Key Insights

The global agricultural testing market is experiencing robust growth, driven by increasing demand for food safety and quality, stringent government regulations, and the rising adoption of precision agriculture techniques. The market's 5.70% CAGR from 2019-2024 indicates a strong trajectory, projected to continue in the forecast period (2025-2033). This growth is fueled by several key factors. Firstly, heightened consumer awareness of food safety and traceability is pushing farmers and food processors to invest heavily in thorough testing methodologies, ensuring adherence to global standards. Secondly, increasing governmental regulations regarding pesticide residues, heavy metal contamination, and genetically modified organisms (GMOs) are compelling agricultural stakeholders to conduct regular testing for compliance. Finally, the rise of precision agriculture, emphasizing data-driven decision-making, relies heavily on soil, water, and seed testing to optimize resource allocation and maximize yields. Key segments like water testing and soil testing are expected to dominate due to their vital role in irrigation management and crop health assessment, while the bio-solids testing segment is poised for significant growth driven by sustainable agricultural practices. The competitive landscape is characterized by a mix of large multinational corporations and specialized agricultural testing laboratories, indicating a mature market with diverse service offerings catering to the specific needs of different agricultural segments.

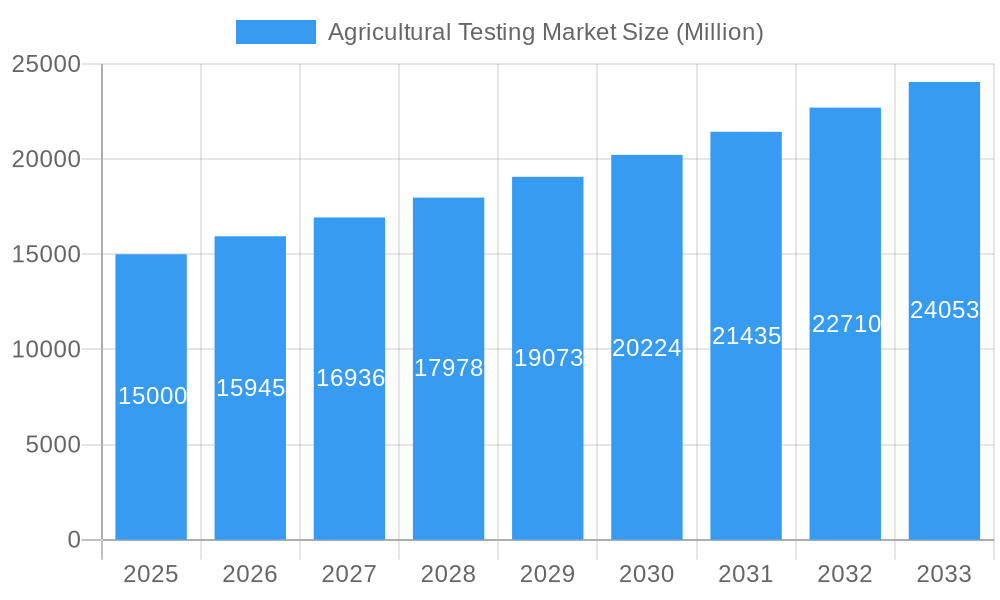

Agricultural Testing Market Market Size (In Billion)

Geographic expansion is another important factor, with North America and Europe currently holding substantial market shares. However, rapidly developing economies in Asia Pacific are expected to drive significant growth in the coming years, fueled by increasing agricultural production and investments in agricultural infrastructure. While the market faces some restraints, such as high testing costs and the need for skilled professionals, ongoing technological advancements, such as the development of rapid and cost-effective testing methods, are mitigating these challenges. Overall, the agricultural testing market presents significant opportunities for companies involved in developing and deploying innovative testing technologies and services, catering to the growing need for sustainable and efficient agricultural practices globally. The market's future growth will be significantly shaped by continuous technological advancements, stricter regulatory landscapes and the ongoing adoption of precision farming strategies.

Agricultural Testing Market Company Market Share

Agricultural Testing Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Agricultural Testing Market, covering market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes data from the historical period (2019-2024) to forecast market trends from 2025 to 2033. The market is segmented by sample type, encompassing Water Testing, Soil Testing, Seed Testing, Bio-Solids Testing, Manure Testing, and Other Samples. Key players analyzed include 3M Company, Biolumix Inc, Intertek Group PLC, Agilent Technologies Inc, BioMérieux SA, Aurea Agrosciences, SCS Global Services, Apal Agricultural Laboratory, ALS Limited, Eurofins Scientific, EMD Millipore Corporation, Bureau Veritas SA, Element Materials Technology, TÜV Nord Group, Charm Sciences Inc, and Neogen Corporation. The report projects a total market value exceeding xx Million by 2033.

Agricultural Testing Market Market Structure & Competitive Dynamics

The agricultural testing market exhibits a moderately concentrated structure, with a few large multinational players holding significant market share. These companies benefit from established brand recognition, extensive global networks, and diverse testing capabilities. However, the market also accommodates numerous smaller, specialized laboratories catering to niche segments or specific geographic regions. The competitive landscape is shaped by factors like technological innovation, regulatory compliance, and the ability to offer integrated solutions.

- Market Concentration: The top 5 players collectively hold an estimated xx% market share, indicating a competitive but not overly dominant landscape.

- Innovation Ecosystems: Significant investment in R&D drives the development of advanced testing methodologies, automation, and data analytics tools. Collaborations between established players and technology startups are increasingly common.

- Regulatory Frameworks: Stringent regulations regarding food safety, environmental protection, and quality control influence market growth and drive demand for reliable testing services. Compliance costs can be a significant barrier to entry for smaller players.

- Product Substitutes: While direct substitutes are limited, there’s competitive pressure from companies offering alternative technologies or integrated solutions that reduce the need for separate testing services.

- End-User Trends: Increasing demand for sustainable agriculture practices, consumer preference for high-quality and safe food, and growing awareness of environmental issues fuel market growth.

- M&A Activities: Recent years have witnessed several mergers and acquisitions, with deal values averaging xx Million per transaction. These activities reflect consolidation trends and efforts to expand service offerings and geographic reach. For example, a significant acquisition in 2022 valued at xx Million significantly altered market dynamics.

Agricultural Testing Market Industry Trends & Insights

The agricultural testing market is experiencing robust growth, driven by several key factors. The increasing global population and rising demand for food security necessitate improved agricultural practices, which in turn boost the demand for reliable testing services. Technological advancements, particularly in areas like genomics, molecular biology, and data analytics, are revolutionizing testing methodologies, leading to faster, more accurate, and cost-effective solutions. The market is witnessing a shift towards integrated testing solutions, where multiple tests are conducted simultaneously, improving efficiency and reducing turnaround times. Consumer preferences for sustainably produced food and increasing regulatory scrutiny further fuel market growth.

The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Market penetration is increasing gradually, with adoption rates particularly high in developed economies and rapidly developing regions experiencing significant agricultural expansion. The competitive intensity remains high, with companies focusing on expanding their service portfolios, strengthening their technological capabilities, and building strategic partnerships to gain a competitive edge. The overall market landscape is characterized by strong growth potential, driven by diverse factors, but with significant competitive pressure.

Dominant Markets & Segments in Agricultural Testing Market

The North American agricultural testing market is currently the most dominant, followed by Europe and Asia-Pacific. This dominance is attributed to several factors:

North America:

- Key Drivers: High agricultural output, stringent regulatory frameworks, significant investments in agricultural technology, and well-established testing infrastructure.

- Dominance Analysis: The region benefits from advanced testing technologies, a high level of awareness about the importance of agricultural testing, and substantial government funding for agricultural research and development.

Europe:

- Key Drivers: Stringent food safety regulations, a large and well-developed agricultural sector, and increasing focus on sustainable agricultural practices.

- Dominance Analysis: While similar to North America, Europe's market is fragmented, with smaller, specialized companies alongside major global players.

Asia-Pacific:

- Key Drivers: Rapid agricultural expansion, increasing food demand, growing awareness of food safety and quality, and significant investments in agricultural infrastructure.

- Dominance Analysis: This region exhibits significant growth potential, but market penetration is still lower compared to North America and Europe.

Among the sample types, Soil Testing currently holds the largest market share, followed by Water Testing. This is largely driven by the crucial role soil health plays in agricultural productivity and the increasing emphasis on water quality management in irrigation.

Agricultural Testing Market Product Innovations

Recent innovations focus on faster, more accurate, and cost-effective testing methods. The adoption of advanced technologies like near-infrared spectroscopy (NIRS), polymerase chain reaction (PCR), and next-generation sequencing (NGS) enhances testing capabilities. Integrated platforms combining multiple testing procedures, miniaturized devices for on-site testing, and cloud-based data management systems are gaining traction. These improvements cater to the demand for rapid turnaround times and greater efficiency, enhancing the overall value proposition for end-users.

Report Segmentation & Scope

This report segments the agricultural testing market by sample type:

- Water Testing: This segment focuses on testing irrigation water for contaminants and pathogens, impacting crop yield and quality. Growth is projected at xx% CAGR.

- Soil Testing: Analyzing soil composition to determine nutrient levels and potential problems, crucial for optimizing fertilization and crop management. Growth is projected at xx% CAGR.

- Seed Testing: Assessing seed quality, germination rate, and disease presence, ensuring high planting success rates. Growth is projected at xx% CAGR.

- Bio-Solids Testing: Testing biosolids for nutrient content and potential contaminants before agricultural application. Growth is projected at xx% CAGR.

- Manure Testing: Analyzing manure for nutrient levels and potential pollutants, aiding in efficient and environmentally sound fertilizer management. Growth is projected at xx% CAGR.

- Other Samples: This includes testing of plant tissue, animal feed, and other relevant agricultural materials. Growth is projected at xx% CAGR.

Each segment's competitive landscape varies, with some dominated by established players and others seeing more competition from smaller, specialized companies.

Key Drivers of Agricultural Testing Market Growth

Several factors drive the agricultural testing market's growth: Stringent government regulations emphasizing food safety and environmental protection necessitate comprehensive testing. The demand for sustainable and efficient agricultural practices encourages the use of precision agriculture technologies, relying heavily on testing data. Technological advancements, particularly in rapid and cost-effective testing methods, further fuel market expansion. Rising consumer awareness regarding food quality and safety reinforces the importance of agricultural testing throughout the supply chain.

Challenges in the Agricultural Testing Market Sector

The agricultural testing market faces several challenges: The high cost of advanced testing technologies can be a barrier to entry for smaller companies. Maintaining consistent quality across different testing labs and ensuring data standardization can be difficult. The complexity of regulatory frameworks and evolving standards demand continuous adaptation from market players. Supply chain disruptions and fluctuations in raw material prices also impact operational costs and profitability. The market experiences cyclical trends linked to agricultural production cycles and global commodity prices.

Leading Players in the Agricultural Testing Market Market

- 3M Company

- Biolumix Inc

- Intertek Group PLC

- Agilent Technologies Inc

- BioMérieux SA

- Aurea Agrosciences

- SCS Global Services

- Apal Agricultural Laboratory

- ALS Limited

- Eurofins Scientific

- EMD Millipore Corporation

- Bureau Veritas SA

- Element Materials Technology

- TÜV Nord Group

- Charm Sciences Inc

- Neogen Corporation

Key Developments in Agricultural Testing Market Sector

- August 2022: Hill laboratories introduced a new soil test method (Hot Water Carbon (HWEC) test) using near infra-red spectroscopy (NIRS) for faster and cheaper results.

- November 2022: SCS Global Services launched a new plant-based certification program with ANSI-accredited standards, emphasizing rigorous auditing and testing.

- February 2023: Hill Laboratories partnered with Mérieux NutriSciences to provide comprehensive food safety testing and auditing solutions for New Zealand food businesses.

Strategic Agricultural Testing Market Market Outlook

The agricultural testing market is poised for continued growth, driven by technological advancements, increasing demand for food safety and security, and the growing adoption of sustainable agricultural practices. Strategic opportunities exist in developing innovative testing solutions, expanding into emerging markets, and focusing on providing integrated and customized services. Companies that invest in R&D, build strategic partnerships, and adapt to evolving regulatory landscapes are well-positioned to capture significant market share. The increasing demand for data-driven decision-making in agriculture will also drive demand for advanced analytical services.

Agricultural Testing Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Agricultural Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Agricultural Testing Market Regional Market Share

Geographic Coverage of Agricultural Testing Market

Agricultural Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Custom Product Development; Use of CROs for Regulatory Services

- 3.3. Market Restrains

- 3.3.1. Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry

- 3.4. Market Trends

- 3.4.1. Regulations and Legislations Pertaining to Agriculture and Environmental Safety

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Agricultural Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Agricultural Testing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Agricultural Testing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Agricultural Testing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Agricultural Testing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Agricultural Testing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 3M Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Biolumix Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intertek Group PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Agilent Technologies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BioMerieux SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aurea Agrosciences

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SCS Global Services

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Apal Agricultural Laboratory

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ALS Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eurofins Scientific

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 EMD Millipore Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bureau Veritas SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Element Materials Technology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TUV Nord Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Charm Sciences Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Neogen Corporation

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 3M Company

List of Figures

- Figure 1: Global Agricultural Testing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Agricultural Testing Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Agricultural Testing Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Agricultural Testing Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Agricultural Testing Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Agricultural Testing Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Agricultural Testing Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Agricultural Testing Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Agricultural Testing Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Agricultural Testing Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Agricultural Testing Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Agricultural Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Agricultural Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Agricultural Testing Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Agricultural Testing Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Agricultural Testing Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Agricultural Testing Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Agricultural Testing Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Agricultural Testing Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Agricultural Testing Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Agricultural Testing Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Agricultural Testing Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Agricultural Testing Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Agricultural Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Agricultural Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Agricultural Testing Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Agricultural Testing Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Agricultural Testing Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Agricultural Testing Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Agricultural Testing Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Agricultural Testing Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Agricultural Testing Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Agricultural Testing Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Agricultural Testing Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Agricultural Testing Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Agricultural Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Agricultural Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Agricultural Testing Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Agricultural Testing Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Agricultural Testing Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Agricultural Testing Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Agricultural Testing Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Agricultural Testing Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Agricultural Testing Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Agricultural Testing Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Agricultural Testing Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Agricultural Testing Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Agricultural Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Agricultural Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Agricultural Testing Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Agricultural Testing Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Agricultural Testing Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Agricultural Testing Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Agricultural Testing Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Agricultural Testing Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Agricultural Testing Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Agricultural Testing Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Agricultural Testing Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Agricultural Testing Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Agricultural Testing Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Agricultural Testing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Agricultural Testing Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Agricultural Testing Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Agricultural Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Agricultural Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Agricultural Testing Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Agricultural Testing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Agricultural Testing Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Agricultural Testing Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Agricultural Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Agricultural Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Agricultural Testing Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Agricultural Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Agricultural Testing Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Agricultural Testing Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Agricultural Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Agricultural Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Agricultural Testing Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Agricultural Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Agricultural Testing Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Agricultural Testing Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Agricultural Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Agricultural Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Agricultural Testing Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Agricultural Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Agricultural Testing Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Agricultural Testing Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Agricultural Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Agricultural Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Agricultural Testing Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Agricultural Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Agricultural Testing Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Agricultural Testing Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Agricultural Testing Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Agricultural Testing Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Agricultural Testing Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Agricultural Testing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Agricultural Testing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Agricultural Testing Market?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Agricultural Testing Market?

Key companies in the market include 3M Company, Biolumix Inc, Intertek Group PLC, Agilent Technologies Inc, BioMerieux SA, Aurea Agrosciences, SCS Global Services, Apal Agricultural Laboratory, ALS Limited, Eurofins Scientific, EMD Millipore Corporation, Bureau Veritas SA, Element Materials Technology, TUV Nord Group, Charm Sciences Inc, Neogen Corporation.

3. What are the main segments of the Agricultural Testing Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Custom Product Development; Use of CROs for Regulatory Services.

6. What are the notable trends driving market growth?

Regulations and Legislations Pertaining to Agriculture and Environmental Safety.

7. Are there any restraints impacting market growth?

Data and Cyber Security Concerns; Lack of Experts and Professionals in this Industry.

8. Can you provide examples of recent developments in the market?

February 2023: Hill laboratories company signed a joint partnership agreement with Merieux Nutrisciences. The Hill Laboratories team will work with the Mérieux NutriSciences team of experts to provide comprehensive solutions for New Zealand food businesses, encompassing food safety testing and auditing services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Agricultural Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Agricultural Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Agricultural Testing Market?

To stay informed about further developments, trends, and reports in the Agricultural Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence