Key Insights

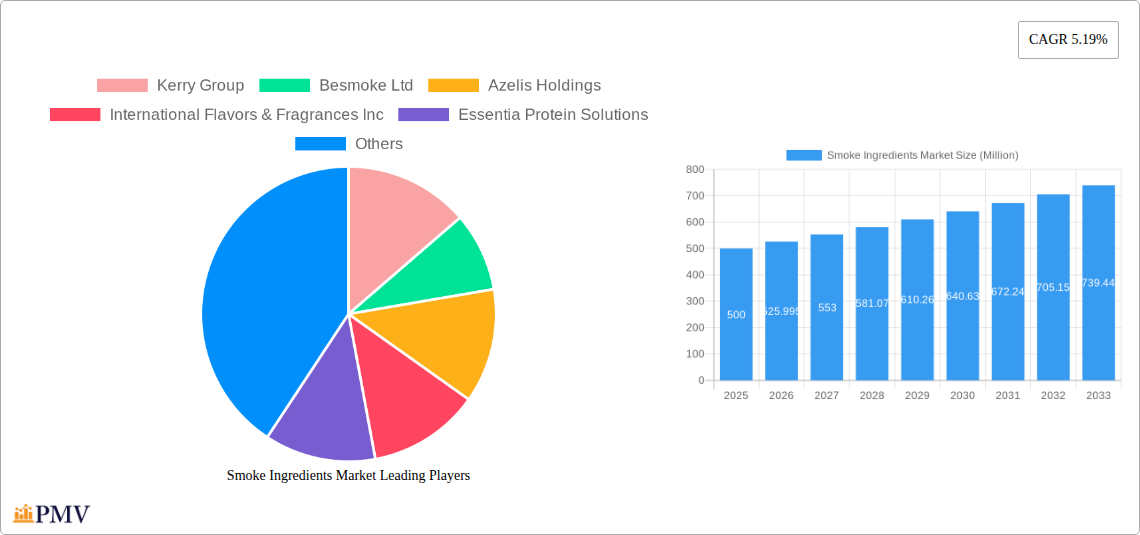

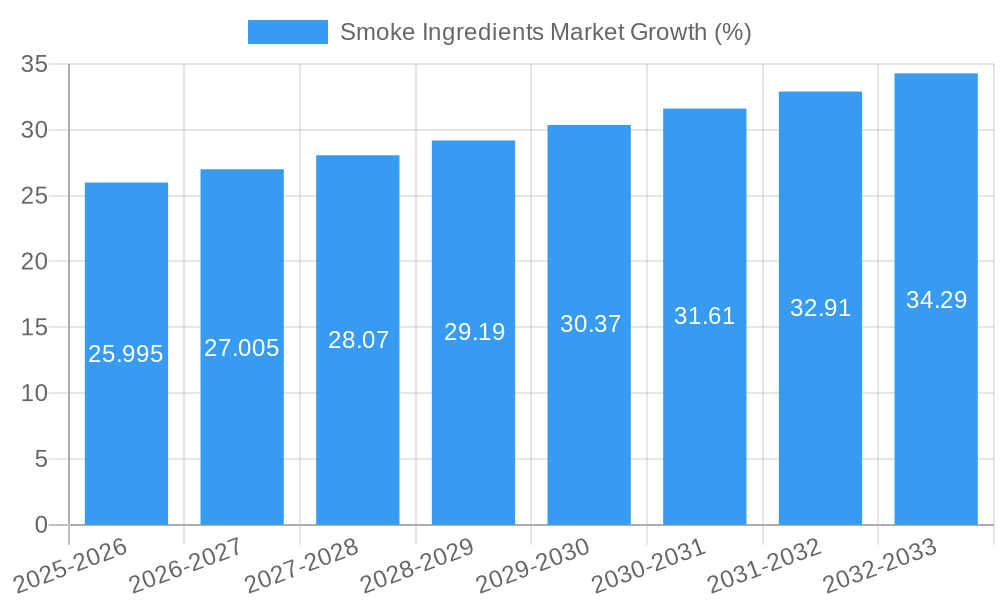

The global smoke ingredients market is experiencing robust growth, projected to reach a substantial value by 2033. A Compound Annual Growth Rate (CAGR) of 5.19% from 2019 to 2033 indicates a consistently expanding market driven by several key factors. The increasing demand for natural and authentic flavors in processed foods and beverages is a significant driver. Consumers are increasingly seeking products with clean labels, pushing manufacturers to replace artificial ingredients with natural alternatives, including smoke flavorings derived from wood smoke. This trend is particularly strong in the meat alternatives and plant-based food sectors, as manufacturers strive to mimic the taste and aroma of traditionally smoked meats. Furthermore, the rising popularity of grilling and barbecuing, especially in developed economies, is contributing to higher demand for smoke ingredients in both homemade and commercially produced foods. While precise market segmentation data isn't provided, it's reasonable to infer significant growth within segments such as liquid smoke concentrates, powdered smoke flavorings, and natural wood smoke extracts. Competition is relatively fragmented, with major players like Kerry Group, International Flavors & Fragrances, and Azelis Holdings vying for market share alongside smaller, specialized companies. However, the presence of many smaller players also indicates opportunities for market entrants with innovative and specialized product offerings.

Despite the positive outlook, the market faces certain restraints. Fluctuations in raw material prices, particularly wood, can impact profitability and pricing strategies. Stringent regulations regarding food safety and labeling in various regions also pose challenges for manufacturers, necessitating compliance investments. However, the continued growth in the food processing industry and persistent consumer demand for flavorful, authentic food products are anticipated to outweigh these challenges, driving the long-term expansion of the smoke ingredients market. The market’s trajectory suggests significant potential for both established industry giants and emerging companies that can successfully leverage the demand for natural, high-quality smoke ingredients. Looking forward, innovation in sustainable sourcing and production methods will likely become increasingly important.

Smoke Ingredients Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the global Smoke Ingredients Market, offering invaluable insights for businesses, investors, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future market trends and opportunities. The report covers market size, segmentation, competitive landscape, growth drivers, challenges, and key developments, providing actionable intelligence for informed decision-making. The total market size in 2025 is estimated at xx Million.

Smoke Ingredients Market Market Structure & Competitive Dynamics

The Smoke Ingredients Market exhibits a moderately concentrated structure, with several key players holding significant market share. The market is characterized by an active innovation ecosystem, driven by the demand for cleaner, more natural smoke flavors and the development of novel technologies like Besmoke Ltd's Puresmoke technology. Regulatory frameworks, particularly those concerning food safety and labeling, significantly impact market dynamics. Product substitutes, such as artificial flavorings, pose a competitive challenge, while the increasing demand for authentic smoked flavors fuels market growth. Mergers and acquisitions (M&A) are common, reflecting the industry’s consolidation and the desire to expand product portfolios and geographical reach. For instance, Azelis Holdings' acquisition of Smoky Light B.V. in January 2023 showcases this trend. While precise market share data for each company is proprietary, the top players, including Kerry Group and International Flavors & Fragrances Inc., command a substantial portion of the market. M&A deal values vary significantly depending on the size and scope of the acquisition. The recent acquisitions saw deal values in the range of xx Million.

- Market Concentration: Moderately concentrated

- Innovation Ecosystems: Active, focusing on natural and clean label solutions

- Regulatory Frameworks: Stringent food safety and labeling regulations

- Product Substitutes: Artificial flavorings

- End-User Trends: Growing demand for authentic smoked flavors

- M&A Activities: Frequent, driven by expansion and innovation

Smoke Ingredients Market Industry Trends & Insights

The Smoke Ingredients Market is experiencing robust growth, driven by the rising popularity of smoked foods and beverages across various regions. The Compound Annual Growth Rate (CAGR) during the forecast period is estimated to be xx%, fueled by factors such as changing consumer preferences towards natural and clean-label products, technological advancements in smoke flavor production, and the expansion of food processing industries. The market penetration of smoke ingredients in various food categories, such as meat, poultry, and seafood, continues to increase. Competitive dynamics are characterized by both intense rivalry among established players and the emergence of innovative startups. Technological disruptions, such as the development of advanced filtration techniques to remove harmful compounds from smoke, are reshaping the market landscape. Consumer preferences are increasingly shifting towards clean-label and natural ingredients, creating opportunities for companies offering sustainable and ethically sourced smoke flavor solutions.

Dominant Markets & Segments in Smoke Ingredients Market

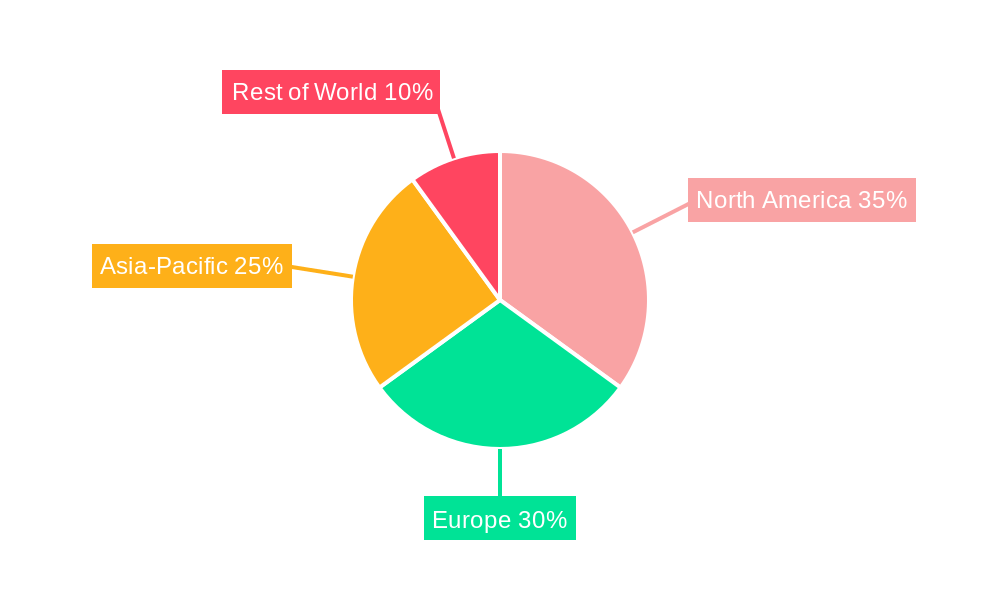

The North American region currently holds a dominant position in the Smoke Ingredients Market, driven by the large and mature food processing industry, high consumer demand for processed foods, and strong regulatory frameworks supporting innovation in food technology. Within North America, the United States represents the largest national market.

- Key Drivers in North America:

- High consumer demand for processed foods with smoked flavor profiles.

- Well-established food processing industry.

- Favorable regulatory environment for food ingredient innovation.

- High per capita consumption of meat and poultry products.

The dominance of North America is expected to continue throughout the forecast period, although other regions, particularly Asia-Pacific, are exhibiting promising growth potential due to rapid economic development, increasing disposable incomes, and rising demand for convenience foods. The report will delve into specific market segments and their respective growth drivers.

Smoke Ingredients Market Product Innovations

Recent innovations in smoke ingredients focus on delivering cleaner, more natural flavors with improved safety profiles. Technologies like Puresmoke from Besmoke Ltd. remove harmful compounds while retaining authentic wood-smoked flavor. These innovations cater to the growing consumer demand for healthier and more natural food options. The increased demand for clean-label products drives competition towards developing smoke ingredients with transparent and easy-to-understand labels.

Report Segmentation & Scope

This report segments the Smoke Ingredients Market by several key factors:

By Type: This segment classifies smoke ingredients into liquid smoke, smoke flavorings, and others. Each segment's growth trajectory and market size will be analyzed.

By Application: This segment divides the market based on food applications: Meat, Poultry, Seafood, Dairy, and others, detailing market sizes and growth projections for each.

By Region: This section focuses on North America, Europe, Asia-Pacific, the Middle East & Africa, and South America, examining regional variances and specific growth drivers. Competitive dynamics within each region are also explored.

Key Drivers of Smoke Ingredients Market Growth

The growth of the Smoke Ingredients Market is driven by several factors:

- Rising consumer demand for smoked foods and beverages: Consumers increasingly seek the unique flavor profile of smoked products across various food categories.

- Technological advancements: Innovation in smoke flavor production enhances the quality and safety of ingredients while ensuring cost-effectiveness.

- Favorable regulatory environment: Supportive regulatory frameworks facilitate market growth and innovation in the food ingredient sector.

Challenges in the Smoke Ingredients Market Sector

Challenges faced by the Smoke Ingredients Market include:

- Stricter regulatory requirements regarding food safety: Compliance with evolving food safety standards can be costly and time-consuming.

- Fluctuations in raw material prices: The cost of raw materials used in smoke flavor production can significantly impact profitability.

- Intense competition among industry players: The competitive landscape necessitates continuous innovation and strategic initiatives.

Leading Players in the Smoke Ingredients Market Market

- Kerry Group

- Besmoke Ltd

- Azelis Holdings

- International Flavors & Fragrances Inc

- Essentia Protein Solutions

- Stringer Flavours Ltd

- B&G Foods

- MSK Ingredients Ltd

- FlavourStream SRL

- Henning Gesellschaft für Nahrungsmitteltechnik mbH

- List Not Exhaustive

Key Developments in Smoke Ingredients Market Sector

- January 2023: Azelis Holdings acquired Smoky Light B.V., expanding its market reach in the Benelux region and beyond.

- August 2021: TMI Foods partnered with Besmoke Ltd to integrate Puresmoke technology, offering cleaner smoked flavors.

- February 2021: International Flavors & Fragrances Inc. merged with Dupont's Nutrition and Biosciences, expanding its product portfolio.

Strategic Smoke Ingredients Market Market Outlook

The Smoke Ingredients Market presents significant growth opportunities, driven by the rising demand for natural and clean-label products, increasing consumer awareness of food safety, and ongoing technological advancements. Strategic partnerships, acquisitions, and investments in research and development are crucial for companies seeking to thrive in this dynamic market. The focus on sustainable sourcing practices and environmentally friendly production methods will also play a significant role in shaping the future of the industry.

Smoke Ingredients Market Segmentation

-

1. Foam

- 1.1. Liquid

- 1.2. Powder

- 1.3. Other Foams

-

2. Application

- 2.1. Dairy

- 2.2. Bakery and Confectionery

- 2.3. Meat and Seafood

- 2.4. Snacks and Sauces

Smoke Ingredients Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Smoke Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Smoked Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smoke Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foam

- 5.1.1. Liquid

- 5.1.2. Powder

- 5.1.3. Other Foams

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery and Confectionery

- 5.2.3. Meat and Seafood

- 5.2.4. Snacks and Sauces

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Foam

- 6. North America Smoke Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Foam

- 6.1.1. Liquid

- 6.1.2. Powder

- 6.1.3. Other Foams

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dairy

- 6.2.2. Bakery and Confectionery

- 6.2.3. Meat and Seafood

- 6.2.4. Snacks and Sauces

- 6.1. Market Analysis, Insights and Forecast - by Foam

- 7. Europe Smoke Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Foam

- 7.1.1. Liquid

- 7.1.2. Powder

- 7.1.3. Other Foams

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dairy

- 7.2.2. Bakery and Confectionery

- 7.2.3. Meat and Seafood

- 7.2.4. Snacks and Sauces

- 7.1. Market Analysis, Insights and Forecast - by Foam

- 8. Asia Pacific Smoke Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Foam

- 8.1.1. Liquid

- 8.1.2. Powder

- 8.1.3. Other Foams

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dairy

- 8.2.2. Bakery and Confectionery

- 8.2.3. Meat and Seafood

- 8.2.4. Snacks and Sauces

- 8.1. Market Analysis, Insights and Forecast - by Foam

- 9. South America Smoke Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Foam

- 9.1.1. Liquid

- 9.1.2. Powder

- 9.1.3. Other Foams

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dairy

- 9.2.2. Bakery and Confectionery

- 9.2.3. Meat and Seafood

- 9.2.4. Snacks and Sauces

- 9.1. Market Analysis, Insights and Forecast - by Foam

- 10. Middle East and Africa Smoke Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Foam

- 10.1.1. Liquid

- 10.1.2. Powder

- 10.1.3. Other Foams

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Dairy

- 10.2.2. Bakery and Confectionery

- 10.2.3. Meat and Seafood

- 10.2.4. Snacks and Sauces

- 10.1. Market Analysis, Insights and Forecast - by Foam

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Kerry Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Besmoke Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Azelis Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 International Flavors & Fragrances Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Essentia Protein Solutions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Stringer Flavours Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 B&G Foods

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MSK Ingredients Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FlavourStream SRL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Henning Gesellschaft für Nahrungsmitteltechnik mbH*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Kerry Group

List of Figures

- Figure 1: Global Smoke Ingredients Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Smoke Ingredients Market Revenue (Million), by Foam 2024 & 2032

- Figure 3: North America Smoke Ingredients Market Revenue Share (%), by Foam 2024 & 2032

- Figure 4: North America Smoke Ingredients Market Revenue (Million), by Application 2024 & 2032

- Figure 5: North America Smoke Ingredients Market Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Smoke Ingredients Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Smoke Ingredients Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Europe Smoke Ingredients Market Revenue (Million), by Foam 2024 & 2032

- Figure 9: Europe Smoke Ingredients Market Revenue Share (%), by Foam 2024 & 2032

- Figure 10: Europe Smoke Ingredients Market Revenue (Million), by Application 2024 & 2032

- Figure 11: Europe Smoke Ingredients Market Revenue Share (%), by Application 2024 & 2032

- Figure 12: Europe Smoke Ingredients Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe Smoke Ingredients Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Smoke Ingredients Market Revenue (Million), by Foam 2024 & 2032

- Figure 15: Asia Pacific Smoke Ingredients Market Revenue Share (%), by Foam 2024 & 2032

- Figure 16: Asia Pacific Smoke Ingredients Market Revenue (Million), by Application 2024 & 2032

- Figure 17: Asia Pacific Smoke Ingredients Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: Asia Pacific Smoke Ingredients Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Asia Pacific Smoke Ingredients Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Smoke Ingredients Market Revenue (Million), by Foam 2024 & 2032

- Figure 21: South America Smoke Ingredients Market Revenue Share (%), by Foam 2024 & 2032

- Figure 22: South America Smoke Ingredients Market Revenue (Million), by Application 2024 & 2032

- Figure 23: South America Smoke Ingredients Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: South America Smoke Ingredients Market Revenue (Million), by Country 2024 & 2032

- Figure 25: South America Smoke Ingredients Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East and Africa Smoke Ingredients Market Revenue (Million), by Foam 2024 & 2032

- Figure 27: Middle East and Africa Smoke Ingredients Market Revenue Share (%), by Foam 2024 & 2032

- Figure 28: Middle East and Africa Smoke Ingredients Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Middle East and Africa Smoke Ingredients Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Middle East and Africa Smoke Ingredients Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Smoke Ingredients Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Smoke Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Smoke Ingredients Market Revenue Million Forecast, by Foam 2019 & 2032

- Table 3: Global Smoke Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Smoke Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Smoke Ingredients Market Revenue Million Forecast, by Foam 2019 & 2032

- Table 6: Global Smoke Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Global Smoke Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Smoke Ingredients Market Revenue Million Forecast, by Foam 2019 & 2032

- Table 13: Global Smoke Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Global Smoke Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United Kingdom Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Germany Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: France Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Russia Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Smoke Ingredients Market Revenue Million Forecast, by Foam 2019 & 2032

- Table 23: Global Smoke Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Smoke Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: India Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: China Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Japan Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Asia Pacific Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Smoke Ingredients Market Revenue Million Forecast, by Foam 2019 & 2032

- Table 31: Global Smoke Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global Smoke Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of South America Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global Smoke Ingredients Market Revenue Million Forecast, by Foam 2019 & 2032

- Table 37: Global Smoke Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Global Smoke Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 39: South Africa Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Saudi Arabia Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Middle East and Africa Smoke Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smoke Ingredients Market?

The projected CAGR is approximately 5.19%.

2. Which companies are prominent players in the Smoke Ingredients Market?

Key companies in the market include Kerry Group, Besmoke Ltd, Azelis Holdings, International Flavors & Fragrances Inc, Essentia Protein Solutions, Stringer Flavours Ltd, B&G Foods, MSK Ingredients Ltd, FlavourStream SRL, Henning Gesellschaft für Nahrungsmitteltechnik mbH*List Not Exhaustive.

3. What are the main segments of the Smoke Ingredients Market?

The market segments include Foam, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Demand for Smoked Food.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2023, Azelis Holdings acquired Smoky Light B.V., an ingredients distributor in the BENELUX region. For the food and nutrition industries, Smoky Light B.V. provides smoke, grill, cooking flavors, browning agents, and additives. With this acquisition, Azelis aims to increase its market share in the Benelux region as well as throughout Europe, the Middle East, and Africa for smoke ingredients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smoke Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smoke Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smoke Ingredients Market?

To stay informed about further developments, trends, and reports in the Smoke Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence