Key Insights

The Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market is poised for significant expansion, propelled by the escalating demand for satellite-based services in telecommunications, Earth observation, and navigation. Regional investments in space programs and satellite technology infrastructure are key growth drivers. Projections indicate a robust market, with an estimated market size of $0.96 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 10.94%. Continued technological advancements, particularly in miniaturization and enhanced performance, will sustain this upward trend through 2033. The market segmentation highlights strong demand across various satellite mass categories, with the 100-500kg segment anticipated to lead due to its optimal balance of capability and cost-effectiveness for diverse applications. The proliferation of Low Earth Orbit (LEO) constellations, including mega-constellations for broadband internet and Earth observation, is a major contributor to market growth. Government and military expenditures, alongside increasing private investment in commercial space ventures within key nations like China, Japan, India, and South Korea, are further bolstering the market. Despite existing regulatory and technological complexities, the market outlook remains highly positive, offering substantial growth opportunities for established and emerging NewSpace companies.

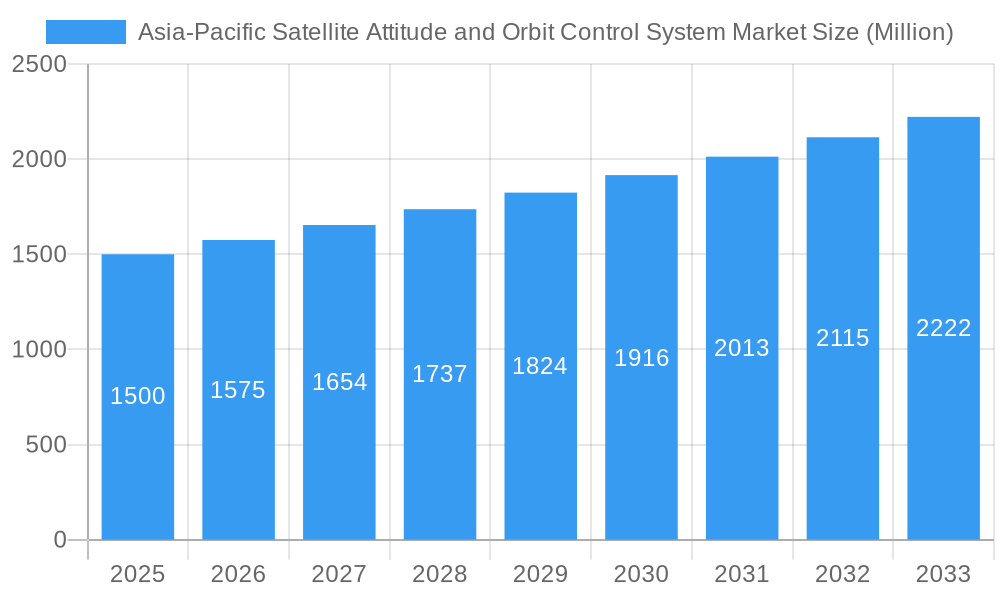

Asia-Pacific Satellite Attitude and Orbit Control System Market Market Size (In Million)

Leading players in the Asia-Pacific AOCS market are strategically positioned to leverage these opportunities. Companies such as NewSpace Systems, SENER Group, and AAC Clyde Space are at the forefront of developing advanced AOCS technologies, prioritizing miniaturization, superior accuracy, and cost-effective solutions. The integration of cutting-edge technologies, including AI-driven autonomous control systems and advanced propulsion, is accelerating market growth. Intensifying competition is expected, with both established corporations and agile startups vying for market dominance. Success will hinge on the ability to deliver innovative, reliable, and competitively priced solutions tailored to the specific demands of various satellite applications and orbital classes. Navigating the diverse regulatory environments and varying technological maturity levels across Asia-Pacific countries presents both challenges and strategic advantages for market participants.

Asia-Pacific Satellite Attitude and Orbit Control System Market Company Market Share

Asia-Pacific Satellite Attitude and Orbit Control System Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Satellite Attitude and Orbit Control System (AOCS) market, offering valuable insights for stakeholders across the aerospace and defense industries. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033. The base year for this analysis is 2025.

Asia-Pacific Satellite Attitude and Orbit Control System Market Market Structure & Competitive Dynamics

The Asia-Pacific Satellite AOCS market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the emergence of innovative startups and the increasing participation of small and medium-sized enterprises (SMEs) are driving increased competition. The regulatory landscape varies across the region, impacting market access and investment strategies. The market is characterized by continuous product innovation, focusing on miniaturization, enhanced precision, and reduced power consumption. This fuels healthy competitive dynamics, pushing companies to differentiate their offerings. Product substitutes, such as alternative navigation systems, are limited due to the specific requirements of satellite operations. The end-user trends reveal a growing demand for advanced AOCS solutions from both commercial and military & government sectors, particularly driven by the increasing adoption of small satellites and satellite constellations. Mergers and acquisitions (M&A) activity within the sector is moderate, with deal values fluctuating depending on the target company's technology and market position. For example, a recent deal involved a xx Million acquisition of a company specializing in advanced star trackers. This trend is expected to continue, further shaping the market landscape.

Asia-Pacific Satellite Attitude and Orbit Control System Market Industry Trends & Insights

The Asia-Pacific Satellite AOCS market is poised for robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is fueled by several factors: the burgeoning space economy, particularly in countries like India, China, Japan, and Australia; rising demand for high-resolution Earth observation and communication satellites; increasing adoption of small satellite constellations for various applications (e.g., IoT, broadband internet); and substantial government investments in space exploration and defense programs. Technological advancements, such as the development of miniaturized sensors, advanced algorithms, and improved power management systems, contribute significantly to market growth. This is further enhanced by declining launch costs and improved reliability, making space-based technologies more accessible. However, the market faces challenges such as the high initial investment costs and potential supply chain disruptions. Market penetration of advanced AOCS technologies is growing steadily, particularly in the commercial sector, indicating significant market potential.

Dominant Markets & Segments in Asia-Pacific Satellite Attitude and Orbit Control System Market

Leading Region: China and India currently lead the Asia-Pacific Satellite AOCS market, driven by significant government investments in space programs and the burgeoning domestic commercial space sector.

Dominant Satellite Mass Segment: The 10-100kg satellite mass segment shows the highest growth, reflecting the rising popularity of CubeSats and smallsat constellations. This is driven by decreasing manufacturing and launch costs, enabling more frequent and cost-effective deployments.

Leading Orbit Class: The LEO (Low Earth Orbit) segment dominates the market, fueled by the growing need for Earth observation, IoT applications, and constellations providing broadband services. However, the GEO (Geostationary Orbit) segment is witnessing steady growth driven by communication satellite applications.

Primary End-User: The commercial sector represents the largest end-user segment, followed closely by the military & government sector, emphasizing the dual-use nature of AOCS technology.

Key Application: Communication satellites remain the largest application segment for AOCS, followed by Earth observation, navigation, and space observation. The growth in all these segments is primarily due to an increase in demand for better-quality services.

Key drivers in these dominant markets include supportive government policies promoting space exploration and technological innovation; robust infrastructure investments in satellite launch facilities and ground control networks; and a growing pool of skilled engineers and scientists.

Asia-Pacific Satellite Attitude and Orbit Control System Market Product Innovations

Recent years have witnessed significant advancements in AOCS technology, characterized by the development of smaller, lighter, more energy-efficient, and cost-effective systems. Miniaturized star trackers, advanced gyroscopes, and improved reaction wheels are key examples of this trend. These innovations significantly reduce the overall weight and power requirements of satellites, enabling more flexible and adaptable spacecraft designs. The market is witnessing a shift towards integrated AOCS solutions, combining multiple components into a single, compact unit. This trend improves reliability, reduces complexity, and simplifies integration. Furthermore, the incorporation of AI and machine learning algorithms is enhancing the precision and autonomy of AOCS systems, optimizing fuel consumption and improving overall mission performance.

Report Segmentation & Scope

This report segments the Asia-Pacific Satellite AOCS market based on satellite mass (Below 10 Kg, 10-100kg, 100-500kg, 500-1000kg, above 1000kg), orbit class (LEO, MEO, GEO), end-user (Commercial, Military & Government, Other), and application (Communication, Earth Observation, Navigation, Space Observation, Others). Each segment’s growth projections, market size, and competitive dynamics are analyzed in detail. For example, the 10-100 kg segment is projected to grow at xx% CAGR due to the rise of small satellites, whereas the GEO segment demonstrates steady growth driven by its applications in communications and broadcasting. The market's competitive dynamics within each segment show varying degrees of concentration, with some segments experiencing high competition and others exhibiting more concentrated market shares.

Key Drivers of Asia-Pacific Satellite Attitude and Orbit Control System Market Growth

The Asia-Pacific Satellite AOCS market's growth is propelled by technological advancements in miniaturization and improved sensor accuracy, government policies promoting space exploration and commercialization, and the increasing demand for high-quality satellite services across diverse applications, including communication, Earth observation, navigation, and space science. The decline in launch costs also plays a key role in encouraging the wider adoption of AOCS. For example, the successful deployment of numerous small satellite constellations demonstrates the cost-effectiveness of these technologies.

Challenges in the Asia-Pacific Satellite Attitude and Orbit Control System Market Sector

Challenges facing the market include high initial investment costs hindering smaller players, potential supply chain disruptions impacting the availability of components, and stringent regulatory frameworks creating barriers to market entry. The competitive landscape is further complicated by the emergence of new entrants and technological disruptions, creating pressure to continuously innovate. These factors can lead to delays in project timelines and increase overall project costs.

Leading Players in the Asia-Pacific Satellite Attitude and Orbit Control System Market Market

Key Developments in Asia-Pacific Satellite Attitude and Orbit Control System Market Sector

- November 2022: Jena-Optronik GmbH's star sensors were used in NASA's Artemis I mission, showcasing the reliability and precision of their technology.

- December 2022: Jena-Optronik's ASTRO CL star trackers were selected for Maxar's new proliferated LEO satellite platform, indicating growing market adoption.

- February 2023: Jena-Optronik secured a contract with Airbus OneWeb Satellites to supply AOCS sensors for their ARROW family of small satellites, further consolidating their market position.

Strategic Asia-Pacific Satellite Attitude and Orbit Control System Market Market Outlook

The Asia-Pacific Satellite AOCS market presents significant growth potential, driven by continued technological advancements, increasing demand for satellite-based services, and supportive government policies. Strategic opportunities lie in developing innovative AOCS solutions tailored for small satellites and constellations, focusing on miniaturization, energy efficiency, and cost reduction. Partnerships and collaborations between established players and emerging technology companies will be crucial in shaping the market's future. The focus on AI and machine learning integration within AOCS systems will further propel market growth, improving efficiency and reliability.

Asia-Pacific Satellite Attitude and Orbit Control System Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

Asia-Pacific Satellite Attitude and Orbit Control System Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Satellite Attitude and Orbit Control System Market Regional Market Share

Geographic Coverage of Asia-Pacific Satellite Attitude and Orbit Control System Market

Asia-Pacific Satellite Attitude and Orbit Control System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Satellite Attitude and Orbit Control System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NewSpace Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SENER Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Innovative Solutions in Space BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sitael S p A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thale

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jena-Optronik

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AAC Clyde Space

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 NewSpace Systems

List of Figures

- Figure 1: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Satellite Attitude and Orbit Control System Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 3: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 4: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 8: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 9: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Satellite Attitude and Orbit Control System Market?

The projected CAGR is approximately 10.94%.

2. Which companies are prominent players in the Asia-Pacific Satellite Attitude and Orbit Control System Market?

Key companies in the market include NewSpace Systems, SENER Group, Innovative Solutions in Space BV, Sitael S p A, Thale, Jena-Optronik, AAC Clyde Space.

3. What are the main segments of the Asia-Pacific Satellite Attitude and Orbit Control System Market?

The market segments include Application, Satellite Mass, Orbit Class, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.96 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Jena-Optronik announced that it has been selected by satellite constellation manufacturer Airbus OneWeb Satellites to provide the ASTRO CL a Attitude and Orbit Control Systems (AOCS) sensor for the ARROW family of small satellites.December 2022: ASTRO CL, the smallest member of Jena-Optronik's ASTRO star tracker family, has been chosen to support the new proliferated LEO satellite platform at Maxar. Each satellite will carry two ASTRO CL star trackers to enable its guidance, navigation and control.November 2022: NASA's mission Artemis I was equipped with two star sensors by Jena-Optronik GmbH, which would ensure the precise alignment of the spaceship on its way to the Moon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Satellite Attitude and Orbit Control System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Satellite Attitude and Orbit Control System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Satellite Attitude and Orbit Control System Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Satellite Attitude and Orbit Control System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence