Key Insights

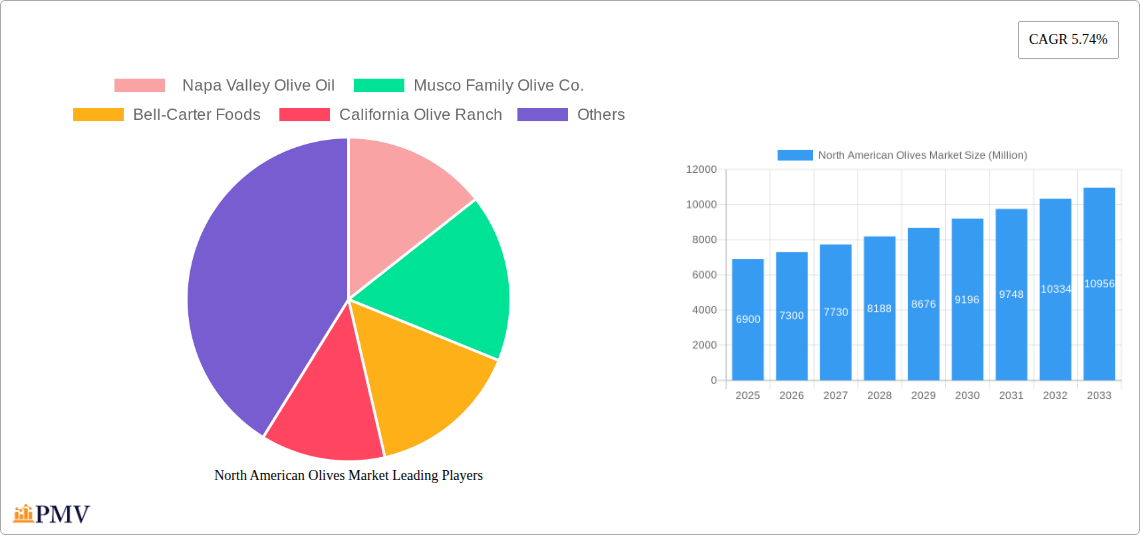

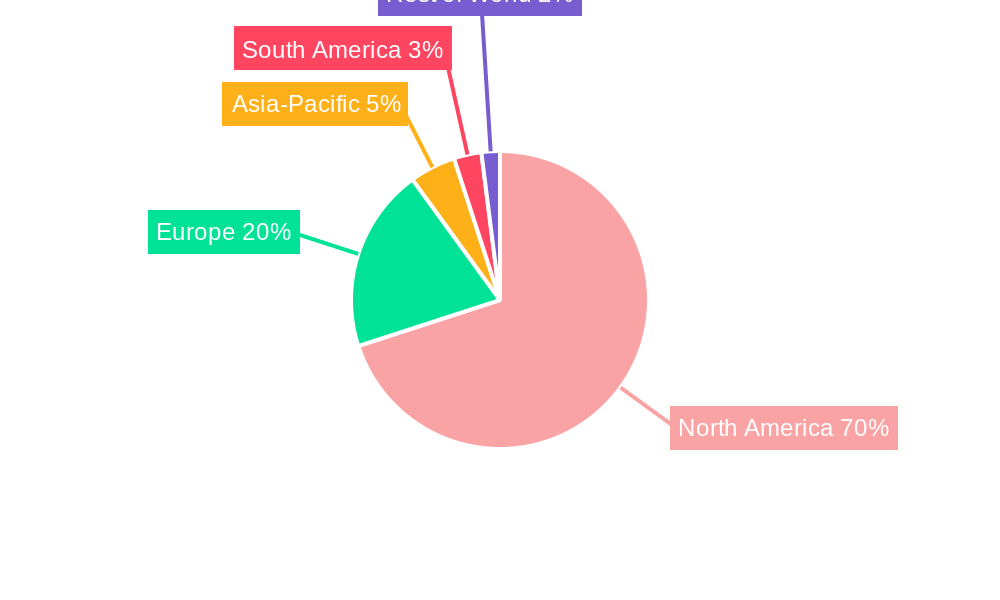

The North American olives market, valued at $6.90 billion in 2025, is projected to experience robust growth, driven by increasing consumer awareness of the health benefits associated with olive consumption and a rising preference for Mediterranean-style diets. This growth is further fueled by the versatility of olives and their derivatives, finding applications across various food segments, including salad dressings, pizzas, dips, and culinary ingredients. The market is segmented into key product categories: table olives, olive oil, olive paste, and olive leaf extract, each exhibiting unique growth trajectories influenced by consumer preferences and evolving culinary trends. Leading companies such as Napa Valley Olive Oil, Musco Family Olive Co., Bell-Carter Foods, and California Olive Ranch are actively shaping market dynamics through product innovation, brand building, and strategic distribution networks. The United States, as the largest market within North America, accounts for a significant share of the overall regional market, while Canada and Mexico contribute substantial growth potential.

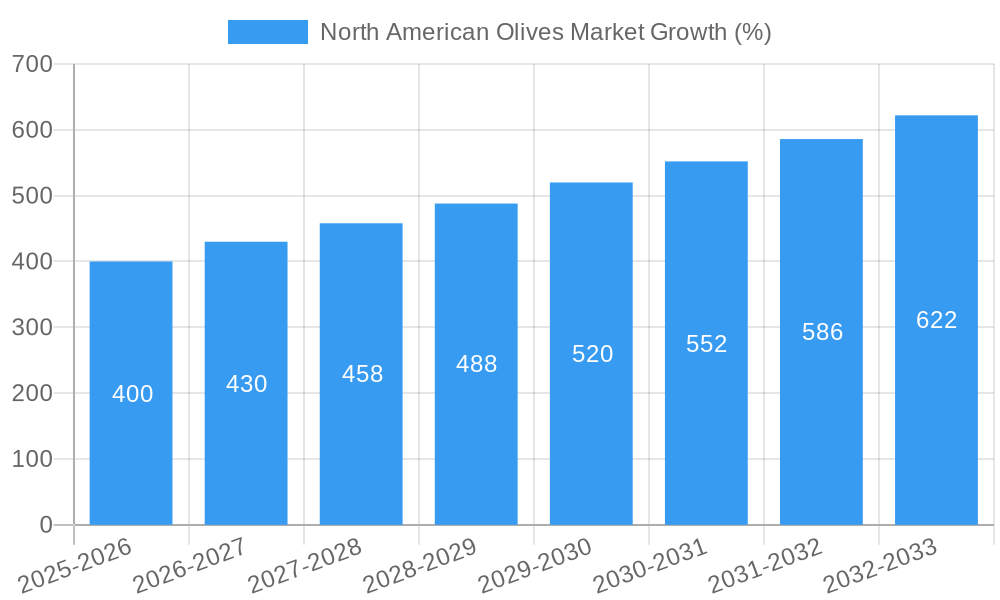

The projected CAGR of 5.74% from 2025 to 2033 suggests substantial market expansion. Growth will likely be influenced by several factors. Increased demand for premium and specialty olive products, including organic and extra virgin options, will drive higher average selling prices. Furthermore, innovations in olive-based food products, such as flavored olive oils and ready-to-use olive-based dips, are expected to contribute to market expansion. While potential restraints like fluctuating olive harvests and global economic conditions exist, the overall market outlook remains positive, fueled by consistently growing consumer demand and an increasing acceptance of the Mediterranean diet's health benefits. Specific regional variations within North America will likely depend on factors such as local culinary preferences and distribution infrastructure.

North American Olives Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North American olives market, covering the period 2019-2033. With a base year of 2025 and a forecast period spanning 2025-2033, this report offers crucial insights for businesses operating within this dynamic sector. The study encompasses detailed segmentation by product (Table Olives, Olive Oil, Olive Paste, Olive Leaf Extract) and application (Salad Dressings, Pizzas, Dips, Culinary Ingredients), offering a granular understanding of market trends and opportunities. Key players like Napa Valley Olive Oil, Musco Family Olive Co., Bell-Carter Foods, and California Olive Ranch are profiled, providing a competitive landscape analysis. The report also incorporates recent industry developments, including significant M&A activity, shaping the future of the North American olives market. The estimated market value for 2025 is xx Million.

North American Olives Market Market Structure & Competitive Dynamics

The North American olives market exhibits a moderately concentrated structure, with a few large players holding significant market share. The market is characterized by a dynamic innovation ecosystem, driven by ongoing research into olive cultivation, processing techniques, and the development of new olive-based products. Regulatory frameworks, particularly concerning food safety and labeling, play a significant role in shaping market dynamics. Product substitutes, such as other vegetable oils and condiments, pose a degree of competitive pressure. Consumer trends, marked by a growing preference for healthier and more natural foods, are fueling demand for olives and olive-based products. Mergers and acquisitions (M&A) activity, as evidenced by the recent acquisition of Bell-Carter Foods by AG Olives, is reshaping the competitive landscape.

- Market Concentration: High concentration in specific segments, with top players holding approximately xx% of the total market share in 2025.

- Innovation: Continuous research into improving olive cultivation techniques, extraction methods, and product diversification.

- Regulatory Framework: Stringent food safety and labeling regulations impacting operational costs and product development.

- M&A Activity: The acquisition of Bell-Carter Foods by AG Olives in September 2022 represents a significant consolidation in the market. The total value of M&A deals in the sector from 2019 to 2024 is estimated at xx Million.

- End-User Trends: Growing consumer demand for healthy and natural food options drives market expansion.

North American Olives Market Industry Trends & Insights

The North American olives market is experiencing robust growth, driven primarily by increasing consumer awareness of the health benefits associated with olive consumption. The market has witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is expected to continue in the forecast period (2025-2033), albeit at a slightly moderated rate, with a projected CAGR of xx%. This moderation may be attributed to factors such as price fluctuations, weather patterns influencing yields, and potential economic downturns. Technological advancements in olive processing and extraction are leading to improved product quality and efficiency. The market penetration of olive oil, particularly extra virgin olive oil, continues to increase as consumers become more discerning about the health qualities of their food. The competitive landscape remains intensely dynamic, characterized by both intense competition and strategic collaborations.

Dominant Markets & Segments in North American Olives Market

The California region dominates the North American olives market, accounting for the largest share of production and consumption. This dominance is attributable to California's favorable climate and well-established olive cultivation infrastructure. Within the product segments, olive oil holds the largest market share, driven by its widespread use in culinary applications and its perceived health benefits. In terms of applications, culinary ingredients (including cooking oil and salad dressing) dominate the market, contributing to the overall market growth.

- Key Drivers of California's Dominance:

- Favorable Climate: Ideal growing conditions for olive trees.

- Established Infrastructure: Well-developed farming practices and processing facilities.

- Government Support: Supportive policies promoting agricultural development.

- Olive Oil Segment Dominance:

- Health Benefits: Consumers associate olive oil with heart health and overall well-being.

- Culinary Versatility: Wide range of applications across various cuisines.

- High Value: Premium olive oils command higher prices compared to other segments.

- Culinary Ingredient Application:

- Versatility: Olive oil and olives are used across a wide array of dishes.

- Healthy Perception: Growing consumer preference for healthy eating habits.

- Cultural Acceptance: Olive oil and olives are integrated into various cultures’ cuisines.

North American Olives Market Product Innovations

Recent innovations have focused on enhancing the quality, taste, and convenience of olive-based products. This includes the development of novel extraction methods to maximize the yield of high-quality olive oil and the creation of value-added products like infused olive oils and olive-based functional foods. Manufacturers are increasingly incorporating sustainable and eco-friendly practices throughout their supply chains to meet growing consumer demand for environmentally responsible products. This aligns with evolving technological trends in food processing, promoting efficiency and sustainability.

Report Segmentation & Scope

This report segments the North American olives market by product type and application.

Product: Table Olives, Olive Oil (including extra virgin olive oil), Olive Paste, Olive Leaf Extract. Each segment's market size, growth projections, and competitive dynamics are analyzed.

Application: Salad Dressings, Pizzas, Dips, and Culinary Ingredients. The report evaluates the market share and growth potential of each application.

The report provides a comprehensive analysis of each segment, offering market size estimations, growth projections, and competitive analyses.

Key Drivers of North American Olives Market Growth

Several factors contribute to the growth of the North American olives market. These include the rising awareness of health benefits associated with olive consumption, increased demand for premium and specialty olive oils, growing popularity of Mediterranean-style diets, and technological advancements in olive cultivation and processing. Government initiatives promoting agricultural development and support for olive farmers further contribute to market expansion. Favorable economic conditions and increased disposable incomes among consumers also fuel market growth.

Challenges in the North American Olives Market Sector

The North American olives market faces challenges, including fluctuations in olive yields due to climate change and pest infestations, increasing production costs, and competition from other vegetable oils and condiments. Supply chain disruptions can impact the availability and pricing of olives and olive-based products. Stringent regulatory compliance requirements related to food safety and labeling add to the operational complexities for businesses in the sector. These factors pose potential risks to the market’s overall growth trajectory.

Leading Players in the North American Olives Market Market

- Napa Valley Olive Oil

- Musco Family Olive Co.

- Bell-Carter Foods

- California Olive Ranch

Key Developments in North American Olives Market Sector

September 2022: Bell-Carter Foods, a leading table olive producer, was acquired by Aceitunas Guadalquivir (AG Olives), signifying consolidation within the industry.

February 2023: A USD 70,000 grant from the University of Florida, supplemented by USD 5,000 from the Florida Olive Council, was awarded to research the viability of olives as a new cash crop in Florida. This indicates a potential expansion of olive cultivation beyond established regions.

Strategic North American Olives Market Market Outlook

The North American olives market presents significant opportunities for growth. Expanding into new markets, developing innovative products leveraging olive leaf extracts and other by-products, and focusing on sustainable and ethical sourcing practices will be key strategic imperatives. Investing in research and development to improve cultivation techniques and processing efficiencies will also contribute to future market success. Capitalizing on consumer demand for healthier and more sustainable food options remains paramount for sustained growth in this dynamic sector.

North American Olives Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North American Olives Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North American Olives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Dietary Revolution Leading to Upsurge in Demand for Olive Oil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Olives Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North American Olives Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Canada North American Olives Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Mexico North American Olives Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. United States North American Olives Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North American Olives Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North American Olives Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North American Olives Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Napa Valley Olive Oil

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Musco Family Olive Co.

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Bell-Carter Foods

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 California Olive Ranch

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.1 Napa Valley Olive Oil

List of Figures

- Figure 1: North American Olives Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North American Olives Market Share (%) by Company 2024

List of Tables

- Table 1: North American Olives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North American Olives Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: North American Olives Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: North American Olives Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: North American Olives Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: North American Olives Market Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: North American Olives Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: North American Olives Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: North American Olives Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: North American Olives Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: North American Olives Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: North American Olives Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: North American Olives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: North American Olives Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: North American Olives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North American Olives Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: United States North American Olives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States North American Olives Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Canada North American Olives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North American Olives Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Mexico North American Olives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico North American Olives Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: Rest of North America North American Olives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of North America North American Olives Market Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: North American Olives Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: North American Olives Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 27: North American Olives Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: North American Olives Market Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 29: North American Olives Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: North American Olives Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 31: North American Olives Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 32: North American Olives Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 33: North American Olives Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 34: North American Olives Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 35: North American Olives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North American Olives Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 37: North American Olives Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 38: North American Olives Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 39: North American Olives Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 40: North American Olives Market Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 41: North American Olives Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 42: North American Olives Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 43: North American Olives Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 44: North American Olives Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 45: North American Olives Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 46: North American Olives Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 47: North American Olives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: North American Olives Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 49: North American Olives Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 50: North American Olives Market Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 51: North American Olives Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 52: North American Olives Market Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 53: North American Olives Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 54: North American Olives Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 55: North American Olives Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 56: North American Olives Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 57: North American Olives Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 58: North American Olives Market Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 59: North American Olives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: North American Olives Market Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Olives Market?

The projected CAGR is approximately 5.74%.

2. Which companies are prominent players in the North American Olives Market?

Key companies in the market include Napa Valley Olive Oil , Musco Family Olive Co., Bell-Carter Foods , California Olive Ranch.

3. What are the main segments of the North American Olives Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Dietary Revolution Leading to Upsurge in Demand for Olive Oil.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

February 2023: The University of Florida/Institute of Food and Agriculture Sciences approved a nearly USD 70,000-worth grant for evaluating olive as a new cash crop for Florida. In addition, the Florida Olive Council funded USD 5,000 for the project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Olives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Olives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Olives Market?

To stay informed about further developments, trends, and reports in the North American Olives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence