Key Insights

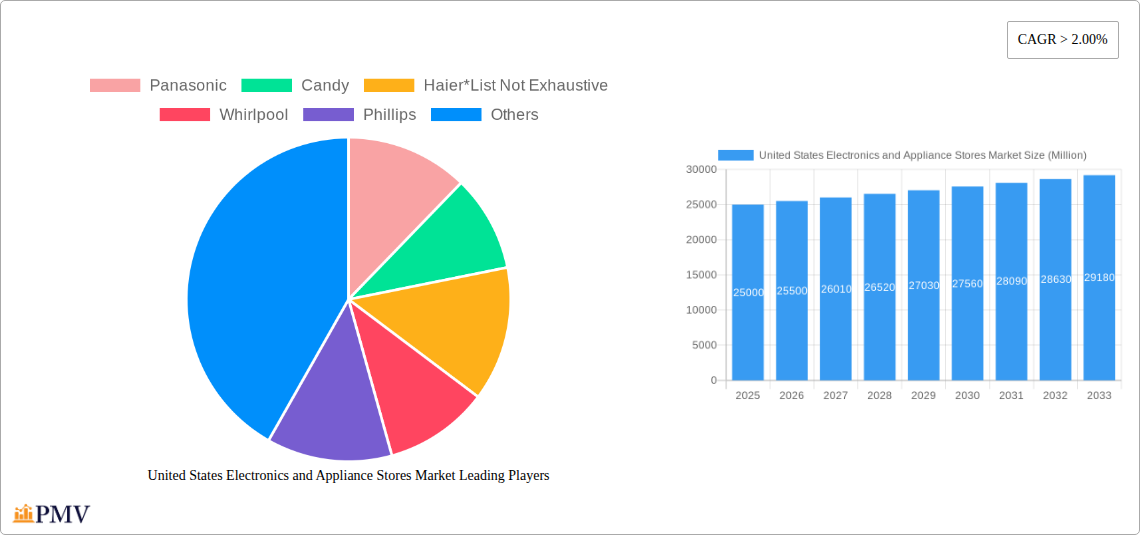

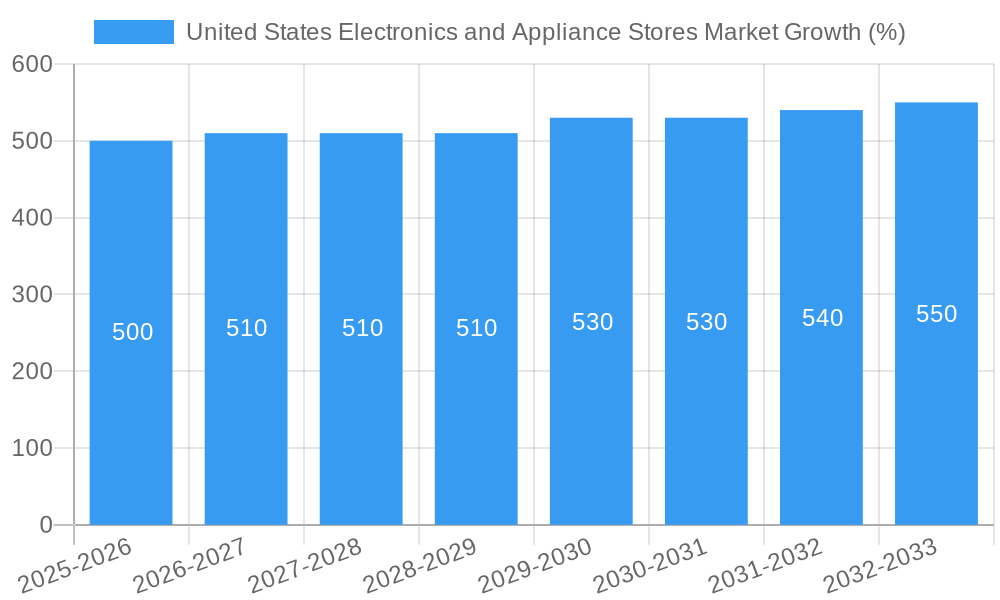

The United States electronics and appliance stores market is a dynamic sector experiencing steady growth, fueled by increasing disposable incomes, technological advancements, and a rising demand for smart home appliances. The market's Compound Annual Growth Rate (CAGR) exceeding 2.0% indicates a consistent expansion, projected to continue through 2033. Key drivers include the proliferation of energy-efficient appliances, the growing adoption of smart home technology, and the increasing preference for online retail channels offering convenience and competitive pricing. Major players like Panasonic, Whirlpool, and Samsung (inferred based on similar market presence) are strategically investing in product innovation and enhancing their online presence to capitalize on these trends. The market is segmented by type of retailer (hardware suppliers, security stores, consumer electronics stores), ownership (retail chains, independent retailers), and store type (exclusive showrooms, inclusive dealers, online). The robust growth is further amplified by the increasing popularity of subscription services for appliance maintenance and repair, creating recurring revenue streams for retailers.

While the market exhibits robust growth, challenges remain. Competition is intense, with established brands facing pressure from emerging players offering innovative products at competitive price points. Supply chain disruptions and fluctuating component costs can impact profitability. Furthermore, consumer preference shifts and evolving technological landscapes require retailers to continuously adapt their strategies. Despite these challenges, the long-term outlook for the US electronics and appliance stores market remains positive, driven by the ongoing demand for advanced technology and the growing consumer preference for modern home appliances and electronics. The market’s segmentation provides opportunities for niche players to thrive by focusing on specific consumer needs and retail channels. Analyzing consumer buying patterns and adapting to changing consumer preferences will be critical for sustained success in this competitive marketplace.

This comprehensive report provides a detailed analysis of the United States Electronics and Appliance Stores Market, offering invaluable insights for industry stakeholders, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market structure, competitive dynamics, emerging trends, and future growth projections. The study incorporates extensive data analysis and expert insights to provide a 360-degree view of this dynamic market.

United States Electronics and Appliance Stores Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the US electronics and appliance stores market, encompassing market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of large retail chains and independent retailers, with varying degrees of market share. Major players such as Whirlpool, Panasonic, and Haier compete fiercely, driving innovation and influencing pricing strategies. The market exhibits moderate concentration, with the top five players holding approximately xx% of the market share in 2025. Regulatory frameworks, including consumer protection laws and energy efficiency standards, significantly impact market dynamics. The increasing prevalence of online retailers presents a notable challenge to traditional brick-and-mortar stores, necessitating adaptive strategies. M&A activities have significantly reshaped the market landscape, with notable acquisitions such as Whirlpool's acquisition of InSinkErator in November 2022, demonstrating a consolidation trend. The average deal value for M&A transactions in the sector during the historical period (2019-2024) was approximately xx Million. Innovation in areas like smart appliances and energy-efficient technologies is driving growth and reshaping the competitive dynamics. The evolving consumer preference for sustainable and technologically advanced products also plays a significant role.

United States Electronics and Appliance Stores Market Industry Trends & Insights

The US electronics and appliance stores market is experiencing robust growth, driven by several key factors. Rising disposable incomes, increasing urbanization, and a preference for technologically advanced home appliances are major contributors to the expanding market. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Technological advancements, such as the integration of smart home technologies and the increasing popularity of online shopping, are significantly transforming the industry. Consumer preferences are shifting towards energy-efficient and eco-friendly appliances, driving demand for products with high energy efficiency ratings and sustainable manufacturing practices. The rise of e-commerce continues to disrupt traditional retail models, compelling retailers to adapt their strategies to effectively compete in the online marketplace. Market penetration of smart appliances is increasing steadily, exceeding xx% in 2025. The competitive landscape is evolving with the emergence of new players and strategic partnerships aimed at expanding product offerings and enhancing customer experiences.

Dominant Markets & Segments in United States Electronics and Appliance Stores Market

The US electronics and appliance stores market exhibits significant segmentation based on type of store, ownership, and product type.

By Type: The Consumer Electronic Store segment currently dominates, accounting for the largest market share, driven by increased consumer spending on electronics and home entertainment systems. Hardware supplier and Security stores segments are also showing moderate growth.

By Ownership: Retail Chains hold a significant market share due to their extensive reach and brand recognition. However, Independent Retailers demonstrate resilience due to their specialized offerings and personalized customer service.

By Type of Store: Online retailers are witnessing rapid growth, propelled by the increasing adoption of e-commerce, while Exclusive Retailers/Showrooms maintain a strong presence due to their ability to provide personalized shopping experiences. Inclusive Retailers/Dealers Stores also play a significant role in market distribution.

The strongest growth is observed in the South region, driven by factors such as population growth, rising disposable incomes, and a robust housing market. This segment is expected to maintain its dominant position throughout the forecast period. Key drivers in this region include favorable economic policies that stimulate consumer spending, robust infrastructure supporting logistics and distribution, and a concentrated population base leading to a high demand for consumer electronics and appliances.

United States Electronics and Appliance Stores Market Product Innovations

Recent years have witnessed significant product innovations in the US electronics and appliance stores market. Smart appliances with features like Wi-Fi connectivity, voice control, and energy monitoring are gaining popularity. Manufacturers are increasingly focusing on energy efficiency, sustainability, and user-friendly designs. The integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies is revolutionizing the industry, creating smart home ecosystems that improve convenience and efficiency. Manufacturers are also incorporating advanced materials and manufacturing processes to enhance product durability and performance. These innovations are enhancing the user experience and addressing growing consumer demands for convenience and sustainability.

Report Segmentation & Scope

This report segments the US Electronics and Appliance Stores Market based on:

By Type: Hardware Supplier, Security Stores, Consumer Electronic Store. Each segment's growth projection, market size, and competitive dynamics are comprehensively analyzed.

By Ownership: Retail Chain, Independent Retailer. The report provides a detailed analysis of the market share, growth potential, and competitive strategies of each segment.

By Type of Store: Exclusive Retailers/showroom, Inclusive Retailers/Dealers Store, Online. The report examines the distinct features and market performance of each distribution channel.

Key Drivers of United States Electronics and Appliance Stores Market Growth

Several key factors drive the growth of the US electronics and appliance stores market. Technological advancements, such as the integration of smart home technology and the development of energy-efficient appliances, are fueling demand. Rising disposable incomes, particularly among younger demographics, contribute to higher consumer spending on electronics and appliances. Favorable government policies promoting energy efficiency and sustainable consumption patterns further stimulate market growth. Finally, the continuous evolution of consumer preferences toward convenience, smart functionality, and eco-friendly products plays a significant role in expanding market size.

Challenges in the United States Electronics and Appliance Stores Market Sector

The US electronics and appliance stores market faces several challenges. Supply chain disruptions and increasing raw material costs significantly impact production and pricing. Intense competition from both domestic and international players, coupled with the increasing popularity of online retail channels, creates price pressure and necessitates innovative marketing strategies. Furthermore, stringent environmental regulations and safety standards necessitate continuous technological upgrades and compliance measures, adding to operational costs. These challenges necessitate strategic adjustments by market players to maintain profitability and growth.

Leading Players in the United States Electronics and Appliance Stores Market Market

Key Developments in United States Electronics and Appliance Stores Market Sector

August 2023: GE Appliances and Google Cloud expanded their partnership, integrating generative AI into the SmartHQ app for personalized recipe generation (Flavorly™ AI). This enhances customer experience and boosts brand loyalty.

November 2022: Whirlpool's acquisition of InSinkErator strengthens its position in the kitchen appliance market, expanding its product portfolio and market reach. This acquisition demonstrates the consolidation trend within the industry.

February 2022: Mitsubishi Electric Corporation acquired Computer Protection Technology, Inc. (CPT), expanding its UPS business in North America. This strategic move aims to capitalize on the growing demand for reliable power protection solutions.

Strategic United States Electronics and Appliance Stores Market Market Outlook

The future of the US electronics and appliance stores market appears promising. Continued technological innovation, rising consumer spending, and evolving consumer preferences will drive significant growth. Strategic partnerships and mergers and acquisitions will likely reshape the competitive landscape, favoring players with robust technological capabilities and efficient supply chain management. Companies focusing on sustainability, energy efficiency, and seamless customer experiences are expected to gain a competitive advantage. The market presents substantial opportunities for growth and innovation, especially in the smart home technology and eco-friendly appliance segments.

United States Electronics and Appliance Stores Market Segmentation

-

1. Type

- 1.1. Hardware Supplier

- 1.2. Security Stores

- 1.3. Consumer Electronic Store

-

2. Ownership

- 2.1. Retail Chain

- 2.2. Independent Retailer

-

3. Type of Store

- 3.1. Exclusive Retailers/showroom

- 3.2. Inclusive Retailers/Dealers Store

- 3.3. Online

United States Electronics and Appliance Stores Market Segmentation By Geography

- 1. United States

United States Electronics and Appliance Stores Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Innovation in LED Display; Increased Applications for Digital Signage

- 3.3. Market Restrains

- 3.3.1. Shorter Operating Range of WiGig Products

- 3.4. Market Trends

- 3.4.1. AI And IOT Enabled Electronic Appliance DrivingUS Electronics and Appliance Stores Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware Supplier

- 5.1.2. Security Stores

- 5.1.3. Consumer Electronic Store

- 5.2. Market Analysis, Insights and Forecast - by Ownership

- 5.2.1. Retail Chain

- 5.2.2. Independent Retailer

- 5.3. Market Analysis, Insights and Forecast - by Type of Store

- 5.3.1. Exclusive Retailers/showroom

- 5.3.2. Inclusive Retailers/Dealers Store

- 5.3.3. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

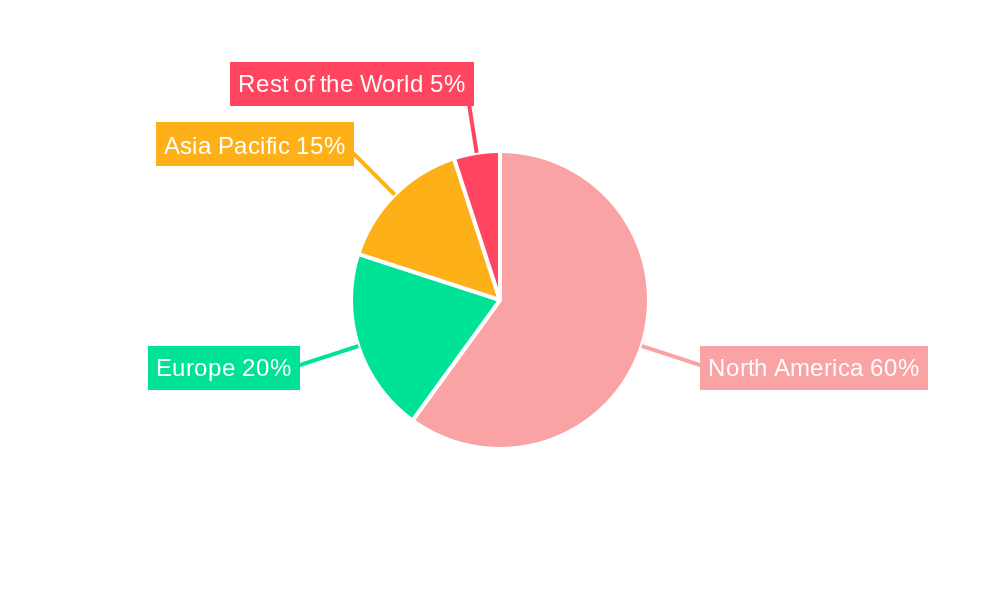

- 6. North America United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of the World United States Electronics and Appliance Stores Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Panasonic

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Candy

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Haier*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Whirlpool

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Phillips

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bosch

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Toshiba

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hitachi Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 GE Appliance

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Panasonic

List of Figures

- Figure 1: United States Electronics and Appliance Stores Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Electronics and Appliance Stores Market Share (%) by Company 2024

List of Tables

- Table 1: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 4: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Type of Store 2019 & 2032

- Table 5: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Electronics and Appliance Stores Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Electronics and Appliance Stores Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Electronics and Appliance Stores Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Electronics and Appliance Stores Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Ownership 2019 & 2032

- Table 16: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Type of Store 2019 & 2032

- Table 17: United States Electronics and Appliance Stores Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Electronics and Appliance Stores Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the United States Electronics and Appliance Stores Market?

Key companies in the market include Panasonic, Candy, Haier*List Not Exhaustive, Whirlpool, Phillips, Bosch, Toshiba, Hitachi Limited, GE Appliance.

3. What are the main segments of the United States Electronics and Appliance Stores Market?

The market segments include Type, Ownership, Type of Store.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Innovation in LED Display; Increased Applications for Digital Signage.

6. What are the notable trends driving market growth?

AI And IOT Enabled Electronic Appliance DrivingUS Electronics and Appliance Stores Market.

7. Are there any restraints impacting market growth?

Shorter Operating Range of WiGig Products.

8. Can you provide examples of recent developments in the market?

In August 2023, GE Appliances, a Haier company, and Google Cloud expanded their partnership to enhance and personalize consumer experiences with generative AI. GE Appliances’ SmartHQ consumer app will use Google Cloud’s generative AI platform, Vertex AI, to offer users the ability to generate custom recipes based on the food in their kitchen with its new feature called Flavorly™ AI.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Electronics and Appliance Stores Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Electronics and Appliance Stores Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Electronics and Appliance Stores Market?

To stay informed about further developments, trends, and reports in the United States Electronics and Appliance Stores Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence