Key Insights

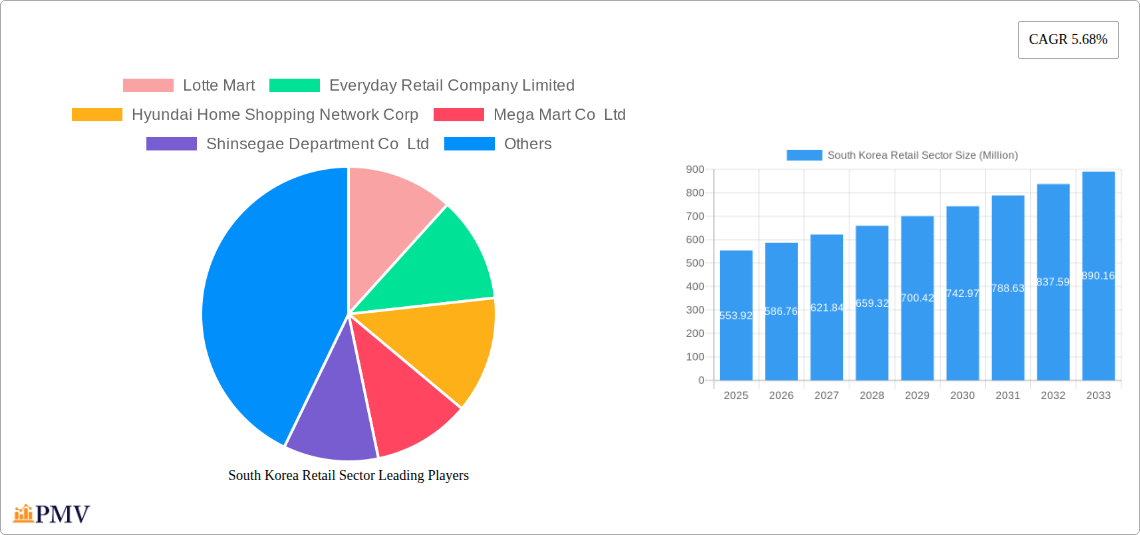

The South Korean retail sector, valued at $553.92 million in 2025, is projected to experience robust growth, driven by a rising disposable income, increasing urbanization, and a burgeoning e-commerce landscape. The sector's Compound Annual Growth Rate (CAGR) of 5.68% from 2025 to 2033 indicates a steady expansion, with significant opportunities for both established players and emerging businesses. Key growth drivers include the increasing adoption of omnichannel strategies by major retailers, the rising popularity of convenient store formats catering to busy lifestyles, and the continuous technological advancements enhancing the customer experience, such as mobile payment systems and personalized recommendations. Furthermore, the South Korean government's initiatives to support small and medium-sized enterprises (SMEs) are expected to contribute to the sector's growth, fostering competition and innovation. However, challenges remain, including intensifying competition from international retailers and the need for continuous adaptation to evolving consumer preferences and technological disruptions.

South Korea Retail Sector Market Size (In Million)

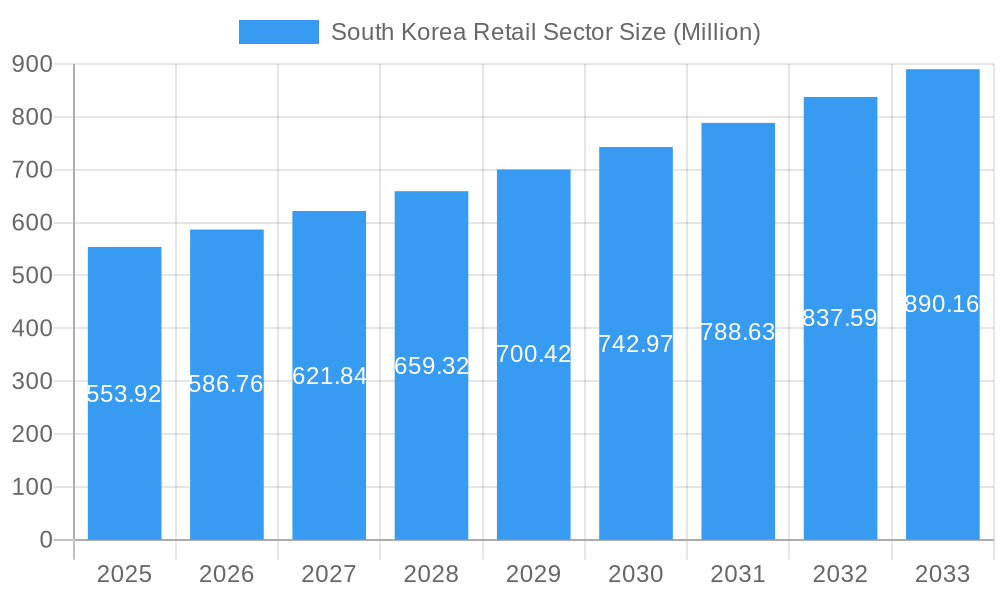

The competitive landscape is shaped by a mix of large conglomerates like Lotte Mart, Shinsegae, and E-Mart, alongside international players like Costco and smaller, specialized retailers. The market segmentation is likely diverse, encompassing grocery, apparel, electronics, and specialized retail segments. The future will likely see continued consolidation among players, with larger retailers investing in technology and expanding their omnichannel presence to maintain their market share. The success of individual companies will hinge on their ability to effectively leverage data analytics, personalized marketing, and efficient supply chain management to meet the evolving demands of the sophisticated South Korean consumer. Predicting precise regional market share requires more granular data; however, the concentration of population and economic activity in major metropolitan areas suggests that these regions will dominate the market.

South Korea Retail Sector Company Market Share

South Korea Retail Sector: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the South Korea retail sector, encompassing market structure, competitive dynamics, industry trends, and future growth projections from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), with estimated values for 2025. This report is crucial for businesses looking to enter or expand within the dynamic South Korean retail landscape. The report analyzes key players such as Lotte Mart, Everyday Retail Company Limited, Hyundai Home Shopping Network Corp, Mega Mart Co Ltd, Shinsegae Department Co Ltd, 7-Eleven, E-Mart Inc, Costco Wholesale Korea Ltd, Homeplus Co Ltd, Grand Department Store Co Ltd, and Five Guys, though this list is not exhaustive. The report delves into various segments within the South Korean retail market, providing actionable insights for informed decision-making. Expected market values are in Millions.

South Korea Retail Sector Market Structure & Competitive Dynamics

The South Korean retail sector is characterized by a mix of large, established players and emerging smaller businesses. Market concentration is relatively high, with a few major players holding significant market share. Lotte Mart, E-Mart Inc., and Shinsegae Department Co Ltd, for example, dominate the supermarket and department store segments. The innovation ecosystem is vibrant, with constant technological advancements and evolving consumer preferences driving innovation in areas such as e-commerce, omnichannel strategies, and personalized shopping experiences. The regulatory framework is relatively robust, with regulations governing areas such as food safety, consumer protection, and fair competition. Product substitutes are readily available, particularly in the online retail space, increasing competitive pressure. End-user trends show a growing preference for convenience, online shopping, and personalized experiences. M&A activities are frequent, with deal values reaching xx Million in recent years, primarily driven by consolidation efforts and expansion strategies. For instance, the market share of Lotte Mart is estimated at xx%, while E-Mart Inc holds approximately xx%. Recent M&A activity reflects a consolidation trend, with smaller players often acquired by larger corporations.

South Korea Retail Sector Industry Trends & Insights

The South Korean retail sector is experiencing robust growth, driven by several factors. The country's rising disposable incomes and expanding middle class are key contributors to increased consumer spending. Technological disruptions, such as the rise of e-commerce and mobile payments, are reshaping the retail landscape, enabling faster transactions and more convenient shopping experiences. Consumer preferences are evolving toward personalized experiences, sustainability, and omnichannel shopping options, requiring retailers to adapt their strategies accordingly. The sector's CAGR during the forecast period (2025-2033) is estimated at xx%, reflecting the sustained growth trajectory. Market penetration of e-commerce is expected to reach xx% by 2033, indicating substantial growth in online retail channels. Intense competition among retailers drives innovation and efficiency improvements, further fueling market growth. The changing demographic landscape, with an increasingly aging population, also presents both challenges and opportunities for retailers to tailor their offerings accordingly.

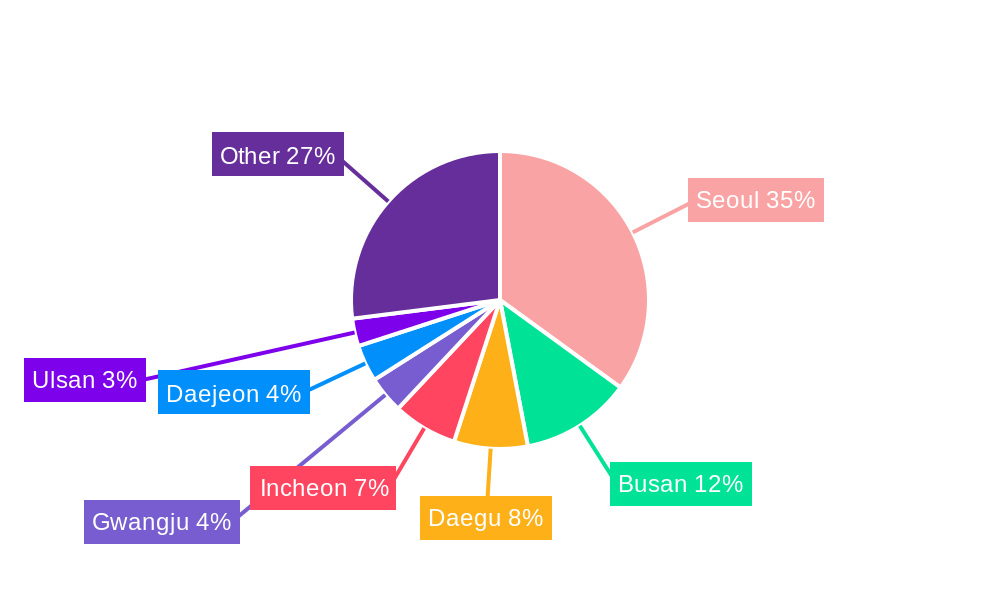

Dominant Markets & Segments in South Korea Retail Sector

The Seoul Metropolitan Area represents the most dominant region in the South Korean retail sector, driven by high population density, strong purchasing power, and developed infrastructure. This dominance is sustained by robust economic activity, superior transportation networks, and a high concentration of businesses and consumers.

- Key Drivers in Seoul Metropolitan Area:

- High population density and purchasing power

- Well-developed transportation infrastructure

- Strong economic activity and business concentration

- Supportive government policies promoting retail development.

The dominance of Seoul is primarily attributed to its concentration of high-income consumers, advanced logistics, and the presence of major retail players. Other regions contribute significantly to the overall market, but the Seoul Metropolitan Area remains the undisputed leader in terms of sales volume and market share. Further analysis is required to precisely delineate the share held by this region.

South Korea Retail Sector Product Innovations

Recent product innovations within the South Korean retail sector focus on enhancing customer experience through technology integration. Omnichannel solutions, personalized recommendations, and seamless integration between online and offline channels are gaining traction. Retailers are also emphasizing sustainable and ethically sourced products, driven by growing consumer demand for environmentally friendly options. These innovations aim to boost customer loyalty and competitive advantage in a rapidly evolving market. The use of data analytics is improving inventory management, optimizing supply chains, and creating more targeted marketing campaigns.

Report Segmentation & Scope

This report segments the South Korean retail sector based on various criteria, including retail format (e.g., supermarkets, hypermarkets, department stores, convenience stores, online retail), product category (e.g., food and grocery, apparel, electronics, cosmetics), and geographic region. Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail, providing a comprehensive view of the market landscape. Market size projections for each segment are detailed within the complete report, along with specific growth rates and market share analyses.

Key Drivers of South Korea Retail Sector Growth

The South Korean retail sector's growth is propelled by several key drivers. Firstly, rising disposable incomes and a growing middle class fuel consumer spending. Secondly, technological advancements, such as the proliferation of e-commerce and mobile payment systems, are transforming shopping habits and creating new opportunities. Thirdly, supportive government policies and a well-developed infrastructure facilitate business growth and market expansion. Lastly, the strong emphasis on innovation within the sector leads to the development of new products, services, and shopping experiences.

Challenges in the South Korea Retail Sector

The South Korean retail sector faces significant challenges, including increasing competition from both domestic and international players. Supply chain disruptions, particularly exacerbated by geopolitical events, can impact product availability and prices. Furthermore, stringent regulatory compliance requirements and high operating costs can hinder profitability. The aging population presents unique challenges for retailers to adjust to changing consumer needs and preferences.

Leading Players in the South Korea Retail Sector Market

- Lotte Mart

- Everyday Retail Company Limited

- Hyundai Home Shopping Network Corp

- Mega Mart Co Ltd

- Shinsegae Department Co Ltd

- 7-Eleven

- E-Mart Inc

- Costco Wholesale Korea Ltd

- Homeplus Co Ltd

- Grand Department Store Co Ltd

- Five Guys

Key Developments in South Korea Retail Sector

September 2023: Lotte Mart announced the creation of unique shopping zones for non-Korean tourists in its key stores. This initiative aims to attract a significant portion of the tourism market and enhance sales.

June 2023: Five Guys opened its first South Korean location in Seoul, marking the entry of a prominent US burger chain into the South Korean market. This signifies a growing interest from international players in the South Korean retail landscape.

Strategic South Korea Retail Sector Market Outlook

The South Korean retail sector presents significant future growth potential, driven by continued economic growth, rising consumer spending, and technological advancements. Strategic opportunities exist for retailers who can effectively adapt to evolving consumer preferences, embrace technological innovation, and establish robust omnichannel strategies. The market's dynamic nature necessitates continuous innovation and adaptation to maintain competitiveness and capitalize on emerging opportunities. Focus on personalized customer experiences, sustainable practices, and leveraging data analytics will be critical for success.

South Korea Retail Sector Segmentation

-

1. Product Type

- 1.1. Food, Beverage, and Tobacco Products

- 1.2. Personal Care and Household

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

- 1.7. Pharmaceuticals and Luxury Goods

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

South Korea Retail Sector Segmentation By Geography

- 1. South Korea

South Korea Retail Sector Regional Market Share

Geographic Coverage of South Korea Retail Sector

South Korea Retail Sector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products

- 3.3. Market Restrains

- 3.3.1. Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products

- 3.4. Market Trends

- 3.4.1. Growing E-Commerce is Driving the Retail Market in South Korea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Retail Sector Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food, Beverage, and Tobacco Products

- 5.1.2. Personal Care and Household

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.1.7. Pharmaceuticals and Luxury Goods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lotte Mart

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Everyday Retail Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Home Shopping Network Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mega Mart Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shinsegae Department Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 7-Eleven

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 E-Mart Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Costco Wholesale Korea Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Homeplus Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grand Department Store Co Ltd*

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Five Guys**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Lotte Mart

List of Figures

- Figure 1: South Korea Retail Sector Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Retail Sector Share (%) by Company 2025

List of Tables

- Table 1: South Korea Retail Sector Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: South Korea Retail Sector Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: South Korea Retail Sector Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South Korea Retail Sector Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: South Korea Retail Sector Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South Korea Retail Sector Volume Billion Forecast, by Region 2020 & 2033

- Table 7: South Korea Retail Sector Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: South Korea Retail Sector Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: South Korea Retail Sector Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: South Korea Retail Sector Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South Korea Retail Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South Korea Retail Sector Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Retail Sector?

The projected CAGR is approximately 5.68%.

2. Which companies are prominent players in the South Korea Retail Sector?

Key companies in the market include Lotte Mart, Everyday Retail Company Limited, Hyundai Home Shopping Network Corp, Mega Mart Co Ltd, Shinsegae Department Co Ltd, 7-Eleven, E-Mart Inc, Costco Wholesale Korea Ltd, Homeplus Co Ltd, Grand Department Store Co Ltd*, Five Guys**List Not Exhaustive.

3. What are the main segments of the South Korea Retail Sector?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 553.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products.

6. What are the notable trends driving market growth?

Growing E-Commerce is Driving the Retail Market in South Korea.

7. Are there any restraints impacting market growth?

Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products.

8. Can you provide examples of recent developments in the market?

September 2023: Lotte Mart, a South Korean supermarket retail store chain, announced that it will create a unique shopping zone for non-Korean tourists at its stores that travelers and tourists frequently visit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Retail Sector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Retail Sector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Retail Sector?

To stay informed about further developments, trends, and reports in the South Korea Retail Sector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence