Key Insights

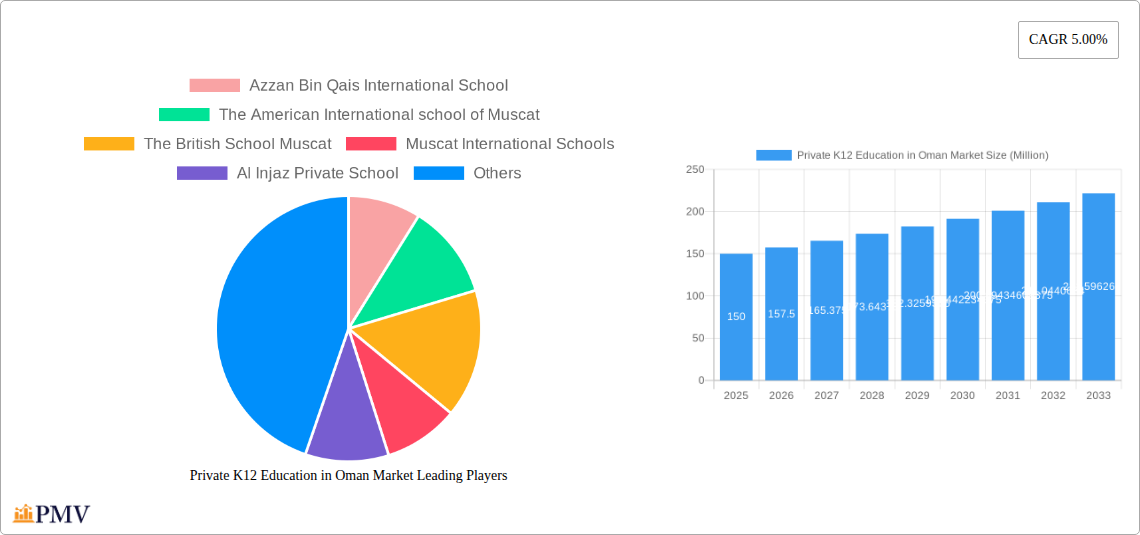

The Private K12 Education market in Oman is poised for robust expansion, projected to reach an estimated XX million by 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 5.00% through 2033. This growth is fueled by a confluence of factors, primarily driven by increasing parental aspirations for high-quality, globally recognized education for their children. The demand for international curricula such as American, British, and CBSE is steadily rising as Omani families seek to equip their students with skills and knowledge that align with global standards, enhancing their future academic and career prospects. This upward trend is further supported by government initiatives aimed at improving the overall educational landscape and a growing expatriate population that contributes to the demand for international schooling. The market is characterized by a diverse range of revenue sources, spanning from Kindergarten to Secondary education, catering to a broad spectrum of parental needs and student developmental stages. Key players like Azzan Bin Qais International School and The American International School of Muscat are at the forefront, investing in modern pedagogical approaches and state-of-the-art facilities to meet this escalating demand.

Private K12 Education in Oman Market Market Size (In Million)

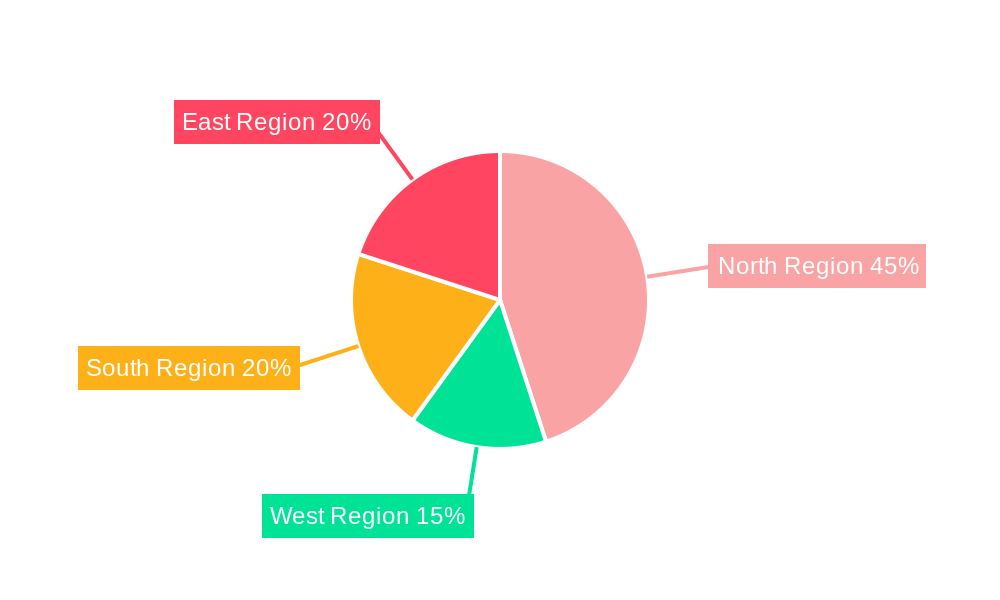

The market dynamics are also shaped by significant trends, including the integration of technology in classrooms, a greater emphasis on holistic development encompassing extracurricular activities, and the adoption of innovative teaching methodologies. However, certain restraints, such as the relatively high tuition fees for premium international schools, can pose a challenge to accessibility for a segment of the population. Nevertheless, the overall outlook remains optimistic, with strategic investments in educational infrastructure and a commitment to fostering a competitive yet nurturing learning environment. The segmentation of the market by curriculum, including American, British, Arabic, CBSE, and others, reflects the diverse educational preferences within Oman. Furthermore, regional data indicates a concentrated demand in the North Region, likely driven by population density and economic activity, although other regions are also showing signs of growth as educational access expands. The projected market trajectory underscores Oman's commitment to enhancing its K12 education sector, aligning with national visions for human capital development.

Private K12 Education in Oman Market Company Market Share

Here is an SEO-optimized, detailed report description for Private K12 Education in Oman Market, incorporating your specified details and structure.

This in-depth market report provides a holistic view of the Oman private K12 education market, offering critical insights for investors, educational institutions, and policymakers. Covering the study period 2019–2033, with a base year of 2025 and an estimated year of 2025, this report meticulously analyzes historical data from 2019–2024 and projects future trends during the forecast period 2025–2033. The Omani K12 education sector is experiencing robust growth, driven by increasing demand for high-quality international curricula and a rising expatriate population. This report delves into market structure, competitive dynamics, industry trends, dominant segments, product innovations, and strategic outlooks, equipping stakeholders with actionable intelligence for informed decision-making in the Oman education market. Explore key segments such as Kindergarten, Primary, Intermediary, and Secondary education, alongside curriculum types including American, British, Arabic, CBSE, and Others. Understand the influence of international school Omani market, private school investment Oman, and education technology Oman.

Private K12 Education in Oman Market Structure & Competitive Dynamics

The Oman private K12 education market exhibits a moderate to high degree of market concentration, with a few established international schools holding significant market share, estimated to be around 60% in 2025. Key players like Azzan Bin Qais International School, The American International School of Muscat, and The British School Muscat lead this segment. Innovation ecosystems are rapidly evolving, with a growing emphasis on digital learning tools and blended learning models, impacting Oman school curriculum development. The regulatory framework, overseen by the Ministry of Education, ensures quality standards but also presents avenues for strategic partnerships and compliance for new entrants. Product substitutes are limited, with the primary alternative being public education, which caters to a different segment of the population. End-user trends indicate a strong preference for Western-style curricula, particularly American and British, driven by parental aspirations for overseas higher education. Mergers and acquisitions (M&A) activities are nascent but present significant opportunities; recent estimated M&A deal values for academic acquisitions in similar regional markets have ranged between 5 to 15 Million, suggesting potential for consolidation and strategic expansion within Oman. Understanding these dynamics is crucial for navigating the Omani international school landscape.

Private K12 Education in Oman Market Industry Trends & Insights

The Oman private K12 education market is poised for significant expansion, driven by a confluence of factors that reshape the educational landscape. Economic diversification initiatives by the Omani government are fostering a more robust and attractive environment for foreign direct investment, leading to an influx of expatriate professionals and their families, thereby increasing demand for private schooling options. This demographic shift is a primary growth driver for the Oman school enrollment trends. Technological disruptions are revolutionizing teaching methodologies and student engagement. The widespread adoption of education technology in Oman, including Learning Management Systems (LMS), interactive whiteboards, and AI-powered tutoring platforms, is enhancing the learning experience and improving educational outcomes. Consumer preferences are increasingly sophisticated, with parents actively seeking schools that offer a holistic education, focusing on critical thinking, creativity, and international mindedness, aligning with the Oman curriculum trends. The competitive dynamics are intensifying, with both established institutions and new entrants vying for market share. This includes a growing interest in specialized educational offerings, such as STEM-focused programs and those catering to specific learning needs. The projected Compound Annual Growth Rate (CAGR) for the Oman private K12 education market is an impressive 7.5% between 2025 and 2033, with market penetration expected to reach 45% by 2033. The average fee for private K12 education in Oman is estimated to be between 5,000 to 15,000 per annum, with premium international schools commanding higher fees. This sustained growth underscores the Oman private education opportunities.

Dominant Markets & Segments in Private K12 Education in Oman Market

Within the Oman private K12 education market, the Primary segment is currently the most dominant, accounting for an estimated 35% of the total market share in 2025. This dominance is fueled by parents prioritizing early educational foundations and seeking established international curricula for their children's formative years. The British curriculum holds a significant lead, representing approximately 40% of the private K12 offerings, closely followed by the American curriculum at around 35%. This preference is largely attributed to their global recognition and perceived advantages for university admissions abroad.

Source of Revenue Dominance:

- Primary Education: Key drivers include the increasing number of young families, government initiatives promoting early childhood education, and parental emphasis on foundational learning. Estimated market size for Primary segment in 2025 is around 120 Million.

- Secondary Education: While currently holding a smaller share (approximately 25%), it is projected to grow robustly due to the demand for specialized programs preparing students for higher education. Its projected market size in 2025 is around 85 Million.

Curriculum Dominance:

- British Curriculum: Drivers include its established reputation, rigorous academic standards, and strong links to UK and Commonwealth universities. This segment is estimated to be worth 140 Million in 2025.

- American Curriculum: Key drivers are its flexibility, broad-based education, and pathways to North American universities. This segment is projected at 120 Million in 2025.

- Arabic Curriculum: While a smaller segment within the private market, it serves a crucial demographic seeking culturally aligned education, with an estimated market size of 30 Million in 2025.

- CBSE: Growing in popularity among the Indian expatriate community, with an estimated market size of 25 Million in 2025.

- Others: This includes various international curricula, contributing to market diversity.

Economic policies encouraging foreign investment and a rising disposable income among the Omani population further bolster the demand for high-quality private education, underpinning the dominance of these segments.

Private K12 Education in Oman Market Product Innovations

Product innovations in the Oman private K12 education market are largely centered on enhancing the learning experience through technology and pedagogical advancements. Schools are increasingly integrating adaptive learning platforms that personalize educational content based on individual student progress, fostering a more efficient learning path. The development of blended learning models, combining online resources with traditional classroom instruction, offers flexibility and accessibility. Furthermore, there's a growing emphasis on STEAM (Science, Technology, Engineering, Arts, and Mathematics) education, with schools investing in advanced laboratory equipment and maker spaces. These innovations provide a significant competitive advantage by catering to evolving parental expectations and preparing students for future-ready careers.

Report Segmentation & Scope

This report segments the Oman private K12 education market across critical parameters to provide granular insights.

Source of Revenue:

- Kindergarten: Encompasses early childhood education, focusing on foundational skills and socialization. Projections indicate a 6% CAGR, with a market size of 30 Million in 2025.

- Primary: Covers elementary education (Grades 1-5), characterized by strong demand and established curricula. Growth is projected at 7% CAGR, with a market size of 120 Million in 2025.

- Intermediary: Covers middle school grades (Grades 6-8), focusing on subject specialization and preparing students for secondary levels. Expected CAGR of 6.5%, with a market size of 50 Million in 2025.

- Secondary: Encompasses high school education (Grades 9-12), crucial for university admissions and career preparation. Projected CAGR of 8%, with a market size of 85 Million in 2025.

Curriculum:

- American: Offers a broad, flexible education leading to global university access. Projected CAGR of 7%, with a market size of 120 Million in 2025.

- British: Known for its academic rigor and established global recognition. Projected CAGR of 7.2%, with a market size of 140 Million in 2025.

- Arabic: Caters to a specific cultural and linguistic preference. Projected CAGR of 5%, with a market size of 30 Million in 2025.

- CBSE: Popular among the Indian expatriate community, offering a well-structured curriculum. Projected CAGR of 6%, with a market size of 25 Million in 2025.

- Others: Includes a variety of international curricula, offering diverse educational pathways. Projected CAGR of 5.5%, with a market size of 15 Million in 2025.

Key Drivers of Private K12 Education in Oman Market Growth

The Oman private K12 education market is propelled by several key drivers. Government initiatives promoting economic diversification and attracting foreign talent create a continuous demand for international schooling. The increasing disposable income and rising living standards among both expatriate and local families enable greater investment in private education. Furthermore, parents' aspirations for their children to gain access to prestigious international universities drive the demand for globally recognized curricula like American and British systems. The growing adoption of educational technology enhances learning outcomes and makes private education more attractive. The development of robust infrastructure for educational institutions further supports market expansion.

Challenges in the Private K12 Education in Oman Market Sector

Despite robust growth, the Oman private K12 education market faces several challenges. Regulatory compliance and the evolving landscape of accreditation requirements can pose significant hurdles for new entrants and existing institutions. The high cost of tuition fees can limit accessibility for a segment of the population, impacting market penetration. Intensifying competition among a growing number of private schools necessitates continuous innovation and differentiation to retain market share. Securing and retaining highly qualified expatriate teachers is a perpetual challenge, impacting the quality of education delivered. Supply chain issues related to educational materials and specialized equipment can also present minor disruptions.

Leading Players in the Private K12 Education in Oman Market Market

- Azzan Bin Qais International School

- The American International School of Muscat

- The British School Muscat

- Muscat International Schools

- Al Injaz Private School

- The International School of Choueifat - Muscat

Key Developments in Private K12 Education in Oman Market Sector

- 2023 Q4: Launch of new STEM-focused programs at leading international schools to align with Oman Vision 2040.

- 2024 Q1: Increased investment in digital learning platforms and virtual reality educational tools by several private schools.

- 2024 Q2: Expansion of extracurricular activities and global exchange programs to enhance student holistic development.

- 2024 Q3: Introduction of scholarships and financial aid programs by some institutions to attract a wider student demographic.

- 2024 Q4: Growing interest in establishing niche international schools offering specialized curricula like IB (International Baccalaureate).

Strategic Private K12 Education in Oman Market Market Outlook

The strategic outlook for the Oman private K12 education market remains exceptionally positive. The ongoing commitment to economic diversification and the continued influx of expatriates will sustain robust demand for high-quality international education. Future growth accelerators will include the further integration of cutting-edge educational technologies, the expansion of specialized educational offerings, and a greater focus on personalized learning pathways. Strategic opportunities lie in developing new campuses in underserved regions, forging partnerships with local businesses for vocational training integration, and enhancing digital infrastructure to support hybrid learning models. The market is set for sustained expansion and increasing sophistication in educational delivery.

Private K12 Education in Oman Market Segmentation

-

1. Source of Revenue

- 1.1. Kindergarten

- 1.2. Primary

- 1.3. Intermediary

- 1.4. Secondary

-

2. Curriculum

- 2.1. American

- 2.2. British

- 2.3. Arabic

- 2.4. CBSE

- 2.5. Others

Private K12 Education in Oman Market Segmentation By Geography

- 1. North Region

- 2. West region

- 3. South Region

- 4. East Region

Private K12 Education in Oman Market Regional Market Share

Geographic Coverage of Private K12 Education in Oman Market

Private K12 Education in Oman Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Government initiatives - National Education Strategy 2040

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.1.1. Kindergarten

- 5.1.2. Primary

- 5.1.3. Intermediary

- 5.1.4. Secondary

- 5.2. Market Analysis, Insights and Forecast - by Curriculum

- 5.2.1. American

- 5.2.2. British

- 5.2.3. Arabic

- 5.2.4. CBSE

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North Region

- 5.3.2. West region

- 5.3.3. South Region

- 5.3.4. East Region

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6. North Region Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6.1.1. Kindergarten

- 6.1.2. Primary

- 6.1.3. Intermediary

- 6.1.4. Secondary

- 6.2. Market Analysis, Insights and Forecast - by Curriculum

- 6.2.1. American

- 6.2.2. British

- 6.2.3. Arabic

- 6.2.4. CBSE

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7. West region Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7.1.1. Kindergarten

- 7.1.2. Primary

- 7.1.3. Intermediary

- 7.1.4. Secondary

- 7.2. Market Analysis, Insights and Forecast - by Curriculum

- 7.2.1. American

- 7.2.2. British

- 7.2.3. Arabic

- 7.2.4. CBSE

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8. South Region Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8.1.1. Kindergarten

- 8.1.2. Primary

- 8.1.3. Intermediary

- 8.1.4. Secondary

- 8.2. Market Analysis, Insights and Forecast - by Curriculum

- 8.2.1. American

- 8.2.2. British

- 8.2.3. Arabic

- 8.2.4. CBSE

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9. East Region Private K12 Education in Oman Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9.1.1. Kindergarten

- 9.1.2. Primary

- 9.1.3. Intermediary

- 9.1.4. Secondary

- 9.2. Market Analysis, Insights and Forecast - by Curriculum

- 9.2.1. American

- 9.2.2. British

- 9.2.3. Arabic

- 9.2.4. CBSE

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Azzan Bin Qais International School

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 The American International school of Muscat

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The British School Muscat

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Muscat International Schools

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Al Injaz Private School

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The International School of Choueifat - Muscat**List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Azzan Bin Qais International School

List of Figures

- Figure 1: Global Private K12 Education in Oman Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North Region Private K12 Education in Oman Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 3: North Region Private K12 Education in Oman Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 4: North Region Private K12 Education in Oman Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 5: North Region Private K12 Education in Oman Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 6: North Region Private K12 Education in Oman Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North Region Private K12 Education in Oman Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: West region Private K12 Education in Oman Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 9: West region Private K12 Education in Oman Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 10: West region Private K12 Education in Oman Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 11: West region Private K12 Education in Oman Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 12: West region Private K12 Education in Oman Market Revenue (Million), by Country 2025 & 2033

- Figure 13: West region Private K12 Education in Oman Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South Region Private K12 Education in Oman Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 15: South Region Private K12 Education in Oman Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 16: South Region Private K12 Education in Oman Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 17: South Region Private K12 Education in Oman Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 18: South Region Private K12 Education in Oman Market Revenue (Million), by Country 2025 & 2033

- Figure 19: South Region Private K12 Education in Oman Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: East Region Private K12 Education in Oman Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 21: East Region Private K12 Education in Oman Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 22: East Region Private K12 Education in Oman Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 23: East Region Private K12 Education in Oman Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 24: East Region Private K12 Education in Oman Market Revenue (Million), by Country 2025 & 2033

- Figure 25: East Region Private K12 Education in Oman Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 2: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 3: Global Private K12 Education in Oman Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 5: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 6: Global Private K12 Education in Oman Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 8: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 9: Global Private K12 Education in Oman Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 11: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 12: Global Private K12 Education in Oman Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Private K12 Education in Oman Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 14: Global Private K12 Education in Oman Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 15: Global Private K12 Education in Oman Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Private K12 Education in Oman Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Private K12 Education in Oman Market?

Key companies in the market include Azzan Bin Qais International School, The American International school of Muscat, The British School Muscat, Muscat International Schools, Al Injaz Private School, The International School of Choueifat - Muscat**List Not Exhaustive.

3. What are the main segments of the Private K12 Education in Oman Market?

The market segments include Source of Revenue, Curriculum.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Government initiatives - National Education Strategy 2040.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Private K12 Education in Oman Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Private K12 Education in Oman Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Private K12 Education in Oman Market?

To stay informed about further developments, trends, and reports in the Private K12 Education in Oman Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence