Key Insights

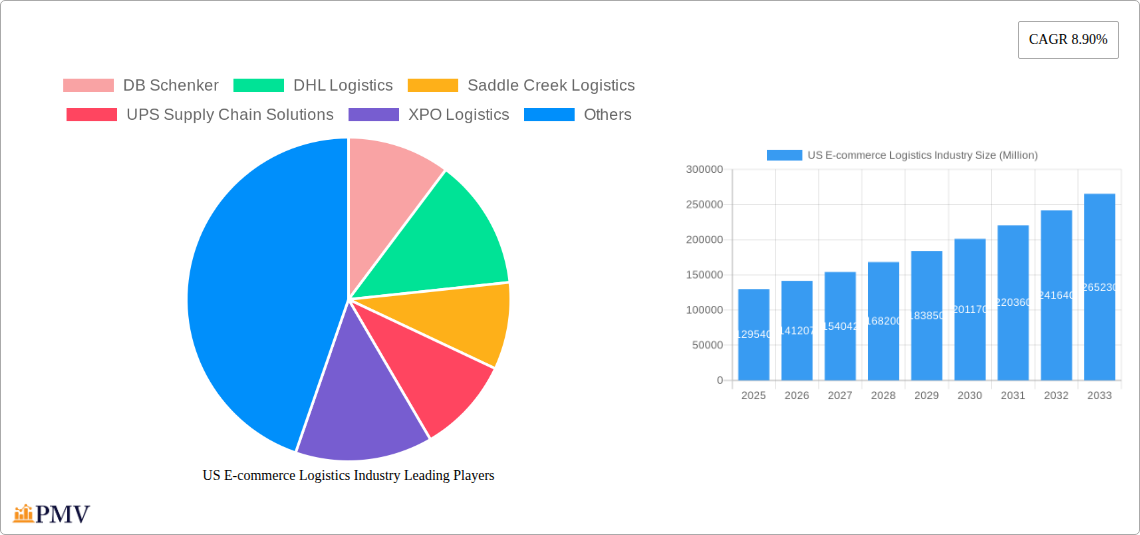

The US e-commerce logistics industry is experiencing robust growth, projected to reach a market size of $129.54 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.90% from 2025 to 2033. This expansion is fueled by several key factors. The surge in online shopping, particularly accelerated by the pandemic, continues to drive demand for efficient and reliable logistics solutions. Consumers expect fast and affordable delivery, pushing companies to invest in advanced technologies like automated warehouses, sophisticated routing software, and last-mile delivery optimization. The increasing diversification of e-commerce products, encompassing fashion, electronics, home goods, and personal care items, further contributes to the industry's growth. Furthermore, the rise of omnichannel retail strategies, integrating online and offline sales, necessitates robust logistics capabilities to manage inventory and fulfill orders seamlessly across multiple channels. Competition is fierce, with major players like FedEx, UPS, DHL, and others vying for market share through strategic partnerships, technological advancements, and expansion of their service offerings. Growth is also being observed across segments such as B2B e-commerce, international shipping, and value-added services like customized packaging and labeling. Regional variations exist, with densely populated areas like the Northeast and West likely experiencing higher demand than the Midwest and South.

US E-commerce Logistics Industry Market Size (In Billion)

The industry faces challenges, however, including rising fuel costs, labor shortages, and the increasing complexity of managing last-mile delivery in urban environments. Addressing these challenges requires innovative solutions, such as leveraging autonomous vehicles, drone delivery, and advanced data analytics for optimized route planning and inventory management. Sustainability is also emerging as a crucial factor, with consumers and businesses increasingly demanding environmentally friendly logistics practices. Companies are adapting by investing in electric vehicles, optimizing delivery routes to reduce fuel consumption, and adopting sustainable packaging materials. The continued integration of technology, coupled with a focus on sustainability and efficient operations, will be key to navigating these challenges and maintaining the industry's strong growth trajectory.

US E-commerce Logistics Industry Company Market Share

US E-commerce Logistics Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the US e-commerce logistics industry, covering market size, segmentation, competitive landscape, and future growth projections from 2019 to 2033. The report utilizes data from the historical period (2019-2024), the base year (2025), and the estimated year (2025) to forecast market trends until 2033. This analysis will be invaluable for businesses operating within or seeking to enter this dynamic sector.

US E-commerce Logistics Industry Market Structure & Competitive Dynamics

The US e-commerce logistics market is characterized by intense competition among a diverse range of players, from global giants to regional specialists. Market concentration is moderate, with several large players holding significant market share, but numerous smaller companies also contributing substantially. The industry exhibits a dynamic innovation ecosystem, driven by technological advancements in automation, data analytics, and sustainable practices. Regulatory frameworks, such as those concerning data privacy and environmental sustainability, significantly influence operations. Product substitutes, including alternative delivery models and in-house logistics solutions, exert competitive pressure. End-user trends towards faster delivery, increased transparency, and personalized experiences continuously shape industry dynamics. Mergers and acquisitions (M&A) activities are frequent, reflecting consolidation and expansion strategies within the sector. For example, in the last five years, M&A deal values have totaled approximately $xx Million, with notable transactions including [Insert Specific Examples of M&A deals with values if available, otherwise use "xx Million"]. The largest players typically hold market shares ranging from 5% to 20%, indicating a fragmented yet concentrated market.

US E-commerce Logistics Industry Industry Trends & Insights

The US e-commerce logistics market is experiencing robust growth, driven primarily by the expansion of online retail and the increasing demand for efficient and reliable delivery services. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, exceeding the historical CAGR of xx% (2019-2024). Technological disruptions, such as the rise of automation, artificial intelligence (AI), and the Internet of Things (IoT), are transforming operations, enhancing efficiency, and reducing costs. Consumer preferences are shifting towards faster delivery options (same-day, next-day), increased transparency in order tracking, and personalized delivery experiences, placing pressure on logistics providers to adapt and innovate. Market penetration of advanced logistics technologies, such as automated warehousing and drone delivery, is gradually increasing, although widespread adoption is still limited due to implementation costs and regulatory constraints. The intensified competition is driving innovation and price optimization, benefiting consumers through enhanced services and reduced shipping costs.

Dominant Markets & Segments in US E-commerce Logistics Industry

The US e-commerce logistics market is geographically diverse, with no single region dominating the market. However, major metropolitan areas with high population density and robust e-commerce activity consistently exhibit higher demand. Key segments within the industry demonstrate varying growth trajectories:

By Service:

- Transportation: Dominated by large carriers, this segment shows consistent growth aligned with e-commerce expansion.

- Warehousing & Inventory Management: Experiences strong demand due to the need for efficient storage and order fulfillment. This is a highly competitive sector with significant automation investment.

- Value-added Services: This segment is experiencing rapid growth as businesses seek customization and enhanced supply chain visibility.

By Business:

- B2C (Business-to-Consumer): This remains the largest and fastest-growing segment, driven by the surge in online shopping.

- B2B (Business-to-Business): While smaller than B2C, this segment is witnessing steady growth, driven by e-procurement and just-in-time inventory management.

By Destination:

- Domestic: Represents the largest share of the market, with a strong focus on optimizing last-mile delivery.

- International/Cross-border: Showcasing increasing growth potential due to globalization and expanding cross-border e-commerce.

By Product:

- Fashion & Apparel: Remains a leading segment due to high consumer demand and online retail's significant share in this category.

- Consumer Electronics: The demand for fast and reliable delivery, especially of high-value items, fuels strong growth in this sector.

- Other Products: This segment includes a broad range of products, each with unique logistics requirements and varying growth patterns.

Key drivers vary across segments, including economic policies supporting e-commerce, infrastructure investments improving transportation networks, and evolving consumer expectations.

US E-commerce Logistics Industry Product Innovations

Recent innovations focus on enhancing efficiency, speed, and sustainability. Automated guided vehicles (AGVs), robotic process automation (RPA), and AI-powered predictive analytics are improving warehouse operations and last-mile delivery. The integration of blockchain technology is increasing supply chain transparency and traceability. Sustainable practices, such as the adoption of electric vehicles and carbon-neutral shipping options, are gaining traction in response to growing environmental concerns. These innovations offer considerable competitive advantages by enabling faster turnaround times, reduced operational costs, and improved customer satisfaction.

Report Segmentation & Scope

This report segments the US e-commerce logistics market comprehensively across service types (Transportation, Warehousing & Inventory Management, Value-added services), business models (B2B, B2C), destinations (Domestic, International), and product categories (Fashion & Apparel, Consumer Electronics, Home Appliances, Furniture, Beauty & Personal Care, Other). Growth projections, market sizes, and competitive dynamics are analyzed for each segment, revealing opportunities and challenges specific to each area. Each segment is expected to exhibit different growth rates, reflecting varying demand and industry-specific dynamics.

Key Drivers of US E-commerce Logistics Industry Growth

Several factors propel the growth of the US e-commerce logistics industry. The continuous rise in online shopping directly fuels demand for efficient delivery services. Technological advancements like automation and AI optimize operations and reduce costs. Government policies supporting e-commerce and infrastructure development, including improved road networks and digital infrastructure, contribute significantly. The increasing focus on sustainability further drives innovation towards eco-friendly logistics solutions.

Challenges in the US E-commerce Logistics Industry Sector

The industry faces several challenges, including the high cost of last-mile delivery, increasing fuel prices, driver shortages, and regulatory hurdles related to data privacy and environmental regulations. Supply chain disruptions, exacerbated by global events, pose significant risks. Intense competition among numerous players necessitates constant innovation and efficient cost management. These factors exert downward pressure on profit margins and necessitate strategic adaptations for sustained growth.

Leading Players in the US E-commerce Logistics Industry Market

- DB Schenker

- DHL Logistics

- Saddle Creek Logistics

- UPS Supply Chain Solutions

- XPO Logistics

- Rakuten Super Logistics

- FedEx

- Geodis Logistics

- Kenco Logistics Services

- Kuehne and Nagel Logistics

- List Not Exhaustive

Key Developments in US E-commerce Logistics Industry Sector

- August 2023: DHL eCommerce opened a new 352,000 sq ft distribution center in Melrose Park, Illinois, featuring an automated sorter capable of handling 40,000 parcels per hour. This expansion, part of a five-year plan, includes 11 new/relocated warehouses with seven more planned. This significantly enhances DHL's capacity and efficiency in a key market.

- April 2023: DHL Express launched GoGreen Plus, expanding sustainable services for US SMEs by enabling customers to offset the carbon footprint of their shipments using Sustainable Aviation Fuel. This initiative reflects the growing importance of sustainability in the industry.

Strategic US E-commerce Logistics Industry Market Outlook

The future of the US e-commerce logistics industry is bright, driven by sustained growth in online retail, technological innovation, and evolving consumer preferences. Strategic opportunities lie in leveraging advanced technologies to enhance efficiency, sustainability, and customer experience. Companies focusing on personalization, transparency, and faster delivery will gain a competitive edge. Expanding into underserved markets and exploring new delivery models, such as drone delivery and micro-fulfillment centers, will also offer significant growth potential. The ongoing focus on sustainability will reshape the industry, favoring environmentally conscious practices and technologies.

US E-commerce Logistics Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory management

- 1.3. Value-added services (Labeling, Packaging, etc)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/cross-border

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal Care Products

- 4.6. Other Products (Toys, Food Products, etc.)

US E-commerce Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US E-commerce Logistics Industry Regional Market Share

Geographic Coverage of US E-commerce Logistics Industry

US E-commerce Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In Cross Border Logistics; Upgrade e-commerce with new supply chain technology

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Warehousing and Inventory management

- 3.4. Market Trends

- 3.4.1. Upgrade e-commerce with new supply chain technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US E-commerce Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory management

- 5.1.3. Value-added services (Labeling, Packaging, etc)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/cross-border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal Care Products

- 5.4.6. Other Products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America US E-commerce Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehousing and Inventory management

- 6.1.3. Value-added services (Labeling, Packaging, etc)

- 6.2. Market Analysis, Insights and Forecast - by Business

- 6.2.1. B2B

- 6.2.2. B2C

- 6.3. Market Analysis, Insights and Forecast - by Destination

- 6.3.1. Domestic

- 6.3.2. International/cross-border

- 6.4. Market Analysis, Insights and Forecast - by Product

- 6.4.1. Fashion and Apparel

- 6.4.2. Consumer Electronics

- 6.4.3. Home Appliances

- 6.4.4. Furniture

- 6.4.5. Beauty and Personal Care Products

- 6.4.6. Other Products (Toys, Food Products, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. South America US E-commerce Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehousing and Inventory management

- 7.1.3. Value-added services (Labeling, Packaging, etc)

- 7.2. Market Analysis, Insights and Forecast - by Business

- 7.2.1. B2B

- 7.2.2. B2C

- 7.3. Market Analysis, Insights and Forecast - by Destination

- 7.3.1. Domestic

- 7.3.2. International/cross-border

- 7.4. Market Analysis, Insights and Forecast - by Product

- 7.4.1. Fashion and Apparel

- 7.4.2. Consumer Electronics

- 7.4.3. Home Appliances

- 7.4.4. Furniture

- 7.4.5. Beauty and Personal Care Products

- 7.4.6. Other Products (Toys, Food Products, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe US E-commerce Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehousing and Inventory management

- 8.1.3. Value-added services (Labeling, Packaging, etc)

- 8.2. Market Analysis, Insights and Forecast - by Business

- 8.2.1. B2B

- 8.2.2. B2C

- 8.3. Market Analysis, Insights and Forecast - by Destination

- 8.3.1. Domestic

- 8.3.2. International/cross-border

- 8.4. Market Analysis, Insights and Forecast - by Product

- 8.4.1. Fashion and Apparel

- 8.4.2. Consumer Electronics

- 8.4.3. Home Appliances

- 8.4.4. Furniture

- 8.4.5. Beauty and Personal Care Products

- 8.4.6. Other Products (Toys, Food Products, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East & Africa US E-commerce Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehousing and Inventory management

- 9.1.3. Value-added services (Labeling, Packaging, etc)

- 9.2. Market Analysis, Insights and Forecast - by Business

- 9.2.1. B2B

- 9.2.2. B2C

- 9.3. Market Analysis, Insights and Forecast - by Destination

- 9.3.1. Domestic

- 9.3.2. International/cross-border

- 9.4. Market Analysis, Insights and Forecast - by Product

- 9.4.1. Fashion and Apparel

- 9.4.2. Consumer Electronics

- 9.4.3. Home Appliances

- 9.4.4. Furniture

- 9.4.5. Beauty and Personal Care Products

- 9.4.6. Other Products (Toys, Food Products, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Asia Pacific US E-commerce Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehousing and Inventory management

- 10.1.3. Value-added services (Labeling, Packaging, etc)

- 10.2. Market Analysis, Insights and Forecast - by Business

- 10.2.1. B2B

- 10.2.2. B2C

- 10.3. Market Analysis, Insights and Forecast - by Destination

- 10.3.1. Domestic

- 10.3.2. International/cross-border

- 10.4. Market Analysis, Insights and Forecast - by Product

- 10.4.1. Fashion and Apparel

- 10.4.2. Consumer Electronics

- 10.4.3. Home Appliances

- 10.4.4. Furniture

- 10.4.5. Beauty and Personal Care Products

- 10.4.6. Other Products (Toys, Food Products, etc.)

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Saddle Creek Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 UPS Supply Chain Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 XPO Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rakuten Super Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FedEx

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Geodis Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kenco Logistics Services

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kuehne and Nagel Logistics**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global US E-commerce Logistics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US E-commerce Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 3: North America US E-commerce Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America US E-commerce Logistics Industry Revenue (Million), by Business 2025 & 2033

- Figure 5: North America US E-commerce Logistics Industry Revenue Share (%), by Business 2025 & 2033

- Figure 6: North America US E-commerce Logistics Industry Revenue (Million), by Destination 2025 & 2033

- Figure 7: North America US E-commerce Logistics Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 8: North America US E-commerce Logistics Industry Revenue (Million), by Product 2025 & 2033

- Figure 9: North America US E-commerce Logistics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: North America US E-commerce Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America US E-commerce Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America US E-commerce Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 13: South America US E-commerce Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 14: South America US E-commerce Logistics Industry Revenue (Million), by Business 2025 & 2033

- Figure 15: South America US E-commerce Logistics Industry Revenue Share (%), by Business 2025 & 2033

- Figure 16: South America US E-commerce Logistics Industry Revenue (Million), by Destination 2025 & 2033

- Figure 17: South America US E-commerce Logistics Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 18: South America US E-commerce Logistics Industry Revenue (Million), by Product 2025 & 2033

- Figure 19: South America US E-commerce Logistics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 20: South America US E-commerce Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: South America US E-commerce Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe US E-commerce Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 23: Europe US E-commerce Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 24: Europe US E-commerce Logistics Industry Revenue (Million), by Business 2025 & 2033

- Figure 25: Europe US E-commerce Logistics Industry Revenue Share (%), by Business 2025 & 2033

- Figure 26: Europe US E-commerce Logistics Industry Revenue (Million), by Destination 2025 & 2033

- Figure 27: Europe US E-commerce Logistics Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 28: Europe US E-commerce Logistics Industry Revenue (Million), by Product 2025 & 2033

- Figure 29: Europe US E-commerce Logistics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: Europe US E-commerce Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe US E-commerce Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa US E-commerce Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 33: Middle East & Africa US E-commerce Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 34: Middle East & Africa US E-commerce Logistics Industry Revenue (Million), by Business 2025 & 2033

- Figure 35: Middle East & Africa US E-commerce Logistics Industry Revenue Share (%), by Business 2025 & 2033

- Figure 36: Middle East & Africa US E-commerce Logistics Industry Revenue (Million), by Destination 2025 & 2033

- Figure 37: Middle East & Africa US E-commerce Logistics Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 38: Middle East & Africa US E-commerce Logistics Industry Revenue (Million), by Product 2025 & 2033

- Figure 39: Middle East & Africa US E-commerce Logistics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 40: Middle East & Africa US E-commerce Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa US E-commerce Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US E-commerce Logistics Industry Revenue (Million), by Service 2025 & 2033

- Figure 43: Asia Pacific US E-commerce Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 44: Asia Pacific US E-commerce Logistics Industry Revenue (Million), by Business 2025 & 2033

- Figure 45: Asia Pacific US E-commerce Logistics Industry Revenue Share (%), by Business 2025 & 2033

- Figure 46: Asia Pacific US E-commerce Logistics Industry Revenue (Million), by Destination 2025 & 2033

- Figure 47: Asia Pacific US E-commerce Logistics Industry Revenue Share (%), by Destination 2025 & 2033

- Figure 48: Asia Pacific US E-commerce Logistics Industry Revenue (Million), by Product 2025 & 2033

- Figure 49: Asia Pacific US E-commerce Logistics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 50: Asia Pacific US E-commerce Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific US E-commerce Logistics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US E-commerce Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global US E-commerce Logistics Industry Revenue Million Forecast, by Business 2020 & 2033

- Table 3: Global US E-commerce Logistics Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: Global US E-commerce Logistics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global US E-commerce Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global US E-commerce Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Global US E-commerce Logistics Industry Revenue Million Forecast, by Business 2020 & 2033

- Table 8: Global US E-commerce Logistics Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Global US E-commerce Logistics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Global US E-commerce Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global US E-commerce Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 15: Global US E-commerce Logistics Industry Revenue Million Forecast, by Business 2020 & 2033

- Table 16: Global US E-commerce Logistics Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 17: Global US E-commerce Logistics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 18: Global US E-commerce Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global US E-commerce Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 23: Global US E-commerce Logistics Industry Revenue Million Forecast, by Business 2020 & 2033

- Table 24: Global US E-commerce Logistics Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 25: Global US E-commerce Logistics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 26: Global US E-commerce Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global US E-commerce Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 37: Global US E-commerce Logistics Industry Revenue Million Forecast, by Business 2020 & 2033

- Table 38: Global US E-commerce Logistics Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 39: Global US E-commerce Logistics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 40: Global US E-commerce Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global US E-commerce Logistics Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 48: Global US E-commerce Logistics Industry Revenue Million Forecast, by Business 2020 & 2033

- Table 49: Global US E-commerce Logistics Industry Revenue Million Forecast, by Destination 2020 & 2033

- Table 50: Global US E-commerce Logistics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 51: Global US E-commerce Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific US E-commerce Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US E-commerce Logistics Industry?

The projected CAGR is approximately 8.90%.

2. Which companies are prominent players in the US E-commerce Logistics Industry?

Key companies in the market include DB Schenker, DHL Logistics, Saddle Creek Logistics, UPS Supply Chain Solutions, XPO Logistics, Rakuten Super Logistics, FedEx, Geodis Logistics, Kenco Logistics Services, Kuehne and Nagel Logistics**List Not Exhaustive.

3. What are the main segments of the US E-commerce Logistics Industry?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 129.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise In Cross Border Logistics; Upgrade e-commerce with new supply chain technology.

6. What are the notable trends driving market growth?

Upgrade e-commerce with new supply chain technology.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Warehousing and Inventory management.

8. Can you provide examples of recent developments in the market?

August 2023: A new distribution center has been opened by DHL eCommerce as part of its five-year strategic growth plan. The new facility, located in the city of Melrose Park in Illinois, encompasses a total area of 352,000 square feet. In addition to capacity enhancement, the facility is equipped with an Automated Honeywell Cross-belt Loop Sorter, which is capable of handling up to forty thousand parcels and packages an hour. As part of the logistics provider's recent expansion, 11 warehouses have been constructed or relocated, and seven more are expected to be finished at some point in the near future, as reported by the sources.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US E-commerce Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US E-commerce Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US E-commerce Logistics Industry?

To stay informed about further developments, trends, and reports in the US E-commerce Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence