Key Insights

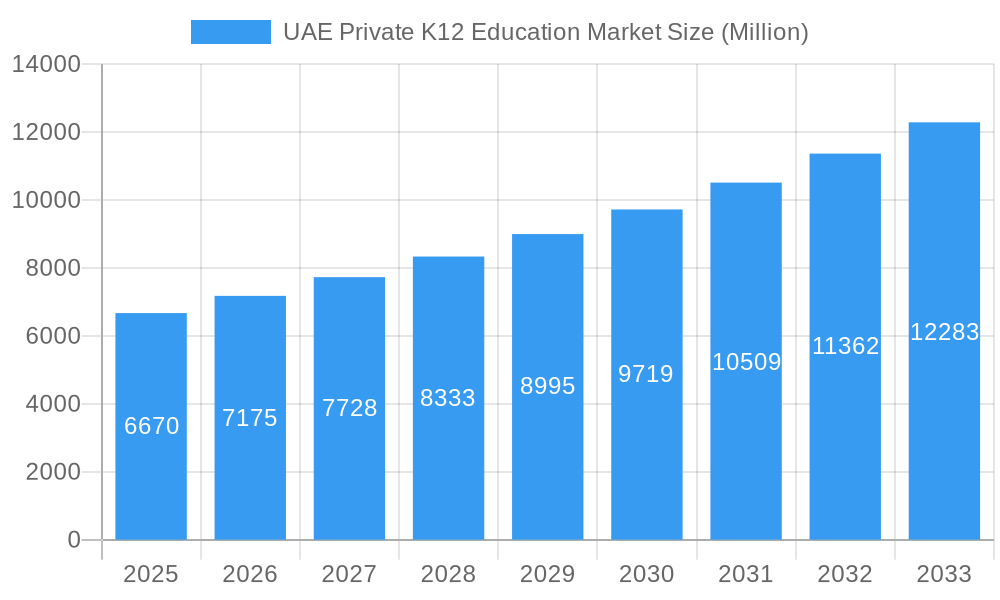

The UAE private K-12 education market exhibits robust growth, projected to reach a market size of \$6.67 billion in 2025, with a compound annual growth rate (CAGR) of 7.5% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning expatriate population seeking high-quality international curricula contributes significantly to market demand. Furthermore, increasing disposable incomes among UAE residents fuel the willingness to invest in premium private education. The government's continued emphasis on improving educational infrastructure and standards further enhances the market's attractiveness. The rising preference for bilingual and international curricula, along with the growing adoption of technology-integrated learning methods, also contributes to market expansion. Competitive pressures from established international schools and new entrants drive innovation and improvements in educational offerings, enhancing the overall quality of education available.

UAE Private K12 Education Market Market Size (In Billion)

The market is segmented by school type (e.g., British, American, IB), curriculum offered, and location. Major players, including GEMS Education, Athena Education, Taleem, Esol Education, and others, compete fiercely, investing in infrastructure upgrades, curriculum development, and attracting high-quality teaching staff. However, challenges exist, such as regulatory changes, potential tuition fee increases impacting affordability, and ensuring alignment with national educational standards. Despite these constraints, the long-term outlook for the UAE private K-12 education market remains positive, driven by consistent population growth, a commitment to quality education, and continuous improvements in infrastructure and teaching methodologies. The market is expected to experience significant growth throughout the forecast period (2025-2033), driven by the factors mentioned above.

UAE Private K12 Education Market Company Market Share

UAE Private K12 Education Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the UAE Private K12 Education market, covering the period from 2019 to 2033. It offers in-depth insights into market structure, competitive dynamics, industry trends, key players, and future growth potential, empowering stakeholders to make informed strategic decisions. The report uses 2025 as its base year and provides forecasts until 2033, with historical data spanning 2019-2024. The market size is predicted to reach xx Million by 2033.

UAE Private K12 Education Market Structure & Competitive Dynamics

The UAE Private K12 education market is characterized by a moderately concentrated landscape, with several large players commanding significant market share. GEMS Education, for instance, holds a substantial portion, estimated at xx%, reflecting its extensive network of schools. However, the market also features numerous smaller, specialized institutions catering to niche segments. The competitive landscape is further shaped by robust regulatory frameworks that emphasize quality and standards, fostering an environment of continuous improvement and innovation. The regulatory emphasis on curriculum and teacher qualifications acts as a significant barrier to entry for new players. Innovation ecosystems are developing, driven by technology integration and the increasing demand for personalized learning experiences. The market witnesses ongoing mergers and acquisitions (M&A) activity, with deal values averaging xx Million in recent years. These M&A activities often involve strategic expansions, acquisitions of smaller schools, and international collaborations. Product substitution is limited as the primary service is education itself, though schools compete through differentiated curricula, facilities and extracurricular activities. End-user trends reveal a growing preference for international curricula and bilingual programs, reflecting the UAE's multicultural population.

- Market Concentration: Moderately concentrated, with GEMS Education holding a significant market share (xx%).

- M&A Activity: Significant activity with average deal values of approximately xx Million.

- Innovation: Focus on technology integration and personalized learning.

- Regulatory Framework: Stringent standards and curriculum guidelines.

- End-User Trends: Growing preference for international curricula and bilingual education.

UAE Private K12 Education Market Industry Trends & Insights

The UAE Private K12 education market is experiencing robust growth, driven by several factors. The increasing expatriate population, coupled with a rising demand for high-quality education, fuels market expansion. A strong emphasis on early childhood education and the government’s investment in education infrastructure contribute to growth. The compound annual growth rate (CAGR) during the historical period (2019-2024) was approximately xx%, and is projected to remain strong at xx% during the forecast period (2025-2033). Technological disruptions, particularly the increased adoption of EdTech solutions, are transforming learning experiences. Consumer preferences are shifting toward personalized learning, flexible curricula, and blended learning models, prompting educational institutions to adapt. Competitive dynamics are further intensified by the entry of new international schools and the expansion of existing players. Market penetration of international curricula is high, estimated at xx%, showcasing the popularity of British, American, and IB programs.

Dominant Markets & Segments in UAE Private K12 Education Market

Dubai remains the dominant market within the UAE's private K12 education sector, driven by a higher concentration of expatriates, robust economic activity, and well-developed infrastructure. Abu Dhabi also contributes significantly, though at a comparatively lower level.

- Key Drivers of Dubai's Dominance:

- High expatriate population.

- Strong economic growth.

- Well-developed infrastructure and facilities.

- Government support for private education.

- Availability of diverse international curricula.

The dominance of Dubai is primarily driven by the large expatriate community seeking international education standards for their children. The city's robust economy and developed infrastructure also provide a favorable environment for private schools to flourish. Government policies supporting private education and the availability of a wide range of international curricula further solidify Dubai's position as the leading market. Abu Dhabi, while a significant player, follows Dubai's lead in growth, although at a slightly slower pace, primarily due to a relatively smaller expatriate population compared to Dubai.

UAE Private K12 Education Market Product Innovations

Recent innovations in the UAE Private K12 education market include the integration of technology into classrooms, personalized learning platforms, and the increasing adoption of blended learning models combining online and in-person instruction. These innovations aim to enhance learning outcomes, cater to diverse learning styles, and improve efficiency. The competitive advantage lies in providing a holistic educational experience leveraging these technological advancements while maintaining a strong focus on traditional teaching methodologies.

Report Segmentation & Scope

The report segments the market based on school type (e.g., British curriculum, American curriculum, IB), grade level (primary, secondary), and location (Dubai, Abu Dhabi, other emirates). Each segment offers unique growth projections and competitive dynamics. For example, the British curriculum segment shows a strong growth projection due to its popularity among expatriates, while the growth in other emirates is projected to lag behind Dubai and Abu Dhabi.

Key Drivers of UAE Private K12 Education Market Growth

The UAE's private K12 education market is propelled by several key factors: a growing expatriate population demanding international standards, significant government investment in education infrastructure, rising disposable incomes enabling parents to afford private education, and the increasing adoption of technological advancements in teaching methodologies. These factors combined are driving consistent market expansion.

Challenges in the UAE Private K12 Education Market Sector

The sector faces challenges including stringent regulatory compliance, intense competition among numerous schools, and potential economic fluctuations impacting parental affordability of private education. The cost of maintaining high-quality teachers and facilities also presents significant ongoing operational challenges.

Leading Players in the UAE Private K12 Education Market

- GEMS Education

- Athena Education

- Taleem

- Esol Education

- Kings' Schools Group

- SABIS Education Services

- British International School

- Al-Mizhar American Academy

- Nord Anglia Education

- Dubai American Academy

- Glendale International School

- Deira International School

Key Developments in UAE Private K12 Education Market Sector

- May 2023: Glendale International School opened in Dubai, with a capacity of 3000 students, signifying significant investment and expansion in the sector.

- March 2023: Kings’ Education, Dubai, partnered with Leap, enhancing its study abroad offerings and catering to student aspirations.

Strategic UAE Private K12 Education Market Outlook

The UAE Private K12 education market holds immense potential for future growth. Strategic opportunities lie in capitalizing on technological advancements, offering specialized programs catering to niche demands (e.g., STEM, arts), and expanding into less saturated regions within the UAE. Focus on personalized learning and international collaborations will be crucial for sustained success.

UAE Private K12 Education Market Segmentation

-

1. Source of Revenue

- 1.1. Kindergarten

- 1.2. Primary

- 1.3. Intermediary

- 1.4. Secondary

-

2. Curriculum

- 2.1. American

- 2.2. British

- 2.3. Arabic/UAE

- 2.4. Indian

- 2.5. Other Curricula

UAE Private K12 Education Market Segmentation By Geography

- 1. North Region

- 2. West Region

- 3. South Region

- 4. East Region

UAE Private K12 Education Market Regional Market Share

Geographic Coverage of UAE Private K12 Education Market

UAE Private K12 Education Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market

- 3.4. Market Trends

- 3.4.1 Increased Rate of Population Growth

- 3.4.2 including Expatriates

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 5.1.1. Kindergarten

- 5.1.2. Primary

- 5.1.3. Intermediary

- 5.1.4. Secondary

- 5.2. Market Analysis, Insights and Forecast - by Curriculum

- 5.2.1. American

- 5.2.2. British

- 5.2.3. Arabic/UAE

- 5.2.4. Indian

- 5.2.5. Other Curricula

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North Region

- 5.3.2. West Region

- 5.3.3. South Region

- 5.3.4. East Region

- 5.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6. North Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 6.1.1. Kindergarten

- 6.1.2. Primary

- 6.1.3. Intermediary

- 6.1.4. Secondary

- 6.2. Market Analysis, Insights and Forecast - by Curriculum

- 6.2.1. American

- 6.2.2. British

- 6.2.3. Arabic/UAE

- 6.2.4. Indian

- 6.2.5. Other Curricula

- 6.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7. West Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 7.1.1. Kindergarten

- 7.1.2. Primary

- 7.1.3. Intermediary

- 7.1.4. Secondary

- 7.2. Market Analysis, Insights and Forecast - by Curriculum

- 7.2.1. American

- 7.2.2. British

- 7.2.3. Arabic/UAE

- 7.2.4. Indian

- 7.2.5. Other Curricula

- 7.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8. South Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 8.1.1. Kindergarten

- 8.1.2. Primary

- 8.1.3. Intermediary

- 8.1.4. Secondary

- 8.2. Market Analysis, Insights and Forecast - by Curriculum

- 8.2.1. American

- 8.2.2. British

- 8.2.3. Arabic/UAE

- 8.2.4. Indian

- 8.2.5. Other Curricula

- 8.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9. East Region UAE Private K12 Education Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 9.1.1. Kindergarten

- 9.1.2. Primary

- 9.1.3. Intermediary

- 9.1.4. Secondary

- 9.2. Market Analysis, Insights and Forecast - by Curriculum

- 9.2.1. American

- 9.2.2. British

- 9.2.3. Arabic/UAE

- 9.2.4. Indian

- 9.2.5. Other Curricula

- 9.1. Market Analysis, Insights and Forecast - by Source of Revenue

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 GEMS Education

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Athena Education

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Taleem

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Esol Education

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kings' Schools Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SABIS Education Services

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 British International School

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Al-Mizhar American Academy

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nord Anglia Education

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dubai American Academy

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Glendale International School

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Deira International School**List Not Exhaustive

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 GEMS Education

List of Figures

- Figure 1: Global UAE Private K12 Education Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UAE Private K12 Education Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 4: North Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 5: North Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 6: North Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 7: North Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 8: North Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 9: North Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 10: North Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 11: North Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

- Figure 15: West Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 16: West Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 17: West Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 18: West Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 19: West Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 20: West Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 21: West Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 22: West Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 23: West Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 24: West Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 25: West Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: West Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 28: South Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 29: South Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 30: South Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 31: South Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 32: South Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 33: South Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 34: South Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 35: South Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 36: South Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 37: South Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: South Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

- Figure 39: East Region UAE Private K12 Education Market Revenue (Million), by Source of Revenue 2025 & 2033

- Figure 40: East Region UAE Private K12 Education Market Volume (Billion), by Source of Revenue 2025 & 2033

- Figure 41: East Region UAE Private K12 Education Market Revenue Share (%), by Source of Revenue 2025 & 2033

- Figure 42: East Region UAE Private K12 Education Market Volume Share (%), by Source of Revenue 2025 & 2033

- Figure 43: East Region UAE Private K12 Education Market Revenue (Million), by Curriculum 2025 & 2033

- Figure 44: East Region UAE Private K12 Education Market Volume (Billion), by Curriculum 2025 & 2033

- Figure 45: East Region UAE Private K12 Education Market Revenue Share (%), by Curriculum 2025 & 2033

- Figure 46: East Region UAE Private K12 Education Market Volume Share (%), by Curriculum 2025 & 2033

- Figure 47: East Region UAE Private K12 Education Market Revenue (Million), by Country 2025 & 2033

- Figure 48: East Region UAE Private K12 Education Market Volume (Billion), by Country 2025 & 2033

- Figure 49: East Region UAE Private K12 Education Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: East Region UAE Private K12 Education Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 2: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 3: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 4: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 5: Global UAE Private K12 Education Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global UAE Private K12 Education Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 8: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 9: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 10: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 11: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 14: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 15: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 16: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 17: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 20: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 21: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 22: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 23: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global UAE Private K12 Education Market Revenue Million Forecast, by Source of Revenue 2020 & 2033

- Table 26: Global UAE Private K12 Education Market Volume Billion Forecast, by Source of Revenue 2020 & 2033

- Table 27: Global UAE Private K12 Education Market Revenue Million Forecast, by Curriculum 2020 & 2033

- Table 28: Global UAE Private K12 Education Market Volume Billion Forecast, by Curriculum 2020 & 2033

- Table 29: Global UAE Private K12 Education Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global UAE Private K12 Education Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Private K12 Education Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the UAE Private K12 Education Market?

Key companies in the market include GEMS Education, Athena Education, Taleem, Esol Education, Kings' Schools Group, SABIS Education Services, British International School, Al-Mizhar American Academy, Nord Anglia Education, Dubai American Academy, Glendale International School, Deira International School**List Not Exhaustive.

3. What are the main segments of the UAE Private K12 Education Market?

The market segments include Source of Revenue, Curriculum.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market.

6. What are the notable trends driving market growth?

Increased Rate of Population Growth. including Expatriates.

7. Are there any restraints impacting market growth?

Government Initiatives to Achieve High Education Standards is Driving Market Growth; Growing Preferences for Private Education is Driving the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Glendale International School opened its doors to students aged 3 to 11 in Dubai. Singapore-based Global Schools Foundation announced the launch. Sprawling over 20,000 square meters, the new premises can accommodate 3000 students.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Private K12 Education Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Private K12 Education Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Private K12 Education Market?

To stay informed about further developments, trends, and reports in the UAE Private K12 Education Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence