Key Insights

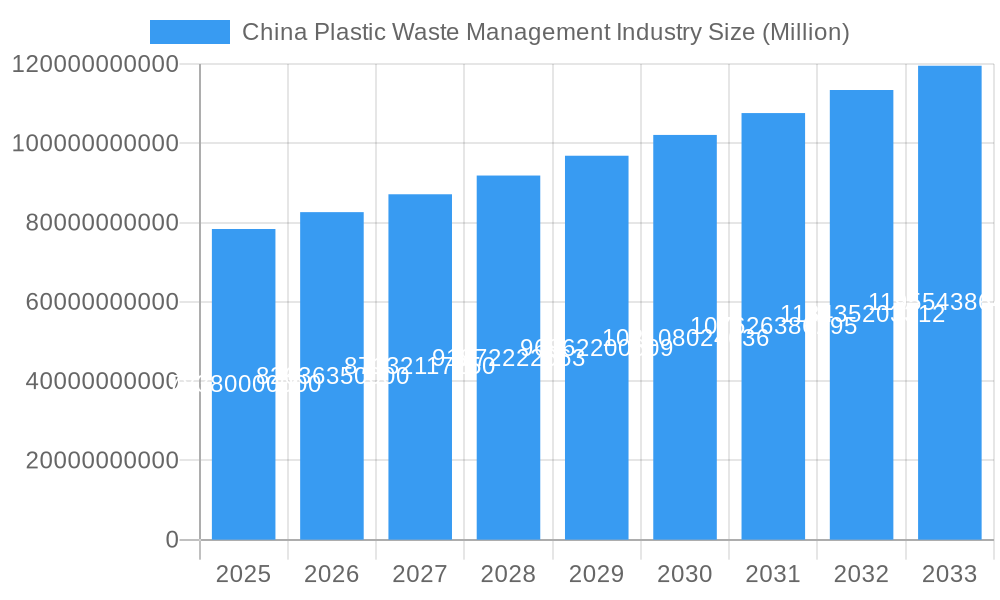

The China plastic waste management market, valued at $78.38 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.25% from 2025 to 2033. This expansion is driven by several key factors. Stringent government regulations aimed at curbing plastic pollution, coupled with increasing environmental awareness among consumers and businesses, are creating a strong demand for efficient waste management solutions. Furthermore, advancements in recycling technologies, particularly chemical recycling and advanced sorting techniques, are enhancing the economic viability and environmental performance of plastic waste processing. The rising adoption of Extended Producer Responsibility (EPR) schemes further incentivizes companies to improve their plastic waste management practices, contributing to market growth. Key players like China Everbright International Limited, Sembcorp Industries Ltd, and Veolia Environnement S.A. are driving innovation and expanding their market share through strategic partnerships, technological investments, and infrastructure development. This competitive landscape fosters continuous improvement and accelerates the market's overall expansion.

China Plastic Waste Management Industry Market Size (In Billion)

However, the market faces certain challenges. Limited infrastructure in certain regions of China, particularly in rural areas, hampers effective waste collection and processing. The heterogeneity of plastic waste streams and the complexity of separating different types of plastics present significant technological hurdles. Fluctuations in global commodity prices for recycled plastics also impact the profitability of waste management operations. Despite these constraints, the long-term outlook remains positive, fueled by continuous policy support, technological breakthroughs, and the growing understanding of the environmental and economic benefits of effective plastic waste management. The market's segmentation, though not explicitly detailed, likely includes services such as collection, sorting, processing, and recycling, as well as the sale of recycled materials. This segmentation further underscores the diverse opportunities and challenges within this dynamic industry.

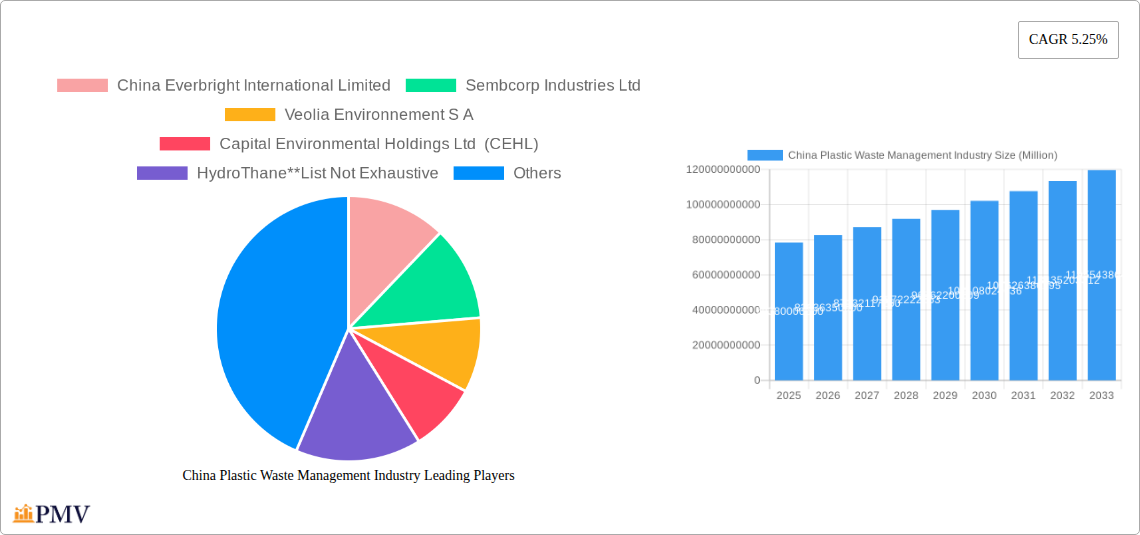

China Plastic Waste Management Industry Company Market Share

China Plastic Waste Management Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China plastic waste management industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and the forecast period spanning 2025-2033. The report leverages extensive data from the historical period (2019-2024) to provide accurate market projections and actionable intelligence. The market size is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

China Plastic Waste Management Industry Market Structure & Competitive Dynamics

The China plastic waste management industry exhibits a moderately concentrated market structure, with several key players dominating significant market shares. While precise figures for market share are proprietary to the full report, China Everbright International Limited, Sembcorp Industries Ltd, Veolia Environnement S A, Capital Environmental Holdings Ltd (CEHL), and HydroThane hold substantial positions. The industry's competitive landscape is shaped by factors including technological innovation, stringent regulatory frameworks aimed at reducing plastic pollution, the emergence of product substitutes (e.g., biodegradable plastics), evolving end-user trends towards sustainable practices, and ongoing mergers and acquisitions (M&A) activities.

- Market Concentration: The market is characterized by a mix of large multinational corporations and smaller, domestic players, leading to varied competitive strategies and market penetration levels.

- Innovation Ecosystems: Significant investment in R&D fuels innovation in waste-to-energy technologies, advanced recycling techniques, and smart waste management solutions.

- Regulatory Frameworks: The Chinese government's increasingly strict environmental regulations drive industry consolidation and the adoption of cleaner technologies.

- Product Substitutes: The growing adoption of biodegradable plastics presents both a challenge and an opportunity for traditional waste management companies.

- End-User Trends: Shifting consumer preferences towards environmentally conscious products are influencing demand for efficient and sustainable waste management services.

- M&A Activities: Several M&A deals in the past five years, with an estimated total value of xx Million, have reshaped the competitive landscape through consolidation and expansion.

China Plastic Waste Management Industry Industry Trends & Insights

The China plastic waste management industry is experiencing robust growth, driven by a confluence of factors. Stringent government regulations on plastic waste disposal are a key driver, pushing companies to adopt modern waste management solutions. Rising environmental awareness among consumers and increasing urbanization are further accelerating market expansion. Technological advancements, such as AI-powered waste sorting and advanced recycling technologies, are transforming the industry's efficiency and sustainability. The market is also witnessing increased adoption of Public-Private Partnerships (PPPs) to improve infrastructure and service delivery. The competitive landscape is characterized by both intense rivalry among existing players and the emergence of new entrants with innovative technologies. This dynamic environment has led to a significant increase in investment in the sector, particularly in regions with high plastic waste generation. The market penetration of advanced recycling technologies is gradually increasing, though challenges remain in scaling up these solutions nationwide.

Dominant Markets & Segments in China Plastic Waste Management Industry

Coastal regions and major metropolitan areas in eastern and southern China are currently leading the market due to factors like higher population density, greater waste generation, and better infrastructure.

- Key Drivers in Dominant Regions:

- Economic Policies: Government initiatives promoting sustainable development and waste reduction incentivize private sector investment.

- Infrastructure Development: Investments in waste collection, sorting, and processing facilities are crucial for handling large volumes of plastic waste.

- Stringent Environmental Regulations: Stricter enforcement and penalties for illegal dumping drive the adoption of proper waste management practices.

- Consumer Awareness: Increasing awareness of environmental issues pushes consumers to participate in recycling programs.

Detailed analysis within the full report reveals that the xx region exhibits the highest market share, driven by a combination of strong government support, robust infrastructure, and a high concentration of industries generating substantial amounts of plastic waste. The market segment focused on xx type of plastic waste also showcases robust growth due to its high recyclability and the associated economic benefits.

China Plastic Waste Management Industry Product Innovations

Recent years have seen significant advancements in plastic waste management technologies, including the development of advanced recycling processes, such as chemical recycling and pyrolysis, which allow for the recovery of valuable materials from plastic waste. Furthermore, innovations in waste-to-energy technologies, such as gasification and anaerobic digestion, are gaining traction, providing sustainable solutions for plastic waste disposal and energy generation. These innovations offer significant competitive advantages by improving efficiency, reducing environmental impact, and creating new revenue streams. The market is witnessing increasing adoption of smart waste management systems that use sensor technology and data analytics to optimize waste collection and sorting processes.

Report Segmentation & Scope

This report segments the China plastic waste management industry based on various parameters:

By Waste Type: This segment includes detailed analysis of the management of different types of plastic waste (e.g., PET, HDPE, PVC). Growth projections and market size estimations are provided for each category.

By Technology: This segment covers various technologies used in plastic waste management, including mechanical recycling, chemical recycling, waste-to-energy, and landfill. Competitive dynamics and market size for each technology are discussed.

By Service Type: This segment analyzes different services offered in the plastic waste management industry, such as waste collection, sorting, processing, and disposal.

Key Drivers of China Plastic Waste Management Industry Growth

Several key factors contribute to the growth of the China plastic waste management industry:

Stringent Government Regulations: The Chinese government's commitment to environmental protection has led to stricter regulations and policies promoting sustainable waste management.

Technological Advancements: Innovations in waste sorting, recycling, and waste-to-energy technologies are increasing efficiency and sustainability.

Rising Environmental Awareness: Increased consumer awareness of environmental issues is driving demand for responsible waste management solutions.

Economic Incentives: Government initiatives and subsidies are promoting private sector investment in the industry.

Challenges in the China Plastic Waste Management Industry Sector

Despite its growth potential, the industry faces several challenges:

Inadequate Infrastructure: Lack of sufficient waste collection and processing facilities in certain regions hinders efficient waste management.

High Recycling Costs: The cost of advanced recycling technologies can be prohibitive for some companies.

Illegal Waste Dumping: Illegal dumping of plastic waste remains a significant environmental issue. This results in an estimated xx Million in lost revenue annually due to uncollected waste.

Leading Players in the China Plastic Waste Management Industry Market

- China Everbright International Limited

- Sembcorp Industries Ltd

- Veolia Environnement S A

- Capital Environmental Holdings Ltd (CEHL)

- HydroThane

Key Developments in China Plastic Waste Management Industry Sector

October 2022: Launch of a new advanced recycling facility by Company X in Shanghai, significantly increasing recycling capacity in the region.

June 2023: Implementation of stricter regulations on plastic waste disposal in Guangdong province.

February 2024: Merger of two leading waste management companies, leading to increased market concentration. (Further details within full report.)

Strategic China Plastic Waste Management Industry Market Outlook

The future of the China plastic waste management industry is bright, with significant growth opportunities driven by continued government support, technological advancements, and rising environmental consciousness. Strategic partnerships between public and private sectors will play a key role in expanding the infrastructure needed to effectively manage the country's ever-growing plastic waste volume. Companies that can innovate and adopt sustainable practices will be best positioned to capture a significant market share in the years to come. The potential for waste-to-energy and advanced recycling technologies to create new revenue streams represents a substantial opportunity for future growth and sustainability.

China Plastic Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. Hazardous waste

- 1.4. E-waste

- 1.5. Plastic waste

- 1.6. Bio-medical waste

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

-

3. Type of ownership

- 3.1. Public

- 3.2. Private

- 3.3. Public - Private Patnership

China Plastic Waste Management Industry Segmentation By Geography

- 1. China

China Plastic Waste Management Industry Regional Market Share

Geographic Coverage of China Plastic Waste Management Industry

China Plastic Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Spotlight on the China e-waste generation and its effective management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Plastic Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. Hazardous waste

- 5.1.4. E-waste

- 5.1.5. Plastic waste

- 5.1.6. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Type of ownership

- 5.3.1. Public

- 5.3.2. Private

- 5.3.3. Public - Private Patnership

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Everbright International Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sembcorp Industries Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Veolia Environnement S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Capital Environmental Holdings Ltd (CEHL)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HydroThane**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 China Everbright International Limited

List of Figures

- Figure 1: China Plastic Waste Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Plastic Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: China Plastic Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: China Plastic Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: China Plastic Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: China Plastic Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: China Plastic Waste Management Industry Revenue Million Forecast, by Type of ownership 2020 & 2033

- Table 6: China Plastic Waste Management Industry Volume Billion Forecast, by Type of ownership 2020 & 2033

- Table 7: China Plastic Waste Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: China Plastic Waste Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: China Plastic Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 10: China Plastic Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 11: China Plastic Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 12: China Plastic Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 13: China Plastic Waste Management Industry Revenue Million Forecast, by Type of ownership 2020 & 2033

- Table 14: China Plastic Waste Management Industry Volume Billion Forecast, by Type of ownership 2020 & 2033

- Table 15: China Plastic Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China Plastic Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Plastic Waste Management Industry?

The projected CAGR is approximately 5.25%.

2. Which companies are prominent players in the China Plastic Waste Management Industry?

Key companies in the market include China Everbright International Limited, Sembcorp Industries Ltd, Veolia Environnement S A, Capital Environmental Holdings Ltd (CEHL), HydroThane**List Not Exhaustive.

3. What are the main segments of the China Plastic Waste Management Industry?

The market segments include Waste type, Disposal methods, Type of ownership.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.38 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Spotlight on the China e-waste generation and its effective management.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Plastic Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Plastic Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Plastic Waste Management Industry?

To stay informed about further developments, trends, and reports in the China Plastic Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence