Key Insights

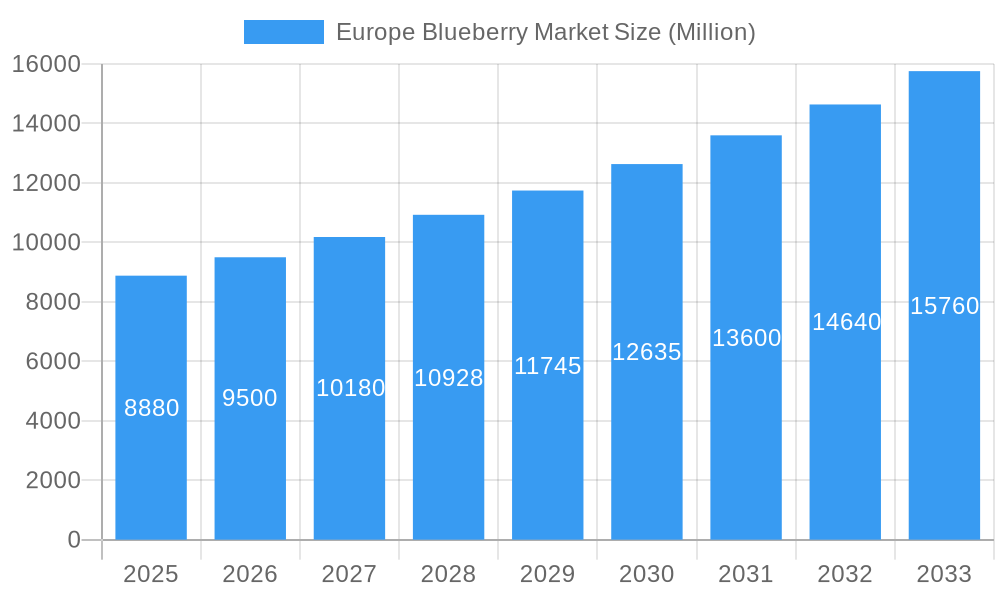

The European blueberry market, valued at €8.88 billion in 2025, is projected to experience robust growth, driven by increasing consumer demand for healthy and convenient snacks and the rising popularity of blueberries in various food and beverage applications. The market's Compound Annual Growth Rate (CAGR) of 6.90% from 2025 to 2033 indicates a significant expansion over the forecast period. Key drivers include growing health consciousness among consumers, the versatile nature of blueberries in diverse food applications (fresh consumption, juices, smoothies, baked goods, yogurt), and the increasing availability of organic blueberries catering to the health-conscious segment. Furthermore, the expanding retail and food service sectors are fueling market growth, with supermarkets, hypermarkets, restaurants, and cafes playing a crucial role in blueberry distribution. Germany, France, the UK, and Italy are expected to be leading contributors to the market's growth, reflecting their high consumption of berries and well-established food retail infrastructure. While the market faces some restraints, such as seasonal supply variations and potential price fluctuations influenced by weather patterns and production challenges, the overall positive market trends are expected to sustain growth. The competitive landscape is characterized by both established players like Driscoll's and Hortifrut and regional producers, leading to innovation and diversification within the market.

Europe Blueberry Market Market Size (In Billion)

The segmentation of the European blueberry market reveals strong potential within the organic segment, reflecting a growing preference for natural and sustainably produced foods. The processed foods application is another significant contributor, showcasing the versatility of blueberries in value-added products. Growth in the food service sector highlights the increasing integration of blueberries into menus in restaurants and cafes, further solidifying the market's expansion. Continued research and development in blueberry cultivation techniques, along with strategic partnerships across the supply chain, are likely to strengthen the European blueberry market's position and support its long-term growth trajectory. The substantial investment in marketing and promotion of blueberries' health benefits are expected to significantly impact consumer preference and market demand in the years to come.

Europe Blueberry Market Company Market Share

Europe Blueberry Market: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe blueberry market, covering the period from 2019 to 2033. It offers in-depth insights into market dynamics, competitive landscape, growth drivers, and future outlook, providing actionable intelligence for industry stakeholders. The base year for this report is 2025, with estimations for 2025 and forecasts extending to 2033. The historical period covered is 2019-2024. The report includes detailed segmentation by product type (organic and conventional blueberries), application (fresh consumption, processed foods), and distribution channel (retail, food service, processing). The total market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe Blueberry Market Market Structure & Competitive Dynamics

The European blueberry market exhibits a moderately concentrated structure, with several key players dominating the landscape. Market share is highly dynamic, influenced by factors such as acquisitions, product innovation, and changing consumer preferences. The leading companies, including Atlantic Blue, Hortifrut, Blue Diamond Growers, Driscoll's, and Fall Creek Farm & Nursery, compete intensely through strategies focusing on brand building, supply chain optimization, and product diversification. The market is characterized by both organic and conventional blueberry production, with a growing demand for organic options. Regulatory frameworks, particularly those related to food safety and labeling, significantly impact market operations. Product substitutes, such as other berries and fruit, create competitive pressure. End-user trends, such as increasing health consciousness and preference for convenient food products, shape market growth. Significant mergers and acquisitions (M&A) activity, illustrated by Hortifrut's acquisition of Atlantic Blue for EUR 241 Million in 2021, reshape the market structure and competitive dynamics. These acquisitions often result in increased production capacity and expansion into new markets. Innovation ecosystems are vital, driving the development of new varieties and processing techniques.

Europe Blueberry Market Industry Trends & Insights

The European blueberry market is experiencing robust growth, driven by several factors. The increasing demand for healthy and nutritious snacks fuels the consumption of fresh blueberries. The rising popularity of processed blueberry products, including juices, smoothies, and baked goods, further contributes to market expansion. Technological advancements in cultivation techniques and post-harvest handling have enhanced product quality and shelf life, boosting market appeal. Changing consumer preferences toward convenience foods are driving the demand for processed blueberry products. The market witnesses continuous innovation with new blueberry varieties offering improved flavor, size, and shelf life. Competitive dynamics are highly dynamic, with both established players and emerging companies vying for market share. The market penetration of organic blueberries is increasing steadily, reflecting growing consumer interest in organic and sustainable food products. The CAGR for the forecast period (2025-2033) is estimated to be xx%, indicating significant growth potential.

Dominant Markets & Segments in Europe Blueberry Market

Within the European blueberry market, several key regions, countries, and segments demonstrate significant dominance. The precise ranking varies by segment and year, but some general trends are evident:

Leading Region: Western Europe, particularly countries like Spain, Poland and Germany, consistently emerges as a leading region due to favorable climatic conditions and established production infrastructure.

Leading Country: Spain, with its extensive blueberry cultivation areas and strong export capabilities, typically holds a prominent position.

Dominant Product Type: While both organic and conventional blueberries experience robust demand, the conventional blueberry segment generally holds a larger market share due to its wider availability and comparatively lower price point. However, the organic segment is experiencing faster growth.

Leading Application: Fresh consumption accounts for a significant portion of total market volume, although the processed foods segment displays strong growth potential driven by product innovation and changing consumer habits.

Dominant Distribution Channel: Retail channels (supermarkets and hypermarkets) constitute the largest distribution segment due to their wide reach and established infrastructure.

Key Drivers for Dominant Segments:

- Economic factors: Consumer spending power and disposable incomes influence demand across segments.

- Infrastructure: Well-developed logistics and supply chain networks support the efficient distribution of blueberries.

- Government policies: Agricultural support programs and regulations impact production and market access.

- Consumer preferences: Growing awareness of health benefits and preference for convenience.

Europe Blueberry Market Product Innovations

The European blueberry market showcases consistent product innovation, focusing on enhancing taste, quality, and shelf life. New blueberry varieties, like Sekoya Pop and Sekoya Beauty developed by Fall Creek Farm & Nursery, are introduced to meet consumer demand for superior taste and texture. Technological advancements in cultivation and post-harvest handling techniques improve product quality and reduce waste. These innovations provide competitive advantages, allowing companies to differentiate their offerings and capture market share. The ongoing trend toward convenient and ready-to-consume products drives the development of value-added blueberry products.

Report Segmentation & Scope

This report segments the Europe blueberry market across various dimensions:

Product Type:

- Conventional Blueberries: This segment comprises the majority of the market, with consistent growth driven by affordability and wide availability. The market size for conventional blueberries is estimated to be xx Million in 2025.

- Organic Blueberries: This high-growth segment reflects increasing consumer demand for organically produced food products. The market size for organic blueberries is estimated to be xx Million in 2025, with a higher projected CAGR compared to the conventional segment.

Application:

- Fresh Consumption: This remains the largest application segment, with consistent demand driven by the health benefits and convenient nature of fresh blueberries.

- Processed Foods: This rapidly expanding segment includes juices, smoothies, yogurt, and baked goods, capitalizing on consumer preference for convenient and ready-to-eat foods.

Distribution Channel:

- Retail: Supermarkets and hypermarkets are the dominant distribution channels, offering wide consumer access.

- Food Service: Restaurants and cafes are an increasingly important segment, offering blueberry-based dishes and desserts.

- Processing: Juice manufacturers and food processors represent a crucial segment, converting blueberries into value-added products.

Key Drivers of Europe Blueberry Market Growth

The European blueberry market is propelled by several key drivers:

- Growing health consciousness: Consumers are increasingly aware of blueberries' nutritional benefits, fueling demand for both fresh and processed products.

- Rising disposable incomes: Increased purchasing power in several European countries supports higher spending on premium food products like blueberries.

- Favorable climatic conditions: Suitable growing conditions in many parts of Europe contribute to ample production.

- Technological advancements: Improved cultivation techniques and post-harvest handling enhance product quality and shelf life.

- Product innovation: The development of new and improved blueberry varieties caters to evolving consumer preferences.

Challenges in the Europe Blueberry Market Sector

The European blueberry market faces various challenges:

- Supply chain disruptions: Weather events, logistical issues, and transportation costs can affect the availability and price of blueberries.

- Fluctuating prices: Seasonal variations and global supply dynamics can lead to price instability.

- Competition from other berries and fruits: Blueberries compete with other berries and fruits for consumer attention and shelf space.

- Regulatory hurdles: Food safety regulations and labeling requirements can add complexity to market operations.

- Labor shortages: Seasonal labor availability can influence production volumes and costs.

Leading Players in the Europe Blueberry Market Market

Key Developments in Europe Blueberry Market Sector

- October 2021: Hortifrut acquires Atlantic Blue for EUR 241 Million, significantly expanding its market presence.

- January 2022: Berries South Africa launches a B2B promotional campaign in Germany, boosting market awareness.

- April 2022: Fall Creek Farm & Nursery showcases new Sekoya blueberry varieties at a Field & Forum event in Spain, highlighting consumer preference for these varieties.

Strategic Europe Blueberry Market Market Outlook

The European blueberry market presents significant growth opportunities. The continued rise in health consciousness and the growing popularity of convenient, ready-to-consume foods will propel demand. Strategic investments in research and development, focusing on new varieties and improved processing techniques, will be crucial for maintaining a competitive edge. Expanding into new markets and exploring innovative distribution channels will also contribute to market expansion. Companies that successfully address supply chain challenges and adapt to evolving consumer preferences are well-positioned to capture market share and achieve sustainable growth.

Europe Blueberry Market Segmentation

-

1. Geography

- 1.1. Spain

- 1.2. Poland

- 1.3. Germany

- 1.4. Netherlands

- 1.5. United Kingdom

- 1.6. France

- 1.7. Italy

Europe Blueberry Market Segmentation By Geography

- 1. Spain

- 2. Poland

- 3. Germany

- 4. Netherlands

- 5. United Kingdom

- 6. France

- 7. Italy

Europe Blueberry Market Regional Market Share

Geographic Coverage of Europe Blueberry Market

Europe Blueberry Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan

- 3.3. Market Restrains

- 3.3.1. ; Volatility in the Prices; Adverse Weather Conditions Affecting Yield

- 3.4. Market Trends

- 3.4.1. Growing Consumer Preference for Home-grown Berries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Blueberry Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Spain

- 5.1.2. Poland

- 5.1.3. Germany

- 5.1.4. Netherlands

- 5.1.5. United Kingdom

- 5.1.6. France

- 5.1.7. Italy

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Spain

- 5.2.2. Poland

- 5.2.3. Germany

- 5.2.4. Netherlands

- 5.2.5. United Kingdom

- 5.2.6. France

- 5.2.7. Italy

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Spain Europe Blueberry Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Spain

- 6.1.2. Poland

- 6.1.3. Germany

- 6.1.4. Netherlands

- 6.1.5. United Kingdom

- 6.1.6. France

- 6.1.7. Italy

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Poland Europe Blueberry Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Spain

- 7.1.2. Poland

- 7.1.3. Germany

- 7.1.4. Netherlands

- 7.1.5. United Kingdom

- 7.1.6. France

- 7.1.7. Italy

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Germany Europe Blueberry Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Spain

- 8.1.2. Poland

- 8.1.3. Germany

- 8.1.4. Netherlands

- 8.1.5. United Kingdom

- 8.1.6. France

- 8.1.7. Italy

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Netherlands Europe Blueberry Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Spain

- 9.1.2. Poland

- 9.1.3. Germany

- 9.1.4. Netherlands

- 9.1.5. United Kingdom

- 9.1.6. France

- 9.1.7. Italy

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. United Kingdom Europe Blueberry Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. Spain

- 10.1.2. Poland

- 10.1.3. Germany

- 10.1.4. Netherlands

- 10.1.5. United Kingdom

- 10.1.6. France

- 10.1.7. Italy

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. France Europe Blueberry Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 11.1.1. Spain

- 11.1.2. Poland

- 11.1.3. Germany

- 11.1.4. Netherlands

- 11.1.5. United Kingdom

- 11.1.6. France

- 11.1.7. Italy

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 12. Italy Europe Blueberry Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 12.1.1. Spain

- 12.1.2. Poland

- 12.1.3. Germany

- 12.1.4. Netherlands

- 12.1.5. United Kingdom

- 12.1.6. France

- 12.1.7. Italy

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Atlantic Blue

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hortifrut

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Blue Diamond Growers

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Driscoll's

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fall Creek Farm & Nursery

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.1 Atlantic Blue

List of Figures

- Figure 1: Europe Blueberry Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Blueberry Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Blueberry Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 2: Europe Blueberry Market Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 3: Europe Blueberry Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Blueberry Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 5: Europe Blueberry Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Europe Blueberry Market Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 7: Europe Blueberry Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Europe Blueberry Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 9: Europe Blueberry Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Europe Blueberry Market Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 11: Europe Blueberry Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Blueberry Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 13: Europe Blueberry Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Europe Blueberry Market Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 15: Europe Blueberry Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Blueberry Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 17: Europe Blueberry Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Europe Blueberry Market Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 19: Europe Blueberry Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Europe Blueberry Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 21: Europe Blueberry Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Europe Blueberry Market Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 23: Europe Blueberry Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Blueberry Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: Europe Blueberry Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 26: Europe Blueberry Market Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 27: Europe Blueberry Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Europe Blueberry Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 29: Europe Blueberry Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Europe Blueberry Market Volume Kiloton Forecast, by Geography 2020 & 2033

- Table 31: Europe Blueberry Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Europe Blueberry Market Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Blueberry Market?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the Europe Blueberry Market?

Key companies in the market include Atlantic Blue , Hortifrut , Blue Diamond Growers, Driscoll's, Fall Creek Farm & Nursery .

3. What are the main segments of the Europe Blueberry Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.88 Million as of 2022.

5. What are some drivers contributing to market growth?

; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan.

6. What are the notable trends driving market growth?

Growing Consumer Preference for Home-grown Berries.

7. Are there any restraints impacting market growth?

; Volatility in the Prices; Adverse Weather Conditions Affecting Yield.

8. Can you provide examples of recent developments in the market?

April 2022: The retailers, supermarkets, and licensees of Sekoya blueberries were able to experience and taste Sekoya Pop ('FCM14-052') and Sekoya Beauty ('FCM12-097') blueberry varieties at the company's Field & Forum event in Spain. At this event, the research and development facilities of Fall Creek Farm & Nursery in Seville (Andalucía, Spain) concluded that the two Sekoya varieties were the most demanding varieties among consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Blueberry Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Blueberry Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Blueberry Market?

To stay informed about further developments, trends, and reports in the Europe Blueberry Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence