Key Insights

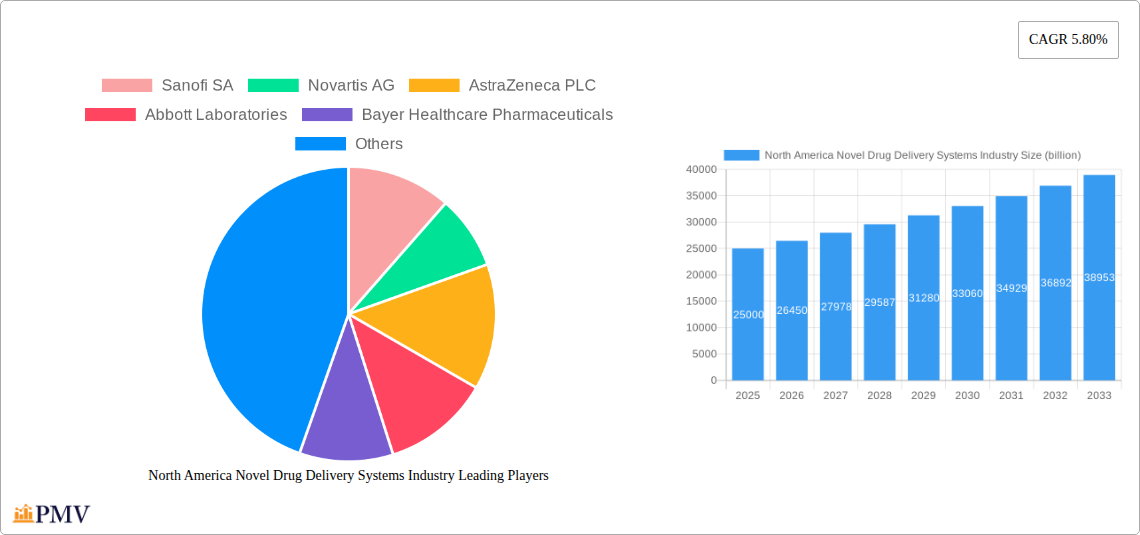

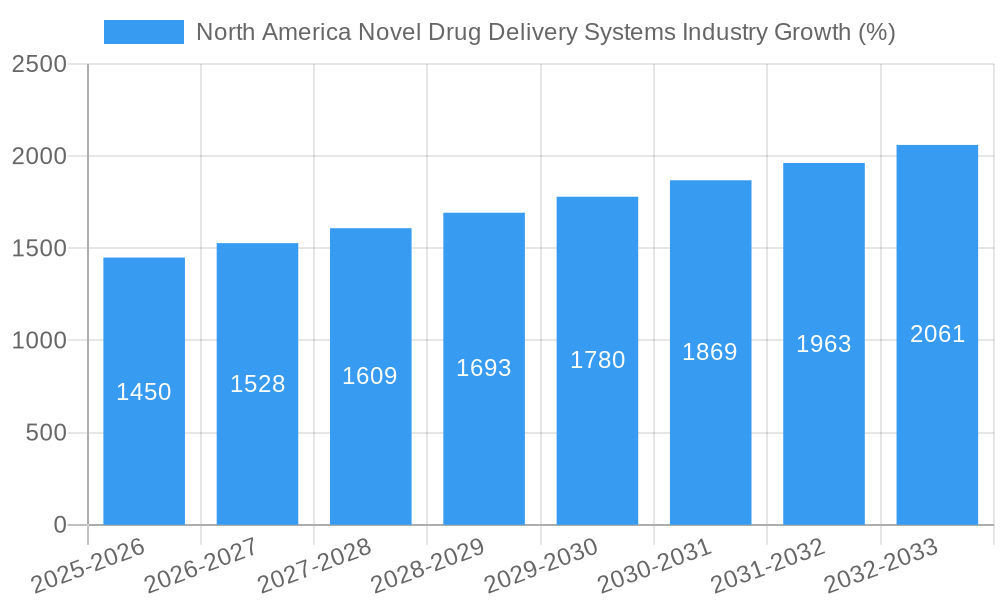

The North American novel drug delivery systems (NDDS) market is experiencing robust growth, driven by the increasing prevalence of chronic diseases, the rising demand for patient-centric therapies, and ongoing technological advancements. The market, estimated at $XX billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This growth is fueled by the increasing adoption of targeted drug delivery systems, offering improved efficacy and reduced side effects compared to traditional methods. Oral drug delivery systems currently hold the largest market share, due to their convenience and ease of administration. However, significant growth is anticipated in other segments like injectable, pulmonary, and transdermal drug delivery systems, owing to their potential to deliver drugs to specific target sites, enhancing therapeutic outcomes. Major pharmaceutical companies such as Sanofi, Novartis, AstraZeneca, and Pfizer are actively involved in R&D and commercialization of novel drug delivery technologies, further accelerating market expansion.

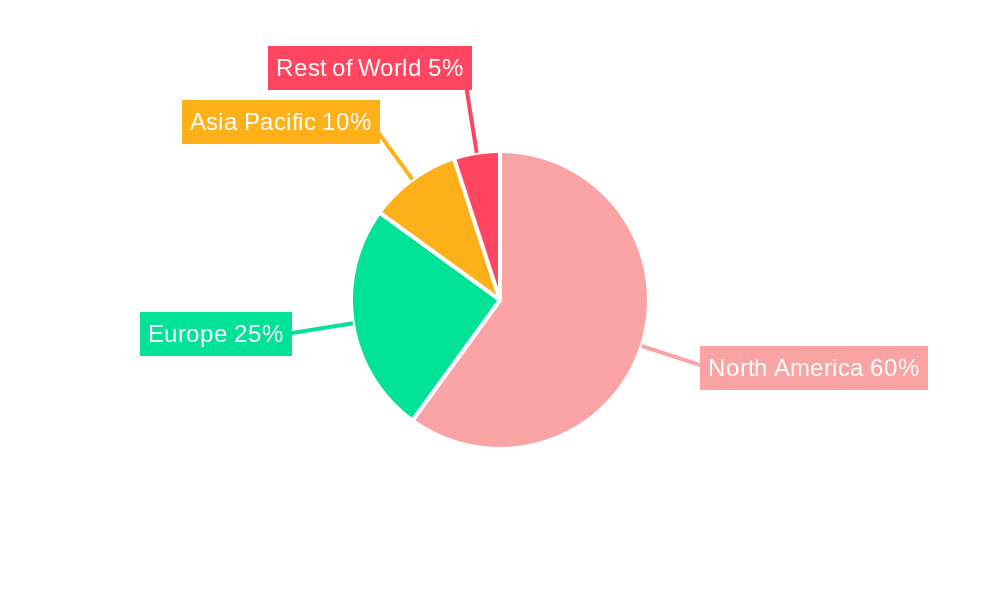

The significant market drivers include the rising geriatric population susceptible to chronic diseases, increasing demand for personalized medicine, and favorable regulatory support for innovative drug delivery technologies. However, the high cost of research and development, stringent regulatory approvals, and potential challenges associated with biocompatibility and scalability represent key restraints. The market segmentation, encompassing various routes of administration (oral, injectable, pulmonary, transdermal) and modes of NDDS (targeted, controlled, modulated), reflects the diverse therapeutic applications and technological advancements within the sector. The North American region, particularly the United States, dominates the market, reflecting its advanced healthcare infrastructure and higher healthcare expenditure. The forecast period suggests continued strong growth, propelled by the ongoing innovation within the NDDS landscape and a growing focus on improving patient treatment outcomes.

North America Novel Drug Delivery Systems Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America novel drug delivery systems (NDDS) market, offering invaluable insights for industry stakeholders. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The market is projected to reach a value of $XX billion by 2033, exhibiting a CAGR of XX% during the forecast period. This report meticulously examines market segmentation by route of administration (oral, injectable, pulmonary, transdermal, others) and mode of NDDS (targeted, controlled, modulated), offering granular analysis of market size, growth drivers, and competitive dynamics. Key players such as Sanofi SA, Novartis AG, AstraZeneca PLC, Abbott Laboratories, Bayer Healthcare Pharmaceuticals, Pfizer Inc, Johnson & Johnson, Merck & Co, Roche Holding AG, and GlaxoSmithKline PLC are analyzed in detail.

North America Novel Drug Delivery Systems Industry Market Structure & Competitive Dynamics

The North American NDDS market is characterized by a moderately consolidated structure with several multinational pharmaceutical giants holding significant market share. The top 10 players account for approximately XX% of the market, reflecting the considerable capital investment and expertise required for NDDS development and commercialization. Market concentration is further influenced by robust intellectual property protection, driving strategic mergers and acquisitions (M&A) activity. The value of M&A deals in the NDDS sector within North America totalled approximately $XX billion between 2019 and 2024. Innovation ecosystems, particularly in the US and Canada, are thriving, fueled by government funding for research and development and collaborations between academia, pharmaceutical companies, and biotech startups. Regulatory frameworks such as those enforced by the FDA significantly impact market entry and product lifecycle management. The presence of substitute therapies and evolving end-user preferences (patient-centric care) are creating new challenges and opportunities for players in the market.

- Market Share: Top 10 players hold approximately XX%

- M&A Deal Value (2019-2024): $XX billion

- Key Regulatory Bodies: FDA (USA), Health Canada

North America Novel Drug Delivery Systems Industry Industry Trends & Insights

The North American NDDS market is experiencing robust growth, propelled by several key trends. The increasing prevalence of chronic diseases necessitates innovative delivery systems for improved patient outcomes and medication adherence. Technological advancements, such as nanotechnology and 3D printing, are revolutionizing drug delivery, enabling targeted therapies and personalized medicine. Consumer preferences are shifting towards more convenient and user-friendly drug delivery methods, driving demand for oral and transdermal systems. Competitive dynamics are characterized by a push toward differentiated products, fostering innovation in drug delivery mechanisms and formulations. The market demonstrates a clear preference for targeted and controlled drug delivery systems. This trend is expected to continue, resulting in a significant market share for these systems within the next decade. The market penetration rate for targeted drug delivery systems is estimated at XX% in 2025, projected to reach XX% by 2033.

Dominant Markets & Segments in North America Novel Drug Delivery Systems Industry

The United States dominates the North American NDDS market, driven by robust healthcare infrastructure, high R&D spending, and a large patient population with chronic diseases. Within segments:

- By Route of Administration: Injectable drug delivery systems hold the largest market share, followed by oral drug delivery systems. The growth of the injectable segment is driven by the increasing demand for biologics and other complex therapies. The oral segment benefits from convenience and ease of administration.

- By Mode of NDDS: Targeted drug delivery systems are experiencing the fastest growth, owing to their improved efficacy and reduced side effects. Controlled release systems maintain a significant market share due to their ability to provide sustained drug delivery, improving patient compliance.

Key Drivers:

- High prevalence of chronic diseases (e.g., diabetes, cancer)

- Favorable regulatory environment fostering innovation

- Significant investments in R&D by pharmaceutical companies

North America Novel Drug Delivery Systems Industry Product Innovations

Recent innovations focus on enhanced targeted delivery, personalized therapies, and improved patient compliance. Nanotechnology enables the precise delivery of drugs to specific cells or tissues, minimizing side effects. 3D printing is facilitating the creation of customized drug delivery devices tailored to individual patient needs. These advancements are not only improving treatment outcomes but are also enhancing the overall patient experience. The increased integration of digital health technologies allows for remote monitoring of drug delivery, which further improves patient adherence.

Report Segmentation & Scope

This report offers a detailed segmentation of the North American NDDS market, encompassing:

By Route of Administration:

- Oral Drug Delivery Systems: Market size projected to reach $XX billion by 2033. Growth driven by advancements in formulation technology.

- Injectable Drug Delivery Systems: Market size projected to reach $XX billion by 2033. Dominated by biologics and advanced therapies.

- Pulmonary Drug Delivery Systems: Market size projected to reach $XX billion by 2033. Growth driven by increasing prevalence of respiratory diseases.

- Transdermal Drug Delivery Systems: Market size projected to reach $XX billion by 2033. Growth driven by improved patient comfort and convenience.

- Others: Market size projected to reach $XX billion by 2033. Includes implantable devices and other innovative delivery systems.

By Mode of NDDS:

- Targeted Drug Delivery Systems: Market size projected to reach $XX billion by 2033. Growth driven by increased efficacy and reduced side effects.

- Controlled Drug Delivery Systems: Market size projected to reach $XX billion by 2033. Growth driven by improved patient compliance and reduced dosing frequency.

- Modulated Drug Delivery Systems: Market size projected to reach $XX billion by 2033. Growth driven by the ability to adapt drug release based on patient needs.

Key Drivers of North America Novel Drug Delivery Systems Industry Growth

The North American NDDS market is driven by several factors, including:

- The rising prevalence of chronic diseases requiring long-term medication.

- Technological advancements such as nanotechnology and microfluidics enhancing drug delivery efficacy and safety.

- Stringent regulatory approvals incentivizing innovation and improved drug delivery systems.

Challenges in the North America Novel Drug Delivery Systems Industry Sector

The NDDS market faces challenges, including:

- High R&D costs and long regulatory approval processes.

- Complexity in formulation and manufacturing, leading to high production costs.

- Intense competition among established pharmaceutical companies and emerging biotech firms.

Leading Players in the North America Novel Drug Delivery Systems Industry Market

- Sanofi SA

- Novartis AG

- AstraZeneca PLC

- Abbott Laboratories

- Bayer Healthcare Pharmaceuticals

- Pfizer Inc

- Johnson & Johnson

- Merck & Co

- Roche Holding AG

- GlaxoSmithKline PLC

Key Developments in North America Novel Drug Delivery Systems Industry Sector

- June 2023: Company X launches a new targeted drug delivery system for cancer treatment.

- October 2022: Company Y announces a strategic partnership to develop a novel pulmonary drug delivery system.

- March 2021: Company Z acquires a biotech startup specializing in nanotechnology for drug delivery.

Strategic North America Novel Drug Delivery Systems Industry Market Outlook

The North American NDDS market presents significant growth potential. Continued advancements in nanotechnology, 3D printing, and other technologies will drive the development of more targeted, efficient, and patient-friendly drug delivery systems. Strategic partnerships and collaborations between pharmaceutical companies, biotech startups, and academic institutions will play a crucial role in accelerating innovation and market growth. The market will see increased focus on personalized medicine and the development of smart drug delivery systems. This presents opportunities for companies specializing in advanced materials, drug formulation, and digital health technologies.

North America Novel Drug Delivery Systems Industry Segmentation

-

1. Route of Administration

- 1.1. Oral Drug Delivery Systems

- 1.2. Injectable Drug Delivery Systems

- 1.3. Pulmonary Drug Delivery Systems

- 1.4. Transdermal Drug Delivery Systems

- 1.5. Others

-

2. Mode of NDDS

- 2.1. Targeted Drug Delivery Systems

- 2.2. Controlled Drug Delivery Systems

- 2.3. Modulated Drug Delivery Systems

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

-

3.1. North America

North America Novel Drug Delivery Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Novel Drug Delivery Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Need of Controlled Release of Drugs; Technological Advancements Promoting Development of NDDS

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Guidelines and Product Recalls; Stability Issues of the Devices

- 3.4. Market Trends

- 3.4.1. Oral Drug Delivery Systems is Expected to Grow Fastest during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Oral Drug Delivery Systems

- 5.1.2. Injectable Drug Delivery Systems

- 5.1.3. Pulmonary Drug Delivery Systems

- 5.1.4. Transdermal Drug Delivery Systems

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Mode of NDDS

- 5.2.1. Targeted Drug Delivery Systems

- 5.2.2. Controlled Drug Delivery Systems

- 5.2.3. Modulated Drug Delivery Systems

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. United States North America Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Sanofi SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Novartis AG

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 AstraZeneca PLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Abbott Laboratories

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Bayer Healthcare Pharmaceuticals

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Pfizer Inc *List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Johnson & Johnson

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Merck & Co

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Roche Holding AG

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 GlaxoSmithKline PLC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Sanofi SA

List of Figures

- Figure 1: North America Novel Drug Delivery Systems Industry Revenue Breakdown (billion, %) by Product 2024 & 2032

- Figure 2: North America Novel Drug Delivery Systems Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Region 2019 & 2032

- Table 2: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Route of Administration 2019 & 2032

- Table 3: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Mode of NDDS 2019 & 2032

- Table 4: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Geography 2019 & 2032

- Table 5: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Region 2019 & 2032

- Table 6: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Country 2019 & 2032

- Table 7: United States North America Novel Drug Delivery Systems Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Novel Drug Delivery Systems Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Novel Drug Delivery Systems Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 10: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Route of Administration 2019 & 2032

- Table 11: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Mode of NDDS 2019 & 2032

- Table 12: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Geography 2019 & 2032

- Table 13: North America Novel Drug Delivery Systems Industry Revenue billion Forecast, by Country 2019 & 2032

- Table 14: United States North America Novel Drug Delivery Systems Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Novel Drug Delivery Systems Industry Revenue (billion) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Novel Drug Delivery Systems Industry Revenue (billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Novel Drug Delivery Systems Industry?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the North America Novel Drug Delivery Systems Industry?

Key companies in the market include Sanofi SA, Novartis AG, AstraZeneca PLC, Abbott Laboratories, Bayer Healthcare Pharmaceuticals, Pfizer Inc *List Not Exhaustive, Johnson & Johnson, Merck & Co, Roche Holding AG, GlaxoSmithKline PLC.

3. What are the main segments of the North America Novel Drug Delivery Systems Industry?

The market segments include Route of Administration, Mode of NDDS, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX billion as of 2022.

5. What are some drivers contributing to market growth?

; Rising Need of Controlled Release of Drugs; Technological Advancements Promoting Development of NDDS.

6. What are the notable trends driving market growth?

Oral Drug Delivery Systems is Expected to Grow Fastest during the Forecast Period.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Guidelines and Product Recalls; Stability Issues of the Devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Novel Drug Delivery Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Novel Drug Delivery Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Novel Drug Delivery Systems Industry?

To stay informed about further developments, trends, and reports in the North America Novel Drug Delivery Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence