Key Insights

The United States rigid plastic packaging market is projected to experience a Compound Annual Growth Rate (CAGR) of 3%. Driven by robust demand for lightweight, durable, and cost-effective packaging across food & beverage, consumer goods, and healthcare sectors, the market is set for significant expansion. Key growth catalysts include the increasing adoption of sustainable and recyclable plastics, a heightened focus on product safety and preservation, and the burgeoning e-commerce sector. Challenges such as environmental concerns regarding plastic waste and fluctuating raw material prices are present. The market is segmented by packaging type, application, and material. Leading companies are actively engaging in material science innovation, mergers and acquisitions, and sustainable packaging solutions. The competitive landscape is dynamic, featuring both established leaders and emerging players.

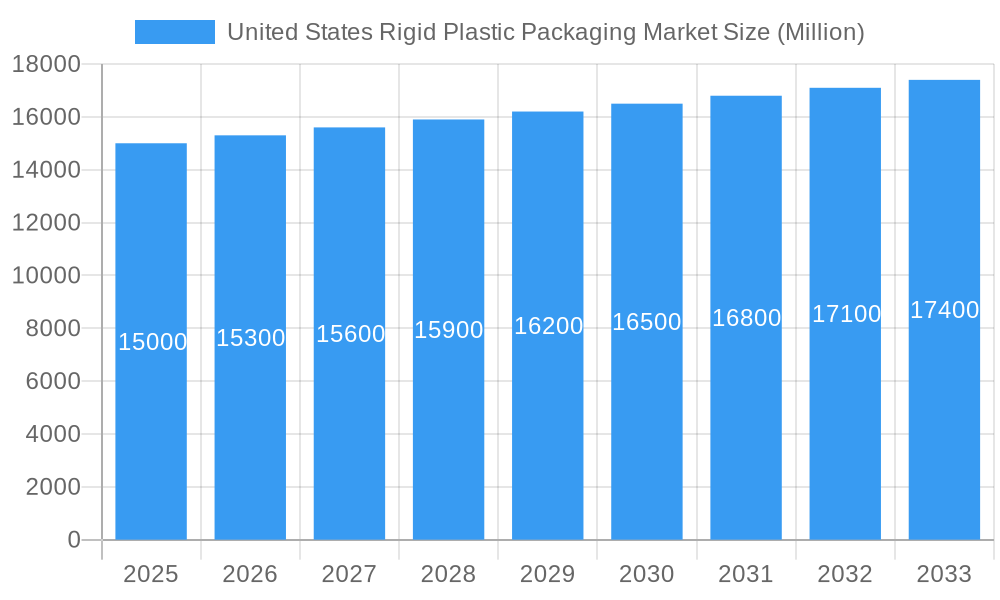

United States Rigid Plastic Packaging Market Market Size (In Billion)

Projected to reach a market size of 252.64 billion by 2033, the United States rigid plastic packaging market, with a base year of 2025, is expected to witness steady growth. This expansion will be fueled by evolving consumer demands, particularly in e-commerce and convenient food packaging. Comprehensive market analysis, including company financials and industry publications, offers deep insights into market trends and future trajectories.

United States Rigid Plastic Packaging Market Company Market Share

United States Rigid Plastic Packaging Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the United States rigid plastic packaging market, covering market size, growth drivers, challenges, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is invaluable for industry stakeholders, investors, and market entrants seeking actionable insights into this dynamic sector.

United States Rigid Plastic Packaging Market Structure & Competitive Dynamics

The United States rigid plastic packaging market is characterized by a moderately concentrated structure, with a few major players holding significant market share. Berry Global Inc., Amcor Group GmbH, and Silgan Holdings Inc. are among the established giants, commanding a collective xx% market share in 2025. However, the market also features several smaller, agile companies that are innovating and disrupting the status quo. The intensity of competition is high, driven by factors such as product differentiation, pricing pressures, and the increasing demand for sustainable packaging solutions.

- Market Concentration: High, with top 5 players holding xx% market share in 2025.

- Innovation Ecosystems: Active, with significant investment in R&D focused on sustainable materials and advanced manufacturing technologies.

- Regulatory Frameworks: Subject to evolving regulations concerning recyclability and environmental impact, influencing material selection and manufacturing processes.

- Product Substitutes: Growing pressure from alternative packaging materials like paperboard and glass, particularly in segments with strong sustainability concerns.

- End-User Trends: Shift towards e-commerce is increasing demand for protective and convenient packaging solutions.

- M&A Activities: Significant M&A activity observed in the historical period (2019-2024), with deal values totaling approximately xx Million USD, reflecting consolidation trends in the market. This consolidation is expected to continue in the forecast period.

United States Rigid Plastic Packaging Market Industry Trends & Insights

The United States rigid plastic packaging market is experiencing robust growth, driven by increasing consumption of packaged goods across diverse sectors such as food and beverage, pharmaceuticals, and consumer goods. The market is expected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million USD by 2033. Several key factors are shaping this growth trajectory:

- Growth Drivers: Rising disposable incomes, changing lifestyles, and the expanding e-commerce sector are fueling demand for packaged goods. Technological advancements in packaging design and materials are also creating new opportunities. The increasing adoption of sustainable packaging practices is a significant market driver. Market penetration of recycled PET is increasing but still has significant room for growth.

- Technological Disruptions: Advancements in lightweighting technologies, barrier coatings, and smart packaging are enhancing product functionality and shelf life, thereby boosting market demand.

- Consumer Preferences: Growing consumer awareness of environmental sustainability is driving demand for eco-friendly and recyclable packaging solutions. This is placing increasing pressure on manufacturers to adopt sustainable practices.

- Competitive Dynamics: Intense competition among established players and emerging companies is leading to innovation and cost reduction. This is driving down prices and creating opportunities for new entrants.

Dominant Markets & Segments in United States Rigid Plastic Packaging Market

The Northeast region dominates the United States rigid plastic packaging market, driven by high population density, robust industrial activity, and a strong consumer base. Its dominance is further strengthened by the presence of major packaging manufacturers and extensive distribution networks.

- Key Drivers of Northeast Dominance:

- High population density and robust consumer spending

- Well-established manufacturing infrastructure and supply chains

- Significant concentration of key players in the packaging industry

- Favourable regulatory environment supporting market growth.

The detailed analysis further segments the market based on packaging type (bottles, containers, closures, etc.), material type (PET, HDPE, PP, etc.), and end-use industry (food & beverage, pharmaceuticals, personal care, etc.). Each segment presents unique growth opportunities and challenges, with growth projections varying based on individual market dynamics. The food and beverage segment is expected to maintain its leading position, driven by the continued growth in packaged food consumption.

United States Rigid Plastic Packaging Market Product Innovations

Recent product innovations are focused on enhancing sustainability, improving functionality, and increasing efficiency. Lightweighting techniques are gaining traction to reduce material usage and transportation costs, while advancements in barrier coatings are improving product shelf life and reducing waste. The integration of smart packaging technologies is opening up new possibilities for tracking and monitoring product quality and freshness. These innovations are shaping the competitive landscape and influencing consumer choices.

Report Segmentation & Scope

This report provides a detailed segmentation of the United States rigid plastic packaging market based on several key parameters:

- By Material Type: PET, HDPE, PP, PVC, and others. Growth projections vary significantly by material type reflecting different sustainability concerns and associated regulations. PET is expected to show strong growth fuelled by advancements in recycled PET utilization.

- By Product Type: Bottles, jars, containers, closures, and others. Growth will be driven by changing consumer preferences and functionality requirements.

- By End-Use Industry: Food & beverage, pharmaceuticals, personal care, consumer goods, industrial goods. Growth rates vary by end-use sector, influenced by specific industry trends and regulatory considerations.

- By Region: Northeast, Southeast, Midwest, Southwest, and West. Regional variations in market growth are influenced by population density, economic activity, and regulatory environments.

Key Drivers of United States Rigid Plastic Packaging Market Growth

Several factors are propelling the growth of the United States rigid plastic packaging market. These include:

- Technological Advancements: Innovations in material science, manufacturing processes, and design are creating more efficient, sustainable, and functional packaging solutions.

- E-commerce Boom: The rapid growth of online retail is increasing demand for robust and protective packaging.

- Changing Consumer Preferences: Consumers are increasingly demanding convenient, sustainable, and aesthetically pleasing packaging.

- Government Regulations: Regulations promoting recyclability and reducing plastic waste are driving the adoption of eco-friendly materials and processes.

Challenges in the United States Rigid Plastic Packaging Market Sector

The United States rigid plastic packaging market faces several challenges:

- Environmental Concerns: Growing public awareness of plastic waste and its environmental impact is leading to stricter regulations and increased pressure for sustainable solutions. This is impacting material choices and production processes and adding significant costs to manufacturers.

- Fluctuating Raw Material Prices: The prices of raw materials like petroleum-based resins can fluctuate significantly, impacting production costs and profitability.

- Intense Competition: High competition among existing players and increasing pressure from emerging businesses necessitates constant innovation and efficient cost management.

Leading Players in the United States Rigid Plastic Packaging Market Market

- Berry Global Inc.

- Aptar Group Inc.

- Amcor Group GmbH

- Graham Packaging Company

- Sonoco Products Company

- Altium Packaging

- Silgan Holdings Inc.

- Reliable Caps LLC

- Pretium Packaging

- Axium Packaging Inc

Key Developments in United States Rigid Plastic Packaging Market Sector

- August 2024: Origin Materials and Reed City Group partner to mass-produce PET caps and closures in North America, utilizing advanced high-speed equipment and automation to process both virgin and recycled PET. This signifies a significant step towards wider adoption of sustainable packaging solutions.

- October 2023: Chlorophyll Water transitions to 100% rPET bottles, becoming the first bottled water brand in the US to achieve Clean Label Project Certification. This highlights the growing consumer demand for sustainable and transparent packaging practices.

Strategic United States Rigid Plastic Packaging Market Outlook

The future of the United States rigid plastic packaging market is bright, driven by continued growth in packaged goods consumption, technological advancements, and a growing focus on sustainability. Strategic opportunities exist for companies that can effectively innovate, differentiate their products, and adapt to evolving consumer preferences and regulatory requirements. The increased adoption of recycled content and the development of biodegradable alternatives will play a crucial role in shaping the market's future landscape. Companies that can successfully navigate these trends and meet the growing demand for sustainable packaging solutions are poised for significant growth in the coming years.

United States Rigid Plastic Packaging Market Segmentation

-

1. Product

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Pr

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE & LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 2.5. Polyvinyl chloride (PVC)

- 2.6. Other Ri

-

2.1. Polyethylene (PE)

-

3. End-use Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Cosmetics and Personal Care

- 3.5. Industri

- 3.6. Building and Construction

- 3.7. Automotive

- 3.8. Other En

United States Rigid Plastic Packaging Market Segmentation By Geography

- 1. United States

United States Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of United States Rigid Plastic Packaging Market

United States Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector

- 3.4. Market Trends

- 3.4.1. Food And Beverage Sector Drives Demand For Rigid Plastic Packaging Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE & LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 5.2.5. Polyvinyl chloride (PVC)

- 5.2.6. Other Ri

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-use Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Cosmetics and Personal Care

- 5.3.5. Industri

- 5.3.6. Building and Construction

- 5.3.7. Automotive

- 5.3.8. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Berry Global Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aptar Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor Group GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Graham Packaging Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Altium Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silgan Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Reliable Caps LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pretium Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Axium Packaging Inc 7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Berry Global Inc

List of Figures

- Figure 1: United States Rigid Plastic Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: United States Rigid Plastic Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United States Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: United States Rigid Plastic Packaging Market Revenue billion Forecast, by End-use Industry 2020 & 2033

- Table 4: United States Rigid Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Rigid Plastic Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: United States Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: United States Rigid Plastic Packaging Market Revenue billion Forecast, by End-use Industry 2020 & 2033

- Table 8: United States Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Rigid Plastic Packaging Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the United States Rigid Plastic Packaging Market?

Key companies in the market include Berry Global Inc, Aptar Group Inc, Amcor Group GmbH, Graham Packaging Company, Sonoco Products Company, Altium Packaging, Silgan Holdings Inc, Reliable Caps LLC, Pretium Packaging, Axium Packaging Inc 7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the United States Rigid Plastic Packaging Market?

The market segments include Product, Material, End-use Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 252.64 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector.

6. What are the notable trends driving market growth?

Food And Beverage Sector Drives Demand For Rigid Plastic Packaging Products.

7. Are there any restraints impacting market growth?

Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector.

8. Can you provide examples of recent developments in the market?

August 2024: Origin Materials, a tech firm dedicated to facilitating the global shift toward sustainable materials, has teamed up with Reed City Group, a comprehensive injection mold builder and molder, hydraulic press manufacturer, and provider of automation solutions. Together, they aim to mass-produce PET caps and closures in North America. At Reed City Group's facilities in Michigan, the duo is set to run commercial manufacturing lines for Origin's PET caps and closures. These lines are set to utilize advanced high-speed equipment and automation to transform both virgin and recycled PET into caps. Notably, Origin's caps are set to be the first commercially viable PET closures to penetrate the mass market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the United States Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence