Key Insights

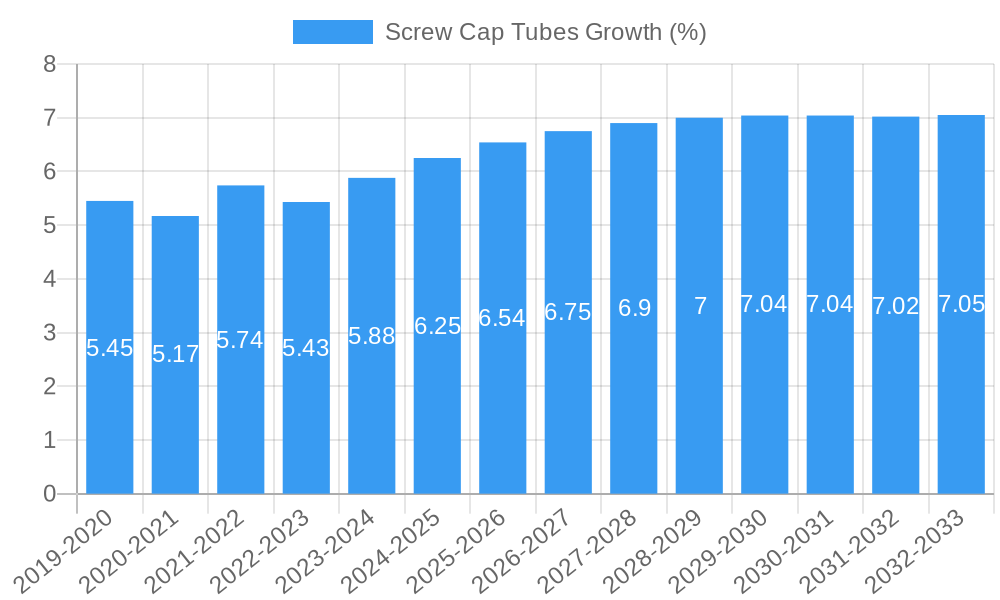

The global screw cap tubes market is poised for significant expansion, projected to reach an estimated XXX million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% from its base year of 2025. This impressive growth trajectory is largely fueled by an increasing demand across various applications, including laboratories, hospitals, and family use, driven by advancements in medical research, diagnostics, and a growing emphasis on personal health monitoring. The market benefits from the widespread adoption of these tubes in sample collection, storage, and transportation due to their superior sealing capabilities, preventing contamination and evaporation, which are critical for accurate and reliable results. Furthermore, the escalating number of clinical trials and research initiatives globally, particularly in fields like genomics, proteomics, and cell-based assays, directly translates to a higher consumption of screw cap tubes. The evolving healthcare landscape, with its increasing reliance on sophisticated diagnostic tools and personalized medicine, further underpins the sustained demand for these essential laboratory consumables.

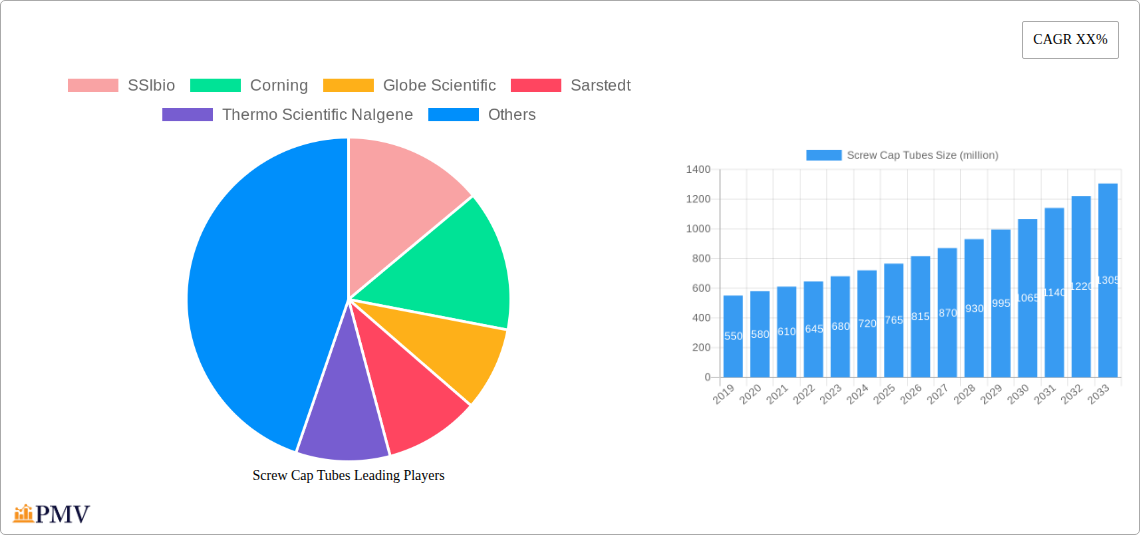

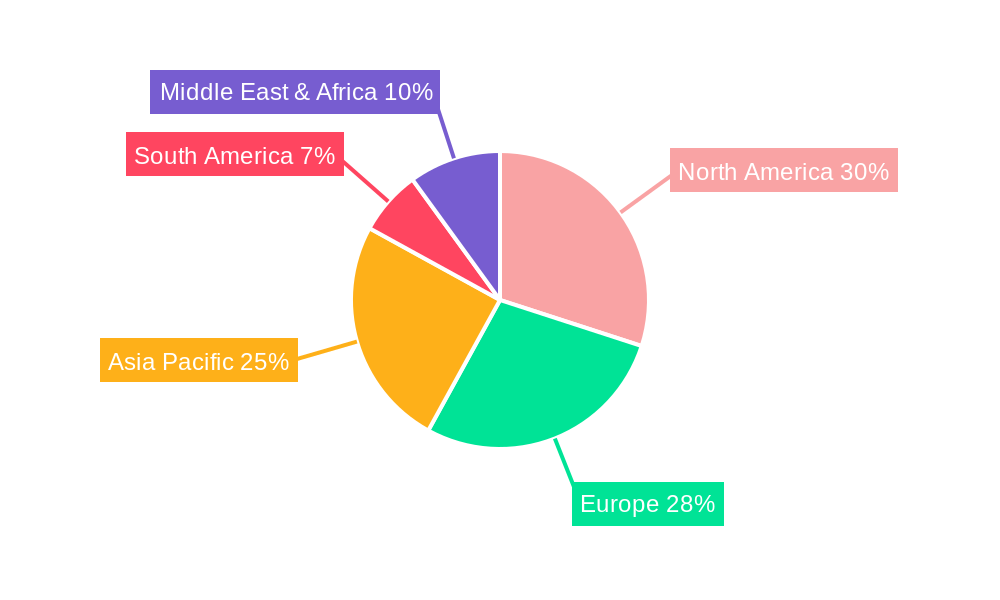

The market is characterized by a diverse range of product types, including PP, PC, PE, PA, PS, PF, and CAB, each catering to specific application needs and chemical compatibility requirements. Key market players such as SSIbio, Corning, Thermo Scientific Nalgene, and Sarstedt are at the forefront of innovation, continuously introducing advanced screw cap tubes with enhanced features like sterility, cryogenic storage capabilities, and specialized labeling options. While the market demonstrates strong growth potential, certain restraints, such as stringent regulatory compliance and the fluctuating prices of raw materials like plastic polymers, could pose challenges. However, the overarching trend towards automation in laboratories and the growing preference for single-use, sterile consumables are expected to mitigate these concerns. Geographically, the Asia Pacific region, led by China and India, is anticipated to witness the most rapid growth due to expanding healthcare infrastructure and increasing R&D investments, while North America and Europe are expected to maintain their significant market share due to established healthcare systems and advanced research capabilities.

Global Screw Cap Tubes Market Analysis: Comprehensive Industry Report 2025-2033

This in-depth market research report provides a comprehensive analysis of the global screw cap tubes market, spanning the historical period of 2019-2024, the base year of 2025, and a forecast period from 2025 to 2033. Our analysis meticulously examines market structure, competitive dynamics, industry trends, dominant segments, product innovations, growth drivers, challenges, leading players, key developments, and strategic outlook, offering valuable insights for stakeholders across the life sciences, healthcare, and research industries.

Screw Cap Tubes Market Structure & Competitive Dynamics

The global screw cap tubes market exhibits a moderately fragmented structure, characterized by the presence of both large, established manufacturers and numerous niche players. Market concentration varies by specific product type and regional demand. The innovation ecosystem is robust, driven by continuous advancements in material science and product design to enhance sample integrity, user convenience, and safety. Regulatory frameworks, particularly concerning clinical diagnostics and biopharmaceutical sample handling, play a crucial role in shaping product development and market access. Product substitutes, such as snap-cap tubes or other sample containment solutions, exist but are generally not as preferred for applications requiring a secure, leak-proof seal. End-user trends point towards an increasing demand for specialized tubes with enhanced chemical resistance, temperature stability, and traceability features. Mergers and acquisitions (M&A) activities, while not widespread, contribute to market consolidation and the expansion of product portfolios. For instance, M&A deal values in the broader laboratory consumables sector have averaged several million, impacting the competitive landscape of screw cap tubes. Key players are strategically investing in R&D to address evolving laboratory needs and maintain competitive advantage, aiming for market shares in the hundreds of millions within their specialized segments.

Screw Cap Tubes Industry Trends & Insights

The global screw cap tubes market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This upward trajectory is fueled by a confluence of factors, including the escalating demand for reliable sample storage and transportation in clinical diagnostics, pharmaceutical research, and biotechnology. Technological disruptions are a key theme, with manufacturers increasingly adopting advanced polymers like polypropylene (PP) and polycarbonate (PC) to offer enhanced chemical inertness, superior autoclavability, and improved mechanical strength. The shift towards personalized medicine and high-throughput screening methodologies further bolsters the demand for precisely engineered screw cap tubes that can accommodate a wide range of sample volumes and processing conditions. Consumer preferences are leaning towards user-friendly designs, such as tubes with integrated sealing mechanisms, clear volumetric markings, and compatibility with automated liquid handling systems. The competitive dynamics are characterized by intense product differentiation based on material quality, sealing performance, temperature resistance (ranging from cryogenic storage at -80 million Celsius to autoclave conditions), and adherence to stringent quality standards. Market penetration is expected to deepen, particularly in emerging economies undergoing rapid development in their healthcare and research infrastructure.

Dominant Markets & Segments in Screw Cap Tubes

The Laboratory application segment currently dominates the global screw cap tubes market, accounting for over 60% of the total market share. This dominance is driven by the pervasive use of screw cap tubes in diverse laboratory settings, including academic research institutions, pharmaceutical and biotechnology companies, and contract research organizations (CROs). The polypropylene (PP) type segment is the most prominent, representing approximately 45% of the market value. PP offers an excellent balance of chemical resistance, temperature tolerance, and cost-effectiveness, making it the material of choice for general laboratory applications, sample storage, and centrifugation.

Key Drivers for Laboratory Segment Dominance:

- Increasing R&D Expenditure: Global investment in scientific research and development, particularly in life sciences and drug discovery, directly translates to higher consumption of laboratory consumables, including screw cap tubes.

- Growth in Biotechnology and Pharmaceutical Industries: The expansion of these sectors, driven by new drug development and the need for precise sample management, significantly fuels demand.

- High-Throughput Screening (HTS): HTS platforms widely utilize screw cap tubes for sample preparation and analysis, creating substantial volume demand.

- Advancements in Molecular Diagnostics: The proliferation of PCR, qPCR, and other molecular diagnostic techniques necessitates reliable and sterile sample containment.

Key Drivers for PP Type Dominance:

- Cost-Effectiveness: PP is generally more affordable than other advanced polymers, making it an attractive option for bulk purchases.

- Chemical Inertness: Its resistance to a broad range of chemicals ensures sample integrity.

- Autoclavability: PP can withstand sterilization cycles, making it suitable for sterile laboratory environments.

- Versatility: It is adaptable for various applications, from sample collection to long-term storage.

The Hospital segment represents a significant secondary market, driven by clinical diagnostics, blood banking, and tissue sample preservation. The Family segment, though smaller, is growing with the increasing adoption of home-based testing kits and personal sample storage solutions. In terms of material types, polycarbonate (PC) tubes are gaining traction for applications requiring higher clarity and impact resistance, while polyethylene (PE) is favored for its flexibility and chemical compatibility with certain reagents. The plastic film (PF) and cellulose acetate butyrate (CAB) types cater to more specialized niche applications with unique performance requirements.

Screw Cap Tubes Product Innovations

Recent product innovations in the screw cap tubes market are largely focused on enhancing user experience, improving sample preservation, and ensuring greater sterility. Manufacturers are developing tubes with advanced sealing technologies to prevent leaks and evaporation, even under extreme temperatures (e.g., down to -80 million Celsius). Developments include self-sealing caps, tamper-evident closures, and tubes with integrated DNA/RNA protection agents. Furthermore, enhanced clarity and anti-fog coatings on certain tube types improve sample visibility, crucial for accurate volume assessment and identification. The trend towards automation in laboratories has also spurred the development of tubes compatible with robotic liquid handlers and centrifuges, offering features like barcode labeling and specific rack designs. These innovations aim to provide competitive advantages by addressing evolving laboratory workflows and stringent sample integrity requirements.

Report Segmentation & Scope

This report segment analysis details the global screw cap tubes market across key applications and material types. The Laboratory application segment is projected to experience a market size of over 500 million units by 2025, driven by ongoing research and development activities. The Hospital segment is estimated to reach a market size of over 300 million units in the same year, fueled by increasing diagnostic procedures. The Family segment, though smaller, is forecast to grow at a CAGR of 7.0% due to the rise of home-based health monitoring.

Segmenting by material type, Polypropylene (PP) tubes command the largest market share, estimated at over 400 million units in 2025, due to their versatility and cost-effectiveness. Polycarbonate (PC) tubes are expected to reach 150 million units, driven by specialized applications requiring high clarity and durability. Polyethylene (PE) tubes are projected to be around 100 million units, favored for their chemical resistance and flexibility. Niche segments like Polyamide (PA), Polystyrene (PS), Polyester (PF), and Cellulose Acetate Butyrate (CAB) cater to specific needs and are expected to show moderate growth.

Key Drivers of Screw Cap Tubes Growth

Several key drivers are propelling the growth of the screw cap tubes market. Technological advancements in polymer science are leading to the development of tubes with enhanced chemical resistance, temperature stability, and mechanical strength, meeting the demands of increasingly sophisticated laboratory procedures. Economic factors, such as rising healthcare expenditure globally and increased government funding for scientific research, directly translate into higher demand for laboratory consumables. The growing prevalence of chronic diseases and the subsequent rise in diagnostic testing are also significant contributors. Furthermore, favorable regulatory environments supporting clinical diagnostics and biopharmaceutical development encourage the adoption of standardized and reliable sample handling solutions. The expansion of the biotechnology sector and the increasing focus on personalized medicine further boost the need for high-quality, specialized screw cap tubes for sample collection, storage, and analysis.

Challenges in the Screw Cap Tubes Sector

Despite the positive growth outlook, the screw cap tubes sector faces several challenges. Intense price competition among manufacturers, particularly for standard PP tubes, can compress profit margins. Stringent regulatory requirements for certain applications, such as those in pharmaceutical manufacturing and clinical trials, necessitate significant investment in quality control and validation, increasing production costs. Supply chain disruptions, as experienced in recent years, can impact the availability and cost of raw materials, affecting production schedules and pricing. Environmental concerns related to plastic waste are also a growing consideration, prompting a need for more sustainable material options and recycling initiatives, which may require further investment and technological development.

Leading Players in the Screw Cap Tubes Market

The global screw cap tubes market is served by a diverse range of leading manufacturers, including:

- SSIbio

- Corning

- Globe Scientific

- Sarstedt

- Thermo Scientific Nalgene

- Chemglass

- MTC Bio

- Labcon

- AlphaGem Bio

- SP Wilmad-LabGlass

- Biosigma SpA

- Abdos Labtech

- ExtraGene

- Nerbe plus

- Omni International

- CellTreat

- MTC Bio

Key Developments in Screw Cap Tubes Sector

- 2023: Introduction of new screw cap tubes with enhanced leak-proof sealing capabilities for cryogenic applications by several leading manufacturers.

- 2022: Significant investment in R&D for biodegradable and recyclable screw cap tubes driven by growing environmental consciousness.

- 2021: Expansion of product portfolios to include specialized tubes for COVID-19 testing and sample collection.

- 2020: Increased demand for sterile and certified screw cap tubes for pharmaceutical research and diagnostics.

- 2019: Advancements in surface treatments for screw cap tubes to prevent sample adhesion and improve recovery rates.

Strategic Screw Cap Tubes Market Outlook

The strategic outlook for the screw cap tubes market remains highly positive, driven by sustained innovation and growing demand across key end-use industries. The increasing adoption of automation in laboratories and the expansion of molecular diagnostics present significant growth accelerators. Manufacturers are likely to focus on developing value-added products, such as tubes with integrated features like labeling, sterilization, and specific chemical treatments. Strategic opportunities lie in expanding market presence in emerging economies, forging partnerships with diagnostic kit manufacturers, and investing in sustainable material research to cater to evolving environmental regulations and consumer preferences. The market is expected to witness continued growth, with opportunities for companies that can offer high-quality, reliable, and specialized screw cap tube solutions.

Screw Cap Tubes Segmentation

-

1. Application

- 1.1. Laboratory

- 1.2. Hospital

- 1.3. Family

-

2. Types

- 2.1. PP

- 2.2. PC

- 2.3. PE

- 2.4. PA

- 2.5. PS

- 2.6. PF

- 2.7. CAB

Screw Cap Tubes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Screw Cap Tubes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Screw Cap Tubes Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Laboratory

- 5.1.2. Hospital

- 5.1.3. Family

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. PP

- 5.2.2. PC

- 5.2.3. PE

- 5.2.4. PA

- 5.2.5. PS

- 5.2.6. PF

- 5.2.7. CAB

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Screw Cap Tubes Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Laboratory

- 6.1.2. Hospital

- 6.1.3. Family

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. PP

- 6.2.2. PC

- 6.2.3. PE

- 6.2.4. PA

- 6.2.5. PS

- 6.2.6. PF

- 6.2.7. CAB

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Screw Cap Tubes Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Laboratory

- 7.1.2. Hospital

- 7.1.3. Family

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. PP

- 7.2.2. PC

- 7.2.3. PE

- 7.2.4. PA

- 7.2.5. PS

- 7.2.6. PF

- 7.2.7. CAB

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Screw Cap Tubes Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Laboratory

- 8.1.2. Hospital

- 8.1.3. Family

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. PP

- 8.2.2. PC

- 8.2.3. PE

- 8.2.4. PA

- 8.2.5. PS

- 8.2.6. PF

- 8.2.7. CAB

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Screw Cap Tubes Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Laboratory

- 9.1.2. Hospital

- 9.1.3. Family

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. PP

- 9.2.2. PC

- 9.2.3. PE

- 9.2.4. PA

- 9.2.5. PS

- 9.2.6. PF

- 9.2.7. CAB

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Screw Cap Tubes Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Laboratory

- 10.1.2. Hospital

- 10.1.3. Family

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. PP

- 10.2.2. PC

- 10.2.3. PE

- 10.2.4. PA

- 10.2.5. PS

- 10.2.6. PF

- 10.2.7. CAB

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SSIbio

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Corning

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Globe Scientific

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sarstedt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Scientific Nalgene

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chemglass

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MTC Bio

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Labcon

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AlphaGem Bio

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SP Wilmad-LabGlass

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Biosigma SpA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Abdos Labtech

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ExtraGene

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nerbe plus

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Omni International

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 CellTreat

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 MTC Bio

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 SSIbio

List of Figures

- Figure 1: Global Screw Cap Tubes Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Screw Cap Tubes Revenue (million), by Application 2024 & 2032

- Figure 3: North America Screw Cap Tubes Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Screw Cap Tubes Revenue (million), by Types 2024 & 2032

- Figure 5: North America Screw Cap Tubes Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Screw Cap Tubes Revenue (million), by Country 2024 & 2032

- Figure 7: North America Screw Cap Tubes Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Screw Cap Tubes Revenue (million), by Application 2024 & 2032

- Figure 9: South America Screw Cap Tubes Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Screw Cap Tubes Revenue (million), by Types 2024 & 2032

- Figure 11: South America Screw Cap Tubes Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Screw Cap Tubes Revenue (million), by Country 2024 & 2032

- Figure 13: South America Screw Cap Tubes Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Screw Cap Tubes Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Screw Cap Tubes Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Screw Cap Tubes Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Screw Cap Tubes Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Screw Cap Tubes Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Screw Cap Tubes Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Screw Cap Tubes Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Screw Cap Tubes Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Screw Cap Tubes Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Screw Cap Tubes Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Screw Cap Tubes Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Screw Cap Tubes Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Screw Cap Tubes Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Screw Cap Tubes Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Screw Cap Tubes Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Screw Cap Tubes Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Screw Cap Tubes Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Screw Cap Tubes Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Screw Cap Tubes Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Screw Cap Tubes Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Screw Cap Tubes Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Screw Cap Tubes Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Screw Cap Tubes Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Screw Cap Tubes Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Screw Cap Tubes Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Screw Cap Tubes Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Screw Cap Tubes Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Screw Cap Tubes Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Screw Cap Tubes Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Screw Cap Tubes Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Screw Cap Tubes Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Screw Cap Tubes Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Screw Cap Tubes Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Screw Cap Tubes Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Screw Cap Tubes Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Screw Cap Tubes Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Screw Cap Tubes Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Screw Cap Tubes Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Screw Cap Tubes?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Screw Cap Tubes?

Key companies in the market include SSIbio, Corning, Globe Scientific, Sarstedt, Thermo Scientific Nalgene, Chemglass, MTC Bio, Labcon, AlphaGem Bio, SP Wilmad-LabGlass, Biosigma SpA, Abdos Labtech, ExtraGene, Nerbe plus, Omni International, CellTreat, MTC Bio.

3. What are the main segments of the Screw Cap Tubes?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Screw Cap Tubes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Screw Cap Tubes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Screw Cap Tubes?

To stay informed about further developments, trends, and reports in the Screw Cap Tubes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence