Key Insights

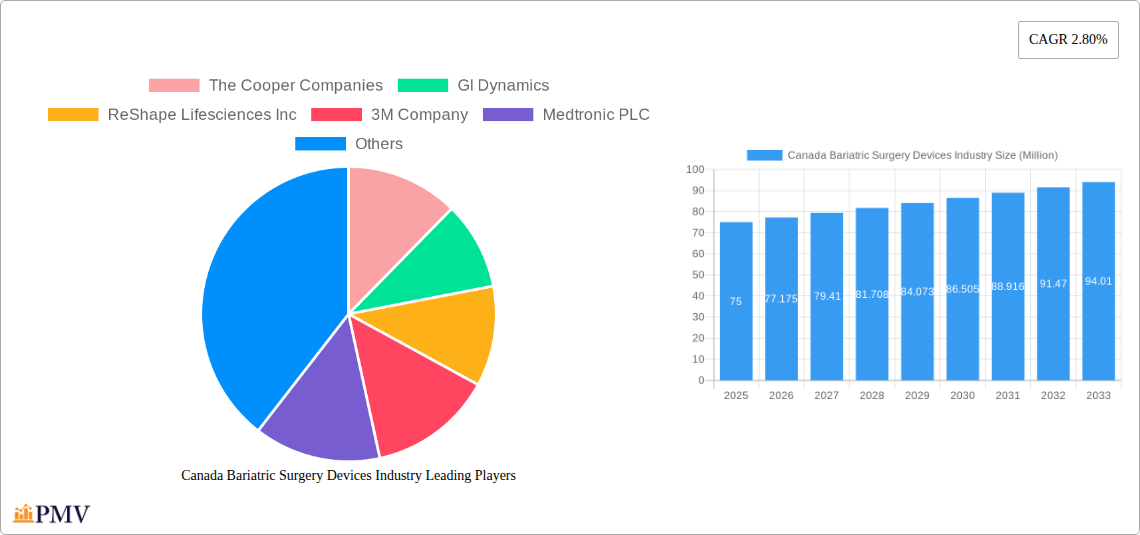

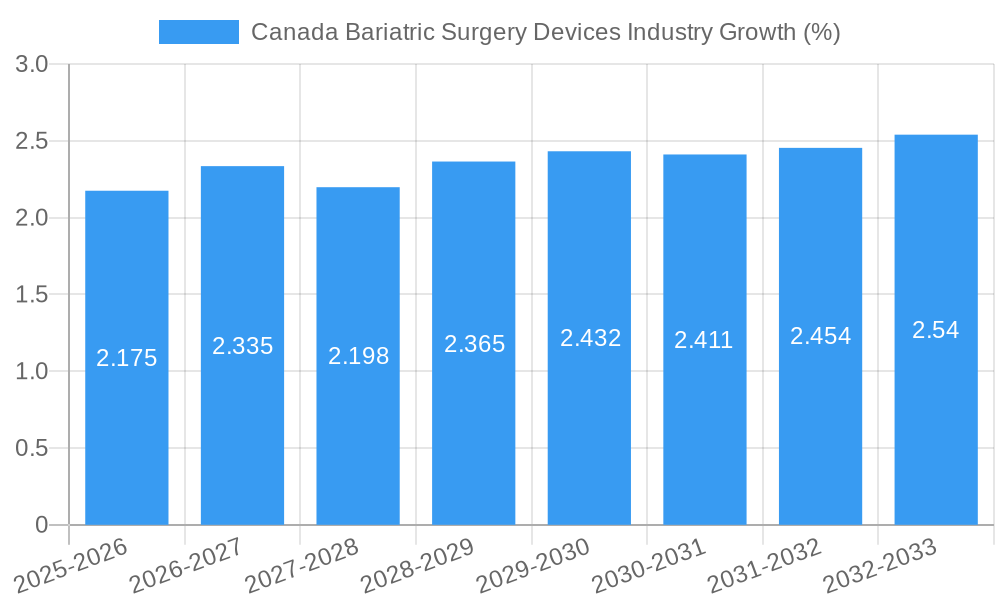

The Canadian bariatric surgery devices market, valued at approximately $75 million in 2025, is projected to experience steady growth, driven by rising obesity rates and an increasing awareness of minimally invasive surgical procedures. The 2.80% CAGR indicates a consistent expansion over the forecast period (2025-2033), reaching an estimated market size of approximately $95 million by 2033. This growth is fueled by several factors, including technological advancements in implantable and assisting devices leading to improved surgical outcomes and patient recovery times. The increasing number of bariatric surgeries performed in hospitals and ambulatory surgical centers further contributes to market expansion. Demand for minimally invasive procedures and advanced technologies like adjustable gastric banding devices are key trends shaping the market. However, factors such as high procedural costs and potential complications associated with bariatric surgery could act as restraints on market growth. The market is segmented by device type (assisting, implantable, and other devices) and end-use (hospitals, surgical centers, ambulatory surgical centers). The Cooper Companies, GI Dynamics, ReShape Lifesciences Inc, 3M Company, Medtronic PLC, Apollo Endosurgery Inc, and Olympus Corporation are key players competing in this dynamic market.

The Canadian market's relatively small size compared to larger global markets reflects the smaller population base. However, the consistent growth rate indicates significant potential for expansion. Future market growth will depend on the continued adoption of advanced technologies, government healthcare policies supporting bariatric surgery, and the increasing affordability of these devices. The segment of implantable devices is likely to experience faster growth than assisting devices due to its potential to offer long-term weight management solutions. Hospitals are expected to remain the largest end-use segment due to their comprehensive infrastructure and expertise in performing complex surgical procedures. Competitive dynamics will likely revolve around technological innovation, pricing strategies, and distribution networks.

This comprehensive report provides an in-depth analysis of the Canada bariatric surgery devices market, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The base year for this analysis is 2025. We project a market value of xx Million by 2033, showcasing significant growth opportunities within this dynamic sector.

Canada Bariatric Surgery Devices Industry Market Structure & Competitive Dynamics

The Canadian bariatric surgery devices market exhibits a moderately concentrated structure, with key players such as The Cooper Companies, GI Dynamics, ReShape Lifesciences Inc, 3M Company, Medtronic PLC, Apollo Endosurgery Inc, and Olympus Corporation holding significant market share. Market share data for 2025 reveals that Medtronic PLC holds approximately 25% of the market, followed by The Cooper Companies at 18% and 3M Company at 15%. The remaining share is distributed among other players, indicating a competitive landscape with opportunities for both established and emerging companies.

The Canadian regulatory framework, specifically Health Canada's regulations, plays a crucial role in market access and product approvals. Innovation in this sector is driven by advancements in minimally invasive techniques, improved device efficacy, and a growing emphasis on patient safety. M&A activity has been relatively moderate in recent years, with a notable transaction being the acquisition of [Company Name] by [Acquiring Company] in [Year] for an estimated value of xx Million. Further M&A activities are anticipated as companies seek to expand their product portfolios and market reach. End-user trends demonstrate an increasing preference for less invasive procedures and shorter recovery times, which is impacting the demand for specific device types. The increasing prevalence of obesity and related comorbidities further fuels market growth. Substitutes such as lifestyle modifications and pharmaceutical interventions exist but are often less effective in managing severe obesity, driving demand for surgical devices.

Canada Bariatric Surgery Devices Industry Industry Trends & Insights

The Canada bariatric surgery devices market is experiencing robust growth, driven by several key factors. The rising prevalence of obesity and related health complications in Canada is a primary driver, pushing increased demand for effective weight loss solutions. Technological advancements, such as the development of minimally invasive devices and improved surgical techniques, are streamlining procedures and reducing recovery times. This trend is further enhanced by improved patient outcomes and increased patient satisfaction. Consumer preferences are increasingly favoring less invasive surgical options, reflecting a shift towards minimally disruptive procedures.

The market experienced a Compound Annual Growth Rate (CAGR) of approximately 8% during the historical period (2019-2024). We project a CAGR of 7% for the forecast period (2025-2033), driven by continuing technological advancements and increasing adoption of bariatric surgery. Market penetration remains relatively low, but projections indicate a significant increase in adoption due to improved insurance coverage and public awareness campaigns. Competitive dynamics are shaping the market through continuous product innovation, strategic partnerships, and expansion of distribution channels.

Dominant Markets & Segments in Canada Bariatric Surgery Devices Industry

Dominant Segments:

Device Type: Implantable devices represent the largest segment, driven by their long-term effectiveness and improved patient outcomes. Assisting devices show significant growth potential due to their ease of use and versatility in different surgical procedures.

End-Use: Hospitals remain the dominant end-user segment due to their established infrastructure and expertise in complex surgical procedures. However, ambulatory surgical centers are experiencing substantial growth due to increasing adoption of minimally invasive techniques and rising demand for cost-effective solutions.

Key Drivers of Segment Dominance:

- Economic Policies: Government initiatives to address rising healthcare costs are driving the adoption of cost-effective surgical techniques and devices.

- Infrastructure: The robust healthcare infrastructure in major Canadian cities supports the growth of bariatric surgery procedures.

- Technological Advancements: Innovations in minimally invasive surgical techniques are increasing the efficiency and reducing the costs associated with these procedures.

- Reimbursement Policies: Increased insurance coverage for bariatric surgery procedures contributes to the high demand within the market.

Canada Bariatric Surgery Devices Industry Product Innovations

Recent product developments include the introduction of smaller, less invasive devices, along with improved implant designs that enhance long-term effectiveness and reduce complications. These innovations focus on addressing the increasing patient demand for improved treatment options. Technological advancements in materials science, robotics, and imaging are further driving innovation in device design and functionality, enabling greater precision and enhanced surgical outcomes. The market fit for these innovations is evident in the increasing adoption rates among surgeons and a growing number of successful procedures, highlighting the value proposition for both patients and healthcare providers.

Report Segmentation & Scope

This report segments the Canadian bariatric surgery devices market based on device type (Assisting Devices, Implantable Devices, Other Devices) and end-use (Hospitals, Surgical Centers, Ambulatory Surgical Centers). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The assisting devices segment is projected to experience substantial growth due to increasing demand for minimally invasive techniques. Implantable devices retain the largest market share due to their effectiveness in long-term weight management. The other devices segment comprises ancillary products and instruments essential for surgical procedures, showing steady growth mirroring the overall market expansion. Hospitals form the largest end-use segment, but ambulatory surgical centers are projected to witness the highest growth rate due to cost-efficiency and patient convenience. Surgical Centers maintain a substantial market share due to the specialized nature of bariatric procedures.

Key Drivers of Canada Bariatric Surgery Devices Industry Growth

The growth of the Canada bariatric surgery devices market is fueled by several key drivers. Technological advancements leading to minimally invasive techniques and improved device efficacy have enhanced patient outcomes and reduced recovery times, stimulating market demand. The rising prevalence of obesity and associated comorbidities in Canada creates a significant need for effective weight management solutions, directly impacting the market size. Favorable reimbursement policies by insurance providers and government initiatives further contribute to market expansion by making bariatric surgery accessible to a larger patient population. The robust healthcare infrastructure in Canada supports the growth of these specialized surgical procedures and the effective deployment of advanced medical devices.

Challenges in the Canada Bariatric Surgery Devices Industry Sector

Several challenges hinder growth within the Canada bariatric surgery devices industry. Regulatory hurdles associated with device approvals and reimbursement policies can create delays and increase costs for manufacturers. Supply chain disruptions can impact the availability of devices, potentially affecting surgical schedules and patient care. Intense competition among established players and emerging companies puts pressure on pricing and profitability margins. The high cost of bariatric surgery procedures can pose a barrier for some patients, hindering market penetration despite rising demand. These factors collectively impact market growth and require careful navigation by stakeholders.

Leading Players in the Canada Bariatric Surgery Devices Industry Market

- The Cooper Companies

- GI Dynamics

- ReShape Lifesciences Inc

- 3M Company

- Medtronic PLC

- Apollo Endosurgery Inc

- Olympus Corporation

Key Developments in Canada Bariatric Surgery Devices Industry Sector

- October 2022: Medtronic PLC launched a new adjustable gastric banding system, expanding its product portfolio.

- June 2023: Apollo Endosurgery Inc. announced a strategic partnership to enhance distribution channels in Canada.

- March 2024: ReShape Lifesciences Inc. received regulatory approval for a novel bariatric device.

Strategic Canada Bariatric Surgery Devices Industry Market Outlook

The future of the Canadian bariatric surgery devices market appears promising, driven by continuing technological advancements, rising prevalence of obesity, and favorable regulatory changes. Strategic opportunities exist for companies to focus on minimally invasive device development, innovative surgical techniques, and strategic partnerships to expand market reach. Expansion into underserved regions, targeting specific patient segments, and development of digital health solutions to enhance patient engagement can offer significant growth potential. The overall market is poised for substantial growth in the coming years, driven by a convergence of technological, economic, and social factors.

Canada Bariatric Surgery Devices Industry Segmentation

-

1. Device

-

1.1. Assisting Devices

- 1.1.1. Suturing Device

- 1.1.2. Closure Device

- 1.1.3. Stapling Device

- 1.1.4. Trocars

- 1.1.5. Other Assisting Devices

- 1.2. Implantable Devices

- 1.3. Other Devices

-

1.1. Assisting Devices

Canada Bariatric Surgery Devices Industry Segmentation By Geography

- 1. Canada

Canada Bariatric Surgery Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increase in Obesity Patients; Government Initiatives to Curb Obesity; Rising Prevalence of Type 2 Diabetes and Heart Diseases

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Surgery

- 3.4. Market Trends

- 3.4.1. Closure Device is Expected to Register a High CAGR in the Assisting Device Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Bariatric Surgery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Assisting Devices

- 5.1.1.1. Suturing Device

- 5.1.1.2. Closure Device

- 5.1.1.3. Stapling Device

- 5.1.1.4. Trocars

- 5.1.1.5. Other Assisting Devices

- 5.1.2. Implantable Devices

- 5.1.3. Other Devices

- 5.1.1. Assisting Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 The Cooper Companies

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GI Dynamics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ReShape Lifesciences Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 3M Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Apollo Endosurgery Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Olympus Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 The Cooper Companies

List of Figures

- Figure 1: Canada Bariatric Surgery Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Bariatric Surgery Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Bariatric Surgery Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Bariatric Surgery Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Canada Bariatric Surgery Devices Industry Revenue Million Forecast, by Device 2019 & 2032

- Table 4: Canada Bariatric Surgery Devices Industry Volume K Unit Forecast, by Device 2019 & 2032

- Table 5: Canada Bariatric Surgery Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Bariatric Surgery Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Canada Bariatric Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Canada Bariatric Surgery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Canada Bariatric Surgery Devices Industry Revenue Million Forecast, by Device 2019 & 2032

- Table 10: Canada Bariatric Surgery Devices Industry Volume K Unit Forecast, by Device 2019 & 2032

- Table 11: Canada Bariatric Surgery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Canada Bariatric Surgery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Bariatric Surgery Devices Industry?

The projected CAGR is approximately 2.80%.

2. Which companies are prominent players in the Canada Bariatric Surgery Devices Industry?

Key companies in the market include The Cooper Companies, GI Dynamics, ReShape Lifesciences Inc, 3M Company, Medtronic PLC, Apollo Endosurgery Inc, Olympus Corporation.

3. What are the main segments of the Canada Bariatric Surgery Devices Industry?

The market segments include Device.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increase in Obesity Patients; Government Initiatives to Curb Obesity; Rising Prevalence of Type 2 Diabetes and Heart Diseases.

6. What are the notable trends driving market growth?

Closure Device is Expected to Register a High CAGR in the Assisting Device Segment.

7. Are there any restraints impacting market growth?

; High Cost of Surgery.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Bariatric Surgery Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Bariatric Surgery Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Bariatric Surgery Devices Industry?

To stay informed about further developments, trends, and reports in the Canada Bariatric Surgery Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence