Key Insights

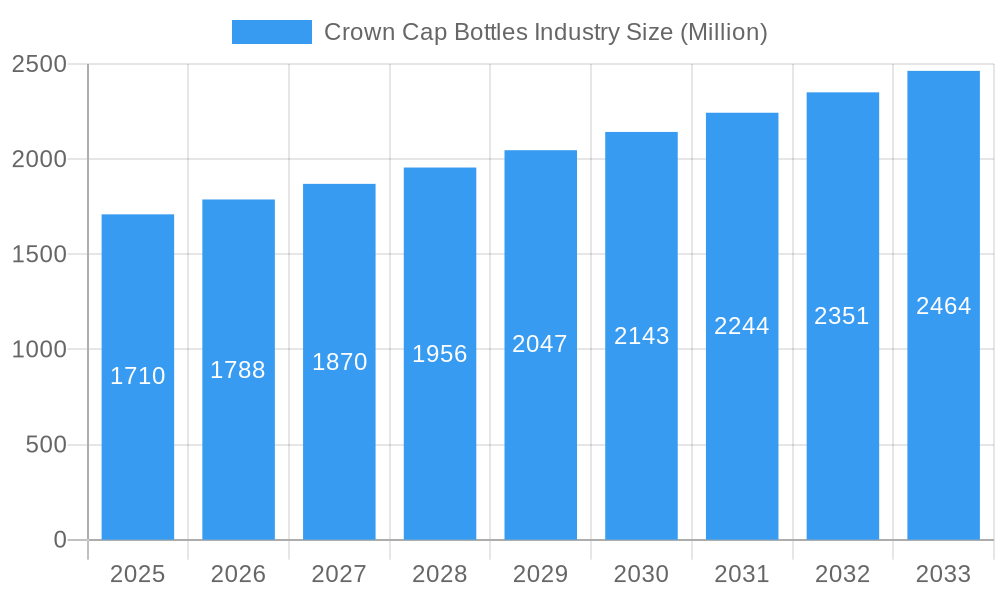

The crown cap bottle market, valued at $1.71 billion in 2025, is projected to experience robust growth, driven by the increasing demand for packaged beverages and food products globally. A compound annual growth rate (CAGR) of 4.54% from 2025 to 2033 indicates a significant expansion of this market over the forecast period. Key growth drivers include the rising consumption of beverages, particularly alcoholic and non-alcoholic drinks, along with the convenience and preservation offered by crown cap bottles. The preference for sustainable and eco-friendly packaging solutions is also influencing market trends, leading manufacturers to explore materials like recycled aluminum and steel. Market segmentation reveals a strong presence across applications, with beverages (both alcoholic and non-alcoholic) dominating the landscape. Material-wise, aluminum, steel, and tin-plated materials maintain significant market share due to their durability, cost-effectiveness, and recyclability. While specific regional data is unavailable, we can infer significant market presence in North America, Europe, and Asia-Pacific, given the high concentration of beverage and food production in these regions. Competitive dynamics are characterized by a mix of established global players like Crown Holdings Inc. and regional manufacturers, suggesting a balance between large-scale production and localized market penetration. Potential restraints could include fluctuations in raw material prices, evolving consumer preferences, and the emergence of alternative packaging solutions.

Crown Cap Bottles Industry Market Size (In Billion)

The projected growth trajectory for the crown cap bottle market indicates continued expansion across diverse sectors. The forecast period (2025-2033) presents ample opportunity for market participants to capitalize on emerging trends, including the growing popularity of craft breweries and premium beverages, which often leverage crown cap bottles for their aesthetic appeal and perceived quality. Moreover, strategic partnerships and mergers & acquisitions are expected to further reshape the competitive landscape. Companies are increasingly focusing on innovations to improve the sustainability of their products and processes, aligning with growing consumer demand for eco-conscious packaging choices. This push for sustainability is likely to become a major differentiating factor for manufacturers in the coming years. The long-term outlook for the crown cap bottle market remains positive, driven by consistent demand from diverse industries and a strong emphasis on sustainable packaging solutions.

Crown Cap Bottles Industry Company Market Share

Crown Cap Bottles Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Crown Cap Bottles industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by application (Beverage – Alcoholic Beverages: Beer, Wine; Non-alcoholic Beverages: Food) and material (Aluminum, Steel, and Tin-plated). The study utilizes a combination of primary and secondary research methodologies and incorporates data from leading industry players like AMD Industries Inc, Viscose Closures Ltd, Samhwa Crown & Closure, Crown Holdings Inc, Nippon Closures Co Ltd, Avon Crowncaps & Containers Nigeria Ltd, Finn-Korkki Oy, Astir Vitogiannis Bros SA, Evergreen Resources, and PELLICONI & C SPA (list not exhaustive). The total market size is estimated to reach xx Million by 2025.

Crown Cap Bottles Industry Market Structure & Competitive Dynamics

The Crown Cap Bottles industry exhibits a moderately consolidated market structure, with a few major players holding significant market share. The market concentration is influenced by factors such as economies of scale, technological advancements, and brand recognition. Innovation ecosystems play a crucial role, with companies constantly striving to improve cap designs, materials, and manufacturing processes. Regulatory frameworks, particularly those related to food safety and environmental regulations, significantly impact industry operations. Product substitutes, such as screw caps and other closure systems, present competitive pressure. End-user trends, including growing demand for sustainable and convenient packaging, are shaping industry development.

Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values ranging from xx Million to xx Million. Key M&A activities include:

- Consolidation of regional players to increase market reach.

- Acquisitions to expand product portfolios and technological capabilities.

Market Share (Estimated 2025):

- Crown Holdings Inc: xx%

- Samhwa Crown & Closure: xx%

- Nippon Closures Co Ltd: xx%

- Other players: xx%

Crown Cap Bottles Industry Industry Trends & Insights

The Crown Cap Bottles market is witnessing robust growth, driven by several factors. The global beverage industry's expansion, particularly in emerging markets, fuels demand for crown caps. Technological advancements in materials science and manufacturing processes lead to improved cap performance and sustainability. Consumer preferences for convenient, tamper-evident packaging further drive adoption. Competitive dynamics are characterized by ongoing innovation, price competition, and strategic partnerships. The market is expected to experience a CAGR of xx% during the forecast period (2025-2033), with market penetration steadily increasing across various regions.

Dominant Markets & Segments in Crown Cap Bottles Industry

The beverage segment dominates the Crown Cap Bottles market, accounting for approximately xx% of the total market value in 2025. Within the beverage segment, alcoholic beverages, particularly beer, demonstrate strong growth, driven by rising consumption and expanding production capacity. The aluminum material segment holds the largest market share due to its lightweight nature, recyclability, and cost-effectiveness.

Key Drivers for Dominance:

- Beverage Segment: Rising global consumption of alcoholic and non-alcoholic beverages.

- Aluminum Segment: Superior properties compared to steel and tin-plated options.

- Developed Regions (e.g., North America, Europe): Well-established beverage industry and strong consumer preference.

Geographic Dominance Analysis: North America and Europe currently hold the largest market share, primarily due to higher per capita consumption of beverages and established infrastructure. However, emerging markets in Asia and Africa are witnessing rapid growth, driven by increasing disposable incomes and changing consumption patterns.

Crown Cap Bottles Industry Product Innovations

Recent product innovations focus on enhancing sustainability and improving functionality. Lightweight designs reduce material usage and transportation costs, while innovative coatings enhance barrier properties and extend shelf life. The integration of smart technologies, although currently limited, presents a significant growth opportunity in the future. Market fit is largely determined by consumer preferences, regulatory requirements, and the cost-effectiveness of new technologies.

Report Segmentation & Scope

The report segments the Crown Cap Bottles market by application and material:

By Application:

- Beverage: This segment is further divided into alcoholic beverages (beer, wine) and non-alcoholic beverages (soft drinks, juices, food). The beverage segment is projected to grow at a CAGR of xx% during the forecast period.

- Alcoholic Beverages: The beer sub-segment is the largest contributor due to high volume consumption. Projected growth is xx% CAGR.

- Non-alcoholic Beverages: This segment benefits from growing demand for healthier beverages. Projected growth is xx% CAGR.

By Material:

- Aluminum: Aluminum caps maintain the largest market share due to lightweight, recyclability and cost-effectiveness. Projected growth is xx% CAGR.

- Steel and Tin-plated: This segment benefits from its strength and cost competitiveness in certain applications. Projected growth is xx% CAGR.

Key Drivers of Crown Cap Bottles Industry Growth

Several factors contribute to the growth of the Crown Cap Bottles industry. Technological advancements, such as improved manufacturing processes and innovative materials, enhance production efficiency and product quality. The expanding global beverage industry, particularly in developing economies, significantly fuels demand. Favorable government regulations and economic policies supporting the food and beverage sector further encourage growth.

Challenges in the Crown Cap Bottles Industry Sector

Challenges include fluctuating raw material prices, particularly aluminum and steel, impacting production costs and profitability. Stringent environmental regulations related to waste management and sustainability add to operational complexities. Intense competition from alternative packaging solutions, such as screw caps, poses a continuous threat. Supply chain disruptions and geopolitical instability also impact the industry. These factors are estimated to reduce annual growth by approximately xx% in certain years.

Leading Players in the Crown Cap Bottles Industry Market

- AMD Industries Inc

- Viscose Closures Ltd

- Samhwa Crown & Closure

- Crown Holdings Inc https://www.crowncork.com/

- Nippon Closures Co Ltd

- Avon Crowncaps & Containers Nigeria Ltd

- Finn-Korkki Oy

- Astir Vitogiannis Bros SA

- Evergreen Resources

- PELLICONI & C SPA

Key Developments in Crown Cap Bottles Industry Sector

- July 2023: Crown Holdings Inc. launched its Twentyby30 sustainability program and expanded its Aluminium Stewardship Initiative (ASI) certifications across the Asia-Pacific region, highlighting a growing focus on ESG principles within the industry. This initiative is expected to positively impact the industry's image and sustainability practices, potentially driving increased demand for sustainably produced crown caps.

Strategic Crown Cap Bottles Industry Market Outlook

The Crown Cap Bottles industry is poised for continued growth, driven by several factors. The increasing demand for beverages globally, coupled with the preference for convenient and tamper-evident packaging, creates a fertile ground for expansion. Technological innovations focused on sustainability and enhanced functionality further enhance market prospects. Strategic partnerships and acquisitions will likely shape the competitive landscape, leading to increased consolidation and market share concentration. The industry will also need to address the growing focus on sustainability to maintain long-term growth.

Crown Cap Bottles Industry Segmentation

-

1. Material

- 1.1. Aluminum

- 1.2. Steel and Tin-plated

-

2. Application

-

2.1. Beverage

-

2.1.1. Alcoholic Beverages

- 2.1.1.1. Beer

- 2.1.1.2. Wine

- 2.1.2. Non-alcoholic Beverages

-

2.1.1. Alcoholic Beverages

- 2.2. Food

-

2.1. Beverage

Crown Cap Bottles Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Crown Cap Bottles Industry Regional Market Share

Geographic Coverage of Crown Cap Bottles Industry

Crown Cap Bottles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Alcoholic and Carbonated Drinks; Growing Adoption of Improved Packaging Designs to Aid Product Differentiation and Branding

- 3.3. Market Restrains

- 3.3.1. Increasing Utilization of Plastic in the Beverage Industry

- 3.4. Market Trends

- 3.4.1. Non-Alcoholic Beverages are Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crown Cap Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Aluminum

- 5.1.2. Steel and Tin-plated

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverage

- 5.2.1.1. Alcoholic Beverages

- 5.2.1.1.1. Beer

- 5.2.1.1.2. Wine

- 5.2.1.2. Non-alcoholic Beverages

- 5.2.1.1. Alcoholic Beverages

- 5.2.2. Food

- 5.2.1. Beverage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Crown Cap Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Aluminum

- 6.1.2. Steel and Tin-plated

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Beverage

- 6.2.1.1. Alcoholic Beverages

- 6.2.1.1.1. Beer

- 6.2.1.1.2. Wine

- 6.2.1.2. Non-alcoholic Beverages

- 6.2.1.1. Alcoholic Beverages

- 6.2.2. Food

- 6.2.1. Beverage

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Crown Cap Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Aluminum

- 7.1.2. Steel and Tin-plated

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Beverage

- 7.2.1.1. Alcoholic Beverages

- 7.2.1.1.1. Beer

- 7.2.1.1.2. Wine

- 7.2.1.2. Non-alcoholic Beverages

- 7.2.1.1. Alcoholic Beverages

- 7.2.2. Food

- 7.2.1. Beverage

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Crown Cap Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Aluminum

- 8.1.2. Steel and Tin-plated

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Beverage

- 8.2.1.1. Alcoholic Beverages

- 8.2.1.1.1. Beer

- 8.2.1.1.2. Wine

- 8.2.1.2. Non-alcoholic Beverages

- 8.2.1.1. Alcoholic Beverages

- 8.2.2. Food

- 8.2.1. Beverage

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Crown Cap Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Aluminum

- 9.1.2. Steel and Tin-plated

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Beverage

- 9.2.1.1. Alcoholic Beverages

- 9.2.1.1.1. Beer

- 9.2.1.1.2. Wine

- 9.2.1.2. Non-alcoholic Beverages

- 9.2.1.1. Alcoholic Beverages

- 9.2.2. Food

- 9.2.1. Beverage

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Crown Cap Bottles Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Aluminum

- 10.1.2. Steel and Tin-plated

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Beverage

- 10.2.1.1. Alcoholic Beverages

- 10.2.1.1.1. Beer

- 10.2.1.1.2. Wine

- 10.2.1.2. Non-alcoholic Beverages

- 10.2.1.1. Alcoholic Beverages

- 10.2.2. Food

- 10.2.1. Beverage

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AMD Industries Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Viscose Closures Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Samhwa Crown & Closure

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Crown Holdings Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nippon Closures Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Avon Crowncaps & Containers Nigeria Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Finn-Korkki Oy

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Astir Vitogiannis Bros SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Evergreen Resources*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PELLICONI & C SPA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AMD Industries Inc

List of Figures

- Figure 1: Global Crown Cap Bottles Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Crown Cap Bottles Industry Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Crown Cap Bottles Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Crown Cap Bottles Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Crown Cap Bottles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Crown Cap Bottles Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Crown Cap Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Crown Cap Bottles Industry Revenue (Million), by Material 2025 & 2033

- Figure 9: Europe Crown Cap Bottles Industry Revenue Share (%), by Material 2025 & 2033

- Figure 10: Europe Crown Cap Bottles Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Crown Cap Bottles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Crown Cap Bottles Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Crown Cap Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Crown Cap Bottles Industry Revenue (Million), by Material 2025 & 2033

- Figure 15: Asia Pacific Crown Cap Bottles Industry Revenue Share (%), by Material 2025 & 2033

- Figure 16: Asia Pacific Crown Cap Bottles Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Crown Cap Bottles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Crown Cap Bottles Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Crown Cap Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Crown Cap Bottles Industry Revenue (Million), by Material 2025 & 2033

- Figure 21: Latin America Crown Cap Bottles Industry Revenue Share (%), by Material 2025 & 2033

- Figure 22: Latin America Crown Cap Bottles Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America Crown Cap Bottles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Crown Cap Bottles Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Crown Cap Bottles Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Crown Cap Bottles Industry Revenue (Million), by Material 2025 & 2033

- Figure 27: Middle East and Africa Crown Cap Bottles Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East and Africa Crown Cap Bottles Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Crown Cap Bottles Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Crown Cap Bottles Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Crown Cap Bottles Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Crown Cap Bottles Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Crown Cap Bottles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Crown Cap Bottles Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Crown Cap Bottles Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 5: Global Crown Cap Bottles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Crown Cap Bottles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Crown Cap Bottles Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 8: Global Crown Cap Bottles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Crown Cap Bottles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Crown Cap Bottles Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 11: Global Crown Cap Bottles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Crown Cap Bottles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Crown Cap Bottles Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 14: Global Crown Cap Bottles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Crown Cap Bottles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Crown Cap Bottles Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 17: Global Crown Cap Bottles Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Crown Cap Bottles Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crown Cap Bottles Industry?

The projected CAGR is approximately 4.54%.

2. Which companies are prominent players in the Crown Cap Bottles Industry?

Key companies in the market include AMD Industries Inc, Viscose Closures Ltd, Samhwa Crown & Closure, Crown Holdings Inc, Nippon Closures Co Ltd, Avon Crowncaps & Containers Nigeria Ltd, Finn-Korkki Oy, Astir Vitogiannis Bros SA, Evergreen Resources*List Not Exhaustive, PELLICONI & C SPA.

3. What are the main segments of the Crown Cap Bottles Industry?

The market segments include Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Alcoholic and Carbonated Drinks; Growing Adoption of Improved Packaging Designs to Aid Product Differentiation and Branding.

6. What are the notable trends driving market growth?

Non-Alcoholic Beverages are Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Increasing Utilization of Plastic in the Beverage Industry.

8. Can you provide examples of recent developments in the market?

July 2023 - Crown Holdings Inc., as part of its commitment to advancing responsible supply chains, adopted a sustainability program called the Twentyby30 and announced extending its Aluminium Stewardship Initiative (ASI) certifications across the Asia-Pacific region. The ASI standard focuses on environmental, social, and governance (ESG) principles in the aluminum value chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crown Cap Bottles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crown Cap Bottles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crown Cap Bottles Industry?

To stay informed about further developments, trends, and reports in the Crown Cap Bottles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence