Key Insights

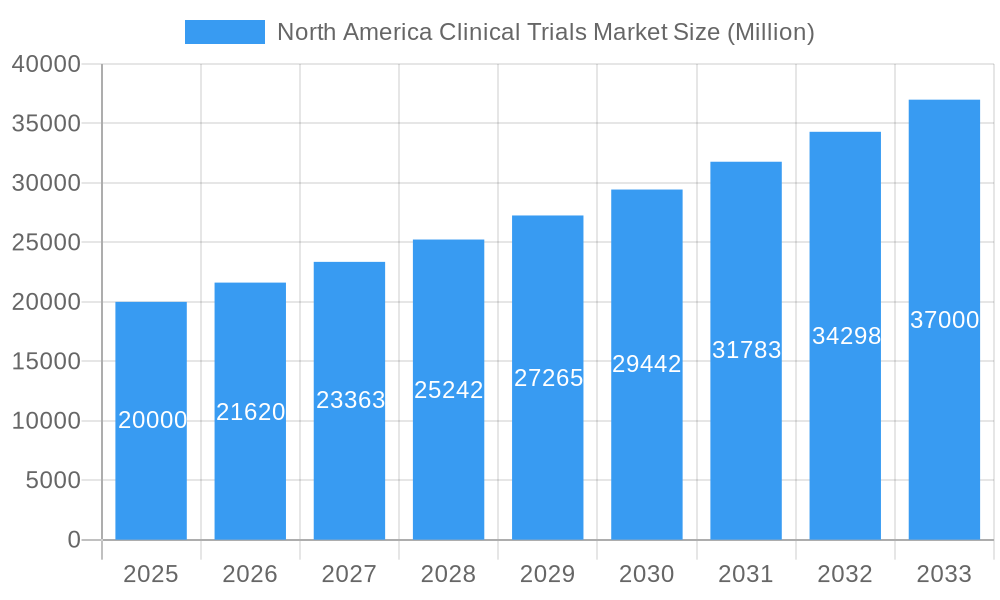

The North America clinical trials market, encompassing Phases I-IV and diverse trial designs including double-blind, single-blind, non-blind randomized, and observational studies, is demonstrating substantial growth. Fueled by the increasing prevalence of chronic diseases, an aging demographic, and amplified investments in biomedical research and development, the market is anticipated to sustain a significant Compound Annual Growth Rate (CAGR) of 6.1% from 2025 to 2033. Key industry leaders such as Novo Nordisk, Roche, and Pfizer are instrumental in this expansion through considerable R&D investments, strategic alliances, and the pioneering of novel therapeutics. Market segmentation highlights a pronounced emphasis on randomized controlled trials, aligning with rigorous regulatory standards and the demand for robust clinical evidence. The United States is projected to lead the North America market, attributed to its advanced healthcare infrastructure, substantial research funding, and a deep talent pool of researchers and participants. Government initiatives designed to expedite drug development and streamline regulatory pathways further bolster this upward trend. This market is valued at 59.29 billion in the base year 2024.

North America Clinical Trials Market Market Size (In Billion)

Despite significant growth, the market faces certain constraints, including high clinical trial expenditures, stringent regulatory approval processes, and the increasing intricacy of conducting multinational trials. Future market expansion will hinge on several critical factors: the successful development and commercialization of innovative treatments, continued investment in technologies that enhance efficiency and lower costs, and the adaptability of the regulatory framework to industry shifts. While the rising incidence of chronic diseases offers a persistent growth avenue, effectively managing clinical trial costs and navigating regulatory complexities will be paramount for sustained market expansion. Intense competition among leading pharmaceutical firms and Contract Research Organizations (CROs) necessitates continuous innovation in improving operational efficiency and cost reduction, while upholding the highest standards of clinical trial execution.

North America Clinical Trials Market Company Market Share

North America Clinical Trials Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America clinical trials market, offering valuable insights for stakeholders across the pharmaceutical, biotechnology, and healthcare sectors. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth potential. The study encompasses key segments including Phase I, II, III, and IV trials, categorized by study design (Treatment Studies, Randomized Control Trials - Double Blind, Single Blind, Non-blind, and Non-randomized Control Trials/Observational Studies). The report features detailed profiles of leading players like Novo Nordisk AS, PAREXEL International Corporation, F. Hoffmann-La Roche Ltd, ICON PLC, Eli Lilly and Company, Clinipace, Pharmaceutical Product Development LLC, IQVIA, Laboratory Corporation of America Holdings, and Pfizer Inc., providing crucial data for strategic decision-making.

North America Clinical Trials Market Market Structure & Competitive Dynamics

The North America clinical trials market is characterized by a moderately concentrated structure with a few large players holding significant market share. However, a vibrant ecosystem of smaller CROs (Contract Research Organizations) and specialized service providers contribute to innovation and competition. The regulatory landscape, primarily governed by the FDA (Food and Drug Administration), significantly impacts market dynamics. Stringent regulations drive higher costs and longer timelines for drug development but also ensure patient safety and efficacy. Product substitutes, primarily alternative therapies and diagnostic tools, exert competitive pressure, influencing clinical trial design and scope. End-user trends, such as growing demand for personalized medicine and advanced therapies, are shaping clinical trial strategies. Furthermore, M&A activities are prevalent, with larger companies acquiring smaller CROs and specialized service providers to expand their service offerings and geographical reach. For example, in 2022, an estimated xx Million in M&A deals were recorded, indicating significant consolidation in the market. Market share among the top 10 players is estimated at xx%, leaving room for smaller, specialized companies to carve out niches and compete.

North America Clinical Trials Market Industry Trends & Insights

The North America clinical trials market is experiencing robust growth, driven by several key factors. The rising prevalence of chronic diseases like cancer, diabetes, and cardiovascular diseases is a primary driver, increasing demand for new treatments and thus, clinical trials. Technological advancements, including AI-powered data analysis and telemedicine, are improving efficiency and reducing costs, accelerating trial timelines. Furthermore, increasing government funding for research and development, coupled with favorable regulatory policies, stimulates market expansion. Consumer preferences are also shifting towards personalized medicine, with patients actively seeking participation in trials that address their specific needs. The market is expected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of advanced technologies like AI in clinical trials is projected to reach xx% by 2033. The competitive landscape remains dynamic, with both established players and emerging companies vying for market share.

Dominant Markets & Segments in North America Clinical Trials Market

The United States dominates the North America clinical trials market due to its robust healthcare infrastructure, extensive research facilities, and high concentration of pharmaceutical and biotechnology companies.

- Key Drivers for US Dominance:

- High funding for R&D from both public and private sectors.

- Large patient pool with diverse demographics.

- Well-established regulatory framework.

- Presence of leading pharmaceutical and biotech companies.

Segment Dominance:

- Phase III trials: Hold the largest market share due to the high cost and complexity involved in late-stage clinical development. This stage is crucial for regulatory approval.

- Treatment Studies: This study design is dominant due to its focus on evaluating the efficacy of new treatments.

- Double-Blind Randomized Trials: This design is the gold standard in clinical trials, offering robust results to mitigate biases and enhance the reliability of findings.

The market share distribution across other segments (Phase I, II, IV and different Randomized and Non-randomized trial designs) varies, influenced by factors like the stage of drug development and research objectives.

North America Clinical Trials Market Product Innovations

Significant innovations are transforming the clinical trials landscape. The adoption of decentralized clinical trials (DCTs) leverages technology to enhance accessibility and efficiency, making trials less geographically constrained and more patient-friendly. Digital health technologies, such as wearable sensors and remote monitoring devices, enhance data collection and improve patient engagement. AI-driven analytics helps expedite data analysis and improve the overall efficiency of the clinical trial process. These innovations enhance the cost-effectiveness and speed of clinical trials, enabling faster drug development and improving the overall success rate.

Report Segmentation & Scope

This report segments the North America clinical trials market based on several key parameters.

Phase: Phase I, Phase II, Phase III, Phase IV trials are analyzed individually, examining market size, growth projections, and competitive landscapes. Phase III trials constitute a significant portion of the market due to their importance in regulatory approvals.

Design: The report analyzes Treatment Studies, Randomized Controlled Trials (Double-blind, Single-blind, Non-blind), and Non-randomized Control Trials (Observational Studies). Each design presents unique challenges and opportunities with varying costs and timelines.

Growth projections are provided for each segment based on various factors including technological advancements, regulatory changes, and industry trends. The competitive dynamics within each segment are also assessed.

Key Drivers of North America Clinical Trials Market Growth

Several key factors are driving the expansion of the North America clinical trials market. The increasing prevalence of chronic diseases necessitates the development of new therapies, leading to increased demand for clinical trials. Advancements in technology, such as AI and telehealth, are boosting efficiency and reducing costs. Moreover, significant investment in R&D, both from private and public sectors, fuels clinical trial activities. Favorable regulatory environments, coupled with government initiatives supporting clinical research, further contribute to market growth.

Challenges in the North America Clinical Trials Market Sector

Despite significant growth, the North America clinical trials market faces challenges. Regulatory hurdles, including stringent approval processes and evolving guidelines, increase costs and timelines. Supply chain issues and shortages of essential resources, especially during periods of high demand, can impact trial timelines and cost. Furthermore, intense competition among CROs and other service providers can compress margins and necessitate innovative strategies to differentiate services. These factors contribute to challenges in maintaining profitability and ensuring efficient operations.

Leading Players in the North America Clinical Trials Market Market

- Novo Nordisk AS

- PAREXEL International Corporation

- F. Hoffmann-La Roche Ltd

- ICON PLC

- Eli Lilly and Company

- Clinipace

- Pharmaceutical Product Development LLC

- IQVIA

- Laboratory Corporation of America Holdings

- Pfizer Inc

Key Developments in North America Clinical Trials Market Sector

- September 2022: IVERIC bio, Inc. initiated an Open-label Extension (OLE) Phase 3 trial for avacincaptad pegol.

- September 2022: The University of Illinois at Chicago launched a clinical trial investigating blood flow and blood pressure in Down syndrome.

These developments highlight the ongoing innovation and research within the North America clinical trials market, driving future growth and shaping the competitive landscape.

Strategic North America Clinical Trials Market Market Outlook

The North America clinical trials market holds significant future potential. Continued advancements in technology and the rising prevalence of chronic diseases will drive sustained growth. Strategic opportunities exist for companies to leverage innovative technologies like AI and DCTs to enhance efficiency and reduce costs. Companies focused on specialized therapeutic areas and patient-centric approaches will likely gain a competitive advantage. The market's future growth hinges on addressing challenges like regulatory hurdles and ensuring patient access to clinical trials. By proactively adapting to these changes, stakeholders can capitalize on the market's expansive growth trajectory.

North America Clinical Trials Market Segmentation

-

1. Phase

- 1.1. Phase I

- 1.2. Phase II

- 1.3. Phase III

- 1.4. Phase IV

-

2. Design

-

2.1. Treatment Studies

-

2.1.1. Randomized Control Trial

- 2.1.1.1. Double Blind Trial Randomized Trial

- 2.1.1.2. Single Blind Trial Randomized Trial

- 2.1.1.3. Non-blind Randomized Trial

- 2.1.2. Adaptive Clinical Trial

- 2.1.3. Non-randomized Control Trial

-

2.1.1. Randomized Control Trial

-

2.2. Observational Studies

- 2.2.1. Cohort Study

- 2.2.2. Case Control Study

- 2.2.3. Cross Sectional Study

- 2.2.4. Ecological Study

-

2.1. Treatment Studies

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Clinical Trials Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Clinical Trials Market Regional Market Share

Geographic Coverage of North America Clinical Trials Market

North America Clinical Trials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Clinical Trials; High R&D Expenditure of the Pharmaceutical Industry; Rising Prevalence of Diseases

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Workforce for Clinical Research; Stringent Regulations

- 3.4. Market Trends

- 3.4.1. Phase III is the Largest Segment Under Phases that is Expected to Grow During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Clinical Trials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 5.1.1. Phase I

- 5.1.2. Phase II

- 5.1.3. Phase III

- 5.1.4. Phase IV

- 5.2. Market Analysis, Insights and Forecast - by Design

- 5.2.1. Treatment Studies

- 5.2.1.1. Randomized Control Trial

- 5.2.1.1.1. Double Blind Trial Randomized Trial

- 5.2.1.1.2. Single Blind Trial Randomized Trial

- 5.2.1.1.3. Non-blind Randomized Trial

- 5.2.1.2. Adaptive Clinical Trial

- 5.2.1.3. Non-randomized Control Trial

- 5.2.1.1. Randomized Control Trial

- 5.2.2. Observational Studies

- 5.2.2.1. Cohort Study

- 5.2.2.2. Case Control Study

- 5.2.2.3. Cross Sectional Study

- 5.2.2.4. Ecological Study

- 5.2.1. Treatment Studies

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 6. United States North America Clinical Trials Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 6.1.1. Phase I

- 6.1.2. Phase II

- 6.1.3. Phase III

- 6.1.4. Phase IV

- 6.2. Market Analysis, Insights and Forecast - by Design

- 6.2.1. Treatment Studies

- 6.2.1.1. Randomized Control Trial

- 6.2.1.1.1. Double Blind Trial Randomized Trial

- 6.2.1.1.2. Single Blind Trial Randomized Trial

- 6.2.1.1.3. Non-blind Randomized Trial

- 6.2.1.2. Adaptive Clinical Trial

- 6.2.1.3. Non-randomized Control Trial

- 6.2.1.1. Randomized Control Trial

- 6.2.2. Observational Studies

- 6.2.2.1. Cohort Study

- 6.2.2.2. Case Control Study

- 6.2.2.3. Cross Sectional Study

- 6.2.2.4. Ecological Study

- 6.2.1. Treatment Studies

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 7. Canada North America Clinical Trials Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 7.1.1. Phase I

- 7.1.2. Phase II

- 7.1.3. Phase III

- 7.1.4. Phase IV

- 7.2. Market Analysis, Insights and Forecast - by Design

- 7.2.1. Treatment Studies

- 7.2.1.1. Randomized Control Trial

- 7.2.1.1.1. Double Blind Trial Randomized Trial

- 7.2.1.1.2. Single Blind Trial Randomized Trial

- 7.2.1.1.3. Non-blind Randomized Trial

- 7.2.1.2. Adaptive Clinical Trial

- 7.2.1.3. Non-randomized Control Trial

- 7.2.1.1. Randomized Control Trial

- 7.2.2. Observational Studies

- 7.2.2.1. Cohort Study

- 7.2.2.2. Case Control Study

- 7.2.2.3. Cross Sectional Study

- 7.2.2.4. Ecological Study

- 7.2.1. Treatment Studies

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 8. Mexico North America Clinical Trials Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 8.1.1. Phase I

- 8.1.2. Phase II

- 8.1.3. Phase III

- 8.1.4. Phase IV

- 8.2. Market Analysis, Insights and Forecast - by Design

- 8.2.1. Treatment Studies

- 8.2.1.1. Randomized Control Trial

- 8.2.1.1.1. Double Blind Trial Randomized Trial

- 8.2.1.1.2. Single Blind Trial Randomized Trial

- 8.2.1.1.3. Non-blind Randomized Trial

- 8.2.1.2. Adaptive Clinical Trial

- 8.2.1.3. Non-randomized Control Trial

- 8.2.1.1. Randomized Control Trial

- 8.2.2. Observational Studies

- 8.2.2.1. Cohort Study

- 8.2.2.2. Case Control Study

- 8.2.2.3. Cross Sectional Study

- 8.2.2.4. Ecological Study

- 8.2.1. Treatment Studies

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Novo Nordisk AS

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 PAREXEL International Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 F Hoffmann-La Roche Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 ICON PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Eli Lilly and Company

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Clinipace

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Pharmaceutical Product Development LLC

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 IQVIA

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Laboratory Corporation of America

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Pfizer Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Novo Nordisk AS

List of Figures

- Figure 1: North America Clinical Trials Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Clinical Trials Market Share (%) by Company 2025

List of Tables

- Table 1: North America Clinical Trials Market Revenue billion Forecast, by Phase 2020 & 2033

- Table 2: North America Clinical Trials Market Revenue billion Forecast, by Design 2020 & 2033

- Table 3: North America Clinical Trials Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Clinical Trials Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Clinical Trials Market Revenue billion Forecast, by Phase 2020 & 2033

- Table 6: North America Clinical Trials Market Revenue billion Forecast, by Design 2020 & 2033

- Table 7: North America Clinical Trials Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Clinical Trials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Clinical Trials Market Revenue billion Forecast, by Phase 2020 & 2033

- Table 10: North America Clinical Trials Market Revenue billion Forecast, by Design 2020 & 2033

- Table 11: North America Clinical Trials Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Clinical Trials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Clinical Trials Market Revenue billion Forecast, by Phase 2020 & 2033

- Table 14: North America Clinical Trials Market Revenue billion Forecast, by Design 2020 & 2033

- Table 15: North America Clinical Trials Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Clinical Trials Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Clinical Trials Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the North America Clinical Trials Market?

Key companies in the market include Novo Nordisk AS, PAREXEL International Corporation, F Hoffmann-La Roche Ltd, ICON PLC, Eli Lilly and Company, Clinipace, Pharmaceutical Product Development LLC, IQVIA, Laboratory Corporation of America, Pfizer Inc.

3. What are the main segments of the North America Clinical Trials Market?

The market segments include Phase, Design, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 59.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Clinical Trials; High R&D Expenditure of the Pharmaceutical Industry; Rising Prevalence of Diseases.

6. What are the notable trends driving market growth?

Phase III is the Largest Segment Under Phases that is Expected to Grow During the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled Workforce for Clinical Research; Stringent Regulations.

8. Can you provide examples of recent developments in the market?

In September 2022, IVERIC bio, Inc. started an Open-label Extension (OLE) phase 3 trial to assess the safety of intravitreal administration of avacincaptad pegol (complement C5 inhibitor) in patients with geographic atrophy who previously completed phase 3 study ISEE2008 (GATHER2).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Clinical Trials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Clinical Trials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Clinical Trials Market?

To stay informed about further developments, trends, and reports in the North America Clinical Trials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence