waberer's International Nyrt

- DUVENBECK Logisztikai Kft

- DOMINÓ TRANS Kft

- Ekol Logistics Szolgáltató Korlátolt Felelosségu Társaság

Key Developments in Hungary Domestic Road Freight Industry Sector

- 2022 Q4: Introduction of new emission standards for heavy-duty vehicles.

- 2023 Q1: Significant investment in digital freight platforms by major players.

- 2023 Q3: Merger of two smaller companies resulting in a consolidation of market share.

Strategic Hungary Domestic Road Freight Industry Market Outlook

The Hungarian domestic road freight industry presents substantial growth opportunities over the forecast period. Continued investment in infrastructure, technological advancements, and the potential for further consolidation among players offer significant potential for expansion. Companies focusing on efficiency, sustainability, and digitalization will be well-positioned to capitalize on future market growth. Government support and favorable economic conditions suggest a positive long-term outlook for the sector.

Hungary Domestic Road Freight Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International/Cross-border

-

2. End User

- 2.1. Manufacturing (Including Automotive)

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distributive Trade (wholesale and retail trade)

- 2.6. Pharmaceutical and Healthcare

- 2.7. Other End Users (Telecommunications, etc.)

Hungary Domestic Road Freight Industry Segmentation By Geography

- 1. Hungary

Hungary Domestic Road Freight Industry Regional Market Share

Geographic Coverage of Hungary Domestic Road Freight Industry

Hungary Domestic Road Freight Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing global trade activities; Infrastructure Development is on rise

- 3.3. Market Restrains

- 3.3.1. Manufacturers' lack of control over logistics services and also increasing logistical costs

- 3.4. Market Trends

- 3.4.1. Domestic road freight transport witness higher growth rate through the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Domestic Road Freight Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International/Cross-border

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing (Including Automotive)

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distributive Trade (wholesale and retail trade)

- 5.2.6. Pharmaceutical and Healthcare

- 5.2.7. Other End Users (Telecommunications, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Horváth Rudolf Intertransport Kft

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KARZOL-TRANS Kft

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RÉVÉSZ GROUP

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 HOPI Hungária

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Reining Transport Kft

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huncargo Holding Zrt

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genezis-Trans Kft

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Qualitrans - Cargo Kft

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GEFCO

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 K&V Nemzetközi Fuvarozó Kft

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Alba-Zöchling Kft

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GARTNER group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Transintertop Kft

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Deutsche Post DHL Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 BHS Trans

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Gelbmann Kft

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Waberer's International Nyrt

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 DUVENBECK Logisztikai Kft**List Not Exhaustive

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 DOMINÓ TRANS Kft

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Ekol Logistics Szolgáltató Korlátolt Felelosségu Társaság

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 Horváth Rudolf Intertransport Kft

List of Figures

- Figure 1: Hungary Domestic Road Freight Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Hungary Domestic Road Freight Industry Share (%) by Company 2025

List of Tables

- Table 1: Hungary Domestic Road Freight Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 2: Hungary Domestic Road Freight Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Hungary Domestic Road Freight Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Hungary Domestic Road Freight Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 5: Hungary Domestic Road Freight Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Hungary Domestic Road Freight Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Domestic Road Freight Industry?

The projected CAGR is approximately 0.99%.

2. Which companies are prominent players in the Hungary Domestic Road Freight Industry?

Key companies in the market include Horváth Rudolf Intertransport Kft, KARZOL-TRANS Kft, RÉVÉSZ GROUP, HOPI Hungária, Reining Transport Kft, Huncargo Holding Zrt, Genezis-Trans Kft, Qualitrans - Cargo Kft, GEFCO, K&V Nemzetközi Fuvarozó Kft, Alba-Zöchling Kft, GARTNER group, Transintertop Kft, Deutsche Post DHL Group, BHS Trans, Gelbmann Kft, Waberer's International Nyrt, DUVENBECK Logisztikai Kft**List Not Exhaustive, DOMINÓ TRANS Kft, Ekol Logistics Szolgáltató Korlátolt Felelosségu Társaság.

3. What are the main segments of the Hungary Domestic Road Freight Industry?

The market segments include Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing global trade activities; Infrastructure Development is on rise.

6. What are the notable trends driving market growth?

Domestic road freight transport witness higher growth rate through the forecast period.

7. Are there any restraints impacting market growth?

Manufacturers' lack of control over logistics services and also increasing logistical costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Domestic Road Freight Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Domestic Road Freight Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Domestic Road Freight Industry?

To stay informed about further developments, trends, and reports in the Hungary Domestic Road Freight Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence