Key Insights

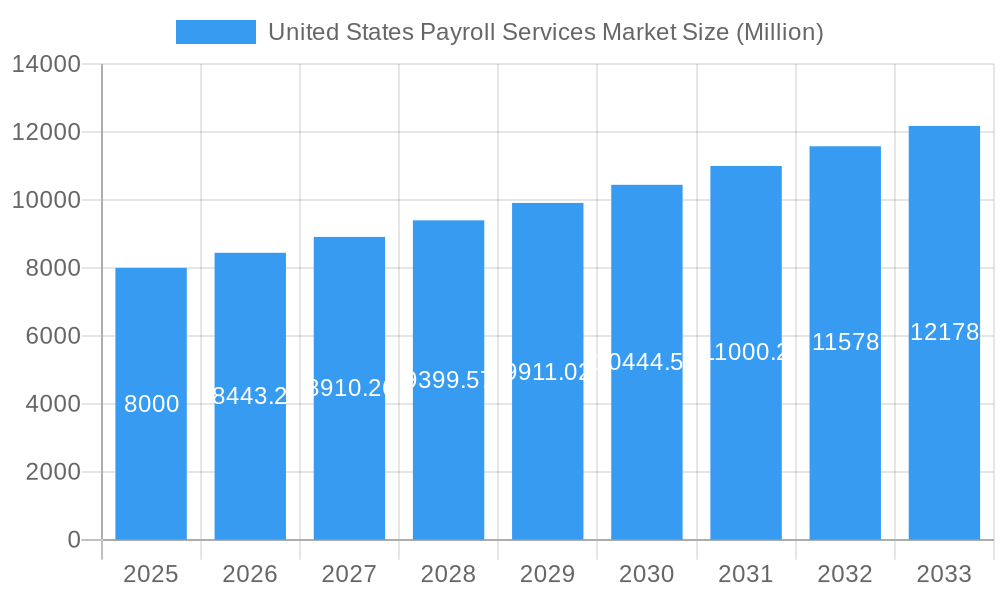

The United States payroll services market, currently valued at approximately $8 billion (in 2025), exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 5.54% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of cloud-based payroll solutions offers businesses enhanced efficiency, scalability, and cost-effectiveness. Furthermore, stringent government regulations concerning payroll compliance and reporting are driving demand for sophisticated payroll services that ensure legal adherence. The growing prevalence of small and medium-sized enterprises (SMEs), which often lack the internal resources for comprehensive payroll management, further contributes to market growth. Finally, the ongoing digital transformation across industries necessitates the integration of payroll systems with other business applications, creating opportunities for advanced payroll solutions.

United States Payroll Services Market Market Size (In Billion)

However, market growth is not without its challenges. Competition from established players like ADP, Paychex, and Intuit (QuickBooks), alongside emerging fintech startups, creates a fiercely competitive landscape. The need for continuous investment in technology and infrastructure to maintain a competitive edge is a significant restraint. The market also faces challenges associated with data security and privacy, demanding robust security measures to protect sensitive employee information. Segmentation within the market reflects varying client needs, with solutions catering to small businesses, large enterprises, and specialized sectors. The market's regional distribution likely shows concentration in densely populated states with high business activity, but detailed regional data is needed for conclusive analysis. The forecast period (2025-2033) suggests continued growth, though the exact trajectory will be influenced by macroeconomic factors and technological advancements.

United States Payroll Services Market Company Market Share

United States Payroll Services Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the United States Payroll Services Market, covering the period 2019-2033. It offers actionable insights into market dynamics, competitive landscapes, and future growth potential, enabling businesses to make informed strategic decisions. The study period encompasses the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). The estimated market value for 2025 is xx Million.

United States Payroll Services Market Structure & Competitive Dynamics

The US payroll services market is characterized by a blend of established giants and emerging innovative players. Market concentration is moderate, with a few dominant players holding significant market share, but numerous smaller companies catering to niche segments. ADP and Paychex are the undisputed leaders, commanding a combined market share of approximately xx%, based on 2024 revenue. However, the market exhibits a dynamic competitive landscape, with ongoing M&A activities and technological advancements constantly reshaping the competitive dynamics. Regulatory frameworks, primarily at the state level, influence compliance requirements and operational costs. The availability of various product substitutes, including in-house payroll solutions and basic accounting software with payroll capabilities, impacts the market's overall penetration and growth. Furthermore, evolving end-user preferences towards cloud-based solutions, mobile accessibility, and integrated HR platforms are shaping market trends.

- Market Concentration: Moderate, with ADP and Paychex leading.

- Innovation Ecosystems: Strong, driven by technological advancements and competition.

- Regulatory Frameworks: Significant influence on compliance and operational costs.

- Product Substitutes: Presence of alternative payroll solutions, affecting market penetration.

- End-User Trends: Growing preference for cloud-based and mobile-accessible solutions.

- M&A Activities: Frequent acquisitions and mergers, reshaping market dynamics. Recent deals totaled an estimated xx Million in value.

United States Payroll Services Market Industry Trends & Insights

The US payroll services market exhibits robust growth, driven by several key factors. The increasing adoption of cloud-based payroll solutions is a primary catalyst, offering scalability, cost-effectiveness, and enhanced data security. Furthermore, the expanding gig economy and the rise of remote work are fueling demand for flexible and efficient payroll management systems. Technological disruptions, such as the integration of AI and machine learning for automation and improved accuracy, are significantly impacting the market. Consumer preferences are shifting towards solutions offering advanced features like integrated time and attendance tracking, benefits administration, and reporting capabilities. The competitive landscape is marked by intense innovation, with companies constantly upgrading their platforms and functionalities to meet evolving customer needs. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration is steadily increasing, particularly among small and medium-sized enterprises (SMEs).

Dominant Markets & Segments in United States Payroll Services Market

The largest segment within the US payroll services market is the small and medium-sized enterprises (SMEs) sector. This segment's dominance is attributed to the high volume of SMEs across the nation requiring efficient and cost-effective payroll solutions.

- Key Drivers for SME Dominance:

- High concentration of SMEs across diverse industries.

- Growing need for streamlined payroll processes to reduce administrative burden.

- Increasing adoption of cloud-based solutions offering cost-effectiveness and scalability.

- Favorable government policies supporting small business growth.

United States Payroll Services Market Product Innovations

Recent product innovations in the US payroll services market focus on enhancing automation, integration, and user experience. Many providers are incorporating AI-powered features for improved accuracy and efficiency in payroll processing. Integration with other HR and accounting software platforms is becoming increasingly common, offering a seamless workflow for businesses. Mobile accessibility and user-friendly interfaces are key differentiators in attracting and retaining customers. The market is witnessing a surge in the adoption of instant payment solutions, providing faster and more convenient payroll disbursement for employees.

Report Segmentation & Scope

This report segments the US payroll services market based on several key factors:

- By Deployment: Cloud-based and On-premise solutions, with cloud-based witnessing faster growth due to flexibility and cost-effectiveness.

- By Business Size: Small, Medium, and Large Enterprises, with SMEs representing the largest segment.

- By Industry: Healthcare, Manufacturing, Retail, Technology, etc., showcasing varying needs and preferences across different sectors.

Each segment is analyzed based on market size, growth projections, and competitive dynamics.

Key Drivers of United States Payroll Services Market Growth

Several factors fuel the growth of the US payroll services market. Technological advancements, particularly cloud computing and AI, are driving automation and efficiency. The expanding gig economy necessitates flexible payroll solutions. Stringent regulatory compliance requirements necessitate specialized services. Finally, a robust economy and increased employment contribute to a larger user base.

Challenges in the United States Payroll Services Market Sector

The US payroll services market faces challenges including increasing regulatory compliance complexities leading to operational costs, and the need to adapt constantly to evolving technological landscape and competitive pressures from new entrants.

Leading Players in the United States Payroll Services Market Market

- ADP (Automatic Data Processing)

- Paychex

- Gusto

- Intuit (QuickBooks)

- TriNet

- Paycor

- Zenefits

- SurePayroll

- OnPay

- Square Payroll

- List Not Exhaustive

Key Developments in United States Payroll Services Market Sector

- June 2023: UKG Inc. acquired Immedis, expanding its global payroll reach.

- April 2024: Everee partnered with NextCrew to integrate instant payment solutions into staffing platforms.

Strategic United States Payroll Services Market Outlook

The US payroll services market presents significant growth opportunities. Continued technological innovation, particularly in AI and automation, will further enhance efficiency and accuracy. Expanding into niche markets and offering customized solutions tailored to specific industry needs will drive further growth. Strategic partnerships and acquisitions will remain key strategies for market expansion and consolidation. The focus on enhancing the employee experience through features such as instant payment options and seamless integration with other HR tools will be crucial for success.

United States Payroll Services Market Segmentation

-

1. Type

- 1.1. Small-size Company

- 1.2. Mid-size Company

- 1.3. Large Enterprises

-

2. End User

- 2.1. Healthcare

- 2.2. Manufacturing

- 2.3. Retail

- 2.4. IT

- 2.5. Finance

- 2.6. Professional Services

United States Payroll Services Market Segmentation By Geography

- 1. United States

United States Payroll Services Market Regional Market Share

Geographic Coverage of United States Payroll Services Market

United States Payroll Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Complexity of Payroll Regulations; Rise of Gig Economy

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Payroll Regulations; Rise of Gig Economy

- 3.4. Market Trends

- 3.4.1. Rise of Gig Economy Influencing US Payroll Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Payroll Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Small-size Company

- 5.1.2. Mid-size Company

- 5.1.3. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Healthcare

- 5.2.2. Manufacturing

- 5.2.3. Retail

- 5.2.4. IT

- 5.2.5. Finance

- 5.2.6. Professional Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADP (Automatic Data Processing)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Paychex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gusto

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Intuit (QuickBooks)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TriNet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Paycor

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zenefits

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SurePayroll

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 OnPay

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Square Payroll**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADP (Automatic Data Processing)

List of Figures

- Figure 1: United States Payroll Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Payroll Services Market Share (%) by Company 2025

List of Tables

- Table 1: United States Payroll Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Payroll Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: United States Payroll Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: United States Payroll Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: United States Payroll Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Payroll Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United States Payroll Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: United States Payroll Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: United States Payroll Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: United States Payroll Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: United States Payroll Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Payroll Services Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Payroll Services Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the United States Payroll Services Market?

Key companies in the market include ADP (Automatic Data Processing), Paychex, Gusto, Intuit (QuickBooks), TriNet, Paycor, Zenefits, SurePayroll, OnPay, Square Payroll**List Not Exhaustive.

3. What are the main segments of the United States Payroll Services Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 8 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Complexity of Payroll Regulations; Rise of Gig Economy.

6. What are the notable trends driving market growth?

Rise of Gig Economy Influencing US Payroll Services.

7. Are there any restraints impacting market growth?

Increasing Complexity of Payroll Regulations; Rise of Gig Economy.

8. Can you provide examples of recent developments in the market?

April 2024: Everee, a prominent payroll firm known for its instant payment solutions, joined forces with NextCrew. This collaboration aims to revolutionize payroll processes, ensuring swift and seamless payments for workers. By integrating Everee's cutting-edge payroll tech with NextCrew's comprehensive staffing platform, the partnership promises to elevate the payroll experience for both staffing firms and their temporary employees.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Payroll Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Payroll Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Payroll Services Market?

To stay informed about further developments, trends, and reports in the United States Payroll Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence