Key Insights

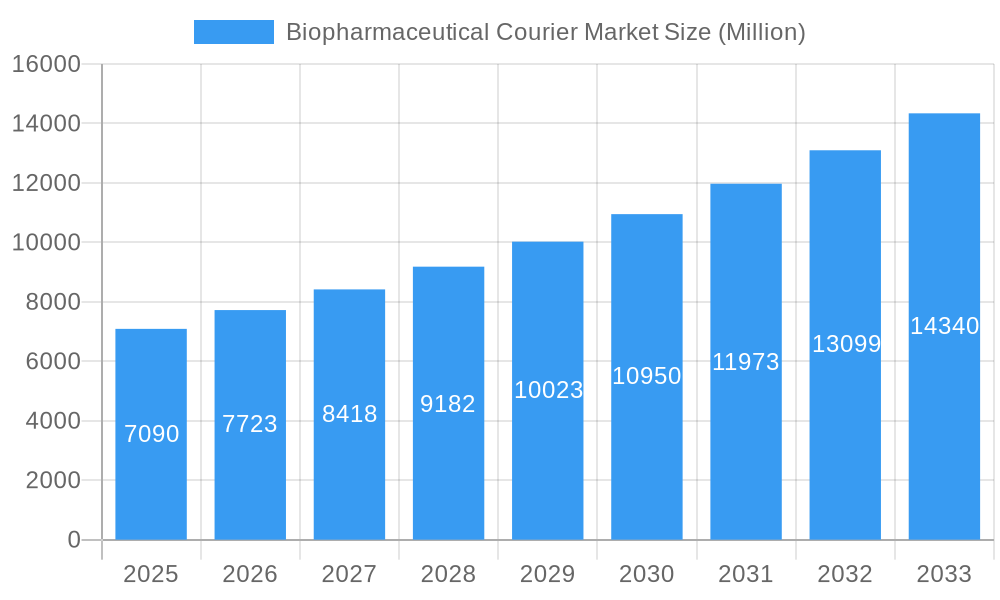

The biopharmaceutical courier market, valued at $7.09 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.83% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of chronic diseases globally fuels demand for temperature-sensitive biopharmaceuticals, requiring specialized courier services. Advancements in biotechnology and the development of novel therapies, including cell and gene therapies, further necessitate reliable and efficient cold chain logistics. Furthermore, stringent regulatory requirements regarding the handling and transportation of these sensitive products are pushing companies to outsource logistics to specialized firms, boosting market growth. The market is segmented by type of operation (cold chain and non-cold chain), services (transportation, storage, packaging, and labeling), business model (B2B and B2C), and destination (domestic and international). The cold chain segment dominates due to the temperature-sensitive nature of many biopharmaceuticals. B2B transactions currently represent a larger portion of the market, but B2C is expected to grow significantly with the rise of direct-to-patient delivery models for specialized medications. Major players like World Courier, DHL, UPS, Marken, FedEx, and Cryoport are leading the market, constantly innovating to meet the evolving needs of the biopharmaceutical industry. Competition is intense, with companies focusing on technological advancements, strategic partnerships, and global network expansion to maintain their market share. Geographic expansion, particularly in rapidly developing economies in Asia-Pacific, presents significant opportunities for growth in the coming years.

Biopharmaceutical Courier Market Market Size (In Billion)

The North American and European markets currently hold significant shares, driven by strong pharmaceutical industries and robust regulatory frameworks. However, the Asia-Pacific region is poised for substantial growth due to rising healthcare expenditure, increasing prevalence of chronic diseases, and improving infrastructure for cold chain logistics. The market faces challenges such as maintaining consistent temperature control during transportation, navigating complex regulatory landscapes across different countries, and managing the high costs associated with specialized handling and transportation. Nevertheless, the long-term outlook for the biopharmaceutical courier market remains highly positive, fueled by continued innovation in the biopharmaceutical industry and the growing need for specialized logistics solutions. The ongoing investment in advanced technologies like real-time monitoring systems, predictive analytics, and automation will further streamline operations and enhance efficiency within the sector.

Biopharmaceutical Courier Market Company Market Share

Biopharmaceutical Courier Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Biopharmaceutical Courier Market, offering invaluable insights for stakeholders across the pharmaceutical supply chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report utilizes both historical data (2019-2024) and predictive modeling to deliver a robust and actionable market overview. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. This report covers key segments including Cold Chain and Non-Cold Chain operations, Transportation, Storage, Packaging and Labeling services, B2B and B2C business models, and Domestic and International destinations. Leading players such as World Courier, DHL, UPS, Marken, FedEx, LifeConEx, Cryoport, and QuickSTAT are analyzed in detail.

Biopharmaceutical Courier Market Market Structure & Competitive Dynamics

The Biopharmaceutical Courier Market is characterized by a moderately concentrated structure, with several major players holding significant market share. World Courier, DHL, UPS, and FedEx are among the dominant players, collectively accounting for approximately xx% of the market in 2025. However, the market also showcases a vibrant landscape of smaller specialized firms, such as Marken, LifeConEx, Cryoport, and QuickSTAT, catering to niche segments and fostering innovation.

The regulatory framework governing this market is stringent, emphasizing safety, security, and compliance with Good Distribution Practices (GDP) and other international standards. This necessitates significant investments in infrastructure, technology, and training. The market also experiences a dynamic M&A landscape, with recent deals valued at approximately xx Million in total over the last five years driving consolidation and expansion into new markets and service offerings. End-user trends are towards increased demand for specialized services, particularly in cold chain logistics for temperature-sensitive biologics and advanced therapies. Product substitution is limited due to stringent regulatory hurdles and the need for specialized handling and expertise.

- Market Concentration: Moderately concentrated, with top four players holding xx% market share (2025).

- Innovation Ecosystems: Strong focus on cold chain technologies, automation, and data-driven logistics solutions.

- Regulatory Frameworks: Stringent GDP compliance requirements driving investment in infrastructure and technology.

- Product Substitutes: Limited due to specialized handling and regulatory compliance needs.

- End-User Trends: Increased demand for specialized cold chain solutions for biologics and advanced therapies.

- M&A Activity: Significant activity in recent years, with total deal value exceeding xx Million over the past five years.

Biopharmaceutical Courier Market Industry Trends & Insights

The Biopharmaceutical Courier Market is experiencing robust growth, driven primarily by the increasing global demand for biopharmaceuticals, including biologics and advanced therapies, that require specialized handling. The market is witnessing significant technological advancements, particularly in cold chain technologies (e.g., passive and active temperature-controlled containers, real-time monitoring systems). This technological disruption is enhancing efficiency, reducing waste, and improving the reliability of temperature-sensitive drug delivery. Moreover, the growing prevalence of chronic diseases and the increasing investments in R&D are further propelling market expansion. Competitive dynamics are shaping market strategies, with a focus on specialization, technological innovation, and strategic partnerships. The market penetration of advanced cold chain solutions is expected to grow at xx% CAGR during the forecast period. Consumer preferences increasingly favor reliable, secure, and compliant services, prompting significant investments in track-and-trace technologies and data analytics.

Dominant Markets & Segments in Biopharmaceutical Courier Market

The North American region dominates the Biopharmaceutical Courier Market, driven by robust pharmaceutical R&D spending, established infrastructure, and a large number of biopharmaceutical companies. Within North America, the United States holds the largest share.

- By Type of Operation: The Cold Chain segment is the dominant segment, accounting for approximately xx% of the total market in 2025 due to its importance for temperature-sensitive pharmaceuticals.

- By Services: Transportation services constitute the largest market share, followed by storage and packaging and labeling.

- By Business: B2B business model dominates, accounting for xx% of the market in 2025.

- By Destination: International shipments represent a significant share due to the global nature of the biopharmaceutical industry and cross-border clinical trials.

Key Drivers:

- North America: Robust pharmaceutical R&D, developed infrastructure, high biopharmaceutical company concentration.

- Cold Chain: Rising demand for temperature-sensitive biologics and specialized therapies.

- Transportation: Essential for end-to-end delivery in the biopharmaceutical supply chain.

- B2B: High volume of pharmaceutical shipments between manufacturers, distributors, and healthcare providers.

- International: Global clinical trials, worldwide distribution of biopharmaceuticals.

Biopharmaceutical Courier Market Product Innovations

Recent innovations include the development of advanced passive and active temperature-controlled containers with enhanced insulation and temperature monitoring capabilities. The integration of real-time tracking and monitoring systems through IoT and AI technologies is also improving efficiency and transparency. These innovations are enhancing supply chain visibility, minimizing transit times and risks, and improving the overall reliability of biopharmaceutical delivery, which aligns with the increasing demand for more robust and sophisticated cold chain logistics solutions.

Report Segmentation & Scope

This report segments the Biopharmaceutical Courier Market based on:

- Type of Operation: Cold Chain and Non-Cold Chain – The Cold Chain segment is projected to experience faster growth due to increasing demand for temperature-sensitive pharmaceuticals.

- Services: Transportation, Storage, Packaging, and Labeling – Transportation services are the largest segment, while the demand for value-added services like packaging and labeling is on the rise.

- Business Model: B2B and B2C – The B2B segment holds the largest market share due to the majority of biopharmaceutical shipments occurring between businesses.

- Destination: Domestic and International – The international segment is projected to grow at a higher rate due to globalization of the biopharmaceutical industry.

Each segment’s growth trajectory, market size, and competitive dynamics are analyzed in detail within the full report.

Key Drivers of Biopharmaceutical Courier Market Growth

Several factors are driving the Biopharmaceutical Courier Market's growth:

- Technological advancements: Improving cold chain technologies, real-time tracking, and data analytics are enhancing efficiency and reliability.

- Rising demand for biopharmaceuticals: Growing prevalence of chronic diseases and increasing R&D investments fuel demand for temperature-sensitive drug delivery.

- Stringent regulatory compliance: Emphasis on GDP necessitates specialized logistics solutions for safe and efficient drug distribution.

Challenges in the Biopharmaceutical Courier Market Sector

The Biopharmaceutical Courier Market faces various challenges:

- Regulatory compliance: Stringent regulations and standards necessitate high investment and specialized expertise.

- Supply chain disruptions: Global events and logistical bottlenecks can negatively impact delivery times and costs. The impact is estimated at xx Million in lost revenue annually for the industry (based on 2024 figures).

- Competitive pressures: Intense competition requires continuous innovation and cost optimization to maintain market share.

Key Developments in Biopharmaceutical Courier Market Sector

- September 2023: Astellas Pharma announces plans for a new EUR 330 million (USD 354.32 million) plant in Ireland, signifying potential increased demand for biopharmaceutical courier services starting in 2024.

- September 2023: Avalon Pharma's USD 26.7 billion investment in a new plant in Saudi Arabia indicates potential expansion of the market in the Middle East and increased demand for specialized pharmaceutical logistics.

Strategic Biopharmaceutical Courier Market Market Outlook

The Biopharmaceutical Courier Market is poised for continued growth, fueled by technological advancements, increased demand for biopharmaceuticals, and expanding global reach of the pharmaceutical industry. Strategic opportunities lie in specializing in niche segments, leveraging data analytics for enhanced supply chain optimization, and investing in cutting-edge cold chain technologies. The market presents significant potential for companies that can meet the growing demands for reliable, secure, and compliant pharmaceutical delivery services.

Biopharmaceutical Courier Market Segmentation

-

1. Services

- 1.1. Transportation

- 1.2. Storage

- 1.3. Packaging, and Labeling

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International

-

4. Type of Operation

- 4.1. Cold Chain

- 4.2. Non Cold Chain

Biopharmaceutical Courier Market Segmentation By Geography

- 1. Asia Pacific

- 2. North America

- 3. Europe

- 4. Latin America

- 5. Middle East

Biopharmaceutical Courier Market Regional Market Share

Geographic Coverage of Biopharmaceutical Courier Market

Biopharmaceutical Courier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Boom driving the market; Increasing demand from healthcare sector driving the market

- 3.3. Market Restrains

- 3.3.1. Regulatory challenges affecting the market; Infrastructure limitations hindering the growth of the market

- 3.4. Market Trends

- 3.4.1. Immense Growth Projection for the Cold Chain Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biopharmaceutical Courier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Transportation

- 5.1.2. Storage

- 5.1.3. Packaging, and Labeling

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Type of Operation

- 5.4.1. Cold Chain

- 5.4.2. Non Cold Chain

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.5.2. North America

- 5.5.3. Europe

- 5.5.4. Latin America

- 5.5.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Asia Pacific Biopharmaceutical Courier Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Transportation

- 6.1.2. Storage

- 6.1.3. Packaging, and Labeling

- 6.2. Market Analysis, Insights and Forecast - by Business

- 6.2.1. B2B

- 6.2.2. B2C

- 6.3. Market Analysis, Insights and Forecast - by Destination

- 6.3.1. Domestic

- 6.3.2. International

- 6.4. Market Analysis, Insights and Forecast - by Type of Operation

- 6.4.1. Cold Chain

- 6.4.2. Non Cold Chain

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. North America Biopharmaceutical Courier Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Transportation

- 7.1.2. Storage

- 7.1.3. Packaging, and Labeling

- 7.2. Market Analysis, Insights and Forecast - by Business

- 7.2.1. B2B

- 7.2.2. B2C

- 7.3. Market Analysis, Insights and Forecast - by Destination

- 7.3.1. Domestic

- 7.3.2. International

- 7.4. Market Analysis, Insights and Forecast - by Type of Operation

- 7.4.1. Cold Chain

- 7.4.2. Non Cold Chain

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe Biopharmaceutical Courier Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Transportation

- 8.1.2. Storage

- 8.1.3. Packaging, and Labeling

- 8.2. Market Analysis, Insights and Forecast - by Business

- 8.2.1. B2B

- 8.2.2. B2C

- 8.3. Market Analysis, Insights and Forecast - by Destination

- 8.3.1. Domestic

- 8.3.2. International

- 8.4. Market Analysis, Insights and Forecast - by Type of Operation

- 8.4.1. Cold Chain

- 8.4.2. Non Cold Chain

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Latin America Biopharmaceutical Courier Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Transportation

- 9.1.2. Storage

- 9.1.3. Packaging, and Labeling

- 9.2. Market Analysis, Insights and Forecast - by Business

- 9.2.1. B2B

- 9.2.2. B2C

- 9.3. Market Analysis, Insights and Forecast - by Destination

- 9.3.1. Domestic

- 9.3.2. International

- 9.4. Market Analysis, Insights and Forecast - by Type of Operation

- 9.4.1. Cold Chain

- 9.4.2. Non Cold Chain

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Middle East Biopharmaceutical Courier Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Transportation

- 10.1.2. Storage

- 10.1.3. Packaging, and Labeling

- 10.2. Market Analysis, Insights and Forecast - by Business

- 10.2.1. B2B

- 10.2.2. B2C

- 10.3. Market Analysis, Insights and Forecast - by Destination

- 10.3.1. Domestic

- 10.3.2. International

- 10.4. Market Analysis, Insights and Forecast - by Type of Operation

- 10.4.1. Cold Chain

- 10.4.2. Non Cold Chain

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 World Courier

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UPS

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Marken

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FedEx

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LifeConEx**List Not Exhaustive 7 3 Other Companie

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cryoport

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 QuickSTAT

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 World Courier

List of Figures

- Figure 1: Global Biopharmaceutical Courier Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Biopharmaceutical Courier Market Revenue (Million), by Services 2025 & 2033

- Figure 3: Asia Pacific Biopharmaceutical Courier Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: Asia Pacific Biopharmaceutical Courier Market Revenue (Million), by Business 2025 & 2033

- Figure 5: Asia Pacific Biopharmaceutical Courier Market Revenue Share (%), by Business 2025 & 2033

- Figure 6: Asia Pacific Biopharmaceutical Courier Market Revenue (Million), by Destination 2025 & 2033

- Figure 7: Asia Pacific Biopharmaceutical Courier Market Revenue Share (%), by Destination 2025 & 2033

- Figure 8: Asia Pacific Biopharmaceutical Courier Market Revenue (Million), by Type of Operation 2025 & 2033

- Figure 9: Asia Pacific Biopharmaceutical Courier Market Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 10: Asia Pacific Biopharmaceutical Courier Market Revenue (Million), by Country 2025 & 2033

- Figure 11: Asia Pacific Biopharmaceutical Courier Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America Biopharmaceutical Courier Market Revenue (Million), by Services 2025 & 2033

- Figure 13: North America Biopharmaceutical Courier Market Revenue Share (%), by Services 2025 & 2033

- Figure 14: North America Biopharmaceutical Courier Market Revenue (Million), by Business 2025 & 2033

- Figure 15: North America Biopharmaceutical Courier Market Revenue Share (%), by Business 2025 & 2033

- Figure 16: North America Biopharmaceutical Courier Market Revenue (Million), by Destination 2025 & 2033

- Figure 17: North America Biopharmaceutical Courier Market Revenue Share (%), by Destination 2025 & 2033

- Figure 18: North America Biopharmaceutical Courier Market Revenue (Million), by Type of Operation 2025 & 2033

- Figure 19: North America Biopharmaceutical Courier Market Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 20: North America Biopharmaceutical Courier Market Revenue (Million), by Country 2025 & 2033

- Figure 21: North America Biopharmaceutical Courier Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Biopharmaceutical Courier Market Revenue (Million), by Services 2025 & 2033

- Figure 23: Europe Biopharmaceutical Courier Market Revenue Share (%), by Services 2025 & 2033

- Figure 24: Europe Biopharmaceutical Courier Market Revenue (Million), by Business 2025 & 2033

- Figure 25: Europe Biopharmaceutical Courier Market Revenue Share (%), by Business 2025 & 2033

- Figure 26: Europe Biopharmaceutical Courier Market Revenue (Million), by Destination 2025 & 2033

- Figure 27: Europe Biopharmaceutical Courier Market Revenue Share (%), by Destination 2025 & 2033

- Figure 28: Europe Biopharmaceutical Courier Market Revenue (Million), by Type of Operation 2025 & 2033

- Figure 29: Europe Biopharmaceutical Courier Market Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 30: Europe Biopharmaceutical Courier Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe Biopharmaceutical Courier Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Biopharmaceutical Courier Market Revenue (Million), by Services 2025 & 2033

- Figure 33: Latin America Biopharmaceutical Courier Market Revenue Share (%), by Services 2025 & 2033

- Figure 34: Latin America Biopharmaceutical Courier Market Revenue (Million), by Business 2025 & 2033

- Figure 35: Latin America Biopharmaceutical Courier Market Revenue Share (%), by Business 2025 & 2033

- Figure 36: Latin America Biopharmaceutical Courier Market Revenue (Million), by Destination 2025 & 2033

- Figure 37: Latin America Biopharmaceutical Courier Market Revenue Share (%), by Destination 2025 & 2033

- Figure 38: Latin America Biopharmaceutical Courier Market Revenue (Million), by Type of Operation 2025 & 2033

- Figure 39: Latin America Biopharmaceutical Courier Market Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 40: Latin America Biopharmaceutical Courier Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Biopharmaceutical Courier Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East Biopharmaceutical Courier Market Revenue (Million), by Services 2025 & 2033

- Figure 43: Middle East Biopharmaceutical Courier Market Revenue Share (%), by Services 2025 & 2033

- Figure 44: Middle East Biopharmaceutical Courier Market Revenue (Million), by Business 2025 & 2033

- Figure 45: Middle East Biopharmaceutical Courier Market Revenue Share (%), by Business 2025 & 2033

- Figure 46: Middle East Biopharmaceutical Courier Market Revenue (Million), by Destination 2025 & 2033

- Figure 47: Middle East Biopharmaceutical Courier Market Revenue Share (%), by Destination 2025 & 2033

- Figure 48: Middle East Biopharmaceutical Courier Market Revenue (Million), by Type of Operation 2025 & 2033

- Figure 49: Middle East Biopharmaceutical Courier Market Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 50: Middle East Biopharmaceutical Courier Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East Biopharmaceutical Courier Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Type of Operation 2020 & 2033

- Table 5: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Services 2020 & 2033

- Table 7: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Type of Operation 2020 & 2033

- Table 10: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Services 2020 & 2033

- Table 12: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Business 2020 & 2033

- Table 13: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 14: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Type of Operation 2020 & 2033

- Table 15: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Services 2020 & 2033

- Table 17: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Business 2020 & 2033

- Table 18: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 19: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Type of Operation 2020 & 2033

- Table 20: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Services 2020 & 2033

- Table 22: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Business 2020 & 2033

- Table 23: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 24: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Type of Operation 2020 & 2033

- Table 25: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Services 2020 & 2033

- Table 27: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Business 2020 & 2033

- Table 28: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 29: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Type of Operation 2020 & 2033

- Table 30: Global Biopharmaceutical Courier Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biopharmaceutical Courier Market?

The projected CAGR is approximately 8.83%.

2. Which companies are prominent players in the Biopharmaceutical Courier Market?

Key companies in the market include World Courier, DHL, UPS, Marken, FedEx, LifeConEx**List Not Exhaustive 7 3 Other Companie, Cryoport, QuickSTAT.

3. What are the main segments of the Biopharmaceutical Courier Market?

The market segments include Services, Business, Destination, Type of Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.09 Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Boom driving the market; Increasing demand from healthcare sector driving the market.

6. What are the notable trends driving market growth?

Immense Growth Projection for the Cold Chain Segment.

7. Are there any restraints impacting market growth?

Regulatory challenges affecting the market; Infrastructure limitations hindering the growth of the market.

8. Can you provide examples of recent developments in the market?

September 2023: Astellas Pharma, one of the largest pharmaceutical manufacturers in Europe, announced plans to construct a new EUR 330 million (USD 354.32 million) plant in the County Kerry, Ireland town of Tralee. The plant is expected to open in 2028, subject to planning consent, and Astellas plans to begin construction in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biopharmaceutical Courier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biopharmaceutical Courier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biopharmaceutical Courier Market?

To stay informed about further developments, trends, and reports in the Biopharmaceutical Courier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence