Key Insights

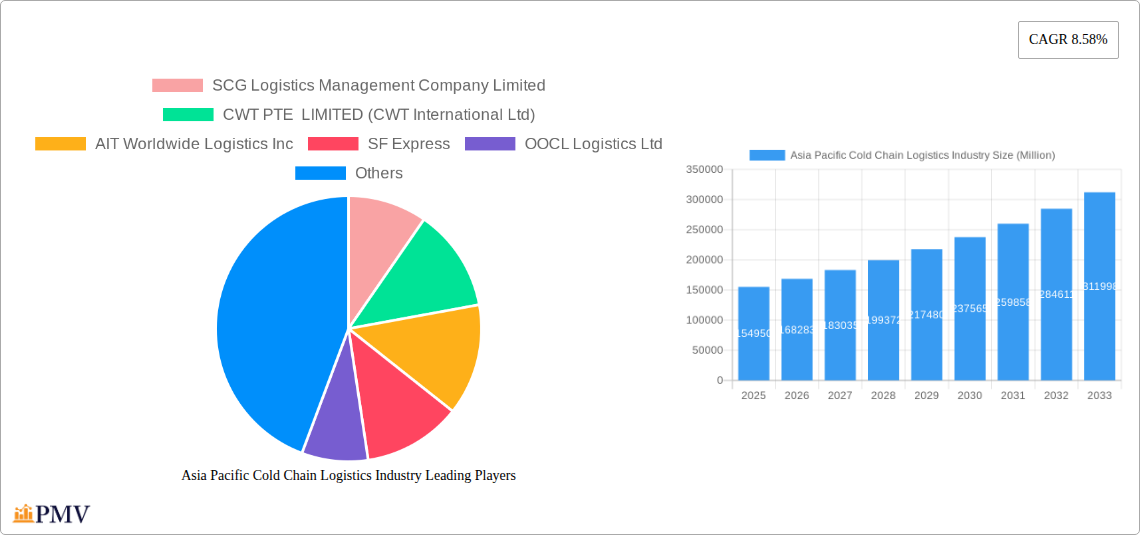

The Asia-Pacific cold chain logistics market, valued at $154.95 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.58% from 2025 to 2033. This surge is driven by several key factors. Firstly, the region's burgeoning middle class is fueling increased demand for perishable goods like fresh produce, dairy, and meat, necessitating efficient cold chain infrastructure. Secondly, the rise of e-commerce and online grocery delivery significantly boosts the need for reliable temperature-controlled transportation and storage solutions. Thirdly, stringent government regulations regarding food safety and quality are prompting businesses to invest heavily in sophisticated cold chain technologies and management systems. Finally, advancements in refrigeration technology, including improved insulation, energy-efficient units, and real-time temperature monitoring, contribute to enhanced efficiency and cost-effectiveness.

Asia Pacific Cold Chain Logistics Industry Market Size (In Billion)

However, the market also faces challenges. Infrastructure limitations, particularly in less developed areas, pose a significant hurdle. Moreover, the high initial investment costs associated with setting up and maintaining cold chain facilities can be a deterrent for smaller players. Fluctuations in fuel prices and the need for skilled labor also present ongoing challenges. Nevertheless, the long-term outlook remains positive, with significant growth potential driven by increasing consumer demand, technological advancements, and supportive government policies focusing on food security and supply chain modernization across countries like China, India, and others within the Asia-Pacific region. The diverse applications across horticulture, dairy, meat, pharmaceuticals, and life sciences further contribute to the market's expansive nature. Competitive players such as SCG Logistics, CWT, and others are poised to capitalize on this expanding opportunity, investing in new technologies and expanding their reach to meet the growing demand.

Asia Pacific Cold Chain Logistics Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Asia Pacific cold chain logistics industry, covering market size, growth projections, competitive landscape, and key trends from 2019 to 2033. The study period is 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033 and the historical period is 2019-2024. The report is essential for businesses, investors, and policymakers seeking to understand and navigate this dynamic market. The market value is predicted to reach xx Million by 2033.

Asia Pacific Cold Chain Logistics Industry Market Structure & Competitive Dynamics

The Asia Pacific cold chain logistics market is characterized by a moderately concentrated structure, with several large multinational players alongside a significant number of regional and local operators. Market share is distributed across various business models, including integrated logistics providers, specialized cold chain companies, and third-party logistics (3PL) providers. Leading players such as SCG Logistics Management Company Limited, CWT PTE LIMITED (CWT International Ltd), and SF Express hold significant market share, while others such as AIT Worldwide Logistics Inc, OOCL Logistics Ltd, and CJ Rokin Logistics are also key participants. Nichirei Logistics Group Inc, United Parcel Service of America, X2 Logistics Network (X2 GROUP), and JWD Infologistics Public Company Ltd further contribute to the competitive dynamics. This list is not exhaustive.

Innovation is driven by technological advancements in temperature-controlled transportation, warehousing, and monitoring technologies. Regulatory frameworks, varying across countries in the region, impact operational costs and compliance requirements. Product substitutes, such as improved packaging materials and alternative preservation methods, exert some pressure. End-user demand for high-quality, safe, and efficiently delivered temperature-sensitive products is a key driver.

Mergers and acquisitions (M&A) activity is notable, with deal values fluctuating based on market conditions and strategic goals. For instance, the partnership between SCG Logistics, DENSO Sales (Thailand), and Toyota Tsusho Thailand (September 2022) exemplifies a strategic move to consolidate and improve the refrigeration ecosystem. The total M&A deal value within the last five years is estimated at xx Million.

Asia Pacific Cold Chain Logistics Industry Industry Trends & Insights

The Asia Pacific cold chain logistics market is witnessing robust growth, driven by several factors. Rising disposable incomes, increasing demand for perishable goods (particularly in rapidly urbanizing areas), and the expansion of e-commerce are major growth drivers. The compound annual growth rate (CAGR) is projected at xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of IoT sensors for real-time monitoring and the use of blockchain technology for enhanced traceability, are transforming the industry. Consumer preferences are shifting towards fresher, higher-quality products, increasing demand for reliable cold chain solutions. Intense competition is pushing companies to innovate, optimize their operations, and offer value-added services such as blast freezing, labeling, and inventory management. Market penetration of advanced technologies is expected to reach xx% by 2033.

Dominant Markets & Segments in Asia Pacific Cold Chain Logistics Industry

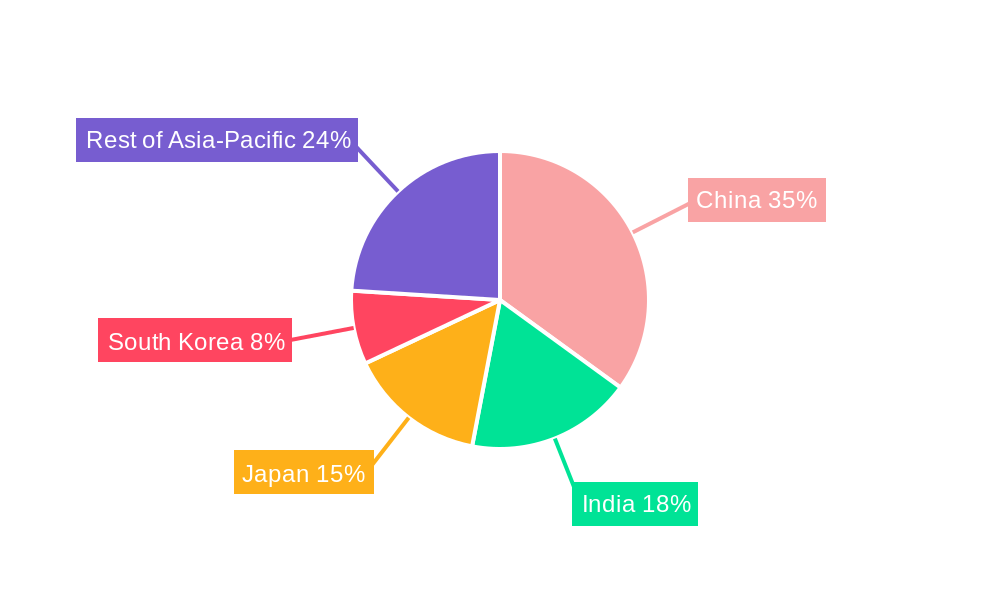

China, followed by Japan and India, represent the dominant markets in the Asia Pacific cold chain logistics industry.

Key Drivers by Country:

- China: Rapid economic growth, expanding middle class, and extensive infrastructure development.

- Japan: High demand for fresh and processed food, sophisticated cold chain infrastructure, and stringent quality standards.

- India: Growing population, rising disposable incomes, and increasing demand for perishable goods, despite infrastructural limitations.

Dominant Segments:

- By Services: Transportation dominates the market, driven by the need for efficient movement of temperature-sensitive goods. Value-added services are experiencing significant growth, as companies seek to offer comprehensive solutions. Storage remains crucial, but its growth is moderate compared to transportation and value-added services.

- By Temperature Type: The frozen segment holds the largest market share, owing to the high demand for frozen food products. The chilled segment is also experiencing considerable growth, driven by the increasing consumption of fresh produce and dairy products.

- By Application: Food products (horticulture, dairy, meat, fish, and poultry) constitute the major application segment, followed by the pharmaceutical and life sciences sectors. These industries have stringent requirements for temperature control and traceability, leading to robust growth.

Asia Pacific Cold Chain Logistics Industry Product Innovations

Significant product innovations focus on enhancing temperature control, improving monitoring capabilities, and increasing supply chain visibility. Advancements include the integration of IoT sensors into transport vehicles and storage facilities, providing real-time data on temperature and location. The use of blockchain technology for improved traceability and the development of more efficient and eco-friendly refrigerants are also notable trends. These innovations cater to growing consumer demands for enhanced food safety and supply chain transparency, ensuring greater market fit.

Report Segmentation & Scope

This report segments the Asia Pacific cold chain logistics market by services (storage, transportation, value-added services), temperature type (chilled, frozen), application (horticulture, dairy, meats, fish, poultry, processed food products, pharma, life sciences, chemicals, other), and country (China, Japan, India, South Korea, Indonesia, Thailand, Australia, Philippines, Rest of Asia-Pacific). Each segment's growth projections, market sizes, and competitive dynamics are analyzed comprehensively. The report projects significant growth across all segments, driven by factors such as rising disposable incomes, changing consumer preferences, and technological advancements. Competitive intensity varies across segments and countries, reflecting differences in market maturity and regulatory frameworks.

Key Drivers of Asia Pacific Cold Chain Logistics Industry Growth

Growth in the Asia Pacific cold chain logistics industry is propelled by several factors: rising disposable incomes driving higher consumption of perishable goods, expanding e-commerce and online grocery delivery, increasing urbanization leading to greater demand for efficient food distribution, and stringent food safety regulations boosting demand for temperature-controlled storage and transport. Further, technological innovations such as IoT and blockchain enhance efficiency and traceability, improving overall market conditions.

Challenges in the Asia Pacific Cold Chain Logistics Industry Sector

Several challenges hinder the industry's growth. These include the lack of standardized cold chain infrastructure across the region, leading to higher transportation and storage costs. Moreover, inconsistent regulatory frameworks across various countries create operational complexities and compliance hurdles. Competition within the industry is fierce, creating pricing pressure and making it challenging for smaller players to thrive. The high cost of maintaining cold chain integrity and energy efficiency remains a significant concern for many companies. Additionally, the impact of climate change adds further complexity to maintaining suitable temperatures.

Leading Players in the Asia Pacific Cold Chain Logistics Industry Market

- SCG Logistics Management Company Limited

- CWT PTE LIMITED (CWT International Ltd)

- AIT Worldwide Logistics Inc

- SF Express

- OOCL Logistics Ltd

- CJ Rokin Logistics

- Nichirei Logistics Group Inc

- United Parcel Service of America

- X2 Logistics Network (X2 GROUP)

- JWD Infologistics Public Company Ltd

Key Developments in Asia Pacific Cold Chain Logistics Industry Sector

- October 2022: UPS expanded its Premier service for time and temperature-sensitive shipments to Thailand and Singapore, enhancing its service offerings and increasing competition in the region.

- September 2022: The partnership between SCG Logistics, DENSO Sales (Thailand), and Toyota Tsusho Thailand aims to elevate Thailand's refrigeration ecosystem and food safety standards, potentially influencing future market developments.

Strategic Asia Pacific Cold Chain Logistics Industry Market Outlook

The Asia Pacific cold chain logistics market presents significant growth potential driven by evolving consumer behavior, technological advancements, and supportive government policies focused on food security and public health. Strategic opportunities lie in investing in advanced technologies like IoT and AI to improve efficiency and traceability. Expanding into underserved markets and offering value-added services tailored to specific industry needs will provide significant competitive advantages. The focus on sustainability and eco-friendly solutions will also become increasingly important for market success in the long term.

Asia Pacific Cold Chain Logistics Industry Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, Etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other Applications

Asia Pacific Cold Chain Logistics Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Cold Chain Logistics Industry Regional Market Share

Geographic Coverage of Asia Pacific Cold Chain Logistics Industry

Asia Pacific Cold Chain Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing international trade; Advancements in technology

- 3.3. Market Restrains

- 3.3.1. Geopolitical uncertainities; Changing trade policies

- 3.4. Market Trends

- 3.4.1. Decreasing Volume of Domestic Water Freight Transport in Japan

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Cold Chain Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, Etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SCG Logistics Management Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CWT PTE LIMITED (CWT International Ltd)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AIT Worldwide Logistics Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SF Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OOCL Logistics Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CJ Rokin Logistics**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nichirei Logistics Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Parcel Service of America

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 X2 Logistics Network (X2 GROUP)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JWD Infologistics Public Company Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SCG Logistics Management Company Limited

List of Figures

- Figure 1: Asia Pacific Cold Chain Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Cold Chain Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Asia Pacific Cold Chain Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Cold Chain Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Cold Chain Logistics Industry?

The projected CAGR is approximately 8.58%.

2. Which companies are prominent players in the Asia Pacific Cold Chain Logistics Industry?

Key companies in the market include SCG Logistics Management Company Limited, CWT PTE LIMITED (CWT International Ltd), AIT Worldwide Logistics Inc, SF Express, OOCL Logistics Ltd, CJ Rokin Logistics**List Not Exhaustive, Nichirei Logistics Group Inc, United Parcel Service of America, X2 Logistics Network (X2 GROUP), JWD Infologistics Public Company Ltd.

3. What are the main segments of the Asia Pacific Cold Chain Logistics Industry?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing international trade; Advancements in technology.

6. What are the notable trends driving market growth?

Decreasing Volume of Domestic Water Freight Transport in Japan.

7. Are there any restraints impacting market growth?

Geopolitical uncertainities; Changing trade policies.

8. Can you provide examples of recent developments in the market?

October 2022: Express giant UPS expanded its Premier service for time and temperature-sensitive shipments to Thailand and Singapore. The service offers to track and prioritize loads and has three tiers, with Premier Gold service available in two locations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Cold Chain Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Cold Chain Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Cold Chain Logistics Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Cold Chain Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence