Key Insights

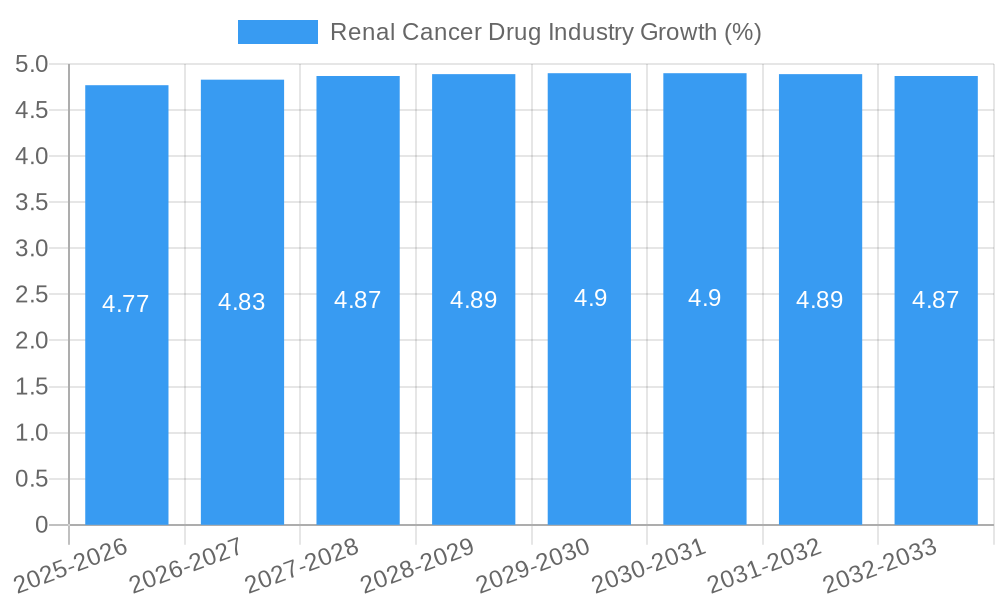

The Renal Cancer Drug Industry is poised for significant growth, with a market size projected to reach $6.92 million by 2025 and a compound annual growth rate (CAGR) of 4.86% from 2025 to 2033. This growth is driven by the increasing prevalence of renal cell carcinoma and advancements in targeted therapies and immunotherapies. Key market segments include drugs categorized by therapeutic and pharmacologic classes such as angiogenesis inhibitors, monoclonal antibodies, and mTOR inhibitors, along with diagnostics. The market is further segmented by cancer types, with clear cell RCC being the most prominent due to its high incidence rate. Major players like Bayer AG, Amgen Inc, and Novartis International AG are intensifying their R&D efforts to introduce innovative treatments, thereby fueling market expansion.

Geographically, North America holds the largest market share due to advanced healthcare infrastructure and high awareness levels, followed by Europe and the Asia Pacific. Within North America, the United States is the leading contributor, supported by substantial investments in cancer research and a robust regulatory framework. Emerging markets in the Asia Pacific, particularly China and India, are expected to witness rapid growth owing to increasing healthcare expenditures and rising patient awareness. However, challenges such as high treatment costs and stringent regulatory approvals may restrain market growth. Nonetheless, the industry's focus on personalized medicine and the development of novel therapies are anticipated to open new avenues for growth, ensuring sustained progress through to 2033.

Renal Cancer Drug Industry Market Structure & Competitive Dynamics

The Renal Cancer Drug Industry presents a fiercely competitive and dynamic market landscape. Key players, including Bayer AG, Amgen Inc., and Novartis International AG, are at the forefront of innovation, fueling substantial market growth. While market concentration is moderate, with leading companies holding approximately 40% of the market share, the competitive intensity is high. This is driven by a robust innovation ecosystem, fueled by substantial R&D investments from companies like Pfizer Inc. and F. Hoffmann-La Roche, who are actively developing cutting-edge therapies. Stringent regulatory frameworks, governed by agencies such as the FDA and EMA, significantly influence market entry and timelines for product development, creating both challenges and opportunities for market participants.

- Market Share Concentration: While the top companies currently hold around 40% of the market share, intense competition suggests this figure is likely to fluctuate significantly in the coming years.

- Mergers & Acquisitions (M&A) Activity: The last five years have witnessed over $5 billion in M&A activity within the renal cancer drug sector, reflecting a clear trend toward industry consolidation and the pursuit of larger market share.

- Competitive Product Landscape: The availability of various alternative treatments, encompassing immunotherapy, targeted therapies, and other modalities, significantly shapes market dynamics and necessitates continuous innovation to maintain a competitive edge.

- Evolving End-User Preferences: A growing preference for personalized medicine is driving increased demand for targeted therapies tailored to individual patient characteristics and genetic profiles, impacting treatment strategies and market segmentation.

- Regulatory Landscape and Compliance: Adherence to stringent international regulatory standards (e.g., FDA, EMA) acts as a significant barrier to entry for new players, yet simultaneously ensures the delivery of high-quality and safe products to patients.

Renal Cancer Drug Industry Industry Trends & Insights

The Renal Cancer Drug Industry is witnessing significant growth, propelled by various factors. The global market is expected to grow at a CAGR of 6.5% from 2025 to 2033, driven by increasing incidences of renal cancer and advancements in therapeutic options. Technological disruptions, such as the integration of AI in drug discovery and development, are reshaping the industry. Consumer preferences are shifting towards less invasive and more effective treatments, with a notable increase in demand for immunotherapy and targeted therapies.

Competitive dynamics are intense, with companies like Bristol-Myers Squibb and Merck KGaA (EMD Serono) vying for market dominance through strategic collaborations and product launches. The market penetration of new drugs, particularly in regions with high renal cancer prevalence like North America and Europe, is significant. The industry is also benefiting from favorable reimbursement policies and increasing healthcare expenditure, which enhance patient access to advanced treatments. However, challenges such as high development costs and regulatory hurdles continue to impact market growth.

Dominant Markets & Segments in Renal Cancer Drug Industry

North America stands out as the leading region in the Renal Cancer Drug Industry, driven by a robust healthcare infrastructure and high incidence rates of renal cancer. Within the market segments, drugs under the therapeutic class of targeted therapy are dominant, capturing a significant share due to their efficacy and specificity.

- Economic Policies: Favorable reimbursement policies in the US and Canada support market growth.

- Infrastructure: Advanced healthcare systems in North America facilitate the adoption of new therapies.

The segment of angiogenesis inhibitors within the pharmacologic class is also prominent, with drugs like sunitinib and pazopanib leading the market. Clear cell RCC, the most common type of renal cancer, dominates the cancer type segment, with a projected market size of $10 Billion by 2033.

- Targeted Therapy: Dominates due to high efficacy and specificity, expected to grow at a CAGR of 7%.

- Angiogenesis Inhibitors: Key players include Bayer AG and Pfizer Inc, with a market size of $4 Billion in 2025.

- Clear Cell RCC: The largest segment by cancer type, driven by its prevalence and the availability of effective treatments.

Renal Cancer Drug Industry Product Innovations

Recent advancements in the Renal Cancer Drug Industry have focused intently on enhancing both the efficacy and safety profiles of existing and novel treatments. The introduction of innovative targeted therapies and immunotherapies, such as checkpoint inhibitors, has profoundly impacted patient outcomes, leading to improved survival rates and quality of life. Furthermore, technological advancements, including personalized medicine approaches and the utilization of biomarkers for patient stratification, are refining treatment strategies and driving a more precise and effective allocation of resources. This precision medicine approach is crucial for maximizing treatment efficacy and minimizing adverse effects.

Report Segmentation & Scope

This report segments the Renal Cancer Drug Industry by various key factors, including drug component, therapeutic class, pharmacologic class, and specific cancer type (e.g., clear cell renal cell carcinoma – ccRCC). The overall drug segment is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 6.5%, fueled by ongoing innovation and the development of more effective treatments. Targeted therapy is currently the leading therapeutic class, anticipating a market size of $8 billion by 2033. Within pharmacologic classes, angiogenesis inhibitors and monoclonal antibodies are prominent, with estimated market sizes of $4 billion and $3 billion, respectively, by 2025. Clear cell RCC represents the dominant cancer type within this market, with a projected market size reaching $10 billion by 2033. The competitive landscape within each segment remains highly intense, with leading players engaging in a continuous race to develop and launch innovative treatments.

Key Drivers of Renal Cancer Drug Industry Growth

The expansion of the Renal Cancer Drug Industry is propelled by several key factors. Technological advancements, particularly the development and refinement of targeted therapies and immunotherapies, stand as cornerstones of this growth. Economic factors, including rising healthcare expenditure globally and supportive reimbursement policies in many regions, significantly impact market expansion. Regulatory support, exemplified by expedited approval pathways for innovative treatments (such as the FDA's Breakthrough Therapy designation), plays a crucial role in accelerating the introduction of new therapies to the market, thus further stimulating growth. These factors collectively drive the ongoing expansion and evolution of this critical sector.

Challenges in the Renal Cancer Drug Industry Sector

The Renal Cancer Drug Industry faces several challenges that could impede growth. Regulatory hurdles, such as stringent approval processes, can delay market entry and increase development costs. Supply chain issues, particularly during global disruptions, affect the availability of critical drugs. Competitive pressures are intense, with numerous players vying for market share, leading to price wars and reduced profit margins. These challenges collectively have a quantifiable impact, with regulatory delays alone costing companies up to $100 Million in lost revenue annually.

Leading Players in the Renal Cancer Drug Industry Market

- Bayer AG

- Amgen Inc

- Novartis International AG

- Abbott Laboratories

- Bristol-Myers Squibb

- Merck KGaA (EMD Serono)

- Seattle Genetic

- F Hoffmann-La Roche

- Pfizer Inc

Key Developments in Renal Cancer Drug Industry Sector

- October 2022: Health Canada approved KEYTRUDA (pembrolizumab) as monotherapy for the adjuvant treatment of adults with renal cell carcinoma (RCC) at intermediate-high or high risk of recurrence following nephrectomy or following nephrectomy and resection of metastatic lesions. This approval significantly enhances the treatment options available for RCC patients.

- August 2022: The European Commission (EC) approved Celltrion Healthcare's Vegzelma (CT-P16) for the treatment of metastatic renal cell carcinoma and other malignancies. This development broadens the market for biosimilar therapies and impacts competitive dynamics.

Strategic Renal Cancer Drug Industry Market Outlook

The Renal Cancer Drug Industry is poised for sustained and robust growth, driven by several factors. Significant opportunities exist in expanding into emerging markets, capitalizing on the increasing prevalence of renal cancer globally. The integration of advanced technologies, such as AI and machine learning, offers substantial potential for accelerating drug discovery and development. A continuing focus on personalized medicine and the refinement of targeted therapies will be key to optimizing patient outcomes and enhancing the overall market potential. The industry's long-term success hinges on its capacity to adapt to evolving market dynamics, embrace technological innovation, and consistently deliver effective and safe treatments to patients in need.

Renal Cancer Drug Industry Segmentation

-

1. Cancer Type

- 1.1. Clear cell RCC

- 1.2. Papillary RCC

- 1.3. Chromophobe RCC

- 1.4. Urothelial carcinoma/Transitional cell carcinoma

- 1.5. Other Ki

-

2. Component

-

2.1. Drugs

-

2.1.1. Therapeutic Class

- 2.1.1.1. Targeted Therapy

- 2.1.1.2. Immunotherapy

- 2.1.1.3. Other Therapeutic Class

-

2.1.2. Pharmacologic Class

- 2.1.2.1. Angiogenesis Inhibitors

- 2.1.2.2. Monoclonal Antibodies

- 2.1.2.3. mTOR Inhibitors

- 2.1.2.4. Cytokine Immunotherapy (IL-2)

-

2.1.1. Therapeutic Class

-

2.2. Diagnostics

- 2.2.1. Biopsy

- 2.2.2. Imaging Tests

- 2.2.3. Blood Tests

- 2.2.4. Other Diagnostics

-

2.1. Drugs

Renal Cancer Drug Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Renal Cancer Drug Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.86% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Kidney Cancer; Increased R&D Expenditure of Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with Treatment; Low Success Rate in Clinical Trials for Cancer Drugs

- 3.4. Market Trends

- 3.4.1. Clear Cell RCC is Expected Witness a Growth in the Kidney Cancer Therapeutics and Diagnostics Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Renal Cancer Drug Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cancer Type

- 5.1.1. Clear cell RCC

- 5.1.2. Papillary RCC

- 5.1.3. Chromophobe RCC

- 5.1.4. Urothelial carcinoma/Transitional cell carcinoma

- 5.1.5. Other Ki

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Drugs

- 5.2.1.1. Therapeutic Class

- 5.2.1.1.1. Targeted Therapy

- 5.2.1.1.2. Immunotherapy

- 5.2.1.1.3. Other Therapeutic Class

- 5.2.1.2. Pharmacologic Class

- 5.2.1.2.1. Angiogenesis Inhibitors

- 5.2.1.2.2. Monoclonal Antibodies

- 5.2.1.2.3. mTOR Inhibitors

- 5.2.1.2.4. Cytokine Immunotherapy (IL-2)

- 5.2.1.1. Therapeutic Class

- 5.2.2. Diagnostics

- 5.2.2.1. Biopsy

- 5.2.2.2. Imaging Tests

- 5.2.2.3. Blood Tests

- 5.2.2.4. Other Diagnostics

- 5.2.1. Drugs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Cancer Type

- 6. North America Renal Cancer Drug Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Cancer Type

- 6.1.1. Clear cell RCC

- 6.1.2. Papillary RCC

- 6.1.3. Chromophobe RCC

- 6.1.4. Urothelial carcinoma/Transitional cell carcinoma

- 6.1.5. Other Ki

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Drugs

- 6.2.1.1. Therapeutic Class

- 6.2.1.1.1. Targeted Therapy

- 6.2.1.1.2. Immunotherapy

- 6.2.1.1.3. Other Therapeutic Class

- 6.2.1.2. Pharmacologic Class

- 6.2.1.2.1. Angiogenesis Inhibitors

- 6.2.1.2.2. Monoclonal Antibodies

- 6.2.1.2.3. mTOR Inhibitors

- 6.2.1.2.4. Cytokine Immunotherapy (IL-2)

- 6.2.1.1. Therapeutic Class

- 6.2.2. Diagnostics

- 6.2.2.1. Biopsy

- 6.2.2.2. Imaging Tests

- 6.2.2.3. Blood Tests

- 6.2.2.4. Other Diagnostics

- 6.2.1. Drugs

- 6.1. Market Analysis, Insights and Forecast - by Cancer Type

- 7. Europe Renal Cancer Drug Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Cancer Type

- 7.1.1. Clear cell RCC

- 7.1.2. Papillary RCC

- 7.1.3. Chromophobe RCC

- 7.1.4. Urothelial carcinoma/Transitional cell carcinoma

- 7.1.5. Other Ki

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Drugs

- 7.2.1.1. Therapeutic Class

- 7.2.1.1.1. Targeted Therapy

- 7.2.1.1.2. Immunotherapy

- 7.2.1.1.3. Other Therapeutic Class

- 7.2.1.2. Pharmacologic Class

- 7.2.1.2.1. Angiogenesis Inhibitors

- 7.2.1.2.2. Monoclonal Antibodies

- 7.2.1.2.3. mTOR Inhibitors

- 7.2.1.2.4. Cytokine Immunotherapy (IL-2)

- 7.2.1.1. Therapeutic Class

- 7.2.2. Diagnostics

- 7.2.2.1. Biopsy

- 7.2.2.2. Imaging Tests

- 7.2.2.3. Blood Tests

- 7.2.2.4. Other Diagnostics

- 7.2.1. Drugs

- 7.1. Market Analysis, Insights and Forecast - by Cancer Type

- 8. Asia Pacific Renal Cancer Drug Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Cancer Type

- 8.1.1. Clear cell RCC

- 8.1.2. Papillary RCC

- 8.1.3. Chromophobe RCC

- 8.1.4. Urothelial carcinoma/Transitional cell carcinoma

- 8.1.5. Other Ki

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Drugs

- 8.2.1.1. Therapeutic Class

- 8.2.1.1.1. Targeted Therapy

- 8.2.1.1.2. Immunotherapy

- 8.2.1.1.3. Other Therapeutic Class

- 8.2.1.2. Pharmacologic Class

- 8.2.1.2.1. Angiogenesis Inhibitors

- 8.2.1.2.2. Monoclonal Antibodies

- 8.2.1.2.3. mTOR Inhibitors

- 8.2.1.2.4. Cytokine Immunotherapy (IL-2)

- 8.2.1.1. Therapeutic Class

- 8.2.2. Diagnostics

- 8.2.2.1. Biopsy

- 8.2.2.2. Imaging Tests

- 8.2.2.3. Blood Tests

- 8.2.2.4. Other Diagnostics

- 8.2.1. Drugs

- 8.1. Market Analysis, Insights and Forecast - by Cancer Type

- 9. Middle East and Africa Renal Cancer Drug Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Cancer Type

- 9.1.1. Clear cell RCC

- 9.1.2. Papillary RCC

- 9.1.3. Chromophobe RCC

- 9.1.4. Urothelial carcinoma/Transitional cell carcinoma

- 9.1.5. Other Ki

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Drugs

- 9.2.1.1. Therapeutic Class

- 9.2.1.1.1. Targeted Therapy

- 9.2.1.1.2. Immunotherapy

- 9.2.1.1.3. Other Therapeutic Class

- 9.2.1.2. Pharmacologic Class

- 9.2.1.2.1. Angiogenesis Inhibitors

- 9.2.1.2.2. Monoclonal Antibodies

- 9.2.1.2.3. mTOR Inhibitors

- 9.2.1.2.4. Cytokine Immunotherapy (IL-2)

- 9.2.1.1. Therapeutic Class

- 9.2.2. Diagnostics

- 9.2.2.1. Biopsy

- 9.2.2.2. Imaging Tests

- 9.2.2.3. Blood Tests

- 9.2.2.4. Other Diagnostics

- 9.2.1. Drugs

- 9.1. Market Analysis, Insights and Forecast - by Cancer Type

- 10. South America Renal Cancer Drug Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Cancer Type

- 10.1.1. Clear cell RCC

- 10.1.2. Papillary RCC

- 10.1.3. Chromophobe RCC

- 10.1.4. Urothelial carcinoma/Transitional cell carcinoma

- 10.1.5. Other Ki

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Drugs

- 10.2.1.1. Therapeutic Class

- 10.2.1.1.1. Targeted Therapy

- 10.2.1.1.2. Immunotherapy

- 10.2.1.1.3. Other Therapeutic Class

- 10.2.1.2. Pharmacologic Class

- 10.2.1.2.1. Angiogenesis Inhibitors

- 10.2.1.2.2. Monoclonal Antibodies

- 10.2.1.2.3. mTOR Inhibitors

- 10.2.1.2.4. Cytokine Immunotherapy (IL-2)

- 10.2.1.1. Therapeutic Class

- 10.2.2. Diagnostics

- 10.2.2.1. Biopsy

- 10.2.2.2. Imaging Tests

- 10.2.2.3. Blood Tests

- 10.2.2.4. Other Diagnostics

- 10.2.1. Drugs

- 10.1. Market Analysis, Insights and Forecast - by Cancer Type

- 11. North America Renal Cancer Drug Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Renal Cancer Drug Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Renal Cancer Drug Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Renal Cancer Drug Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Renal Cancer Drug Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Bayer AG

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Amgen Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Novartis International AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Abbott Laboratories

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Bristol-Myers Squibb

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Merck KGaA (EMD Serono)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Seattle Genetic*List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 F Hoffmann-La Roche

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Pfizer Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Bayer AG

List of Figures

- Figure 1: Global Renal Cancer Drug Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Renal Cancer Drug Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Renal Cancer Drug Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Renal Cancer Drug Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Renal Cancer Drug Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Renal Cancer Drug Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Renal Cancer Drug Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Renal Cancer Drug Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Renal Cancer Drug Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Renal Cancer Drug Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Renal Cancer Drug Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Renal Cancer Drug Industry Revenue (Million), by Cancer Type 2024 & 2032

- Figure 13: North America Renal Cancer Drug Industry Revenue Share (%), by Cancer Type 2024 & 2032

- Figure 14: North America Renal Cancer Drug Industry Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Renal Cancer Drug Industry Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Renal Cancer Drug Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Renal Cancer Drug Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Renal Cancer Drug Industry Revenue (Million), by Cancer Type 2024 & 2032

- Figure 19: Europe Renal Cancer Drug Industry Revenue Share (%), by Cancer Type 2024 & 2032

- Figure 20: Europe Renal Cancer Drug Industry Revenue (Million), by Component 2024 & 2032

- Figure 21: Europe Renal Cancer Drug Industry Revenue Share (%), by Component 2024 & 2032

- Figure 22: Europe Renal Cancer Drug Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Renal Cancer Drug Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Renal Cancer Drug Industry Revenue (Million), by Cancer Type 2024 & 2032

- Figure 25: Asia Pacific Renal Cancer Drug Industry Revenue Share (%), by Cancer Type 2024 & 2032

- Figure 26: Asia Pacific Renal Cancer Drug Industry Revenue (Million), by Component 2024 & 2032

- Figure 27: Asia Pacific Renal Cancer Drug Industry Revenue Share (%), by Component 2024 & 2032

- Figure 28: Asia Pacific Renal Cancer Drug Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Renal Cancer Drug Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Renal Cancer Drug Industry Revenue (Million), by Cancer Type 2024 & 2032

- Figure 31: Middle East and Africa Renal Cancer Drug Industry Revenue Share (%), by Cancer Type 2024 & 2032

- Figure 32: Middle East and Africa Renal Cancer Drug Industry Revenue (Million), by Component 2024 & 2032

- Figure 33: Middle East and Africa Renal Cancer Drug Industry Revenue Share (%), by Component 2024 & 2032

- Figure 34: Middle East and Africa Renal Cancer Drug Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Renal Cancer Drug Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Renal Cancer Drug Industry Revenue (Million), by Cancer Type 2024 & 2032

- Figure 37: South America Renal Cancer Drug Industry Revenue Share (%), by Cancer Type 2024 & 2032

- Figure 38: South America Renal Cancer Drug Industry Revenue (Million), by Component 2024 & 2032

- Figure 39: South America Renal Cancer Drug Industry Revenue Share (%), by Component 2024 & 2032

- Figure 40: South America Renal Cancer Drug Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Renal Cancer Drug Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Renal Cancer Drug Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Renal Cancer Drug Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 3: Global Renal Cancer Drug Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Global Renal Cancer Drug Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Renal Cancer Drug Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Renal Cancer Drug Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Renal Cancer Drug Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Renal Cancer Drug Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Renal Cancer Drug Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Renal Cancer Drug Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 32: Global Renal Cancer Drug Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 33: Global Renal Cancer Drug Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Renal Cancer Drug Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 38: Global Renal Cancer Drug Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 39: Global Renal Cancer Drug Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Renal Cancer Drug Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 47: Global Renal Cancer Drug Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 48: Global Renal Cancer Drug Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Renal Cancer Drug Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 56: Global Renal Cancer Drug Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 57: Global Renal Cancer Drug Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Renal Cancer Drug Industry Revenue Million Forecast, by Cancer Type 2019 & 2032

- Table 62: Global Renal Cancer Drug Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 63: Global Renal Cancer Drug Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Renal Cancer Drug Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Renal Cancer Drug Industry?

The projected CAGR is approximately 4.86%.

2. Which companies are prominent players in the Renal Cancer Drug Industry?

Key companies in the market include Bayer AG, Amgen Inc, Novartis International AG, Abbott Laboratories, Bristol-Myers Squibb, Merck KGaA (EMD Serono), Seattle Genetic*List Not Exhaustive, F Hoffmann-La Roche, Pfizer Inc.

3. What are the main segments of the Renal Cancer Drug Industry?

The market segments include Cancer Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Kidney Cancer; Increased R&D Expenditure of Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Clear Cell RCC is Expected Witness a Growth in the Kidney Cancer Therapeutics and Diagnostics Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost Associated with Treatment; Low Success Rate in Clinical Trials for Cancer Drugs.

8. Can you provide examples of recent developments in the market?

In October 2022, Health Canada approved KEYTRUDA (pembrolizumab) as monotherapy for the adjuvant treatment of adults with renal cell carcinoma (RCC) at intermediate-high or high risk of recurrence following nephrectomy or following nephrectomy and resection of metastatic lesions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Renal Cancer Drug Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Renal Cancer Drug Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Renal Cancer Drug Industry?

To stay informed about further developments, trends, and reports in the Renal Cancer Drug Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence