Key Insights

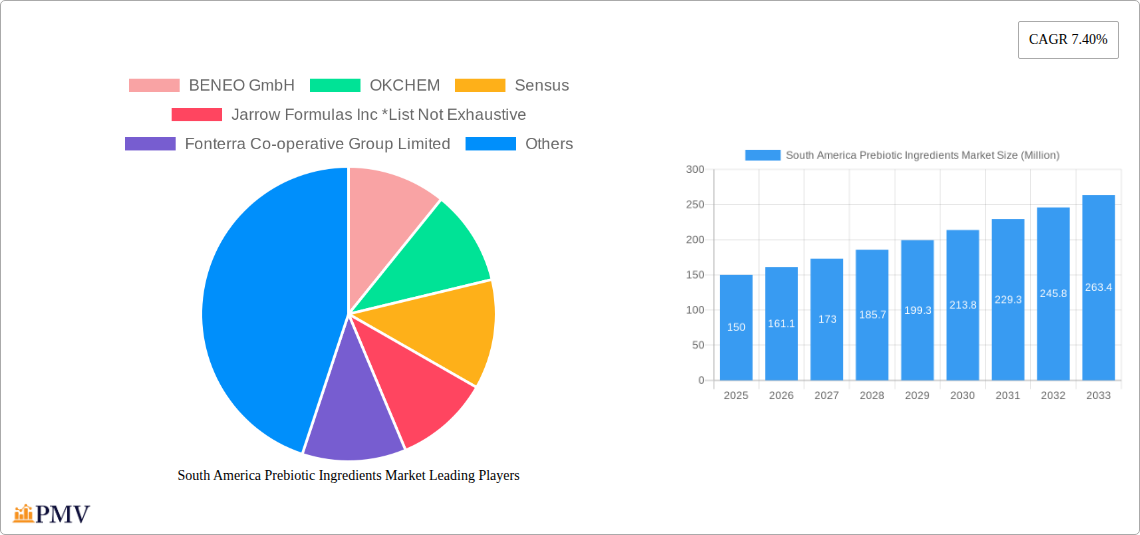

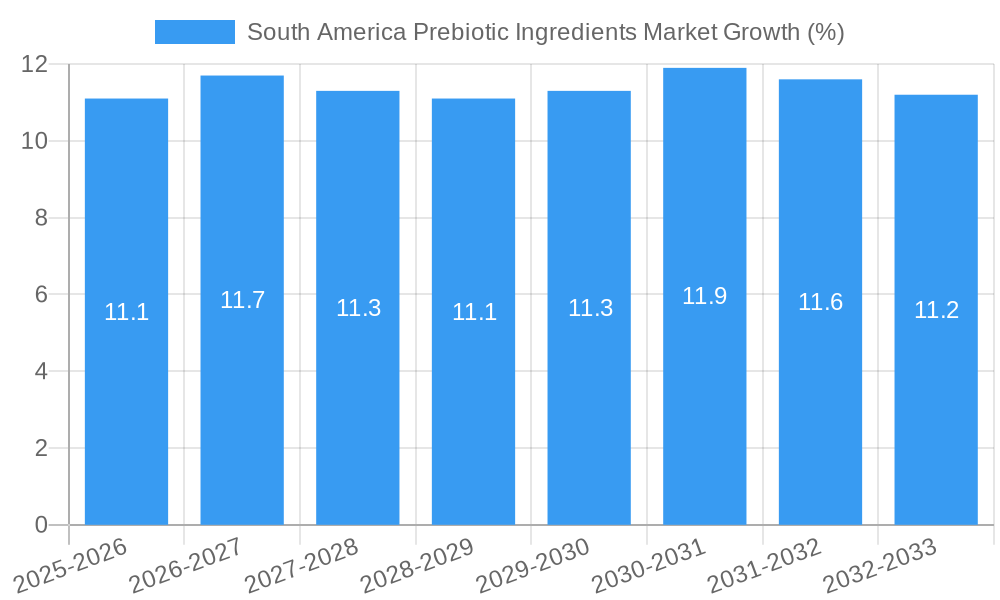

The South American prebiotic ingredients market, currently valued at approximately $XX million (estimated based on global market size and regional market share estimations), is projected to experience robust growth with a compound annual growth rate (CAGR) of 7.40% from 2025 to 2033. This expansion is driven by several key factors. Rising consumer awareness of gut health and its link to overall well-being fuels demand for prebiotic-enriched products, particularly infant formula and functional foods and beverages. The increasing prevalence of digestive disorders and the growing adoption of preventative healthcare measures further contribute to market growth. Furthermore, the burgeoning animal feed industry, seeking to enhance animal health and productivity, presents a significant opportunity for prebiotic ingredient manufacturers. Specific prebiotic types like FOS (fructo-oligosaccharide) and GOS (galacto-oligosaccharide) are experiencing particularly strong growth due to their established efficacy and widespread availability. However, challenges remain, including fluctuations in raw material prices and the need for further research to fully understand the long-term health benefits of different prebiotic ingredients.

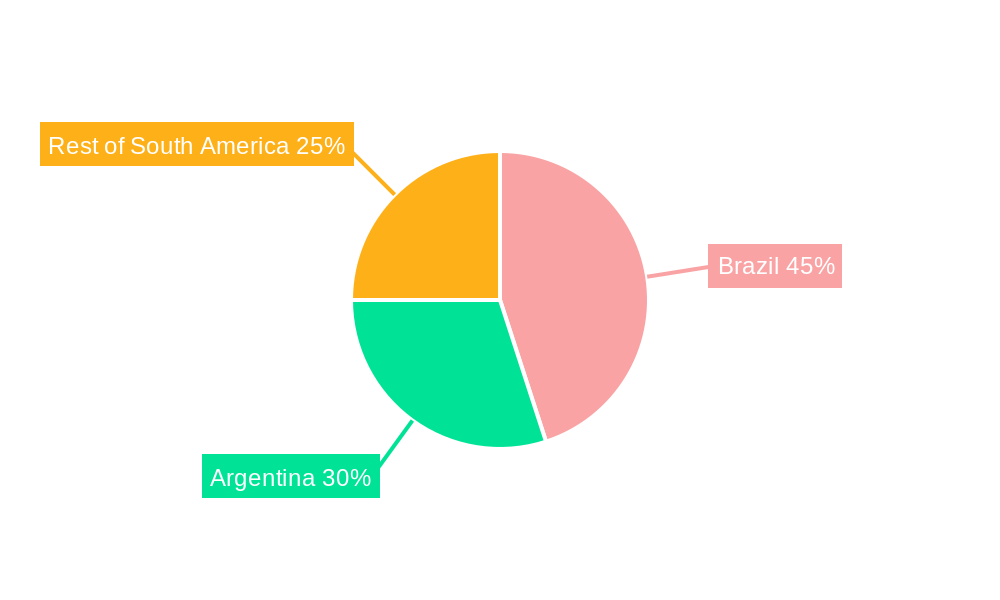

Brazil and Argentina are currently the largest markets within South America for prebiotic ingredients, driven by higher disposable incomes and a greater adoption of health-conscious lifestyles. The "Rest of South America" segment is anticipated to exhibit faster growth than Brazil and Argentina over the forecast period due to increasing urbanization, rising middle-class populations, and greater accessibility to health and wellness products. The market segmentation by application reveals that infant formula and fortified food and beverage applications currently dominate, reflecting the high demand for prebiotic-enhanced nutrition in these sectors. Key players like BENEO GmbH, OKCHEM, Sensus, and Fonterra are actively expanding their presence through strategic partnerships, product innovations, and acquisitions to solidify their market position and capitalize on the region's growth potential. The market's future trajectory hinges on effective regulatory frameworks, advancements in prebiotic research and technology, and targeted marketing campaigns emphasizing the benefits of prebiotics to consumers and producers alike.

This comprehensive report provides a detailed analysis of the South America prebiotic ingredients market, offering invaluable insights for businesses, investors, and industry stakeholders. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages rigorous research methodologies and incorporates market sizing estimations in Million USD. It segments the market by type (Insulin, FOS, GOS, Other Ingredients) and application (Infant Formula, Fortified Food & Beverage, Dietary Supplements, Animal Feed, Other Applications), providing granular data and insightful analysis to drive informed decision-making.

South America Prebiotic Ingredients Market Structure & Competitive Dynamics

This section delves into the competitive landscape of the South America prebiotic ingredients market. We analyze market concentration, revealing a moderately fragmented market with key players holding significant but not dominant shares. The estimated market share of BENEO GmbH in 2025 is xx%, while OKCHEM holds approximately xx%. Sensus and Fonterra Co-operative Group Limited together account for an estimated xx% market share. The remaining share is distributed among numerous smaller players and regional producers.

Innovation within the market is driven by the ongoing R&D efforts focused on developing novel prebiotic ingredients with enhanced functionalities and improved bioavailability. The regulatory framework in South America varies across countries, influencing product approvals and market access. Existing regulations primarily focus on food safety and labeling, with increasing emphasis on functional food claims. Substitute products include certain types of fiber and probiotics, although the unique health benefits of prebiotics maintain a distinct market demand. End-user trends indicate a growing preference for natural and clean-label ingredients, pushing manufacturers towards sustainable sourcing and processing methods.

Mergers and acquisitions (M&A) activity has been moderate, with a few key deals reported in recent years. The total value of M&A transactions within the South America prebiotic ingredients market between 2019 and 2024 is estimated at xx Million. These activities often involved smaller companies being acquired by larger multinational corporations to enhance their product portfolios and market reach.

South America Prebiotic Ingredients Market Industry Trends & Insights

The South America prebiotic ingredients market is experiencing robust growth, driven primarily by increasing consumer awareness of gut health and the associated benefits of prebiotics. The market's Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated to be xx%, and is projected to reach xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including the rising prevalence of digestive disorders, increasing demand for functional foods and dietary supplements, and a growing preference for natural and organic products.

Technological advancements in prebiotic ingredient extraction and processing are contributing to improved product quality and cost-effectiveness. Consumer preferences are shifting towards products with enhanced efficacy and demonstrable health benefits, prompting innovation in prebiotic ingredient formulation and delivery systems. The competitive dynamics are marked by both established players and emerging companies, leading to increased product diversification and price competition. Market penetration of prebiotic ingredients in various applications, such as infant formula and dietary supplements, is continuously increasing, reflecting the growing acceptance and demand for these ingredients. The market penetration rate for prebiotic ingredients in infant formula in 2024 is estimated at xx%.

Dominant Markets & Segments in South America Prebiotic Ingredients Market

The Brazilian market is currently the dominant regional player in South America's prebiotic ingredients market, accounting for approximately xx% of the total market value in 2025. This dominance is largely attributed to its larger population size, growing disposable incomes, and increased consumer health consciousness. Other significant markets include Argentina, Colombia, and Mexico.

By Type: The GOS (Galacto-oligosaccharide) segment commands a significant market share, driven by its wide range of applications and established health benefits. The FOS (Fructo-oligosaccharide) segment also exhibits substantial growth, fueled by increasing demand in the infant formula and dietary supplement sectors. Other ingredients, including MOS and other functional fibers, are experiencing a steady increase in their market share, owing to their various functional properties and potential health benefits.

By Application: The infant formula segment is a major driver of market growth, reflecting the high demand for nutritional and functional ingredients in infant food products. The fortified food and beverage segment is also experiencing rapid growth due to the rising prevalence of health-conscious consumers seeking products with added nutritional benefits. The dietary supplements segment's growth is being fueled by the increasing popularity of prebiotics as a dietary supplement to promote gut health.

Key drivers for the market's dominance include:

- A growing middle class with increased disposable income.

- Rising health consciousness and awareness of the benefits of prebiotics.

- Favorable regulatory frameworks supportive of functional food products.

South America Prebiotic Ingredients Market Product Innovations

Recent product innovations focus on developing prebiotic ingredients with enhanced efficacy, improved stability, and broader applications. Novel formulations are emerging that combine prebiotics with other functional ingredients to create synergistic effects and enhance product appeal. Technological trends include the use of advanced extraction techniques to ensure high purity and yield, as well as the development of more sustainable and environmentally friendly production methods. The market fit for these innovations is strong, given the growing demand for premium, high-quality prebiotic ingredients.

Report Segmentation & Scope

This report provides a comprehensive analysis of the South America prebiotic ingredients market, segmented by type and application.

By Type: The market is categorized into Insulin, FOS (Fructo-oligosaccharide), GOS (Galacto-oligosaccharide), and Other Ingredients (including MOS and other functional fibers). Each segment's growth trajectory, market size, and competitive landscape are deeply analyzed. The FOS and GOS segments exhibit the strongest growth, driven by their extensive use in diverse applications. Other ingredients are witnessing increasing interest due to their specific health benefits and functional properties.

By Application: The report covers Infant Formula, Fortified Food and Beverage, Dietary Supplements, Animal Feed, and Other Applications. The growth rates and competitive dynamics within each application segment are analyzed in detail, highlighting the dominant applications and their future prospects. The infant formula segment is predicted to dominate the market due to its strong growth potential and increasing demand for functional ingredients in infant nutrition.

Key Drivers of South America Prebiotic Ingredients Market Growth

The South America prebiotic ingredients market's growth is spurred by several factors: the rising prevalence of digestive disorders, increased health consciousness among consumers, growing demand for functional foods and dietary supplements, and technological advancements leading to improved product quality and affordability. Government initiatives promoting healthy eating habits and the burgeoning food and beverage industry also contribute significantly to market expansion.

Challenges in the South America Prebiotic Ingredients Market Sector

Challenges include fluctuations in raw material prices, inconsistent regulatory frameworks across countries, and intense competition from both domestic and international players. Supply chain vulnerabilities, particularly regarding raw material sourcing and transportation, can also impact market stability. These factors can constrain market growth if not effectively addressed.

Leading Players in the South America Prebiotic Ingredients Market Market

- BENEO GmbH

- OKCHEM

- Sensus

- Jarrow Formulas Inc

- Fonterra Co-operative Group Limited

- Nexira

Key Developments in South America Prebiotic Ingredients Market Sector

- 2022 (Q4): Launch of a new GOS-based infant formula by a major player in Brazil.

- 2023 (Q1): Acquisition of a smaller prebiotic ingredient producer by a multinational company.

- 2023 (Q3): Introduction of a novel prebiotic ingredient with enhanced bioavailability.

Strategic South America Prebiotic Ingredients Market Market Outlook

The South America prebiotic ingredients market holds significant future potential, fueled by expanding consumer awareness, evolving dietary preferences, and continuous innovation. Strategic opportunities exist for companies focused on developing sustainable sourcing practices, enhancing product functionality, and targeting niche market segments. The market is expected to continue its robust growth trajectory, driven by increasing demand for gut-health solutions and expanding applications across diverse industries.

South America Prebiotic Ingredients Market Segmentation

-

1. Type

- 1.1. Insulin

- 1.2. FOS (Fructo-oligosaccharide)

- 1.3. GOS (Galacto-oligosaccharide)

- 1.4. Other In

-

2. Application

- 2.1. Infant Formula

- 2.2. Fortified Food and Beverage

- 2.3. Dietary Supplements

- 2.4. Animal Feed

- 2.5. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Prebiotic Ingredients Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Prebiotic Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Growing Inclination Toward Prebiotics & Synbiotics Products Across The Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insulin

- 5.1.2. FOS (Fructo-oligosaccharide)

- 5.1.3. GOS (Galacto-oligosaccharide)

- 5.1.4. Other In

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infant Formula

- 5.2.2. Fortified Food and Beverage

- 5.2.3. Dietary Supplements

- 5.2.4. Animal Feed

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Insulin

- 6.1.2. FOS (Fructo-oligosaccharide)

- 6.1.3. GOS (Galacto-oligosaccharide)

- 6.1.4. Other In

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infant Formula

- 6.2.2. Fortified Food and Beverage

- 6.2.3. Dietary Supplements

- 6.2.4. Animal Feed

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Insulin

- 7.1.2. FOS (Fructo-oligosaccharide)

- 7.1.3. GOS (Galacto-oligosaccharide)

- 7.1.4. Other In

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infant Formula

- 7.2.2. Fortified Food and Beverage

- 7.2.3. Dietary Supplements

- 7.2.4. Animal Feed

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Insulin

- 8.1.2. FOS (Fructo-oligosaccharide)

- 8.1.3. GOS (Galacto-oligosaccharide)

- 8.1.4. Other In

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infant Formula

- 8.2.2. Fortified Food and Beverage

- 8.2.3. Dietary Supplements

- 8.2.4. Animal Feed

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Brazil South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Prebiotic Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 BENEO GmbH

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 OKCHEM

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Sensus

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Jarrow Formulas Inc *List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Fonterra Co-operative Group Limited

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nexira

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.1 BENEO GmbH

List of Figures

- Figure 1: South America Prebiotic Ingredients Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Prebiotic Ingredients Market Share (%) by Company 2024

List of Tables

- Table 1: South America Prebiotic Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Prebiotic Ingredients Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South America Prebiotic Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South America Prebiotic Ingredients Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Prebiotic Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Prebiotic Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Prebiotic Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Prebiotic Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Prebiotic Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Prebiotic Ingredients Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: South America Prebiotic Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: South America Prebiotic Ingredients Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Prebiotic Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Prebiotic Ingredients Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: South America Prebiotic Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: South America Prebiotic Ingredients Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Prebiotic Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Prebiotic Ingredients Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: South America Prebiotic Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: South America Prebiotic Ingredients Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Prebiotic Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Prebiotic Ingredients Market?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the South America Prebiotic Ingredients Market?

Key companies in the market include BENEO GmbH, OKCHEM, Sensus, Jarrow Formulas Inc *List Not Exhaustive, Fonterra Co-operative Group Limited, Nexira.

3. What are the main segments of the South America Prebiotic Ingredients Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Growing Inclination Toward Prebiotics & Synbiotics Products Across The Region.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Prebiotic Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Prebiotic Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Prebiotic Ingredients Market?

To stay informed about further developments, trends, and reports in the South America Prebiotic Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence