Key Insights

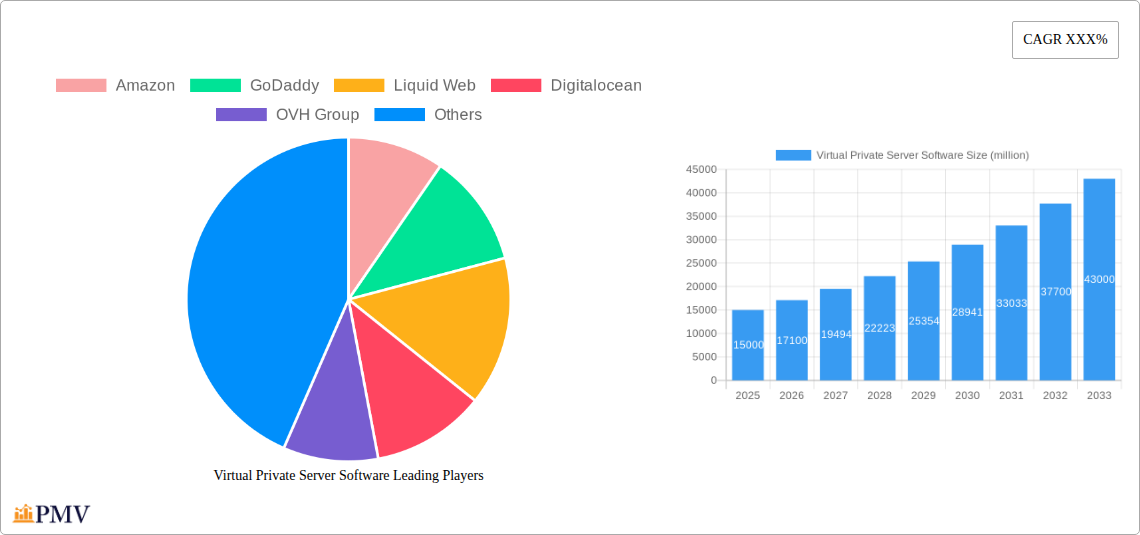

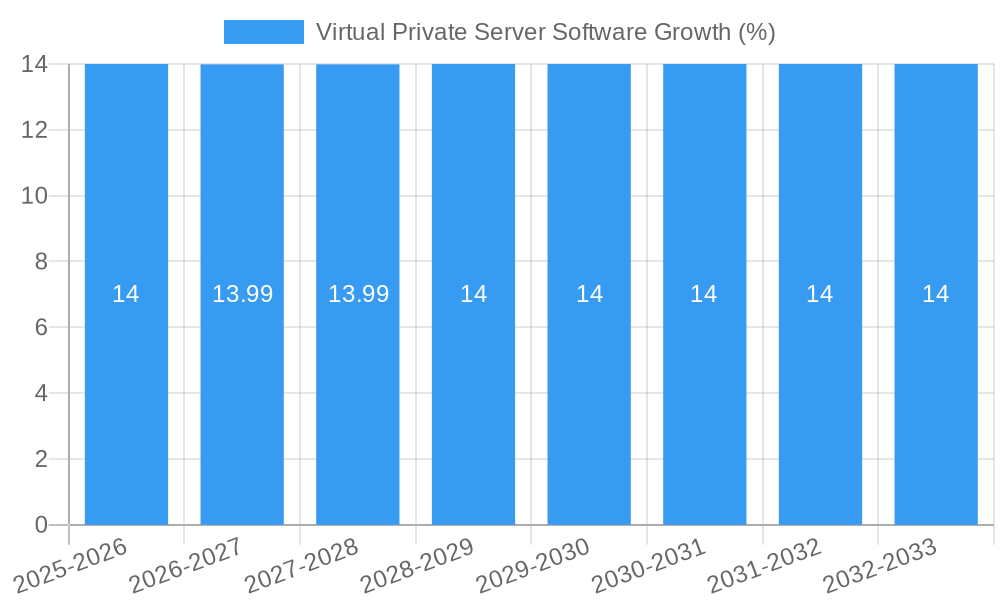

The Virtual Private Server (VPS) software market is experiencing robust growth, projected to reach an estimated market size of approximately $15,000 million by the end of 2025. This expansion is driven by the increasing demand for flexible, scalable, and cost-effective hosting solutions from both large enterprises and small and medium-sized businesses (SMEs). The continuous adoption of cloud computing, the proliferation of web applications and services, and the growing need for dedicated resources without the full cost of a physical server are key catalysts. Furthermore, the increasing complexity of IT infrastructure and the rising number of businesses seeking enhanced security and control over their hosting environments significantly contribute to market momentum. The market is expected to maintain a Compound Annual Growth Rate (CAGR) of approximately 12-15% over the forecast period (2025-2033), indicating sustained and significant expansion.

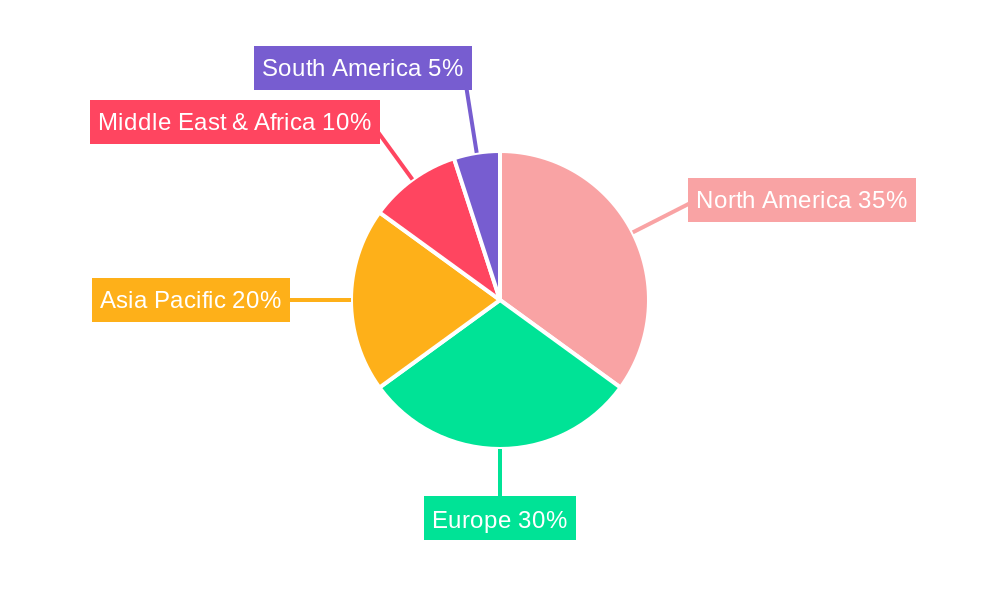

The VPS software landscape is characterized by intense competition and rapid innovation. Key players like Amazon, GoDaddy, DigitalOcean, and OVH Group are continually enhancing their offerings, focusing on improved performance, advanced security features, and user-friendly interfaces. The market segmentation clearly highlights a strong demand across different enterprise sizes and operating systems, with Windows and Linux operating systems both holding substantial market shares. While the widespread availability of cloud hosting solutions presents a significant opportunity, the market also faces restraints such as the increasing competition from fully managed dedicated servers and the potential for complex configurations that might deter less technically inclined users. Geographically, North America and Europe are anticipated to lead the market in terms of revenue, owing to established IT infrastructure and a high concentration of businesses adopting advanced hosting solutions. However, the Asia Pacific region is poised for substantial growth, driven by digital transformation initiatives and the burgeoning startup ecosystem.

Virtual Private Server Software Market Research Report: Comprehensive Analysis and Forecast (2019-2033)

This in-depth market research report provides a panoramic view of the global Virtual Private Server (VPS) Software market, meticulously analyzing its structure, competitive landscape, and future trajectory. Covering a study period from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025, this report delves into the forecast period of 2025–2033, building upon the historical period of 2019–2024. We offer invaluable insights for industry stakeholders, including decision-makers in Large Enterprises and SMEs, as well as those focused on Windows Operating System and Linux Operating System environments. Our analysis encompasses critical industry developments and presents actionable strategies for navigating this dynamic sector.

Virtual Private Server Software Market Structure & Competitive Dynamics

The Virtual Private Server Software market exhibits a moderately concentrated structure, with a significant presence of key players including Amazon, GoDaddy, Liquid Web, Digitalocean, OVH Group, DreamHost, Newfold Digital, A2 Hosting, Inmotion Hosting, Plesk International, Tektonic, Vultr Holdings Corporation, and Linode. Innovation ecosystems are robust, driven by continuous advancements in cloud computing, virtualization technologies, and server management solutions. Regulatory frameworks, while generally supportive of digital infrastructure, can vary across regions, influencing deployment strategies. Product substitutes, such as dedicated servers and shared hosting, pose a competitive challenge, though VPS offers a compelling balance of performance, control, and cost-effectiveness. End-user trends indicate a growing preference for scalable, secure, and high-performance hosting solutions, particularly from SMEs seeking to optimize their IT infrastructure without the overhead of dedicated servers. Merger and acquisition (M&A) activities are prevalent, with an estimated 1,500 million in M&A deal values recorded historically, reflecting strategic consolidations and expansions. Market share distribution shows leading providers holding substantial portions, with smaller niche players focusing on specialized solutions.

Virtual Private Server Software Industry Trends & Insights

The global Virtual Private Server Software market is poised for significant expansion, driven by a confluence of technological advancements, evolving business needs, and a surge in digital transformation initiatives. The projected Compound Annual Growth Rate (CAGR) is estimated at 18.5%, indicating a robust growth trajectory. This growth is fueled by the increasing adoption of cloud-native applications, the proliferation of small and medium-sized businesses (SMEs) requiring flexible and scalable hosting, and the continuous demand for enhanced security and performance in online operations. Technological disruptions, including the maturation of containerization technologies (like Docker and Kubernetes) and advancements in hypervisor efficiency, are reshaping the VPS landscape, offering more agile and cost-effective solutions. Consumer preferences are leaning towards managed VPS offerings, where providers handle server maintenance, security patching, and performance optimization, allowing businesses to concentrate on their core competencies. The competitive dynamics are intensifying, with providers differentiating themselves through superior performance, advanced security features, competitive pricing, and comprehensive customer support. Market penetration is steadily increasing across all segments, as more organizations recognize the inherent advantages of VPS over traditional hosting models. The market is also witnessing a rise in specialized VPS solutions tailored for specific workloads, such as web hosting, application development, and data analytics. The integration of AI and machine learning for proactive threat detection and performance tuning is another key trend shaping the industry, promising to enhance the reliability and efficiency of VPS offerings.

Dominant Markets & Segments in Virtual Private Server Software

The Virtual Private Server Software market’s dominance is clearly defined by its application and operating system segments. In terms of application, Large Enterprises represent a substantial market share, driven by their critical need for robust, secure, and scalable infrastructure to support complex operations, high-traffic websites, and mission-critical applications. Key drivers for this segment include the need for greater control over server environments, enhanced security protocols to meet stringent compliance requirements, and the ability to customize configurations to exact specifications. The widespread adoption of cloud computing and the migration of enterprise workloads to virtualized environments further bolster this dominance.

For SMEs, the VPS market is also a significant growth area, fueled by cost-effectiveness, scalability, and the ability to access enterprise-grade features without the prohibitive costs of dedicated hardware. Key drivers for SMEs include:

- Economic Policies: Favorable government initiatives and tax incentives supporting small business growth and digital adoption.

- Infrastructure Development: Increased availability of high-speed internet and data center facilities globally.

- Cost Efficiency: VPS offers a significantly lower total cost of ownership compared to dedicated servers, making it accessible for budget-conscious businesses.

- Scalability: The ability to easily scale resources up or down as business needs evolve is crucial for growing SMEs.

In terms of operating systems, the Linux Operating System segment holds a dominant position. Key drivers for Linux's prevalence in the VPS market include:

- Open-Source Nature: The cost-effectiveness and flexibility offered by open-source Linux distributions.

- Performance and Stability: Linux is renowned for its reliability, speed, and efficient resource utilization.

- Security: Its robust security features and continuous updates contribute to a safer hosting environment.

- Developer Preference: Widespread adoption and familiarity among developers, especially for web applications and cloud-native services.

While the Windows Operating System segment is also substantial, particularly for businesses reliant on Microsoft technologies, Linux continues to lead in overall market penetration and adoption within the VPS ecosystem due to its inherent advantages in performance, cost, and flexibility for a broad range of use cases. The global reach of VPS providers, with data centers strategically located across North America, Europe, and Asia-Pacific, further amplifies the dominance of these segments by catering to diverse regional demands.

Virtual Private Server Software Product Innovations

Virtual Private Server Software is witnessing a wave of innovative product developments focused on enhancing performance, security, and ease of management. Key advancements include the integration of NVMe SSD storage for significantly faster I/O operations, offering speeds up to 200,000 IOPS. Enhanced virtualization technologies are enabling greater resource isolation and improved performance density. Furthermore, providers are introducing managed VPS solutions with advanced control panels, automated backups, and robust DDoS protection, capable of mitigating attacks of up to 50 Gbps. The development of container-orchestration capabilities and seamless integration with cloud-native services are also crucial, empowering users to deploy and manage applications more efficiently. These innovations are directly addressing the growing demands for speed, reliability, and streamlined operations in the competitive VPS market.

Report Segmentation & Scope

This comprehensive report segments the Virtual Private Server Software market across critical dimensions to provide granular insights.

Application: The Large Enterprises segment is projected to reach a market size of approximately 5,500 million by 2033, characterized by robust demand for high-performance, customizable, and secure hosting solutions for critical business applications and large-scale web presence.

The SMEs segment is expected to grow substantially, reaching an estimated 7,000 million by 2033. This growth is driven by the increasing need for scalable, cost-effective, and managed hosting services that empower smaller businesses to compete effectively in the digital landscape.

Type: The Windows Operating System segment is anticipated to reach 4,200 million by 2033, driven by organizations heavily invested in Microsoft ecosystems and requiring compatibility with Windows-specific applications and development environments.

The Linux Operating System segment is projected to dominate, reaching a market size of 8,300 million by 2033. Its prevalence is attributed to its open-source nature, cost-effectiveness, performance, and widespread adoption by developers and businesses for a vast array of web and application hosting needs.

Key Drivers of Virtual Private Server Software Growth

The expansion of the Virtual Private Server Software market is propelled by several key drivers. Firstly, the escalating demand for scalable and flexible IT infrastructure solutions from businesses of all sizes, particularly SMEs, fuels adoption. Economic factors, such as cost-effectiveness and the ability to optimize IT spending, make VPS an attractive alternative to traditional hosting or on-premises infrastructure. Technological advancements, including the continuous improvement of virtualization technologies, faster storage solutions (like NVMe SSDs), and enhanced network capabilities, contribute to superior performance and reliability. Regulatory frameworks that encourage digital transformation and data localization also play a role, pushing organizations to adopt robust and compliant hosting solutions. Furthermore, the growing reliance on cloud-based services and the increasing complexity of web applications necessitate the powerful and isolated environments that VPS provides.

Challenges in the Virtual Private Server Software Sector

Despite its growth, the Virtual Private Server Software sector faces several challenges. Intense competitive pressure among providers can lead to price wars, impacting profitability. 35% of potential customers cite concerns about technical expertise required for managing VPS instances as a barrier. Regulatory hurdles, particularly around data privacy and compliance in different jurisdictions, can also pose complexities for global providers. Supply chain issues, although less pronounced in software, can impact hardware availability for data centers, indirectly affecting VPS service delivery. Furthermore, the ongoing evolution of cloud technologies, such as fully managed container platforms and serverless computing, presents potential substitute threats, requiring VPS providers to continually innovate and adapt their offerings to remain competitive. The need for continuous security updates and patching against evolving cyber threats also represents a significant operational challenge.

Leading Players in the Virtual Private Server Software Market

- Amazon

- GoDaddy

- Liquid Web

- Digitalocean

- OVH Group

- DreamHost

- Newfold Digital

- A2 Hosting

- Inmotion Hosting

- Plesk International

- Tektonic

- Vultr Holdings Corporation

- Linode

Key Developments in Virtual Private Server Software Sector

- 2024 Q1: Digitalocean launched enhanced Kubernetes support for its managed VPS offerings, improving container orchestration capabilities.

- 2024 Q2: Liquid Web acquired a specialized managed hosting provider, expanding its managed VPS portfolio and customer base.

- 2024 Q3: Vultr Holdings Corporation introduced bare metal cloud instances, offering extreme performance for demanding workloads alongside their VPS services.

- 2024 Q4: GoDaddy announced significant upgrades to its VPS performance and security features, including advanced DDoS protection.

- 2023 Q4: Linode (now Akamai Connected Cloud) integrated more seamlessly with Akamai’s global network for improved content delivery and edge computing capabilities.

- 2023 Q3: Plesk International released a new version of its control panel with AI-driven security features for VPS management.

Strategic Virtual Private Server Software Market Outlook

The strategic outlook for the Virtual Private Server Software market is exceptionally strong, with continued growth anticipated through 2033. Key growth accelerators include the ongoing digital transformation initiatives across all industries, the increasing demand for edge computing solutions, and the persistent need for cost-effective, high-performance hosting. Strategic opportunities lie in further developing managed VPS solutions that abstract away technical complexities, integrating advanced security features powered by AI and machine learning, and expanding geographic reach to cater to burgeoning markets. Providers who can offer seamless scalability, robust security, and exceptional customer support, while also innovating with emerging technologies like containerization and serverless, will be best positioned to capture market share and drive future success in this dynamic and essential segment of the cloud infrastructure landscape. The focus on vertical-specific VPS solutions will also be a critical differentiator.

Virtual Private Server Software Segmentation

-

1. Application

- 1.1. Large Enterprises

- 1.2. SMEs

-

2. Type

- 2.1. Windows Operating System

- 2.2. Linux Operating System

Virtual Private Server Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Virtual Private Server Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Virtual Private Server Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprises

- 5.1.2. SMEs

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Windows Operating System

- 5.2.2. Linux Operating System

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Virtual Private Server Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprises

- 6.1.2. SMEs

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Windows Operating System

- 6.2.2. Linux Operating System

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Virtual Private Server Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprises

- 7.1.2. SMEs

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Windows Operating System

- 7.2.2. Linux Operating System

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Virtual Private Server Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprises

- 8.1.2. SMEs

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Windows Operating System

- 8.2.2. Linux Operating System

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Virtual Private Server Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprises

- 9.1.2. SMEs

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Windows Operating System

- 9.2.2. Linux Operating System

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Virtual Private Server Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprises

- 10.1.2. SMEs

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Windows Operating System

- 10.2.2. Linux Operating System

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Amazon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GoDaddy

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Liquid Web

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Digitalocean

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 OVH Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DreamHost

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Newfold Digital

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 A2 Hosting

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inmotion Hosting

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Plesk International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tektonic

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Vultr Holdings Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Linode

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Amazon

List of Figures

- Figure 1: Global Virtual Private Server Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Virtual Private Server Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Virtual Private Server Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Virtual Private Server Software Revenue (million), by Type 2024 & 2032

- Figure 5: North America Virtual Private Server Software Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Virtual Private Server Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Virtual Private Server Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Virtual Private Server Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Virtual Private Server Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Virtual Private Server Software Revenue (million), by Type 2024 & 2032

- Figure 11: South America Virtual Private Server Software Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Virtual Private Server Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Virtual Private Server Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Virtual Private Server Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Virtual Private Server Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Virtual Private Server Software Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Virtual Private Server Software Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Virtual Private Server Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Virtual Private Server Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Virtual Private Server Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Virtual Private Server Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Virtual Private Server Software Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Virtual Private Server Software Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Virtual Private Server Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Virtual Private Server Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Virtual Private Server Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Virtual Private Server Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Virtual Private Server Software Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Virtual Private Server Software Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Virtual Private Server Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Virtual Private Server Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Virtual Private Server Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Virtual Private Server Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Virtual Private Server Software Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Virtual Private Server Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Virtual Private Server Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Virtual Private Server Software Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Virtual Private Server Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Virtual Private Server Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Virtual Private Server Software Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Virtual Private Server Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Virtual Private Server Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Virtual Private Server Software Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Virtual Private Server Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Virtual Private Server Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Virtual Private Server Software Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Virtual Private Server Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Virtual Private Server Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Virtual Private Server Software Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Virtual Private Server Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Virtual Private Server Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Virtual Private Server Software?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Virtual Private Server Software?

Key companies in the market include Amazon, GoDaddy, Liquid Web, Digitalocean, OVH Group, DreamHost, Newfold Digital, A2 Hosting, Inmotion Hosting, Plesk International, Tektonic, Vultr Holdings Corporation, Linode.

3. What are the main segments of the Virtual Private Server Software?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Virtual Private Server Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Virtual Private Server Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Virtual Private Server Software?

To stay informed about further developments, trends, and reports in the Virtual Private Server Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence