Key Insights

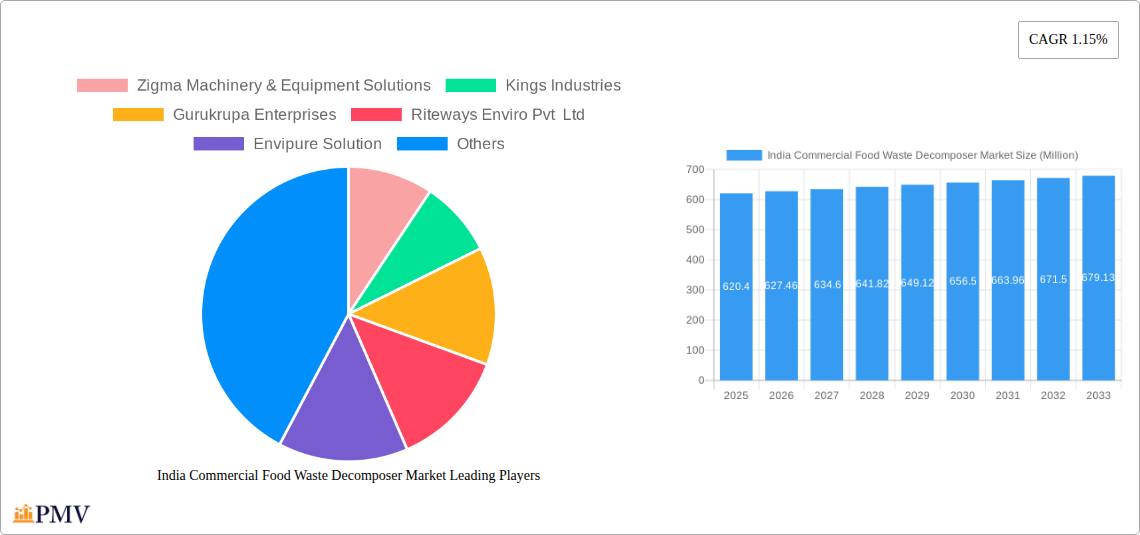

The India Commercial Food Waste Decomposer Market, valued at $620.40 million in 2025, is projected to experience steady growth driven by increasing awareness of sustainable waste management practices and stringent government regulations aimed at reducing landfill waste. The 1.15% CAGR indicates a relatively stable, albeit not explosive, market expansion over the forecast period (2025-2033). Key drivers include the burgeoning food service industry, particularly in urban areas, coupled with rising environmental concerns and the need for efficient waste disposal solutions. Trends such as the adoption of innovative composting technologies and the increasing preference for eco-friendly solutions further contribute to market growth. However, the market faces certain restraints, including high initial investment costs for decomposer systems and the need for consistent operational management and maintenance. Despite these challenges, the long-term outlook remains positive, fueled by supportive government policies and growing consumer demand for sustainable practices within the commercial food sector. The market's segmentation, while not explicitly detailed, likely includes variations in decomposer technology (e.g., aerobic, anaerobic), capacity, and target customer segments (e.g., restaurants, hotels, large-scale food processing units). This segmentation plays a critical role in determining the market’s future trajectory. The presence of numerous players, such as Zigma Machinery & Equipment Solutions, Kings Industries, and others, suggests a competitive landscape with opportunities for both established and emerging companies.

India Commercial Food Waste Decomposer Market Market Size (In Million)

The projected market size for the subsequent years will rely on consistent application of the CAGR. While the current data only provides a snapshot for 2025, the market’s gradual expansion is predicted to continue, reflecting a steady increase in demand. Factors like technological advancements, evolving government policies, and shifts in consumer preferences will influence this growth rate. Nevertheless, the relatively low CAGR suggests a mature market with potential for incremental gains rather than disruptive growth. Detailed regional analysis, while missing from the provided information, would offer valuable insights into market concentration and growth patterns across different regions within India. Further investigation into the specific technologies employed and their market share would also provide a more comprehensive understanding of the landscape.

India Commercial Food Waste Decomposer Market Company Market Share

India Commercial Food Waste Decomposer Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Commercial Food Waste Decomposer Market, offering invaluable insights for businesses, investors, and policymakers. Covering the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth trajectories. The report utilizes a rigorous methodology, incorporating both historical data (2019-2024) and future projections, to provide accurate and reliable market estimations in Million.

India Commercial Food Waste Decomposer Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the Indian commercial food waste decomposer market, focusing on market concentration, innovation, regulation, and M&A activities. The market exhibits a moderately fragmented structure with several key players vying for market share. The competitive landscape is further shaped by a dynamic innovation ecosystem, fostering the development of technologically advanced decomposers. Regulatory frameworks, while still evolving, play a crucial role in influencing market growth. The presence of substitute technologies, such as incineration and landfilling, presents challenges. However, increasing environmental concerns and stringent waste management regulations are driving the adoption of food waste decomposers.

End-user trends, particularly among hotels, restaurants, and commercial kitchens, favor efficient, hygienic, and environmentally friendly solutions. M&A activity in the global food waste management sector, exemplified by Whirlpool Corporation's acquisition of InSinkErator in April 2022 (a deal valued at xx Million), signals a trend of consolidation and expansion. While precise market share data for each Indian player is unavailable (xx%), the report estimates that the top 5 players account for approximately xx% of the market, reflecting a moderately consolidated but still competitive landscape.

India Commercial Food Waste Decomposer Market Industry Trends & Insights

The Indian commercial food waste decomposer market is witnessing significant growth, driven by several factors. Increasing urbanization, rising food consumption, and stricter government regulations regarding waste management are key growth catalysts. The market's CAGR during the forecast period (2025-2033) is estimated at xx%, indicating robust expansion. Technological disruptions, such as the introduction of advanced composting technologies and automated systems, are further enhancing the efficiency and appeal of these decomposers. Consumer preferences are shifting towards eco-friendly and sustainable waste management practices, creating strong demand. This trend is being further amplified by the heightened awareness regarding environmental sustainability and the associated cost savings. Market penetration is expected to increase from xx% in 2025 to xx% by 2033, showcasing the market's potential for growth.

Dominant Markets & Segments in India Commercial Food Waste Decomposer Market

The report identifies the metropolitan areas of major cities in India as the dominant market for commercial food waste decomposers. Key drivers for this dominance include:

- High population density: Leading to increased food waste generation.

- Stringent waste management regulations: Encouraging adoption of efficient waste processing solutions.

- Developed infrastructure: Enabling the efficient installation and operation of decomposers.

- Growing awareness of environmental sustainability: Among businesses and consumers.

This segment is expected to dominate the market throughout the forecast period due to the confluence of these factors. The detailed analysis within the report reveals that the hotel and restaurant segments are the largest contributors within this space. The continued growth in this sector is attributed to stringent hygiene standards and government regulations.

India Commercial Food Waste Decomposer Market Product Innovations

Recent innovations in the commercial food waste decomposer market focus on enhancing efficiency, reducing operational costs, and improving hygiene. New models incorporate advanced technologies like automated systems and improved composting processes, making them more appealing to businesses. These innovations emphasize ease of use, faster decomposition times, and reduced environmental impact. This focus on technological advancement is crucial in solidifying the market's position as a preferred solution for commercial food waste management.

Report Segmentation & Scope

The report segments the market based on several criteria, providing granular insights into various aspects of the industry. Segmentation includes:

- By Type: Aerobic, Anaerobic, etc., each segment has specific growth projections and market sizes, as well as a comprehensive analysis of competitive dynamics.

- By Capacity: Small, Medium, Large, each capacity segment presents unique growth trajectories and associated market opportunities.

- By End-User: Hotels, Restaurants, Food Processing Units, and others. This segmentation reveals the relative market share and contribution of each user group.

Key Drivers of India Commercial Food Waste Decomposer Market Growth

Several factors are driving the growth of the India Commercial Food Waste Decomposer Market. These include:

- Government regulations: Stringent waste management regulations are pushing businesses to adopt sustainable solutions.

- Rising environmental awareness: Growing concern about environmental impact is leading to increased demand for eco-friendly waste management practices.

- Technological advancements: Innovations in decomposer technology are enhancing efficiency and reducing costs.

- Urbanization and increasing food consumption: These factors are leading to a significant increase in the volume of food waste generated.

Challenges in the India Commercial Food Waste Decomposer Market Sector

The market faces challenges including:

- High initial investment costs: The initial investment can be a deterrent for small businesses.

- Lack of awareness: Limited awareness about the benefits of food waste decomposers among some businesses.

- Supply chain disruptions: Potential disruptions in the supply of raw materials and components can impact production and availability.

- Competition from alternative waste management methods: Incineration and landfills remain viable options for some businesses. These factors need to be addressed for sustained market growth.

Leading Players in the India Commercial Food Waste Decomposer Market Market

- Zigma Machinery & Equipment Solutions

- Kings Industries

- Gurukrupa Enterprises

- Riteways Enviro Pvt Ltd

- Envipure Solution

- Vakratund Invention India Private Limited

- Reva Engineering Enterprises

- Ecopollutech Engineers

- Greenrich Grow India Private Limited

- Greenshield Enviro (List Not Exhaustive)

Key Developments in India Commercial Food Waste Decomposer Market Sector

- September 2023: InSinkErator launched new garbage disposals offering quick waste grinding and environmentally friendly solutions. This launch is expected to intensify competition and drive innovation within the market.

- April 2022: Whirlpool Corporation acquired InSinkErator, expanding its presence in the food waste disposer market. This acquisition highlights the growing importance of this sector and indicates future consolidation.

Strategic India Commercial Food Waste Decomposer Market Market Outlook

The India Commercial Food Waste Decomposer Market holds significant growth potential. Continued government support, technological advancements, and increasing environmental awareness will drive market expansion. Strategic opportunities exist for companies focusing on innovation, cost-effectiveness, and sustainable solutions. The market's future success lies in addressing the challenges mentioned earlier and capitalizing on the rising demand for eco-friendly waste management practices.

India Commercial Food Waste Decomposer Market Segmentation

-

1. Machine Type

- 1.1. Continuous Composters

- 1.2. Batch Composters

-

2. Application

- 2.1. Agricultural

- 2.2. Restaurants & Hotels

- 2.3. Food Processing Industries

-

3. Sales Channel

- 3.1. Direct Sales

- 3.2. Distributor

-

4. Capacity

- 4.1. Small-Scale

- 4.2. Medium-Scale

- 4.3. Large-Scale

India Commercial Food Waste Decomposer Market Segmentation By Geography

- 1. India

India Commercial Food Waste Decomposer Market Regional Market Share

Geographic Coverage of India Commercial Food Waste Decomposer Market

India Commercial Food Waste Decomposer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices

- 3.3. Market Restrains

- 3.3.1. Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices

- 3.4. Market Trends

- 3.4.1. Growing Food Service Industry Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Commercial Food Waste Decomposer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Continuous Composters

- 5.1.2. Batch Composters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Agricultural

- 5.2.2. Restaurants & Hotels

- 5.2.3. Food Processing Industries

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Direct Sales

- 5.3.2. Distributor

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. Small-Scale

- 5.4.2. Medium-Scale

- 5.4.3. Large-Scale

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zigma Machinery & Equipment Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kings Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gurukrupa Enterprises

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Riteways Enviro Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Envipure Solution

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vakratund Invention India Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Reva Engineering Enterprises

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ecopollutech Engineers

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Greenrich Grow India Private Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Greenshield Enviro**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zigma Machinery & Equipment Solutions

List of Figures

- Figure 1: India Commercial Food Waste Decomposer Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Commercial Food Waste Decomposer Market Share (%) by Company 2025

List of Tables

- Table 1: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 2: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Machine Type 2020 & 2033

- Table 3: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 6: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 7: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 8: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Capacity 2020 & 2033

- Table 9: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Region 2020 & 2033

- Table 11: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 12: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Machine Type 2020 & 2033

- Table 13: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Application 2020 & 2033

- Table 15: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 16: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Sales Channel 2020 & 2033

- Table 17: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Capacity 2020 & 2033

- Table 18: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Capacity 2020 & 2033

- Table 19: India Commercial Food Waste Decomposer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: India Commercial Food Waste Decomposer Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Commercial Food Waste Decomposer Market?

The projected CAGR is approximately 1.15%.

2. Which companies are prominent players in the India Commercial Food Waste Decomposer Market?

Key companies in the market include Zigma Machinery & Equipment Solutions, Kings Industries, Gurukrupa Enterprises, Riteways Enviro Pvt Ltd, Envipure Solution, Vakratund Invention India Private Limited, Reva Engineering Enterprises, Ecopollutech Engineers, Greenrich Grow India Private Limited, Greenshield Enviro**List Not Exhaustive.

3. What are the main segments of the India Commercial Food Waste Decomposer Market?

The market segments include Machine Type, Application, Sales Channel, Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 620.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices.

6. What are the notable trends driving market growth?

Growing Food Service Industry Drives the Market.

7. Are there any restraints impacting market growth?

Growing Consumer Awareness for Organic Products; Adoption of Sustainable Waste Management Practices.

8. Can you provide examples of recent developments in the market?

September 2023: InSinkErator introduced new garbage disposals in the market. The new garbage disposal aims to grind a variety of wastes quickly and provide environmentally friendly solutions for managing food waste.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Commercial Food Waste Decomposer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Commercial Food Waste Decomposer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Commercial Food Waste Decomposer Market?

To stay informed about further developments, trends, and reports in the India Commercial Food Waste Decomposer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence