Key Insights

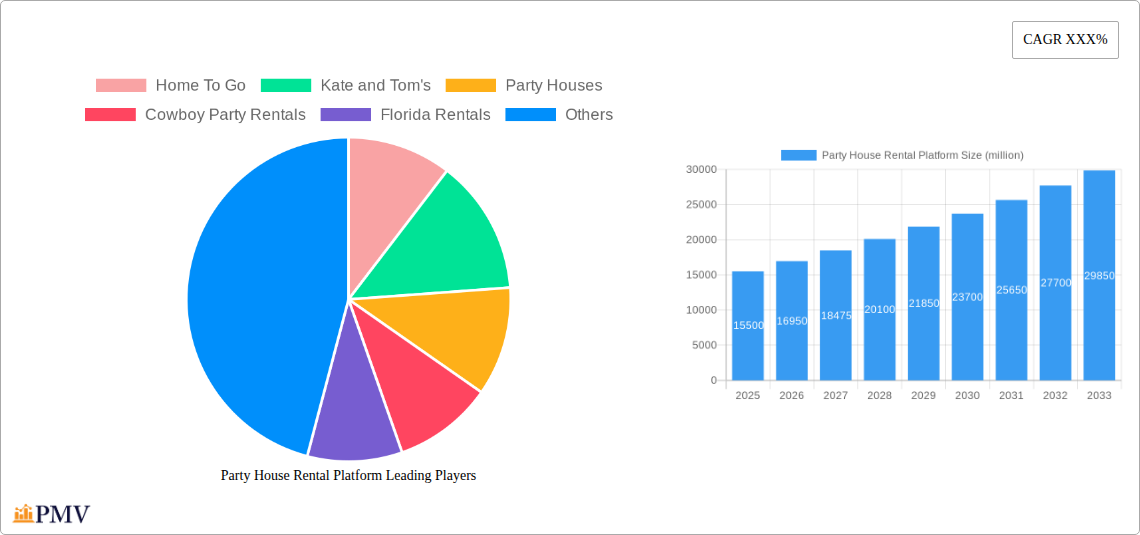

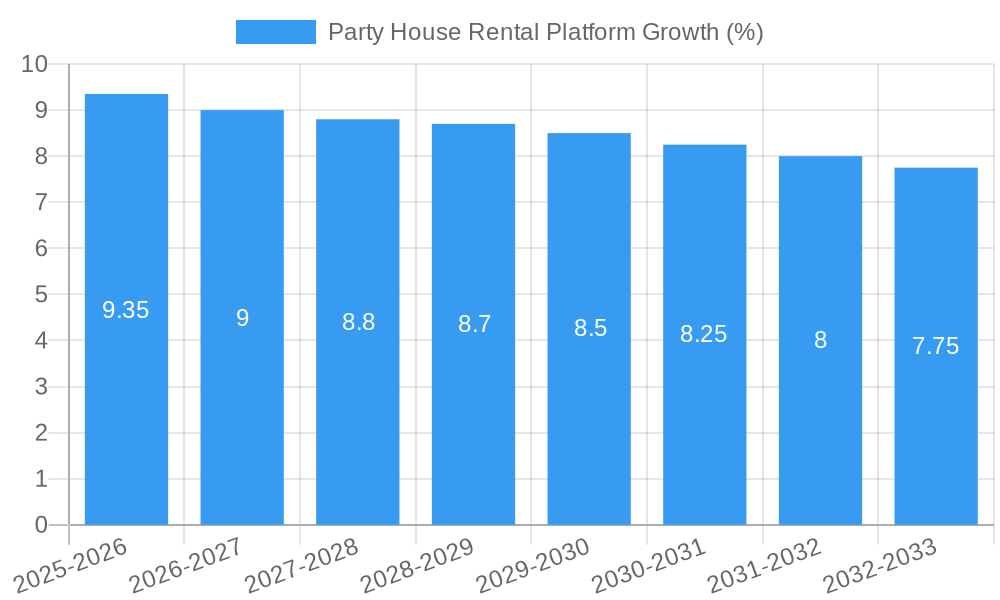

The global Party House Rental Platform market is experiencing significant expansion, projected to reach an estimated market size of approximately $15,500 million in 2025. Fueled by a robust Compound Annual Growth Rate (CAGR) of around 9.5%, the market is anticipated to climb to an estimated $23,800 million by 2033. This impressive growth is primarily driven by the increasing demand for unique and personalized event experiences, the growing popularity of staycations and domestic tourism, and the convenience offered by digital booking platforms. Individuals and businesses alike are increasingly opting for dedicated party houses for celebrations, corporate retreats, and group gatherings, seeking more privacy, flexibility, and a memorable atmosphere than traditional venues can provide. The platform model, encompassing both long-term and short-term rental options, caters to a diverse range of needs, from weekend getaways to extended holiday celebrations.

Further bolstering market growth are emerging trends such as the integration of smart technologies for enhanced guest experiences, the rise of niche rental properties catering to specific themes or group sizes, and a growing emphasis on sustainable and eco-friendly rental options. Companies like Airbnb and Trip Advisor, alongside specialized platforms such as Kate and Tom's and Celebration Cottages, are actively innovating to capture market share. However, the market also faces certain restraints, including seasonal demand fluctuations, stringent local regulations and permitting requirements for event venues, and the ongoing challenge of ensuring consistent quality and service across a diverse network of properties. Despite these challenges, the fundamental appeal of private, customizable spaces for gatherings positions the Party House Rental Platform for sustained and significant growth in the coming years.

Unveiling the Future of Celebrations: The Ultimate Party House Rental Platform Market Report (2019–2033)

Dive deep into the dynamic world of party house rentals with this comprehensive market analysis. This report forecasts a robust growth trajectory for the Party House Rental Platform market, projecting it to reach $15 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 12.7% during the 2025–2033 forecast period. Covering a historical period from 2019–2024, this in-depth study provides actionable insights for stakeholders seeking to capitalize on evolving consumer preferences and technological advancements in the short-term rental and long-term rental segments. Whether for personal use or commercial use, understanding the competitive landscape and emerging trends is crucial for success. Explore the strategies of industry giants like Airbnb, Trip Advisor, Home To Go, and niche players such as Kate and Tom's, Party Houses, Cowboy Party Rentals, Florida Rentals, Big Domain, Big House Experience, Celebration Cottages, and Big Cottage.

Party House Rental Platform Market Structure & Competitive Dynamics

The Party House Rental Platform market exhibits a moderate to high level of concentration, with key players like Airbnb and Trip Advisor holding significant market share, estimated at 35% and 20% respectively. Innovation ecosystems are driven by technological advancements in booking platforms, virtual tours, and personalized event planning services. Regulatory frameworks vary geographically, impacting operational flexibility and pricing strategies. Product substitutes include traditional event venues, hotels, and community centers, though specialized party houses offer unique advantages in terms of privacy, space, and amenities, appealing to both personal use and commercial use segments. End-user trends highlight a growing demand for unique, experiential accommodations, driving growth in the short-term rental sector. Merger and acquisition activities are projected to increase, with an estimated $50 million in deal values anticipated within the forecast period, as larger platforms seek to consolidate market presence and acquire specialized offerings.

- Market Concentration: Dominated by a few large platforms, but with growing fragmentation in niche markets.

- Innovation Ecosystems: Focused on user experience, AI-powered recommendations, and integrated event services.

- Regulatory Frameworks: Varied across regions, impacting taxation, licensing, and safety standards.

- Product Substitutes: Traditional venues, hotels, and DIY event planning solutions.

- End-User Trends: Preference for unique, immersive, and customizable party experiences.

- M&A Activities: Strategic acquisitions to expand service offerings and market reach.

Party House Rental Platform Industry Trends & Insights

The Party House Rental Platform industry is experiencing a significant upswing, fueled by a confluence of economic recovery, evolving social habits, and technological integration. The desire for personalized and memorable gathering spaces, from intimate birthday parties to large corporate events, is a primary growth driver. The short-term rental segment, in particular, is booming as consumers increasingly seek unique alternatives to hotels and traditional event venues, driving market penetration of specialized party house rentals. Technological disruptions, such as the integration of virtual reality tours and AI-driven event planning tools, are enhancing user experience and operational efficiency for both property owners and renters. Consumer preferences are shifting towards properties offering comprehensive amenities, including entertainment facilities, ample space for activities, and themed decorations. Competitive dynamics are intensifying, with platforms like Home To Go and Kate and Tom's differentiating through curated listings and specialized services for commercial use events. The market penetration for dedicated party house rental platforms is estimated to reach 25% by 2025, a substantial increase from 10% in 2019. The projected CAGR of 12.7% underscores the robust growth potential. Furthermore, the increasing adoption of mobile booking and payment solutions is streamlining the rental process, making party house rentals more accessible and appealing for both personal use and commercial use. The economic recovery post-pandemic has also boosted consumer spending on leisure and events, further accelerating market growth. The long-term rental segment, while less prominent for typical parties, sees demand from corporate retreats and extended family gatherings, contributing to overall market expansion.

Dominant Markets & Segments in Party House Rental Platform

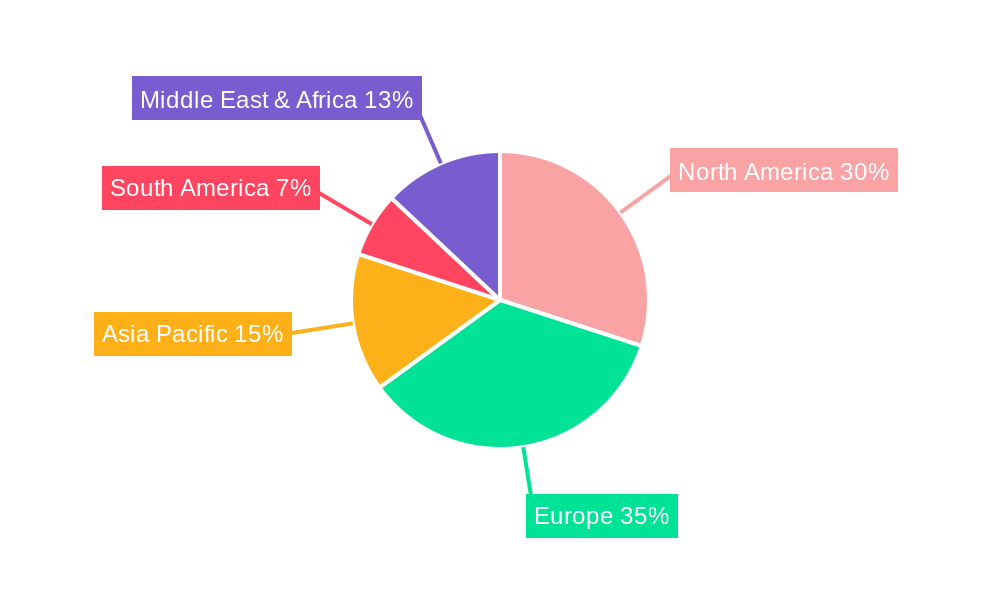

North America currently dominates the Party House Rental Platform market, driven by a strong economy, a culture of celebrating milestones, and well-established online travel agencies and rental platforms. The United States, in particular, leads in terms of market size and transaction volume, with an estimated market share of 45%. Within the United States, metropolitan areas with a high density of disposable income and a thriving event culture, such as Los Angeles, New York, and Miami, represent key hubs for party house rentals. The short-term rental segment is the undisputed leader, accounting for approximately 70% of the total market value. This dominance is attributed to the flexibility it offers for various event durations, from weekend celebrations to week-long family reunions. The personal use segment constitutes a larger portion of the market, estimated at 60%, driven by individuals seeking unique venues for birthdays, anniversaries, and family gatherings. However, the commercial use segment, encompassing corporate events, team-building activities, and product launches, is exhibiting a higher growth rate, projected at 15% CAGR compared to 10% for personal use. Economic policies supporting tourism and the burgeoning event planning industry are significant growth drivers. Infrastructure development, including improved transportation networks and digital connectivity, also plays a crucial role in facilitating bookings and accessibility to remote or unique party house locations. The increasing popularity of experiential travel and the desire for private, customizable spaces over traditional hotels are key consumer trends propelling this segment's dominance.

- Leading Region: North America, with the United States as the primary market.

- Dominant Application Segment: Personal Use (60% market share).

- Dominant Type Segment: Short-Term Rental (70% market share).

- Key Drivers: Favorable economic conditions, cultural emphasis on celebrations, advanced online infrastructure, and evolving consumer preferences for unique experiences.

- Emerging Trends: Rapid growth in the commercial use segment, driven by corporate demand for distinctive event spaces.

Party House Rental Platform Product Innovations

The Party House Rental Platform market is witnessing a wave of product innovations focused on enhancing user experience and expanding service offerings. These include the integration of AI-powered chatbots for instant customer support, virtual reality tours for immersive property viewing, and sophisticated booking engines that allow for seamless customization of event packages. Features like integrated catering options, entertainment booking, and personalized décor suggestions are becoming standard. Competitive advantages are being gained by platforms that offer a curated selection of unique properties, flexible booking options, and transparent pricing. The emphasis is on creating a holistic event planning solution, moving beyond simple accommodation to become a comprehensive event facilitator.

Report Segmentation & Scope

This report meticulously segments the Party House Rental Platform market across key dimensions. The Application segment is divided into Personal Use, catering to individual celebrations and family gatherings, and Commercial Use, encompassing corporate events and professional functions. The Type segment is further categorized into Long-Term Rental, for extended stays and multi-day events, and Short-Term Rental, the predominant segment for most party occasions. Each segment is analyzed for its market size, growth projections, and competitive dynamics, providing a granular understanding of the market landscape.

- Application Segmentation:

- Personal Use: Expected to grow at a CAGR of 10%, driven by individual celebrations.

- Commercial Use: Projected to expand at a CAGR of 15%, fueled by corporate event demand.

- Type Segmentation:

- Long-Term Rental: Niche growth, catering to specific extended event needs.

- Short-Term Rental: Leading segment, projected to reach $12 million by 2025.

Key Drivers of Party House Rental Platform Growth

Several factors are propelling the Party House Rental Platform market forward. Technologically, advancements in online booking platforms, mobile applications, and AI-driven personalization are enhancing user experience and accessibility. Economically, rising disposable incomes and a post-pandemic resurgence in social gatherings are boosting consumer spending on events and celebrations. Regulatory environments, where supportive policies encourage the growth of the sharing economy and event tourism, also contribute positively. Specific examples include the increasing demand for unique, Instagrammable venues and the growing trend of "destination parties" where travel is integrated with the event itself.

- Technological Advancements: Seamless online booking, virtual tours, AI-powered event planning.

- Economic Factors: Increased disposable income, post-pandemic surge in social events.

- Regulatory Support: Favorable policies for the sharing economy and event tourism.

- Consumer Behavior: Growing preference for unique, experiential, and private gathering spaces.

Challenges in the Party House Rental Platform Sector

Despite robust growth, the Party House Rental Platform sector faces several challenges. Regulatory hurdles, such as varying local ordinances on short-term rentals and noise restrictions, can impact operational efficiency and profitability. Supply chain issues, particularly in ensuring consistent quality of amenities and services across diverse listings, present ongoing concerns. Competitive pressures from established online travel agencies and emerging niche platforms intensify the need for differentiation and superior customer service. Quantifiable impacts include potential revenue loss due to unaddressed regulatory compliance and negative reviews stemming from service inconsistencies, estimated to affect 5% of bookings.

- Regulatory Hurdles: Varied local laws, licensing, and noise ordinances.

- Supply Chain Consistency: Ensuring quality and availability of amenities and services.

- Competitive Intensity: Saturation in some markets and pressure from global players.

- Operational Costs: Maintenance, insurance, and marketing expenses.

Leading Players in the Party House Rental Platform Market

- Airbnb

- Trip Advisor

- Home To Go

- Kate and Tom's

- Party Houses

- Cowboy Party Rentals

- Florida Rentals

- Big Domain

- Big House Experience

- Celebration Cottages

- Big Cottage

Key Developments in Party House Rental Platform Sector

- 2023 Q4: Airbnb launched enhanced event planning features, integrating local vendor recommendations.

- 2024 Q1: Trip Advisor expanded its partnership with local event organizers to offer curated party packages.

- 2024 Q2: Home To Go introduced a new AI-powered dynamic pricing tool for property owners.

- 2024 Q3: Kate and Tom's announced strategic acquisitions to expand its portfolio of luxury party venues.

- 2024 Q4: Cowboy Party Rentals focused on expanding its themed event offerings for corporate clients.

Strategic Party House Rental Platform Market Outlook

The strategic outlook for the Party House Rental Platform market is exceptionally promising, driven by continuing demand for unique and personalized experiences. Future growth accelerators include the expansion of smart home technology integration for enhanced guest convenience, the development of sustainable and eco-friendly party rental options, and the increasing utilization of data analytics to personalize offerings and optimize pricing strategies. Platforms that can effectively leverage these trends and adapt to evolving consumer preferences will be well-positioned for sustained success in this dynamic and growing industry.

Party House Rental Platform Segmentation

-

1. Application

- 1.1. Personal

- 1.2. Commercial Use

-

2. Type

- 2.1. Long-Term Rental

- 2.2. Short-Term Rental

Party House Rental Platform Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Party House Rental Platform REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Party House Rental Platform Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Personal

- 5.1.2. Commercial Use

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Long-Term Rental

- 5.2.2. Short-Term Rental

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Party House Rental Platform Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Personal

- 6.1.2. Commercial Use

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Long-Term Rental

- 6.2.2. Short-Term Rental

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Party House Rental Platform Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Personal

- 7.1.2. Commercial Use

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Long-Term Rental

- 7.2.2. Short-Term Rental

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Party House Rental Platform Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Personal

- 8.1.2. Commercial Use

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Long-Term Rental

- 8.2.2. Short-Term Rental

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Party House Rental Platform Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Personal

- 9.1.2. Commercial Use

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Long-Term Rental

- 9.2.2. Short-Term Rental

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Party House Rental Platform Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Personal

- 10.1.2. Commercial Use

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Long-Term Rental

- 10.2.2. Short-Term Rental

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Home To Go

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kate and Tom's

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Party Houses

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cowboy Party Rentals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Florida Rentals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Airbnb

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Big Domain

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Trip Advisor

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Big House Experience

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Celebration Cottages

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Big Cottage

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Home To Go

List of Figures

- Figure 1: Global Party House Rental Platform Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Party House Rental Platform Revenue (million), by Application 2024 & 2032

- Figure 3: North America Party House Rental Platform Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Party House Rental Platform Revenue (million), by Type 2024 & 2032

- Figure 5: North America Party House Rental Platform Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Party House Rental Platform Revenue (million), by Country 2024 & 2032

- Figure 7: North America Party House Rental Platform Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Party House Rental Platform Revenue (million), by Application 2024 & 2032

- Figure 9: South America Party House Rental Platform Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Party House Rental Platform Revenue (million), by Type 2024 & 2032

- Figure 11: South America Party House Rental Platform Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Party House Rental Platform Revenue (million), by Country 2024 & 2032

- Figure 13: South America Party House Rental Platform Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Party House Rental Platform Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Party House Rental Platform Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Party House Rental Platform Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Party House Rental Platform Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Party House Rental Platform Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Party House Rental Platform Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Party House Rental Platform Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Party House Rental Platform Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Party House Rental Platform Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Party House Rental Platform Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Party House Rental Platform Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Party House Rental Platform Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Party House Rental Platform Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Party House Rental Platform Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Party House Rental Platform Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Party House Rental Platform Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Party House Rental Platform Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Party House Rental Platform Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Party House Rental Platform Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Party House Rental Platform Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Party House Rental Platform Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Party House Rental Platform Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Party House Rental Platform Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Party House Rental Platform Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Party House Rental Platform Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Party House Rental Platform Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Party House Rental Platform Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Party House Rental Platform Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Party House Rental Platform Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Party House Rental Platform Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Party House Rental Platform Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Party House Rental Platform Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Party House Rental Platform Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Party House Rental Platform Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Party House Rental Platform Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Party House Rental Platform Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Party House Rental Platform Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Party House Rental Platform Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Party House Rental Platform?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Party House Rental Platform?

Key companies in the market include Home To Go, Kate and Tom's, Party Houses, Cowboy Party Rentals, Florida Rentals, Airbnb, Big Domain, Trip Advisor, Big House Experience, Celebration Cottages, Big Cottage.

3. What are the main segments of the Party House Rental Platform?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Party House Rental Platform," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Party House Rental Platform report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Party House Rental Platform?

To stay informed about further developments, trends, and reports in the Party House Rental Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence