Key Insights

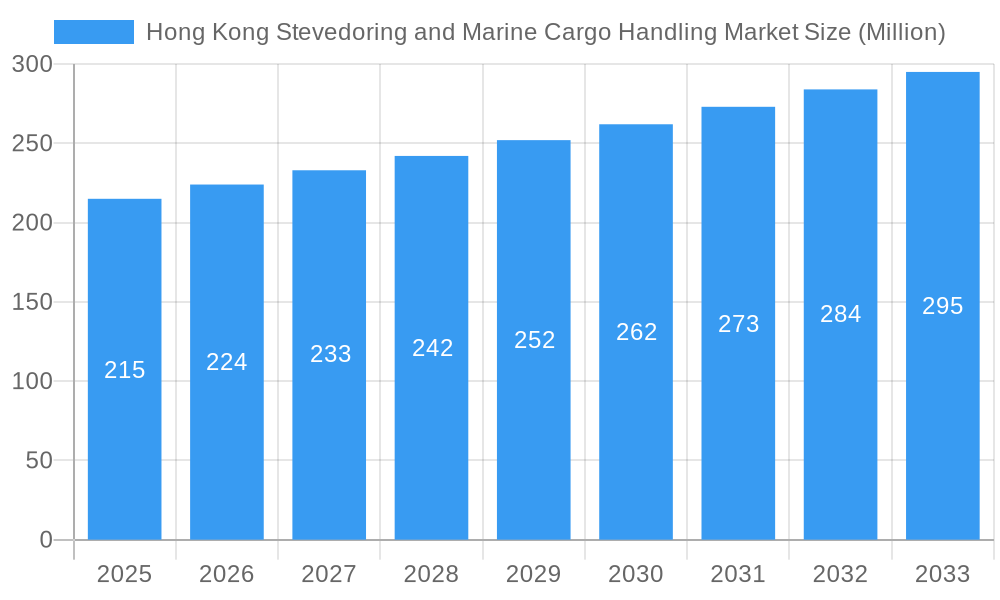

The Hong Kong Stevedoring and Marine Cargo Handling Market is projected for significant expansion, with an estimated market size of $10.94 billion by 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.7% from 2025 to 2033. This growth is driven by escalating global trade volumes, particularly the rise in e-commerce and complex global supply chains contributing to increased containerized cargo. Key growth factors include Hong Kong's strategic position as a major Asian transshipment hub, substantial investments in port infrastructure and advanced handling technologies, and the consistent demand for efficient cargo movement. The market is further bolstered by Hong Kong's deep-water port facilities and its critical role in facilitating trade between mainland China and the international market.

Hong Kong Stevedoring and Marine Cargo Handling Market Market Size (In Billion)

The market is largely characterized by containerized cargo handling, mirroring global shipping trends. Stevedoring services remain fundamental, with ongoing technological advancements enhancing efficiency and safety. While bulk cargo still holds a considerable share, the specialization in containerized logistics is a prominent trend. Market growth is being strategically navigated around potential restraints, such as intense regional port competition and fluctuating global economic conditions, through continuous modernization and the adoption of smart port technologies. Leading industry players, including A.P. Moller - Maersk, DP World Limited, and COSCO Group, are making substantial investments in innovation and capacity expansion, highlighting the market's dynamism and Hong Kong's commitment to maintaining its competitive advantage. The Asia Pacific region, especially China and ASEAN countries, is anticipated to be a primary engine of this growth.

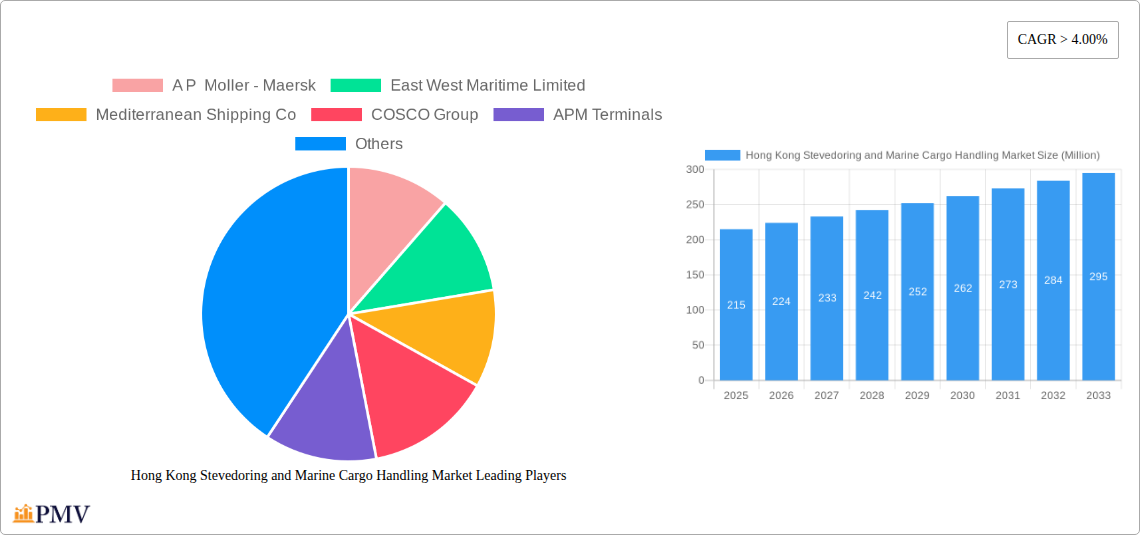

Hong Kong Stevedoring and Marine Cargo Handling Market Company Market Share

Hong Kong Stevedoring and Marine Cargo Handling Market: Comprehensive Industry Report (2025-2033)

Gain critical insights into the Hong Kong stevedoring and marine cargo handling market with this comprehensive report. Analyzing the base year (2025) and a forecast period extending to 2033, this report offers actionable intelligence for stakeholders. It covers market structure, competitive dynamics, emerging trends, dominant segments, product innovations, and strategic outlooks.

This report is meticulously designed for industry professionals, investors, and strategic planners aiming to navigate the complexities of Hong Kong's vital maritime logistics sector. Our analysis relies on robust data and expert foresight to provide a clear pathway for future growth and investment opportunities.

Keywords: Hong Kong Stevedoring, Marine Cargo Handling, Hong Kong Logistics, Containerized Cargo Handling, Bulk Cargo Handling, Port Operations Hong Kong, Maritime Industry Asia, Supply Chain Hong Kong, DP World Hong Kong, APM Terminals Hong Kong, COSCO Hong Kong, MSC Hong Kong, Hapag-Lloyd Hong Kong, CMA CGM Hong Kong, Evergreen Marine Hong Kong, Stevedoring Services Hong Kong, Cargo Transportation Hong Kong, Port Infrastructure Hong Kong, Asia-Pacific Maritime.

Hong Kong Stevedoring and Marine Cargo Handling Market Market Structure & Competitive Dynamics

The Hong Kong stevedoring and marine cargo handling market is characterized by a moderately consolidated structure, with a few dominant global players and a significant number of specialized local service providers. Market concentration is influenced by substantial capital investment required for advanced port infrastructure and specialized equipment, creating high barriers to entry. Innovation ecosystems are thriving, driven by the adoption of automation, AI-powered logistics management, and sustainable operational practices to enhance efficiency and reduce turnaround times. Regulatory frameworks, overseen by bodies like the Hong Kong Maritime and Port Board, focus on safety, environmental protection, and trade facilitation, shaping operational standards and investment incentives. Product substitutes are limited within the core stevedoring and cargo handling functions, primarily involving alternative port facilities or shifts in shipping routes, but innovation in related services like advanced warehousing and cold chain logistics can indirectly influence demand. End-user trends reveal a growing preference for integrated logistics solutions, demanding end-to-end visibility and streamlined operations. Mergers and acquisition (M&A) activities are a key driver of market evolution. For instance, the August 2022 acquisition of LF Logistics by A.P. Moeller Maersk for USD 3.6 billion highlights the strategic consolidation aimed at enhancing contract logistics and inland transportation capabilities in the Asia-Pacific region. This M&A trend is expected to continue as companies seek to expand their service portfolios, geographic reach, and technological prowess. The market share of leading players is substantial, with major terminal operators managing a significant portion of container throughput.

Hong Kong Stevedoring and Marine Cargo Handling Market Industry Trends & Insights

The Hong Kong stevedoring and marine cargo handling market is poised for significant growth, fueled by robust economic activity in the Greater Bay Area and sustained global trade volumes. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. A key growth driver is the increasing sophistication of supply chains, demanding faster, more efficient, and technologically advanced cargo handling solutions. Technological disruptions are at the forefront, with the integration of Artificial Intelligence (AI) for route optimization and predictive maintenance, the deployment of autonomous vehicles and drones for internal logistics, and the adoption of blockchain for enhanced transparency and security in cargo tracking. Smart port initiatives, focusing on IoT devices for real-time data collection and analysis, are revolutionizing operational efficiency and decision-making. Consumer preferences are shifting towards e-commerce enablement, requiring flexible and responsive cargo handling services that can cater to just-in-time delivery schedules and a higher volume of diverse goods. This necessitates investments in specialized handling equipment for various cargo types, from delicate electronics to bulk commodities. Competitive dynamics are intensifying, with companies vying for market share through strategic partnerships, service diversification, and investments in cutting-edge technology. The June 2022 acquisition of Sea-Air Logistics Ltd. by Scan Global Logistics underscores the ongoing trend of consolidation and service expansion within the freight forwarding and logistics sector, aiming to bolster capabilities in key Asian markets. Market penetration of advanced technologies is steadily increasing, driving down operational costs and improving service quality, thereby creating a more competitive and customer-centric environment. The ongoing development of Hong Kong as a key maritime hub, coupled with strategic investments in infrastructure and digital transformation, positions the market for sustained expansion and innovation in the coming years. The port's critical role in regional and global trade, supported by efficient stevedoring and cargo handling, ensures its continued relevance.

Dominant Markets & Segments in Hong Kong Stevedoring and Marine Cargo Handling Market

Within the Hong Kong stevedoring and marine cargo handling market, Containerized Cargo represents the dominant segment by volume and revenue, driven by the city's role as a major transshipment hub and its extensive international trade connections. The strategic importance of containerized cargo handling is intrinsically linked to global manufacturing and consumption patterns. Economic policies promoting free trade and efficient customs procedures significantly bolster this segment. Infrastructure development, including the expansion and modernization of container terminals, further solidifies its dominance.

- Key Drivers for Containerized Cargo Dominance:

- High Volume Global Trade: Hong Kong's position as a gateway to mainland China and a key node in global shipping routes.

- Advanced Port Infrastructure: World-class container terminals equipped with high-capacity gantry cranes and sophisticated yard management systems.

- Technological Integration: Widespread adoption of automated guided vehicles (AGVs), blockchain for tracking, and AI for terminal operations.

- Favorable Economic Policies: Free port status and streamlined customs procedures.

Stevedoring services, by definition, are fundamental to all cargo handling operations and thus form a core, indispensable segment. The efficiency and safety of stevedoring directly impact the overall turnaround time of vessels and the cost-effectiveness of cargo movement. The demand for specialized stevedoring services is consistently high, driven by the constant flow of ships through one of the world's busiest ports.

- Key Drivers for Stevedoring Segment Strength:

- High Vessel Throughput: A constant stream of container ships, bulk carriers, and other vessels requiring expert loading and unloading.

- Safety and Efficiency Standards: Strict adherence to international safety regulations and the need for highly skilled labor.

- Technological Upgrades: Investment in advanced quay cranes, spreaders, and other machinery to handle larger vessels and diverse cargo.

The Cargo and Handling Transportation segment, while encompassing stevedoring, also includes the subsequent movement of goods from the port to inland destinations or vice-versa. This involves trucking, warehousing, and last-mile delivery. The efficiency of this segment is crucial for maintaining supply chain fluidity and is heavily influenced by Hong Kong's advanced logistics network and road infrastructure.

- Key Drivers for Cargo and Handling Transportation:

- Integrated Logistics Networks: Seamless connectivity between sea, land, and air transportation.

- Demand for Just-in-Time Delivery: Driven by manufacturing and retail sectors, requiring rapid and reliable transportation.

- Warehousing and Distribution Hubs: Hong Kong's strategic location as a distribution point for the Asia-Pacific region.

While Bulk Cargo and Other Cargo Types (e.g., project cargo, liquid bulk) represent smaller segments compared to containerized cargo, they remain vital for specific industries. Bulk cargo handling requires specialized equipment and infrastructure for commodities like grains, minerals, and chemicals. The diversity of cargo handled contributes to the overall resilience and comprehensive nature of Hong Kong's maritime logistics capabilities.

Hong Kong Stevedoring and Marine Cargo Handling Market Product Innovations

Innovation in the Hong Kong stevedoring and marine cargo handling market is increasingly focused on enhancing efficiency, sustainability, and safety through technology. Companies are investing in automation for repetitive tasks, such as the deployment of autonomous guided vehicles (AGVs) for container movement within terminals and AI-driven yard management systems to optimize storage and retrieval. The adoption of IoT sensors on equipment and cargo provides real-time data for predictive maintenance and improved tracking. Digitalization, including blockchain technology for secure and transparent cargo documentation, is also gaining traction. These innovations offer significant competitive advantages by reducing operational costs, minimizing human error, and improving vessel turnaround times, thereby meeting the evolving demands of global trade for faster and more reliable logistics.

Report Segmentation & Scope

This report segments the Hong Kong stevedoring and marine cargo handling market into the following categories:

By Type:

- Stevedoring: This segment encompasses the loading and unloading of cargo from vessels. It is a foundational service with consistent demand, driven by the continuous flow of maritime traffic. Projections indicate steady growth, reflecting the port's enduring importance.

- Cargo and Handling Transportation: This broad segment includes the movement of cargo within the port vicinity, from terminals to warehousing, and onward transportation. Growth is anticipated to be strong, fueled by the demand for integrated logistics solutions and e-commerce fulfillment.

- Other Types: This category covers specialized services such as ship repair, bunkering, and pilotage, which are ancillary but crucial for port operations. While niche, these services contribute to the comprehensive ecosystem.

By Cargo Type:

- Containerized Cargo: This segment dominates the market, driven by global trade in manufactured goods. Projections show continued robust growth, supported by ongoing infrastructure upgrades and technological advancements in container handling.

- Bulk Cargo: This includes commodities like grains, ores, and coal. Demand is subject to global commodity cycles but remains a significant component of port activity.

- Other Cargo Types: This encompasses liquid bulk, project cargo, and specialized freight. Growth in this segment is linked to specific industry demands and infrastructure projects.

The scope of this report is to provide a comprehensive analysis of these segments, detailing market sizes, growth projections, and competitive dynamics from 2019 to 2033.

Key Drivers of Hong Kong Stevedoring and Marine Cargo Handling Market Growth

The growth of the Hong Kong stevedoring and marine cargo handling market is propelled by several key factors. Firstly, the city's strategic location as a major transshipment hub for mainland China and the Asia-Pacific region remains a fundamental driver. Secondly, ongoing investments in port infrastructure and the adoption of advanced technologies like automation, AI, and IoT are significantly enhancing operational efficiency and capacity. Thirdly, the robust growth of global trade, particularly in containerized goods and e-commerce, directly translates to increased demand for cargo handling services. Furthermore, government initiatives aimed at promoting Hong Kong as a premier maritime center, coupled with a stable regulatory environment, foster investor confidence and operational expansion. The increasing demand for integrated logistics solutions and specialized cargo handling further supports market expansion.

Challenges in the Hong Kong Stevedoring and Marine Cargo Handling Market Sector

Despite its strengths, the Hong Kong stevedoring and marine cargo handling market faces several challenges. Intense competition from neighboring ports in the region, offering competitive rates and infrastructure, poses a continuous threat to market share. Fluctuations in global trade volumes, influenced by geopolitical tensions and economic downturns, can lead to unpredictable demand. Increasing environmental regulations regarding emissions and waste management necessitate significant investment in sustainable practices and technologies. The shortage of skilled labor for specialized roles in stevedoring and advanced cargo handling can also impact operational efficiency. Additionally, the high operational costs associated with maintaining and upgrading advanced port equipment and infrastructure present a continuous financial challenge for market players.

Leading Players in the Hong Kong Stevedoring and Marine Cargo Handling Market Market

- A P Moller - Maersk

- East West Maritime Limited

- Mediterranean Shipping Co

- COSCO Group

- APM Terminals

- DP World Limited

- Evergreen Marine (Hong Kong) Ltd

- Ahlers Bridge Hong Kong Ltd

- Hapag-Lloyd

- CMA CGM Group

Key Developments in Hong Kong Stevedoring and Marine Cargo Handling Market Sector

- Aug 2022: A.P. Moeller Maersk acquired Hong Kong-based contract logistics services provider LF Logistics for USD 3.6 billion. This strategic move allows Maersk to leverage LF Logistics' expertise in omnichannel fulfillment, e-commerce, and inland transportation, significantly strengthening its presence and capabilities in the Asia-Pacific region.

- June 2022: Scan Global Logistics, a global full-service logistics provider, acquired Sea-Air Logistics Ltd. This acquisition bolsters Scan Global Logistics' offerings in ocean and airfreight forwarding and logistics services across Hong Kong, China, and Singapore, enhancing its network with nine local offices and warehousing facilities.

Strategic Hong Kong Stevedoring and Marine Cargo Handling Market Market Outlook

The strategic outlook for the Hong Kong stevedoring and marine cargo handling market is cautiously optimistic, with significant opportunities for growth driven by technological advancement and regional economic integration. The ongoing digitalization of port operations, including the adoption of AI, IoT, and blockchain, is expected to unlock new levels of efficiency and transparency. Continued investment in automation and sustainable practices will be crucial for maintaining competitiveness and meeting environmental standards. The market is also likely to witness further consolidation through M&A activities as companies seek to broaden their service offerings and expand their global reach. Hong Kong's role as a pivotal gateway for trade within the Greater Bay Area and the broader Asia-Pacific region provides a strong foundation for sustained demand. Strategic partnerships and the development of smart port initiatives will be key accelerators for future growth and market leadership.

Hong Kong Stevedoring and Marine Cargo Handling Market Segmentation

-

1. Type

- 1.1. Stevedoring

- 1.2. Cargo and Handling Transportation

- 1.3. Other Types

-

2. Cargo Type

- 2.1. Bulk Cargo

- 2.2. Containerized Cargo

- 2.3. Other Cargo Types

Hong Kong Stevedoring and Marine Cargo Handling Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

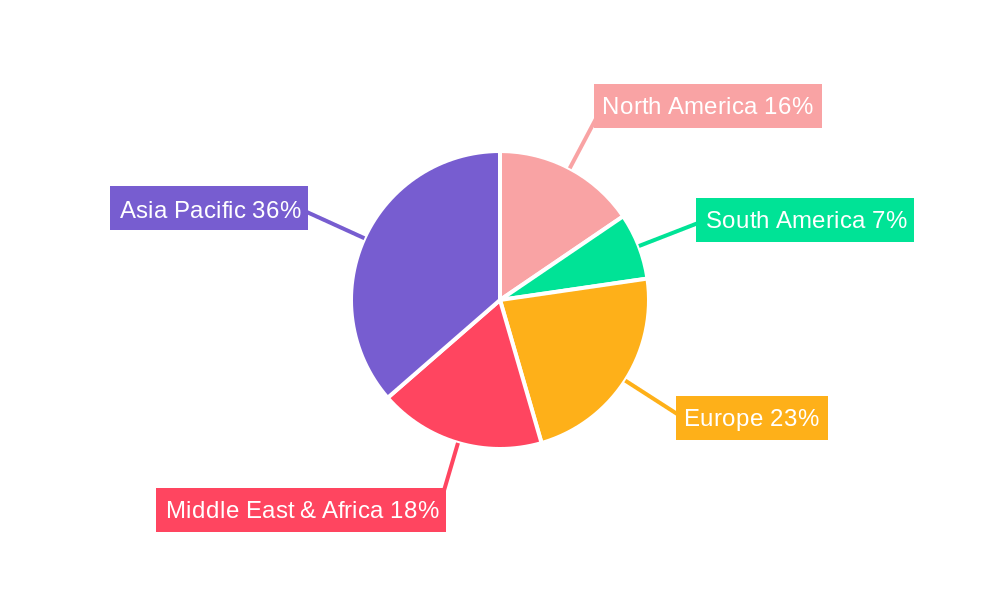

Hong Kong Stevedoring and Marine Cargo Handling Market Regional Market Share

Geographic Coverage of Hong Kong Stevedoring and Marine Cargo Handling Market

Hong Kong Stevedoring and Marine Cargo Handling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. Increasing Sea Freight Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hong Kong Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stevedoring

- 5.1.2. Cargo and Handling Transportation

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Bulk Cargo

- 5.2.2. Containerized Cargo

- 5.2.3. Other Cargo Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hong Kong Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Stevedoring

- 6.1.2. Cargo and Handling Transportation

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Cargo Type

- 6.2.1. Bulk Cargo

- 6.2.2. Containerized Cargo

- 6.2.3. Other Cargo Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hong Kong Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Stevedoring

- 7.1.2. Cargo and Handling Transportation

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Cargo Type

- 7.2.1. Bulk Cargo

- 7.2.2. Containerized Cargo

- 7.2.3. Other Cargo Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hong Kong Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Stevedoring

- 8.1.2. Cargo and Handling Transportation

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Cargo Type

- 8.2.1. Bulk Cargo

- 8.2.2. Containerized Cargo

- 8.2.3. Other Cargo Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hong Kong Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Stevedoring

- 9.1.2. Cargo and Handling Transportation

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Cargo Type

- 9.2.1. Bulk Cargo

- 9.2.2. Containerized Cargo

- 9.2.3. Other Cargo Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hong Kong Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Stevedoring

- 10.1.2. Cargo and Handling Transportation

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Cargo Type

- 10.2.1. Bulk Cargo

- 10.2.2. Containerized Cargo

- 10.2.3. Other Cargo Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 A P Moller - Maersk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 East West Maritime Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mediterranean Shipping Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 COSCO Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 APM Terminals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DP World Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Evergreen Marine (Hong Kong) Ltd**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ahlers Bridge Hong Kong Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hapag-Lloyd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CMA CGM Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Cargo Type 2025 & 2033

- Figure 5: North America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 6: North America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Type 2025 & 2033

- Figure 9: South America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Cargo Type 2025 & 2033

- Figure 11: South America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 12: South America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Cargo Type 2025 & 2033

- Figure 17: Europe Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 18: Europe Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Cargo Type 2025 & 2033

- Figure 23: Middle East & Africa Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 24: Middle East & Africa Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Asia Pacific Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Cargo Type 2025 & 2033

- Figure 29: Asia Pacific Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Cargo Type 2025 & 2033

- Figure 30: Asia Pacific Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Hong Kong Stevedoring and Marine Cargo Handling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 3: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 6: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 12: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 18: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 30: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 39: Global Hong Kong Stevedoring and Marine Cargo Handling Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hong Kong Stevedoring and Marine Cargo Handling Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hong Kong Stevedoring and Marine Cargo Handling Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Hong Kong Stevedoring and Marine Cargo Handling Market?

Key companies in the market include A P Moller - Maersk, East West Maritime Limited, Mediterranean Shipping Co, COSCO Group, APM Terminals, DP World Limited, Evergreen Marine (Hong Kong) Ltd**List Not Exhaustive, Ahlers Bridge Hong Kong Ltd, Hapag-Lloyd, CMA CGM Group.

3. What are the main segments of the Hong Kong Stevedoring and Marine Cargo Handling Market?

The market segments include Type, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.94 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

Increasing Sea Freight Driving the Market.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

Aug 2022: A.P. Moeller Maersk acquired Hong Kong-based contract logistics services provider LF Logistics for USD 3.6 billion. In the Asia-Pacific area, Maersk can harness LF Logistics' superior capabilities in omnichannel fulfillment services, e-commerce, and inland transportation to the shippers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hong Kong Stevedoring and Marine Cargo Handling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hong Kong Stevedoring and Marine Cargo Handling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hong Kong Stevedoring and Marine Cargo Handling Market?

To stay informed about further developments, trends, and reports in the Hong Kong Stevedoring and Marine Cargo Handling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence