Key Insights

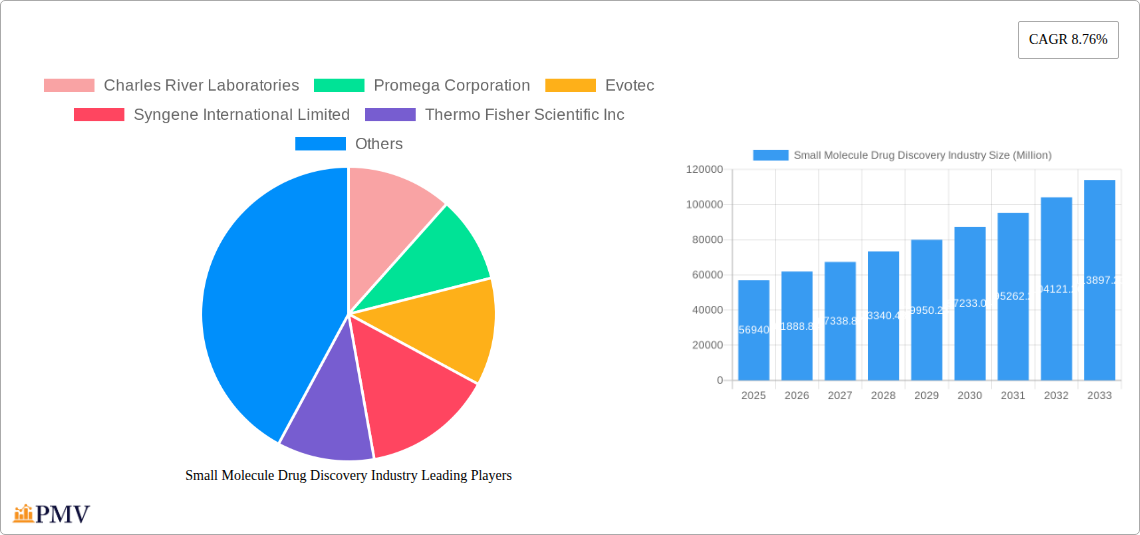

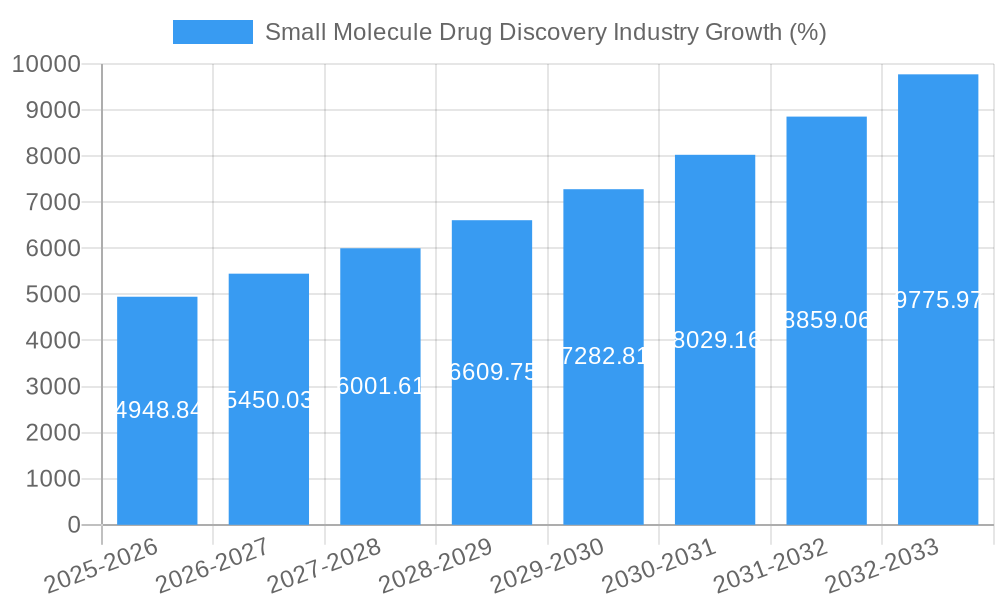

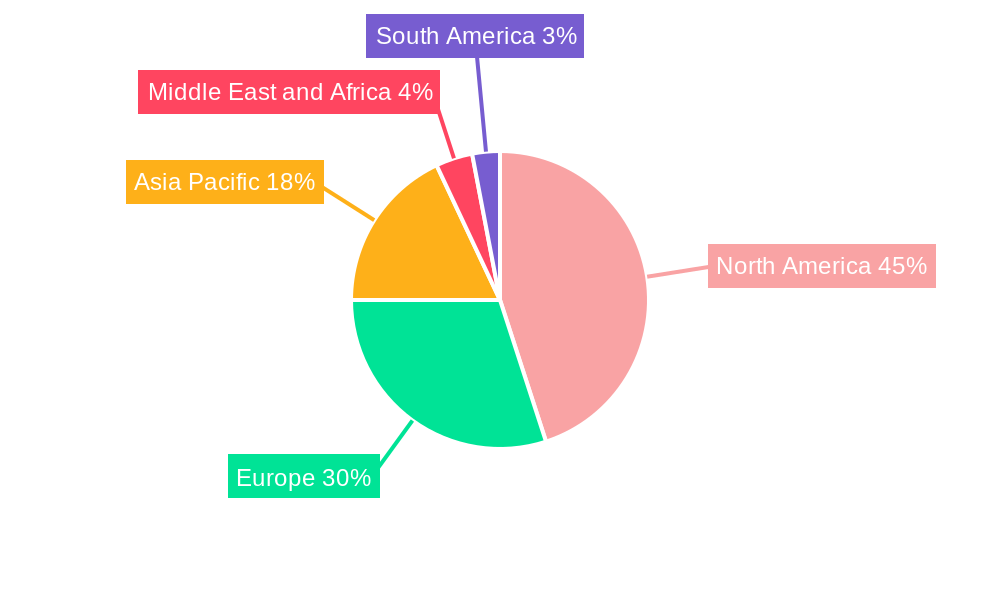

The small molecule drug discovery market, valued at $56.94 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 8.76% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases like cancer, cardiovascular disorders, and metabolic syndromes necessitates the development of novel small molecule therapies. Secondly, advancements in technologies such as high-throughput screening, artificial intelligence (AI)-driven drug design, and sophisticated analytical techniques are significantly accelerating the drug discovery process, reducing time-to-market and overall costs. Furthermore, the burgeoning biotechnology sector and increased R&D investments by pharmaceutical companies are further propelling market growth. The market's segmentation reflects this dynamism, with Oncology, Central Nervous System, and Cardiovascular therapeutic areas dominating, indicating the high unmet medical needs and considerable investment in these fields. Geographical distribution reveals strong market presence in North America and Europe, primarily due to established research infrastructure, regulatory frameworks, and high healthcare expenditure. However, the Asia-Pacific region is expected to witness rapid growth due to rising healthcare spending and increasing adoption of advanced technologies. The competitive landscape is characterized by a mix of large pharmaceutical companies and specialized drug discovery service providers, highlighting a collaborative ecosystem driving innovation.

The market's restraints include the high cost of drug development and regulatory hurdles. Stringent regulatory approvals, coupled with lengthy clinical trial periods, pose challenges to market expansion. However, the continuous advancement of technology and the strategic partnerships between pharmaceutical companies and technology providers are expected to mitigate these challenges. Future market growth will likely be shaped by the emergence of personalized medicine, which demands the development of targeted therapies, creating new opportunities within the small molecule drug discovery landscape. The integration of AI and machine learning into the drug discovery pipeline is expected to significantly impact market growth in the coming years, leading to improved efficiency, reduced development timelines, and increased success rates. The continued focus on unmet medical needs in various therapeutic areas will drive further innovation and market expansion in the forecast period.

This comprehensive report provides a detailed analysis of the global small molecule drug discovery market, offering invaluable insights for industry stakeholders, investors, and researchers. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report projects market trends through 2033. The report leverages extensive data analysis to forecast market size and growth, identify key market drivers and challenges, and highlight leading players and emerging trends. The total market value is projected to reach xx Million by 2033.

Small Molecule Drug Discovery Industry Market Structure & Competitive Dynamics

The small molecule drug discovery market is characterized by a moderately concentrated structure, with a few large players commanding significant market share. However, a dynamic ecosystem of smaller, specialized companies and emerging biotech firms contributes to innovation. The market is influenced by stringent regulatory frameworks, particularly concerning drug approval and safety. Product substitutes, such as biologics and advanced therapies, exert competitive pressure, while end-user trends—such as growing demand for personalized medicine and targeted therapies—shape market growth. Mergers and acquisitions (M&A) are frequent, with deal values exceeding xx Million annually in recent years.

- Market Concentration: The top 10 companies hold approximately xx% of the market share, with the remaining share distributed among numerous smaller players.

- Innovation Ecosystems: Collaboration between pharmaceutical companies, academic institutions, and contract research organizations (CROs) fuels innovation.

- Regulatory Frameworks: Stringent regulatory approvals influence timelines and costs associated with drug development.

- M&A Activity: Significant M&A activity reflects consolidation and strategic expansion within the industry, with average deal values exceeding xx Million. Examples include [Insert example M&A deal, if available, with value].

Small Molecule Drug Discovery Industry Industry Trends & Insights

The small molecule drug discovery market is experiencing robust growth, driven by several key factors. The rising prevalence of chronic diseases, particularly cancer, cardiovascular, and neurological disorders, fuels demand for novel drug therapies. Technological advancements, such as artificial intelligence (AI) and machine learning (ML), are accelerating drug discovery processes and improving efficacy. Furthermore, increasing investments in R&D by pharmaceutical and biotechnology companies are contributing to market expansion. The market is estimated to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration increasing from xx% in 2025 to xx% by 2033. The shift towards personalized medicine is driving the demand for more targeted small molecule drugs, resulting in increased market competition and further technological advancements.

Dominant Markets & Segments in Small Molecule Drug Discovery Industry

The North American market currently dominates the small molecule drug discovery industry, driven by robust R&D spending, a strong regulatory framework, and a large pool of skilled researchers. Within the segmentation, Oncology and Central Nervous System (CNS) therapeutic areas lead in terms of market size and investment, fueled by significant unmet medical needs.

By Process/Phase: Lead Optimization and Hit Generation & Selection segments hold significant market shares due to the intensive research and technological involvement in these stages.

By Therapeutic Area:

- Oncology: High prevalence of cancer and ongoing research into novel cancer therapies.

- Central Nervous System (CNS): Growing understanding of neurological diseases and the need for effective treatments.

- Cardiovascular: High prevalence of cardiovascular diseases worldwide.

- Other Therapeutic Areas: Significant growth potential exists in areas like metabolic disorders, respiratory diseases, and gastrointestinal disorders. These markets are characterized by a high level of unmet medical needs and active research and development activities.

Key Drivers (North America): Robust R&D investment, advanced infrastructure, supportive regulatory frameworks, strong intellectual property protection, and a large pool of skilled researchers.

Small Molecule Drug Discovery Industry Product Innovations

Recent product innovations focus on enhancing the efficiency and speed of drug discovery. This includes AI-powered platforms for target identification and lead optimization, as well as high-throughput screening technologies that accelerate the identification of potential drug candidates. Advances in combinatorial chemistry and DNA-encoded libraries (DEL) allow for the generation of diverse chemical libraries for screening and optimization. The trend is towards developing more targeted and personalized therapies, maximizing efficacy while minimizing side effects.

Report Segmentation & Scope

This report segments the small molecule drug discovery market based on process/phase (Target ID/Validation, Hit Generation and Selection, Lead Identification, Lead Optimization) and therapeutic area (Oncology, Central Nervous System, Cardiovascular, Respiratory, Metabolic Disorders, Gastrointestinal, Other Therapeutic Areas). Each segment is analyzed individually to provide detailed market size, growth projections, and competitive landscapes. Growth projections are driven by factors specific to each segment, such as technological advancements and clinical trial successes within specific therapeutic areas.

Key Drivers of Small Molecule Drug Discovery Industry Growth

Several factors drive growth within the small molecule drug discovery industry. Firstly, the growing prevalence of chronic diseases and unmet medical needs are pushing the demand for innovative therapies. Secondly, significant advancements in technology, including AI and machine learning for drug design and development, are accelerating the discovery process and improving efficacy. Lastly, increased funding from both private and public sources provides vital resources for research and development.

Challenges in the Small Molecule Drug Discovery Industry Sector

The small molecule drug discovery industry faces several significant challenges, including the high cost of drug development, the stringent regulatory environment, and the inherent risks associated with clinical trials. The complexity of biological systems and the need for efficient target identification pose additional hurdles. Supply chain disruptions can also impact the availability of essential reagents and materials, affecting research and development timelines and costs. Finally, intense competition from other drug modalities, such as biologics, further adds pressure on the market.

Leading Players in the Small Molecule Drug Discovery Industry Market

- Charles River Laboratories

- Promega Corporation

- Evotec

- Syngene International Limited

- Thermo Fisher Scientific Inc

- Labcorp Drug Development

- Curia Global Inc

- ICON Plc

- Schrödinger Inc

- Teva Pharmaceuticals

- Jubilant Biosys Ltd

- Eurofins Discovery

Key Developments in Small Molecule Drug Discovery Industry Sector

- July 2022: RxCelerate launched RxNfinit, a new small molecule discovery platform leveraging machine learning and combinatorial chemistry. This launch significantly impacts the market by accelerating drug discovery processes and potentially reducing development times.

- August 2022: BioDuro-Sundia and X-Chem launched DEL technology services in China, expanding access to advanced drug discovery technologies and accelerating drug development in the region. This development increases the pace of innovation in the Chinese pharmaceutical market.

Strategic Small Molecule Drug Discovery Industry Market Outlook

The future of the small molecule drug discovery market looks promising, with continued growth driven by technological advancements, increasing R&D investment, and a growing demand for novel therapies. Strategic opportunities exist for companies focused on AI-driven drug discovery, personalized medicine, and novel therapeutic areas. Companies capable of navigating the regulatory landscape and managing the inherent risks of drug development are poised to capture significant market share. The market is expected to witness further consolidation through M&A activity, leading to a more concentrated yet dynamic landscape.

Small Molecule Drug Discovery Industry Segmentation

-

1. Therapeutic Area

- 1.1. Oncology

- 1.2. Central Nervous System

- 1.3. Cardiovascular

- 1.4. Respiratory

- 1.5. Metabolic Disorders

- 1.6. Gastrointestinal

- 1.7. Other Therapeutic Areas

-

2. Process/Phase

- 2.1. Target ID/Validation

- 2.2. Hit Generation and Selection

- 2.3. Lead Identification

- 2.4. Lead Optimization

Small Molecule Drug Discovery Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Small Molecule Drug Discovery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Small Molecule Drugs; Increasing Number of Contract Organizations for R&D; Small Molecules in Treatment of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. High Drug Development Costs; Strict Regulations

- 3.4. Market Trends

- 3.4.1. Target ID/Validation Segment is Expected to Witness High Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Small Molecule Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 5.1.1. Oncology

- 5.1.2. Central Nervous System

- 5.1.3. Cardiovascular

- 5.1.4. Respiratory

- 5.1.5. Metabolic Disorders

- 5.1.6. Gastrointestinal

- 5.1.7. Other Therapeutic Areas

- 5.2. Market Analysis, Insights and Forecast - by Process/Phase

- 5.2.1. Target ID/Validation

- 5.2.2. Hit Generation and Selection

- 5.2.3. Lead Identification

- 5.2.4. Lead Optimization

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 6. North America Small Molecule Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 6.1.1. Oncology

- 6.1.2. Central Nervous System

- 6.1.3. Cardiovascular

- 6.1.4. Respiratory

- 6.1.5. Metabolic Disorders

- 6.1.6. Gastrointestinal

- 6.1.7. Other Therapeutic Areas

- 6.2. Market Analysis, Insights and Forecast - by Process/Phase

- 6.2.1. Target ID/Validation

- 6.2.2. Hit Generation and Selection

- 6.2.3. Lead Identification

- 6.2.4. Lead Optimization

- 6.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 7. Europe Small Molecule Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 7.1.1. Oncology

- 7.1.2. Central Nervous System

- 7.1.3. Cardiovascular

- 7.1.4. Respiratory

- 7.1.5. Metabolic Disorders

- 7.1.6. Gastrointestinal

- 7.1.7. Other Therapeutic Areas

- 7.2. Market Analysis, Insights and Forecast - by Process/Phase

- 7.2.1. Target ID/Validation

- 7.2.2. Hit Generation and Selection

- 7.2.3. Lead Identification

- 7.2.4. Lead Optimization

- 7.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 8. Asia Pacific Small Molecule Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 8.1.1. Oncology

- 8.1.2. Central Nervous System

- 8.1.3. Cardiovascular

- 8.1.4. Respiratory

- 8.1.5. Metabolic Disorders

- 8.1.6. Gastrointestinal

- 8.1.7. Other Therapeutic Areas

- 8.2. Market Analysis, Insights and Forecast - by Process/Phase

- 8.2.1. Target ID/Validation

- 8.2.2. Hit Generation and Selection

- 8.2.3. Lead Identification

- 8.2.4. Lead Optimization

- 8.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 9. Middle East and Africa Small Molecule Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 9.1.1. Oncology

- 9.1.2. Central Nervous System

- 9.1.3. Cardiovascular

- 9.1.4. Respiratory

- 9.1.5. Metabolic Disorders

- 9.1.6. Gastrointestinal

- 9.1.7. Other Therapeutic Areas

- 9.2. Market Analysis, Insights and Forecast - by Process/Phase

- 9.2.1. Target ID/Validation

- 9.2.2. Hit Generation and Selection

- 9.2.3. Lead Identification

- 9.2.4. Lead Optimization

- 9.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 10. South America Small Molecule Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 10.1.1. Oncology

- 10.1.2. Central Nervous System

- 10.1.3. Cardiovascular

- 10.1.4. Respiratory

- 10.1.5. Metabolic Disorders

- 10.1.6. Gastrointestinal

- 10.1.7. Other Therapeutic Areas

- 10.2. Market Analysis, Insights and Forecast - by Process/Phase

- 10.2.1. Target ID/Validation

- 10.2.2. Hit Generation and Selection

- 10.2.3. Lead Identification

- 10.2.4. Lead Optimization

- 10.1. Market Analysis, Insights and Forecast - by Therapeutic Area

- 11. North America Small Molecule Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Small Molecule Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Small Molecule Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Small Molecule Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Small Molecule Drug Discovery Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Charles River Laboratories

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Promega Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Evotec

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Syngene International Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Thermo Fisher Scientific Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Labcorp Drug Development

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Curia Global Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ICON Plc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Schrödinger Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Teva Pharmaceuticals*List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Jubilant Biosys Ltd

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Eurofins Discovery

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Charles River Laboratories

List of Figures

- Figure 1: Global Small Molecule Drug Discovery Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Small Molecule Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Small Molecule Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Small Molecule Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Small Molecule Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Small Molecule Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Small Molecule Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Small Molecule Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Small Molecule Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Small Molecule Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Small Molecule Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Small Molecule Drug Discovery Industry Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 13: North America Small Molecule Drug Discovery Industry Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 14: North America Small Molecule Drug Discovery Industry Revenue (Million), by Process/Phase 2024 & 2032

- Figure 15: North America Small Molecule Drug Discovery Industry Revenue Share (%), by Process/Phase 2024 & 2032

- Figure 16: North America Small Molecule Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Small Molecule Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Small Molecule Drug Discovery Industry Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 19: Europe Small Molecule Drug Discovery Industry Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 20: Europe Small Molecule Drug Discovery Industry Revenue (Million), by Process/Phase 2024 & 2032

- Figure 21: Europe Small Molecule Drug Discovery Industry Revenue Share (%), by Process/Phase 2024 & 2032

- Figure 22: Europe Small Molecule Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Small Molecule Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Small Molecule Drug Discovery Industry Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 25: Asia Pacific Small Molecule Drug Discovery Industry Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 26: Asia Pacific Small Molecule Drug Discovery Industry Revenue (Million), by Process/Phase 2024 & 2032

- Figure 27: Asia Pacific Small Molecule Drug Discovery Industry Revenue Share (%), by Process/Phase 2024 & 2032

- Figure 28: Asia Pacific Small Molecule Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Small Molecule Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Small Molecule Drug Discovery Industry Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 31: Middle East and Africa Small Molecule Drug Discovery Industry Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 32: Middle East and Africa Small Molecule Drug Discovery Industry Revenue (Million), by Process/Phase 2024 & 2032

- Figure 33: Middle East and Africa Small Molecule Drug Discovery Industry Revenue Share (%), by Process/Phase 2024 & 2032

- Figure 34: Middle East and Africa Small Molecule Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Small Molecule Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Small Molecule Drug Discovery Industry Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 37: South America Small Molecule Drug Discovery Industry Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 38: South America Small Molecule Drug Discovery Industry Revenue (Million), by Process/Phase 2024 & 2032

- Figure 39: South America Small Molecule Drug Discovery Industry Revenue Share (%), by Process/Phase 2024 & 2032

- Figure 40: South America Small Molecule Drug Discovery Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Small Molecule Drug Discovery Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 3: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Process/Phase 2019 & 2032

- Table 4: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 32: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Process/Phase 2019 & 2032

- Table 33: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 38: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Process/Phase 2019 & 2032

- Table 39: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 47: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Process/Phase 2019 & 2032

- Table 48: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 56: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Process/Phase 2019 & 2032

- Table 57: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 62: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Process/Phase 2019 & 2032

- Table 63: Global Small Molecule Drug Discovery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Small Molecule Drug Discovery Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Small Molecule Drug Discovery Industry?

The projected CAGR is approximately 8.76%.

2. Which companies are prominent players in the Small Molecule Drug Discovery Industry?

Key companies in the market include Charles River Laboratories, Promega Corporation, Evotec, Syngene International Limited, Thermo Fisher Scientific Inc, Labcorp Drug Development, Curia Global Inc, ICON Plc, Schrödinger Inc, Teva Pharmaceuticals*List Not Exhaustive, Jubilant Biosys Ltd, Eurofins Discovery.

3. What are the main segments of the Small Molecule Drug Discovery Industry?

The market segments include Therapeutic Area, Process/Phase.

4. Can you provide details about the market size?

The market size is estimated to be USD 56.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Small Molecule Drugs; Increasing Number of Contract Organizations for R&D; Small Molecules in Treatment of Chronic Diseases.

6. What are the notable trends driving market growth?

Target ID/Validation Segment is Expected to Witness High Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Drug Development Costs; Strict Regulations.

8. Can you provide examples of recent developments in the market?

August 2022: BioDuro-Sundia and X-Chem, a DEL technology pioneer in small molecule drug discovery, launched DNA Encoded Compound Library (DEL) technology services in China to help more innovative pharmaceutical companies quickly discover small molecule drugs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Small Molecule Drug Discovery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Small Molecule Drug Discovery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Small Molecule Drug Discovery Industry?

To stay informed about further developments, trends, and reports in the Small Molecule Drug Discovery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence